Home > Analyses > Basic Materials > Linde plc

Linde plc powers the invisible forces that drive modern life, from medical oxygen to industrial hydrogen. This global industrial gas giant shapes critical sectors like healthcare, energy, and manufacturing with its advanced gas solutions and engineered plants. Renowned for innovation and operational excellence, Linde commands a durable competitive moat in specialty chemicals. As we examine its current fundamentals, the key question emerges: does Linde’s market valuation still reflect its growth potential in a transforming global economy?

Table of contents

Business Model & Company Overview

Linde plc, founded in 1879 and headquartered in Woking, UK, stands as a global leader in the industrial gas and engineering sector. It delivers a comprehensive ecosystem of atmospheric and process gases, alongside turnkey process plants. This integrated approach serves diverse industries from healthcare to aerospace, reinforcing its dominant market position in specialty chemicals worldwide.

The company generates value by blending gas production with engineering services, balancing hardware plant construction and recurring gas supply contracts. Linde’s strategic footprint spans the Americas, Europe, the Middle East, Africa, and Asia Pacific. Its deep technical expertise and global scale create a formidable economic moat, shaping the future of industrial gas infrastructure.

Financial Performance & Fundamental Metrics

I analyze Linde plc’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder returns.

Income Statement

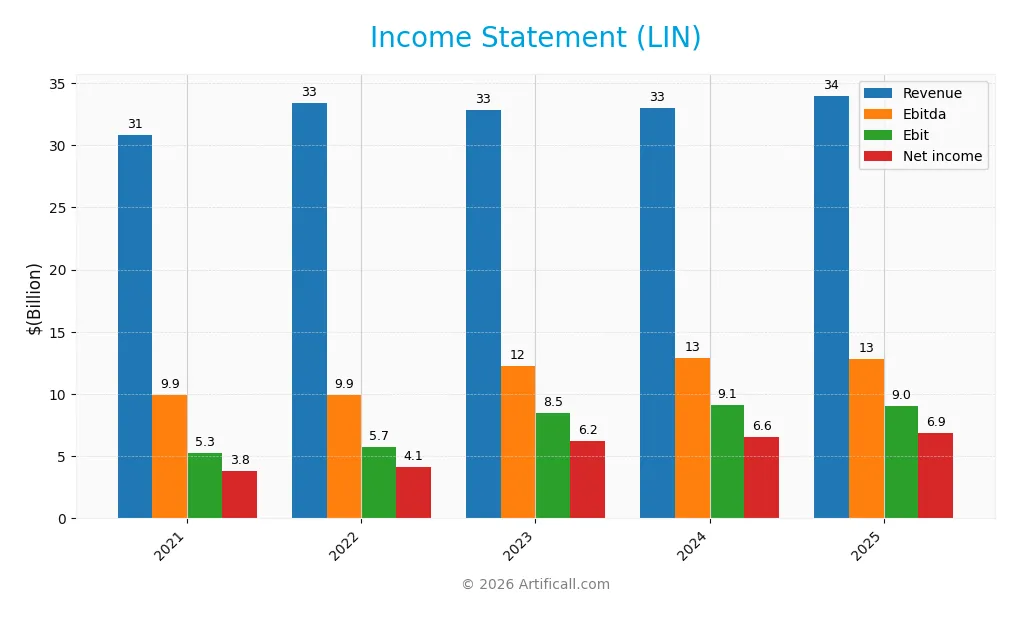

This table presents Linde plc’s key income statement figures over the last five fiscal years, reflecting its revenue, expenses, and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 30.8B | 33.4B | 32.9B | 33.0B | 33.9B |

| Cost of Revenue | 22.2B | 23.7B | 21.3B | 20.9B | 19.3B |

| Operating Expenses | 3.3B | 3.3B | 3.4B | 3.5B | 5.8B |

| Gross Profit | 8.6B | 9.7B | 11.5B | 12.1B | 14.7B |

| EBITDA | 9.9B | 9.9B | 12.3B | 12.9B | 12.9B |

| EBIT | 5.3B | 5.7B | 8.5B | 9.1B | 9.0B |

| Interest Expense | 159M | 192M | 488M | 572M | 212M |

| Net Income | 3.8B | 4.1B | 6.2B | 6.6B | 6.9B |

| EPS | 7.4 | 8.3 | 12.7 | 13.7 | 14.7 |

| Filing Date | 2022-02-28 | 2023-02-28 | 2024-02-28 | 2025-02-26 | 2026-02-05 |

Income Statement Evolution

From 2021 to 2025, Linde plc’s revenue rose 10.4%, with a 3% increase in the last year signaling slowing growth. Net income surged 80.3%, driven by a sharp margin expansion. Gross margin improved notably, reaching 43.3%, while EBIT margin held firm at 26.6%, reflecting stable operational efficiency despite modest revenue growth.

Is the Income Statement Favorable?

In 2025, Linde reported $34B revenue and $6.9B net income, yielding a solid 20.3% net margin. EBIT margin remained robust at 26.6%, with interest expense low at 0.62% of revenue, supporting profitability. EPS grew 7.1% in the year, confirming earnings strength. Overall, fundamentals appear favorable, though recent revenue growth deceleration warrants monitoring.

Financial Ratios

The table below presents key financial ratios for Linde plc (LIN) over the past five fiscal years, reflecting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 9.2% | 12.4% | 12.4% | 18.9% | 19.9% |

| ROE | 5.3% | 8.7% | 10.4% | 15.6% | 17.2% |

| ROIC | 3.7% | 5.6% | 7.0% | 8.8% | 9.2% |

| P/E | 55.5 | 46.8 | 39.3 | 32.3 | 30.5 |

| P/B | 2.9 | 4.1 | 4.1 | 5.0 | 5.3 |

| Current Ratio | 0.80 | 0.74 | 0.79 | 0.80 | 0.89 |

| Quick Ratio | 0.67 | 0.62 | 0.67 | 0.67 | 0.76 |

| D/E | 0.36 | 0.35 | 0.47 | 0.51 | 0.59 |

| Debt-to-Assets | 19.5% | 18.6% | 23.6% | 25.1% | 28.2% |

| Interest Coverage | 34.1 | 33.2 | 33.6 | 16.6 | 15.0 |

| Asset Turnover | 0.31 | 0.38 | 0.42 | 0.41 | 0.41 |

| Fixed Asset Turnover | 0.95 | 1.18 | 1.42 | 1.29 | 1.28 |

| Dividend Yield | 1.46% | 1.22% | 1.44% | 1.24% | 1.32% |

Evolution of Financial Ratios

From 2020 to 2024, Linde’s Return on Equity (ROE) improved steadily from 5.3% to 17.2%, indicating enhanced profitability. The Current Ratio showed slight fluctuation but remained below 1, reflecting tight liquidity. The Debt-to-Equity Ratio increased from 0.36 to 0.59, signaling moderate leverage growth with stable profitability margins.

Are the Financial Ratios Fovorable?

In 2024, profitability metrics like net margin (19.9%) and ROE (17.2%) are favorable, supported by a WACC of 7.2% below ROIC of 9.2%, which is neutral. Liquidity ratios remain unfavorable with a Current Ratio of 0.89 and Quick Ratio of 0.76. Leverage is neutral at 0.59 debt-to-equity, while valuation metrics such as P/E (30.5) and P/B (5.26) are unfavorable. Overall, the financial ratios present a neutral stance.

Shareholder Return Policy

Linde plc pays dividends with a payout ratio near 40%, yielding about 1.3% annually. Dividend per share has steadily increased from $3.85 in 2020 to $5.55 in 2024. Share buybacks are not mentioned, suggesting dividends remain the primary shareholder return method.

The company covers dividends comfortably through free cash flow, with a dividend and capex coverage ratio above 1.3. This disciplined distribution aligns with sustainable long-term value creation, balancing shareholder returns and reinvestment needs in a capital-intensive sector.

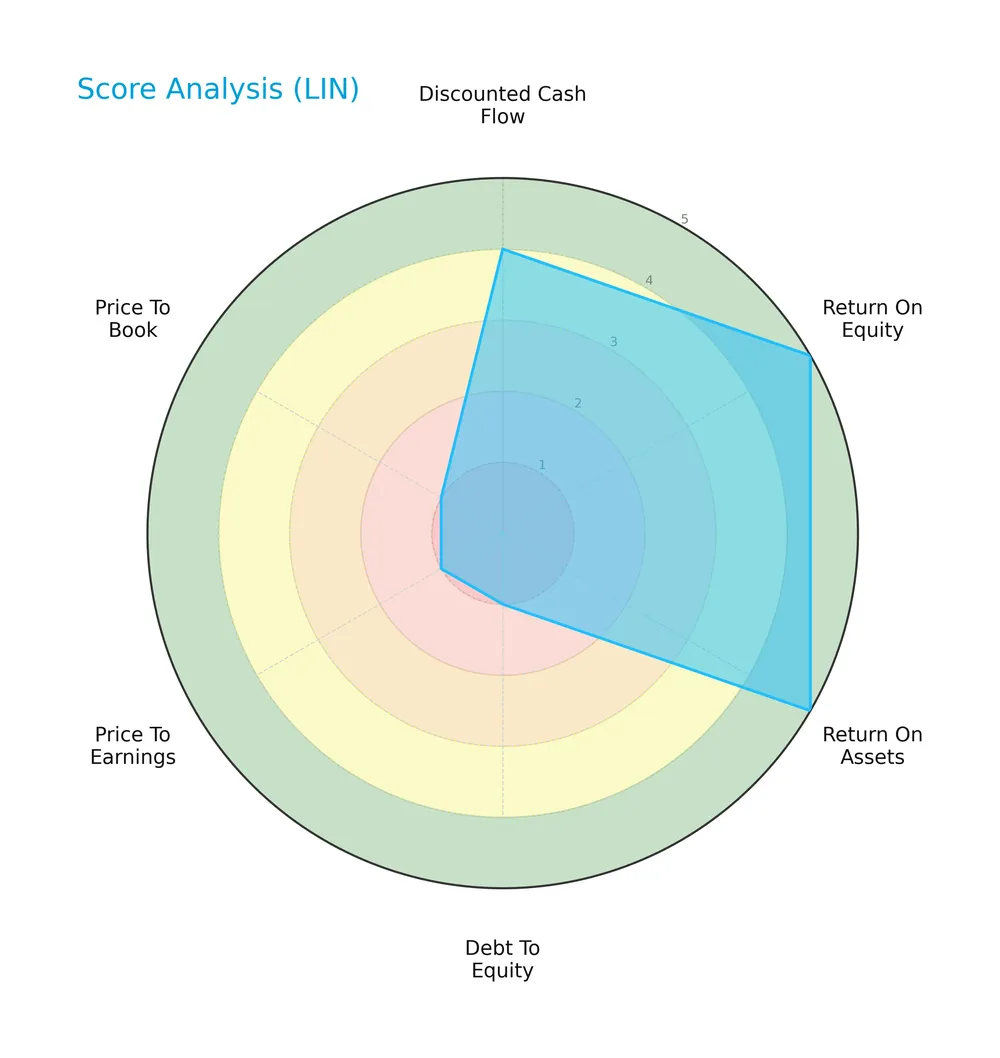

Score analysis

The radar chart below summarizes key financial metrics evaluating the company’s valuation, profitability, and leverage:

Linde plc scores very favorably on return on equity and assets, reflecting strong profitability. The discounted cash flow score is favorable, indicating solid intrinsic value. However, debt-to-equity, price-to-earnings, and price-to-book scores are very unfavorable, highlighting valuation and leverage concerns.

Analysis of the company’s bankruptcy risk

Linde plc’s Altman Z-Score places it well within the safe zone, indicating a low risk of bankruptcy and strong financial stability:

Is the company in good financial health?

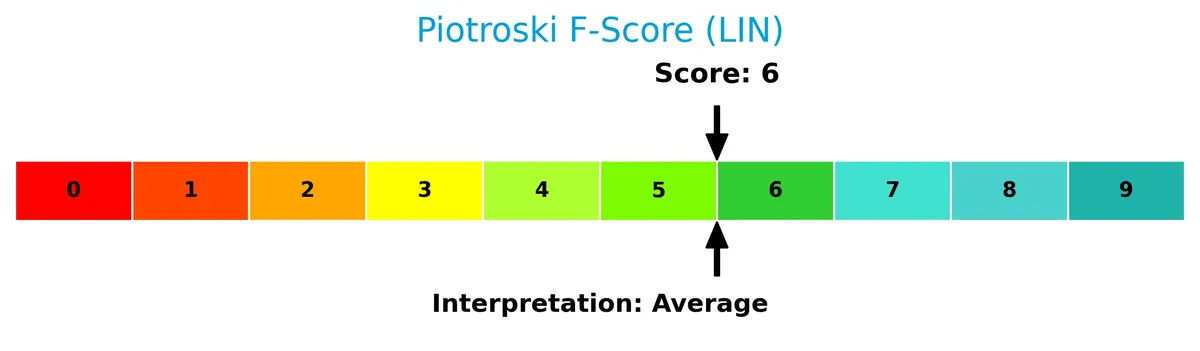

The Piotroski Score diagram shows the company’s financial health based on profitability, leverage, liquidity, and efficiency:

With a Piotroski Score of 6, Linde plc demonstrates average financial strength, suggesting moderate resilience but room for improvement in operational or financial efficiency.

Competitive Landscape & Sector Positioning

This section analyzes Linde plc’s strategic position, revenue segments, key products, and competitors within the specialty chemicals sector. I will assess whether Linde holds a competitive advantage over its industry peers.

Strategic Positioning

Linde plc maintains a diversified product portfolio, spanning atmospheric and process gases alongside engineering services. Its geographic exposure covers North and South America, Europe, Middle East, Africa, and Asia Pacific, with balanced revenue contributions across key markets like the US, Germany, China, and Brazil.

Revenue by Segment

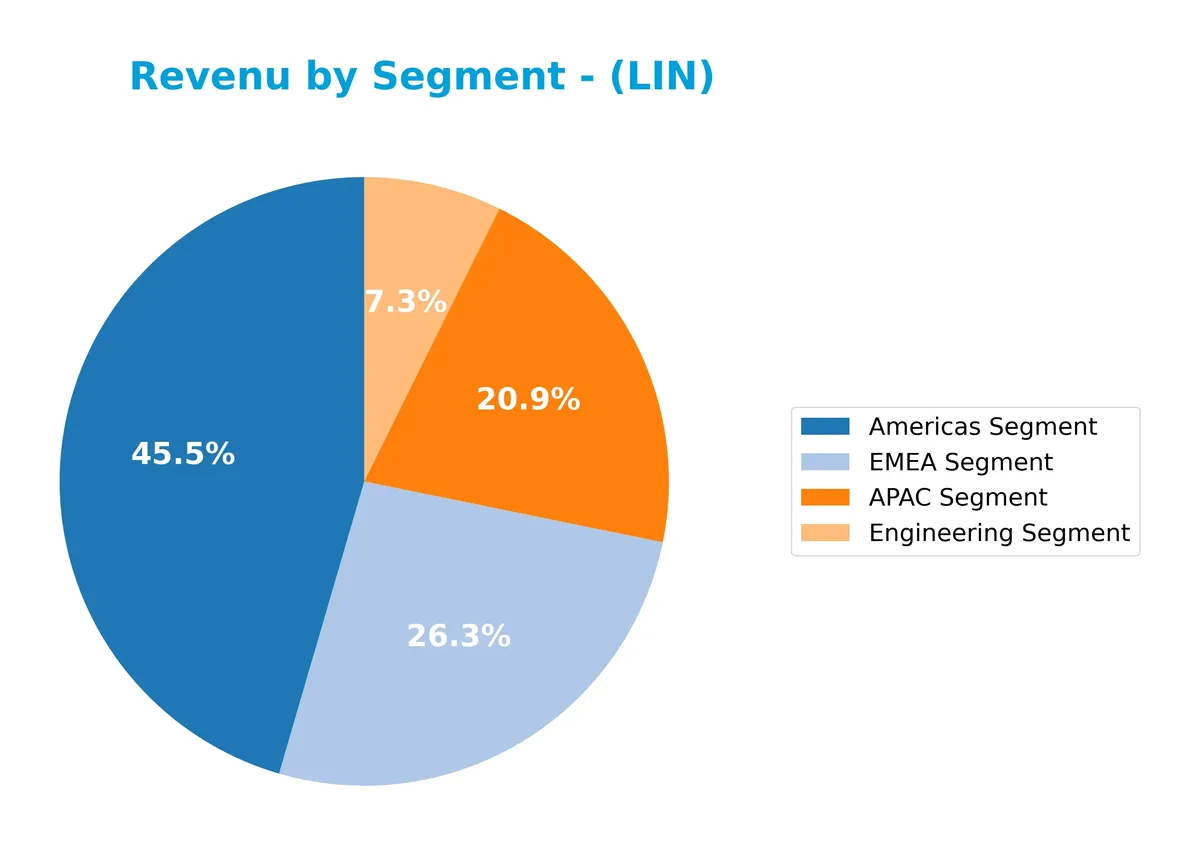

This pie chart illustrates Linde plc’s revenue distribution by segment for the fiscal year 2024, highlighting the key regional and business areas driving the company’s sales.

Linde’s Americas Segment leads with $14.4B in 2024, showing steady growth since 2019. The EMEA Segment follows at $8.4B, slightly down from 2023’s $8.5B, signaling a mild slowdown. APAC remains a solid contributor at $6.6B, reflecting consistent expansion in Asia-Pacific markets. Engineering revenue declined to $2.3B, indicating a strategic shift or project timing effects. The mix underscores regional diversity but growing concentration in the Americas.

Key Products & Brands

The table below summarizes Linde plc’s key products and brands across its main industrial gas and engineering segments:

| Product | Description |

|---|---|

| Atmospheric Gases | Oxygen, nitrogen, argon, and rare gases supplied for various industrial and healthcare uses. |

| Process Gases | Carbon dioxide, helium, hydrogen, electronic and specialty gases, and acetylene. |

| Engineering Segment | Design and construction of turnkey process plants, including air separation and hydrogen. |

| Regional Segments | Operations split into Americas, EMEA, and APAC regions serving diverse industrial customers. |

Linde’s core business combines atmospheric and process gases with engineering services. The company’s regional segments reflect its global footprint, addressing industries from healthcare to steelmaking with tailored gas solutions and plant construction expertise.

Main Competitors

There are 9 competitors in the Basic Materials sector, with the top 10 leaders by market capitalization listed below:

| Competitor | Market Cap. |

|---|---|

| Linde plc | 200B |

| The Sherwin-Williams Company | 81.5B |

| Ecolab Inc. | 74.5B |

| Air Products and Chemicals, Inc. | 55.8B |

| PPG Industries, Inc. | 23.4B |

| International Flavors & Fragrances Inc. | 17.4B |

| DuPont de Nemours, Inc. | 17.1B |

| Albemarle Corporation | 16.9B |

| LyondellBasell Industries N.V. | 14.3B |

Linde plc ranks 1st among its 9 competitors by market capitalization. It holds a market cap 7.1% above the top player benchmark. The company is well above both the average market cap of the top 10 competitors (56B) and the sector median (23.4B). Linde maintains a significant lead, with no competitor above it and a 163.5% gap to the next closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Linde plc have a competitive advantage?

Linde plc currently does not demonstrate a clear competitive advantage, as its ROIC barely trails the WACC, indicating value is not consistently created. However, the company’s profitability is improving with a growing ROIC trend from 2020 to 2024, signaling operational efficiency gains.

Looking ahead, Linde’s extensive geographic reach and diversified industrial gas offerings support expansion opportunities. The company’s engineering capabilities and presence in emerging markets position it for growth driven by new plant constructions and evolving industrial demand.

SWOT Analysis

This SWOT analysis highlights Linde plc’s core internal capabilities and external market conditions to guide strategic decisions.

Strengths

- strong global footprint

- diversified product portfolio

- favorable net margin and ROE

Weaknesses

- low current and quick ratios

- high valuation multiples (PE and PB)

- moderate asset turnover

Opportunities

- expanding industrial gas demand

- growth in emerging markets

- innovation in hydrogen and specialty gases

Threats

- raw material price volatility

- regulatory risks in multiple jurisdictions

- competitive pressure in specialty chemicals

Linde’s robust profitability and global scale provide a solid foundation. However, liquidity constraints and stretched valuation require caution. The company should leverage growth in emerging markets and clean energy while mitigating regulatory and supply risks.

Stock Price Action Analysis

The following weekly chart illustrates Linde plc’s stock price movements over the past 12 months:

Trend Analysis

Over the past 12 months, Linde plc’s stock price declined by 1.82%, indicating a neutral trend since the change falls between -2% and +2%. The trend shows acceleration with a high volatility level, reflected by a standard deviation of 19.06. The price ranged between 399.57 and 486.45 during this period.

Volume Analysis

Trading volume over the last three months shows a buyer-dominant pattern with 67.68% of activity attributed to buyers. Volume is increasing, signaling growing investor interest and positive market participation. This buyer-driven momentum suggests confidence in the stock during this recent period.

Target Prices

Analysts set a confident target consensus for Linde plc, reflecting robust expectations for the stock’s near-term performance.

| Target Low | Target High | Consensus |

|---|---|---|

| 490 | 516 | 500.33 |

The target range from 490 to 516 suggests moderate upside potential, with a consensus near 500 signaling steady market confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines key analyst ratings and consumer feedback to provide insight into Linde plc’s market perception.

Stock Grades

Here are the recent stock grades for Linde plc from established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-21 |

| RBC Capital | Maintain | Outperform | 2025-12-12 |

| UBS | Upgrade | Buy | 2025-11-11 |

| RBC Capital | Maintain | Outperform | 2025-11-06 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| Seaport Global | Upgrade | Buy | 2025-11-03 |

| B of A Securities | Maintain | Buy | 2025-11-03 |

| JP Morgan | Maintain | Overweight | 2025-11-03 |

| UBS | Maintain | Neutral | 2025-10-06 |

| Citigroup | Maintain | Buy | 2025-10-06 |

The majority of grades indicate strong confidence, with multiple upgrades to buy and consistent buy or outperform ratings. This pattern underscores a prevailing positive market sentiment towards the stock.

Consumer Opinions

Consumers express mixed sentiments about Linde plc, reflecting strong product reliability but some concerns over service responsiveness.

| Positive Reviews | Negative Reviews |

|---|---|

| Consistently reliable gas supply for operations | Customer service response times can lag |

| High-quality industrial gases with excellent purity | Pricing feels high compared to competitors |

| Strong safety standards and operational expertise | Occasional delays in delivery schedules |

Overall, customers praise Linde’s product quality and safety focus. However, recurring critiques target slower customer support and pricing pressure, signaling areas for operational improvement.

Risk Analysis

Below is a table summarizing key risks facing Linde plc, including their likelihood and potential impact on the business:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E (30.53) and P/B (5.26) ratios suggest overvaluation. | High | High |

| Liquidity Risk | Current ratio (0.89) and quick ratio (0.76) below 1 indicate tight liquidity. | Medium | Medium |

| Debt Risk | Moderate debt-to-equity (0.59) with favorable debt-to-assets (28.21%). | Medium | Medium |

| Market Volatility | Beta of 0.847 shows below-market volatility but some sensitivity. | Low | Medium |

| Operational Risk | Asset turnover (0.41) below industry benchmark signals inefficiency. | Medium | Medium |

Linde’s overvaluation risk is most concerning given its stretched multiples compared to sector peers. Tight liquidity ratios warrant caution in downturns. However, the company’s Altman Z-score (3.84) confirms financial stability. Operational inefficiencies and moderate leverage add to risk but remain manageable.

Should You Buy Linde plc?

Linde plc appears to be a moderately profitable company with improving operational efficiency and a slightly favorable moat supported by growing ROIC. Despite a challenging leverage profile, its overall rating of B suggests a very favorable investment quality, balanced with moderate financial risk.

Strength & Efficiency Pillars

Linde plc exhibits robust profitability with a net margin of 20.3% and a return on equity of 17.23%, signaling efficient management and solid earnings generation. Its Altman Z-score of 3.84 places it safely in the zone of financial stability, reducing bankruptcy risk. The company’s ROIC of 9.19% surpasses its WACC of 7.19%, confirming Linde as a clear value creator. A Piotroski score of 6 indicates average financial health, while interest coverage remains strong at 42.6, reflecting sound debt servicing ability.

Weaknesses and Drawbacks

Linde faces valuation headwinds with a high P/E of 30.53 and P/B of 5.26, suggesting the stock trades at a premium relative to earnings and book value. Liquidity ratios are concerning: a current ratio of 0.89 and quick ratio of 0.76 highlight short-term liquidity risk. Additionally, asset turnover at 0.41 signals inefficient asset use compared to sector peers. These factors, combined with moderately unfavorable debt-to-equity metrics, could pressure the stock during market volatility.

Our Verdict about Linde plc

Linde’s long-term fundamentals appear favorable, underpinned by strong profitability and value creation. Recent market trends are buyer-dominant, with a 67.68% buyer volume share, supporting positive momentum. The profile may appear attractive for long-term exposure, although premium valuation and liquidity risks suggest cautious position sizing. Investors could consider a measured approach while monitoring operational efficiency improvements.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Linde PLC (LIN) Q4 2025 Earnings Call Highlights: Record Performance Amidst Challenges – GuruFocus (Feb 05, 2026)

- Is Linde PLC Gaining or Losing Market Support? – Benzinga (Feb 05, 2026)

- Linde: Stock Remains A ‘Hold’ As I Missed The Perfect Buying Opportunity (NASDAQ:LIN) – Seeking Alpha (Feb 05, 2026)

- Linde (LIN) Q4 Earnings: Taking a Look at Key Metrics Versus Estimates – Yahoo Finance (Feb 05, 2026)

- Linde (LIN) Surpasses Q4 Earnings and Revenue Estimates – Nasdaq (Feb 05, 2026)

For more information about Linde plc, please visit the official website: linde.com