Home > Analyses > Technology > IPG Photonics Corporation

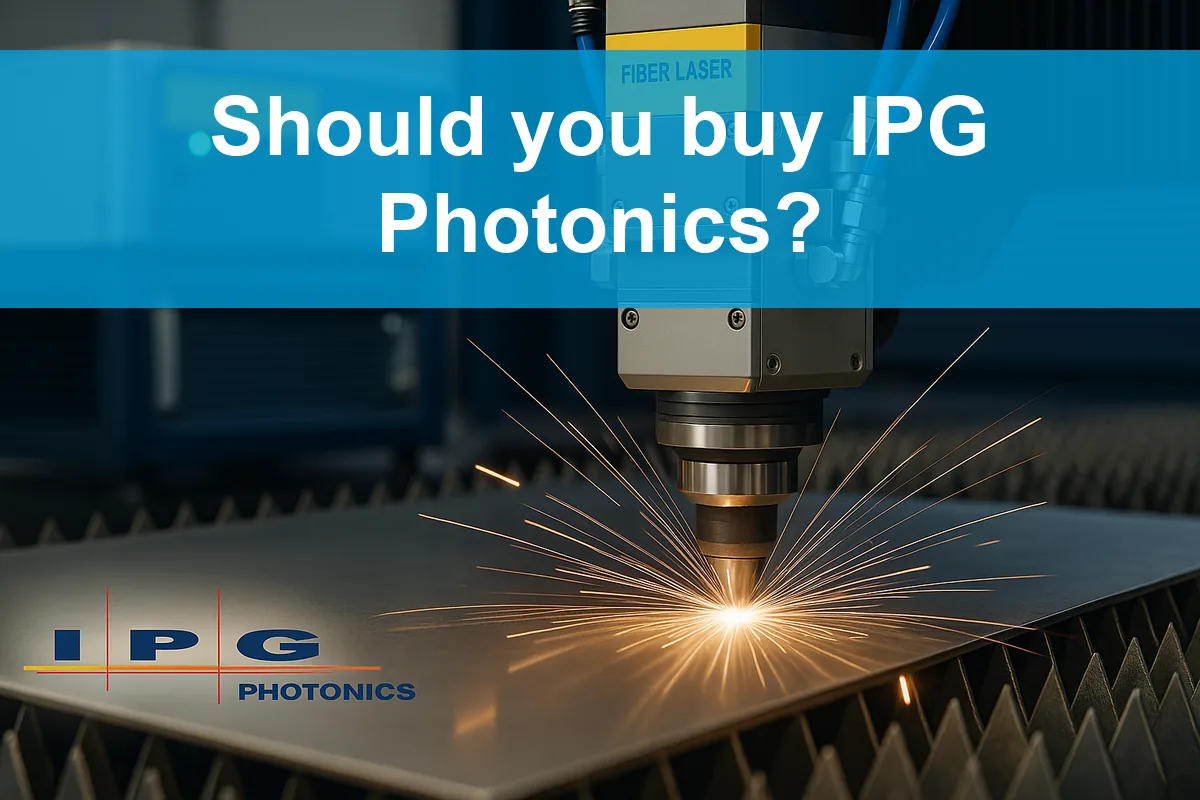

IPG Photonics revolutionizes manufacturing with its cutting-edge fiber lasers, powering precision across industries worldwide. The company leads the semiconductor sector with innovative laser and amplifier technologies that enhance materials processing, communications, and medical applications. Known for quality and market influence, IPG pushes the boundaries of photonics. As 2026 unfolds, investors must ask: do IPG’s strong fundamentals and technological moat still support its premium valuation and future growth potential?

Table of contents

Business Model & Company Overview

IPG Photonics Corporation, founded in 1990 and headquartered in Marlborough, MA, leads the semiconductor sector with its high-performance fiber and diode laser technologies. The company’s core business integrates advanced fiber lasers, amplifiers, and optical components into a cohesive ecosystem powering materials processing, communications, and medical applications globally. Its innovation-driven mission sets it apart in a competitive landscape.

IPG monetizes its technology through a balanced mix of hardware sales—laser systems, amplifiers, and accessories—and recurring service contracts, targeting OEMs, system integrators, and end users. Its strategic footprint spans the Americas, Europe, and Asia, enabling robust global reach. This diversified revenue engine strengthens IPG’s competitive advantage, anchored by proprietary fiber laser technology that shapes the future of industrial laser applications.

Financial Performance & Fundamental Metrics

I analyze IPG Photonics Corporation’s income statement, key financial ratios, and dividend payout policy to assess its operational efficiency and shareholder returns.

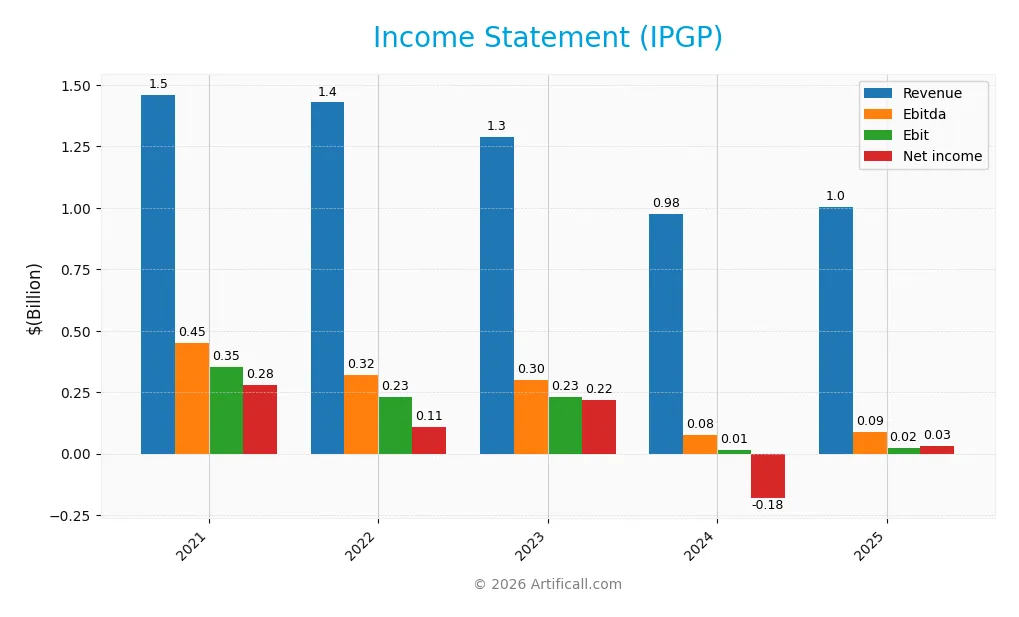

Income Statement

Below is the Income Statement for IPG Photonics Corporation over the last five fiscal years.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 1.46B | 1.43B | 1.29B | 977M | 1.00B |

| Cost of Revenue | 764M | 874M | 746M | 639M | 622M |

| Operating Expenses | 329M | 386M | 310M | 546M | 368M |

| Gross Profit | 696M | 555M | 542M | 338M | 381M |

| EBITDA | 449M | 322M | 301M | 76M | 90M |

| EBIT | 353M | 231M | 232M | 14M | 23M |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | 278M | 110M | 219M | -182M | 31M |

| EPS | 5.21 | 2.17 | 4.64 | -4.09 | 0.73 |

| Filing Date | 2022-02-22 | 2023-02-27 | 2024-02-21 | 2025-02-20 | 2026-02-23 |

Income Statement Evolution

From 2021 to 2025, IPG Photonics’ revenue declined significantly by 31%, while net income plunged nearly 89%. However, gross profit margin improved, reaching 38% in 2025, reflecting better cost control. EBIT margin remained neutral at 2.3%, indicating operating efficiency stabilized despite revenue pressures. The recent year showed a modest 2.7% revenue growth, reversing prior declines.

Is the Income Statement Favorable?

In 2025, IPGP reported $1B in revenue and $31M net income, marking a strong rebound from a loss in 2024. Gross profit rose 13%, driving margin expansion. EBIT improved 59%, but the operating income remained thin at 1.3%. Zero interest expense is a positive sign. Overall, fundamentals appear cautiously favorable, supported by margin recovery and earnings growth, yet top-line growth remains modest.

Financial Ratios

The table below summarizes key financial ratios for IPG Photonics Corporation over the last five fiscal years, providing a clear snapshot of profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 19.1% | 7.7% | 17.0% | -18.6% | 3.1% |

| ROE | 10.1% | 4.6% | 9.1% | -8.97% | 1.5% |

| ROIC | 9.7% | 4.1% | 7.4% | -9.97% | 0.4% |

| P/E | 33.0 | 43.7 | 23.4 | -17.8 | 98.1 |

| P/B | 3.35 | 2.01 | 2.12 | 1.59 | 1.43 |

| Current Ratio | 7.49 | 7.23 | 8.91 | 6.98 | 6.08 |

| Quick Ratio | 6.02 | 5.38 | 6.80 | 5.59 | 4.74 |

| D/E | 0.021 | 0.016 | 0.008 | 0.009 | 0.00 |

| Debt-to-Assets | 1.8% | 1.4% | 0.7% | 0.8% | 0.0% |

| Interest Coverage | 0 | 0 | 0 | 0 | 0 |

| Asset Turnover | 0.46 | 0.52 | 0.48 | 0.43 | 0.41 |

| Fixed Asset Turnover | 2.30 | 2.46 | 2.14 | 1.66 | 1.57 |

| Dividend Yield | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

Evolution of Financial Ratios

From 2021 to 2025, IPG Photonics’ Return on Equity (ROE) declined sharply from 10.1% to 1.46%. The Current Ratio decreased from a high 7.49 to 6.08, indicating slightly reduced liquidity but still above typical benchmarks. Debt-to-Equity remained negligible, consistently close to zero, reflecting minimal leverage and stable capital structure.

Are the Financial Ratios Favorable?

In 2025, profitability ratios show weakness: net margin at 3.1% and ROE at 1.46%, both unfavorable compared to sector averages. Liquidity is mixed, with a high Current Ratio flagged as unfavorable possibly due to inefficient asset use, while Quick Ratio is favorable. Leverage is very low, debt ratios and interest coverage are favorable, but asset turnover is low. Overall, the financial ratios are slightly unfavorable, indicating caution.

Shareholder Return Policy

IPG Photonics Corporation does not pay dividends, reflecting a reinvestment strategy focused on growth and operational stability. The company does not engage in share buybacks either, indicating a preference to retain capital for internal uses rather than returning cash to shareholders.

This approach aligns with the company’s financial profile, which shows fluctuating profitability and occasional free cash flow deficits. Retaining earnings supports sustainable long-term value creation by funding innovation and capacity expansion, though it limits immediate shareholder income.

Score analysis

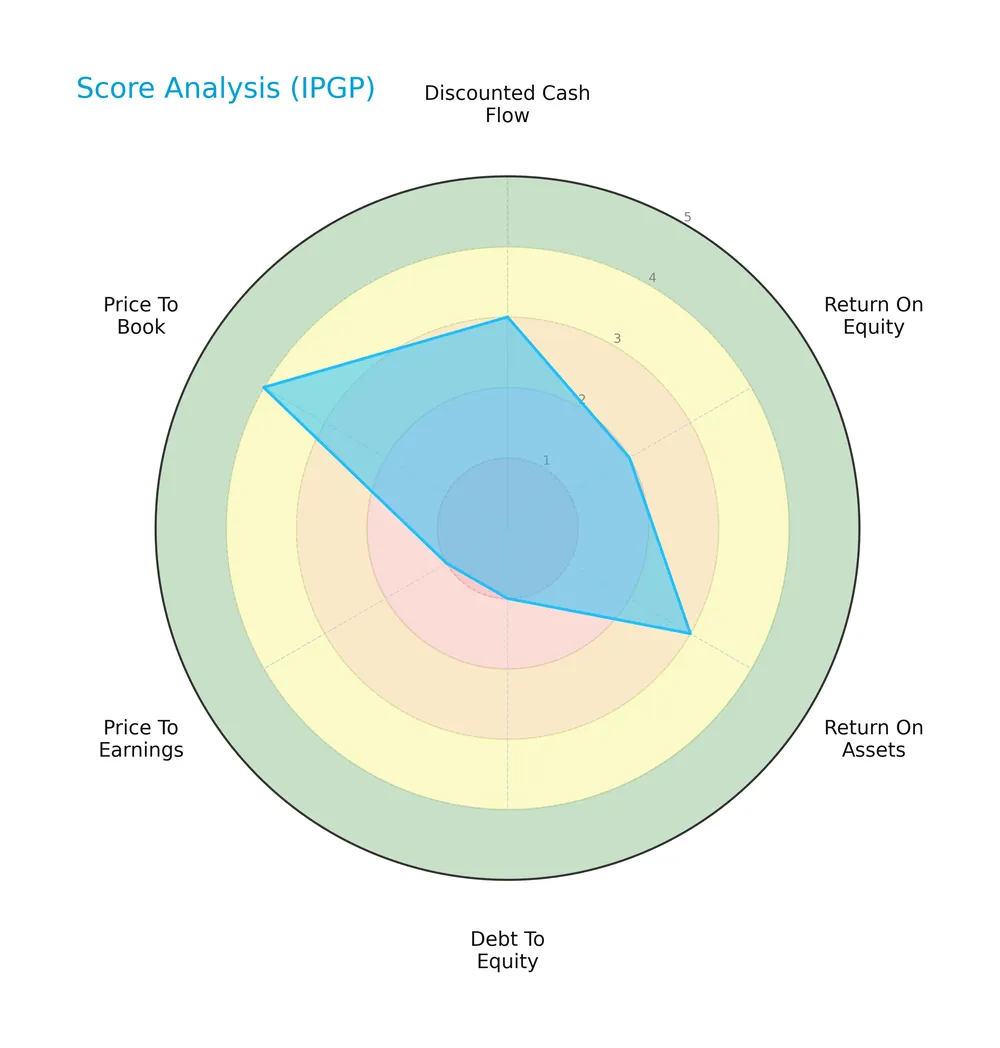

The following radar chart illustrates IPG Photonics Corporation’s current financial scores across key valuation and performance metrics:

IPGP shows moderate strength in discounted cash flow and return on assets, but struggles with return on equity. Its debt and price multiples are very unfavorable, though the price-to-book ratio remains favorable, indicating mixed fundamentals.

Analysis of the company’s bankruptcy risk

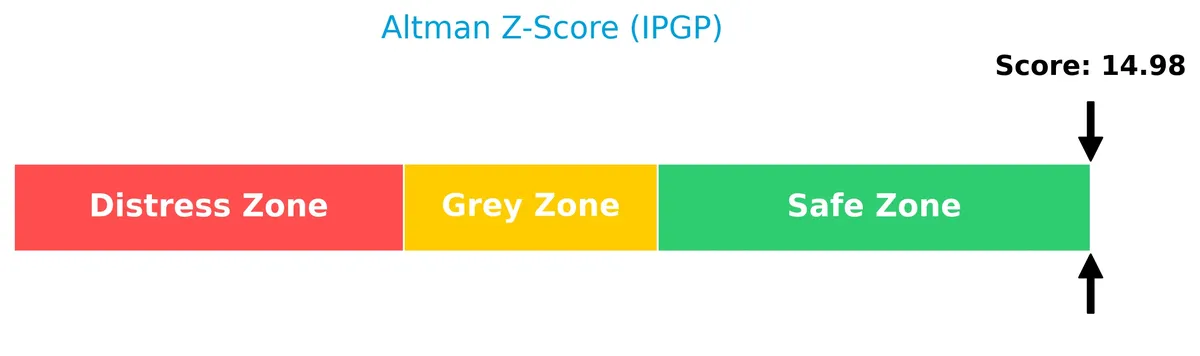

IPG Photonics is positioned firmly in the safe zone according to its Altman Z-Score, signaling a very low risk of bankruptcy:

Is the company in good financial health?

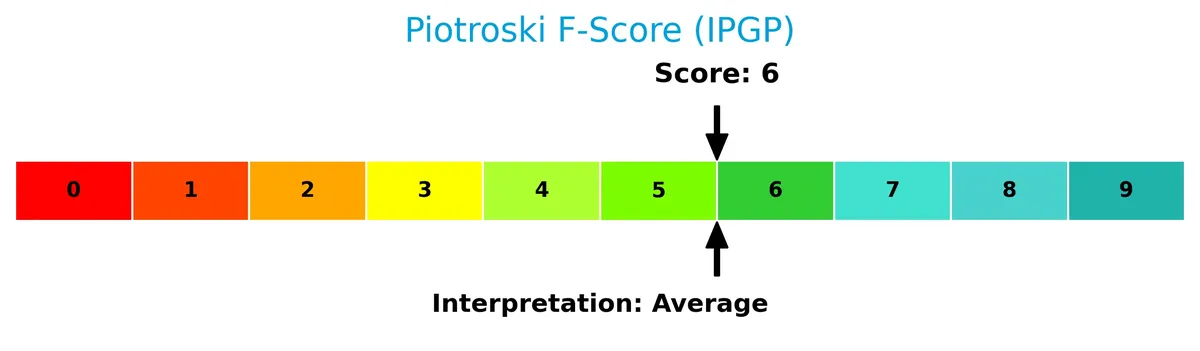

This Piotroski diagram presents IPG Photonics’ financial health based on profitability, leverage, and efficiency measures:

With a Piotroski Score of 6, IPGP demonstrates average financial strength. The company is neither weak nor exceptionally strong, indicating moderate operational and financial stability.

Competitive Landscape & Sector Positioning

This sector analysis examines IPG Photonics Corporation’s strategic positioning, revenue segments, and key products. I will assess whether IPGP holds a competitive advantage over its main industry peers.

Strategic Positioning

IPG Photonics maintains a concentrated product portfolio focusing on fiber lasers, amplifiers, and laser systems across materials processing, communications, and medical sectors. Geographically, revenue is diversified with significant exposure in Asia, particularly China, Europe, and North America, reflecting a balanced global footprint.

Revenue by Segment

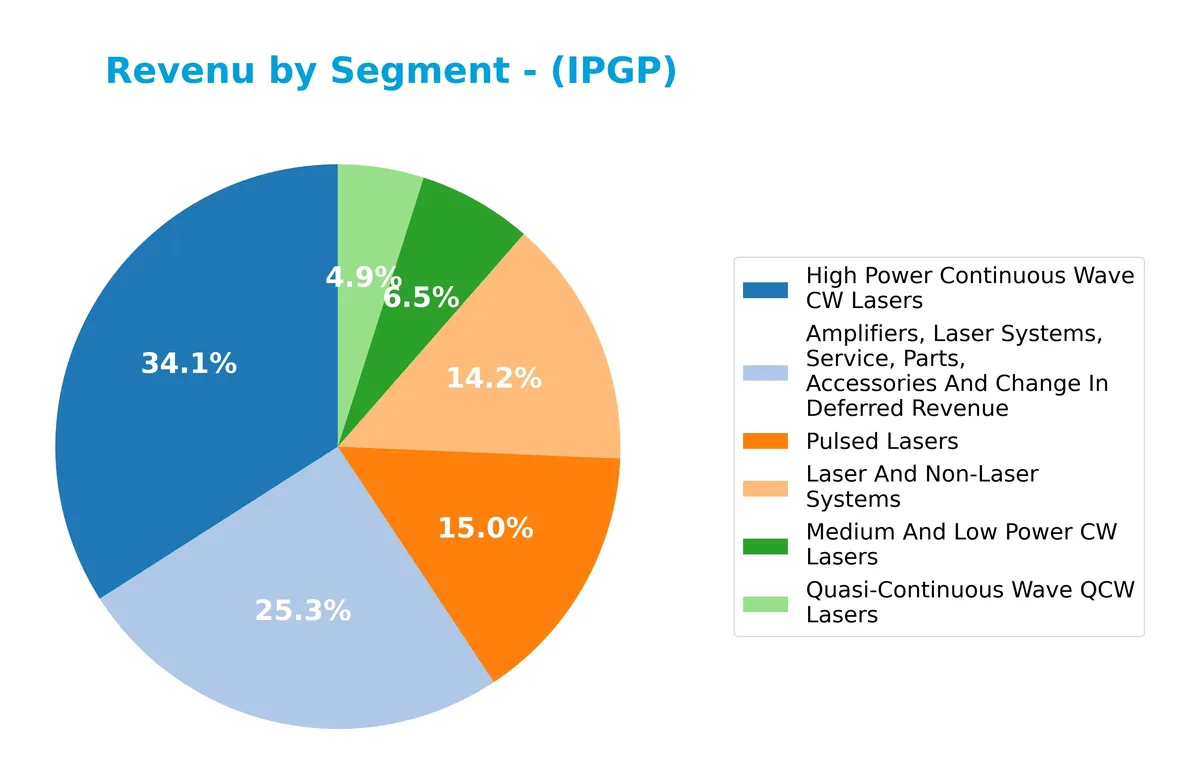

This pie chart illustrates IPG Photonics Corporation’s revenue breakdown by product segment for fiscal year 2025, showcasing the relative contributions of laser categories.

In 2025, High Power Continuous Wave (CW) Lasers remain the dominant revenue driver at $309M, reflecting a core strength. Laser and Non-Laser Systems contribute $147M, while Pulsed Lasers add $143M, indicating a balanced portfolio. Medium and Low Power CW Lasers and Quasi-Continuous Wave QCW Lasers generate smaller shares, $88M and $52M respectively. The slight decline in High Power CW Lasers from prior years signals industry cyclicality and warrants monitoring.

Key Products & Brands

The table below details IPG Photonics Corporation’s key products and their descriptions:

| Product | Description |

|---|---|

| High Power Continuous Wave (CW) Lasers | Fiber lasers delivering continuous high power for industrial materials processing applications. |

| Laser and Non-Laser Systems | Integrated laser systems, 2D cutters, multi-axis systems, and related non-laser equipment and accessories. |

| Medium and Low Power CW Lasers | Lower power fiber lasers designed for precision and specialized manufacturing processes. |

| Pulsed Lasers | High-energy pulsed fiber lasers used in materials processing and advanced applications. |

| Quasi-Continuous Wave (QCW) Lasers | Lasers operating in quasi-continuous mode for specific industrial and scientific uses. |

| Amplifiers, Laser Systems, Service, Parts, Accessories and Deferred Revenue | Erbium-doped and specialty fiber amplifiers, laser system components, and after-sales support products. |

IPG Photonics offers a diversified portfolio centered on fiber laser technologies. Their products target materials processing, communications, and advanced industrial applications. This range supports both continuous wave and pulsed laser demands.

Main Competitors

There are 38 competitors in the Semiconductor industry, with the table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

IPG Photonics Corporation ranks 32nd among 38 competitors. Its market cap is just 0.12% of the leader, NVIDIA. The company sits below both the average market cap of the top 10 (975B) and the sector median (31B). It trails its nearest competitor by approximately 24.26%, indicating a significant gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does IPG Photonics Corporation have a competitive advantage?

IPG Photonics currently lacks a competitive advantage, as indicated by its declining ROIC and a negative spread versus WACC, signaling value destruction and weakening profitability. Despite a solid gross margin of 38%, the company’s overall ROIC trend is very unfavorable, reflecting challenges in capital efficiency.

Looking ahead, IPG Photonics emphasizes innovation in fiber lasers and integrated systems across materials processing, communications, and medical fields. Expansion in Asia and new product opportunities may support future growth, though execution risks remain given recent profitability trends.

SWOT Analysis

This SWOT analysis highlights key internal and external factors shaping IPG Photonics Corporation’s strategic position.

Strengths

- strong gross margin at 38%

- zero debt enhances financial flexibility

- global sales diversification with growth in Asia

Weaknesses

- declining ROIC signals value destruction

- below-par net margin at 3.1%

- high P/E of 98 suggests overvaluation risk

Opportunities

- expanding fiber laser market in industrial automation

- growing demand in Asia, especially China

- innovation in high-power laser systems

Threats

- intense competition in semiconductors

- global supply chain risks

- sensitivity to economic cycles affecting capital spending

IPG Photonics shows solid operational strengths but struggles with profitability and return on invested capital. Its strategic focus must leverage growth opportunities in Asia and innovation while managing high valuation risks and competitive pressures.

Stock Price Action Analysis

The weekly chart below illustrates IPG Photonics Corporation’s stock price movements, highlighting key trends and volatility patterns over the past 12 months:

Trend Analysis

Over the past 12 months, IPGP’s stock price rose 56.0%, reflecting a clear bullish trend with accelerating momentum. The price ranged from a low of 52.12 to a high of 153.91, supported by a volatility level of 14.7% standard deviation. Recent months show intensified gains with a 74.51% increase.

Volume Analysis

Trading volume has increased recently, with buyer volume at 16.9M against seller volume of 8.7M for the last three months. Buyers dominated 66.03% of trades, suggesting strong investor demand and heightened market participation favoring accumulation.

Target Prices

Analysts present a clear target price consensus for IPG Photonics Corporation.

| Target Low | Target High | Consensus |

|---|---|---|

| 110 | 180 | 151.67 |

The consensus target of $151.67 signals moderate upside potential. Analysts expect the stock to trade between $110 and $180, reflecting confidence balanced with market volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding IPG Photonics Corporation’s market performance.

Stock Grades

Here are the latest verified analyst grades for IPG Photonics Corporation from established firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-02-13 |

| Raymond James | Downgrade | Outperform | 2026-02-13 |

| Roth Capital | Maintain | Buy | 2026-02-03 |

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Needham | Maintain | Hold | 2025-02-12 |

| Stifel | Maintain | Buy | 2025-02-12 |

The overall trend shows a predominant bias toward Buy and Outperform ratings, with multiple upgrades since early 2025. Notably, Citigroup’s stance remains mixed, reflecting some divergence in views.

Consumer Opinions

Consumers show a mix of admiration and criticism for IPG Photonics Corporation, reflecting its complex market position.

| Positive Reviews | Negative Reviews |

|---|---|

| “Outstanding laser technology with high precision.” | “Customer service response times can be slow.” |

| “Robust product durability under industrial conditions.” | “Pricing is on the higher side compared to competitors.” |

| “Innovative solutions driving efficiency in manufacturing.” | “Limited availability of replacement parts in some regions.” |

Overall, customers praise IPGP’s cutting-edge technology and product reliability. However, they frequently cite customer support delays and premium pricing as areas needing improvement.

Risk Analysis

Below is a summary of key risks for IPG Photonics Corporation, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Extremely high P/E ratio (98x) suggests potential overvaluation. | High | High |

| Profitability Risk | Low net margin (3.1%) and ROE (1.46%) indicate weak earnings. | High | Medium |

| Liquidity Risk | Very high current ratio (6.08) may signal inefficient asset use. | Medium | Low |

| Leverage Risk | Zero debt reduces financial risk but may limit growth options. | Low | Low |

| Market Volatility | Beta near 1 suggests stock moves with market; sector cyclicality. | Medium | Medium |

| Financial Health | Altman Z-Score (14.06) indicates very low bankruptcy risk. | Low | Low |

The most concerning risks are the extreme valuation and weak profitability metrics, which have persisted despite a strong balance sheet and zero debt. This disconnect suggests investors should approach with caution amid semiconductor sector cyclicality.

Should You Buy IPG Photonics Corporation?

IPG Photonics appears to be in a safe zone for bankruptcy risk but exhibits a very unfavorable moat, reflecting declining profitability and value destruction. Despite manageable leverage, the overall B- rating suggests moderate operational efficiency with notable valuation risks.

Strength & Efficiency Pillars

IPG Photonics Corporation operates with a gross margin of 38.0%, reflecting solid operational efficiency. However, profitability metrics such as net margin (3.1%) and return on equity (1.46%) remain subdued. The return on invested capital (0.41%) falls well below the weighted average cost of capital (8.44%), indicating the company is currently destroying shareholder value rather than creating it. Despite a favorable interest expense ratio and zero debt load, IPGP struggles to convert revenue into meaningful profits or returns.

Weaknesses and Drawbacks

The company’s Altman Z-Score of 14.06 firmly places it in the safe zone, so solvency risk is minimal. Yet, IPGP faces significant valuation and leverage concerns. A sky-high price-to-earnings ratio of 98.08 signals a richly priced stock, raising questions about market expectations sustainability. The current ratio at 6.08 might appear strong but reflects potential inefficiencies in asset utilization. Combined with a weak asset turnover of 0.41 and neutral-to-unfavorable profitability trends, these factors pose challenges to near-term market confidence.

Our Final Verdict about IPG Photonics Corporation

IPGP’s long-term fundamental profile appears challenged given its value destruction and weak returns. Despite a bullish overall stock trend coupled with buyer dominance in recent months, the company’s elevated valuation and operational inefficiencies suggest caution. Investors might view IPGP as a speculative growth play that requires a wait-and-see approach for a better entry point, especially considering its inability to generate returns above its cost of capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Decoding IPG Photonics Corp (IPGP): A Strategic SWOT Insight – GuruFocus (Feb 24, 2026)

- IPG PHOTONICS CORP SEC 10-K Report – TradingView (Feb 23, 2026)

- Why IPG Photonics (IPGP) Is Up 24.7% After Q4 Beat And New $100 Million Buyback – Yahoo Finance (Feb 19, 2026)

- Is IPG Photonics’ (IPGP) New Buyback After a Profit Return a Nuanced Capital Allocation Signal? – simplywall.st (Feb 23, 2026)

- COHR Appears Expensive to Its Industry: Is AI Premium Warranted? – Finviz (Feb 23, 2026)

For more information about IPG Photonics Corporation, please visit the official website: ipgphotonics.com