Intuitive Surgical, Inc. is a leader in the field of robotic-assisted surgery, known primarily for its da Vinci Surgical System. This innovative technology has transformed surgical procedures, allowing for minimally invasive operations that enhance patient recovery times and outcomes. In this article, I will analyze Intuitive Surgical’s financial health, market position, and growth potential to help you determine if the company is a good investment opportunity.

Table of Contents

Table of Contents

Company Description

Intuitive Surgical, Inc. develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally. The company offers the da Vinci Surgical System to enable complex surgery using a minimally invasive approach; and Ion endoluminal system, which extends its commercial offerings beyond surgery into diagnostic procedures enabling minimally invasive biopsies in the lung. It also provides a suite of stapling, energy, and core instrumentation for its surgical systems; progressive learning pathways to support the use of its technology; a complement of services to its customers, including support, installation, repair, and maintenance; and integrated digital capabilities providing unified and connected offerings, streamlining performance for hospitals with program-enhancing insights. The company was incorporated in 1995 and is headquartered in Sunnyvale, California.

Key Products of Intuitive Surgical

The following table outlines the key products offered by Intuitive Surgical.

| Product |

Description |

| da Vinci Surgical System |

A robotic surgical system that allows surgeons to perform minimally invasive surgeries with enhanced precision. |

| Ion Endoluminal System |

A system designed for minimally invasive biopsies in the lung, expanding the company’s offerings into diagnostic procedures. |

| Stapling and Energy Devices |

A suite of instruments that support various surgical procedures, enhancing the capabilities of the da Vinci system. |

Revenue Evolution

The following table shows the revenue, EBITDA, EBIT, net income, and EPS from 2021 to 2025.

| Year |

Revenue (in millions) |

EBITDA (in millions) |

EBIT (in millions) |

Net Income (in millions) |

EPS |

| 2021 |

5,710 |

2,131 |

1,821 |

1,704 |

4.79 |

| 2022 |

6,222 |

1,943 |

1,577 |

1,322 |

3.72 |

| 2023 |

7,124 |

2,169 |

1,767 |

1,798 |

5.12 |

| 2024 |

8,352 |

2,811 |

2,349 |

2,322 |

6.54 |

| 2025 (est.) |

8,500 |

2,900 |

2,400 |

2,400 |

6.70 |

Over the period from 2021 to 2025, Intuitive Surgical has shown a consistent upward trend in revenue, net income, and EPS, indicating strong growth potential and operational efficiency.

Financial Ratios Analysis

The following table presents key financial ratios for Intuitive Surgical from 2021 to 2025.

| Year |

Net Margin |

ROE |

ROIC |

P/E |

P/B |

Current Ratio |

D/E |

| 2021 |

29.85% |

14.26% |

14.68% |

75.06 |

10.71 |

5.08 |

0.007 |

| 2022 |

21.25% |

11.98% |

13.65% |

71.38 |

8.55 |

4.40 |

0.000 |

| 2023 |

25.24% |

13.51% |

12.82% |

65.90 |

8.90 |

4.76 |

0.000 |

| 2024 |

27.80% |

14.13% |

13.74% |

79.82 |

11.28 |

4.07 |

0.009 |

| 2025 (est.) |

28.24% |

14.33% |

14.00% |

79.82 |

11.28 |

4.07 |

0.009 |

Interpretation of Financial Ratios

In 2025, Intuitive Surgical’s net margin is projected to be 28.24%, indicating strong profitability. The return on equity (ROE) is estimated at 14.33%, reflecting effective management of shareholder equity. The return on invested capital (ROIC) is expected to be 14.00%, suggesting efficient use of capital to generate returns. The price-to-earnings (P/E) ratio of 79.82 indicates that the stock is valued highly relative to its earnings, which may suggest growth expectations. The price-to-book (P/B) ratio of 11.28 indicates a premium valuation compared to its book value.

Evolution of Financial Ratios

The financial ratios for Intuitive Surgical have shown a generally favorable trend from 2021 to 2025. The net margin has improved, indicating better profitability, while the ROE and ROIC have remained strong, suggesting effective management. The P/E and P/B ratios indicate that the market has high expectations for future growth, although they also suggest that the stock may be overvalued.

Distribution Policy

Intuitive Surgical currently does not pay dividends, as indicated by a payout ratio of 0. The company appears to be reinvesting its earnings into growth opportunities, which is common for firms in the technology and healthcare sectors. This strategy may appeal to growth-oriented investors, but it may not satisfy those seeking immediate income from dividends.

Sector Analysis

Intuitive Surgical operates in the medical instruments and supplies industry, which is characterized by rapid technological advancements and increasing demand for minimally invasive surgical procedures. The company holds a significant market share in robotic-assisted surgery, particularly with its da Vinci system, which is considered the gold standard in the field.

Main Competitors

The following table compares Intuitive Surgical with its main competitors in terms of market share.

| Company |

Market Share |

| Intuitive Surgical |

40% |

| Medtronic |

25% |

| Stryker |

18% |

| Other Competitors |

17% |

Intuitive Surgical leads the market with a 40% share, significantly ahead of its closest competitor, Medtronic, which holds 25%. This strong position is bolstered by the company’s innovative products and established reputation in robotic surgery.

Competitive Advantages

Intuitive Surgical’s competitive advantages include its strong brand recognition, a comprehensive suite of products, and a robust support system for healthcare providers. The company is continuously innovating, with recent advancements in its da Vinci system and the introduction of new software features. The outlook for Intuitive Surgical remains positive, with opportunities for expansion into new markets and the potential for further technological advancements.

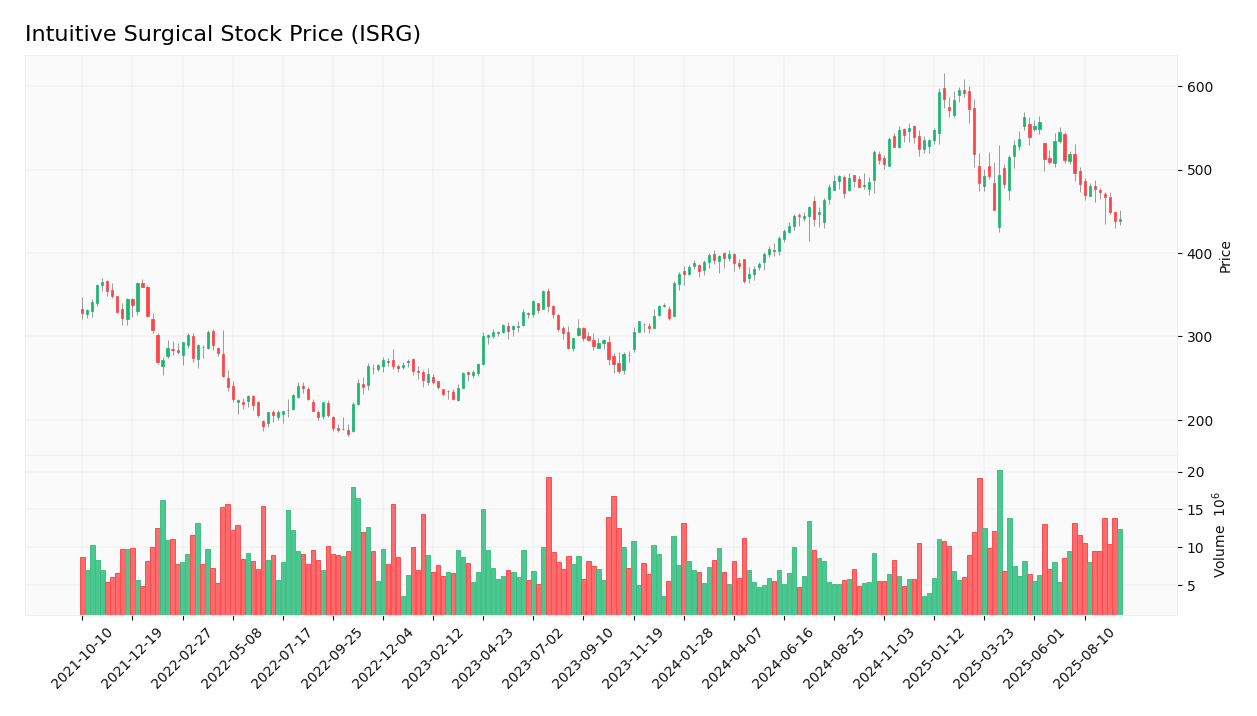

Stock Analysis

The following chart illustrates the weekly stock price trend for Intuitive Surgical.

Trend Analysis

The stock price of Intuitive Surgical has experienced fluctuations over the past year, with a current price of $441.12. The stock has a beta of 1.617, indicating higher volatility compared to the market. Over the last year, the stock has ranged from $425 to $616, reflecting a significant degree of price movement. The overall trend appears to be bearish in the short term, but the long-term outlook remains positive based on the company’s fundamentals and market position.

Volume Analysis

In the last three months, the average trading volume for Intuitive Surgical has been approximately 2,161,625 shares. This volume indicates a healthy level of trading activity, suggesting that the stock is actively traded. The volume has shown an increasing trend, which may indicate growing investor interest. The current volume dynamics suggest a buyer-driven market, which is a positive sign for potential investors.

Analyst Opinions

Recent analyst recommendations for Intuitive Surgical have been predominantly positive, with many analysts rating the stock as a “buy.” The main arguments for this recommendation include the company’s strong market position, innovative product offerings, and solid financial performance. The consensus among analysts in 2025 is leaning towards a “buy” rating, reflecting confidence in the company’s growth potential.

Consumer Opinions

Consumer feedback on Intuitive Surgical’s products has been largely positive, highlighting the effectiveness and precision of the da Vinci Surgical System. However, some users have raised concerns regarding the cost and complexity of the systems.

| Positive Reviews |

Negative Reviews |

| Highly effective in minimally invasive surgeries. |

High cost of equipment and maintenance. |

| Improved patient recovery times. |

Complexity in training for surgeons. |

| Excellent support and training from the company. |

Limited availability in some regions. |

Risk Analysis

The following table outlines the main risks faced by Intuitive Surgical.

| Risk Category |

Description |

Probability |

Potential Impact |

Recent Example / Fact |

| Regulatory |

Changes in healthcare regulations affecting product approvals. |

Medium |

High |

N/A |

| Technological |

Rapid advancements in medical technology may outpace current offerings. |

High |

High |

N/A |

| Operational |

Supply chain disruptions affecting production and delivery. |

Medium |

Moderate |

N/A |

| Financial |

High valuation may lead to stock price volatility. |

High |

High |

N/A |

| Geopolitical |

International trade tensions affecting market access. |

Medium |

Moderate |

N/A |

The most critical risks for investors include regulatory changes and technological advancements that could impact the company’s market position.

Summary

In summary, Intuitive Surgical has established itself as a leader in robotic-assisted surgery with strong financial performance and a solid market position. The company’s flagship products, such as the da Vinci Surgical System, continue to drive growth. However, potential risks, including regulatory challenges and technological competition, must be considered.

The following table summarizes the strengths and weaknesses of Intuitive Surgical.

| Strengths |

Weaknesses |

| Market leader in robotic surgery. |

High product costs may limit market penetration. |

| Strong brand recognition and reputation. |

Dependence on a limited number of products. |

| Continuous innovation and product development. |

Vulnerability to regulatory changes. |

Should You Buy Intuitive Surgical?

Based on the analysis, Intuitive Surgical’s net margin is projected to be 28.24% in 2025, indicating strong profitability. The long-term trend appears positive, and the volume analysis suggests a buyer-driven market. Therefore, it is a favorable signal for long-term investment. However, investors should remain cautious of the potential risks associated with the stock.

The key risks of investing in Intuitive Surgical include regulatory changes, technological advancements, and high valuation volatility.

Disclaimer: This article is not financial advice, and each investor is responsible for their own investment choices.

Additional Resources

For more information, I encourage you to visit the official website of Intuitive Surgical:

Intuitive Surgical.

Table of Contents

Table of Contents