Home > Analyses > Industrials > J.B. Hunt Transport Services, Inc.

J.B. Hunt Transport Services, Inc. moves the backbone of North America’s economy by seamlessly connecting goods to consumers through its vast and diversified logistics network. Renowned for its leadership in integrated freight and innovative transportation solutions, J.B. Hunt operates a robust fleet that spans intermodal, dedicated, and last-mile delivery services. As the logistics landscape evolves rapidly, the key question for investors is whether J.B. Hunt’s solid fundamentals and market influence continue to support its premium valuation and growth prospects in 2026.

Table of contents

Business Model & Company Overview

J.B. Hunt Transport Services, Inc., founded in 1961 and headquartered in Lowell, Arkansas, stands as a dominant player in integrated freight and logistics across North America. Its ecosystem spans diverse segments including Intermodal, Dedicated Contract Services, and Final Mile Services, creating a cohesive platform that streamlines surface transportation, delivery, and supply chain solutions. With a fleet exceeding 100K company-owned trailers and thousands of tractors and trucks, J.B. Hunt harnesses scale and operational depth to meet complex logistics demands.

The company’s revenue engine balances asset-heavy operations with technology-driven logistics services, blending equipment ownership with brokerage and digital freight marketplaces. Its multi-segment approach enables strategic penetration across the Americas, Europe, and Asia, supporting a wide range of freight types from dry-van to refrigerated and expedited shipments. J.B. Hunt’s competitive advantage lies in its integrated network and innovative capacity solutions, underpinning a resilient economic moat that shapes the future of freight logistics.

Financial Performance & Fundamental Metrics

This section provides an overview of J.B. Hunt Transport Services, Inc.’s income statement, key financial ratios, and dividend payout policy to guide investment decisions.

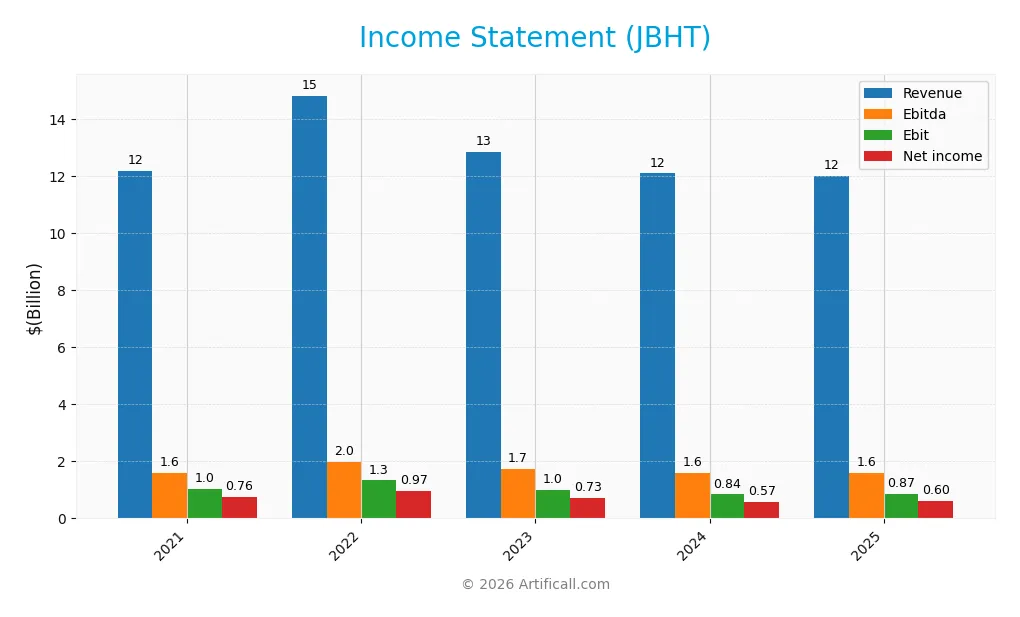

Income Statement

The table below presents J.B. Hunt Transport Services, Inc.’s key income statement figures for the fiscal years 2021 through 2025, in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 12.2B | 14.8B | 12.8B | 12.1B | 12.0B |

| Cost of Revenue | 10.3B | 12.3B | 10.6B | 10.0B | 10.7B |

| Operating Expenses | 824M | 1.14B | 1.22B | 1.23B | 397M |

| Gross Profit | 1.87B | 2.47B | 2.21B | 2.06B | 1.26B |

| EBITDA | 1.60B | 1.98B | 1.74B | 1.60B | 1.58B |

| EBIT | 1.05B | 1.33B | 1.00B | 839M | 865M |

| Interest Expense | 46M | 51M | 66M | 79M | 71M |

| Net Income | 761M | 969M | 728M | 571M | 598M |

| EPS | 7.22 | 9.31 | 7.06 | 5.60 | 6.12 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-21 | 2026-01-15 |

Income Statement Evolution

J.B. Hunt Transport Services experienced a slight decline in revenue over 2021-2025, with a 1.39% overall decrease and a 0.73% drop in 2025 alone. Net income fell more sharply, down 21.36% across the period, though it rose modestly by 5.57% in 2025. Margins showed mixed trends: gross and net margins declined overall, while EBIT margin remained stable, indicating some control over operating efficiency.

Is the Income Statement Favorable?

In 2025, JBHT posted revenue of $12B and net income of $598M, with a net margin near 5%, classified as neutral. EBIT margin was steady at 7.21%, while interest expenses were favorably low at 0.59% of revenue. Despite a one-year increase in EPS by 10%, the overall income statement evaluation is unfavorable due to longer-term declines in profitability and revenue. The fundamentals suggest caution given the mixed performance metrics.

Financial Ratios

The following table presents key financial ratios for J.B. Hunt Transport Services, Inc. over the last five fiscal years, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 6.25% | 6.54% | 5.68% | 4.72% | 4.99% |

| ROE | 24.40% | 26.44% | 17.75% | 14.22% | 0% |

| ROIC | 14.13% | 15.44% | 10.04% | 8.39% | 0% |

| P/E | 28.31 | 18.73 | 28.31 | 30.48 | 31.73 |

| P/B | 6.91 | 4.95 | 5.02 | 4.33 | 0 |

| Current Ratio | 1.33 | 1.41 | 1.35 | 1.06 | 0 |

| Quick Ratio | 1.32 | 1.38 | 1.32 | 1.03 | 0 |

| D/E | 0.48 | 0.43 | 0.47 | 0.45 | 0 |

| Debt-to-Assets | 21.33% | 19.63% | 21.91% | 20.99% | 0% |

| Interest Coverage | 22.61 | 25.98 | 15.06 | 10.52 | 12.19 |

| Asset Turnover | 1.75 | 1.85 | 1.46 | 1.42 | 0 |

| Fixed Asset Turnover | 2.86 | 2.80 | 2.09 | 2.00 | 0 |

| Dividend Yield | 0.58% | 0.92% | 0.84% | 1.01% | 0.91% |

Evolution of Financial Ratios

From 2021 to 2025, J.B. Hunt Transport Services, Inc. showed a decline in key profitability metrics. Return on Equity (ROE) dropped to zero in 2025, indicating a loss in shareholder value creation. The Current Ratio fell to zero in 2025 from over 1.3 in prior years, signaling deteriorating liquidity. Meanwhile, the Debt-to-Equity ratio also dropped to zero in 2025, reflecting changes in leverage structure or data unavailability. Profitability margins weakened overall.

Are the Financial Ratios Favorable?

In 2025, the company’s financial ratios suggest an unfavorable profile overall. Profitability metrics such as net margin (4.99%) and ROE are marked unfavorable. Liquidity ratios like current and quick ratios are zero and unfavorable, while leverage ratios such as debt-to-equity and debt-to-assets are favorable. Interest coverage remains strong at 12.19, indicating manageable debt service. Market valuation is high with a P/E of 31.73, considered unfavorable. The global assessment rates the ratios as predominantly unfavorable.

Shareholder Return Policy

J.B. Hunt Transport Services, Inc. maintains a consistent dividend payout ratio around 24-31%, with dividends per share gradually increasing to $1.76 in 2025 and an annual yield near 0.9-1.0%. The payout appears covered by net income, suggesting disciplined distribution.

The company also engages in share buybacks, complementing dividend returns. This balanced approach supports sustainable long-term shareholder value by combining income with capital return, while avoiding excessive risk from over-distribution or repurchase programs.

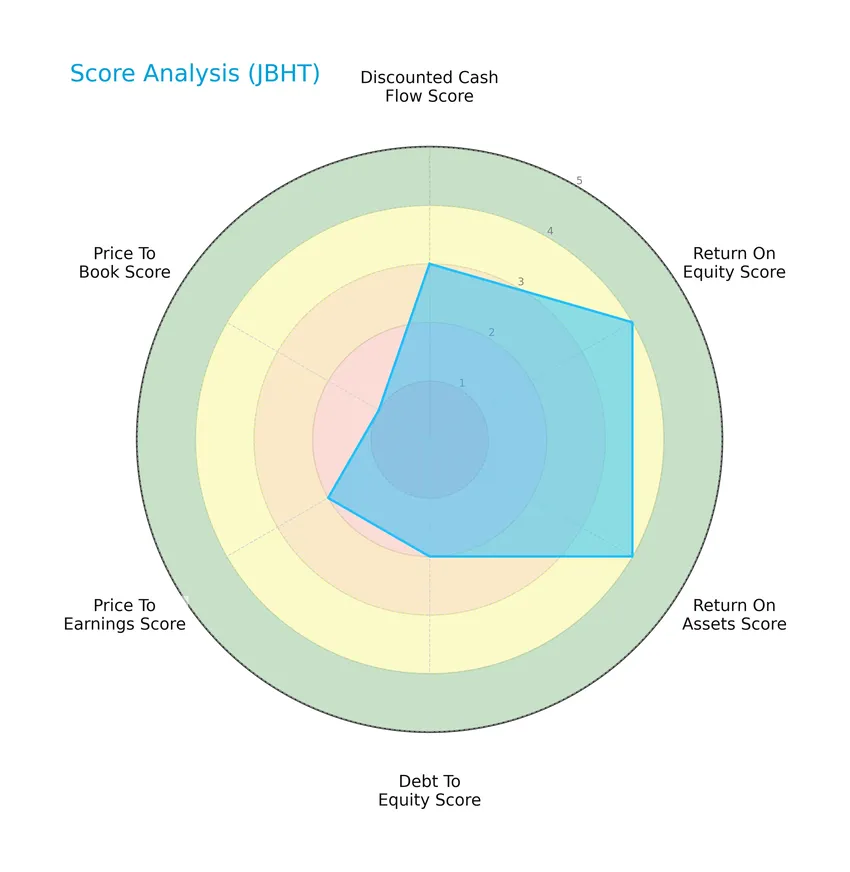

Score analysis

The following radar chart presents a comprehensive view of J.B. Hunt Transport Services, Inc.’s financial scores across key valuation and performance metrics:

The company shows favorable returns on equity and assets with scores of 4 each, reflecting efficient use of capital and assets. Debt-to-equity and price-to-earnings scores are moderate at 2, indicating average leverage and valuation. Discounted cash flow is moderate at 3, while price-to-book is very unfavorable at 1, suggesting the stock may be overvalued relative to book value.

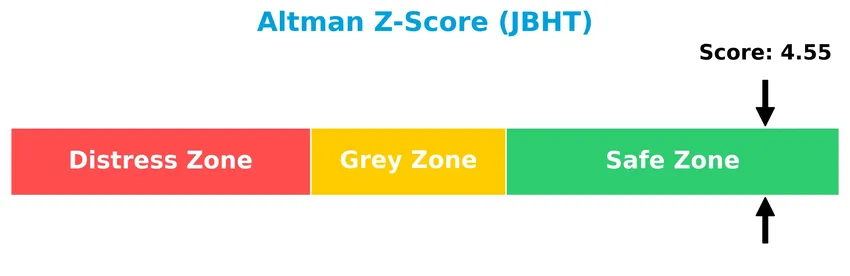

Analysis of the company’s bankruptcy risk

J.B. Hunt Transport Services, Inc. is positioned well within the safe zone according to the Altman Z-Score, indicating a low risk of bankruptcy and strong financial stability:

Is the company in good financial health?

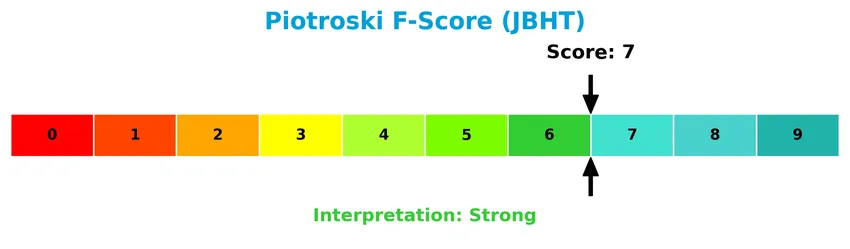

The Piotroski Score diagram below illustrates the company’s financial strength based on nine fundamental criteria:

With a Piotroski Score of 7, J.B. Hunt demonstrates strong financial health, suggesting sound profitability, liquidity, and operational efficiency, though not at the very highest level of financial robustness.

Competitive Landscape & Sector Positioning

This sector analysis will explore J.B. Hunt Transport Services, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether the company holds a competitive advantage over its peers in the integrated freight and logistics industry.

Strategic Positioning

J.B. Hunt Transport Services, Inc. operates a diversified product portfolio across five distinct segments—Intermodal, Dedicated Contract Services, Integrated Capacity Solutions, Final Mile Services, and Truckload—focusing exclusively on the North American market, which underscores a concentrated geographic exposure within the integrated freight and logistics industry.

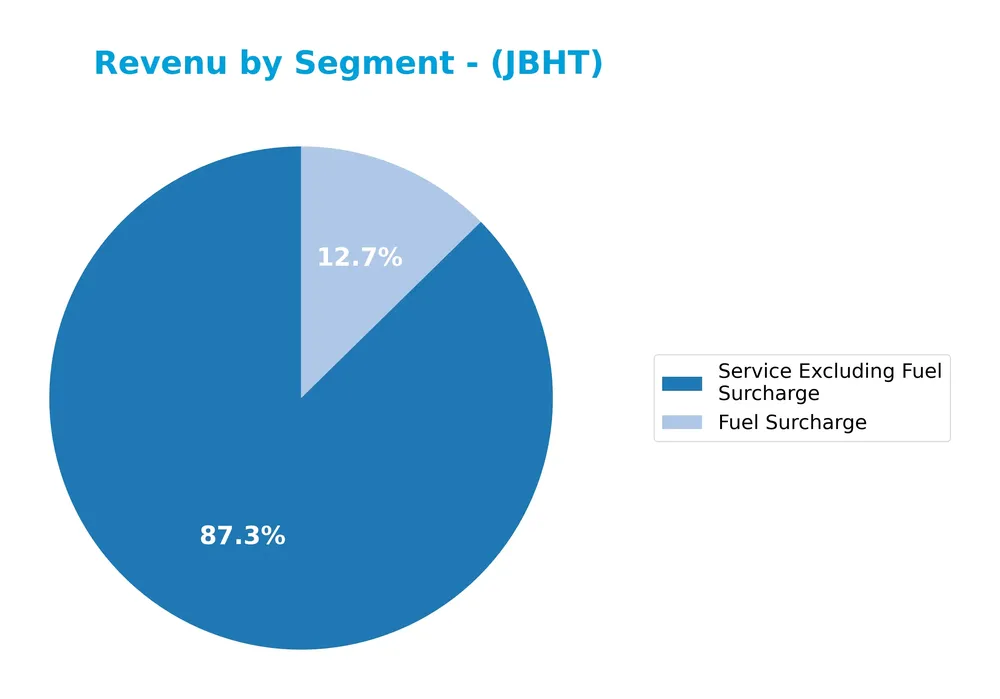

Revenue by Segment

The pie chart presents J.B. Hunt Transport Services, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting key sources of income within the company.

In 2024, J.B. Hunt’s revenue primarily stems from two segments: Service Excluding Fuel Surcharge at $10.6B and Fuel Surcharge at $1.5B. The Service Excluding Fuel Surcharge segment remains the dominant driver, although it has seen a slight decline from $12.4B in 2022 to $10.6B in 2024. Meanwhile, Fuel Surcharge revenues have decreased more notably from $2.4B in 2022 to $1.5B in 2024, indicating a slowdown and potential concentration risk if reliance on fuel adjustments persists.

Key Products & Brands

The table below highlights J.B. Hunt Transport Services, Inc.’s key products and business segments:

| Product | Description |

|---|---|

| Intermodal (JBI) | Intermodal freight solutions with 104,973 company-owned trailing equipment, 85,649 chassis units, 5,612 tractors, and 6,943 drivers. |

| Dedicated Contract Services (DCS) | Supply chain solutions with 11,139 company-owned trucks, 544 customer trucks, 6 contractor trucks, 21,069 trailers, and 7,753 customer trailers. |

| Integrated Capacity Solutions (ICS) | Freight brokerage and logistics, including flatbed, refrigerated, expedited, less-than-truckload, dry-van, intermodal, and an online marketplace. |

| Final Mile Services (FMS) | Delivery services using 1,272 company-owned trucks, 272 customer trucks, 19 contractor trucks, 1,036 trailers, and 185 customer trailers. |

| Truckload (JBT) | Dry-van freight services with 734 company tractors and 11,172 trailers, transporting a wide range of freight types. |

J.B. Hunt operates through five main segments focused on diverse transportation and logistics services, supported by a large fleet and extensive equipment to serve North American freight needs.

Main Competitors

There are 5 competitors in total within the Integrated Freight & Logistics industry; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| United Parcel Service, Inc. | 85.7B |

| FedEx Corporation | 69.2B |

| Expeditors International of Washington, Inc. | 20.8B |

| C.H. Robinson Worldwide, Inc. | 19.3B |

| J.B. Hunt Transport Services, Inc. | 18.7B |

J.B. Hunt Transport Services ranks 5th among its competitors with a market cap about 23% the size of the leader, United Parcel Service. The company is positioned below both the average market cap of the top 10 (42.8B) and the sector median (20.8B). It trails its nearest competitor, C.H. Robinson, by approximately 1.75%, indicating a closely contested position at the lower end of the peer group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does JBHT have a competitive advantage?

J.B. Hunt Transport Services, Inc. does not present clear evidence of a competitive advantage based on available data, with declining ROIC and an overall unfavorable income statement evaluation. Its financial metrics show neutral to unfavorable margins and growth trends, indicating challenges in sustaining excess returns.

Looking ahead, JBHT operates diversified segments including intermodal, dedicated contract services, and final mile delivery, offering potential opportunities to leverage its extensive fleet and logistics solutions in North America. Continued innovation in these areas may impact its future market position.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors influencing J.B. Hunt Transport Services, Inc., to guide strategic investment decisions.

Strengths

- diversified service segments

- extensive company-owned fleet

- strong Altman Z-Score in safe zone

Weaknesses

- declining revenue and net income over period

- unfavorable profit margins

- moderate debt-to-equity management

Opportunities

- growth in e-commerce boosting final mile demand

- expansion of integrated logistics solutions

- technology-driven operational efficiencies

Threats

- intense competition in freight and logistics

- economic sensitivity affecting freight volumes

- rising fuel and labor costs

Overall, J.B. Hunt shows operational breadth and financial stability, but persistent profit and revenue declines require strategic focus on innovation and cost control. Capitalizing on e-commerce growth and technology can offset competitive and economic risks.

Stock Price Action Analysis

The weekly stock chart of J.B. Hunt Transport Services, Inc. (JBHT) illustrates price movements and trading activity over the past 12 months:

Trend Analysis

Over the past 12 months, JBHT’s stock price increased by 1.68%, indicating a bullish trend as per the defined criteria. The price moved within a range of 129.23 to 206.85, showing acceleration in the upward momentum. The standard deviation of 20.05 suggests moderate volatility during this period.

Volume Analysis

Trading volume for JBHT has been increasing, with buyer volume closely matching seller volume at 49.84% overall. In the recent period from November 2025 to January 2026, buyer dominance rose to 67.27%, reflecting a buyer-driven market. This suggests growing investor interest and robust market participation.

Target Prices

The consensus target prices for J.B. Hunt Transport Services, Inc. reflect a moderately optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 240 | 150 | 195 |

Analysts expect the stock to trade between 150 and 240, with an average consensus target around 195, indicating moderate upside potential from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding J.B. Hunt Transport Services, Inc. (JBHT).

Stock Grades

Here is a summary of recent stock grades assigned to J.B. Hunt Transport Services, Inc. by reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-20 |

| Stifel | Maintain | Hold | 2026-01-16 |

| UBS | Maintain | Neutral | 2026-01-16 |

| Truist Securities | Maintain | Hold | 2026-01-15 |

| Barclays | Maintain | Equal Weight | 2026-01-15 |

| Stifel | Maintain | Hold | 2026-01-14 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-13 |

| JP Morgan | Maintain | Overweight | 2026-01-12 |

| Bernstein | Maintain | Market Perform | 2026-01-09 |

| Goldman Sachs | Maintain | Neutral | 2026-01-08 |

The overall trend reflects a predominantly neutral to positive outlook, with multiple firms maintaining hold or equivalent ratings and select analysts assigning outperform or overweight designations. The consensus remains a buy, supported by 25 analysts favoring purchase and no sell recommendations.

Consumer Opinions

Consumers have varied perspectives on J.B. Hunt Transport Services, Inc., reflecting both its operational strengths and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable delivery times and professional service. | Occasional delays reported during peak seasons. |

| Friendly and helpful customer service representatives. | Communication lapses in tracking shipments. |

| Competitive pricing compared to other logistics firms. | Limited flexibility in scheduling pickups. |

Overall, consumers appreciate J.B. Hunt’s reliability and customer service but note challenges with occasional delays and communication, especially during high-demand periods.

Risk Analysis

Below is a summary table highlighting key risk categories relevant to J.B. Hunt Transport Services, Inc., including their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Stock price fluctuations affected by broader economic cycles and sector-specific trends. | Medium | High |

| Profitability Risk | Unfavorable net margin (4.99%) and return on equity (0%) indicate pressure on earnings quality. | High | Medium |

| Valuation Risk | Elevated price-to-earnings ratio (31.73) suggests potential overvaluation risk. | Medium | Medium |

| Operational Risk | Complex multi-segment operations expose the company to supply chain disruptions or inefficiencies. | Medium | High |

| Financial Health | Strong Altman Z-Score (4.55) indicates low bankruptcy risk, but some liquidity ratios are unfavorable. | Low | Medium |

| Dividend Yield Risk | Low dividend yield (0.91%) may reduce attractiveness to income-focused investors. | Medium | Low |

The most significant risks for JBHT stem from its profitability challenges and operational complexities, which could pressure margins amid economic uncertainty. Despite a favorable bankruptcy risk score, valuation remains stretched. Investors should monitor earnings trends and sector conditions closely.

Should You Buy J.B. Hunt Transport Services, Inc.?

J.B. Hunt appears to be positioned with improving profitability and a manageable debt profile, supported by a safe Altman Z-Score and a strong Piotroski Score. While its competitive moat is unclear due to declining ROIC, the overall B rating suggests a very favorable financial health profile.

Strength & Efficiency Pillars

J.B. Hunt Transport Services, Inc. presents a solid financial foundation as evidenced by an Altman Z-Score of 4.55, placing the company comfortably in the safe zone and indicating low bankruptcy risk. The Piotroski Score of 7 further underscores strong financial health. Favorable leverage metrics, including a debt-to-equity ratio marked as favorable and an interest coverage ratio of 12.19, demonstrate prudent financial management. While ROE and ROIC data are unavailable or unfavorable, the company’s strong balance sheet and operational efficiency offer a degree of resilience amid market fluctuations.

Weaknesses and Drawbacks

Despite these strengths, several valuation and profitability concerns temper the outlook. A high P/E ratio of 31.73 signals a premium valuation, which may limit upside potential if growth slows. Net margin at 4.99% is marked unfavorable, reflecting margin pressure, and the company’s earnings growth has declined over the medium term. Liquidity ratios such as the current and quick ratios are reported as unfavorable, hinting at potential short-term financial constraints. The absence of ROIC data and a declining trend in profitability metrics raise questions about long-term value creation capacity.

Our Verdict about J.B. Hunt Transport Services, Inc.

The fundamental profile of J.B. Hunt is moderately favorable, supported by strong financial health scores and a robust capital structure. The bullish overall stock trend and recent buyer dominance with a 67.27% buyer volume suggest positive market sentiment. Given the premium valuation and some profitability headwinds, J.B. Hunt may appear attractive for investors seeking exposure to a financially stable company, though a cautious, wait-and-see stance could be prudent to identify a more advantageous entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Is J.B. Hunt (JBHT) Fairly Priced After Strong Five Year Share Price Performance – simplywall.st (Jan 24, 2026)

- J.B. Hunt Transport Services, Inc. Reports U.S. GAAP Revenues, Net Earnings and Earnings Per Share for Both the Fourth Quarter and Year Ended December 31, 2025 – J.B. Hunt (Jan 15, 2026)

- J. B. Hunt Transport Services, Inc. Announces Increase to Quarterly Dividend – Business Wire (Jan 22, 2026)

- Hicks, J B Hunt Transport Services president, sells $823k in shares – Investing.com (Jan 24, 2026)

- Argus Upgrades J.B. Hunt Transport Services (NASDAQ:JBHT) to Strong-Buy – MarketBeat (Jan 24, 2026)

For more information about J.B. Hunt Transport Services, Inc., please visit the official website: jbhunt.com