Home > Analyses > Consumer Defensive > Keurig Dr Pepper Inc.

Keurig Dr Pepper Inc. transforms daily routines by delivering iconic beverages that refresh millions across the U.S. and beyond. As a dominant force in the non-alcoholic beverage industry, it leads with popular brands like Dr Pepper, Snapple, and Keurig coffee systems, combining innovation with a broad product portfolio. Known for quality and market influence, the company continuously adapts to shifting consumer tastes. The key question now is whether Keurig Dr Pepper’s solid fundamentals still justify its current valuation and future growth prospects.

Table of contents

Business Model & Company Overview

Keurig Dr Pepper Inc., founded in 1981 and headquartered in Burlington, Massachusetts, stands as a leading player in the non-alcoholic beverages industry. Its integrated ecosystem spans Coffee Systems, Packaged Beverages, Beverage Concentrates, and Latin America Beverages, delivering a diverse portfolio that includes K-Cup pods, brewers, and iconic brands like Dr Pepper, Canada Dry, and Snapple. This cohesive product lineup supports a unified mission to serve retailers, distributors, and end consumers globally.

The company’s revenue engine balances hardware sales from coffee brewers with recurring income from coffee pods and extensive beverage concentrate production. Its strategic footprint covers key markets across the Americas, Europe, and Asia, underpinning steady demand. With a market cap of $37.7B and a workforce of 29K, Keurig Dr Pepper leverages a strong economic moat built on brand loyalty and wide distribution, shaping the future of beverage consumption worldwide.

Financial Performance & Fundamental Metrics

In this section, I analyze Keurig Dr Pepper Inc.’s income statement, key financial ratios, and dividend payout policy to assess its fundamental strength.

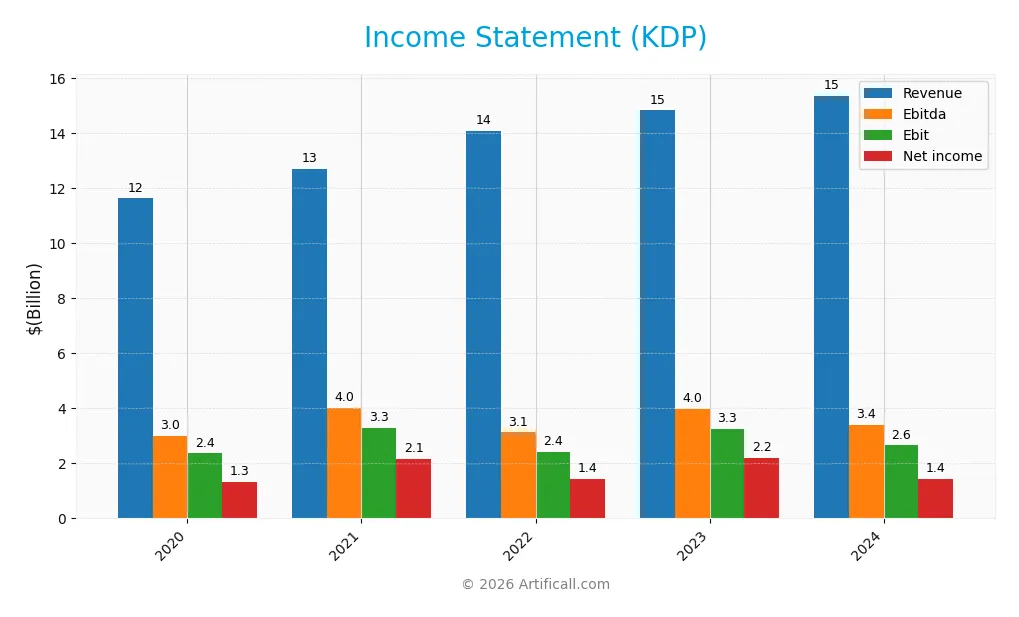

Income Statement

The following table summarizes Keurig Dr Pepper Inc.’s key income statement figures for the fiscal years 2020 through 2024 in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 11.62B | 12.68B | 14.06B | 14.81B | 15.35B |

| Cost of Revenue | 5.13B | 5.71B | 6.73B | 6.73B | 6.82B |

| Operating Expenses | 4.01B | 4.08B | 4.72B | 4.89B | 5.94B |

| Gross Profit | 6.49B | 6.98B | 7.32B | 8.08B | 8.53B |

| EBITDA | 3.01B | 4.01B | 3.12B | 3.97B | 3.38B |

| EBIT | 2.36B | 3.30B | 2.41B | 3.25B | 2.65B |

| Interest Expense | 597M | 525M | 468M | 596M | 684M |

| Net Income | 1.33B | 2.15B | 1.44B | 2.18B | 1.44B |

| EPS | 0.94 | 1.52 | 1.01 | 1.56 | 1.06 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-25 |

Income Statement Evolution

From 2020 to 2024, Keurig Dr Pepper Inc.’s revenue grew by 32.13% overall, though the one-year growth rate in 2024 was a modest 3.62%, indicating a slowdown. Net income increased by 8.75% over the full period but declined by 36.24% in the last year. Gross margins remained favorable at 55.56%, while operating expenses grew at the same pace as revenue, pressuring EBIT and net margins, which contracted in the most recent year.

Is the Income Statement Favorable?

In 2024, KDP reported revenue of $15.35B and net income of $1.44B, with net margin at 9.39%, reflecting a decrease from the prior year. EBIT margin stood at 17.26%, supported by stable gross profit growth of 5.56%, but EBIT declined by 18.57%. Interest expenses remained favorable at 4.46% of revenue. Overall, despite some margin compression and lower net income growth last year, the income statement fundamentals are assessed as generally favorable.

Financial Ratios

The table below presents key financial ratios for Keurig Dr Pepper Inc. (KDP) over the fiscal years 2020 to 2024, offering a snapshot of profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 11% | 17% | 10% | 15% | 9% |

| ROE | 5.6% | 8.6% | 5.7% | 8.5% | 5.9% |

| ROIC | 4.2% | 5.0% | 4.8% | 5.4% | 4.0% |

| P/E | 34.0 | 24.3 | 35.2 | 21.4 | 30.4 |

| P/B | 1.9 | 2.1 | 2.0 | 1.8 | 1.8 |

| Current Ratio | 0.31 | 0.47 | 0.47 | 0.38 | 0.49 |

| Quick Ratio | 0.21 | 0.33 | 0.31 | 0.25 | 0.33 |

| D/E | 0.61 | 0.53 | 0.54 | 0.58 | 0.71 |

| Debt-to-Assets | 29% | 26% | 26% | 28% | 32% |

| Interest Coverage | 4.2 | 5.5 | 5.6 | 5.4 | 3.8 |

| Asset Turnover | 0.23 | 0.25 | 0.27 | 0.28 | 0.29 |

| Fixed Asset Turnover | 4.1 | 4.0 | 4.2 | 4.1 | 4.0 |

| Dividend Yield | 1.9% | 1.8% | 2.1% | 2.4% | 2.7% |

Evolution of Financial Ratios

From 2020 to 2024, Keurig Dr Pepper Inc. displayed fluctuating trends in key ratios. Return on Equity (ROE) showed a decline, reaching 5.94% in 2024, indicating reduced profitability. The Current Ratio improved slightly to 0.49 in 2024 but remained below 1, signaling ongoing liquidity constraints. The Debt-to-Equity Ratio increased to 0.71, reflecting higher leverage with moderate stability in profitability margins.

Are the Financial Ratios Favorable?

The 2024 financial ratios for KDP present a mixed picture. Profitability ratios like net margin (9.39%) and ROE (5.94%) are neutral to unfavorable, while liquidity ratios such as current (0.49) and quick (0.33) are unfavorable, suggesting short-term financial stress. Leverage ratios are neutral with a Debt-to-Equity at 0.71, and efficiency is challenged by a low asset turnover (0.29). Favorable metrics include a strong fixed asset turnover (3.99) and dividend yield (2.73%), but overall the ratios are slightly unfavorable.

Shareholder Return Policy

Keurig Dr Pepper Inc. maintains a consistent dividend payout with a ratio of 83% in 2024 and a dividend yield near 2.7%, supported by robust free cash flow coverage of approximately 75%. The company also executes share buybacks, balancing distributions with capital expenditures.

This combined approach of dividends and buybacks appears aligned with sustainable shareholder value creation, though the relatively high payout ratio warrants monitoring for potential risks linked to cash flow fluctuations or excessive leverage.

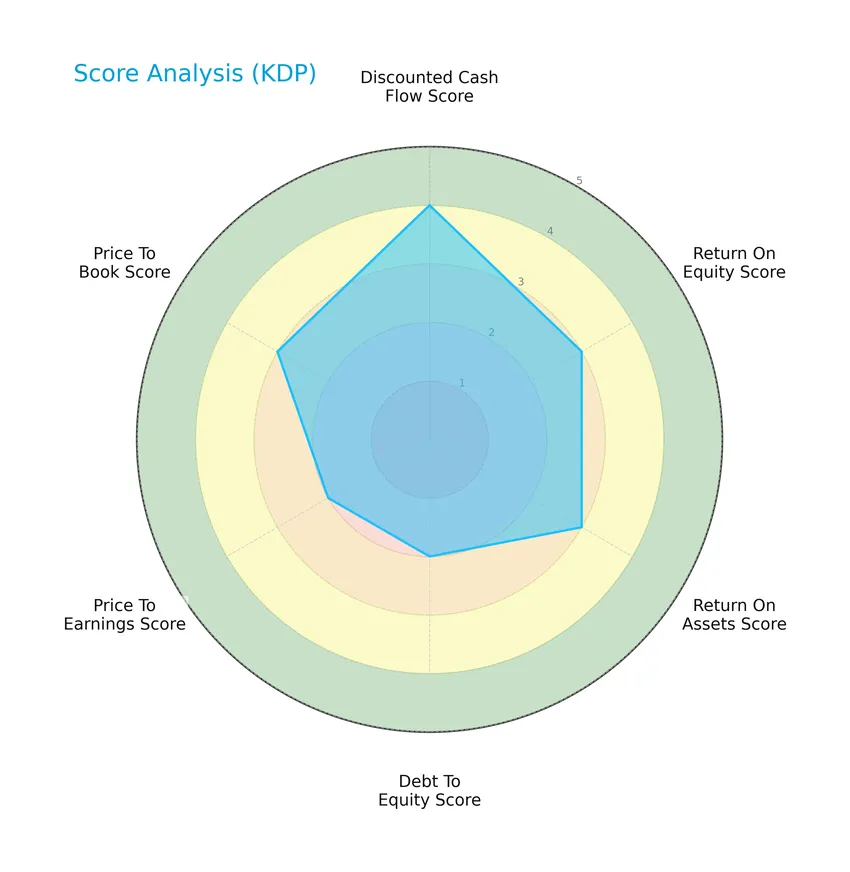

Score analysis

The following radar chart illustrates Keurig Dr Pepper Inc.’s key financial scores across various valuation and profitability metrics:

Keurig Dr Pepper shows a discounted cash flow score rated favorable at 4, while return on equity and assets both hold moderate scores of 3. Debt-to-equity and price-to-earnings scores are moderate but slightly lower at 2, with price-to-book also moderate at 3, reflecting balanced but cautious valuation indicators.

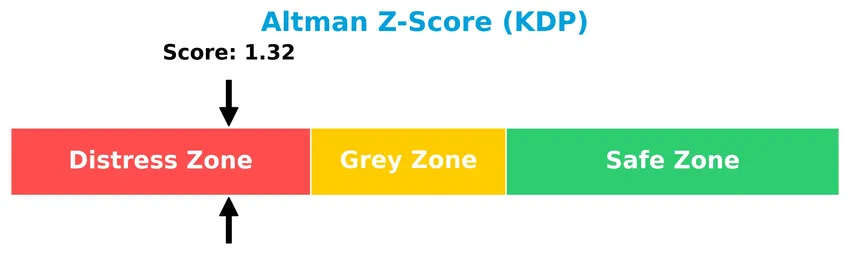

Analysis of the company’s bankruptcy risk

Keurig Dr Pepper’s Altman Z-Score places it in the distress zone, indicating a higher likelihood of financial distress and bankruptcy risk:

Is the company in good financial health?

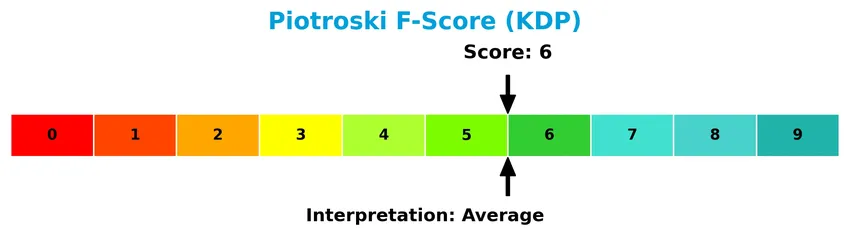

The Piotroski Score diagram provides insight into the company’s financial strength based on nine key criteria:

With a Piotroski Score of 6, Keurig Dr Pepper is considered to have average financial health, suggesting moderate strength but room for improvement in operational efficiency and profitability.

Competitive Landscape & Sector Positioning

This section provides an overview of Keurig Dr Pepper Inc.’s positioning within the non-alcoholic beverage sector, covering strategic aspects and revenue segments. I will also examine whether the company holds a competitive advantage compared to its main rivals.

Strategic Positioning

Keurig Dr Pepper Inc. maintains a diversified product portfolio across Coffee Systems, Packaged Beverages, Beverage Concentrates, and Latin America Beverages, with dominant revenue from K-Cup Pods and LRB segments. Geographically, it is heavily concentrated in the U.S. market, generating over $13B in 2024, with international sales around $2B.

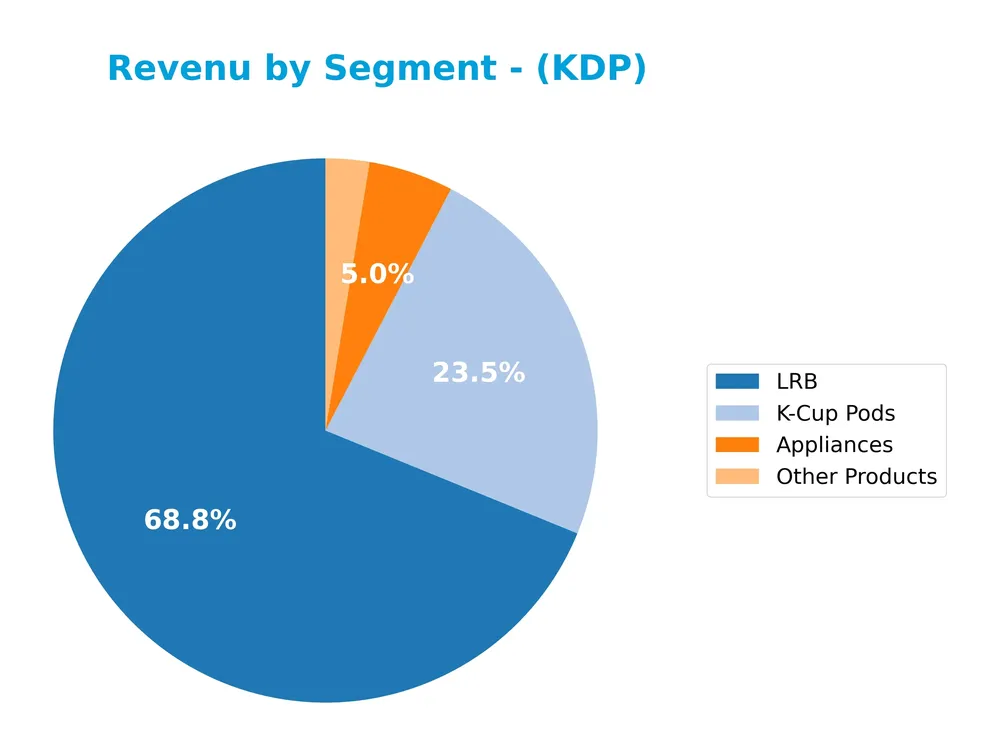

Revenue by Segment

This pie chart illustrates Keurig Dr Pepper Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contribution of each business area.

In 2024, the Liquid Refreshment Beverages (LRB) segment led with $10.6B in revenue, showing steady growth from $9.9B in 2023. K-Cup Pods remained a key driver with $3.6B, slightly down from the prior year. Appliances and Other Products contributed $772M and $399M respectively, indicating a more modest scale. The concentration in LRB suggests a reliance on beverage sales, with a slight deceleration in K-Cup Pod growth worth monitoring.

Key Products & Brands

The key products and brands of Keurig Dr Pepper Inc. are segmented as follows:

| Product | Description |

|---|---|

| Coffee Systems | Manufacturing and distribution of coffee systems, K-Cup pods, brewers, and specialty coffee. |

| Packaged Beverages | Manufacture and distribution of packaged beverages, contract manufacturing, and partner brand distribution. |

| Beverage Concentrates | Production and sales of beverage concentrates and syrups under brands such as Dr Pepper, Canada Dry, 7UP, and Snapple. |

| Latin America Beverages | Manufacture and distribution of carbonated mineral water, flavored soft drinks, bottled water, and juices under brands like Peñafiel, Clamato, and Squirt. |

| Appliances | Sales of coffee brewing appliances (revenue reported separately in 2023-2024). |

| K-Cup Pods | Sales of K-Cup pods for single-serve coffee brewing (revenue reported separately in 2023-2024). |

| Other Products | Miscellaneous products falling outside main categories (revenue reported separately in 2023-2024). |

Keurig Dr Pepper’s portfolio spans coffee systems, beverage concentrates, packaged drinks, and regional beverage brands, reflecting a diversified presence in the non-alcoholic beverage industry.

Main Competitors

There are 7 competitors in the Beverages – Non-Alcoholic industry; below is a table listing the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Coca-Cola Company | 297B |

| PepsiCo, Inc. | 194B |

| Monster Beverage Corporation | 74B |

| Coca-Cola Europacific Partners PLC | 41.7B |

| Keurig Dr Pepper Inc. | 37.7B |

| Coca-Cola Consolidated, Inc. | 13.3B |

| Celsius Holdings, Inc. | 11.8B |

Keurig Dr Pepper Inc. ranks 5th among its 7 competitors, with a market cap representing approximately 12.7% of the leader, The Coca-Cola Company. The company is positioned below both the average market cap of the top 10 competitors (95.8B) and the median market cap of the sector (41.7B). It maintains a 10.51% market cap advantage over its closest competitor above, indicating a moderate gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does KDP have a competitive advantage?

Keurig Dr Pepper Inc. currently does not present a competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company’s ROIC trend over 2020-2024 is negative, reflecting decreasing efficiency in capital use.

Looking ahead, Keurig Dr Pepper’s diverse beverage portfolio and expansion in international markets offer potential growth opportunities. Continued development across Coffee Systems and Latin America Beverages segments may support future revenue increases despite current profitability challenges.

SWOT Analysis

This SWOT analysis highlights Keurig Dr Pepper Inc.’s key strategic factors to support informed investment decisions.

Strengths

- Strong brand portfolio across beverages

- Consistent revenue growth over 5 years

- Favorable gross and EBIT margins

Weaknesses

- Declining ROIC and profitability

- Low liquidity ratios (current and quick)

- High P/E ratio signaling valuation concerns

Opportunities

- Expanding international market presence

- Innovation in beverage concentrates and coffee systems

- Growing demand for healthier beverage options

Threats

- Intense competition in non-alcoholic beverages

- Rising input costs impacting margins

- Financial distress risk indicated by Altman Z-Score

Overall, Keurig Dr Pepper shows resilience through solid revenue growth and brand strength but faces profitability and liquidity challenges. Strategic focus should prioritize improving operational efficiency and leveraging international expansion while closely managing financial risks.

Stock Price Action Analysis

The following weekly stock chart illustrates Keurig Dr Pepper Inc.’s price movements over the past 100 weeks, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, KDP’s stock price decreased by 5.19%, indicating a bearish trend with accelerating decline. The price ranged between a high of 37.61 and a low of 25.5, showing notable volatility with a standard deviation of 3.01. However, in the recent period from November 2025 to January 2026, the stock reversed direction with a 6.93% increase and a moderate slope of 0.06, signaling a short-term recovery.

Volume Analysis

Trading volume for KDP has been increasing overall, with a total volume of approximately 6.6B shares. Seller volume slightly exceeded buyer volume historically, but recent activity from November 2025 to January 2026 shows clear buyer dominance at 65.45%, with buyers accounting for 511M shares versus 270M sold. This suggests growing investor interest and stronger market participation favoring buyers in the short term.

Target Prices

Analysts present a clear consensus on Keurig Dr Pepper Inc.’s target price range.

| Target High | Target Low | Consensus |

|---|---|---|

| 38 | 24 | 32 |

The target prices indicate moderate optimism, with analysts expecting the stock to trade around $32, suggesting potential upside from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Keurig Dr Pepper Inc. (KDP).

Stock Grades

Here is a summary of recent stock grades provided by reputable financial institutions for Keurig Dr Pepper Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Downgrade | Hold | 2025-12-17 |

| Piper Sandler | Maintain | Overweight | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-10-28 |

| Wells Fargo | Maintain | Overweight | 2025-10-28 |

| JP Morgan | Maintain | Overweight | 2025-10-20 |

| B of A Securities | Maintain | Buy | 2025-10-08 |

| Goldman Sachs | Maintain | Neutral | 2025-10-02 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| Barclays | Downgrade | Equal Weight | 2025-09-24 |

| BNP Paribas | Downgrade | Underperform | 2025-09-22 |

The consensus remains a “Buy” with 16 buy ratings versus 11 holds and only one sell, reflecting a generally positive outlook despite some recent downgrades from a few firms.

Consumer Opinions

Consumers of Keurig Dr Pepper Inc. (KDP) express a mix of enthusiasm and criticism about the brand’s products and services.

| Positive Reviews | Negative Reviews |

|---|---|

| Enjoy the convenience and variety of beverage options offered. | Some find the pricing on certain products slightly high. |

| Appreciate the consistent quality and flavor of drinks. | Complaints about occasional delays in product availability. |

| Like the eco-friendly initiatives and recyclable packaging. | Some users experience issues with Keurig machines malfunctioning. |

Overall, consumers praise KDP for its diverse product lineup and commitment to sustainability. However, pricing and product accessibility remain areas where some customers see room for improvement.

Risk Analysis

The following table summarizes key risks associated with Keurig Dr Pepper Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score in distress zone suggests potential financial distress and bankruptcy risk. | High | High |

| Profitability | Unfavorable ROE (5.94%) and ROIC (4.04%) indicate weak returns on capital and equity. | Medium | Medium |

| Liquidity | Low current ratio (0.49) and quick ratio (0.33) imply potential difficulties meeting short-term obligations. | Medium | High |

| Valuation | Elevated P/E ratio (30.36) may signal overvaluation risk compared to industry peers. | Medium | Medium |

| Market Dependence | Beta of 0.349 shows low market volatility sensitivity but limits upside during market rallies. | Low | Low |

| Operational Efficiency | Low asset turnover (0.29) could indicate inefficiencies in using assets to generate sales. | Medium | Medium |

The most pressing risk is the financial health concern, with the Altman Z-Score placing KDP in the distress zone, indicating a heightened bankruptcy risk if conditions worsen. Liquidity constraints further amplify this risk, as the company shows weak short-term liquidity ratios. Investors should exercise caution and monitor these factors closely.

Should You Buy Keurig Dr Pepper Inc.?

Keurig Dr Pepper Inc. appears to be experiencing eroding operational efficiency and value destruction, indicated by a very unfavorable moat and declining ROIC. Despite a manageable leverage profile, financial distress signals persist, reflected in a B rating and moderate overall scores.

Strength & Efficiency Pillars

Keurig Dr Pepper Inc. exhibits solid profitability with a gross margin of 55.56% and an EBIT margin of 17.26%, reflecting operational efficiency. The company maintains a favorable interest expense ratio at 4.46% and a net margin of 9.39%. While return on equity (5.94%) and return on invested capital (4.04%) are modest, the weighted average cost of capital (4.74%) slightly exceeds ROIC, indicating the company is currently not a value creator. Financial health metrics are mixed, with an Altman Z-Score of 1.32 signaling distress risk, but a Piotroski score of 6 suggesting average financial strength.

Weaknesses and Drawbacks

Keurig Dr Pepper faces notable challenges. Its price-to-earnings ratio of 30.36 signals a premium valuation that may pressure future returns. Liquidity is a concern with a current ratio of 0.49 and a quick ratio of 0.33, both unfavorable and indicating potential short-term solvency issues. The asset turnover ratio is low at 0.29, reflecting inefficiency in asset utilization. Additionally, the Altman Z-Score places the company in the distress zone, which heightens bankruptcy risk. The stock trend remains bearish with a 5.19% price decline overall, although recent trends show buyer dominance.

Our Verdict about Keurig Dr Pepper Inc.

The fundamental profile of Keurig Dr Pepper appears mixed but leans slightly unfavorable due to financial health risks and valuation concerns. Despite a bearish overall trend, recent buyer dominance and improving price momentum might signal a tentative recovery. Therefore, while the company may appear to present long-term challenges, the recent market behavior suggests cautious investors could consider a wait-and-see approach for a potentially more attractive entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Y Intercept Hong Kong Ltd Acquires Shares of 422,718 Keurig Dr Pepper, Inc $KDP – MarketBeat (Jan 24, 2026)

- Keurig Dr Pepper Inc.’s (NASDAQ:KDP) Stock Been Rising But Financials Look Weak: Should Shareholders Be Worried? – Yahoo Finance (Jan 21, 2026)

- What to expect from Keurig Dr Pepper’s Q4 2025 earnings report – MSN (Jan 22, 2026)

- Keurig Dr Pepper Launches Offer for JDE Peet’s Shares – PR Newswire (Jan 15, 2026)

- Keurig Dr Pepper to Report Fourth Quarter 2025 Results and Host Conference Call – starlocalmedia.com (Jan 22, 2026)

For more information about Keurig Dr Pepper Inc., please visit the official website: keurigdrpepper.com