Home > Analyses > Consumer Defensive > Kenvue Inc.

Kenvue Inc. touches billions of lives daily through trusted health and personal care essentials. Its portfolio features iconic brands like Tylenol, Neutrogena, and Listerine, setting industry standards in innovation and quality. As a standalone leader spun off from Johnson & Johnson, Kenvue commands significant market influence within consumer health. The critical question now is whether its robust fundamentals and brand moat justify its current valuation and future growth trajectory.

Table of contents

Business Model & Company Overview

Kenvue Inc., founded in 2022 and headquartered in Skillman, New Jersey, stands as a global leader in the Household & Personal Products sector. It operates an integrated ecosystem across three key segments—Self Care, Skin Health and Beauty, and Essential Health—offering trusted brands like Tylenol, Neutrogena, and Band-Aid. This cohesive portfolio addresses diverse consumer health needs, reinforcing Kenvue’s dominant market position and broad appeal worldwide.

The company’s revenue engine balances consumer staples with strong brand loyalty, driven by recurring demand across Americas, Europe, and Asia. Its product mix spans from over-the-counter remedies to personal care essentials, generating steady cash flow and resilience against market fluctuations. Kenvue’s competitive advantage lies in this diversified platform and global reach, creating a durable economic moat that shapes the future of consumer health.

Financial Performance & Fundamental Metrics

I analyze Kenvue Inc.’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder returns.

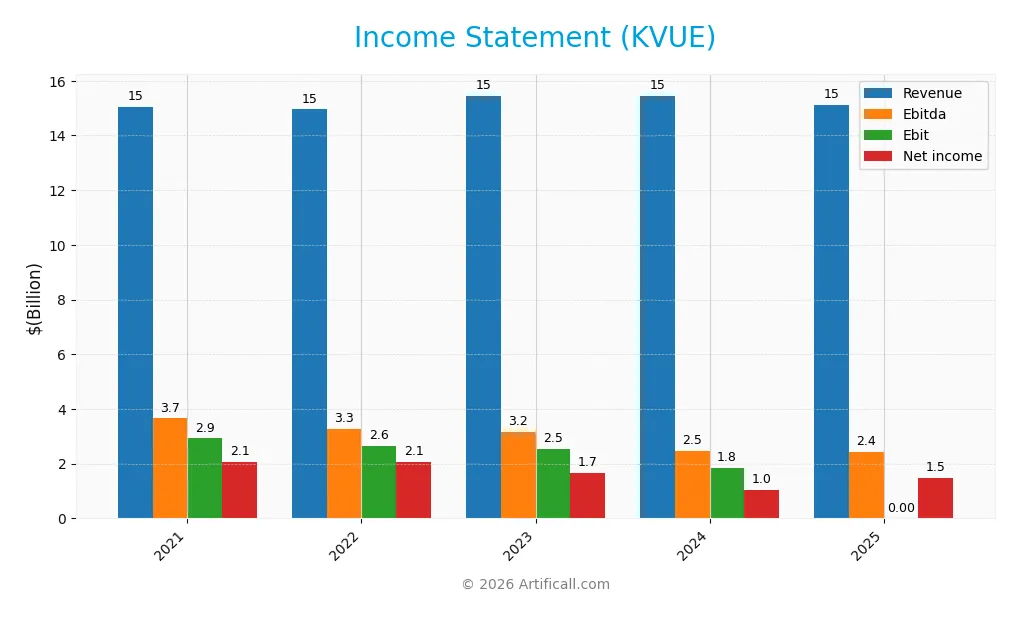

Income Statement

Below is Kenvue Inc.’s income statement summary for fiscal years 2021 through 2025, illustrating key financial metrics in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 15.1B | 14.9B | 15.4B | 15.5B | 15.1B |

| Cost of Revenue | 6.6B | 6.7B | 6.8B | 6.5B | 6.3B |

| Operating Expenses | 5.5B | 5.6B | 6.1B | 7.1B | 6.1B |

| Gross Profit | 8.4B | 8.3B | 8.6B | 8.9B | 8.8B |

| EBITDA | 3.7B | 3.3B | 3.2B | 2.5B | 2.4B |

| EBIT | 2.9B | 2.6B | — | 1.8B | — |

| Interest Expense | 0 | 0 | 358M | 431M | 379M |

| Net Income | 2.1B | 2.1B | 1.7B | 1.0B | 1.5B |

| EPS | 1.10 | 1.08 | 0.90 | 0.54 | 0.77 |

| Filing Date | 2021-12-31 | 2022-12-31 | 2024-03-01 | 2025-02-24 | 2026-02-17 |

Income Statement Evolution

Kenvue’s revenue slightly declined by 2.14% in 2025 after minimal overall growth of 0.46% since 2021. Gross profit also edged down by 1.86% last year, reflecting stable but pressured margins. Net income fell 29.26% over the period, with a noticeable dip in EBIT margin to zero, indicating margin compression and rising costs relative to earnings.

Is the Income Statement Favorable?

In 2025, Kenvue posted a 15.1B revenue with a 58.13% gross margin, which remains favorable. However, EBIT margin dropped to 0%, signaling operational challenges. Interest expense at 2.51% of revenue is manageable, and net margin improved to 9.72%. Despite positive net margin and EPS growth, the overall income statement leans unfavorable due to declining profitability and key margin pressures.

Financial Ratios

The table below summarizes key financial ratios for Kenvue Inc. from 2021 to 2025, providing a clear view of profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 13.8% | 13.8% | 10.8% | 6.7% | 9.7% |

| ROE | 10.2% | 10.3% | 14.8% | 10.7% | 0% |

| ROIC | 8.7% | 8.9% | 8.3% | 6.2% | 0% |

| P/E | 24.5 | 25.0 | 23.9 | 39.4 | 22.4 |

| P/B | 2.49 | 2.58 | 3.55 | 4.20 | 0 |

| Current Ratio | 1.22 | 1.50 | 1.12 | 0.96 | 0 |

| Quick Ratio | 0.80 | 0.93 | 0.78 | 0.69 | 0 |

| D/E | 0.006 | 0.45 | 0.75 | 0.90 | 0 |

| Debt-to-Assets | 0.005 | 0.33 | 0.30 | 0.34 | 0 |

| Interest Coverage | 0 | 0 | 7.0 | 4.3 | 6.4 |

| Asset Turnover | 0.54 | 0.55 | 0.55 | 0.60 | 0 |

| Fixed Asset Turnover | 8.24 | 8.21 | 7.56 | 8.36 | 0 |

| Dividend Yield | 0% | 0% | 36.6% | 3.8% | 4.8% |

Evolution of Financial Ratios

Over the period, Kenvue’s ROE and ROIC both declined to zero by 2025, indicating deteriorating profitability. The current ratio also dropped sharply to zero in 2025, signaling liquidity concerns. Meanwhile, the debt-to-equity ratio trended downward, hitting zero in 2025, reflecting reduced leverage or possible de-leveraging efforts.

Are the Financial Ratios Favorable?

In 2025, profitability ratios show a neutral net margin of 9.72%, but ROE and ROIC are unfavorable at zero. Liquidity ratios are also unfavorable due to zero current and quick ratios. Debt metrics are favorable with zero debt-to-equity and debt-to-assets ratios. Market ratios like P/E are neutral, while dividend yield at 4.8% is favorable. Overall, the ratios appear slightly unfavorable.

Shareholder Return Policy

Kenvue Inc. maintains a consistent dividend policy with a payout ratio slightly above 100% in 2025, supported by a 4.8% annual yield and a stable dividend per share near $0.83. The company also engages in share buybacks, balancing cash returns to shareholders against free cash flow coverage risks.

While the dividend payout slightly exceeds net income, Kenvue’s free cash flow covers most distributions, signaling cautious capital allocation. This approach supports sustainable long-term value but warrants monitoring for potential pressure from high payout ratios amid market cycles.

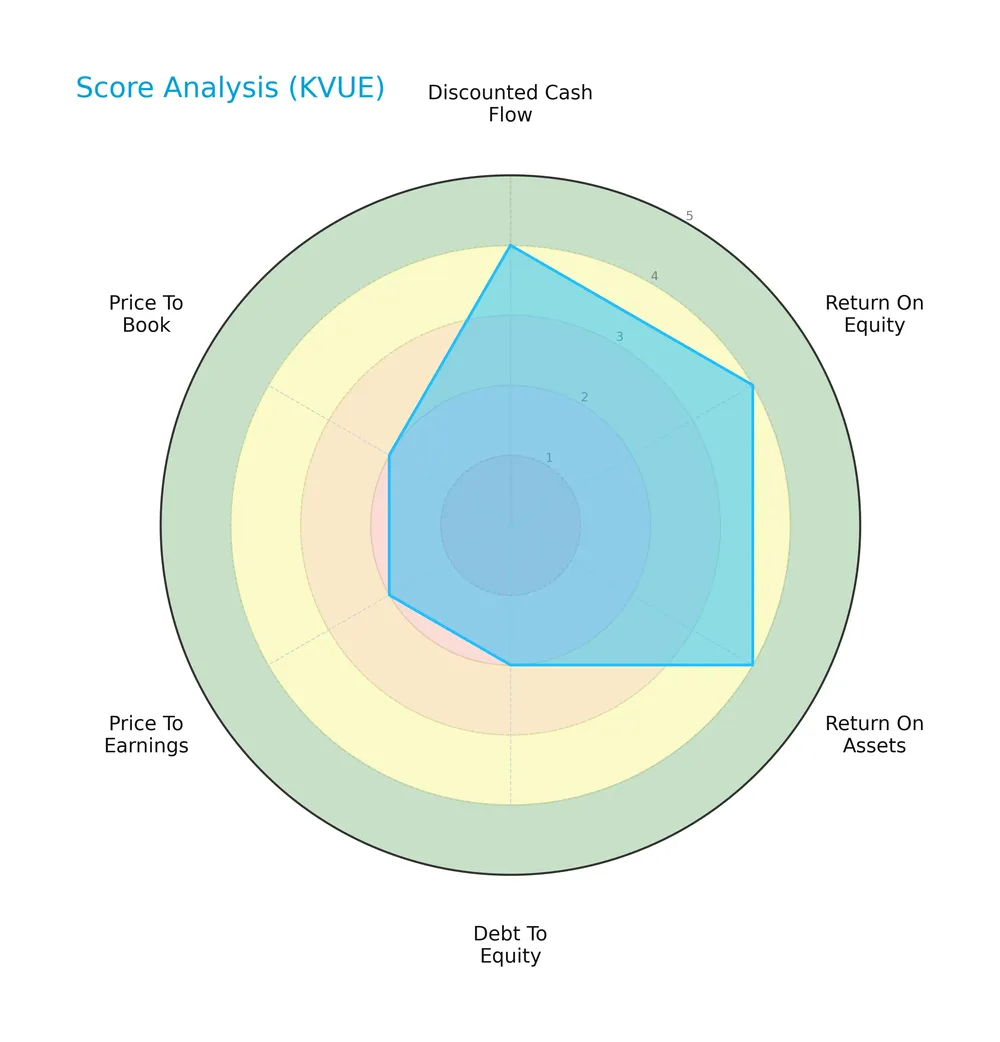

Score analysis

The radar chart below displays Kenvue Inc.’s various financial scores, highlighting strengths and weaknesses across key metrics:

Kenvue scores favorably on discounted cash flow, return on equity, and return on assets, each rated 4. However, debt-to-equity, price-to-earnings, and price-to-book scores are weaker at 2, indicating valuation and leverage concerns.

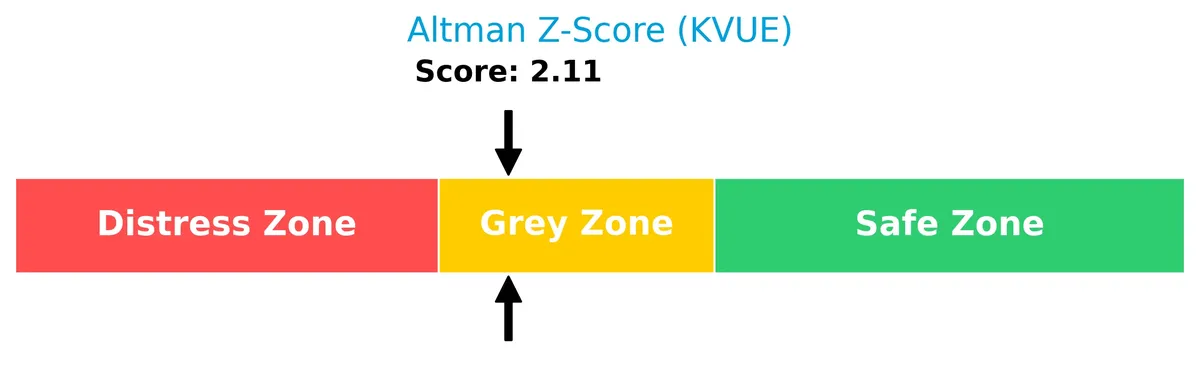

Analysis of the company’s bankruptcy risk

Kenvue’s Altman Z-Score falls in the grey zone, signaling moderate bankruptcy risk and financial caution for investors:

Is the company in good financial health?

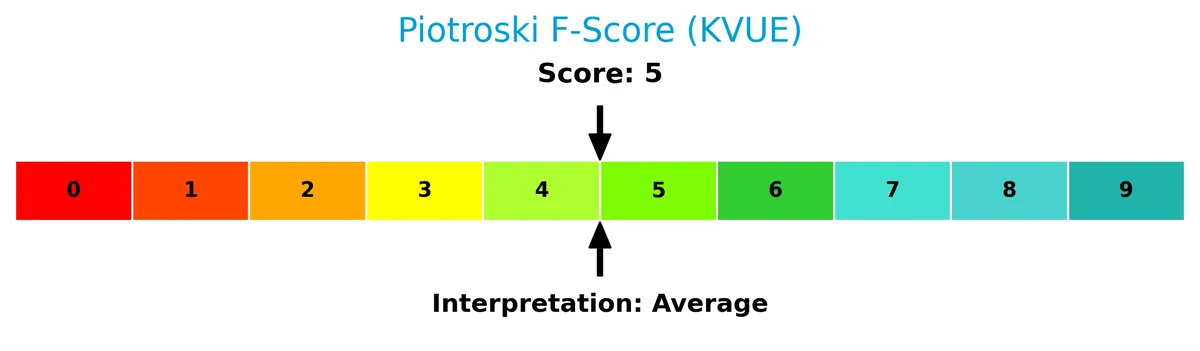

The Piotroski diagram illustrates Kenvue’s average financial health status based on key profitability and efficiency metrics:

With a Piotroski Score of 5, Kenvue demonstrates moderate financial strength, neither strongly robust nor weak, suggesting balanced operational performance.

Competitive Landscape & Sector Positioning

This sector analysis reviews Kenvue Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Kenvue holds a competitive advantage over its industry peers.

Strategic Positioning

Kenvue Inc. maintains a diversified product portfolio across three segments: Self Care (6.5B), Essential Health (4.7B), and Skin Health and Beauty (4.2B). Geographically, it balances exposure with a strong North America base (7.6B) complemented by Asia Pacific, EMEA, and Latin America markets.

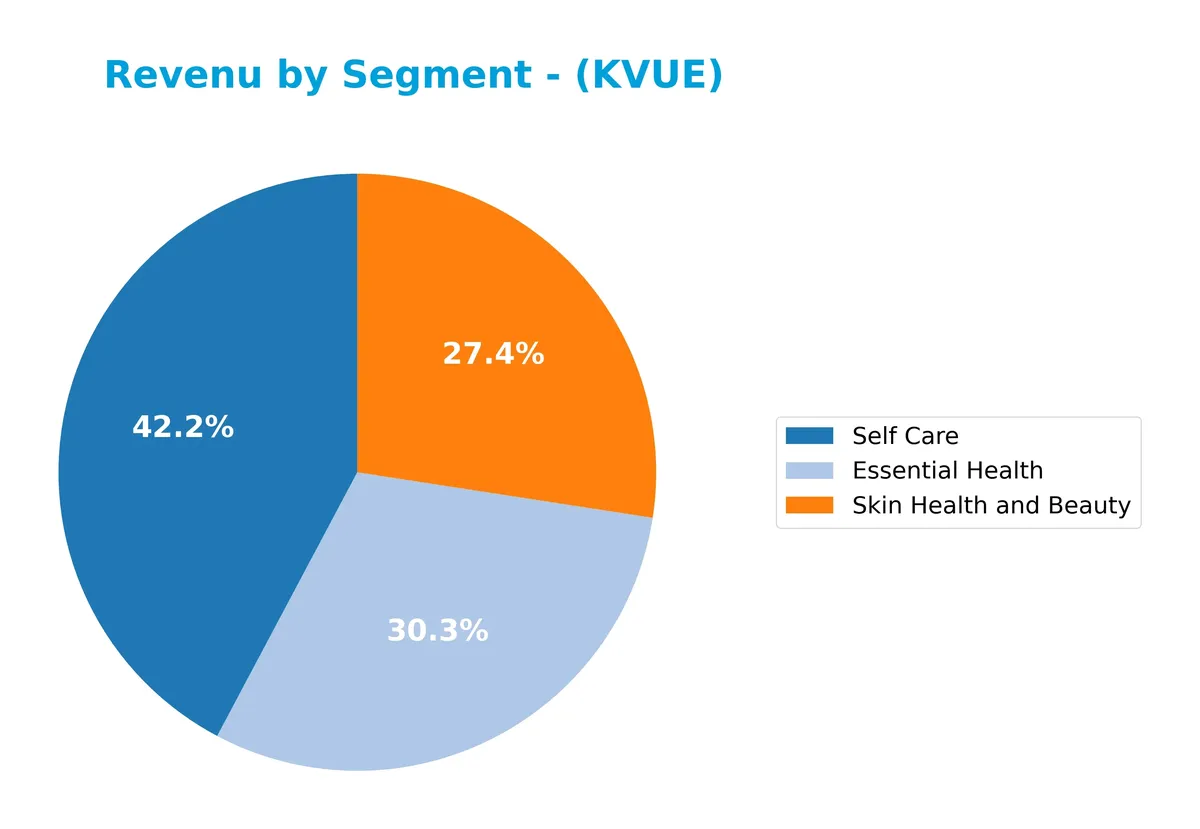

Revenue by Segment

This pie chart illustrates Kenvue Inc.’s revenue distribution across three major segments for fiscal year 2024, highlighting the company’s product diversification and market focus.

In 2024, Self Care leads revenue generation with $6.5B, showing a slight increase from $6.45B in 2023. Essential Health followed, reaching $4.7B, up modestly from $4.6B. Skin Health and Beauty declined to $4.2B from $4.4B, indicating a subtle shift away from this segment. The overall revenue mix emphasizes steady growth in core health and personal care areas, with a small concentration risk as Skin Health weakens.

Key Products & Brands

The following table outlines Kenvue Inc.’s main products and brands across its core segments:

| Product | Description |

|---|---|

| Self Care | Cough, cold, allergy, pain care, digestive health, smoking cessation products under Tylenol, Nicorette, and Zyrtec brands. |

| Skin Health and Beauty | Face, body, hair, sun, and other care products under Neutrogena, Aveeno, and OGX brand names. |

| Essential Health | Oral care, baby, women’s health, and wound care products under Listerine, Johnson’s, Band-Aid, and Stayfree brands. |

Kenvue’s product portfolio spans three distinct segments, each anchored by well-known consumer health and personal care brands. Self Care leads in revenue, followed by Essential Health and Skin Health and Beauty.

Main Competitors

There are 17 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| The Procter & Gamble Company | 331.3B |

| Unilever PLC | 143.2B |

| Colgate-Palmolive Company | 62.6B |

| The Estée Lauder Companies Inc. | 38.5B |

| Kimberly-Clark Corporation | 33.7B |

| Kenvue Inc. | 33.2B |

| Church & Dwight Co., Inc. | 20.2B |

| The Clorox Company | 12.3B |

| e.l.f. Beauty, Inc. | 4.3B |

| Inter Parfums, Inc. | 2.7B |

Kenvue Inc. ranks 6th among 17 competitors with a market cap about 10.65% of the leader, Procter & Gamble. It sits below the average market cap of the top 10 (68.2B) but above the sector median (4.3B). The 4.59% gap to the next competitor above highlights a tight contest for the 5th position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Kenvue have a competitive advantage?

Kenvue Inc. shows mixed signals regarding competitive advantage, with a strong gross margin of 58.13% but zero EBIT margin and declining ROIC over 2021-2025. Its market presence spans key segments in consumer health, with established brands like Tylenol and Neutrogena supporting steady net margins around 9.7%.

Looking ahead, Kenvue’s diversified portfolio across Self Care, Skin Health, and Essential Health segments offers opportunities to capture growth in global markets including Asia Pacific and EMEA. Continued innovation in these segments could drive future revenue expansion despite recent revenue declines and profitability challenges.

SWOT Analysis

This analysis highlights Kenvue Inc.’s internal capabilities and external market conditions to guide strategic decisions.

Strengths

- Strong global brand portfolio

- Diverse product segments across consumer health

- Stable dividend yield of 4.8%

Weaknesses

- Declining revenue growth over five years

- Zero EBIT margin indicates operational challenges

- Weak liquidity ratios signal financial risk

Opportunities

- Expansion in emerging markets

- Innovation in self-care and skin health products

- Growing demand for health-conscious consumer goods

Threats

- Intense competition in consumer health sector

- Rising raw material costs

- Economic slowdown impacting discretionary spending

Kenvue’s strengths in brand diversity and dividend appeal contrast with operational and growth weaknesses. The company must leverage market opportunities while managing financial risks to sustain long-term value.

Stock Price Action Analysis

The weekly price chart below illustrates Kenvue Inc.’s stock movements over the past 12 months, highlighting key fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, KVUE’s stock price declined by 14.21%, reflecting a clear bearish trend with accelerating downward momentum. The price ranged between 24.44 at its peak and 14.37 at its low. Recent months show an 8.74% rebound, indicating a short-term recovery with mild upward slope and lower volatility.

Volume Analysis

Trading volumes over the last three months reveal a buyer-dominant market, with buyers accounting for 62.74% of activity. Volume is increasing, signaling growing investor participation and positive sentiment despite the broader bearish price trend. This suggests cautious optimism among market participants.

Target Prices

Analysts present a moderate target consensus for Kenvue Inc., reflecting cautious optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 15 | 22 | 17.86 |

The target range signals a potential upside from current levels, but the spread suggests some uncertainty among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding Kenvue Inc. (KVUE) performance and reputation.

Stock Grades

Here are the latest verified analyst grades for Kenvue Inc., highlighting recent rating changes and consensus:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Downgrade | Hold | 2026-01-30 |

| Barclays | Maintain | Equal Weight | 2025-11-10 |

| Canaccord Genuity | Downgrade | Hold | 2025-10-29 |

| Jefferies | Maintain | Buy | 2025-10-27 |

| JP Morgan | Maintain | Overweight | 2025-10-10 |

| Citigroup | Maintain | Neutral | 2025-10-09 |

| B of A Securities | Maintain | Buy | 2025-10-08 |

| UBS | Maintain | Neutral | 2025-10-08 |

| Goldman Sachs | Maintain | Neutral | 2025-10-02 |

| Barclays | Maintain | Equal Weight | 2025-10-01 |

The overall trend shows a cautious stance with multiple downgrades to Hold and many analysts maintaining neutral or equal weight ratings. The consensus aligns with a Hold rating, indicating tempered expectations.

Consumer Opinions

Consumers express mixed but generally favorable sentiment about Kenvue Inc., reflecting both trust in its product quality and concerns about service.

| Positive Reviews | Negative Reviews |

|---|---|

| “Kenvue’s products deliver consistent quality and reliability.” | “Customer service response times are frustratingly slow.” |

| “I appreciate the company’s commitment to sustainability.” | “Pricing feels steep compared to competitors.” |

| “The product range covers all my daily needs efficiently.” | “Occasional stock shortages disrupt purchase plans.” |

Overall, customers praise Kenvue’s product quality and sustainability efforts. However, recurring complaints about service delays and pricing pressure signal areas for operational improvement.

Risk Analysis

Below is a summary table of key risks facing Kenvue Inc., including their likelihood and potential impact on the company:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score in grey zone signals moderate bankruptcy risk. | Medium | High |

| Profitability | Zero ROE and ROIC point to weak capital efficiency and returns. | Medium | Medium |

| Liquidity | Current and quick ratios at zero indicate poor short-term liquidity. | High | High |

| Debt Management | Favorable debt-to-equity but low interest coverage raises refinancing risk. | Medium | Medium |

| Valuation | Neutral P/E but unfavorable P/B and debt metrics suggest valuation risks. | Medium | Medium |

| Market Volatility | Low beta (0.55) reduces market risk but limits upside in bull cycles. | Low | Low |

The most pressing concerns are Kenvue’s liquidity and bankruptcy risk. The zero current and quick ratios are red flags for short-term solvency. The Altman Z-Score of 2.1 keeps the company in a “grey zone,” indicating a moderate chance of financial distress, especially in a tightening credit environment. Profitability metrics also lack strength, which may constrain reinvestment and growth. Investors must weigh these risks carefully against the company’s stable dividend yield and defensive sector positioning.

Should You Buy Kenvue Inc.?

Kenvue Inc. appears to have improving profitability and operational efficiency but shows a declining return on invested capital, suggesting an eroding moat. Despite a manageable leverage profile, valuation metrics seem unfavorable. The overall B+ rating indicates a very favorable yet cautious investment profile.

Strength & Efficiency Pillars

Kenvue Inc. shows operational strength with a robust gross margin of 58.13% and a solid net margin of 9.72%, signaling effective cost control and profitability. Despite the absence of reported ROE and ROIC, the net margin growth of 45.84% and EPS growth of 40.74% over one year reveal promising earnings momentum. However, the lack of WACC data and a declining ROIC trend limit a clear assessment of value creation, leaving the company’s capital efficiency uncertain.

Weaknesses and Drawbacks

The company sits in the Altman Z-Score grey zone at 2.11, implying moderate bankruptcy risk, which demands caution. Unfavorable leverage metrics and liquidity ratios—such as poor current and quick ratios—raise solvency concerns. Valuation metrics offer mixed signals: a neutral P/E of 22.42 contrasts with an unavailable or unfavorable P/B ratio. These factors, combined with a bearish overall stock trend and declining revenue growth, underscore near-term financial vulnerabilities.

Our Final Verdict about Kenvue Inc.

Kenvue presents a mixed fundamental profile with operational profitability but notable solvency and valuation risks. Its Altman Z-Score in the grey zone suggests moderate financial stress, making the stock potentially speculative for conservative investors. Despite recent buyer dominance and positive earnings momentum, the bearish longer-term trend and liquidity concerns suggest a cautious, wait-and-see stance.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Kenvue (KVUE) Beats Q4 Earnings and Revenue Estimates – Yahoo Finance (Feb 17, 2026)

- Kenvue Inc. Profit Climbs In Q4 – Nasdaq (Feb 17, 2026)

- Kenvue: Q4 Earnings Snapshot – kare11.com (Feb 17, 2026)

- Kenvue (NYSE: KVUE) details 2025 results, $250M restructuring and Kimberly-Clark deal progress – Stock Titan (Feb 17, 2026)

- Kenvue earnings on deck as Kimberly-Clark merger looms – Investing.com (Feb 17, 2026)

For more information about Kenvue Inc., please visit the official website: kenvue.com