Home > Analyses > Industrials > JBT Marel Corporation

JBT Marel Corporation revolutionizes the food and beverage industry by delivering cutting-edge technology solutions that streamline processing and packaging worldwide. Renowned for its comprehensive suite of advanced machinery—from high-pressure processing to automated material handling—JBT Marel stands out as an innovator driving efficiency and quality across diverse sectors. As the company evolves under its new identity since 2025, I explore whether its solid industry positioning and innovation pipeline continue to justify its growth prospects and current market valuation.

Table of contents

Business Model & Company Overview

JBT Marel Corporation, founded in 1994 and headquartered in Chicago, Illinois, stands as a leading provider of technology solutions for the food and beverage industry worldwide. Its comprehensive ecosystem integrates advanced processing and automation technologies, delivering value-added services like chilling, mixing, portioning, cooking, packaging, and material handling. This broad spectrum supports diverse sectors including pharmaceuticals, pet food, and fast-moving consumer goods, reinforcing its dominant position in industrial machinery.

The company’s revenue engine is powered by a balanced mix of hardware and software solutions, complemented by recurring services such as technical support and automated guided vehicle systems. With strategic operations spanning the Americas, Europe, Middle East, Africa, and Asia Pacific, JBT Marel leverages a global footprint to serve a vast array of industries. Its robust economic moat lies in its integrated technology platform that continually shapes the future of food processing and automation.

Financial Performance & Fundamental Metrics

In this section, I analyze JBT Marel Corporation’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and stability.

Income Statement

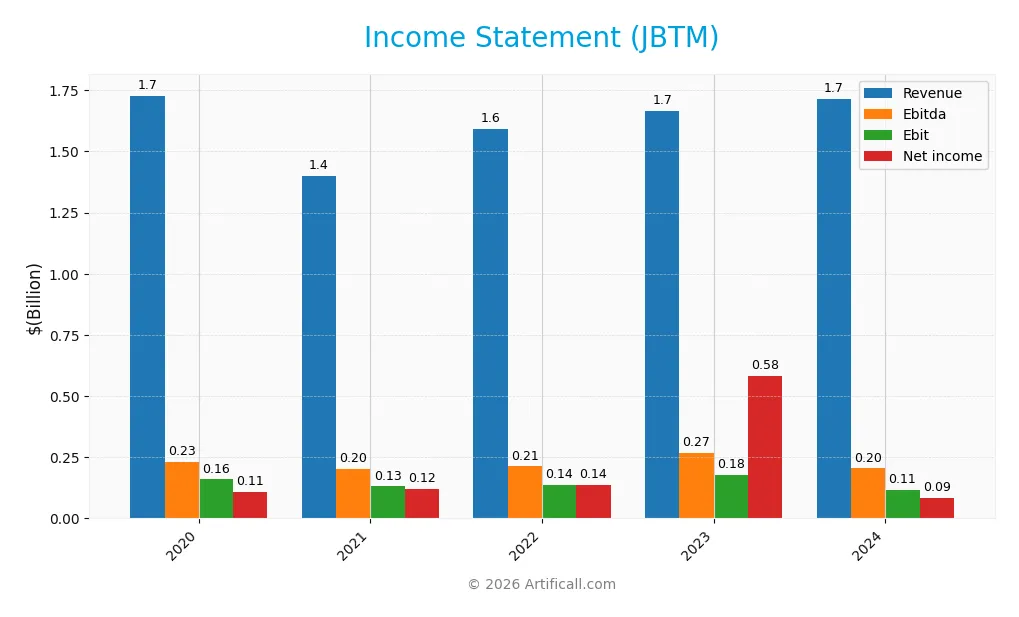

The table below summarizes JBT Marel Corporation’s key income statement figures for the fiscal years 2020 through 2024, showing trends in revenue, profitability, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.73B | 1.40B | 1.59B | 1.66B | 1.72B |

| Cost of Revenue | 1.19B | 919M | 1.06B | 1.08B | 1.09B |

| Operating Expenses | 371M | 357M | 397M | 421M | 508M |

| Gross Profit | 534M | 482M | 529M | 586M | 627M |

| EBITDA | 231M | 203M | 213M | 269M | 204M |

| EBIT | 159M | 131M | 136M | 177M | 115M |

| Interest Expense | 14M | 11M | 16M | 24M | 19M |

| Net Income | 109M | 119M | 137M | 583M | 85M |

| EPS | 3.40 | 3.70 | 4.08 | 18.21 | 2.67 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2024-12-31 |

Income Statement Evolution

From 2020 to 2024, JBT Marel Corporation’s revenue showed slight overall decline, decreasing by 0.68%, with a moderate 3.1% growth in the last year. Gross profit grew favorably by 6.97% in 2024, reflecting improved gross margins at 36.51%. However, EBIT and net income margins faced notable contractions, with EBIT margin steady at 6.69% but net margin declining to 4.98%, signaling margin pressure.

Is the Income Statement Favorable?

In 2024, the income statement reveals mixed fundamentals: gross margin and interest expense ratios are favorable, yet EBIT and net margin growths are significantly negative, with net margin shrinking by 85.78%. Operating expenses grew unfavorably relative to revenue, contributing to a 35.29% decline in EBIT and an 85.38% drop in EPS. Overall, the statement is assessed as unfavorable, indicating challenges in profitability despite stable revenue.

Financial Ratios

The following table presents key financial ratios for JBT Marel Corporation over recent fiscal years, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 6.3% | 8.5% | 8.6% | 35.0% | 5.0% |

| ROE | 17.1% | 15.9% | 15.2% | 39.1% | 5.5% |

| ROIC | 9.0% | 6.1% | 5.7% | 6.3% | 3.7% |

| P/E | 33.5 | 41.3 | 21.3 | 5.5 | 47.6 |

| P/B | 5.7 | 6.6 | 3.2 | 2.1 | 2.6 |

| Current Ratio | 1.3 | 1.3 | 1.5 | 2.3 | 3.5 |

| Quick Ratio | 0.9 | 0.9 | 1.1 | 1.8 | 3.0 |

| D/E | 0.8 | 0.9 | 1.1 | 0.4 | 0.8 |

| Debt-to-Assets | 29.1% | 31.5% | 37.0% | 23.8% | 36.7% |

| Interest Coverage | 11.7 | 11.2 | 8.1 | 6.8 | 6.1 |

| Asset Turnover | 1.0 | 0.7 | 0.6 | 0.6 | 0.5 |

| Fixed Asset Turnover | 6.4 | 5.2 | 6.5 | 6.7 | 7.3 |

| Dividend Yield | 0.4% | 0.3% | 0.4% | 0.4% | 0.3% |

Evolution of Financial Ratios

From 2020 to 2024, JBT Marel Corporation’s Return on Equity (ROE) notably declined from 17.1% in 2020 to 5.5% in 2024, indicating weakening profitability. The Current Ratio improved significantly, rising from roughly 1.35 in 2020 to 3.48 in 2024, reflecting enhanced short-term liquidity. Debt-to-Equity Ratio showed moderate fluctuation but remained relatively stable around 0.8 in 2024, suggesting consistent leverage management.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (5.0%) and ROE (5.5%) are marked unfavorable, aligning with subdued returns. Liquidity presents a mixed picture: the Current Ratio at 3.48 is unfavorable due to potential inefficiency, while the Quick Ratio at 3.04 is favorable, indicating good liquid assets coverage. Leverage ratios including Debt-to-Equity (0.81) and debt-to-assets (36.7%) are neutral. Efficiency shows mixed signals with asset turnover neutral (0.5) but fixed asset turnover favorable (7.34). Market ratios like Price-to-Earnings (47.6) are unfavorable, leading to a slightly unfavorable overall ratio assessment.

Shareholder Return Policy

JBT Marel Corporation consistently pays dividends with a payout ratio around 15%, a dividend per share near $0.41, and a modest yield of approximately 0.32% in 2024. The dividend payments are well covered by free cash flow, indicating financial discipline and manageable distribution levels. Share buyback information is not explicitly provided.

The stable dividend policy combined with coverage by free cash flow suggests a balanced approach to shareholder returns, supporting sustainable long-term value creation. The modest yield and payout ratio reflect cautious risk management, avoiding excessive distributions that could undermine future growth or financial flexibility.

Score analysis

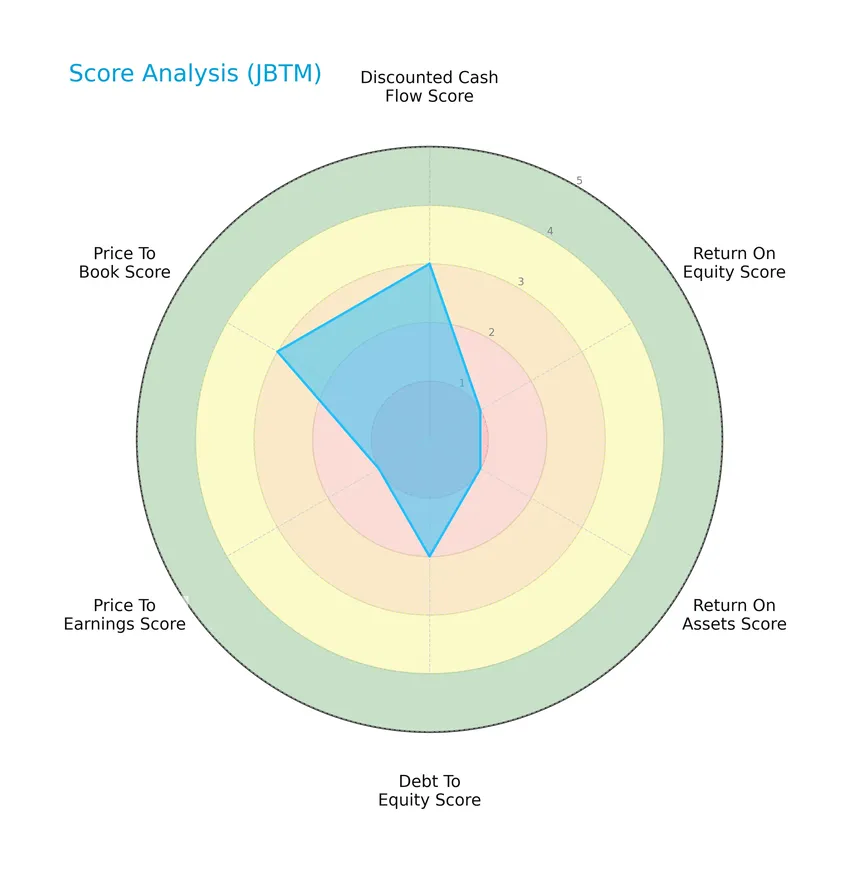

Here is an overview of JBT Marel Corporation’s key financial scores displayed in the radar chart:

The company shows moderate strength in discounted cash flow and price-to-book scores, but very unfavorable returns on equity and assets, alongside a very low price-to-earnings score. Debt-to-equity stands at a moderate level.

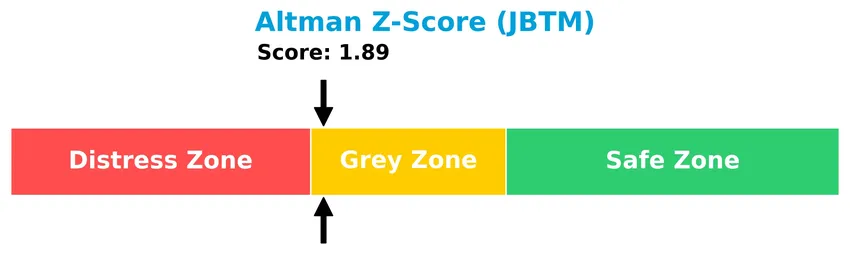

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that JBT Marel Corporation is in the grey zone, suggesting a moderate risk of financial distress and bankruptcy:

Is the company in good financial health?

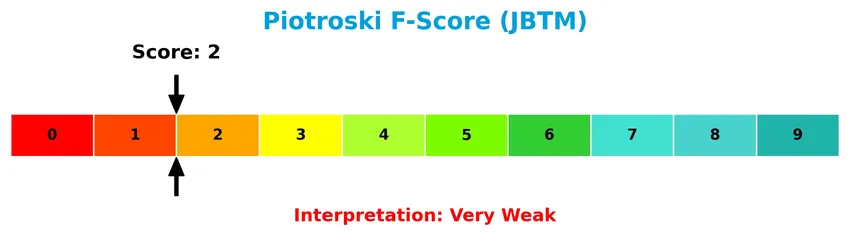

The Piotroski Score diagram provides insight into the company’s financial health status:

With a very weak Piotroski Score of 2, the company exhibits poor financial strength, indicating challenges in profitability, leverage, liquidity, or efficiency measures.

Competitive Landscape & Sector Positioning

This sector analysis will examine JBT Marel Corporation’s strategic positioning, revenue segments, key products, and main competitors. I will also assess whether JBT Marel holds a competitive advantage within its industrial machinery sector.

Strategic Positioning

JBT Marel Corporation operates a diversified product portfolio spanning food and beverage technology solutions, automated guided vehicle systems, and services across multiple industries. Its geographic exposure is global, covering North America, EMEA, Asia Pacific, and Latin America, reflecting a broad industrial machinery market presence.

Key Products & Brands

Below is an overview of JBT Marel Corporation’s key products and brands serving the food and beverage industry:

| Product | Description |

|---|---|

| Value-Added Processing | Solutions including chilling, mixing/grinding, injecting, blending, marinating, tumbling, flattening, forming, portioning, coating, cooking, frying, freezing, extracting, pasteurizing, sterilizing, concentrating, and high pressure processing. |

| Weighing & Inspecting Systems | Equipment for weighing, inspecting, filling, closing, sealing, and end of line material handling used in food, beverage, and health markets. |

| Packaging Solutions | Comprehensive packaging technologies for various industries including food, pharmaceuticals, and consumer goods. |

| Automated Guided Vehicle Systems | Automated systems for material movement in manufacturing, warehouse, and medical facilities. |

JBT Marel Corporation offers a broad spectrum of technology solutions focused on food processing and packaging, complemented by automated material handling systems across multiple global markets.

Main Competitors

There are 24 competitors in total, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eaton Corporation plc | 127.1B |

| Parker-Hannifin Corporation | 114.2B |

| Howmet Aerospace Inc. | 85.2B |

| Emerson Electric Co. | 76.3B |

| Illinois Tool Works Inc. | 73.0B |

| Cummins Inc. | 71.9B |

| AMETEK, Inc. | 48.3B |

| Roper Technologies, Inc. | 46.8B |

| Rockwell Automation, Inc. | 44.8B |

| Symbotic Inc. | 35.9B |

JBT Marel Corporation ranks 20th among 24 competitors, with a market capitalization approximately 6.3% that of the sector leader, Eaton Corporation plc. The company is positioned below both the average market cap of the top 10 competitors (72.4B) and the sector median (32.4B). It maintains a 3.3% gap above its nearest competitor, indicating a modest distance within the lower tier of the sector’s competitive landscape.

Does JBTM have a competitive advantage?

JBT Marel Corporation currently does not present a competitive advantage, as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. Its financial performance shows unfavorable trends in EBIT and net margin growth, further supporting a weak competitive position.

Looking ahead, the company operates across diverse markets including food, beverage, and health sectors, with a broad range of processing and automation technologies. This geographic and industry diversification could offer growth opportunities through new product developments and market expansions despite the current challenges.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights JBT Marel Corporation’s internal strengths and weaknesses alongside external opportunities and threats to support informed investment decisions.

Strengths

- Diverse global market presence

- Advanced technology solutions for food and beverage industries

- Strong product portfolio including automation and packaging

Weaknesses

- Declining profitability and negative ROIC trend

- Weak financial scores including low Piotroski and Altman Z-Score in grey zone

- High P/E ratio indicating overvaluation risk

Opportunities

- Expansion into growing plant-based and health food markets

- Increasing demand for automation in manufacturing and warehousing

- Potential strategic partnerships and technology innovations

Threats

- Intense competition in industrial machinery

- Economic downturns affecting capital investments

- Supply chain disruptions impacting production and delivery

Overall, JBT Marel Corporation shows solid technological strengths but faces significant financial challenges and profitability decline. Strategic focus on innovation and market expansion, while managing financial risks, will be critical for sustainable growth.

Stock Price Action Analysis

The weekly stock chart for JBT Marel Corporation (JBTM) displays price movements and volume trends over the past 12 months:

Trend Analysis

Over the past 12 months, JBTM’s stock price increased by 51.55%, indicating a bullish trend with price acceleration. The share price ranged from a low of 87.85 to a high of 158.88, supported by a high volatility level measured by a 19.91 standard deviation. Recent weeks show a 9.15% rise with moderate volatility.

Volume Analysis

Trading volumes have been increasing overall, with buyers accounting for 54.25% of total volume during the past year. In the recent 12-week period, buyer dominance strengthened to 69.83%, reflecting buyer-driven activity. This suggests heightened investor interest and positive participation in the stock.

Target Prices

The consensus target prices for JBT Marel Corporation indicate a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 180 | 169 | 174.5 |

Analysts expect the stock to trade between 169 and 180, with a consensus target price of 174.5, reflecting moderate confidence in upward potential.

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding JBT Marel Corporation (JBTM).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

The latest stock grades for JBT Marel Corporation from reputable analysts are summarized in the table below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Buy | Buy | 2025-12-10 |

| William Blair | Upgrade | Outperform | 2025-08-06 |

Both Jefferies and William Blair have upgraded their ratings recently, reflecting increased confidence in the stock. The consensus among analysts currently stands at a Buy, indicating positive sentiment without any Sell or Hold recommendations.

Consumer Opinions

Consumer sentiment around JBT Marel Corporation reflects a mix of appreciation and constructive criticism, revealing key insights into the company’s market perception.

| Positive Reviews | Negative Reviews |

|---|---|

| “JBT Marel’s innovative processing technology has significantly improved our operational efficiency.” | “Customer support response times can be slow, affecting urgent issue resolution.” |

| “The quality and durability of their equipment exceed industry standards.” | “High initial investment costs make it difficult for small businesses to adopt.” |

| “Regular software updates and feature enhancements show their commitment to continuous improvement.” | “Some users experienced compatibility issues with older systems during integration.” |

Overall, consumers praise JBT Marel for its cutting-edge technology and product reliability, while concerns focus mainly on support responsiveness and affordability for smaller clients.

Risk Analysis

Below is a summarized table highlighting the key risk categories, their descriptions, probability, and potential impact for JBT Marel Corporation (JBTM):

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | The Altman Z-Score in the grey zone (1.89) and very weak Piotroski score (2) indicate moderate to high financial distress risk. | High | High |

| Profitability | Low net margin (4.98%), ROE (5.53%), and ROIC (3.65%) suggest profitability struggles. | Medium | Medium |

| Valuation | Elevated P/E ratio (47.63) signals overvaluation risk compared to peers. | Medium | Medium |

| Liquidity | Current ratio (3.48) unfavorable despite quick ratio favorable, may indicate inefficient asset use. | Medium | Medium |

| Market Volatility | Beta near 1 (1.002) implies stock moves with market; recent price drop (-2.03%) shows sensitivity to market swings. | Medium | Medium |

The most pressing risks are financial health concerns due to borderline Altman Z-Score and very weak Piotroski score, signaling potential distress. Additionally, high valuation and weak profitability metrics raise caution. Investors should carefully monitor these factors when considering JBTM.

Should You Buy JBT Marel Corporation?

JBT Marel Corporation appears to be facing significant challenges, with declining operational efficiency and a deteriorating competitive moat suggesting value destruction. Despite a manageable leverage profile, profitability remains weak, reflected in a cautious C rating that suggests moderate investment risk.

Strength & Efficiency Pillars

JBT Marel Corporation exhibits moderate financial health with a current Altman Z-score of 1.89, placing it in the grey zone, signaling some risk but no immediate distress. The Piotroski score of 2 reflects very weak financial strength, highlighting concerns in operational efficiency. Profitability metrics remain subdued, with a net margin at 4.98% and ROE at 5.53%, both unfavorable. Importantly, ROIC at 3.65% falls below the WACC of 7.56%, indicating the company is currently not a value creator and is shedding value.

Weaknesses and Drawbacks

The valuation metrics present significant challenges; JBTM’s P/E ratio stands at 47.63, signaling a high premium that might not be justified by underlying earnings. The current ratio is 3.48, deemed unfavorable, suggesting potential inefficiencies in working capital management despite a quick ratio of 3.04 being favorable. Debt-to-equity ratio at 0.81 is moderate but combined with weak profitability raises leverage concerns. Although recent trading is buyer dominant with 69.83% buyer volume, the elevated valuation and weak margins pose risks for investors seeking stable returns.

Our Verdict about JBT Marel Corporation

JBT Marel’s long-term fundamental profile may appear unfavorable due to declining profitability and value destruction. However, the bullish overall stock trend paired with recent buyer dominance suggests potential for positive price momentum. Despite these technical strengths, the firm’s weak financial fundamentals and stretched valuation imply that investors might adopt a cautious stance, considering a wait-and-see approach until profitability improves and valuation metrics become more attractive.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- JBT Marel Corporation to Host 2026 Investor Day – Yahoo Finance (Jan 07, 2026)

- JBT Marel Corporation enters into market making agreement with Landsbankinn hf. and terminates existing agreement – TradingView — Track All Markets (Jan 19, 2026)

- JBT Marel Corporation Reports Third Quarter 2025 Results and Raises Full Year 2025 Guidance – Business Wire (Nov 03, 2025)

- Diversified Trust Co Acquires New Position in JBT Marel Corporation $JBTM – MarketBeat (Jan 02, 2026)

- JBTM Stock Skyrockets: Time for a Closer Look? – StocksToTrade (Dec 10, 2025)

For more information about JBT Marel Corporation, please visit the official website: jbtc.com