Home > Analyses > Financial Services > KeyCorp

KeyCorp shapes the financial landscape by powering the banking needs of individuals and businesses across 15 states with a robust network of branches and digital services. Renowned for its comprehensive retail and commercial banking solutions, KeyCorp combines innovation and market influence to serve a diverse client base. As the financial sector evolves, the critical question for investors is whether KeyCorp’s solid fundamentals and strategic initiatives continue to justify its current valuation and growth prospects.

Table of contents

Business Model & Company Overview

KeyCorp, founded in 1849 and headquartered in Cleveland, Ohio, stands as a prominent player in the regional banking sector. Through KeyBank National Association, it delivers a cohesive ecosystem of retail and commercial banking services, integrating deposits, lending, wealth management, and advisory solutions. This extensive portfolio serves individuals and SMEs, reinforcing its market position across 15 states with nearly 1,000 branches and over 1,300 ATMs.

The company’s revenue engine balances consumer and commercial banking segments, combining traditional deposit and lending products with investment, treasury, and capital market services. Its strategic footprint spans key U.S. regions, leveraging digital platforms alongside physical branches to capture diverse client needs. KeyCorp’s competitive advantage lies in its integrated service model and broad geographic reach, underpinning its role in shaping the future of regional banking.

Financial Performance & Fundamental Metrics

In this section, I analyze KeyCorp’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and shareholder value.

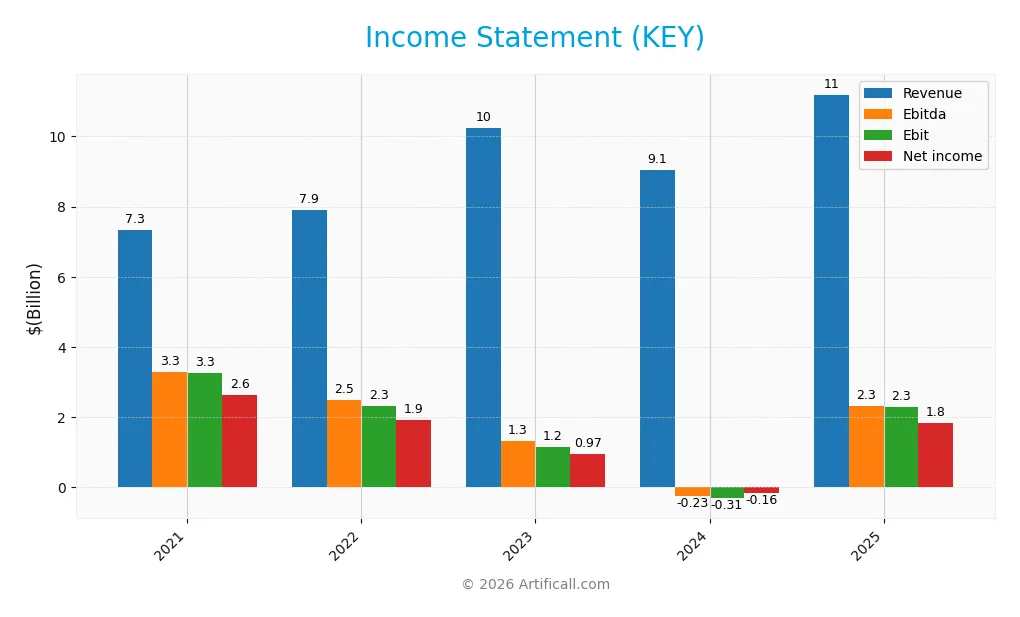

Income Statement

The table below presents KeyCorp’s key income statement figures for fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 7.33B | 7.91B | 10.23B | 9.06B | 11.19B |

| Cost of Revenue | -122M | 1.39B | 4.50B | 4.997B | 4.22B |

| Operating Expenses | 4.20B | 4.19B | 4.57B | 4.36B | 4.66B |

| Gross Profit | 7.46B | 6.52B | 5.73B | 4.06B | 6.97B |

| EBITDA | 3.29B | 2.50B | 1.31B | -233M | 2.32B |

| EBIT | 3.25B | 2.33B | 1.16B | -306M | 2.30B |

| Interest Expense | 296M | 885M | 4.01B | 4.66B | 3.75B |

| Net Income | 2.63B | 1.92B | 967M | -161M | 1.83B |

| EPS | 2.66 | 1.94 | 0.89 | -0.32 | 1.66 |

| Filing Date | 2022-02-22 | 2023-02-22 | 2024-02-22 | 2025-02-21 | 2026-01-20 |

Income Statement Evolution

KeyCorp’s revenue showed a favorable overall growth of 52.55% from 2021 to 2025, with a notable 23.56% increase between 2024 and 2025. Gross profit also improved significantly, growing 71.69% in the last year. Despite this, net income declined by 30.32% over the full period, reflecting margin pressures, as net margin dropped by 54.33%. However, recent margin trends, including a 16.35% net margin in 2025, suggest partial recovery.

Is the Income Statement Favorable?

The most recent fiscal year, 2025, reflects generally favorable fundamentals. Revenue and gross profit growth accelerated, while operating expenses grew in line with revenue, supporting margin stability. EBIT margin at 20.59% and net margin at 16.35% remain positive, though interest expenses represent a relatively high 33.52% of income, an unfavorable factor. Overall, 71.43% of income statement indicators are favorable, signaling a strong, if cautious, financial position.

Financial Ratios

The following table presents KeyCorp’s key financial ratios over the last five fiscal years, offering insight into profitability, valuation, liquidity, leverage, efficiency, and dividend performance:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 36% | 24% | 9% | -2% | 16% |

| ROE | 15% | 14% | 7% | -1% | 9% |

| ROIC | 9% | 5% | 2% | -0.4% | 6% |

| P/E | 8.3x | 8.4x | 13.8x | -101x | 12.4x |

| P/B | 1.26x | 1.20x | 0.91x | 0.90x | 1.11x |

| Current Ratio | 0.39 | 0.30 | 0.35 | 0.17 | 0.77 |

| Quick Ratio | 0.39 | 0.30 | 0.35 | 0.17 | 0.77 |

| D/E | 0.73 | 2.14 | 1.55 | 0.78 | 0.54 |

| Debt-to-Assets | 6.9% | 15.2% | 12.0% | 7.6% | 6.0% |

| Interest Coverage | 11.0x | 2.6x | 0.29x | -0.07x | 0.61x |

| Asset Turnover | 0.039 | 0.042 | 0.054 | 0.048 | 0.061 |

| Fixed Asset Turnover | 10.8x | 12.4x | 15.5x | 14.7x | 17.8x |

| Dividend Yield | 3.8% | 5.3% | 6.8% | 5.7% | 4.0% |

Evolution of Financial Ratios

Over the analyzed period, KeyCorp’s Return on Equity (ROE) showed a downward trend, declining from 15.07% in 2021 to 8.97% in 2025, indicating reduced profitability. The Current Ratio improved modestly, rising from 0.39 in 2021 to 0.77 in 2025, reflecting a slight enhancement in liquidity but remaining below the ideal threshold. The Debt-to-Equity Ratio decreased significantly from 1.55 in 2023 to 0.54 in 2025, signaling lower financial leverage and improved balance sheet stability.

Are the Financial Ratios Favorable?

In 2025, KeyCorp’s profitability, as reflected by a net margin of 16.35%, was favorable, yet ROE at 8.97% and WACC at 14.38% were unfavorable, suggesting challenges in generating returns above capital costs. Liquidity ratios, including a current and quick ratio of 0.77, were unfavorable, indicating potential short-term financial stress. Leverage ratios were mixed: the debt-to-assets ratio was favorable at 5.97%, while the debt-to-equity ratio was neutral at 0.54. Market valuation ratios such as P/E at 12.36 and P/B at 1.11 were favorable, balancing the overall assessment to a neutral stance.

Shareholder Return Policy

KeyCorp maintains a consistent dividend policy with a payout ratio near 49% and a 2025 dividend per share of $0.82, yielding about 4%. The company supports dividends through operational profitability, though free cash flow coverage data is unavailable. Share buybacks are not explicitly stated.

This approach reflects a balanced distribution supporting shareholder returns without excessive risk. The stable dividend alongside moderate payout suggests management aims for sustainable long-term value creation, aligning payout levels with profitability trends and capital discipline.

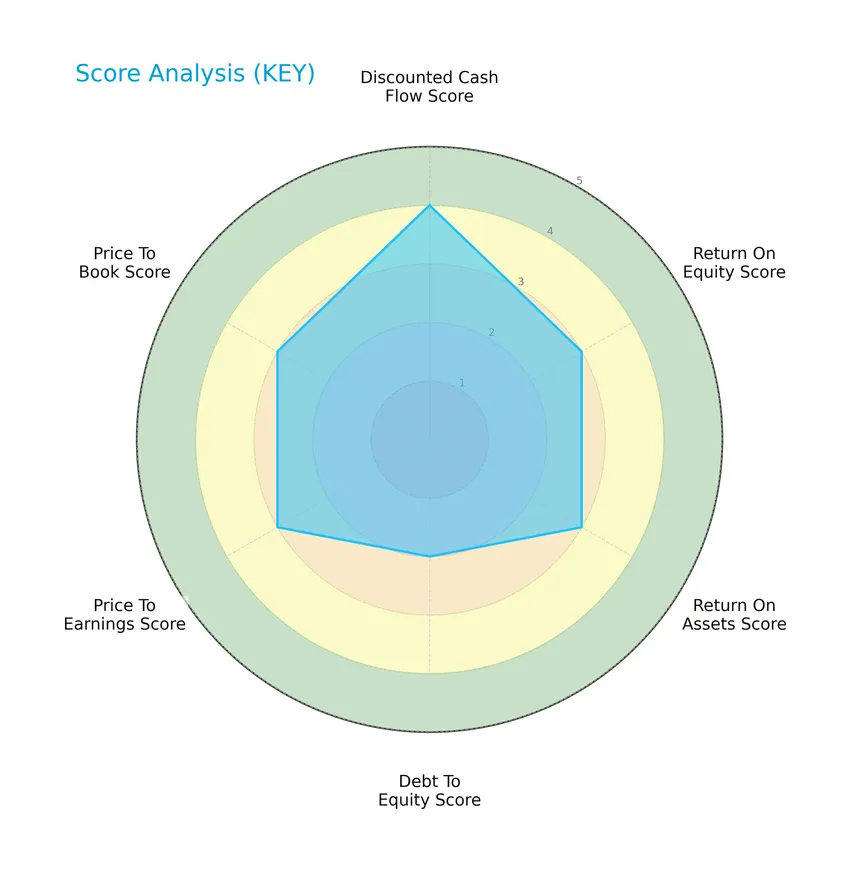

Score analysis

Below is a radar chart illustrating KeyCorp’s key financial scores for a comprehensive overview:

KeyCorp shows a favorable discounted cash flow score of 4, with moderate scores of 3 for return on equity, return on assets, price to earnings, and price to book. The debt to equity score is slightly lower at 2, indicating moderate leverage risk.

—

Analysis of the company’s bankruptcy risk

KeyCorp’s Altman Z-Score places it in the distress zone, indicating a high probability of financial distress:

—

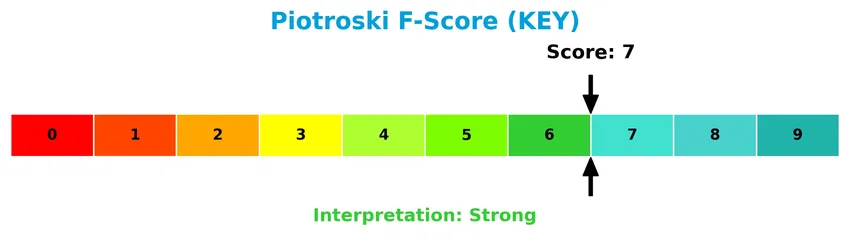

Is the company in good financial health?

The following diagram presents KeyCorp’s Piotroski Score to assess its financial strength:

With a Piotroski Score of 7, KeyCorp demonstrates strong financial health, reflecting solid profitability, efficiency, and liquidity metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine KeyCorp’s strategic positioning, revenue segments, key products, competitors, and competitive advantages. I will also assess whether KeyCorp holds a competitive edge over its main industry rivals.

Strategic Positioning

KeyCorp maintains a concentrated strategic position focused on the U.S. regional banking market, operating primarily through retail and commercial banking segments. Its diversified product portfolio spans consumer deposits, lending, wealth management, and capital markets, serving individuals and middle-market businesses across 15 states.

Revenue by Segment

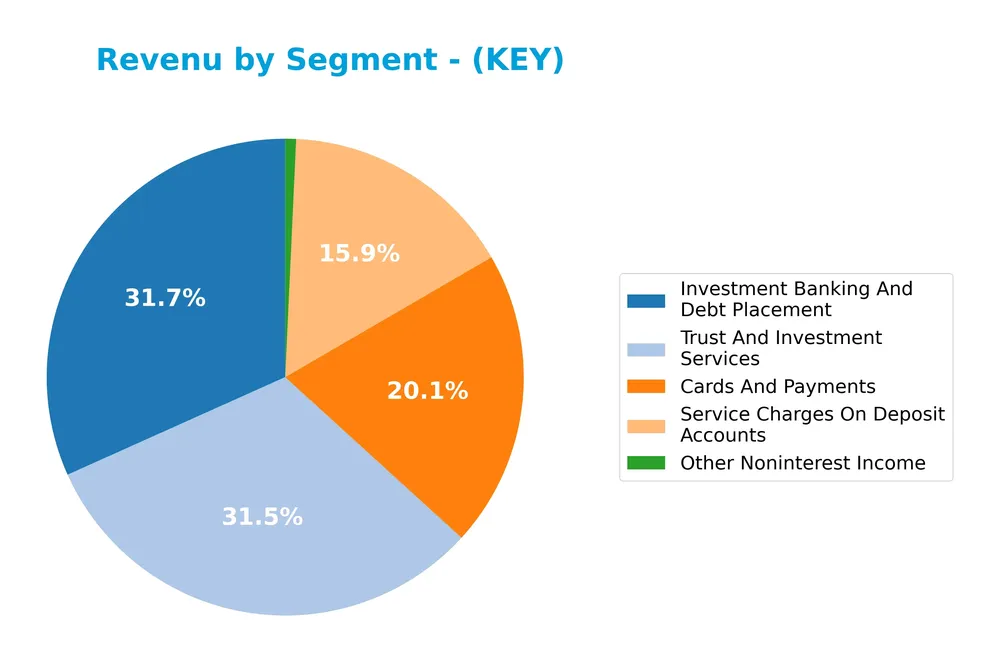

This pie chart illustrates KeyCorp’s revenue distribution by business segments for the fiscal year 2024, highlighting the company’s income sources and their relative contributions.

In 2024, KeyCorp’s revenue was diversified across several segments, with Investment Banking And Debt Placement leading at 521M, closely followed by Trust And Investment Services at 518M. Cards And Payments contributed 331M, while Service Charges On Deposit Accounts accounted for 261M. Other Noninterest Income remained a minor source at 12M. The data suggests a balanced revenue stream without concentration risk, with investment-related services driving growth.

Key Products & Brands

The table below summarizes KeyCorp’s main products and service offerings with their respective focuses:

| Product | Description |

|---|---|

| Consumer Bank | Retail banking products including deposits, lending, credit cards, mortgages, and personal finance services. |

| Commercial Bank | Commercial banking services such as treasury, business advisory, commercial loans, and capital market products. |

| Cards And Payments | Payment card services and related transaction processing products. |

| Investment Banking And Debt Placement | Services including securities underwriting, brokerage, and capital raising through debt and equity issuance. |

| Service Charges On Deposit Accounts | Fees earned from account maintenance and transaction services on deposit accounts. |

| Trust And Investment Services | Wealth management, asset management, portfolio management, and trust-related services for individuals and businesses. |

KeyCorp offers a diversified range of banking and financial services through its Consumer and Commercial Bank segments, supported by specialized products in payments, investment banking, and wealth management.

Main Competitors

There are 9 competitors in the Financial Services sector for KeyCorp, with the table listing the top 9 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| U.S. Bancorp | 83.8B |

| The PNC Financial Services Group, Inc. | 82.9B |

| Truist Financial Corporation | 64.6B |

| Fifth Third Bancorp | 31.5B |

| M&T Bank Corporation | 31.4B |

| Huntington Bancshares Incorporated | 25.5B |

| Citizens Financial Group, Inc. | 25.5B |

| Regions Financial Corporation | 24.9B |

| KeyCorp | 22.9B |

KeyCorp ranks 9th among its competitors with a market cap at 27.75% of the top player, U.S. Bancorp. The company’s valuation is below both the average market cap of the top 10 competitors (43.7B) and the sector median (31.4B). It maintains a 6.84% gap below the next closest competitor, Regions Financial Corporation.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does KeyCorp have a competitive advantage?

KeyCorp does not currently present a competitive advantage, as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company’s ROIC trend over 2021-2025 is negative, confirming a very unfavorable moat status.

Looking ahead, KeyCorp’s diverse portfolio of retail and commercial banking products, along with its presence in 15 states and digital banking capabilities, may offer opportunities to tap into new markets and enhance financial services. However, no specific future products or market expansions have been explicitly highlighted.

SWOT Analysis

This SWOT analysis highlights KeyCorp’s internal capabilities and external environment to guide strategic investment decisions.

Strengths

- strong revenue growth of 23.56% in 2025

- favorable gross margin at 62.27%

- diversified banking and financial services portfolio

Weaknesses

- low current and quick ratios at 0.77 indicating liquidity constraints

- declining ROIC trend signaling weakening profitability

- Altman Z-Score in distress zone raising bankruptcy concerns

Opportunities

- expansion in digital banking and mobile platforms

- growing demand for commercial and consumer loans

- potential to improve operational efficiency and reduce interest expenses

Threats

- high interest expenses at 33.52% of revenue

- competitive pressure in regional banking sector

- economic downturn risks impacting loan portfolios

Overall, KeyCorp demonstrates solid revenue growth and margin strength but faces liquidity and profitability challenges. Strategically, the company should focus on improving capital efficiency and managing risk to capitalize on digital banking growth while mitigating financial distress risks.

Stock Price Action Analysis

The weekly stock chart for KeyCorp (KEY) illustrates price movements and volume trends over the past 12 months, highlighting key support and resistance levels:

Trend Analysis

Over the past 12 months, KeyCorp’s stock price increased by 48.7%, indicating a bullish trend with acceleration. The price moved from a low of 13.36 to a high of 21.19, with a standard deviation of 1.97. Recent weeks show a 16.7% rise with a slope of 0.38 and reduced volatility at 1.44, confirming ongoing upward momentum.

Volume Analysis

Trading volume has been increasing, with buyer-driven activity dominating the past three months. Buyers accounted for 69.35% of volume from November 2025 to January 2026, indicating strong market participation and positive investor sentiment toward KeyCorp’s stock.

Target Prices

The target price consensus for KeyCorp (KEY) indicates moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 25 | 18 | 23.25 |

Analysts expect KeyCorp’s stock to trade between $18 and $25, with a consensus target of $23.25, reflecting a cautiously optimistic outlook.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the recent analyst ratings and consumer feedback regarding KeyCorp’s market performance and services.

Stock Grades

Here is a summary of the latest stock grades for KeyCorp from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-01-07 |

| Baird | Downgrade | Underperform | 2026-01-06 |

| Barclays | Maintain | Equal Weight | 2026-01-05 |

| Truist Securities | Maintain | Hold | 2025-12-22 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-12-17 |

| DA Davidson | Maintain | Buy | 2025-12-10 |

| Truist Securities | Maintain | Hold | 2025-10-17 |

| DA Davidson | Maintain | Buy | 2025-10-17 |

| UBS | Maintain | Buy | 2025-10-07 |

| RBC Capital | Maintain | Outperform | 2025-10-06 |

Overall, the grades show a predominance of Buy and Hold ratings, with a notable downgrade from Baird to Underperform. The consensus remains a Buy, reflecting a generally positive but cautiously varied outlook among analysts.

Consumer Opinions

Consumers have mixed feelings about KeyCorp, reflecting both satisfaction with its services and concerns about certain operational aspects.

| Positive Reviews | Negative Reviews |

|---|---|

| “KeyCorp offers reliable customer support and easy-to-use online banking tools.” | “Long wait times on customer service calls can be frustrating.” |

| “Competitive loan rates and helpful financial advice from staff.” | “Mobile app occasionally crashes and lacks some desired features.” |

| “Branch locations are conveniently placed and staff are friendly.” | “Some fees are higher compared to other banks in the region.” |

Overall, KeyCorp is praised for its customer service and accessibility, but users frequently mention issues with wait times and digital platform stability as areas needing improvement.

Risk Analysis

Below is a detailed table summarizing key risks affecting KeyCorp’s investment profile, highlighting probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score of 0.07 places KeyCorp in distress zone, signaling high bankruptcy risk. | High | High |

| Profitability | Unfavorable ROE (8.97%) and WACC (14.38%) indicate weak returns versus cost of capital. | Medium | Medium |

| Liquidity | Current and quick ratios at 0.77 suggest liquidity constraints under short-term obligations. | Medium | Medium |

| Market Volatility | Beta of 1.08 implies stock price sensitivity to market swings, risking price fluctuations. | Medium | Medium |

| Debt Management | Moderate debt-to-equity ratio (0.54) and interest coverage (0.61) pose refinancing and solvency risks. | Medium | Medium |

| Industry Risks | Regional banking sector faces regulatory shifts and economic cycles affecting loan portfolios. | Medium | High |

KeyCorp’s most pressing risk is its extremely low Altman Z-Score, reflecting a serious financial distress signal despite a strong Piotroski Score of 7. The company’s liquidity and profitability metrics also caution investors due to unfavorable returns and coverage ratios. Market volatility and sector-specific challenges add layers of uncertainty. Careful risk monitoring and diversification are advised before investing.

Should You Buy KeyCorp?

KeyCorp appears to be exhibiting improving profitability with moderate returns on equity, though its competitive moat is very unfavorable due to declining ROIC and value destruction. Despite a substantial leverage profile and distress-level Altman Z-score, its overall B+ rating suggests cautious value creation potential.

Strength & Efficiency Pillars

KeyCorp exhibits solid profitability with a favorable net margin of 16.35% and a gross margin of 62.27%, underscoring operational efficiency. While its ROE stands at a modest 8.97%, the Piotroski score of 7 signals strong financial health. However, the Altman Z-Score of 0.07 places the company in the distress zone, indicating potential bankruptcy risk despite a moderate debt-to-equity ratio of 0.54. The ROIC at 5.83% falls below the WACC of 14.38%, suggesting KeyCorp is currently a value destroyer rather than a creator.

Weaknesses and Drawbacks

KeyCorp faces significant headwinds, notably its weak liquidity position with a current ratio and quick ratio both at 0.77, which is unfavorable for meeting short-term obligations. Interest coverage is critically low at 0.61, signaling potential difficulties servicing debt. The WACC of 14.38% surpasses ROIC, highlighting value erosion. Although P/E at 12.36 and P/B at 1.11 appear reasonable, the distressed Altman Z-Score and low asset turnover of 0.06 raise concerns about operational efficiency and financial stability.

Our Verdict about KeyCorp

KeyCorp’s long-term fundamental profile appears mixed, with strengths in profitability and financial health but critical weaknesses in liquidity and value creation. Given the bullish overall stock trend and buyer dominance in recent periods, the profile may appear attractive for cautious investors. However, the distress-level bankruptcy risk and unfavorable ROIC versus WACC ratio suggest a watchful stance to mitigate downside risks, making a wait-and-see approach prudent.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- KeyCorp (KEY) stock trades up, here is why – MSN (Jan 23, 2026)

- KeyCorp Board of Directors Update – PR Newswire (Jan 20, 2026)

- How The Evolving Price Target Is Rewriting The Story For KeyCorp (KEY) – Yahoo Finance (Jan 21, 2026)

- Did KeyCorp’s US$1.20 Billion Buyback Plan Just Shift KeyCorp’s (KEY) Investment Narrative? – simplywall.st (Jan 23, 2026)

- US lender KeyCorp beats fourth-quarter profit estimates on higher interest income – Reuters (Jan 20, 2026)

For more information about KeyCorp, please visit the official website: key.com