Home > Analyses > Technology > IPG Photonics Corporation

IPG Photonics transforms industries by powering precision with its cutting-edge fiber laser technology. The company dominates the semiconductor landscape with high-performance lasers used in materials processing, communications, and medical fields. Its innovative systems set the standard for quality and market influence worldwide. As IPG approaches new growth phases, I ask whether its robust fundamentals still justify a premium valuation in today’s competitive environment.

Table of contents

Business Model & Company Overview

IPG Photonics Corporation, founded in 1990 and headquartered in Marlborough, Massachusetts, leads the semiconductors sector with its cutting-edge fiber laser technology. The company’s ecosystem revolves around high-performance fiber lasers, amplifiers, and diode lasers that serve diverse materials processing, communications, and medical applications worldwide. IPG’s integrated approach combines hardware and advanced laser systems to deliver precision and power across industries.

The company’s revenue engine balances sales of laser hardware and integrated systems with recurring services supporting global clients in the Americas, Europe, and Asia. IPG’s strategic presence in key markets fuels growth and resilience. Its competitive advantage stems from proprietary fiber laser technology, creating a durable economic moat that shapes the future of laser applications and materials processing globally.

Financial Performance & Fundamental Metrics

I analyze IPG Photonics Corporation’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder returns.

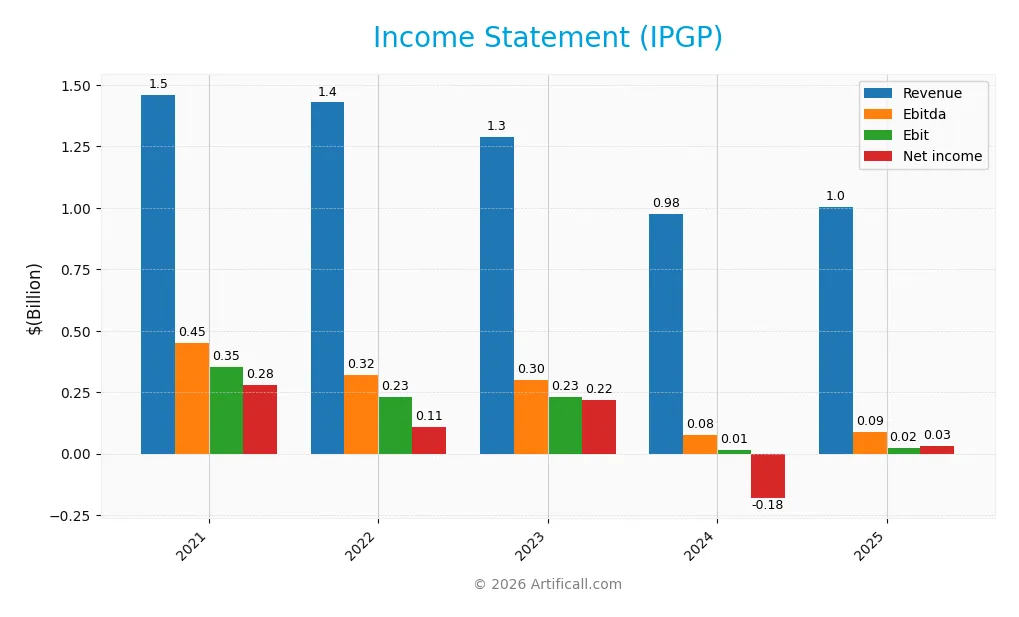

Income Statement

The table below presents IPG Photonics Corporation’s annual income statement figures for fiscal years 2021 through 2025, all reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 1.46B | 1.43B | 1.29B | 977M | 1.00B |

| Cost of Revenue | 764M | 874M | 746M | 639M | 622M |

| Operating Expenses | 329M | 386M | 310M | 546M | 368M |

| Gross Profit | 696M | 555M | 542M | 338M | 381M |

| EBITDA | 449M | 322M | 301M | 76M | 90M |

| EBIT | 353M | 231M | 232M | 14M | 23M |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | 278M | 110M | 219M | -182M | 31M |

| EPS | 5.21 | 2.17 | 4.64 | -4.09 | 0.73 |

| Filing Date | 2022-02-22 | 2023-02-27 | 2024-02-21 | 2025-02-20 | 2026-02-12 |

Income Statement Evolution

From 2021 to 2025, IPG Photonics’ revenue declined by 31%, while net income fell nearly 89%. The 2025 gross margin improved to 38%, signaling better cost control. However, net margin contracted by 84% over the period, reflecting increased expenses and volatility in profitability. Recent margin trends show stabilization after a turbulent decline.

Is the Income Statement Favorable?

In 2025, revenue grew modestly by 2.7%, with gross profit rising 13%, highlighting improved operational efficiency. EBIT surged 59%, lifting the net margin to 3.1%, a neutral yet recovering level. Absence of interest expense supports financial health. Overall, fundamentals appear favorable, balancing improved margins against subdued top-line growth.

Financial Ratios

The following table summarizes key financial ratios for IPG Photonics Corporation over the last five fiscal years, providing a clear view of profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 19.1% | 7.7% | 17.0% | -18.6% | 3.1% |

| ROE | 10.1% | 4.6% | 9.1% | -8.9% | 1.5% |

| ROIC | 9.7% | 4.1% | 7.4% | -10.0% | 0.4% |

| P/E | 33.0 | 43.7 | 23.4 | -17.8 | 98.1 |

| P/B | 3.35 | 2.01 | 2.12 | 1.59 | 1.43 |

| Current Ratio | 7.49 | 7.23 | 8.91 | 6.98 | 6.08 |

| Quick Ratio | 6.02 | 5.38 | 6.80 | 5.59 | 4.74 |

| D/E | 0.02 | 0.02 | 0.01 | 0.01 | 0.00 |

| Debt-to-Assets | 1.8% | 1.4% | 0.7% | 0.8% | 0.0% |

| Interest Coverage | 0 | 0 | 0 | 0 | 0 |

| Asset Turnover | 0.46 | 0.52 | 0.48 | 0.43 | 0.41 |

| Fixed Asset Turnover | 2.30 | 2.46 | 2.14 | 1.66 | 1.57 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2021 to 2025, IPG Photonics’ Return on Equity (ROE) sharply declined from 10.14% to 1.46%, signaling deteriorating profitability. The Current Ratio trended downward but remained high, falling from 7.49 to 6.08, indicating strong liquidity. The Debt-to-Equity Ratio consistently stayed near zero, reflecting minimal leverage and stable capital structure.

Are the Financial Ratios Favorable?

In 2025, profitability ratios such as net margin (3.1%) and ROE (1.46%) are unfavorable, highlighting weak earnings. Liquidity appears mixed: the Current Ratio (6.08) is unfavorable due to excess current assets, while the Quick Ratio (4.74) is favorable. Leverage ratios remain favorable with zero debt. Asset turnover (0.41) is unfavorable, suggesting inefficiency. Overall, the ratios lean slightly unfavorable.

Shareholder Return Policy

IPG Photonics Corporation does not pay dividends, reflecting its focus on reinvestment and growth rather than income distribution. The company has maintained a zero dividend payout ratio consistently, with no dividend yield, indicating a strategy prioritizing capital deployment elsewhere.

The absence of dividends aligns with its ongoing investment in operations, as free cash flow turned negative in 2025, constraining distributions. IPGP does not appear to engage in share buybacks, suggesting a conservative capital allocation approach that supports sustainable long-term value creation.

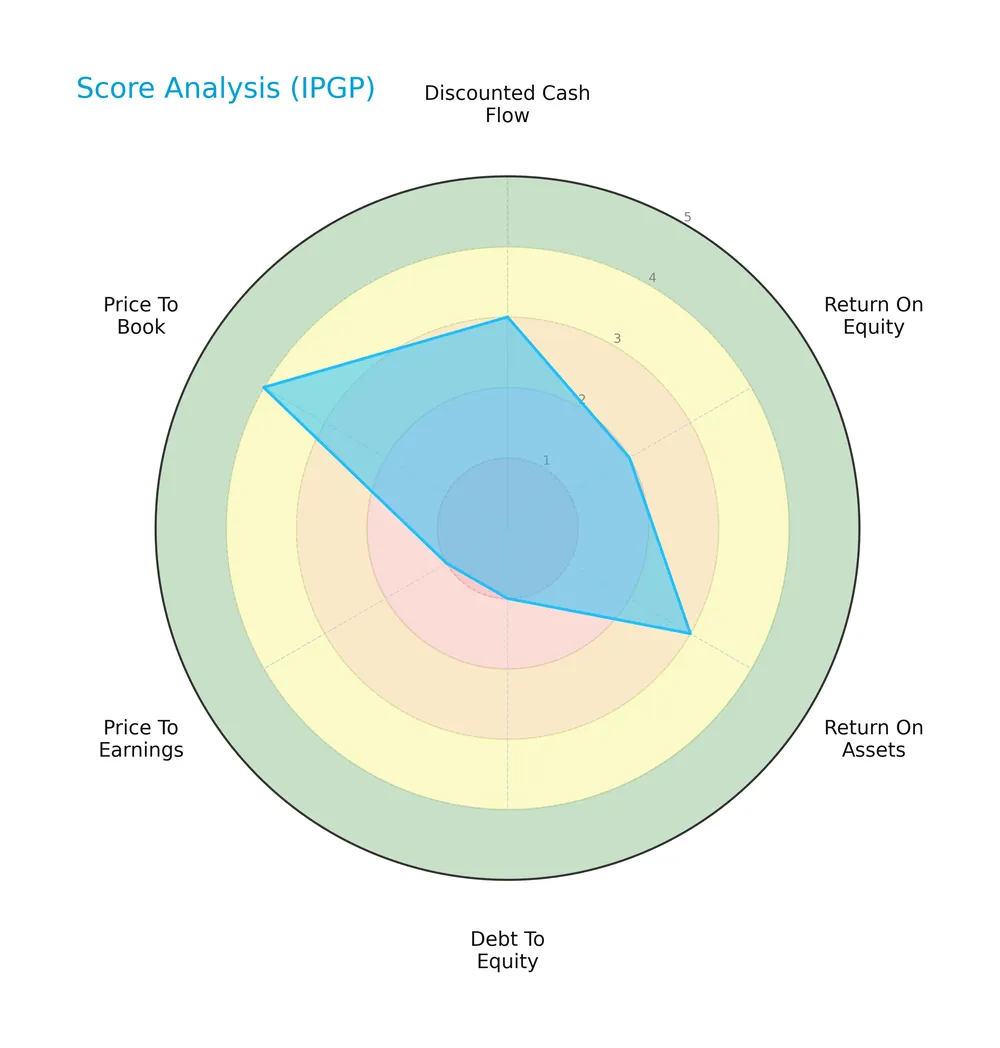

Score analysis

The radar chart below illustrates the key financial scores for IPG Photonics Corporation:

IPGP shows moderate scores in discounted cash flow and return on assets at 3 each. Return on equity is unfavorable at 2. Debt to equity and price to earnings are very unfavorable at 1. Price to book stands out as favorable at 4.

Analysis of the company’s bankruptcy risk

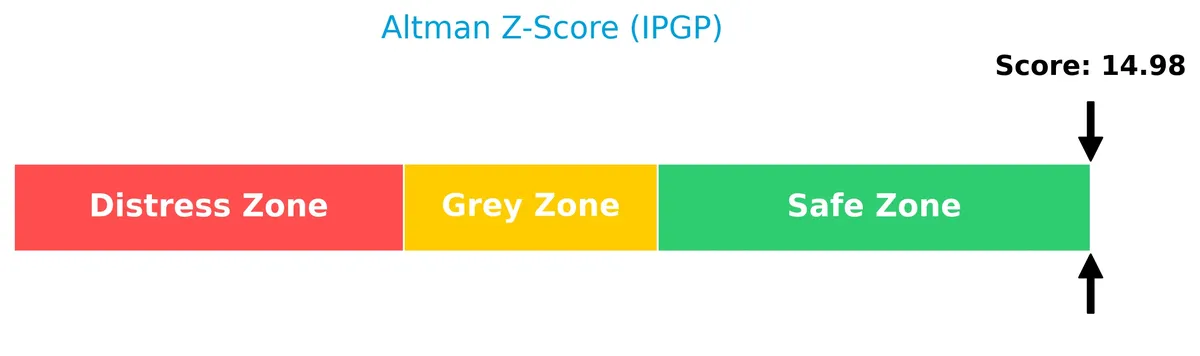

The Altman Z-Score places IPGP confidently in the safe zone, indicating a very low risk of bankruptcy:

Is the company in good financial health?

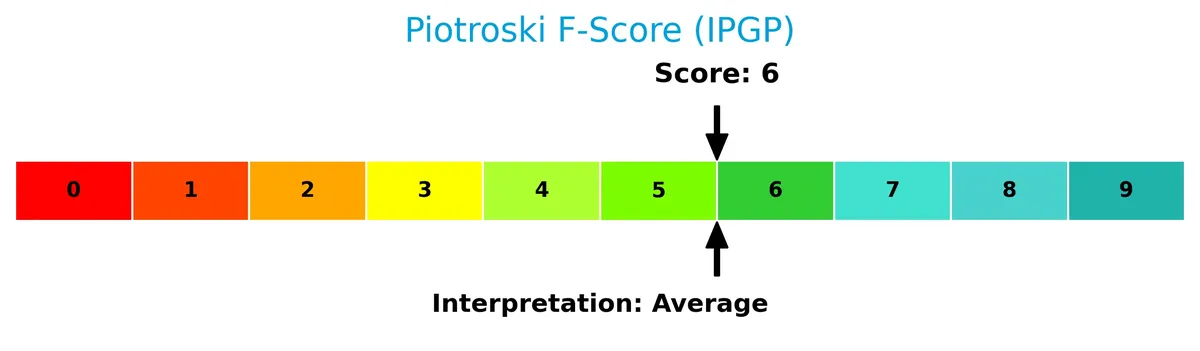

This Piotroski diagram illustrates IPGP’s financial strength based on nine accounting criteria:

With a Piotroski Score of 6, IPGP demonstrates average financial health, suggesting moderate operational efficiency and stability without exceptional strength.

Competitive Landscape & Sector Positioning

This analysis examines the sector positioning and competitive environment of IPG Photonics Corporation. It explores the company’s strategic positioning, revenue segments, key products, and main competitors. I will evaluate whether IPG Photonics holds sustainable competitive advantages over its peers.

Strategic Positioning

IPG Photonics concentrates on high-performance fiber and diode lasers, serving materials processing and communications globally. Its product mix spans amplifiers, continuous wave, pulsed, and quasi-continuous lasers. Geographically, revenue is diversified across North America, China, Europe, and Asia, reflecting a balanced global footprint.

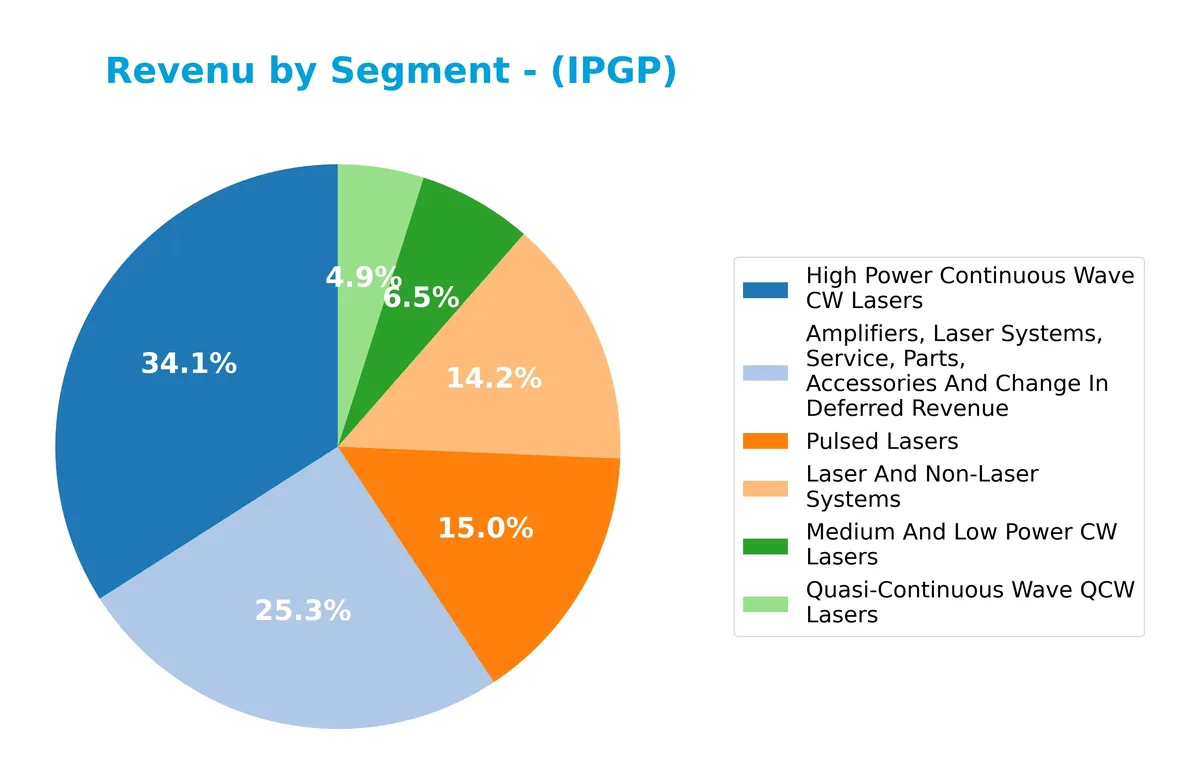

Revenue by Segment

This pie chart illustrates IPG Photonics Corporation’s revenue distribution by segment for the full fiscal year 2024, highlighting the relative size of each product line.

In 2024, High Power Continuous Wave CW Lasers remain the largest revenue driver at 333M, despite a sharp decline from prior years. Amplifiers and related services generate a solid 247M, underscoring their steady contribution. Pulsed Lasers and Laser & Non-Laser Systems provide meaningful diversification with 147M and 139M respectively. The recent year shows a concentration risk as High Power CW Lasers revenue contracts significantly, signaling potential pressure on the core segment.

Key Products & Brands

The table below outlines IPG Photonics Corporation’s principal products and their descriptions:

| Product | Description |

|---|---|

| High Power Continuous Wave CW Lasers | Lasers delivering continuous, high-power output for industrial materials processing. |

| Medium And Low Power CW Lasers | Continuous wave lasers with moderate to low power for precision applications. |

| Pulsed Lasers | Lasers emitting energy in pulses, used for fine material processing and advanced applications. |

| Quasi-Continuous Wave QCW Lasers | Lasers producing quasi-continuous pulses, bridging continuous and pulsed laser functions. |

| Amplifiers, Laser Systems, Service, Parts, Accessories And Change In Deferred Revenue | Fiber amplifiers, integrated laser systems, and related accessories supporting laser operations. |

| Laser And Non-Laser Systems | Various integrated laser and complementary non-laser systems for specialized industrial use. |

IPG Photonics offers a diverse laser technology portfolio focused on materials processing and advanced applications. Their products span high-power continuous lasers to specialized pulsed and quasi-continuous wave systems.

Main Competitors

The sector includes 38 competitors; the following table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

IPG Photonics ranks 32nd among 38 competitors, with a market cap only 0.14% that of the leader, NVIDIA. It sits well below both the average market cap of the top 10 (975B) and the sector median (31B). The company maintains a significant 33.8% gap from the next closest competitor above, underscoring its relatively modest scale in this competitive landscape.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does IPGP have a competitive advantage?

IPG Photonics Corporation currently lacks a competitive advantage, as its return on invested capital (ROIC) significantly trails its weighted average cost of capital (WACC), indicating value destruction. The company’s declining ROIC trend over 2021-2025 confirms shrinking profitability and inefficiency in capital deployment.

Looking ahead, IPG Photonics offers diverse laser and amplifier products across materials processing, communications, and advanced applications. Expansion into new markets and the development of integrated laser systems present growth opportunities despite recent financial headwinds.

SWOT Analysis

This SWOT analysis highlights IPG Photonics Corporation’s strategic position by identifying its key internal and external factors.

Strengths

- Leading fiber laser technology

- Strong market presence in semiconductors

- Zero debt and high liquidity

Weaknesses

- Declining ROIC and profitability

- High P/E ratio indicates overvaluation

- Weak revenue growth over medium term

Opportunities

- Growing demand for advanced materials processing

- Expansion in emerging Asian markets

- Innovation in integrated laser systems

Threats

- Intense competition in semiconductor sector

- Geopolitical risks impacting China sales

- Rapid technological changes requiring heavy R&D

IPG Photonics demonstrates solid technology leadership and financial strength in liquidity. However, declining profitability and valuation concerns demand careful capital allocation. The firm should focus on innovation and geographic diversification to offset external risks.

Stock Price Action Analysis

The weekly chart displays IPG Photonics Corporation’s stock price dynamics over the past 100 weeks, highlighting key price movements and volatility:

Trend Analysis

Over the past year, IPGP’s stock price rose 71.01%, indicating a clear bullish trend with accelerating gains. The price fluctuated between a low of 52.12 and a high of 153.91, with volatility measured by a 12.46 standard deviation, confirming strong upward momentum.

Volume Analysis

Trading volume is increasing, with buyers accounting for 54.65% overall and a dominant 76.82% in the recent three-month period. This buyer-driven activity suggests growing investor confidence and heightened market participation supporting the stock’s rally.

Target Prices

Analysts project a balanced target price range reflecting cautious optimism for IPG Photonics Corporation.

| Target Low | Target High | Consensus |

|---|---|---|

| 110 | 180 | 151.67 |

The target price spread suggests moderate upside potential with some risk, consistent with current industry volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide a comprehensive view of IPG Photonics Corporation.

Stock Grades

The latest grades from leading analysts for IPG Photonics Corporation reveal a broadly positive outlook with some nuanced shifts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-02-13 |

| Raymond James | Downgrade | Outperform | 2026-02-13 |

| Roth Capital | Maintain | Buy | 2026-02-03 |

| Citigroup | Upgrade | Buy | 2025-11-05 |

| Bernstein | Upgrade | Outperform | 2025-08-07 |

| Raymond James | Maintain | Strong Buy | 2025-05-07 |

| CL King | Upgrade | Buy | 2025-03-18 |

| Citigroup | Maintain | Sell | 2025-02-18 |

| Needham | Maintain | Hold | 2025-02-12 |

| Stifel | Maintain | Buy | 2025-02-12 |

The consensus trend leans toward buying, though some firms have moderated enthusiasm from strong buy to outperform. Citigroup stands out with a persistent sell rating earlier in the period, contrasting the general upgrade momentum.

Consumer Opinions

Consumers express a mix of admiration and concern regarding IPG Photonics Corporation’s products and service quality.

| Positive Reviews | Negative Reviews |

|---|---|

| “Exceptional laser technology with reliable performance.” | “Customer support response times can be slow.” |

| “High precision and durability in industrial applications.” | “Pricing feels steep compared to competitors.” |

| “Innovative solutions that improve manufacturing efficiency.” | “Occasional software glitches reported by users.” |

Overall, consumers praise IPG Photonics for its cutting-edge technology and product reliability. However, some highlight customer service delays and premium pricing as notable drawbacks.

Risk Analysis

Below is a summary table highlighting key risks for IPG Photonics Corporation:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Profitability | Low net margin (3.1%) and ROIC (0.41%) well below WACC (8.47%). | Medium | High |

| Valuation | Extremely high P/E ratio (98.08) signals possible overvaluation risk. | High | Medium |

| Financial Health | Very strong liquidity (current ratio 6.08) but unfavorable ratio status. | Low | Low |

| Debt Risk | Zero debt, excellent interest coverage, minimizing financial distress risk. | Low | Low |

| Market Volatility | Beta near 1.03 suggests market-correlated swings in stock price. | Medium | Medium |

| Dividend Policy | No dividend yield, reducing income appeal and potential shareholder return. | High | Low |

I consider the overvaluation risk the most critical due to the P/E ratio vastly exceeding sector averages near 20-30. This gap signals expectations for growth that may not materialize. The weak profitability metrics further stress capital allocation efficiency. However, the company’s zero debt and strong Altman Z-Score (15) place it well clear of bankruptcy risk. The average Piotroski score (6) indicates moderate financial health but leaves room for improvement. Investors should weigh these risks carefully amid current market volatility.

Should You Buy IPG Photonics Corporation?

IPG Photonics appears to be shedding value with declining profitability and a very unfavorable moat profile. Despite a manageable leverage profile supported by a strong liquidity position, overall value creation seems weak, reflected in a cautious B- rating.

Strength & Efficiency Pillars

IPG Photonics Corporation displays operational resilience with a gross margin of 38.0%, indicating solid control over production costs. Although net margin sits at a modest 3.1%, the company maintains a clean balance sheet with zero debt and an infinite interest coverage ratio. The Altman Z-Score of 14.98 places IPGP firmly in the safe zone, confirming strong solvency. However, the return on invested capital (ROIC) at 0.41% falls well below the weighted average cost of capital (WACC) of 8.47%, signaling that IPGP is currently destroying value rather than creating it.

Weaknesses and Drawbacks

Despite financial safety, IPGP faces significant profitability and valuation challenges. Its net margin of 3.1% and ROE at 1.46% are notably weak, reflecting limited profitability. The elevated price-to-earnings ratio of 98.08 signals an expensive valuation, exposing investors to downside risk if growth expectations falter. Additionally, the current ratio of 6.08, while superficially strong, may suggest inefficient asset utilization. The company’s overall score is unfavorable (2), underscoring persistent operational and market pressures that could constrain returns.

Our Final Verdict about IPG Photonics Corporation

IPGP’s financial safety is a strong foundation, but its profitability struggles and high valuation introduce caution. The bullish long-term stock trend and strong recent buyer dominance suggest potential momentum. However, weak returns and stretched multiples mean this profile might appear risky and better suited for investors with a higher risk tolerance. A more conservative approach would be to await clearer signs of value creation before committing significant capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- IPG Photonics Stock Hits 52-Week High After Strong Quarter – Sahm (Feb 13, 2026)

- IPG Photonics Q4 Earnings Beat Estimates, Revenues Rise Y/Y, Shares Up – Yahoo Finance (Feb 13, 2026)

- These Analysts Boost Their Forecasts On IPG Photonics Following Upbeat Q4 Results – Benzinga (Feb 13, 2026)

- IPG Photonics (IPGP) Q4 Earnings and Revenues Top Estimates – Nasdaq (Feb 12, 2026)

- IPG Photonics Stock (+35%): Earnings Beat & Diversification Ignites Squeeze – Trefis (Feb 13, 2026)

For more information about IPG Photonics Corporation, please visit the official website: ipgphotonics.com