Home > Analyses > Real Estate > Kimco Realty Corporation

Kimco Realty transforms everyday shopping into seamless experiences by owning and operating open-air, grocery-anchored centers in prime U.S. markets. With a six-decade legacy, it leads the retail REIT sector through strategic acquisitions and innovative mixed-use developments. Renowned for quality assets and resilient cash flow, Kimco shapes community retail landscapes. The key question: do its fundamentals still support compelling growth and valuation in today’s evolving retail environment?

Table of contents

Business Model & Company Overview

Kimco Realty Corporation, founded over 60 years ago and headquartered in Jericho, NY, stands as one of North America’s largest publicly traded owners and operators of open-air, grocery-anchored shopping centers and mixed-use assets. Its extensive portfolio spans 400 U.S. properties with 70M square feet of leasable space, forming a cohesive ecosystem that caters to essential retail and community needs. Trading on the NYSE since 1991, Kimco has cemented its market position within the S&P 500, reflecting its scale and resilience in the retail REIT sector.

Kimco generates value primarily through leasing and managing retail spaces, balancing steady rental income with active property development and acquisitions. Its footprint concentrates on top metropolitan markets across the U.S., creating a reliable revenue engine through recurring cash flows from long-term tenants. This strategic presence in critical economic hubs supports its strong economic moat, driven by its specialized expertise and dominant portfolio, shaping the future landscape of retail real estate.

Financial Performance & Fundamental Metrics

I will analyze Kimco Realty Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

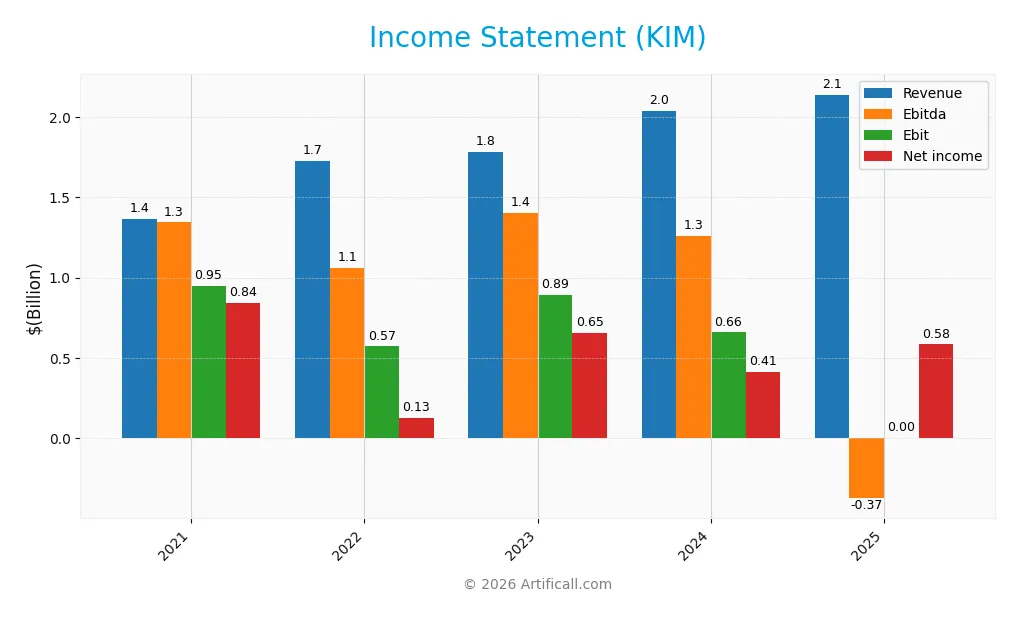

Below is Kimco Realty Corporation’s income statement summary for the fiscal years 2021 through 2025, reflecting core profitability and expense metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 1.36B | 1.73B | 1.78B | 2.04B | 2.14B |

| Cost of Revenue | 418M | 531M | 557M | 638M | 662M |

| Operating Expenses | 522M | 631M | 588M | 770M | 133M |

| Gross Profit | 947M | 1.20B | 1.23B | 1.40B | 1.48B |

| EBITDA | 1.34B | 1.06B | 1.40B | 1.26B | -374M |

| EBIT | 949M | 572M | 894M | 659M | 0 |

| Interest Expense | 204M | 227M | 250M | 308M | 330M |

| Net Income | 844M | 126M | 654M | 411M | 585M |

| EPS | 1.61 | 0.16 | 1.02 | 0.55 | 0.87 |

| Filing Date | 2022-03-01 | 2023-02-24 | 2024-02-26 | 2025-02-21 | 2026-02-12 |

Income Statement Evolution

From 2021 to 2025, Kimco Realty’s revenue grew steadily by 57%, reaching $2.14B in 2025. Despite this, net income declined by 31% over the same period, signaling pressure on profitability. Gross margin remained robust at 69%, while net margin contracted by 56%, reflecting rising costs and margin compression.

Is the Income Statement Favorable?

In 2025, fundamentals show a mixed picture. Revenue rose 5% year-over-year, supporting a 5.6% gross profit increase, which is positive. However, EBIT fell sharply to zero, an unfavorable sign, though net margin improved to 27%. Interest expense is well-managed at 15% of revenue, contributing to a generally favorable income statement despite EBIT weakness.

Financial Ratios

The table below summarizes key financial ratios for Kimco Realty Corporation over the last five fiscal years, highlighting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 62% | 7% | 37% | 20% | 27% |

| ROE | 8.5% | 1.3% | 6.9% | 3.9% | 0% |

| ROIC | 2.3% | 2.1% | 3.2% | 3.0% | 0% |

| P/E | 14.8x | 103.5x | 20.1x | 38.3x | 23.4x |

| P/B | 1.26x | 1.37x | 1.38x | 1.48x | 0x |

| Current Ratio | 8.0 | 4.9 | 6.4 | 3.6 | 0 |

| Quick Ratio | 8.0 | 4.9 | 6.4 | 3.6 | 0 |

| D/E | 0.77x | 0.76x | 0.81x | 0.81x | 0 |

| Debt-to-Assets | 41% | 41% | 42% | 42% | 0% |

| Interest Coverage | 2.1x | 2.5x | 2.6x | 2.0x | -2.3x |

| Asset Turnover | 0.07x | 0.10x | 0.10x | 0.10x | 0 |

| Fixed Asset Turnover | 9.3x | 12.9x | 13.9x | 16.1x | 0 |

| Dividend Yield | 3.1% | 4.2% | 5.0% | 4.4% | 5.0% |

Evolution of Financial Ratios

Kimco Realty’s Return on Equity (ROE) data is missing for 2025, but earlier years show volatility and an overall decline. The Current Ratio dropped sharply to zero in 2025 from a healthy 3.58 in 2024, indicating liquidity deterioration. Debt-to-Equity remained favorable, implying controlled leverage. Profitability margins fluctuated, with net margin improving to 27.32% in 2025, signaling stronger bottom-line stability.

Are the Financial Ratios Favorable?

In 2025, Kimco exhibits a favorable net profit margin of 27.32% and dividend yield near 5%, reflecting solid shareholder returns. However, ROE, Return on Invested Capital (ROIC), current and quick ratios are unfavorable or unavailable, raising concerns about profitability sustainability and liquidity. Debt ratios appear favorable, yet negative interest coverage signals potential financial stress. Overall, the ratio profile is slightly unfavorable, warranting cautious interpretation.

Shareholder Return Policy

Kimco Realty Corporation maintains a dividend policy with a payout ratio exceeding 100%, distributing $1.01 per share in 2025 with a yield near 5%. The company also conducts share buybacks, though payout coverage by free cash flow varies, indicating potential sustainability concerns.

Despite a strong dividend yield, the elevated payout ratio signals a risk of over-distribution. I observe that this approach may pressure cash reserves, suggesting a need for cautious monitoring to ensure long-term value creation aligns with prudent capital allocation.

Score analysis

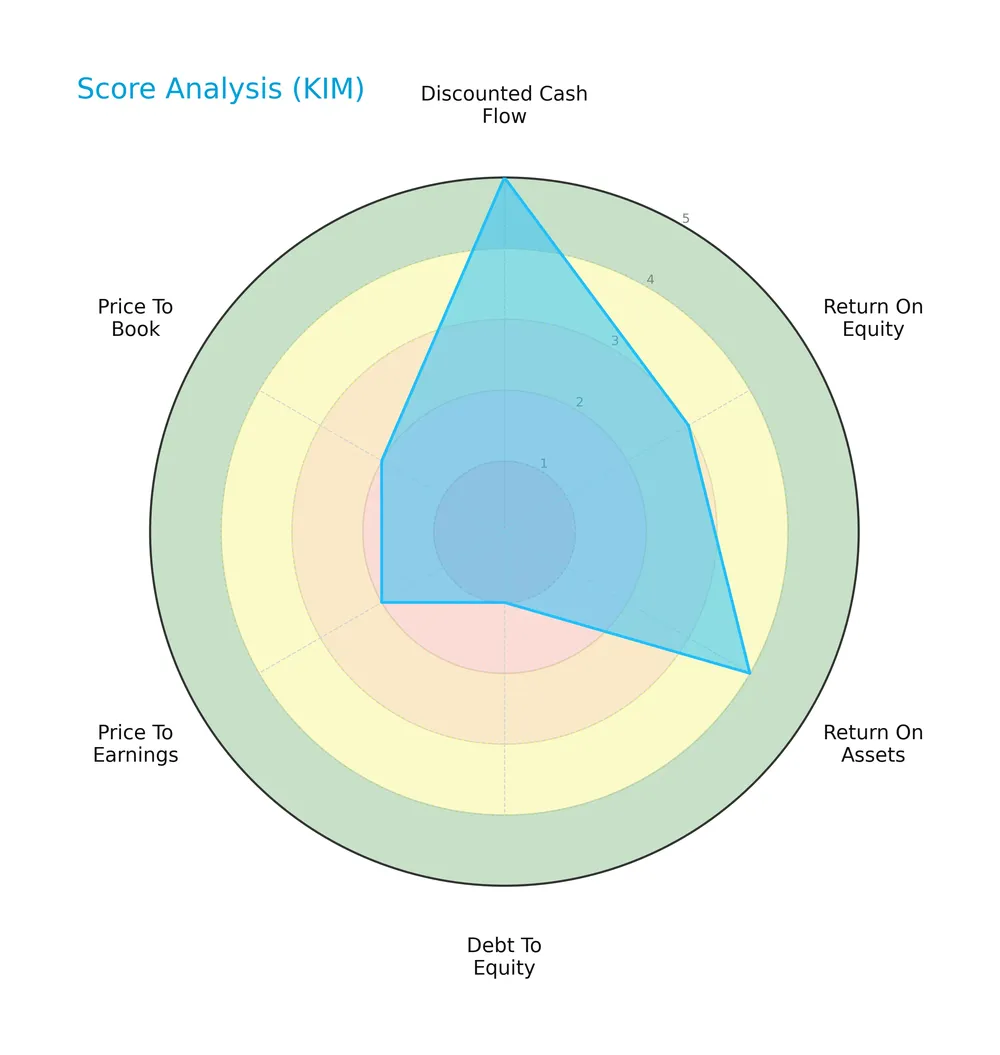

The radar chart below highlights key financial scores for Kimco Realty Corporation, showing strengths and weaknesses across valuation and profitability metrics:

Kimco shows a very favorable discounted cash flow score of 5, indicating solid intrinsic value. Return on assets is favorable at 4, while return on equity is moderate at 3. However, debt to equity is very unfavorable at 1, signaling high leverage risk. Price to earnings and price to book scores are both unfavorable at 2.

Analysis of the company’s bankruptcy risk

Kimco’s Altman Z-Score places it in the distress zone, signaling a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

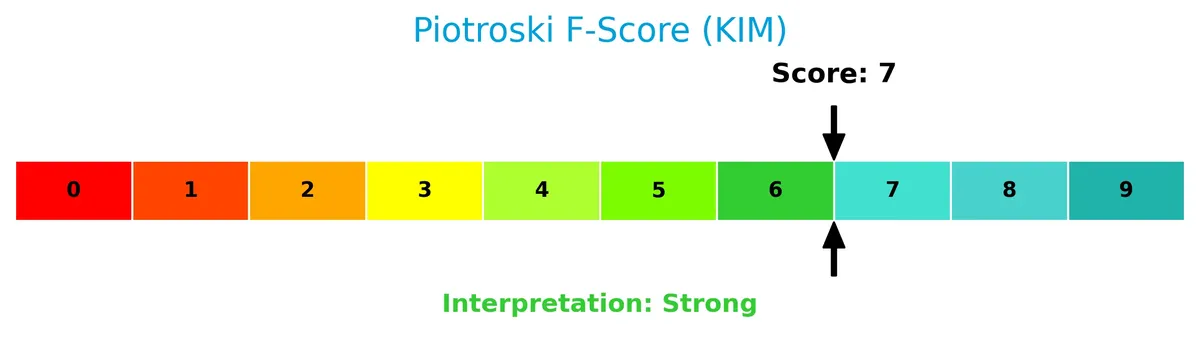

The Piotroski Score diagram below summarizes Kimco’s financial strength based on nine accounting criteria:

With a strong Piotroski Score of 7, Kimco demonstrates solid profitability, liquidity, and operating efficiency, suggesting overall good financial health despite some balance sheet risks.

Competitive Landscape & Sector Positioning

This sector analysis will explore Kimco Realty Corporation’s strategic positioning, revenue segments, key products, main competitors, and competitive advantages. I will assess whether Kimco holds a sustainable edge over its rivals in the retail REIT industry.

Strategic Positioning

Kimco Realty Corporation focuses on open-air, grocery-anchored shopping centers and mixed-use assets across major U.S. metropolitan markets. Its portfolio is concentrated geographically within the U.S. and diversified within retail real estate, generating most revenue from rental properties and reimbursements.

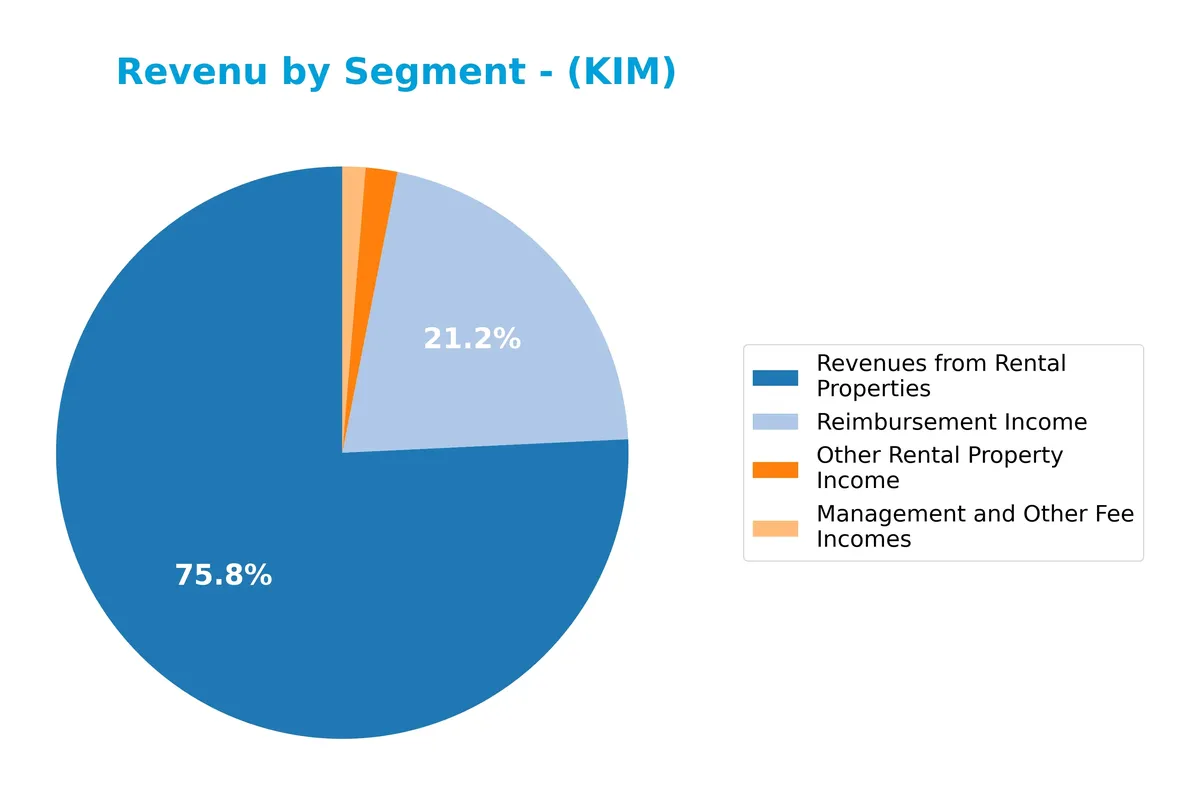

Revenue by Segment

This pie chart illustrates Kimco Realty Corporation’s revenue distribution by segment for the fiscal year 2018, highlighting key income streams contributing to the company’s total revenue.

In 2018, Kimco’s revenue heavily relied on rental properties, generating 882M. Reimbursement income followed with 246M, indicating strong operational cost recoveries. Other rental property income and management fees contributed smaller portions at 21M and 15M, respectively. Compared to 2010, when retail store leases barely registered, the 2018 figures reveal a clear shift toward diversified rental-related income, underlining increased segment concentration risk in property revenues.

Key Products & Brands

Kimco Realty Corporation generates revenue primarily through various rental and fee income streams related to its retail real estate assets:

| Product | Description |

|---|---|

| Revenues from Rental Properties | Income from leasing retail space in open-air, grocery-anchored shopping centers and mixed-use assets. |

| Reimbursement Income | Payments received for reimbursable expenses related to property management and operations. |

| Other Rental Property Income | Additional income from property-related services not classified under standard rentals. |

| Management and Other Fee Incomes | Fees earned from managing properties and providing related services. |

| Retail Store Leases | Leasing revenue specifically from retail store tenants (noted in 2010 data). |

Kimco’s revenue streams reflect its focus on owning and managing grocery-anchored shopping centers. The mix of rental income and management fees highlights a diversified approach to monetizing its real estate portfolio.

Main Competitors

There are 5 competitors in total; the table below lists the top 5 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Simon Property Group, Inc. | 60B |

| Realty Income Corporation | 53B |

| Kimco Realty Corporation | 13.6B |

| Regency Centers Corporation | 12.3B |

| Federal Realty Investment Trust | 8.5B |

Kimco Realty Corporation ranks 3rd among its competitors. Its market cap is about 25% of the leader, Simon Property Group. Kimco sits below the top 10 average cap of 29.4B but above the sector median of 13.6B. The company maintains a 249% market cap lead over its closest competitor above, Realty Income.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does KIM have a competitive advantage?

Kimco Realty Corporation operates one of North America’s largest portfolios of grocery-anchored shopping centers, offering scale and market concentration in major metropolitan areas. Its favorable gross margin of 69% and net margin of 27% reflect operational efficiency in the retail REIT sector.

Looking ahead, Kimco’s extensive footprint in 400 shopping centers and mixed-use assets positions it to capitalize on evolving retail trends and urban development opportunities. The company’s focus on acquisitions, development, and management supports potential growth in new markets and product offerings.

SWOT Analysis

This SWOT analysis highlights Kimco Realty Corporation’s core strategic factors to guide investment decisions.

Strengths

- Large portfolio of 400+ retail centers

- Strong net margin at 27%

- Included in S&P 500 Index

Weaknesses

- Declining ROIC trend

- Low liquidity ratios

- Interest coverage unfavorable

Opportunities

- Expansion in top metropolitan markets

- Growth in grocery-anchored retail demand

- Dividend yield near 5% attracts income investors

Threats

- Retail sector volatility

- Rising interest rates increase debt cost

- Economic downturns reduce consumer spending

Kimco’s strengths in scale and profitability support resilience. However, weak liquidity and declining returns signal caution. The company should leverage market expansion and stable dividend appeal while managing interest risks and sector cyclicality.

Stock Price Action Analysis

The weekly stock chart illustrates Kimco Realty Corporation’s price movements and key levels over the past 12 months:

Trend Analysis

Over the past year, KIM’s stock price increased by 16.92%, indicating a bullish trend with acceleration. The price ranged between 18.1 and 25.57, with a standard deviation of 1.69. Recent months show an 8.03% rise, confirming continued positive momentum and a steady slope of 0.17.

Volume Analysis

Trading volume for KIM has decreased overall, with buyers and sellers nearly balanced historically (49.16% buyer volume). However, the last three months reveal strong buyer dominance at 69.69%, signaling increased investor interest and confidence despite lower total market participation.

Target Prices

Analysts set a clear target price range for Kimco Realty Corporation, reflecting cautious optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 21 | 26 | 23.91 |

The target prices suggest moderate upside potential, with consensus near 24, indicating steady confidence amid market uncertainties.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback concerning Kimco Realty Corporation’s market performance and reputation.

Stock Grades

Here are the latest verified grades for Kimco Realty Corporation from recognized analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2026-01-20 |

| UBS | Maintain | Buy | 2026-01-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-15 |

| Citigroup | Maintain | Neutral | 2025-12-03 |

| Argus Research | Maintain | Buy | 2025-12-01 |

| Scotiabank | Maintain | Sector Perform | 2025-11-13 |

| Barclays | Maintain | Overweight | 2025-10-06 |

| Evercore ISI Group | Maintain | In Line | 2025-09-08 |

| Barclays | Maintain | Overweight | 2025-08-27 |

| Mizuho | Maintain | Neutral | 2025-08-20 |

The consensus reflects a stable outlook with most firms maintaining current ratings. Buy and hold recommendations dominate, signaling moderate confidence without aggressive shifts.

Consumer Opinions

Kimco Realty Corporation sparks diverse consumer sentiment, reflecting its broad retail real estate footprint.

| Positive Reviews | Negative Reviews |

|---|---|

| “Well-maintained properties and convenient locations.” | “Some shopping centers appear dated and need upgrades.” |

| “Responsive management addressing tenant concerns quickly.” | “Parking can be limited during peak shopping hours.” |

| “Strong tenant mix that attracts steady foot traffic.” | “Occasional issues with property cleanliness reported.” |

Overall, consumers appreciate Kimco’s prime locations and tenant diversity, which drive consistent traffic. However, recurring concerns about property upkeep and parking constraints highlight areas needing attention to maintain appeal.

Risk Analysis

Below is a summary of key risks facing Kimco Realty Corporation, including probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Distress | Altman Z-Score signals high bankruptcy risk, below 1.8 | High | Severe |

| Liquidity Risk | Critically low current and quick ratios indicate poor liquidity | High | High |

| Interest Coverage | Negative interest coverage ratio risks inability to service debt | Medium | High |

| Leverage | Favorable debt metrics contrast with weak debt-to-equity score | Medium | Moderate |

| Market Volatility | Beta of 1.076 shows sensitivity to market swings | Medium | Moderate |

| Valuation Concerns | Neutral P/E but unfavorable P/B ratios may pressure stock price | Medium | Moderate |

Kimco’s most urgent risk is its financial distress, evident from a 1.27 Altman Z-Score placing it in the distress zone. Liquidity issues compound this threat, as current and quick ratios are effectively zero. These red flags caution investors despite the strong dividend yield and stable market presence.

Should You Buy Kimco Realty Corporation?

Kimco Realty appears to be in moderate financial health with improving profitability but a declining operational moat. Despite a favorable overall rating of B, its leverage profile remains substantial, suggesting cautious interpretation of its value creation potential.

Strength & Efficiency Pillars

Kimco Realty Corporation maintains a solid operational profile with a net margin of 27.32%, signaling notable profitability. The company’s gross margin stands at an impressive 69.05%, reflecting strong cost control. Interest expense is favorable at -15.43%, easing financial burdens. Despite these operational strengths, key return metrics like ROE and ROIC are unavailable or unfavorable, and the absence of WACC data prevents confirming value creation status. Overall, operational margins remain the core strength amid mixed efficiency signals.

Weaknesses and Drawbacks

Kimco is in financial distress, as indicated by an Altman Z-Score of 1.27, exposing it to a potential bankruptcy risk. This red flag overshadows other metrics, including very unfavorable debt-to-equity ratios and liquidity concerns shown by weak current and quick ratios. Valuation metrics are mixed, with a neutral P/E of 23.4 but unfavorable price-to-book data. Market volume trends show nearly balanced buyer-seller activity, but overall volume is decreasing, which may signal waning investor interest.

Our Final Verdict about Kimco Realty Corporation

Despite operational profitability, Kimco’s distress zone Altman Z-Score of 1.27 makes its investment profile highly speculative. The solvency risk dominates, suggesting caution for conservative investors. While the strong Piotroski score of 7 might indicate some financial resilience, the significant bankruptcy risk means this stock could be too risky for long-term conservative capital deployment.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Kimco Realty: Looking To 2026E After Rotation (NYSE:KIM) – Seeking Alpha (Feb 12, 2026)

- Kimco Realty Corp (KIM) Q4 2025 Earnings Call Highlights: Record Occupancy and Strong FFO Growth – GuruFocus (Feb 12, 2026)

- Kimco Realty (KIM) Meets Q4 FFO Estimates – Yahoo Finance (Feb 12, 2026)

- Kimco Realty (NYSE:KIM) Announces Earnings Results – MarketBeat (Feb 12, 2026)

- Here’s What Key Metrics Tell Us About Kimco Realty (KIM) Q4 Earnings – Nasdaq (Feb 12, 2026)

For more information about Kimco Realty Corporation, please visit the official website: kimcorealty.com