Home > Analyses > Real Estate > Invitation Homes Inc.

Invitation Homes transforms the way Americans live by offering high-quality, updated single-family homes tailored to modern lifestyles. As the nation’s premier residential REIT, it leads the industry with a vast portfolio designed for convenience, proximity to jobs, and top schools. Renowned for its customer-centric approach and operational excellence, Invitation Homes continually sets the standard in home leasing. The key question now is whether its strong fundamentals continue to support attractive growth and valuation in today’s market.

Table of contents

Business Model & Company Overview

Invitation Homes Inc., founded in 2017 and headquartered in Dallas, TX, stands as the nation’s premier single-family home leasing company. Its core business revolves around providing access to high-quality, updated homes that align with evolving lifestyle demands, featuring valued amenities like proximity to jobs and quality schools. This cohesive ecosystem focuses on creating residential environments where individuals and families can truly thrive, supported by a commitment to high-touch service that enhances residents’ living experiences.

The company’s revenue engine balances property leasing with ongoing resident services, generating steady cash flows from a substantial portfolio of single-family homes across the United States. With a market cap of $16.7B, Invitation Homes leverages its strategic presence in key U.S. markets to maintain occupancy and rental growth. Its competitive advantage lies in scale and operational expertise, creating a durable economic moat that shapes the future of residential real estate investment trusts.

Financial Performance & Fundamental Metrics

In this section, I analyze Invitation Homes Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

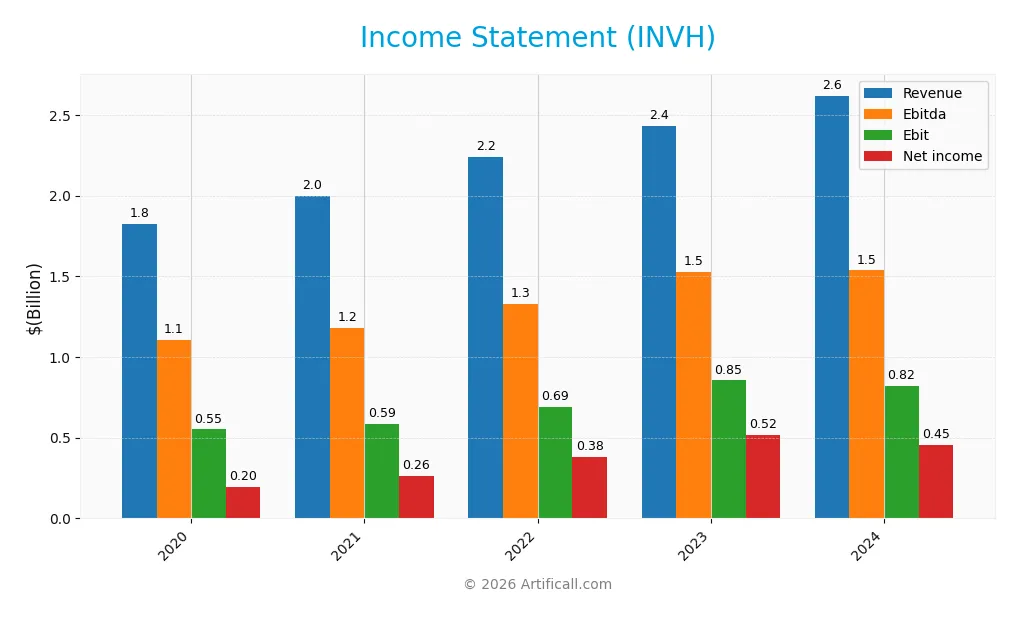

The following table summarizes Invitation Homes Inc.’s key income statement figures for fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.82B | 2.00B | 2.24B | 2.43B | 2.62B |

| Cost of Revenue | 739M | 778M | 874M | 976M | 1.07B |

| Operating Expenses | 616M | 668M | 712M | 757M | 805M |

| Gross Profit | 1.08B | 1.22B | 1.36B | 1.46B | 1.55B |

| EBITDA | 1.10B | 1.18B | 1.33B | 1.53B | 1.54B |

| EBIT | 551M | 585M | 689M | 854M | 821M |

| Interest Expense | 354M | 323M | 304M | 333M | 366M |

| Net Income | 196M | 261M | 383M | 519M | 454M |

| EPS | 0.35 | 0.45 | 0.63 | 0.85 | 0.74 |

| Filing Date | 2021-02-19 | 2022-02-22 | 2023-02-22 | 2024-02-21 | 2025-02-27 |

Income Statement Evolution

Invitation Homes Inc. (INVH) experienced consistent revenue growth of 43.7% from 2020 to 2024, with a 7.7% increase in the latest year. Net income surged by 131.3% over the period despite a 18.9% decline in net margin growth last year. Gross and EBIT margins remained favorable, with gross margin at 59.0% and EBIT margin at 31.4%, showing overall stability and efficiency improvements.

Is the Income Statement Favorable?

The 2024 income statement shows a generally favorable performance with solid gross and net margins of 59.0% and 17.3%, respectively. However, EBIT growth dropped by 3.9% and EPS declined by 12.9% from 2023, reflecting some operational and interest expense pressures. Interest expense accounted for 14.0% of revenue, marking an unfavorable aspect. Overall, the fundamentals appear favorable, supported by strong margin levels and significant long-term growth.

Financial Ratios

The following table presents Invitation Homes Inc.’s key financial ratios over recent years, offering insights into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 11% | 13% | 17% | 21% | 17% |

| ROE | 2.3% | 2.7% | 3.7% | 5.1% | 4.7% |

| ROIC | 2.7% | 3.0% | 3.6% | 3.7% | 4.0% |

| P/E | 83.9 | 100.2 | 47.1 | 40.2 | 43.1 |

| P/B | 1.93 | 2.67 | 1.76 | 2.06 | 2.01 |

| Current Ratio | 3.59 | 5.06 | 3.41 | 5.71 | 0.82 |

| Quick Ratio | 3.59 | 5.06 | 3.41 | 5.71 | 0.82 |

| D/E | 0.94 | 0.82 | 0.75 | 0.84 | 0.84 |

| Debt-to-Assets | 46% | 43% | 42% | 44% | 44% |

| Interest Coverage | 1.32 | 1.71 | 2.14 | 2.10 | 2.02 |

| Asset Turnover | 0.10 | 0.11 | 0.12 | 0.13 | 0.14 |

| Fixed Asset Turnover | 57.5 | 59.5 | 54.6 | 54.0 | 36.6 |

| Dividend Yield | 2.0% | 1.5% | 3.0% | 3.1% | 3.5% |

Evolution of Financial Ratios

Invitation Homes Inc. (INVH) saw a decline in Return on Equity (ROE) in 2024 to 4.65%, indicating reduced profitability compared to prior years. The Current Ratio dropped significantly to 0.82, suggesting weaker short-term liquidity. Debt-to-Equity remained relatively stable at 0.84, reflecting consistent leverage levels. Overall, profitability margins showed modest decreases but remained positive and stable.

Are the Financial Ratios Favorable?

In 2024, profitability ratios like net margin (17.33%) and dividend yield (3.52%) were favorable, supporting income generation. However, ROE (4.65%), return on invested capital (4.02%), and price-to-earnings ratio (43.14) were unfavorable, indicating challenges in efficiency and valuation. Liquidity ratios showed mixed signals, with a low current ratio (0.82) unfavorable but quick ratio neutral. Leverage and interest coverage ratios were neutral. Overall, the financial ratios present a slightly unfavorable profile.

Shareholder Return Policy

Invitation Homes Inc. has consistently paid dividends, with a payout ratio above 100% in recent years and a dividend yield around 3.5% in 2024. The company’s dividend per share has steadily increased from $0.60 in 2020 to $1.13 in 2024. It is important to note the payout exceeds net income, indicating reliance on cash flow or capital.

The company does not report share buybacks, suggesting dividends are the primary method of shareholder returns. Despite the elevated payout ratio, the dividend coverage by free cash flow appears adequate, supporting a sustainable distribution. However, the persistent payout above net income warrants monitoring for long-term financial prudence.

Score analysis

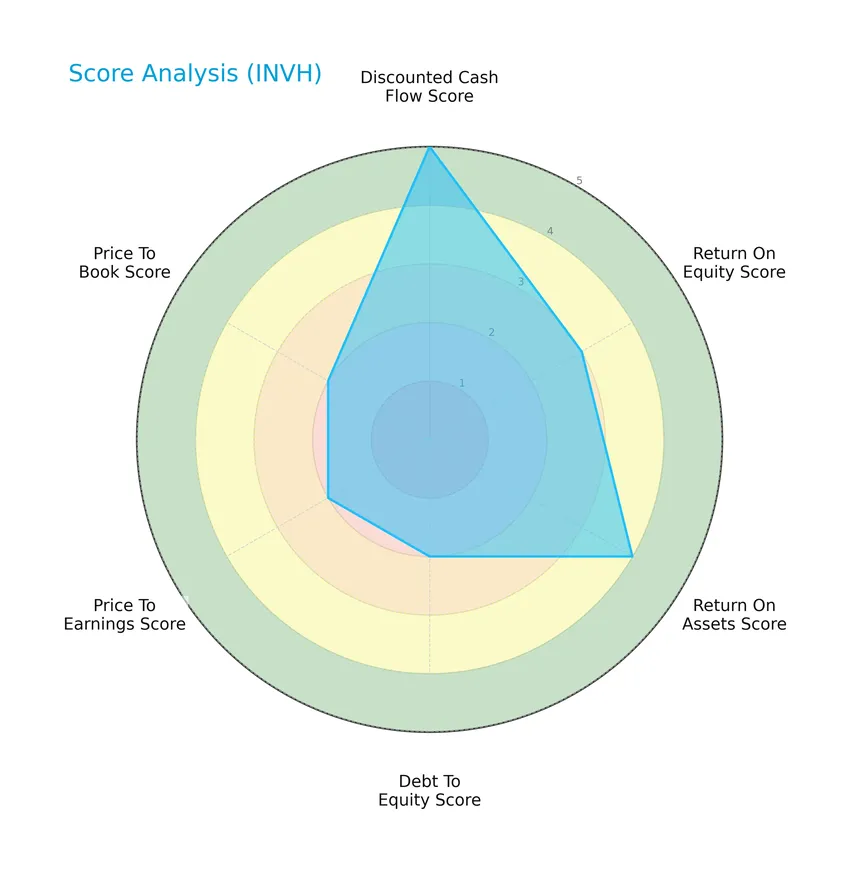

The radar chart below illustrates Invitation Homes Inc.’s key financial scores across multiple evaluation metrics:

Invitation Homes Inc. shows a very favorable discounted cash flow score of 5, while return on equity and price-based metrics remain moderate at 3 and 2 respectively. Return on assets is favorable at 4, but debt-to-equity stands at a moderate 2, indicating balanced financial leverage.

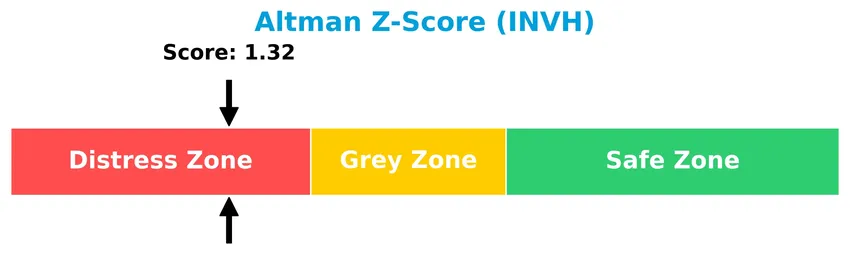

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Invitation Homes Inc. in the distress zone, signaling a higher risk of financial distress and bankruptcy concerns:

Is the company in good financial health?

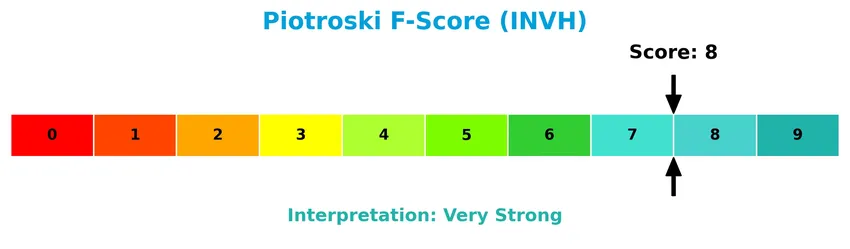

The Piotroski Score diagram provides insights into the company’s financial strength and operational efficiency:

With a very strong Piotroski Score of 8, Invitation Homes Inc. demonstrates solid financial health, reflecting robust profitability, liquidity, and efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine Invitation Homes Inc.’s strategic positioning, revenue segments, key products, main competitors, and competitive advantages. I will also assess whether Invitation Homes holds a competitive advantage over its industry peers.

Strategic Positioning

Invitation Homes Inc. focuses exclusively on the U.S. residential REIT sector, specializing in single-family home leasing. Its product portfolio is concentrated on updated homes near key amenities, reflecting a geographic and asset class specialization rather than diversification across markets or property types.

Key Products & Brands

The following table presents Invitation Homes Inc.’s key products and brand focus:

| Product | Description |

|---|---|

| Single-Family Home Leasing | Leasing of high-quality, updated single-family homes designed to meet changing lifestyle demands with valued features such as proximity to jobs and good schools. |

Invitation Homes Inc. specializes in leasing single-family homes, emphasizing quality living environments and convenient locations to support residents’ lifestyles and needs.

Main Competitors

There are 7 main competitors in the Real Estate sector’s REIT – Residential industry, with the table showing the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| AvalonBay Communities, Inc. | 25.65B |

| Equity Residential | 23.60B |

| Invitation Homes Inc. | 16.99B |

| Essex Property Trust, Inc. | 16.54B |

| Mid-America Apartment Communities, Inc. | 16.29B |

| UDR, Inc. | 12.13B |

| Camden Property Trust | 11.72B |

Invitation Homes Inc. ranks 3rd among its 7 competitors, holding about 65% of the market cap of the leader, AvalonBay Communities. It is positioned below the average market cap of the top 10 competitors (17.56B) but above the sector median (16.54B). The company maintains a significant 41.59% gap to the next competitor above it, highlighting a solid lead over Essex Property Trust.

Does INVH have a competitive advantage?

Invitation Homes Inc. shows a slightly unfavorable competitive advantage as it is currently shedding value, with ROIC below WACC by 2.65%, despite a growing ROIC trend indicating improving profitability. The company benefits from favorable margins, including a 59.04% gross margin and a 31.37% EBIT margin, supporting operational efficiency.

Looking ahead, Invitation Homes may leverage opportunities in the residential REIT sector to enhance value creation, supported by its mission focused on high-quality single-family home leasing and customer service. Continued growth in ROIC and its expanding market presence could influence future competitive positioning.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights Invitation Homes Inc.’s key internal and external factors to support informed investment decisions.

Strengths

- Leading single-family home leasing platform

- Strong gross margin at 59%

- Growing ROIC trend

- Favorable net margin of 17%

- Consistent revenue growth over 5 years

- High dividend yield at 3.5%

Weaknesses

- Low ROE at 4.65%

- Below WACC ROIC indicating value destruction

- Declining EBIT and EPS growth in last year

- Elevated interest expense at 14%

- Current ratio below 1, signaling liquidity concerns

- High P/E ratio at 43, suggesting overvaluation

Opportunities

- Increasing demand for quality rental homes

- Expansion in high-growth urban markets

- Potential to improve operational efficiency and margins

- Rising homeownership costs boosting rental demand

- Leveraging technology for resident experience

- Strategic acquisitions to scale portfolio

Threats

- Interest rate volatility increasing financing costs

- Economic downturn impacting rental demand

- Regulatory risks in residential real estate

- Competition from other REITs and private landlords

- Market saturation in key geographic areas

- Inflationary pressures on maintenance and operations

Invitation Homes shows solid operational strengths and growth potential but faces challenges in profitability ratios and liquidity. The company’s strategy should focus on improving capital efficiency and managing financial risks while capitalizing on rental market trends and portfolio expansion.

Stock Price Action Analysis

The following weekly stock chart illustrates Invitation Homes Inc.’s price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, Invitation Homes Inc. (INVH) stock declined by 21.28%, indicating a bearish trend. The price movement shows deceleration in this downtrend, with a standard deviation of 2.76. The stock reached a high of 37.02 and a low of 26.35, reflecting notable price range contraction.

Volume Analysis

In the last three months, trading volume for INVH has been increasing but remains slightly seller-driven, with sellers accounting for 57.15% of activity. Buyer volume stands at 139M versus seller volume of 186M, suggesting cautious investor sentiment with moderate market participation.

Target Prices

The current analyst consensus for Invitation Homes Inc. presents a balanced outlook with moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 40 | 27 | 33.29 |

Analysts expect the stock price to range between $27 and $40, with a consensus target near $33. This suggests cautious optimism about Invitation Homes’ future performance.

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to Invitation Homes Inc. (INVH).

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

Here is the latest collection of verified stock grades for Invitation Homes Inc. from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Scotiabank | Maintain | Sector Perform | 2026-01-14 |

| Mizuho | Downgrade | Neutral | 2026-01-08 |

| UBS | Maintain | Buy | 2026-01-08 |

| Barclays | Maintain | Overweight | 2025-11-25 |

| JP Morgan | Maintain | Overweight | 2025-11-18 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-13 |

| B of A Securities | Maintain | Neutral | 2025-11-12 |

| Scotiabank | Maintain | Sector Perform | 2025-11-10 |

| Keefe, Bruyette & Woods | Maintain | Market Perform | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-31 |

The overall trend in grades shows a predominance of neutral to moderately positive ratings, with several firms maintaining stable views and Mizuho recently lowering its outlook to neutral. Buy and overweight assessments are present but not dominant, indicating a cautious market stance.

Consumer Opinions

Consumers of Invitation Homes Inc. express a mix of appreciation and concerns, reflecting diverse experiences with the company’s rental properties and services.

| Positive Reviews | Negative Reviews |

|---|---|

| Well-maintained homes with modern amenities. | Slow response times from customer service. |

| Transparent leasing process and clear communication. | Occasional issues with property maintenance delays. |

| Convenient online payment and maintenance requests. | Higher rental prices compared to local averages. |

Overall, consumers praise Invitation Homes for quality properties and ease of leasing, but often highlight slower service response and pricing as areas needing improvement. This feedback suggests a solid product with room for operational enhancements.

Risk Analysis

Below is a summary table of key risks associated with Invitation Homes Inc., focusing on probability and potential impact for investors considering this stock:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score indicates distress zone, signaling potential financial instability risk. | High | High |

| Profitability | Unfavorable ROE (4.65%) and ROIC (4.02%) suggest challenges in generating strong returns. | Moderate | Moderate |

| Liquidity | Current ratio below 1 (0.82) points to potential short-term liquidity issues. | Moderate | Moderate |

| Valuation | High P/E ratio (43.14) may signal overvaluation relative to earnings. | Moderate | Moderate |

| Debt Management | Neutral debt-to-equity (0.84) and interest coverage (2.24) indicate manageable but watchful debt levels. | Moderate | Moderate |

| Market Volatility | Beta at 0.83 shows less volatility than the market, reducing risk from market swings. | Low | Low |

The most critical risk for Invitation Homes remains its low Altman Z-Score, placing it in the distress zone, which signals a heightened bankruptcy risk despite a very strong Piotroski Score of 8. Investors should weigh this financial fragility against the company’s stable dividend yield of 3.52% and favorable net margin of 17.33%. Caution and close monitoring of financial health indicators are advisable.

Should You Buy Invitation Homes Inc.?

Invitation Homes Inc. appears to be improving operational efficiency with growing profitability, yet it could be seen as shedding value given an eroding competitive moat. Despite a substantial leverage profile and distress-zone Altman Z-Score, the overall B+ rating suggests a very favorable investment case.

Strength & Efficiency Pillars

Invitation Homes Inc. exhibits solid profitability metrics with a net margin of 17.33% and a gross margin of 59.04%, underscoring operational efficiency. The Piotroski Score stands at a very strong 8, indicating robust financial health and prudent management. Although the ROIC at 4.02% falls below the WACC of 6.67%, signaling value destruction, the company shows positive ROIC growth trends. The Altman Z-Score of 1.32 places it in the distress zone, raising caution on financial stability despite favorable profitability.

Weaknesses and Drawbacks

The company faces valuation and liquidity concerns, with a high price-to-earnings ratio of 43.14 reflecting a premium valuation that may limit upside potential. The current ratio at 0.82 suggests tight short-term liquidity, raising questions about the ability to cover immediate liabilities. Market dynamics are also challenging, as recent trading shows a slightly seller-dominant environment with only 42.85% buyer volume and a 21.28% price decline over the longer term, indicating selling pressure and volatility risks.

Our Verdict about Invitation Homes Inc.

Invitation Homes Inc. presents a mixed long-term fundamental profile with favorable profitability but clear financial distress signals and valuation risks. Despite a bearish overall trend and recent seller dominance, the firm’s strong Piotroski score and improving operational metrics suggest cautious optimism. Therefore, the profile may appear attractive for investors with a high risk tolerance but could warrant a wait-and-see approach amid current market pressures.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Invitation Homes earnings preview: What to expect – MSN (Jan 23, 2026)

- Will the Federal Home Acquisition Ban and ResiBuilt Push Change Invitation Homes’ (INVH) Narrative – Yahoo Finance (Jan 23, 2026)

- Invitation Homes sets Feb. 19 call on Q4 2025 earnings results – Stock Titan (Jan 21, 2026)

- Invitation Homes Announces Tax Treatment of 2025 Dividends – Business Wire (Jan 22, 2026)

- Optimism Prevails Around Invitation Homes (INVH) Despite SFH Policy Revision Concerns – Finviz (Jan 21, 2026)

For more information about Invitation Homes Inc., please visit the official website: InvitationHomes.com