Home > Analyses > Industrials > Kadant Inc.

Kadant Inc. powers critical industrial processes that keep global packaging, tissue, and recycling industries moving daily. Its innovative flow control, industrial processing, and material handling solutions set the standard for reliability and efficiency. With a reputation for engineering excellence and steady market influence, Kadant shapes how materials are processed and handled worldwide. The key question now is whether its robust fundamentals still justify its premium valuation and growth expectations in 2026.

Table of contents

Business Model & Company Overview

Kadant Inc., founded in 1991 and headquartered in Westford, Massachusetts, stands as a leader in industrial machinery. Its integrated ecosystem spans Flow Control, Industrial Processing, and Material Handling, delivering engineered systems that optimize fluid handling, pulping, and material conveyance. This cohesive portfolio addresses critical operational needs across packaging, tissue, wood products, and agricultural sectors.

Kadant’s revenue engine balances durable equipment with consumables and engineered systems, enabling recurring revenue streams. It serves global markets across the Americas, Europe, and Asia, leveraging innovation in automation, filtration, and biodegradable materials. Kadant’s enduring competitive advantage lies in its ability to offer end-to-end solutions that enhance industrial efficiency and sustainability, securing a durable economic moat in its sector.

Financial Performance & Fundamental Metrics

I will analyze Kadant Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and shareholder value.

Income Statement

The table below summarizes Kadant Inc.’s key income statement figures for the fiscal years 2021 through 2025, showing revenue trends, profitability, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 787M | 905M | 958M | 1.05B | 1.05B |

| Cost of Revenue | 449M | 515M | 541M | 587M | 577M |

| Operating Expenses | 221M | 218M | 251M | 294M | 317M |

| Gross Profit | 337M | 390M | 416M | 466M | 476M |

| EBITDA | 151M | 207M | 201M | 223M | 157M |

| EBIT | 117M | 172M | 167M | 173M | 0 |

| Interest Expense | 4.82M | 6.48M | 8.40M | 20.0M | 15.6M |

| Net Income | 84.0M | 121M | 116M | 112M | 102M |

| EPS | 7.26 | 10.38 | 9.92 | 9.51 | 8.66 |

| Filing Date | 2022-03-01 | 2023-02-28 | 2024-02-27 | 2025-02-25 | 2026-02-18 |

Income Statement Evolution

Kadant’s revenue grew 34% from 2021 to 2025 but declined slightly by 0.11% in the latest year. Gross profit margin held steady near 45%, reflecting consistent cost control. Net income increased 21% over five years but fell 8.5% in 2025, dragging net margin down from prior levels. Operating expenses rose in line with revenue, pressuring profitability.

Is the Income Statement Favorable?

In 2025, Kadant posted $1.05B revenue with $102M net income, yielding a 9.7% net margin—still favorable but down from previous years. The zero EBIT suggests rising operating costs or non-cash charges offset operating income. Interest expense remains manageable, supporting net profits. Overall, fundamentals appear mixed, with margin compression and earnings decline signaling caution despite solid revenue scale.

Financial Ratios

The following table presents key financial ratios for Kadant Inc. (KAI) over the past five fiscal years to assess operational efficiency, profitability, and financial health:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 10.7% | 13.4% | 12.1% | 10.6% | 9.7% |

| ROE | 14.9% | 18.5% | 15.0% | 13.2% | 0% |

| ROIC | 9.6% | 13.3% | 12.6% | 10.1% | 0% |

| P/E | 31.8 | 17.1 | 28.3 | 36.9 | 33.1 |

| P/B | 4.73 | 3.17 | 4.24 | 4.86 | 0 |

| Current Ratio | 1.73 | 1.95 | 2.05 | 2.31 | 0 |

| Quick Ratio | 1.13 | 1.18 | 1.34 | 1.55 | 0 |

| D/E | 0.52 | 0.34 | 0.18 | 0.38 | 0 |

| Debt-to-Assets | 26.0% | 19.4% | 11.5% | 22.6% | 0% |

| Interest Coverage | 24.2 | 26.4 | 19.7 | 8.6 | -10.1 |

| Asset Turnover | 0.69 | 0.79 | 0.81 | 0.74 | 0 |

| Fixed Asset Turnover | 5.91 | 6.39 | 5.78 | 6.18 | 0 |

| Dividend Yield | 0.43% | 0.58% | 0.40% | 0.36% | 0.47% |

Note: Zero or missing values indicate data not reported or unavailable for that year.

Evolution of Financial Ratios

Return on Equity (ROE) data is unavailable for 2025, signaling a gap or decline in profitability metrics. The Current Ratio dropped to zero in 2025 from a stable 2.3 in 2024, indicating a sharp liquidity deterioration. Debt-to-Equity Ratio also fell to zero in 2025, contrasting prior moderate leverage levels, reflecting significant structural changes or reporting gaps. Profitability margins weakened, with net margin declining from 10.6% in 2024 to 9.7% in 2025.

Are the Financial Ratios Fovorable?

In 2025, Kadant Inc. shows mixed financial health. Profitability is neutral with a 9.7% net margin but lacks ROE and ROIC data, marked unfavorable. Liquidity ratios (Current and Quick) at zero present a red flag. Debt ratios are favorable, showing minimal leverage. Market valuation looks stretched with a high P/E of 33.1, while dividend yield is low. Overall, 64% of ratios are unfavorable, indicating caution.

Shareholder Return Policy

Kadant Inc. pays dividends with a payout ratio around 13-15% and a stable dividend per share rising from $0.99 in 2021 to $1.34 in 2025. Dividend yield remains modest near 0.4-0.6%, supported by free cash flow coverage and manageable capital expenditures.

The company also engages in share buybacks, complementing its dividend policy. This balanced approach indicates a commitment to sustainable shareholder returns without overstretching cash resources, aligning with prudent capital allocation for long-term value creation.

Score analysis

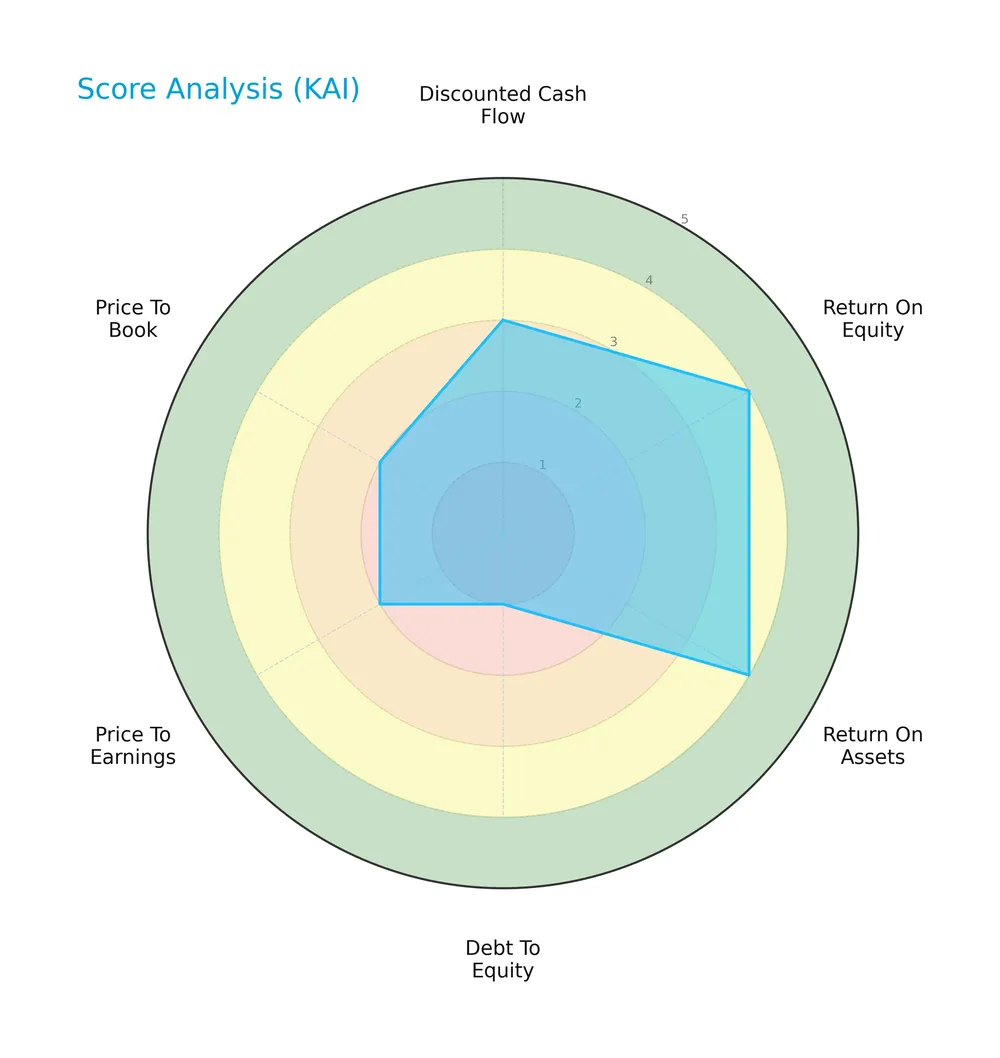

The radar chart below visualizes Kadant Inc.’s financial scores across key valuation and performance metrics:

Kadant shows favorable returns on equity and assets with scores of 4 each, indicating efficient capital use. However, its debt-to-equity score is very unfavorable at 1, signaling potential leverage concerns. Valuation metrics like price-to-earnings and price-to-book are also unfavorable, reflecting market caution.

Analysis of the company’s bankruptcy risk

Kadant’s Altman Z-Score of 4.49 places it firmly in the safe zone, indicating a low risk of bankruptcy and solid financial stability:

Is the company in good financial health?

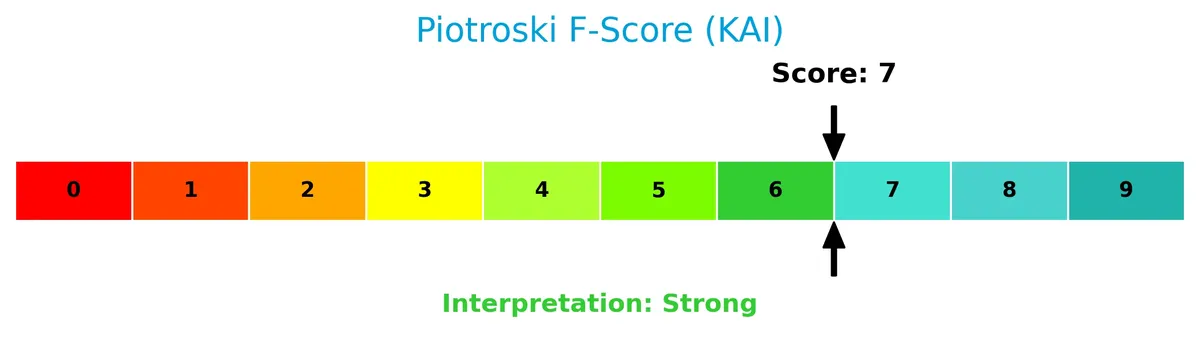

The Piotroski Score diagram below illustrates Kadant’s financial strength based on profitability and efficiency factors:

With a Piotroski Score of 7, Kadant ranks as strong in financial health. This suggests the company maintains solid fundamentals, though it stops short of the highest rating, implying room for further improvement.

Competitive Landscape & Sector Positioning

This analysis examines Kadant Inc.’s strategic position within the industrial machinery sector, focusing on its revenue segments and key products. I will assess whether Kadant holds a competitive advantage compared to its main competitors.

Strategic Positioning

Kadant Inc. maintains a diversified product portfolio across Flow Control, Industrial Processing, and Material Handling segments. Geographically, it generates the majority of revenue from North America, followed by Europe and Asia, reflecting a balanced global footprint in industrial machinery markets.

Revenue by Segment

This pie chart displays Kadant Inc.’s revenue distribution by segment for fiscal year 2024, illustrating the relative contribution of its main business lines.

Kadant’s revenue in 2024 is driven predominantly by Parts and Consumables at $694M, followed by Capital sales at $360M. Historically, Parts and Consumables have grown faster, signaling a shift towards recurring revenue streams. Capital segment revenue has stabilized near $360M, reflecting steady demand. The concentration in Parts and Consumables highlights both opportunity and risk, emphasizing the importance of sustaining product innovation and customer retention.

Key Products & Brands

Kadant Inc. operates with diverse engineered systems and consumables across industrial segments:

| Product | Description |

|---|---|

| Flow Control Systems | Fluid-handling systems including rotary joints, syphons, turbulator bars, expansion joints, and steam/condensate systems. |

| Doctoring, Cleaning & Filtration | Systems and consumables such as doctor blades, fabric-conditioning, formation, and water-filtration systems. |

| Industrial Processing Equipment | Ring and rotary debarkers, stranders, chippers, logging machinery, automation, recycling, and pulping process equipment. |

| Material Handling Equipment | Conveying and vibratory equipment, balers, and biodegradable absorbent granules for agricultural and industrial use. |

| Capital Products | Machinery and engineered systems sold as capital equipment, generating $360M revenue in 2024. |

| Parts and Consumables | Replacement parts and consumables supporting installed equipment, with $694M revenue in 2024. |

Kadant’s product portfolio spans proprietary engineered machinery and consumables, supporting the packaging, tissue, wood products, and alternative fuel industries. The company balances capital equipment sales with recurring consumables revenue, reflecting steady growth and diversified industrial exposure.

Main Competitors

Kadant Inc. faces 24 competitors in the Industrials sector, with the table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eaton Corporation plc | 127B |

| Parker-Hannifin Corporation | 114B |

| Howmet Aerospace Inc. | 85.2B |

| Emerson Electric Co. | 76.3B |

| Illinois Tool Works Inc. | 73B |

| Cummins Inc. | 71.9B |

| AMETEK, Inc. | 48.3B |

| Roper Technologies, Inc. | 46.8B |

| Rockwell Automation, Inc. | 44.8B |

| Symbotic Inc. | 35.9B |

Kadant Inc. ranks 22nd among 24 competitors, with a market cap just 3% of the sector leader Eaton Corporation. It sits well below both the average top 10 market cap of 72.4B and the sector median of 32.4B. The company enjoys a 74.8% market cap gap over its closest rival above, highlighting a significant scale disparity.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Kadant have a competitive advantage?

Kadant operates in specialized industrial machinery with diverse segments, reflecting stable revenue growth and a favorable gross margin near 45%. However, its EBIT margin is currently zero and ROIC trends show decline, limiting clear evidence of a strong competitive moat.

The company’s future outlook includes expanding markets in North America and Europe, supported by engineered systems in flow control and industrial processing. Opportunities lie in leveraging product innovation and geographic diversification to offset recent margin pressures and sustain growth.

SWOT Analysis

This SWOT analysis highlights Kadant Inc.’s key internal and external factors affecting its competitive position and strategic outlook.

Strengths

- diversified product segments

- strong global footprint

- favorable net margin around 9.7%

Weaknesses

- declining ROIC trend

- unfavorable EBIT margin

- weak liquidity ratios

Opportunities

- expansion in industrial automation

- growing demand in sustainable materials

- geographic growth in Asia and Europe

Threats

- intense industry competition

- margin pressure risks

- sensitivity to economic cycles

Kadant’s strengths lie in its diversified offerings and global reach, supporting resilience. However, declining operational efficiency and liquidity issues require cautious management. The company’s growth depends on capitalizing industrial automation and sustainability trends while navigating competitive and economic headwinds.

Stock Price Action Analysis

The weekly chart below illustrates Kadant Inc.’s stock price movement and key volatility patterns over the past 100 weeks:

Trend Analysis

Over the past 12 months, Kadant’s stock price declined by 2.33%, indicating a bearish trend with accelerating downward momentum. The stock showed significant volatility, with a standard deviation of 34.47. Price ranged between a high of 419.01 and a low of 254.91, marking a volatile environment for investors.

Volume Analysis

Trading volume over the last three months shows a slight buyer dominance at 53.07%, with increasing activity. Buyer volume exceeded seller volume by about 465K shares, suggesting cautious optimism and growing market participation amid the recent price recovery.

Target Prices

Analysts set a firm consensus target price for Kadant Inc. at $295.

| Target Low | Target High | Consensus |

|---|---|---|

| 295 | 295 | 295 |

This unanimous target indicates strong confidence in Kadant’s valuation and growth prospects among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide a balanced view of Kadant Inc.’s market perception.

Stock Grades

Here is a summary of recent analyst grades for Kadant Inc., reflecting consistent sentiment from reputable firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barrington Research | Maintain | Outperform | 2026-02-18 |

| DA Davidson | Maintain | Neutral | 2026-02-09 |

| DA Davidson | Maintain | Neutral | 2026-02-04 |

| Barrington Research | Maintain | Outperform | 2026-02-03 |

| Barrington Research | Maintain | Outperform | 2025-10-30 |

| Barrington Research | Maintain | Outperform | 2025-10-29 |

| Barrington Research | Maintain | Outperform | 2025-10-27 |

| Barrington Research | Maintain | Outperform | 2025-10-10 |

| Barrington Research | Maintain | Outperform | 2025-09-23 |

| DA Davidson | Maintain | Neutral | 2025-08-04 |

Barrington Research consistently maintains an Outperform rating, signaling confidence in Kadant’s prospects. DA Davidson holds a Neutral stance, indicating a more cautious view. Overall, grades show stability without recent upgrades or downgrades.

Consumer Opinions

Kadant Inc. evokes strong reactions from its customer base, reflecting its product quality and service reliability.

| Positive Reviews | Negative Reviews |

|---|---|

| Durable, high-performance industrial components | Delays in customer service response times |

| Consistent product quality across batches | Pricing is on the higher side compared to competitors |

| Responsive technical support team | Limited availability of certain parts in some regions |

Overall, consumers praise Kadant for its robust product quality and knowledgeable support. However, recurring concerns include service delays and premium pricing, which could impact customer loyalty if unaddressed.

Risk Analysis

Below is a summary table highlighting key risks Kadant Inc. faces, with their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low liquidity ratios and unfavorable interest coverage suggest cash strain. | High | High |

| Valuation | High P/E ratio (33.07) indicates potential overvaluation risk. | Medium | Medium |

| Operational | Weak asset turnover signals inefficiencies in using company assets. | Medium | Medium |

| Debt Management | Favorable debt ratios but very unfavorable debt-to-equity score signals risk. | Medium | Medium |

| Market Volatility | Beta of 1.228 exposes stock to above-market price swings. | Medium | Medium |

Kadant’s biggest risks stem from liquidity and profitability weaknesses, despite a solid Altman Z-Score (4.49, safe zone) that suggests low bankruptcy risk. The company’s stretched valuation and poor asset efficiency require caution, especially in volatile industrial cycles.

Should You Buy Kadant Inc.?

Kadant Inc. appears to show improving profitability with favorable operational efficiency, despite a declining moat and a challenging leverage profile. Supported by a strong Altman Z-score and a moderate overall rating of B, its financial health suggests a cautious but potentially rewarding profile.

Strength & Efficiency Pillars

Kadant Inc. operates with a solid net margin of 9.69%, reflecting operational profitability despite margin pressures. The company’s Altman Z-Score of 4.49 places it securely in the safe zone, underscoring strong financial health. A Piotroski Score of 7 further confirms robust fundamentals. However, data on ROIC and WACC is unavailable, limiting a full assessment of value creation. Still, Kadant’s consistent revenue growth of 33.78% over five years signals resilient top-line expansion.

Weaknesses and Drawbacks

Kadant faces several challenges. The P/E ratio stands at 33.07, indicating a premium valuation that may pressure future returns. Liquidity ratios are unfavorable, with a low current ratio and quick ratio hinting at potential short-term cash flow constraints. Interest coverage is negative, which is a critical red flag for debt servicing ability. Despite a strong debt-to-equity score, these liquidity and leverage concerns raise caution about financial flexibility. The stock trend remains bearish overall, though recent buyer dominance at 53.07% shows tentative recovery.

Our Final Verdict about Kadant Inc.

Kadant’s profile might appear attractive for long-term exposure given its safe Altman Z-Score and strong Piotroski fundamentals. Despite a bearish overall trend, recent buyer dominance suggests cautious optimism. Nonetheless, elevated valuation and liquidity weaknesses may warrant a wait-and-see approach to secure a better entry point. Investors should remain vigilant about cash flow risks before increasing exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Kadant’s (NYSE:KAI) Q4 CY2025: Strong Sales – Yahoo Finance (Feb 18, 2026)

- Kadant: Q4 Earnings Snapshot – KVUE (Feb 18, 2026)

- (KAI) Kadant Inc. Expects Q1 Adjusted EPS Range $1.78 – $1.88 – marketscreener.com (Feb 18, 2026)

- Kadant Inc (NYSE:KAI) Beats Q4 Estimates and Provides Upbeat Revenue Guidance – ChartMill (Feb 18, 2026)

- Kadant Inc. Reports Fourth Quarter and Fiscal Year 2025 Financial Results with Record Revenue and Strong Cash Flow – Quiver Quantitative (Feb 18, 2026)

For more information about Kadant Inc., please visit the official website: kadant.com