Home > Analyses > Industrials > Lincoln Electric Holdings, Inc.

Lincoln Electric Holdings, Inc. powers the backbone of modern manufacturing with cutting-edge welding and automation technologies. Its global footprint spans industrial fabrication, energy, and transportation sectors, driven by innovative products like robotic welding packages and plasma cutters. Renowned for quality and reliability, Lincoln Electric shapes how industries build and repair critical infrastructure. As market dynamics evolve, I ask whether Lincoln’s robust fundamentals continue to justify its premium valuation and growth prospects.

Table of contents

Business Model & Company Overview

Lincoln Electric Holdings, Inc. is a Cleveland-based leader in manufacturing tools and accessories with a legacy dating back to 1895. It operates a cohesive ecosystem of welding, cutting, and brazing solutions, spanning power sources, automation systems, and consumables. The company’s presence spans diverse industries from automotive to heavy fabrication, serving global markets with precision and innovation.

Its revenue engine balances hardware sales with recurring consumables and integrated automation services, driving steady cash flow. Lincoln Electric commands strong positions across the Americas, Europe, and Asia through direct and distributor channels. This broad footprint and integrated product suite form a durable economic moat, reinforcing its role as a pivotal force shaping industrial manufacturing’s future.

Financial Performance & Fundamental Metrics

I will analyze Lincoln Electric Holdings, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and shareholder value.

Income Statement

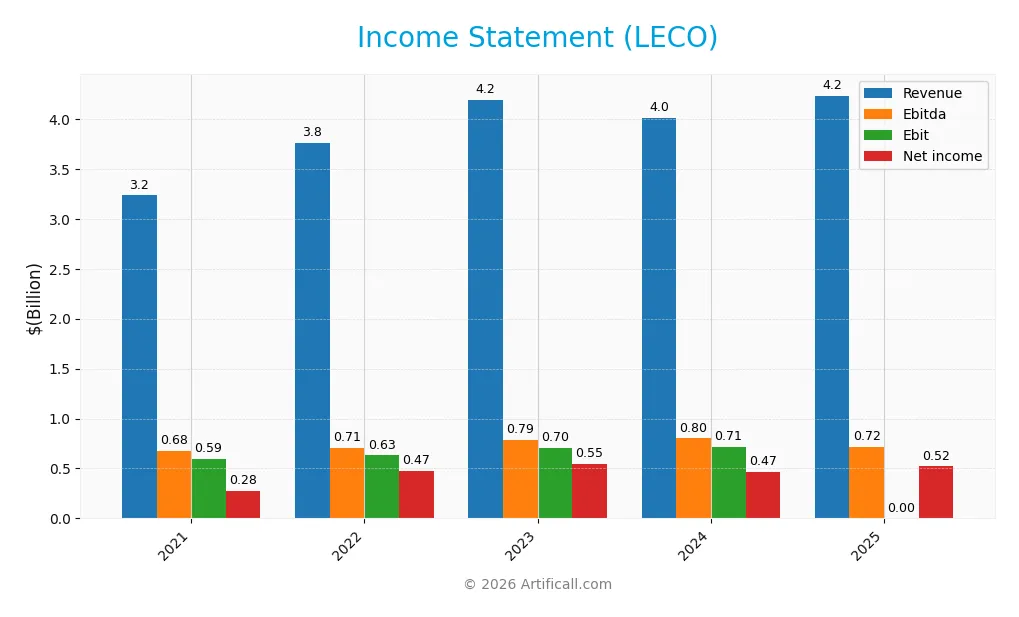

This table summarizes Lincoln Electric Holdings, Inc.’s key income statement metrics over the past five fiscal years, reflecting revenue, expenses, profitability, and EPS trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 3.23B | 3.76B | 4.19B | 4.01B | 4.23B |

| Cost of Revenue | 2.17B | 2.48B | 2.71B | 2.53B | 2.70B |

| Operating Expenses | 607M | 668M | 760M | 841M | 798M |

| Gross Profit | 1.07B | 1.28B | 1.48B | 1.48B | 1.53B |

| EBITDA | 675M | 708M | 789M | 801M | 718M |

| EBIT | 594M | 630M | 703M | 712M | N/A |

| Interest Expense | 22M | 30M | 44M | 43M | 52M |

| Net Income | 277M | 472M | 545M | 466M | 521M |

| EPS | 4.66 | 8.14 | 9.51 | 8.23 | 9.39 |

| Filing Date | 2022-02-18 | 2023-02-21 | 2024-02-27 | 2025-02-26 | 2026-02-12 |

Income Statement Evolution

Lincoln Electric Holdings, Inc. shows steady revenue growth, rising 5.6% in 2025 and 30.9% over five years. Net income increased 5.76% in 2025 and 88.2% overall. Gross margin remains stable around 36%, supporting consistent profitability. However, EBIT margin dropped sharply to zero in 2025, indicating operational challenges despite higher revenue and net income.

Is the Income Statement Favorable?

The 2025 income statement reveals solid fundamentals with a 12.3% net margin and favorable interest expense ratio at 1.22%. EPS grew 14.4%, reflecting efficient capital allocation. Yet, the absence of EBIT suggests operating income volatility. Overall, 71% of income metrics are positive, signaling generally favorable income statement health, though EBIT weakness warrants attention.

Financial Ratios

The table below presents key financial ratios for Lincoln Electric Holdings, Inc. (LECO) over the 2021–2025 fiscal years, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 8.6% | 12.6% | 13.0% | 11.6% | 12.3% |

| ROE | 32.0% | 45.7% | 41.7% | 35.1% | 0.0% |

| ROIC | 20.7% | 20.1% | 21.6% | 18.1% | 0.0% |

| P/E | 29.9 | 17.8 | 22.9 | 22.8 | 25.5 |

| P/B | 9.6 | 8.1 | 9.5 | 8.0 | 0.0 |

| Current Ratio | 1.7 | 1.8 | 2.2 | 1.9 | 0.0 |

| Quick Ratio | 1.0 | 1.0 | 1.5 | 1.3 | 0.0 |

| D/E | 0.95 | 1.21 | 0.89 | 0.99 | 0.0 |

| Debt-to-Assets | 31.6% | 39.3% | 34.3% | 37.4% | 0.0% |

| Interest Coverage | 20.8 | 20.8 | 16.2 | 14.9 | 13.9 |

| Asset Turnover | 1.25 | 1.18 | 1.24 | 1.14 | 0.0 |

| Fixed Asset Turnover | 5.78 | 6.38 | 6.67 | 6.47 | 0.0 |

| Dividend Yield | 1.47% | 1.56% | 1.19% | 1.53% | 1.25% |

Note: Zero values indicate data not reported or unavailable for 2025.

Evolution of Financial Ratios

Lincoln Electric’s Return on Equity (ROE) shows no data for 2025, impairing trend analysis. The Current Ratio dropped to zero in 2025 from a stable 1.7–2.2 range previously. Debt-to-Equity Ratio also reported zero in 2025, after fluctuating near 1.0 before. Profitability margins remained fairly stable, with net profit margin around 12% in 2025.

Are the Financial Ratios Favorable?

In 2025, profitability shows a favorable net margin of 12.3%, but ROE and ROIC are unavailable, limiting insight on capital efficiency. Liquidity ratios, including Current and Quick Ratios, are unfavorable due to zero values. Leverage appears favorable with zero debt ratios reported, but interest coverage and asset turnover are unfavorable or missing. Dividend yield is neutral at 1.25%. Overall, the ratios lean toward an unfavorable assessment.

Shareholder Return Policy

Lincoln Electric Holdings, Inc. maintains a dividend payout ratio around 27-35%, with a steady dividend per share increase from $2.05 in 2021 to $3 in 2025. The dividend yield ranges between 1.18% and 1.56%, supported by consistent free cash flow coverage.

The company also executes share buybacks, complementing dividends to return capital. This balanced approach indicates a disciplined capital allocation strategy, underpinning sustainable shareholder value creation without overextending financial resources.

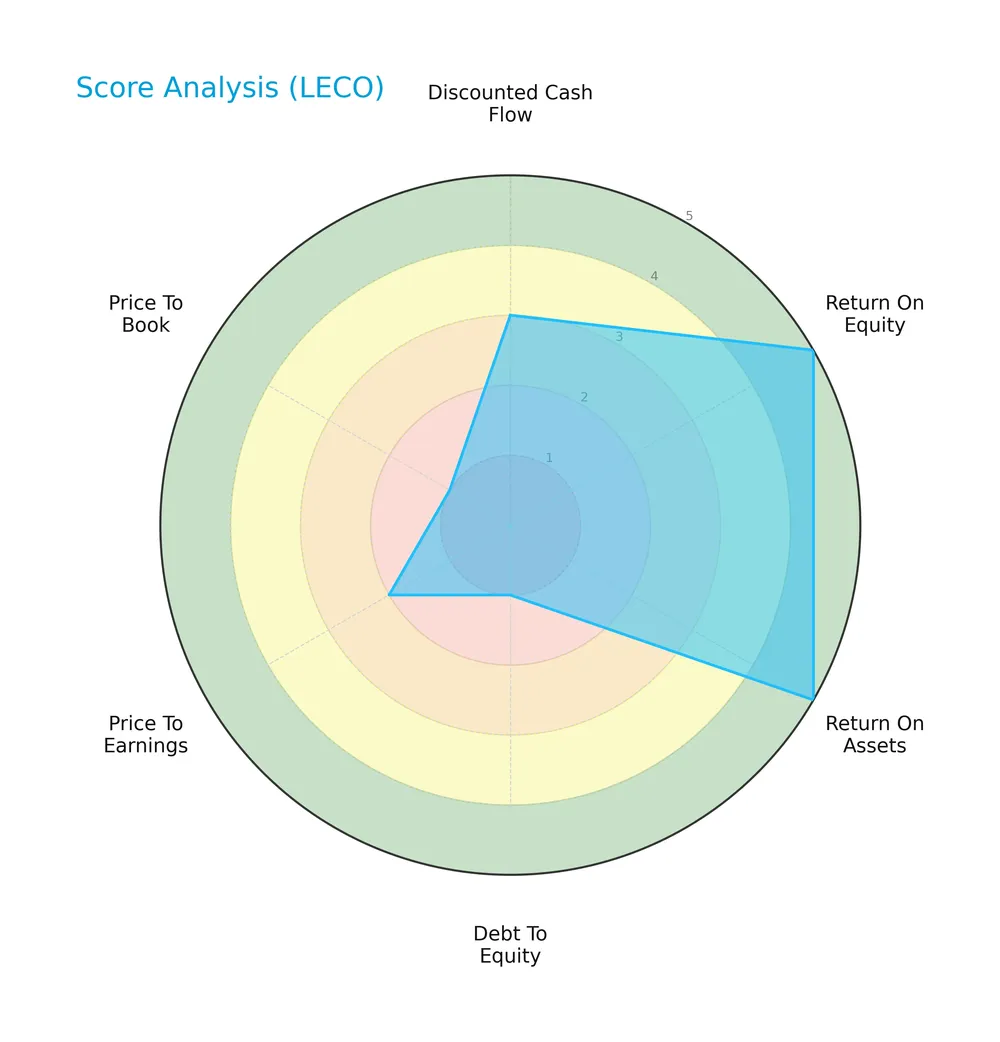

Score analysis

Here is a radar chart illustrating the company’s performance across key financial metrics:

Lincoln Electric Holdings scores very favorably on return on equity and assets, indicating strong profitability. However, its debt-to-equity and price-to-book ratios are very unfavorable, signaling leverage and valuation concerns. Overall, the scores reflect a moderate profile.

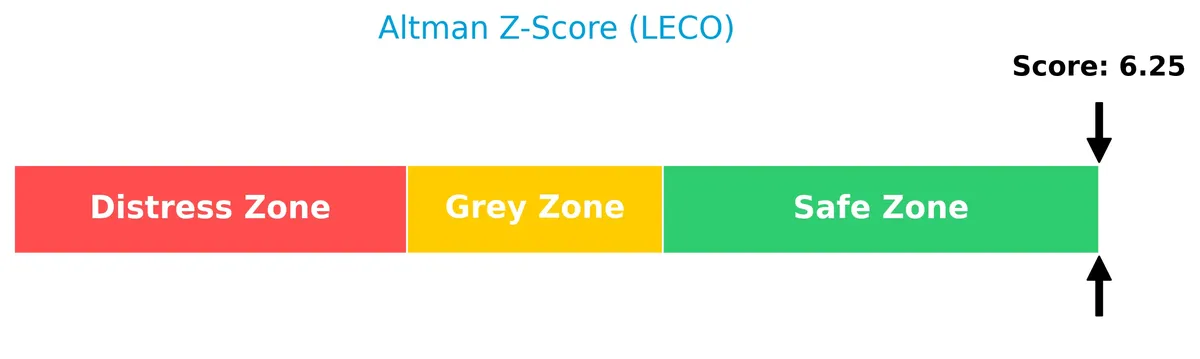

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company comfortably in the safe zone, suggesting very low bankruptcy risk:

Is the company in good financial health?

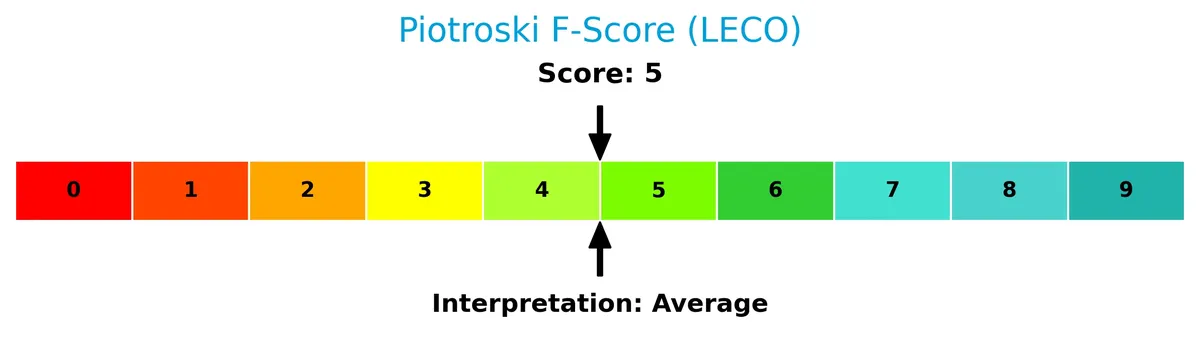

The Piotroski Score diagram presents the company’s financial health status clearly:

With a Piotroski Score of 5, Lincoln Electric Holdings demonstrates average financial strength. This indicates moderate operational efficiency and profitability, but room remains for improvement to reach strong health.

Competitive Landscape & Sector Positioning

This section examines Lincoln Electric Holdings, Inc.’s strategic position within the manufacturing tools and accessories sector. I will analyze revenue streams, key products, and main competitors. I aim to determine whether Lincoln Electric holds a sustainable competitive advantage over its peers.

Strategic Positioning

Lincoln Electric Holdings maintains a diversified product portfolio across welding, cutting, and brazing, with three segments generating $2.7B Americas, $970M International, and $520M Harris Products Group revenues in 2024. Its geographic exposure balances $2.35B U.S. sales with $1.65B from foreign markets, reflecting a broad industrial footprint.

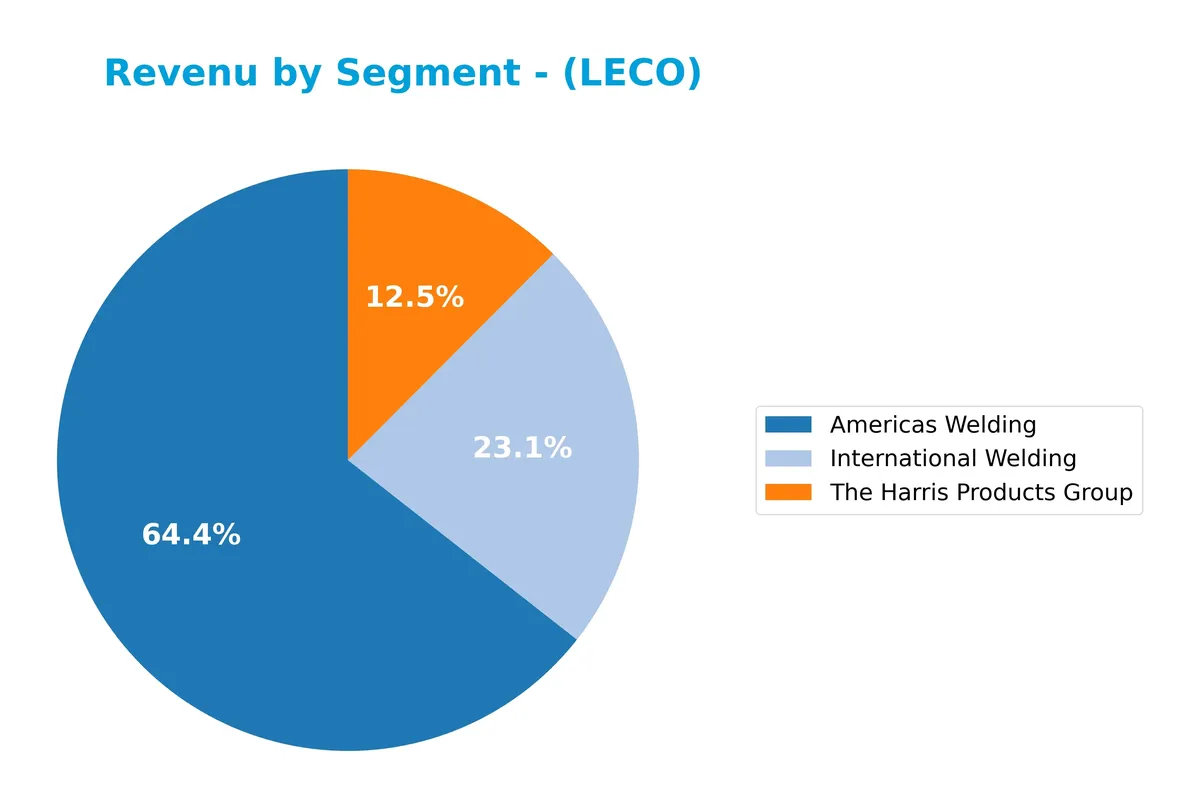

Revenue by Segment

The pie chart displays Lincoln Electric Holdings, Inc.’s revenue distribution by segment for fiscal year 2024, highlighting the company’s primary business drivers.

The Americas Welding segment leads with $2.7B, followed by International Welding at $970M and The Harris Products Group at $520M. Americas Welding shows slight contraction from 2023’s $2.78B, signaling a mild slowdown. International Welding declines more notably from $1.07B, indicating regional challenges. The Harris Products Group grows modestly, balancing segment concentration risks amid evolving market dynamics.

Key Products & Brands

Lincoln Electric Holdings offers a broad portfolio of welding and cutting products across three main segments:

| Product | Description |

|---|---|

| Americas Welding | Welding products including arc welding power sources, wire feeding systems, robotic welding packages, and consumables for the Americas region. |

| International Welding | Welding and cutting equipment and consumables marketed outside the Americas, covering global industrial needs. |

| The Harris Products Group | Products for oxy-fuel welding, cutting, brazing, including regulators, torches, and specialty consumables. |

Lincoln Electric’s product range spans essential welding and cutting solutions with strong geographic segmentation. Its diversified portfolio supports multiple industrial applications worldwide.

Main Competitors

There are 3 competitors in total; below are the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Snap-on Incorporated | 18.3B |

| Lincoln Electric Holdings, Inc. | 13.2B |

| Stanley Black & Decker, Inc. | 11.8B |

Lincoln Electric Holdings ranks 2nd among its competitors with a market cap 88.1% that of the leader, Snap-on Incorporated. It stands above both the average market cap of the top 10 and the sector median. The company is 13.5% below Snap-on, showing a notable but manageable gap to the closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does LECO have a competitive advantage?

Lincoln Electric Holdings, Inc. shows mixed signals on competitive advantage. It delivers favorable gross and net margins, but EBIT margin and ROIC trends indicate challenges in sustaining value creation.

Looking ahead, LECO’s global footprint and diversified welding product lines position it for growth. Expansion into automation and new markets may offer fresh opportunities despite recent operational margin pressures.

SWOT Analysis

This SWOT analysis highlights Lincoln Electric Holdings, Inc.’s core competitive factors and risks to inform strategic decisions.

Strengths

- strong global brand

- diverse welding product portfolio

- steady revenue growth over 5 years

Weaknesses

- declining ROIC trend

- unfavorable EBIT margin

- weak liquidity ratios

Opportunities

- expanding international markets

- automation and robotic welding growth

- rising infrastructure spending

Threats

- intense manufacturing competition

- raw material cost volatility

- economic cyclicality impact

Lincoln Electric’s strengths in brand and product diversity support stable growth despite operational challenges. The company must address profitability and liquidity weaknesses while capitalizing on automation and global expansion to mitigate competitive and economic risks.

Stock Price Action Analysis

The weekly stock chart below illustrates Lincoln Electric Holdings, Inc.’s price movements and volatility over the past 100 weeks:

Trend Analysis

Over the past 100 weeks, LECO’s stock price increased by 13.81%, indicating a bullish trend with acceleration. The price ranged from a low of 172.02 to a high of 298.88. Volatility remains elevated, with a standard deviation of 26.69%, reflecting significant price fluctuations.

Volume Analysis

Trading volume over the last three months shows a steady increase, with buyers holding a slight edge at 52.93%. Buyer activity is neutral, suggesting balanced investor sentiment and stable market participation in this period.

Target Prices

Analysts present a confident target consensus for Lincoln Electric Holdings, Inc. (LECO).

| Target Low | Target High | Consensus |

|---|---|---|

| 208 | 340 | 297.5 |

The target range suggests strong upside potential, with most analysts expecting LECO to trade near $298. This reflects solid confidence in the company’s growth trajectory.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback concerning Lincoln Electric Holdings, Inc. (LECO).

Stock Grades

Here are the latest verified analyst grades for Lincoln Electric Holdings, Inc. from reputable firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Hold | 2026-02-13 |

| Keybanc | Maintain | Overweight | 2026-02-13 |

| Barclays | Maintain | Overweight | 2026-02-13 |

| Roth Capital | Maintain | Buy | 2026-02-03 |

| Barclays | Maintain | Overweight | 2026-01-23 |

| Stifel | Maintain | Hold | 2026-01-23 |

| Morgan Stanley | Maintain | Underweight | 2026-01-12 |

| Stifel | Maintain | Hold | 2025-12-16 |

| Stifel | Maintain | Hold | 2025-10-31 |

| Barclays | Maintain | Overweight | 2025-10-20 |

The consensus reveals a stable outlook with most firms maintaining positions. Overweight and Hold ratings dominate, reflecting cautious optimism amid no major rating shifts.

Consumer Opinions

Consumer sentiment around Lincoln Electric Holdings, Inc. (LECO) reflects a mix of admiration for product quality and concerns over pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “Durable welding equipment that lasts years.” | “Higher price point compared to competitors.” |

| “Excellent customer support and technical advice.” | “Longer delivery times during peak seasons.” |

| “Innovative technology that boosts productivity.” | “Occasional issues with replacement parts availability.” |

Overall, consumers praise LECO’s robust product quality and strong customer service. However, pricing and supply chain delays emerge as consistent pain points.

Risk Analysis

Below is a table summarizing Lincoln Electric Holdings, Inc.’s key risks, their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Weak liquidity ratios (current and quick ratios at 0) signal cash flow constraints. | High | High |

| Valuation | Elevated P/E of 25.5 compared to industry averages may limit upside. | Medium | Medium |

| Leverage | Favorable debt metrics but very low interest coverage poses refinancing risk if rates rise. | Medium | High |

| Profitability | Solid net margin (12.3%) but zero ROE and ROIC indicate inefficient capital use. | Medium | Medium |

| Market Volatility | Beta of 1.27 implies stock price swings exceed market, increasing volatility risk. | High | Medium |

| Operational | Exposure to cyclical manufacturing sectors could impact revenue in downturns. | Medium | Medium |

The most pressing risks are liquidity constraints and leverage challenges. The zero current and quick ratios are red flags in a capital-intensive sector. Despite a strong Altman Z-score placing LECO in a safe zone, inefficient capital allocation reflected in zero ROE/ROIC warrants caution. The stock’s beta above 1.2 means investors should brace for increased volatility relative to the S&P 500.

Should You Buy Lincoln Electric Holdings, Inc.?

Lincoln Electric appears to be a robustly profitable company with strong operational efficiency, supported by a solid Altman Z-Score signaling financial safety. Despite a declining moat and a challenging leverage profile, its overall rating stands at a very favorable B, suggesting a cautiously positive investment profile.

Strength & Efficiency Pillars

Lincoln Electric Holdings, Inc. delivers solid operational performance with a gross margin of 36.25% and a net margin of 12.3%, reflecting efficient cost control and profitability. Despite an unfavorable ROE and ROIC reported at 0%, the company’s interest expense remains low at 1.22%, supporting operational stability. The Altman Z-Score of 6.25 firmly places Lincoln Electric in the safe zone, underscoring a robust solvency profile. These factors collectively suggest strength in core operations, though value creation metrics like ROIC versus WACC remain unavailable for deeper assessment.

Weaknesses and Drawbacks

While Lincoln Electric enjoys financial safety, several valuation and liquidity red flags persist. The price-to-earnings ratio stands at 25.51, marking an unfavorable premium that may pressure future returns. Liquidity ratios, including current and quick ratios, are reported as 0, signaling potential short-term solvency concerns. Debt-to-equity metrics appear favorable, but the interest coverage ratio is 0.0, indicating vulnerability to rising interest costs. Market activity reveals balanced buyer dominance at 52.93%, suggesting neutral investor sentiment but limited momentum.

Our Final Verdict about Lincoln Electric Holdings, Inc.

Lincoln Electric’s profile appears fundamentally stable with a strong solvency position highlighted by a safe Altman Z-Score. Despite operational strengths and a bullish overall trend, valuation and liquidity weaknesses suggest cautious optimism. The neutral buyer dominance and elevated P/E ratio may warrant a wait-and-see approach before committing new capital. This stock might appear suitable for investors seeking exposure to stable operations but wary of short-term financial risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Lincoln Electric (LECO) Margin Expansion Reinforces Bullish Automation Narrative Despite Premium Valuation – simplywall.st (Feb 13, 2026)

- 29,200 Shares in Lincoln Electric Holdings, Inc. $LECO Bought by ING Groep NV – MarketBeat (Feb 13, 2026)

- Lincoln Electric Holdings, Inc. (NASDAQ:LECO) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 13, 2026)

- Lincoln Electric Holdings (LECO) Tops Q4 Earnings Estimates – Yahoo Finance (Feb 12, 2026)

- These Analysts Raise Their Forecasts On Lincoln Electric Following Q4 Results – Benzinga (Feb 13, 2026)

For more information about Lincoln Electric Holdings, Inc., please visit the official website: lincolnelectric.com