Home > Analyses > Communication Services > Live Nation Entertainment, Inc.

Live Nation Entertainment, Inc. transforms the way millions experience live music and entertainment by powering some of the world’s most iconic concerts, festivals, and venues. As a dominant force in the entertainment industry, it excels through its integrated business model spanning concert promotion, ticketing via Ticketmaster, and innovative sponsorship solutions. Renowned for its scale and market influence, Live Nation continually shapes cultural moments globally. The critical question remains: does its robust market position still translate into sustainable growth and attractive investment value in today’s evolving landscape?

Table of contents

Business Model & Company Overview

Live Nation Entertainment, Inc., founded in 2005 and headquartered in Beverly Hills, CA, stands as a dominant player in the live entertainment industry. It operates a cohesive ecosystem combining concert promotion, venue management, ticketing, and sponsorship services, creating a unified platform that connects artists and fans worldwide. With over 25K events annually and ownership or operation of 259 venues globally, the company’s core mission revolves around delivering unforgettable live experiences.

The company’s revenue engine balances ticketing software and services with recurring sponsorship and advertising contracts, alongside concert promotion and venue operations. Its strategic presence spans the Americas, Europe, and Asia, leveraging scale and technology to optimize event sales and brand partnerships. This integrated approach forms a robust economic moat, positioning Live Nation as a key architect of the live entertainment landscape’s future.

Financial Performance & Fundamental Metrics

This section provides a fundamental analysis of Live Nation Entertainment, Inc., focusing on its income statement, key financial ratios, and dividend payout policy.

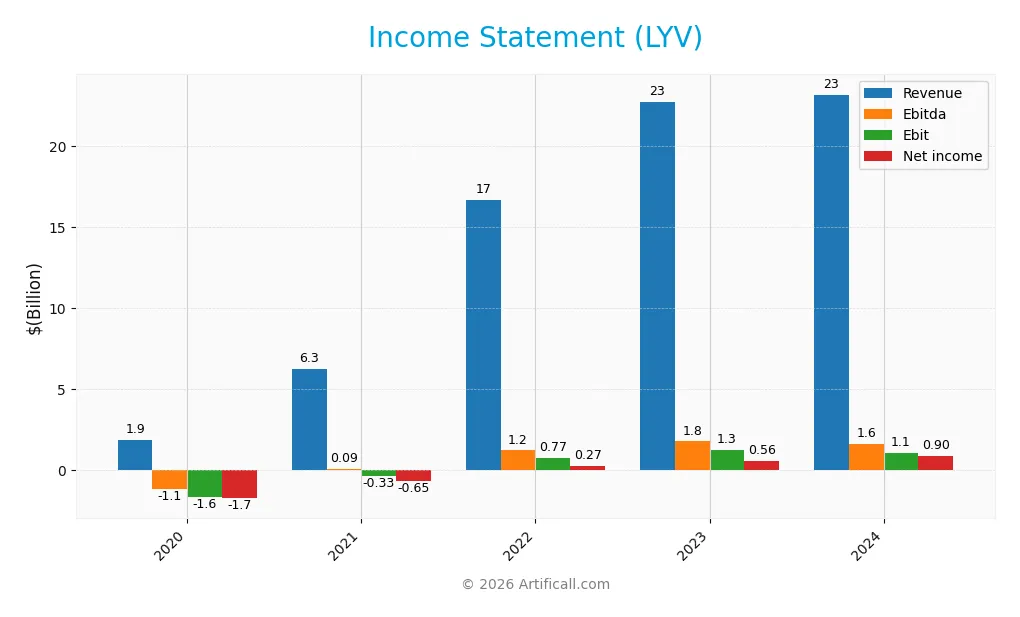

Income Statement

The table below summarizes Live Nation Entertainment, Inc.’s income statement figures for fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.86B | 6.27B | 16.7B | 22.7B | 23.2B |

| Cost of Revenue | 1.40B | 4.36B | 12.3B | 17.3B | 17.3B |

| Operating Expenses | 2.11B | 2.33B | 3.61B | 4.39B | 5.00B |

| Gross Profit | 459M | 1.91B | 4.33B | 5.48B | 5.83B |

| EBITDA | -1.14B | 87.5M | 1.22B | 1.78B | 1.62B |

| EBIT | -1.63B | -329M | 769M | 1.26B | 1.07B |

| Interest Expense | 227M | 282M | 278M | 350M | 326M |

| Net Income | -1.72B | -651M | 266M | 557M | 896M |

| EPS | -8.12 | -3.09 | 0.66 | 1.35 | 2.77 |

| Filing Date | 2021-03-01 | 2022-02-23 | 2023-02-23 | 2024-02-22 | 2025-02-21 |

Income Statement Evolution

From 2020 to 2024, Live Nation Entertainment, Inc. displayed strong revenue growth of 1144.14%, with a slight slowdown in the latest year at 1.89%. Net income also rose significantly by 151.97% over the period, with net margin improving by 104.18%. Gross margin remained favorable at 25.17%, while EBIT and net margins were neutral, reflecting mixed operational efficiency despite overall profitability gains.

Is the Income Statement Favorable?

In 2024, Live Nation’s fundamentals appear generally favorable. Revenue reached $23.2B with a 6.42% increase in gross profit, though EBIT declined 15.68%, indicating margin pressure on operating income. Net margin grew 57.96%, supported by a strong 104.48% EPS growth. Interest expense was low at 1.41% of revenue, enhancing financial stability. Overall, 64.29% of income statement metrics are favorable, suggesting solid but cautiously mixed financial health.

Financial Ratios

The table below presents key financial ratios for Live Nation Entertainment, Inc. (LYV) over the fiscal years 2020 to 2024, offering a snapshot of profitability, efficiency, liquidity, leverage, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -92.7% | -10.4% | 1.6% | 2.5% | 3.9% |

| ROE | 3.7% | 1.1% | -0.7% | -32.5% | 5.2% |

| ROIC | -23.4% | -5.0% | 6.2% | 8.1% | 7.7% |

| P/E | -9.0 | -39.9 | 58.8 | 38.4 | 33.2 |

| P/B | -33.1 | -44.6 | -42.7 | -1247.9 | 172.0 |

| Current Ratio | 0.96 | 0.97 | 0.98 | 0.96 | 0.99 |

| Quick Ratio | 0.96 | 0.97 | 0.98 | 0.95 | 0.99 |

| D/E | -13.7 | -12.8 | -20.9 | -492.1 | 47.7 |

| Debt-to-Assets | 61.0% | 51.8% | 46.8% | 44.2% | 42.1% |

| Interest Coverage | -7.3 | -1.5 | 2.6 | 3.1 | 2.5 |

| Asset Turnover | 0.18 | 0.44 | 1.01 | 1.19 | 1.18 |

| Fixed Asset Turnover | 0.74 | 2.38 | 5.45 | 6.13 | 5.70 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2020 to 2024, Live Nation Entertainment’s Return on Equity (ROE) exhibited notable volatility, reaching a high of 517.3% in 2024 after negative values in earlier years. The Current Ratio remained consistently below 1, indicating tight liquidity, with a slight improvement to 0.99 in 2024. The Debt-to-Equity Ratio showed extreme fluctuations, ending at an unfavorable 47.74 in 2024, reflecting increased leverage and potential financial risk. Profitability margins showed some recovery but remain modest.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (3.87%) and PE ratio (33.25) were unfavorable, while ROE was strongly favorable. Liquidity ratios present a mixed picture: the current ratio is slightly unfavorable at 0.99, but the quick ratio is neutral. Efficiency ratios like asset turnover (1.18) and fixed asset turnover (5.7) are favorable, indicating operational effectiveness. Leverage ratios remain concerning with a high Debt-to-Equity ratio (47.74), though interest coverage is neutral at 3.27. Overall, the financial ratios are slightly unfavorable, with 42.86% unfavorable and only 21.43% favorable metrics.

Shareholder Return Policy

Live Nation Entertainment, Inc. does not pay dividends, reflecting a reinvestment strategy consistent with its growth phase. The company has maintained a zero dividend payout ratio and yield, focusing on operational and free cash flow generation with no share buybacks reported.

This absence of direct shareholder distributions suggests the company prioritizes capital allocation toward expansion and operational needs. Such a policy can support long-term value creation if reinvestments yield sustainable growth, though shareholders receive no immediate income from dividends or buybacks.

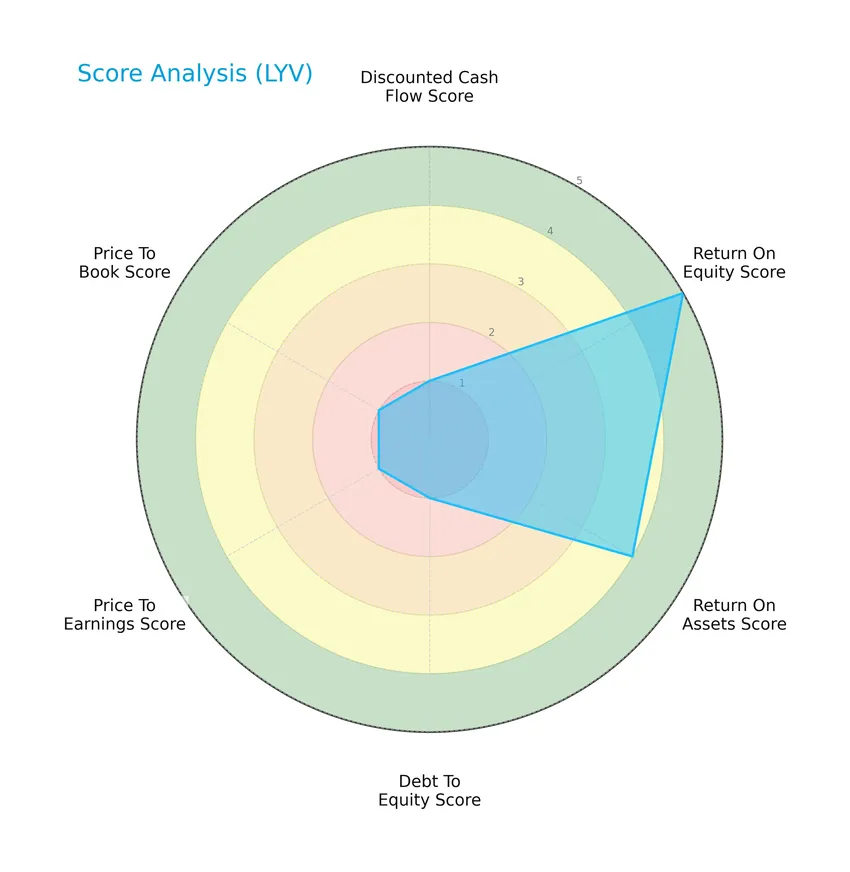

Score analysis

The radar chart below presents an overview of Live Nation Entertainment, Inc.’s key financial scores across valuation, profitability, and leverage metrics:

The company shows a strong return on equity (score 5) and good return on assets (score 4), indicating operational efficiency. However, valuation multiples and leverage scores are very unfavorable (all scores at 1), reflecting potential concerns in price and debt management.

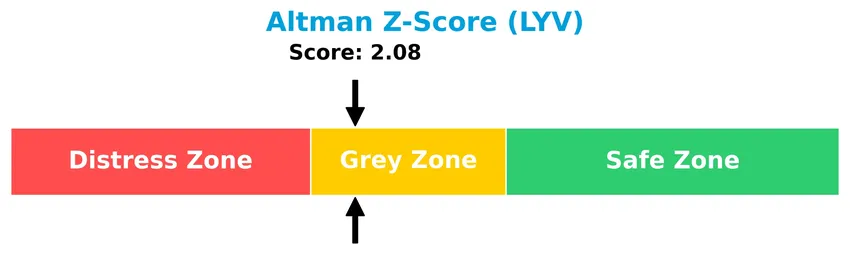

Analysis of the company’s bankruptcy risk

Live Nation Entertainment’s Altman Z-Score places it in the grey zone, indicating a moderate risk of bankruptcy:

Is the company in good financial health?

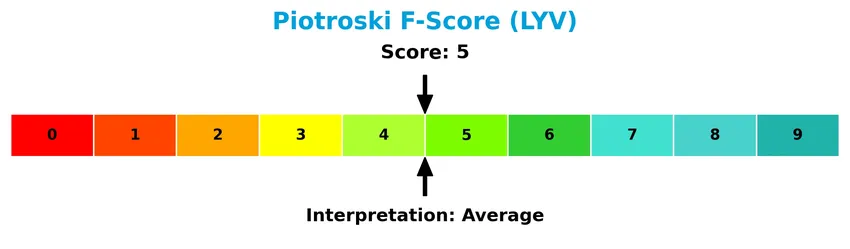

The Piotroski Score diagram illustrates the company’s current financial health assessment:

With a Piotroski Score of 5, Live Nation Entertainment is categorized as having average financial strength, reflecting a balanced but not robust fiscal position.

Competitive Landscape & Sector Positioning

This section provides an overview of Live Nation Entertainment, Inc.’s sector, covering strategic positioning, revenue segments, key products, main competitors, and competitive advantages. I will analyze whether Live Nation holds a competitive advantage over its peers within the live entertainment and ticketing industry.

Strategic Positioning

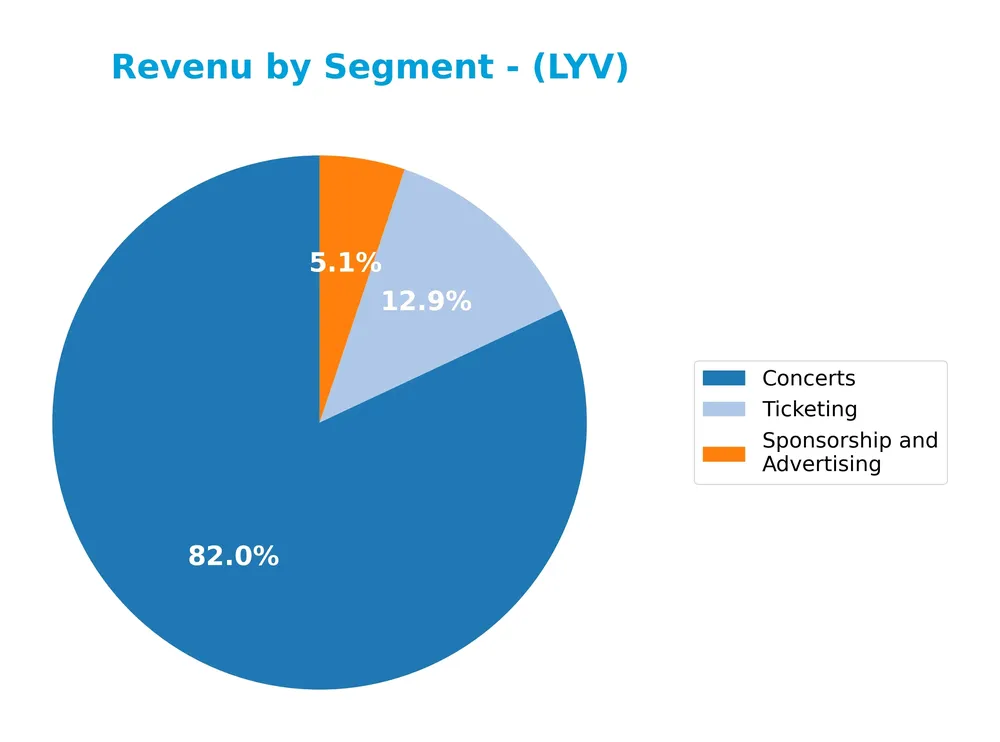

Live Nation Entertainment, Inc. maintains a diversified product portfolio across Concerts (19B USD in 2024), Ticketing (3B USD), and Sponsorship & Advertising (1.2B USD), with significant geographic exposure split between domestic (14.4B USD) and international markets (8.8B USD), reflecting a broad live entertainment footprint.

Revenue by Segment

This pie chart illustrates Live Nation Entertainment, Inc.’s revenue distribution by segment for the fiscal year 2024.

In 2024, the Concerts segment dominated Live Nation’s revenue with $19B, showing strong growth from $13.5B in 2022 and a steady increase year over year. Ticketing contributed $3B, maintaining relative stability, while Sponsorship and Advertising generated $1.2B, slightly down from $1.5B in 2023. The business remains highly concentrated in Concerts, highlighting exposure to live event risks, though the segment’s growth indicates robust demand recovery and expansion.

Key Products & Brands

The table below summarizes Live Nation Entertainment’s main products and brands with their core descriptions:

| Product | Description |

|---|---|

| Concerts | Promotion and production of live music events, operation and management of owned, operated, or leased music venues, music festivals, and artist management services. |

| Ticketing | Ticket sales and management including ticketing software and services, primary platforms livenation.com and ticketmaster.com, resale services, and ticket distribution channels. |

| Sponsorship & Advertising | Sales of sponsorships and advertising placements across venues, events, and digital platforms, development of strategic sponsorship programs, and custom branded events. |

Live Nation Entertainment’s key revenue streams derive from concerts, ticketing, and sponsorship & advertising segments, reflecting its comprehensive involvement in live entertainment, event ticketing, and brand partnerships.

Main Competitors

There are 8 competitors in total, with the table below listing the top 8 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Netflix, Inc. | 385.5B |

| Warner Bros. Discovery, Inc. | 70.6B |

| Live Nation Entertainment, Inc. | 33.7B |

| Fox Corporation | 33.3B |

| TKO Group Holdings, Inc. | 16.9B |

| News Corporation | 16.6B |

| News Corporation | 14.8B |

| Paramount Skydance Corporation Class B Common Stock | 14.1B |

Live Nation Entertainment, Inc. ranks 3rd among its competitors with a market cap representing 8.85% of the sector leader, Netflix. The company sits below the average market cap of the top 10 competitors at 73.2B but remains above the sector median of 25.1B. It holds a significant 106.98% market cap lead over its closest rival above it.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does LYV have a competitive advantage?

Live Nation Entertainment, Inc. currently shows a slightly unfavorable competitive advantage as it is shedding value with an ROIC below its WACC, indicating value destruction despite growing profitability. Its overall moat status reflects this marginal disadvantage in capital efficiency.

Looking ahead, Live Nation’s diversified segments—Concerts, Ticketing, and Sponsorship & Advertising—provide opportunities for growth through expanding international venue management and digital ticketing services. Continued development of strategic sponsorship programs and custom event productions may also support future revenue streams.

SWOT Analysis

This SWOT analysis highlights Live Nation Entertainment, Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to guide strategic investment decisions.

Strengths

- Market leader in live entertainment with extensive venue ownership

- Strong revenue growth over 2020-2024 with expanding international footprint

- High return on equity signaling efficient capital use

Weaknesses

- High debt levels increase financial risk

- Margins remain thin with net margin under 4%

- Valuation metrics (PE, PB) appear stretched

Opportunities

- Growing global demand for live events and festivals

- Expansion of digital ticketing and streaming advertising

- Strategic sponsorships and branded event production

Threats

- Economic downturns impacting discretionary spending

- Competition from alternative entertainment platforms

- Regulatory changes affecting live event operations

Live Nation’s robust market position and growth prospects are tempered by financial leverage and margin pressures. Strategic focus on digital innovation and international expansion can drive further value, but investors should monitor debt levels and macroeconomic risks closely.

Stock Price Action Analysis

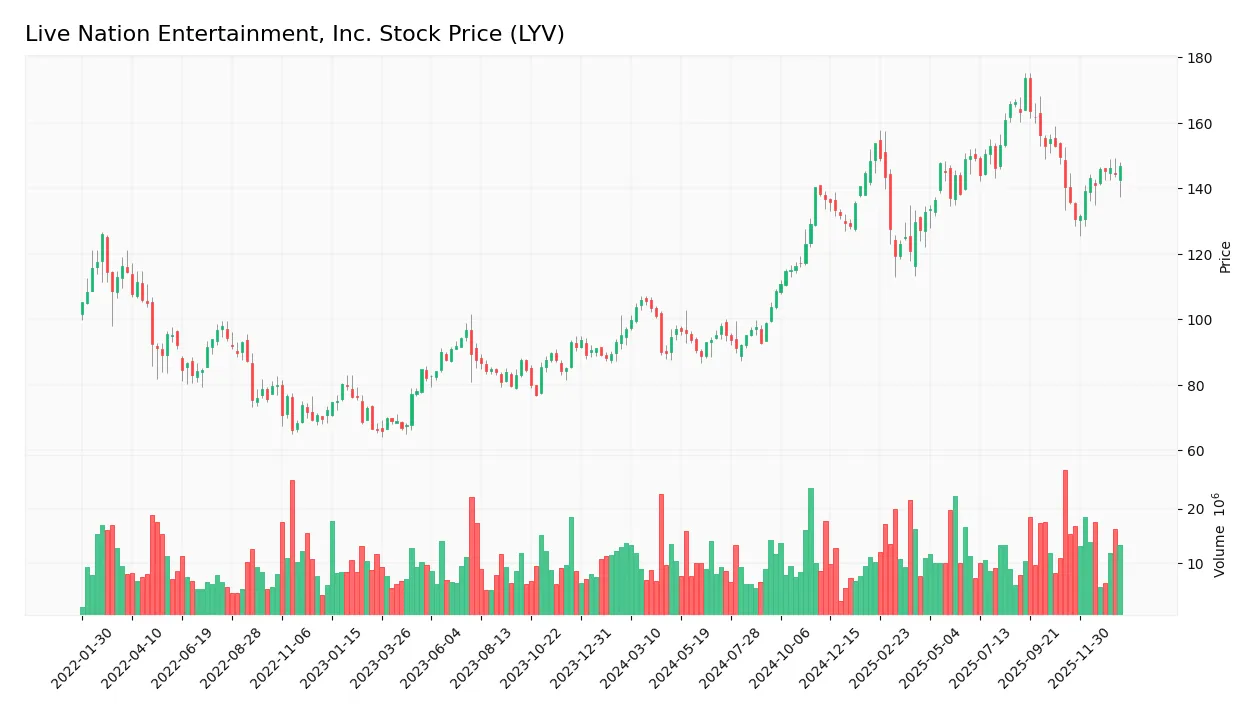

The weekly stock chart for Live Nation Entertainment, Inc. (LYV) reveals significant price movements and recent volatility trends over the analyzed periods:

Trend Analysis

Over the past 12 months, LYV’s stock price increased by 51.28%, indicating a bullish trend with price acceleration. The highest price reached 173.73, the lowest was 88.75, and the standard deviation was 23.47, reflecting notable volatility. In the recent period from November 2025 to January 2026, the price rose by 4.6%, maintaining a bullish trend with a slope of 1.2 and reduced volatility (std deviation 5.38).

Volume Analysis

Trading volumes over the last three months show a slightly seller-dominant activity with buyers accounting for 43.44%. Despite this, the overall volume trend is increasing, indicating growing market participation. This suggests cautious investor sentiment with more selling pressure recently, contrasting with the longer-term buyer dominance of 53.64%.

Target Prices

The consensus target prices for Live Nation Entertainment, Inc. (LYV) indicate a generally optimistic outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 195 | 155 | 177 |

Analysts expect the stock price to range between 155 and 195, with an average consensus target of 177, reflecting moderate confidence in upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback concerning Live Nation Entertainment, Inc. (LYV).

Stock Grades

Here is a summary of recent verified analyst grades for Live Nation Entertainment, Inc., reflecting current market sentiment and rating trends:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Downgrade | Hold | 2026-01-13 |

| Evercore ISI Group | Maintain | Outperform | 2025-12-23 |

| Guggenheim | Maintain | Buy | 2025-11-18 |

| Roth Capital | Maintain | Buy | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| Morgan Stanley | Maintain | Overweight | 2025-11-05 |

| Guggenheim | Maintain | Buy | 2025-11-05 |

| Susquehanna | Maintain | Positive | 2025-11-03 |

| Citigroup | Maintain | Buy | 2025-10-23 |

The overall consensus remains positive with a majority of Buy and Outperform ratings, though Jefferies’ recent downgrade to Hold introduces a note of caution. The consensus rating is Buy, supported by 36 Buy and 6 Hold recommendations, indicating moderate bullish sentiment.

Consumer Opinions

Consumers express a mix of enthusiasm and frustration when it comes to Live Nation Entertainment, reflecting a strong passion for live events tempered by service concerns.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great selection of concerts and events, easy to find tickets.” | “High service fees make ticket prices unexpectedly expensive.” |

| “User-friendly app and website, smooth ticket purchasing.” | “Customer service can be slow and unhelpful during event issues.” |

| “Reliable event updates and excellent venue partnerships.” | “Occasionally tickets get sold out too quickly, frustrating fans.” |

Overall, consumers appreciate Live Nation’s extensive event coverage and platform usability but frequently cite high fees and customer service challenges as areas needing improvement.

Risk Analysis

Below is a summary table highlighting key risks for Live Nation Entertainment, Inc., including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Moderate risk of financial distress indicated by Altman Z-Score in the grey zone (2.08). | Medium | High |

| High Valuation | Unfavorable P/E (33.25) and P/B (172.0) ratios suggest overvaluation risk. | High | Medium |

| Leverage | Elevated debt-to-equity ratio (47.74) with low interest coverage (3.27) risks solvency issues. | Medium | High |

| Liquidity | Current ratio below 1 (0.99) signals potential short-term liquidity challenges. | Medium | Medium |

| Market Volatility | Beta above 1 (1.197) exposes stock price to higher market swings. | High | Medium |

| Industry Dependence | Reliance on live events exposes the company to risks from pandemics, regulatory changes, etc. | Medium | High |

The most concerning risks are financial health and leverage issues, as the company sits in a grey zone for bankruptcy risk and carries significant debt. Additionally, elevated valuation ratios caution against overpaying. Market conditions and event disruptions remain notable risk factors for this entertainment firm. I recommend weighing these carefully in your portfolio decisions.

Should You Buy Live Nation Entertainment, Inc.?

Live Nation Entertainment, Inc. appears to be experiencing improving profitability and growing operational efficiency, yet it could be seen as shedding value with a slightly unfavorable competitive moat. Despite a manageable leverage profile, its overall rating suggests a moderate investment profile with cautious risk considerations.

Strength & Efficiency Pillars

Live Nation Entertainment, Inc. shows robust profitability with a remarkable return on equity of 517.3%, indicating strong shareholder value generation. The company’s asset turnover ratios are favorable, with total asset turnover at 1.18 and fixed asset turnover at 5.7, reflecting efficient use of resources. Financial health is moderate, as evidenced by an Altman Z-Score of 2.08 placing it in the grey zone, and a Piotroski score of 5, which signals average financial strength. However, with a return on invested capital (ROIC) of 7.71% below the weighted average cost of capital (WACC) at 8.28%, Live Nation is currently a value destroyer despite its operational improvements.

Weaknesses and Drawbacks

Several valuation and leverage metrics raise caution. The price-to-earnings ratio stands at a lofty 33.25, while the price-to-book ratio is an extreme 172.0, suggesting the stock is trading at a significant premium and potentially overvalued. Leverage is a concern with a debt-to-equity ratio of 47.74 and a current ratio just below 1.0 at 0.99, indicating liquidity pressures that could constrain flexibility. Recent market behavior confirms these risks, with seller dominance at 56.56% in the latest period, creating short-term selling pressure despite a broader bullish trend.

Our Verdict about Live Nation Entertainment, Inc.

The company’s long-term fundamental profile is mixed, combining solid profitability with financial risks and valuation challenges. Despite a bullish overall stock trend and accelerating momentum, recent seller dominance suggests caution. Therefore, while Live Nation may appear attractive for long-term exposure given its growth trajectory, the current market pressure and stretched valuation might warrant a wait-and-see approach for a more favorable entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rakuten Investment Management Inc. Buys New Position in Live Nation Entertainment, Inc. $LYV – MarketBeat (Jan 24, 2026)

- Live Nation gains after court hearing on DOJ’s antitrust lawsuit ends (LYV:NYSE) – Seeking Alpha (Jan 23, 2026)

- Live Nation Entertainment’s Q4 2025 Earnings: What to Expect – Barchart.com (Jan 19, 2026)

- Live Nation Entertainment (NYSE:LYV) Given New $180.00 Price Target at Moffett Nathanson – MarketBeat (Jan 24, 2026)

- What Makes Live Nation Entertainment (LYV) Attractive – Yahoo Finance (Jan 10, 2026)

For more information about Live Nation Entertainment, Inc., please visit the official website: livenationentertainment.com