Home > Analyses > Financial Services > KKR & Co. Inc.

KKR & Co. Inc. transforms industries by fueling growth through strategic private equity and real estate investments worldwide. It commands leadership in asset management with a diverse portfolio spanning technology, energy, healthcare, and infrastructure. Renowned for innovation and deep market insight, KKR drives value creation in complex, high-stakes deals. As market conditions evolve, I question whether KKR’s fundamentals still support its premium valuation and long-term growth prospects.

Table of contents

Business Model & Company Overview

KKR & Co. Inc., founded in 1976 and headquartered in New York City, is a titan in asset management with a $88B market cap. The firm operates a comprehensive investment ecosystem spanning private equity, real estate, credit, and impact investing. Its strategy integrates diverse sectors from technology to energy, creating a broad yet focused portfolio that leverages deep industry expertise and strategic ownership.

KKR’s revenue engine balances direct acquisitions, fund investments, and asset management fees, generating recurring income across global markets in the Americas, Europe, and Asia. This diversified approach strengthens its financial resilience and market reach. I see KKR’s enduring economic moat in its ability to control portfolio companies, influence governance, and drive value creation over multi-year horizons.

Financial Performance & Fundamental Metrics

I will analyze KKR & Co. Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

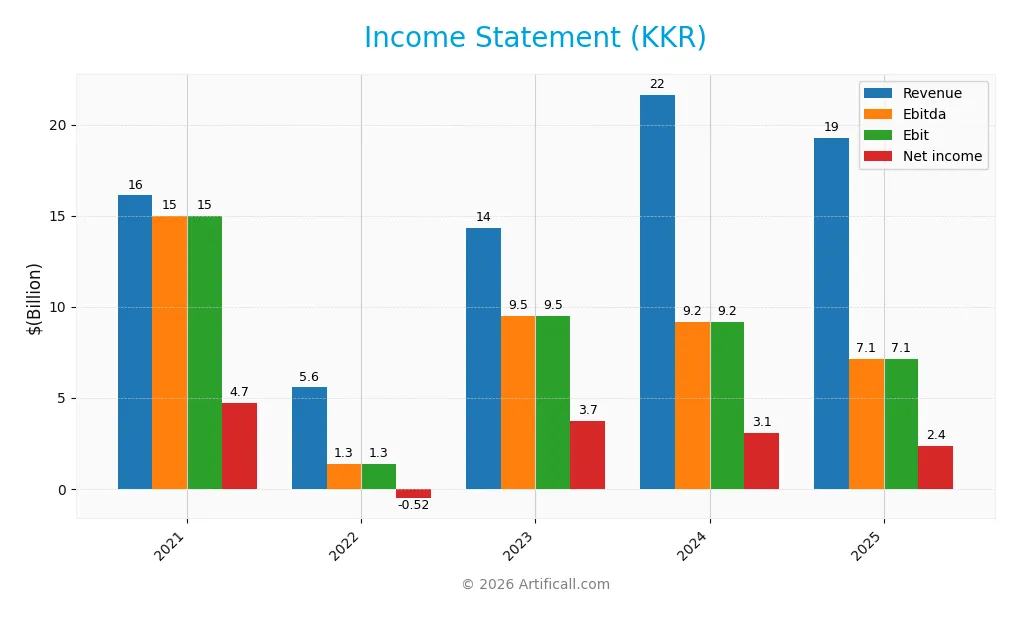

The table below summarizes KKR & Co. Inc.’s key income statement metrics for the fiscal years 2021 through 2025 in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 16.1B | 5.6B | 14.3B | 21.6B | 19.3B |

| Cost of Revenue | 9.2B | 3.6B | 9.5B | 17.8B | 11.2B |

| Operating Expenses | 1.9B | 2.4B | 2.7B | 2.9B | 7.6B |

| Gross Profit | 6.9B | 2.0B | 4.9B | 3.8B | 8.1B |

| EBITDA | 15.0B | 1.3B | 9.5B | 9.2B | 7.1B |

| EBIT | 15.0B | 1.3B | 9.5B | 9.2B | 7.1B |

| Interest Expense | 1.1B | 1.6B | 2.9B | 3.3B | 2.3B |

| Net Income | 4.7B | -522M | 3.7B | 3.1B | 2.4B |

| EPS | 7.95 | -0.79 | 4.24 | 3.47 | 2.52 |

| Filing Date | 2022-02-28 | 2023-02-27 | 2024-02-29 | 2025-02-05 | 2026-02-05 |

Income Statement Evolution

KKR’s revenue rose 19.6% from 2021 to 2025 but declined 11% in the latest year, reflecting recent headwinds. Gross profit more than doubled year-on-year, enhancing gross margins to 41.8%, a favorable shift. However, EBIT and net income fell sharply in 2025, dragging margins down despite stable operating expense control.

Is the Income Statement Favorable?

In 2025, KKR posted a 12.3% net margin, which remains favorable relative to sector norms, yet net income dropped nearly 50% over five years. Interest expense pressure, consuming 11.9% of revenue, weighs on profitability. The recent EPS decline of 29% signals challenges in capital efficiency and earnings quality. Overall, fundamentals appear unfavorable amid margin erosion and income volatility.

Financial Ratios

The following table presents key financial ratios for KKR & Co. Inc. over the last five fiscal years, offering insight into profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 47% | 29% | -9% | 26% | 14% |

| ROE | 15% | 27% | -3% | 16% | 13% |

| ROIC | 2% | 2% | -0.1% | 1% | 0.3% |

| P/E | 11.4 | 9.2 | -66.7 | 19.3 | 42.6 |

| P/B | 1.7 | 2.5 | 1.8 | 3.1 | 5.5 |

| Current Ratio | 2.6 | 1.3 | 1.5 | 4.7 | 4.1 |

| Quick Ratio | 2.6 | 1.3 | 1.5 | 4.7 | 4.1 |

| D/E | 2.5 | 2.3 | 2.3 | 2.2 | 2.1 |

| Debt-to-Assets | 42% | 15% | 16% | 16% | 14% |

| Interest Coverage | 1.3 | 4.4 | -0.2 | 0.7 | 0.3 |

| Asset Turnover | 0.05 | 0.06 | 0.02 | 0.05 | 0.06 |

| Fixed Asset Turnover | 4.4 | 13.3 | 4.0 | 10.3 | 12.2 |

| Dividend Yield | 1.6% | 1.0% | 1.5% | 0.9% | 0.5% |

Evolution of Financial Ratios

KKR’s Return on Equity (ROE) showed variability, peaking near 27% in 2021 before declining to 13% in 2024. The Current Ratio improved markedly from 1.29 in 2021 to over 4.1 by 2024, indicating enhanced liquidity. Debt-to-Equity remained elevated around 2.15, signaling consistent leverage. Profitability deteriorated from strong margins in 2021 to more moderate levels in 2024.

Are the Financial Ratios Fovorable?

In 2024, KKR’s net margin at 14.2% is favorable, but ROE at 13% is neutral, reflecting tempered profitability. Liquidity ratios diverge: the high current ratio is unfavorable due to potential inefficiency, while the quick ratio is favorable. Leverage remains high with a debt-to-equity ratio of 2.15, deemed unfavorable. Asset turnover is low, indicating inefficiency, whereas fixed asset turnover is favorable. Overall, the ratios lean slightly unfavorable.

Shareholder Return Policy

KKR & Co. Inc. maintains a dividend payout ratio near 20%, with dividend per share slightly varying around $0.69 to $0.72 over recent years. The annual dividend yield hovers below 1%, supported by moderate free cash flow coverage and occasional share buybacks.

The company’s distribution strategy balances payouts with capital allocation, reflecting a cautious approach amid fluctuating profit margins. This policy supports sustainable long-term shareholder value, avoiding excessive repurchases or unsustainable dividends despite leverage considerations.

Score analysis

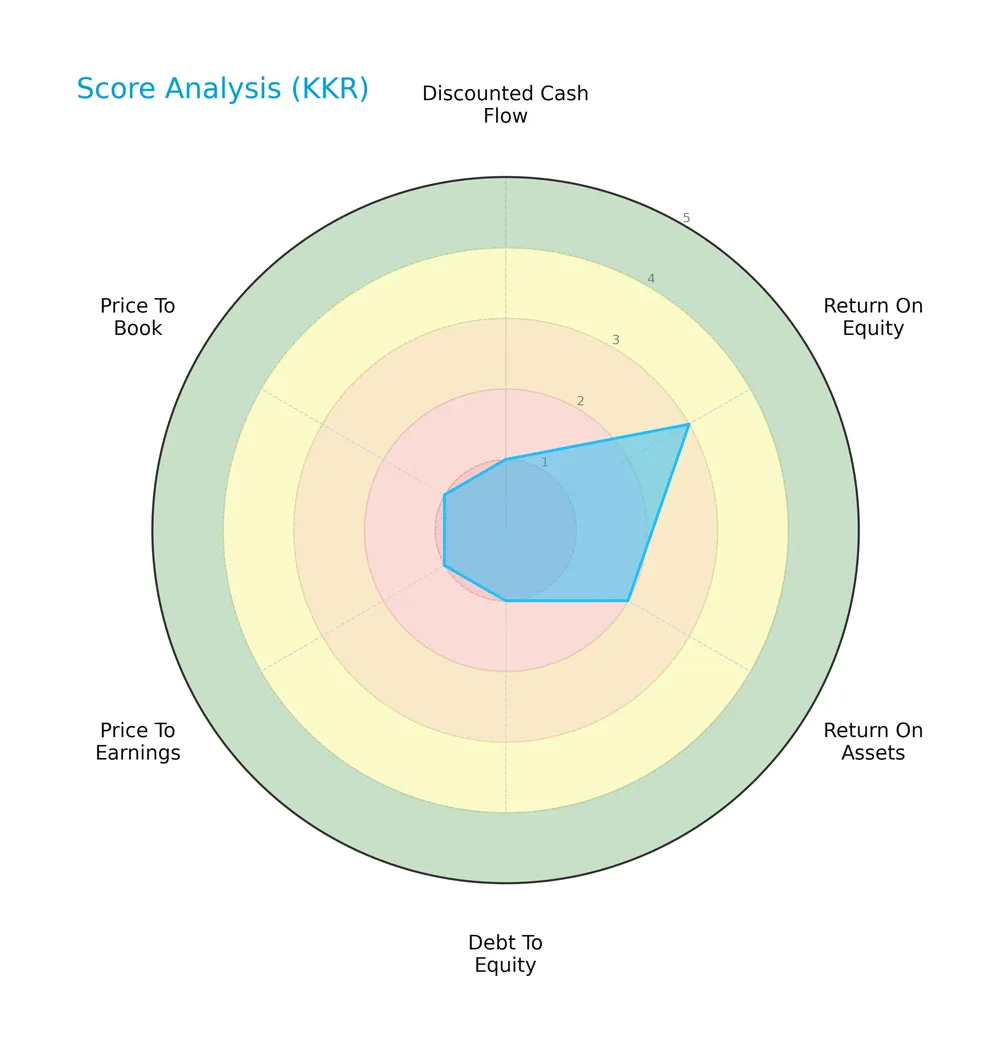

The following radar chart displays the key financial ratios that shape KKR & Co. Inc.’s valuation and risk profile:

KKR shows very unfavorable scores in discounted cash flow, debt-to-equity, price-to-earnings, and price-to-book metrics. Return on equity and assets are moderate, indicating mixed operational efficiency amid financial risk concerns.

Analysis of the company’s bankruptcy risk

KKR currently falls in the distress zone according to its Altman Z-Score, signaling a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

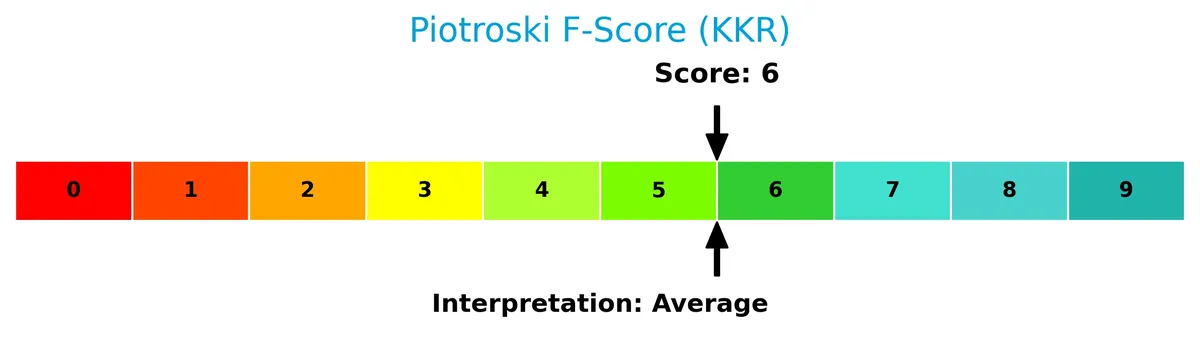

The Piotroski Score diagram highlights KKR’s financial condition through nine performance indicators:

With a score of 6, KKR shows average financial health. This suggests some operational strength but leaves room for improvement in profitability and leverage management.

Competitive Landscape & Sector Positioning

This section analyzes KKR & Co. Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether KKR holds a sustainable competitive advantage over its peers in the asset management sector.

Strategic Positioning

KKR maintains a highly diversified portfolio across asset management, insurance, real estate, energy, and various industrial sectors worldwide. Its geographic exposure spans the Americas, Europe, Asia, and emerging markets. The firm targets both controlling and strategic minority stakes, focusing on mid- to large-cap investments with varied exit strategies.

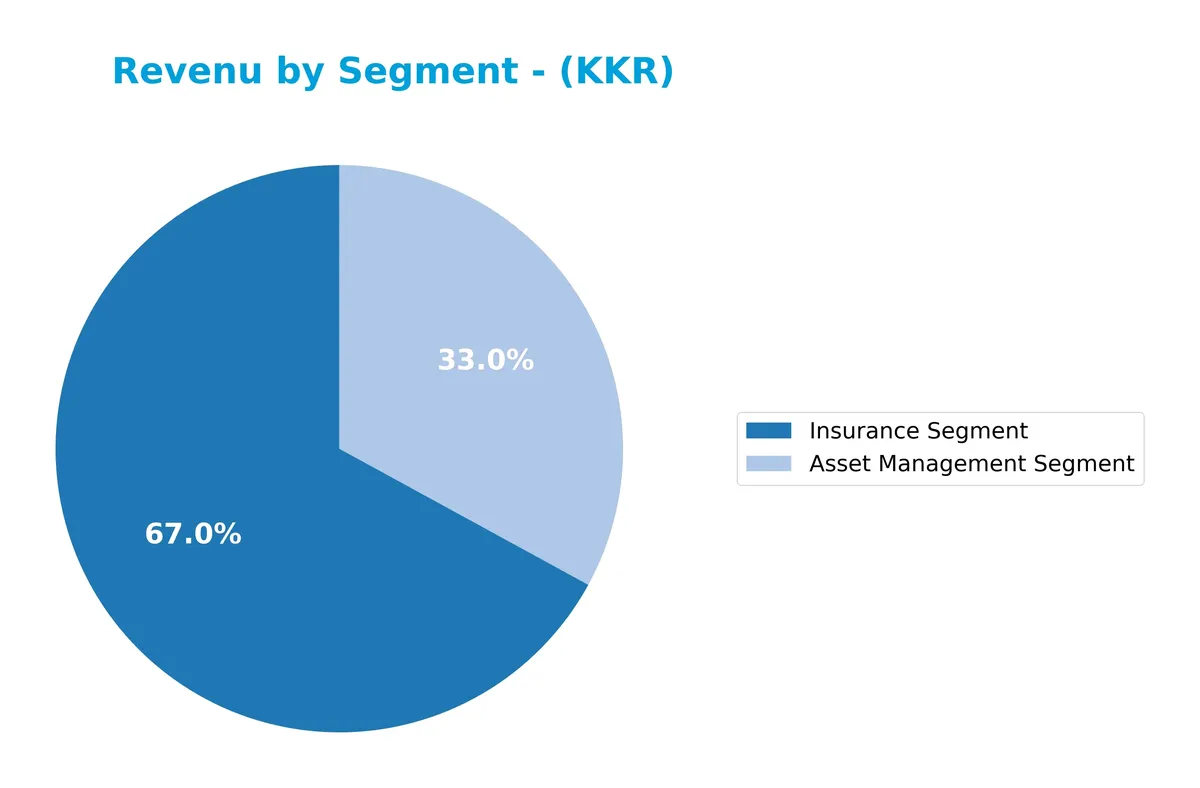

Revenue by Segment

The pie chart illustrates KKR & Co. Inc.’s revenue distribution between its Asset Management and Insurance segments for fiscal year 2024. It highlights the relative scale and contribution of each segment to total revenues.

KKR’s Insurance segment dominates revenue, rising sharply to $14.7B in 2024 from $8.7B in 2023, signaling accelerated growth and increased concentration risk. The Asset Management segment also grew to $7.2B, up from $5.8B, but remains secondary. This trend reflects KKR’s strategic pivot towards insurance, reshaping its revenue base significantly.

Key Products & Brands

The table below outlines KKR & Co. Inc.’s primary product segments and their descriptions:

| Product | Description |

|---|---|

| Asset Management Segment | Provides private equity, real estate, credit, and growth equity investments across industries. |

| Insurance Segment | Offers insurance-related investment products and services. |

| Carried Interests | Earnings derived from the performance of investment funds managed by the firm. |

| Investment Management Fees | Fees charged for managing investment portfolios and funds. |

| Investment Transaction Fees | Fees earned from facilitating and managing transactions and deals. |

| Investment Monitoring Fees | Fees for ongoing oversight and management of investments. |

| Investment Consulting Fees | Advisory services related to investment strategies and decisions. |

| Incentive Fees | Performance-based fees earned when investment returns exceed certain benchmarks. |

| Expense Reimbursement | Recovery of expenses related to investment activities. |

| Fee Credit | Negative adjustments reducing fee income, possibly due to client agreements or refunds. |

| Oil and Gas Revenue | Income from investments and operations in the oil and gas sector. |

| Capital Allocation | Internal funding and allocation activities across investment strategies. |

| Transaction Fee | Fees specifically related to transaction facilitation within investments. |

KKR’s product portfolio centers on asset and insurance management with substantial fee-based income streams. The firm diversifies revenue through transaction, monitoring, consulting, and incentive fees, reflecting a broad, integrated investment approach.

Main Competitors

There are 11 competitors in total; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Blackstone Inc. | 191B |

| BlackRock, Inc. | 168B |

| KKR & Co. Inc. | 115B |

| The Bank of New York Mellon Corporation | 82B |

| Ares Management Corporation | 55B |

| Ameriprise Financial, Inc. | 46B |

| State Street Corporation | 36B |

| Northern Trust Corporation | 26B |

| T. Rowe Price Group, Inc. | 23B |

| Franklin Resources, Inc. | 12B |

KKR & Co. Inc. ranks 3rd among these competitors with a market cap at 46% of Blackstone’s lead. It stands above both the average market cap of the top 10 (75B) and the sector median (46B). The company enjoys a significant 90% market cap gap over its closest competitor above, indicating strong positioning in asset management.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does KKR have a competitive advantage?

KKR presents a complex competitive profile with a broad investment scope across asset classes and geographies but lacks clear evidence of a sustained economic moat due to unavailable ROIC vs. WACC data and a sharply declining ROIC trend. Its diversified strategy covers private equity, real estate, and credit sectors, targeting mid-to-large enterprises with a preference for controlling or strategic minority stakes.

Looking ahead, KKR’s future opportunities lie in expanding its impact investments and growing presence in emerging markets like Asia and Latin America. The firm’s focus on technology, energy, and infrastructure sectors may unlock new revenue streams amid evolving global economic conditions, although recent income statement trends suggest caution regarding profitability sustainability.

SWOT Analysis

This SWOT analysis highlights KKR & Co. Inc.’s core strengths, weaknesses, opportunities, and threats to inform strategic decisions.

Strengths

- diversified global investment portfolio

- strong presence in private equity and real estate

- favorable gross and EBIT margins

Weaknesses

- declining ROIC trend

- unfavorable revenue and EPS growth

- high debt-to-equity ratio

Opportunities

- expansion in emerging markets

- growing impact investing demand

- increased allocations to technology sectors

Threats

- high market volatility

- regulatory changes in financial services

- intense competition in asset management

KKR’s diversified portfolio and margin strength provide resilience. However, declining returns and leverage risks demand cautious capital allocation. Strategic growth in emerging markets and impact sectors can offset competitive and regulatory pressures.

Stock Price Action Analysis

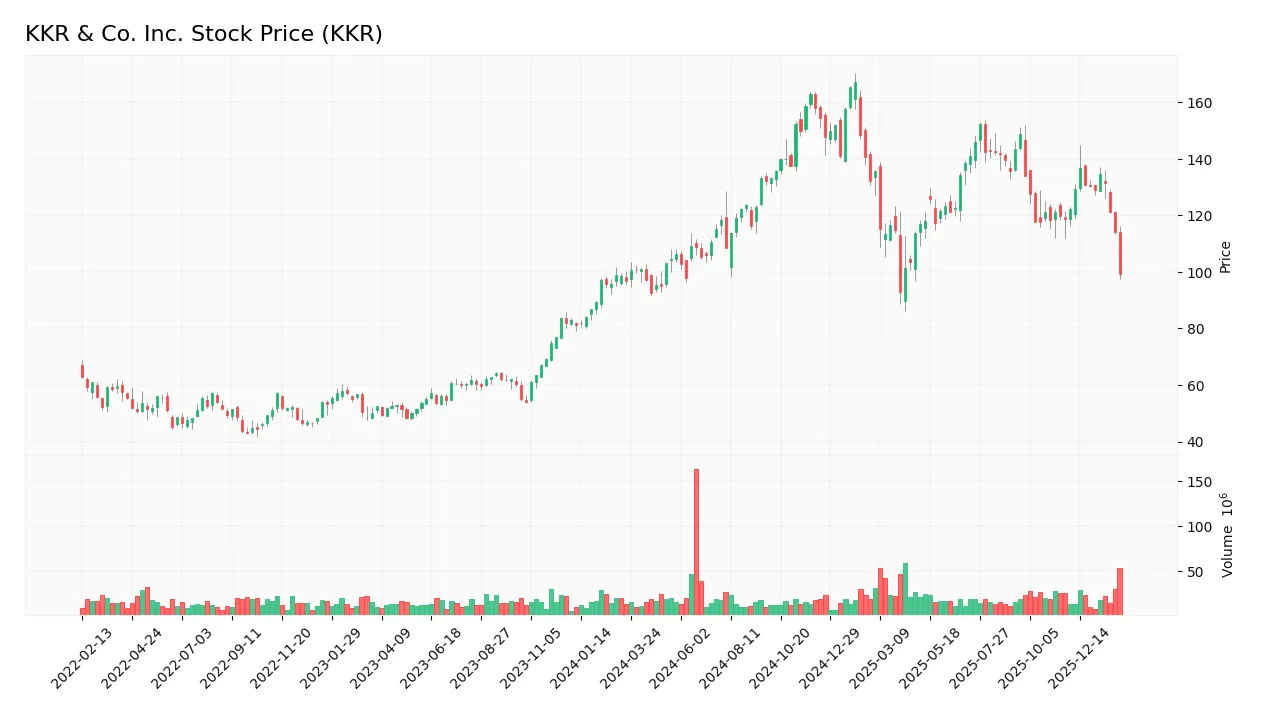

The weekly stock chart for KKR & Co. Inc. illustrates price movements over the past 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, KKR’s stock price increased by 2.55%, indicating a bullish trend with deceleration. The price ranged between 92.62 and 167.07, showing significant volatility with an 18.28 standard deviation. Recent months, however, show a -16.43% decline signaling a sharp short-term downtrend.

Volume Analysis

Trading volume has been increasing overall, with buyer volume slightly exceeding sellers at 50.35%. However, in the last three months, sellers dominated with only 28.58% buyer activity. This shift suggests weakening investor confidence and growing selling pressure in the recent period.

Target Prices

Analysts set a clear target consensus for KKR & Co. Inc., indicating moderate upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 144 | 190 | 165.33 |

The target range spans from $144 to $190, with a consensus near $165, reflecting steady confidence in the stock’s performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

I will examine recent analyst ratings and consumer feedback on KKR & Co. Inc. to gauge market sentiment.

Stock Grades

Here are the latest verified analyst grades for KKR & Co. Inc. from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Downgrade | Hold | 2026-01-14 |

| UBS | Maintain | Buy | 2026-01-13 |

| Barclays | Maintain | Overweight | 2026-01-09 |

| Barclays | Maintain | Overweight | 2025-12-12 |

| Barclays | Maintain | Overweight | 2025-11-11 |

| Oppenheimer | Maintain | Outperform | 2025-11-10 |

| TD Cowen | Maintain | Buy | 2025-11-10 |

| Morgan Stanley | Maintain | Overweight | 2025-10-21 |

| Oppenheimer | Maintain | Outperform | 2025-10-14 |

| Citigroup | Maintain | Buy | 2025-10-13 |

Most analysts maintain positive views, favoring buy or outperform ratings. TD Cowen’s recent downgrade to hold stands out, signaling some caution amid prevailing optimism.

Consumer Opinions

Consumers express a mix of admiration and concern regarding KKR & Co. Inc.’s service quality and transparency.

| Positive Reviews | Negative Reviews |

|---|---|

| Strong track record in private equity investments. | Fees can be high compared to competitors. |

| Transparent communication during investment phases. | Customer service response times are slow. |

| Robust portfolio diversification reduces risk. | Limited accessibility for smaller investors. |

Overall, clients appreciate KKR’s investment expertise and clear communication. However, recurring issues include high fees and slower support, which may deter smaller investors seeking agility and cost efficiency.

Risk Analysis

Below is a table summarizing key risks facing KKR & Co. Inc., their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score at 0.88 signals distress zone, indicating high bankruptcy risk. | High | Severe |

| Valuation | Elevated PE (42.65) and PB (5.55) ratios suggest overvaluation relative to industry averages. | High | Moderate |

| Leverage | High debt-to-equity ratio (2.15) raises concerns about financial flexibility and risk. | High | High |

| Profitability | ROIC at 0.25% is unfavorable and below typical WACC, indicating weak capital efficiency. | Medium | Moderate |

| Dividend Yield | Low dividend yield (0.47%) may deter income-focused investors. | Medium | Low |

| Market Volatility | Beta of 1.97 suggests stock is highly sensitive to market swings, increasing share price risk. | High | Moderate |

KKR’s most critical risks arise from its distressed financial health and high leverage, which amplify vulnerability during market downturns. The steep valuation multiples compound downside risk despite a favorable net margin. I advise close monitoring of liquidity and capital allocation trends.

Should You Buy KKR & Co. Inc.?

KKR appears to be in financial distress with declining operational efficiency and a weakening return on invested capital. While it maintains a manageable liquidity profile, its leverage profile suggests substantial risk. The overall rating of C- reflects these challenges.

Strength & Efficiency Pillars

KKR & Co. Inc. exhibits solid profitability with a net margin of 14.22% and a moderate return on equity at 13.01%. The company maintains an average Piotroski score of 6, suggesting reasonable financial strength. Its quick ratio of 4.12 signals good short-term liquidity, and debt-to-assets stands favorably at 14.11%. However, the return on invested capital is critically low at 0.25%, and WACC data is unavailable, so it cannot be confirmed as a value creator. The Altman Z-score of 0.88 places KKR in the distress zone, indicating financial risk.

Weaknesses and Drawbacks

KKR faces valuation challenges, with a high P/E ratio of 42.65 and P/B ratio of 5.55, reflecting a premium price that may not be justified by fundamentals. The debt-to-equity ratio is elevated at 2.15, highlighting significant leverage concerns. Despite a strong current ratio of 4.12, this is flagged unfavorable here, possibly due to asset quality or working capital structure. Recent market behavior shows seller dominance at 28.58%, intensifying short-term selling pressure and causing a 16.43% price decline since late 2025, which raises caution.

Our Verdict about KKR & Co. Inc.

KKR’s long-term fundamental profile appears mixed, with moderate profitability but clear financial vulnerabilities and stretched valuation. Despite an overall bullish trend in stock price, recent seller dominance and decelerating momentum suggest cautious timing. Investors might consider a wait-and-see approach for a better entry point, given the current market pressure and financial risk signals. The profile may appear attractive for those focusing on liquidity and gross margin strength but carries notable risk.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- KKR to Buy Arctos in $1.4 Billion Deal That Stretches Beyond Sports – Sportico.com (Feb 05, 2026)

- KKR and Singtel to take full ownership of data center firm STT GDC for about $5 billion – CNBC (Feb 04, 2026)

- KKR, Arctos Signal Confidence Sports Leagues Will Approve Deal – Bloomberg.com (Feb 05, 2026)

- KKR Executives Downplay Impact of AI Disruption – The Wall Street Journal (Feb 05, 2026)

- A Look At KKR’s (NYSE:KKR) Valuation After Its Recent Share Price Pullback – simplywall.st (Feb 05, 2026)

For more information about KKR & Co. Inc., please visit the official website: kkr.com