Home > Analyses > Healthcare > Labcorp Holdings Inc.

Labcorp Holdings transforms healthcare by delivering critical laboratory insights that guide millions of medical decisions daily. As a titan in medical equipment and services, it drives innovation through comprehensive testing solutions trusted by doctors, hospitals, and researchers alike. Its reputation for quality and scale shapes industry standards and patient outcomes. Yet, as markets evolve, I ask: does Labcorp’s current financial strength justify its lofty valuation and growth prospects ahead?

Table of contents

Business Model & Company Overview

Labcorp Holdings Inc., founded in 2024 and headquartered in Burlington, NC, stands as a leading force in the Medical – Equipment & Services sector. With a workforce of 60K employees, Labcorp delivers an integrated laboratory services ecosystem that supports doctors, hospitals, pharmaceutical firms, and researchers. This cohesive network enables clear, confident medical decisions at every stage of patient care and clinical research.

The company’s revenue engine balances extensive testing services with advanced diagnostics, catering to a global client base across the Americas, Europe, and Asia. Labcorp’s strategic footprint in healthcare analytics and pharmaceutical trials underpins steady recurring revenue streams. Its strong market position and broad service portfolio create a durable economic moat, shaping the future of diagnostic innovation worldwide.

Financial Performance & Fundamental Metrics

I analyze Labcorp Holdings Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core profitability and shareholder returns.

Income Statement

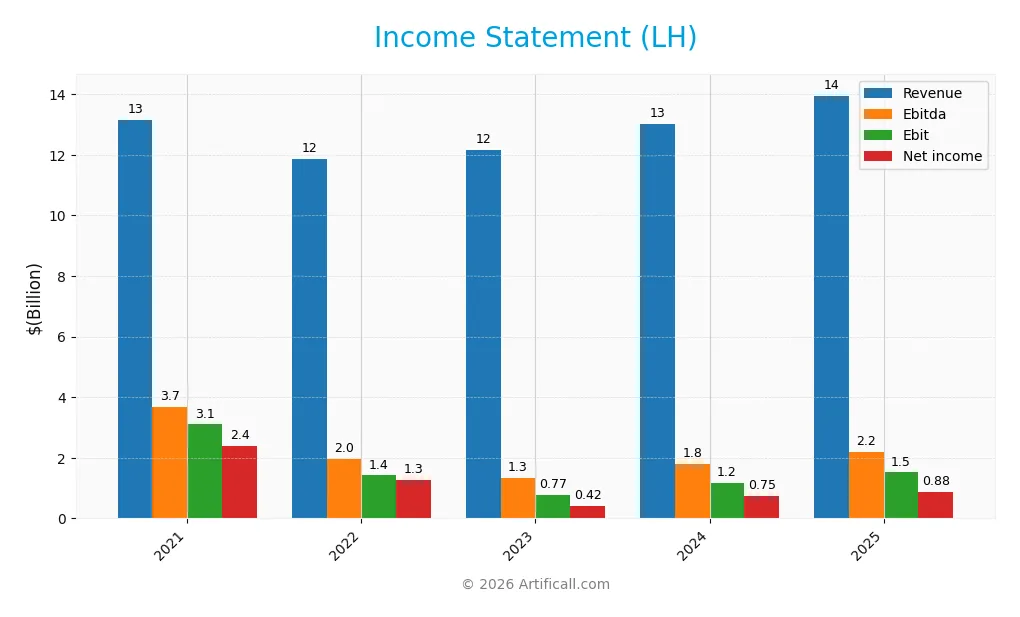

The table below summarizes Labcorp Holdings Inc.’s key income statement items for fiscal years 2021 through 2025, reflecting revenue, expenses, and profitability metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 13.1B | 11.9B | 12.2B | 13.0B | 13.9B |

| Cost of Revenue | 8.1B | 8.2B | 8.8B | 9.4B | 9.9B |

| Operating Expenses | 1.9B | 2.3B | 2.6B | 2.5B | 2.2B |

| Gross Profit | 5.0B | 3.7B | 3.4B | 3.6B | 4.0B |

| EBITDA | 3.7B | 2.0B | 1.3B | 1.8B | 2.2B |

| EBIT | 3.1B | 1.4B | 0.8B | 1.2B | 1.5B |

| Interest Expense | 212M | 180M | 200M | 208M | 224M |

| Net Income | 2.4B | 1.3B | 418M | 746M | 877M |

| EPS | 24.58 | 14.04 | 4.80 | 8.89 | 10.54 |

| Filing Date | 2022-02-25 | 2023-02-28 | 2024-02-26 | 2025-02-25 | 2026-01-29 |

Income Statement Evolution

Labcorp Holdings’ revenue showed steady growth, averaging 6.21% annually from 2021 to 2025, with recent one-year growth at 7.25%. However, net income declined sharply by 63.13% over the period, despite a 9.55% net margin improvement in the last year. Gross margins remained stable and favorable, reflecting controlled cost of revenue.

Is the Income Statement Favorable?

In 2025, Labcorp reported a 13.95B revenue and 877M net income, yielding a 6.28% net margin. EBIT margin at 10.87% and controlled interest expense at 1.61% of revenue indicate operational efficiency. The 29.83% EBIT growth and 18.33% EPS rise over one year support a fundamentally favorable income statement, despite longer-term net income headwinds.

Financial Ratios

The table below summarizes Labcorp Holdings Inc.’s key financial ratios for the fiscal years 2021 through 2025:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 18.1% | 10.8% | 3.4% | 5.7% | 6.3% |

| ROE | 23.1% | 12.7% | 5.3% | 9.3% | 10.2% |

| ROIC | 13.0% | 6.6% | 3.3% | 5.2% | 7.4% |

| P/E | 11.0 | 14.4 | 47.4 | 25.8 | 23.8 |

| P/B | 2.54 | 1.83 | 2.51 | 2.39 | 2.42 |

| Current Ratio | 1.92 | 1.50 | 1.17 | 1.44 | 1.42 |

| Quick Ratio | 1.77 | 1.35 | 1.02 | 1.30 | 1.23 |

| D/E | 0.62 | 0.62 | 0.76 | 0.90 | 0.76 |

| Debt-to-Assets | 31.1% | 31.0% | 35.6% | 39.6% | 35.5% |

| Interest Coverage | 14.4x | 8.0x | 3.6x | 5.2x | 6.8x |

| Asset Turnover | 0.64 | 0.59 | 0.73 | 0.71 | 0.76 |

| Fixed Asset Turnover | 4.67 | 4.25 | 4.18 | 4.27 | 4.53 |

| Dividend Yield | 0.0% | 1.06% | 1.28% | 1.26% | 1.15% |

Evolution of Financial Ratios

Labcorp’s Return on Equity (ROE) declined from 23.14% in 2021 to 10.17% in 2025, reflecting reduced profitability. The Current Ratio softened from 1.92 in 2021 to 1.42 in 2025, indicating a moderate drop in liquidity. Debt-to-Equity remained stable around 0.76, showing consistent leverage management over the period.

Are the Financial Ratios Favorable?

In 2025, profitability ratios like net margin (6.28%) and ROE (10.17%) are neutral, suggesting modest returns. Liquidity ratios are mixed: the quick ratio (1.23) is favorable, but the current ratio (1.42) is neutral. Leverage metrics, including debt-to-equity (0.76) and debt-to-assets (35.48%), are neutral. Efficiency measures show a favorable fixed asset turnover (4.53) but neutral asset turnover (0.76). The overall ratio profile appears slightly favorable.

Shareholder Return Policy

Labcorp Holdings Inc. maintains a consistent dividend policy with a payout ratio around 27-32% and a dividend yield near 1.1-1.3%. The dividend per share has risen steadily from $2.14 in 2022 to $2.89 in 2025, supported by free cash flow coverage exceeding 70%. The company also funds dividends alongside capital expenditures with a coverage ratio above 2.4, indicating prudent financial management.

The presence of share buybacks is not explicitly stated, but dividend sustainability appears solid given the stable net profit margins near 6%. This disciplined payout approach balances shareholder returns and reinvestment capacity. It supports sustainable long-term value creation by avoiding excessive distributions or aggressive repurchases that could strain cash flows or capital structure.

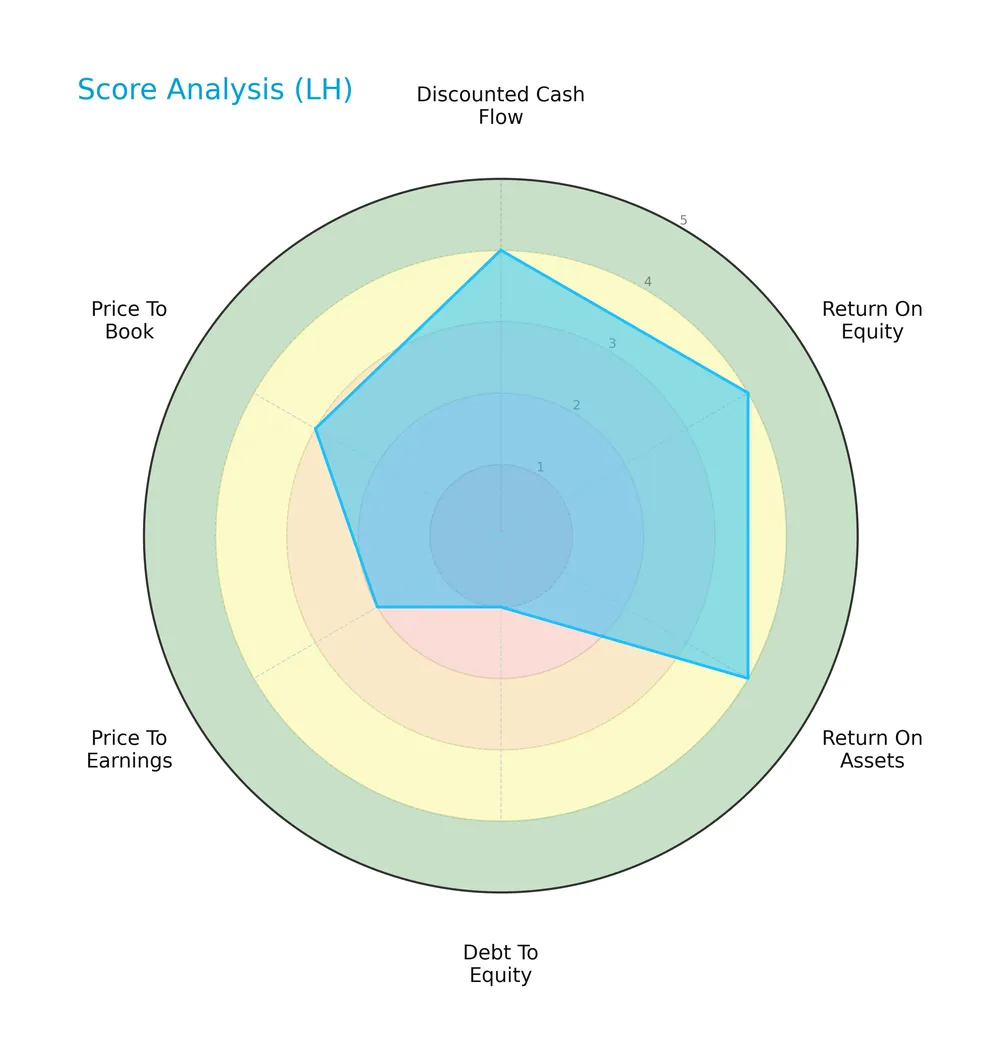

Score analysis

The radar chart below highlights Labcorp Holdings Inc.’s performance across key financial metrics:

Labcorp scores well on discounted cash flow, return on equity, and return on assets, each marked favorable. Debt to equity is very unfavorable, indicating leverage concerns. Price-to-earnings is also unfavorable, while price-to-book is moderate.

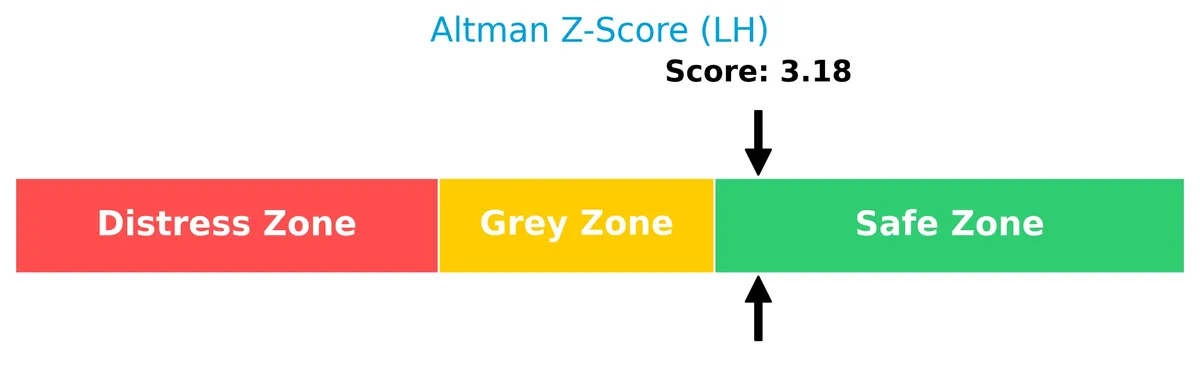

Analysis of the company’s bankruptcy risk

Labcorp’s Altman Z-Score places it safely above the distress threshold, indicating low bankruptcy risk:

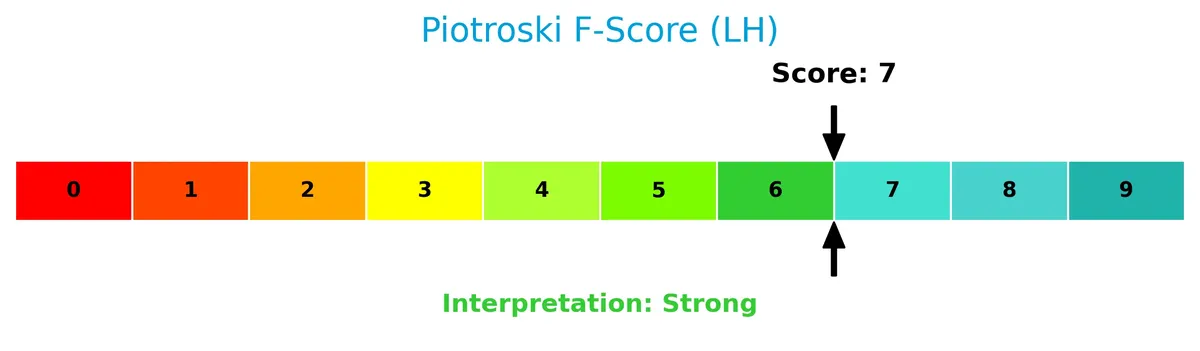

Is the company in good financial health?

The Piotroski diagram illustrates Labcorp’s strong financial health based on nine fundamental criteria:

With a score of 7, Labcorp demonstrates solid profitability, liquidity, and operational efficiency, signaling robust financial stability for investors.

Competitive Landscape & Sector Positioning

This sector analysis explores Labcorp Holdings Inc.’s strategic positioning, revenue streams, and key products. I will assess whether Labcorp holds a competitive advantage over its main competitors.

Strategic Positioning

Labcorp Holdings concentrates on laboratory services with a dominant diagnostics segment generating over $10B in 2024. Its drug development business, once significant, has diminished notably. Geographically, North America drives most revenue, exceeding $13B in 2021, while Europe and other regions contribute modestly.

Revenue by Segment

This pie chart presents Labcorp Holdings Inc.’s revenue breakdown by segment for fiscal year 2024, illustrating the distribution of income sources across its business units.

Labcorp Diagnostics dominates the revenue mix with $10.1B in 2024, showing steady growth from prior years. The Covance Drug Development segment, significant in earlier years, is absent in 2024 data, indicating a strategic shift or reclassification. Historically, Diagnostics has been the core driver, consistently outperforming Drug Development. The recent concentration of revenue in a single segment raises concentration risk but highlights Labs’ focused expertise in diagnostics.

Key Products & Brands

Labcorp’s core offerings and brands span diagnostics and drug development services as detailed below:

| Product | Description |

|---|---|

| LabCorp Diagnostics | Comprehensive clinical laboratory testing services supporting physicians, hospitals, and patients. |

| Covance Drug Development | Drug development services including preclinical and clinical testing for pharmaceutical companies. |

Labcorp’s revenue predominantly derives from its LabCorp Diagnostics segment, offering broad clinical testing. Covance Drug Development complements this with specialized pharmaceutical testing services. The company’s focus on diagnostics and drug development anchors its position in medical equipment and services.

Main Competitors

Labcorp Holdings Inc. faces competition from 64 companies in its sector, with the following top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eli Lilly and Company | 970B |

| Johnson & Johnson | 500B |

| AbbVie Inc. | 405B |

| UnitedHealth Group Incorporated | 305B |

| AstraZeneca PLC | 285B |

| Merck & Co., Inc. | 268B |

| Thermo Fisher Scientific Inc. | 225B |

| Abbott Laboratories | 216B |

| Intuitive Surgical, Inc. | 201B |

| Amgen Inc. | 176B |

Labcorp Holdings ranks 41st among 64 competitors. Its market cap is only 2.36% of the sector leader, Eli Lilly. Labcorp sits below both the average market cap of the top 10 (355B) and the sector median (38B). The distance to its next closest competitor above is a narrow +0.86%, indicating a tight cluster just ahead.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does LH have a competitive advantage?

Labcorp Holdings Inc. currently lacks a competitive advantage, as its ROIC is below WACC, indicating value is being shed and profitability is declining. This slightly unfavorable moat signals inefficiencies in capital use and weakening returns.

Looking ahead, Labcorp’s expanding presence in Europe and North America suggests growth opportunities in laboratory services. Continued innovation and geographic expansion may improve margins and operational efficiency in the evolving healthcare sector.

SWOT Analysis

This analysis identifies Labcorp Holdings Inc.’s key internal and external factors to inform strategic decisions.

Strengths

- Strong market position in medical lab services

- Favorable gross and EBIT margins

- High interest coverage ratio

Weaknesses

- Declining ROIC indicating value erosion

- Net income and EPS down over period

- Moderate debt-to-equity concerns

Opportunities

- Expansion in North American and European markets

- Growing demand for diagnostic services

- Innovation in personalized medicine testing

Threats

- Intense competition in healthcare diagnostics

- Regulatory changes in healthcare policies

- Economic downturn impacting discretionary spending

Labcorp benefits from solid operational margins and market reach but faces profitability pressure and debt risks. Strategic focus should emphasize innovation and geographic growth while managing financial leverage prudently.

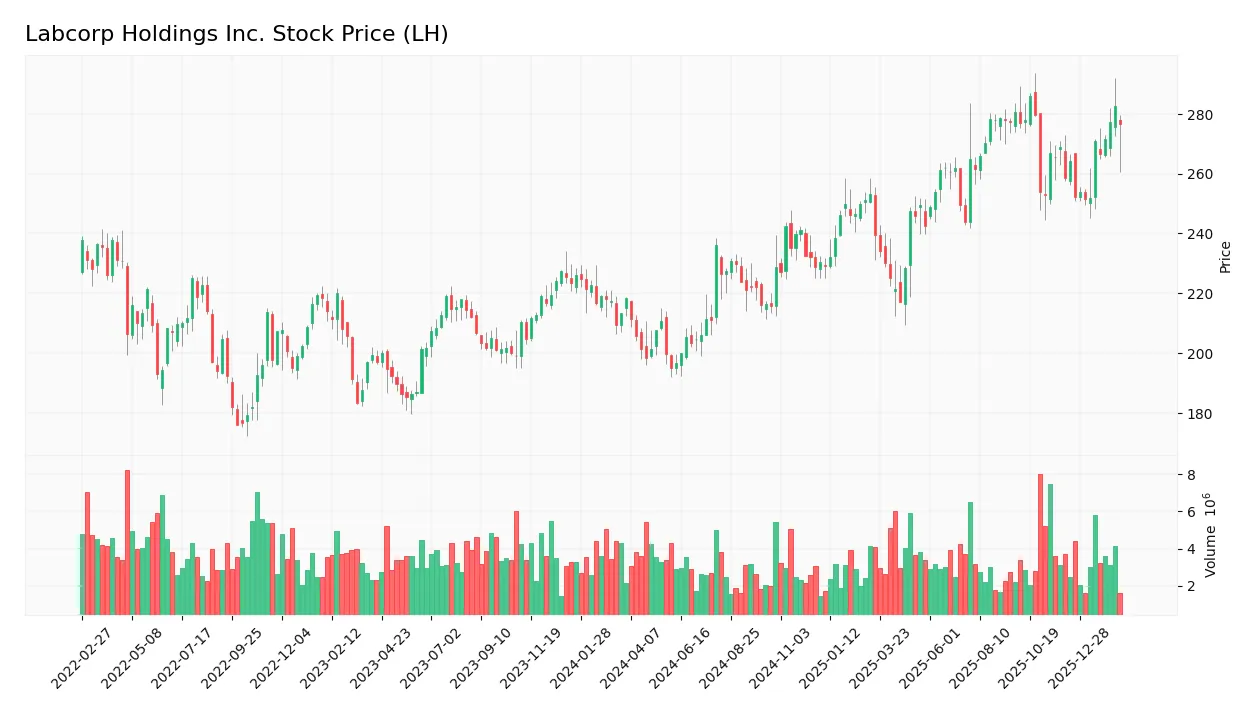

Stock Price Action Analysis

The weekly stock price chart for Labcorp Holdings Inc. (LH) illustrates notable upward momentum and key price levels over the analyzed period:

Trend Analysis

Over the past year, Labcorp’s stock price rose 26.65%, marking a clear bullish trend with acceleration. The price ranged from a low of 195 to a high near 286. Recent months show a 7.07% gain with a steady upward slope of 2.43, confirming ongoing positive momentum despite moderate volatility at 10.66%.

Volume Analysis

Trading volumes are increasing, driven primarily by buyers who account for 62.5% of recent activity. This buyer dominance suggests growing investor confidence and active market participation since December 2025. Seller volume remains comparatively subdued, reinforcing a positive sentiment backdrop.

Target Prices

Analysts set a confident target consensus for Labcorp Holdings Inc., reflecting strong growth expectations.

| Target Low | Target High | Consensus |

|---|---|---|

| 290 | 342 | 315.71 |

The target range suggests analysts anticipate Labcorp’s stock to appreciate moderately, with a consensus price near 316, signaling positive market sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews Labcorp Holdings Inc.’s analyst grades and consumer feedback to assess market sentiment and reputation.

Stock Grades

Here are the latest verified stock grades from reputable financial institutions for Labcorp Holdings Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-02-06 |

| JP Morgan | Maintain | Overweight | 2025-11-07 |

| UBS | Maintain | Buy | 2025-10-29 |

| Mizuho | Maintain | Outperform | 2025-10-17 |

| UBS | Maintain | Buy | 2025-10-17 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-03 |

| Barclays | Maintain | Equal Weight | 2025-10-02 |

| Truist Securities | Maintain | Buy | 2025-07-25 |

| Morgan Stanley | Maintain | Overweight | 2025-07-25 |

| UBS | Maintain | Buy | 2025-07-25 |

The consensus across these respected firms is consistently positive, with most maintaining Buy, Overweight, or Outperform ratings. Barclays stands alone with an Equal Weight rating, indicating a cautious stance within an otherwise broadly favorable outlook.

Consumer Opinions

Labcorp Holdings Inc. continues to evoke mixed reactions from its consumer base, reflecting varied experiences with its services.

| Positive Reviews | Negative Reviews |

|---|---|

| Efficient and accurate test results | Long wait times for customer support |

| Friendly and knowledgeable staff | Occasional billing errors |

| Convenient online appointment system | Limited availability in rural areas |

Overall, consumers praise Labcorp for reliable testing and helpful staff. However, recurring issues include customer service delays and occasional billing problems, which may impact patient satisfaction.

Risk Analysis

Below is a summary table presenting the key risk categories, their likelihood, and potential impact on Labcorp Holdings Inc.:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Stock price fluctuations due to sector sensitivity | Medium | Medium |

| Regulatory Changes | Healthcare regulations affecting laboratory operations | Medium | High |

| Debt Levels | Elevated debt-to-equity ratio increasing financial risk | Medium | Medium |

| Competitive Pressure | Intense competition in medical equipment and services | High | Medium |

| Operational Risks | Supply chain disruptions or service interruptions | Low | High |

Labcorp’s most pressing risks are regulatory changes and competitive pressure. The company’s debt-to-equity ratio at 0.76 signals moderate leverage, which warrants caution. Its Altman Z-Score at 3.18 places it safely above distress thresholds, but sector volatility remains a constant threat.

Should You Buy Labcorp Holdings Inc.?

Labcorp appears to be a moderately profitable company with declining operational efficiency and a slightly unfavorable moat, suggesting value erosion. Despite a manageable debt level and strong financial health indicators, its overall B+ rating reflects a cautiously favorable investment profile.

Strength & Efficiency Pillars

Labcorp Holdings Inc. maintains operational efficiency with a net margin of 6.28% and a return on equity of 10.17%. Its return on invested capital (ROIC) stands at 7.39%, slightly above the weighted average cost of capital (WACC) at 7.27%, positioning the company as a modest value creator. Interest coverage at 6.77x further underscores manageable financing costs. While ROIC shows a declining trend, the firm’s strong Piotroski score of 7 confirms solid financial strength.

Weaknesses and Drawbacks

The company’s valuation metrics exhibit moderate caution, with a price-to-earnings ratio of 23.81 and price-to-book of 2.42, reflecting neither significant undervaluation nor distress. Although debt-to-equity is moderate at 0.76, it flags some leverage risk amid fluctuating profitability. The overall net income growth trend is unfavorable, with a 63.13% decline over the period, raising concerns about sustainable earnings power. Market pressure appears limited as buyers dominate recent trading with 62.53%, reducing short-term volatility risks.

Our Final Verdict about Labcorp Holdings Inc.

Labcorp Holdings Inc. presents a fundamentally stable profile with a safe Altman Z-Score of 3.18, indicating low bankruptcy risk. Despite solid long-term operational efficiency and strong financial health, the recent bullish price trend with buyer dominance suggests potential for continued growth. This profile might appear attractive for investors seeking moderate risk exposure, though ongoing monitoring of profitability trends is prudent given the declining ROIC.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Labcorp Holdings Inc. (NYSE:LH) Given Average Recommendation of “Moderate Buy” by Brokerages – MarketBeat (Feb 18, 2026)

- Labcorp Holdings Inc (LH) Q4 2025 Earnings Call Highlights: Stro – GuruFocus (Feb 17, 2026)

- Why Labcorp (LH) Shares Are Trading Lower Today – Yahoo Finance (Feb 17, 2026)

- Morgan Stanley Maintains Overweight on Labcorp Holdings Inc. (LH) Feb 17, 2026 – Meyka (Feb 17, 2026)

- Labcorp stock slips after Q4 revenue miss (LH:NYSE) – Seeking Alpha (Feb 17, 2026)

For more information about Labcorp Holdings Inc., please visit the official website: labcorp.com