Home > Analyses > Consumer Cyclical > International Paper Company

International Paper shapes everyday life by delivering essential packaging and cellulose fiber products worldwide. Its containerboards protect goods across supply chains, while specialty pulps serve hygiene, textile, and filtration markets. Known for operational scale and innovation, the company anchors the packaging industry with a strong market presence. As global demand evolves, I explore whether International Paper’s fundamentals still justify its valuation and growth prospects in a dynamic market.

Table of contents

Business Model & Company Overview

International Paper Company, founded in 1898 and headquartered in Memphis, Tennessee, stands as a dominant force in the packaging and containers industry. With 65K employees, it operates a cohesive ecosystem spanning Industrial Packaging and Global Cellulose Fibers segments, supplying containerboards and specialty pulps for hygiene, textiles, and construction. Its footprint covers the United States, Middle East, Europe, Africa, Pacific Rim, Asia, and the Americas, reflecting a truly global scale.

The company’s revenue engine balances manufacturing containerboards with producing fluff and specialty pulps, serving end users, converters, and distributors worldwide. This strategic presence across diverse markets enhances resilience and growth potential. International Paper’s competitive advantage lies in its integrated value chain and extensive distribution network, which together fortify its economic moat and influence the future of sustainable packaging.

Financial Performance & Fundamental Metrics

I analyze International Paper Company’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

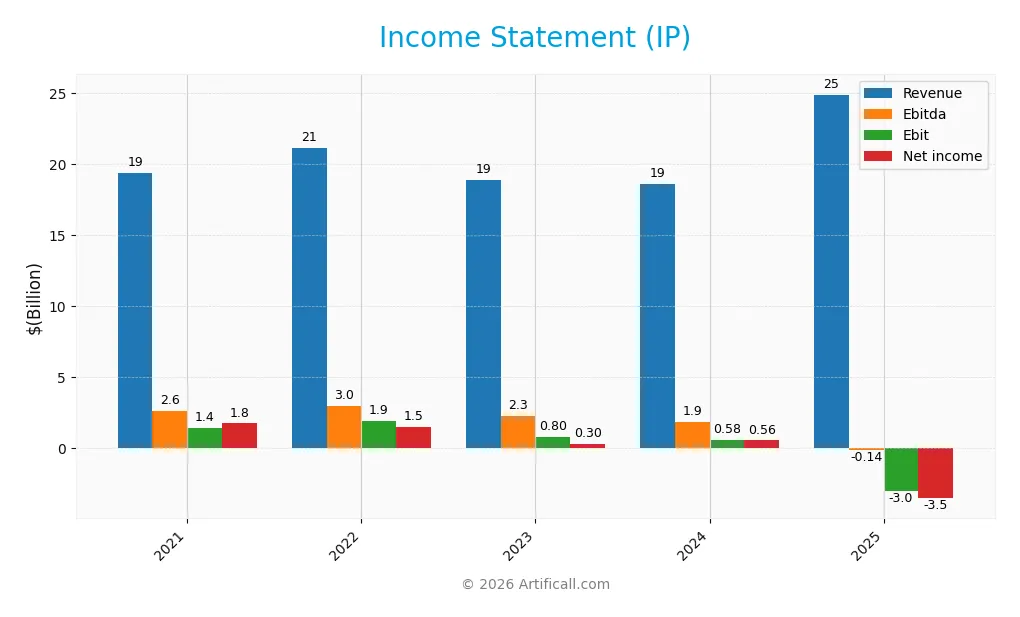

The table below presents International Paper Company’s key income statement metrics over the last five fiscal years, highlighting revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 19.4B | 21.2B | 18.9B | 18.6B | 24.9B |

| Cost of Revenue | 13.8B | 15.1B | 15.1B | 13.4B | 17.5B |

| Operating Expenses | 4.1B | 4.3B | 2.7B | 4.8B | 10.2B |

| Gross Profit | 5.5B | 6.0B | 3.9B | 5.2B | 7.4B |

| EBITDA | 2.6B | 3.0B | 2.3B | 1.9B | -138M |

| EBIT | 1.4B | 1.9B | 803M | 577M | -2.98B |

| Interest Expense | 430M | 403M | 421M | 430M | 372M |

| Net Income | 1.8B | 1.5B | 302M | 557M | -3.5B |

| EPS | 4.50 | 4.14 | 0.83 | 1.60 | -6.71 |

| Filing Date | 2022-02-18 | 2023-02-17 | 2024-02-16 | 2025-02-21 | 2026-01-29 |

Income Statement Evolution

International Paper’s revenue grew 28.6% from 2021 to 2025, with a notable 33.7% jump in 2025 alone. Gross profit also expanded, lifting gross margins to a favorable 29.5%. However, operating and net income trends deteriorated sharply, pushing EBIT and net margins into negative territory, signaling margin compression despite top-line growth.

Is the Income Statement Favorable?

The 2025 income statement shows mixed fundamentals. Revenue and gross profit surged, but operating expenses grew proportionally, eroding EBIT to -12% of revenue. Net income fell to -3.5B USD, with a net margin of -14.1%. Interest expenses remain low relative to revenue, yet the overall profitability profile is unfavorable, reflecting significant operational and non-operating headwinds.

Financial Ratios

The table below presents key financial ratios for International Paper Company from 2021 to 2025, illustrating profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 9.0% | 7.1% | 1.6% | 3.0% | -14.1% |

| ROE | 19.3% | 17.7% | 3.6% | 6.8% | -23.7% |

| ROIC | 5.6% | 8.9% | 5.1% | 2.5% | -7.6% |

| P/E | 10.4 | 8.4 | 41.5 | 33.5 | -5.9 |

| P/B | 2.01 | 1.48 | 1.50 | 2.29 | 1.40 |

| Current Ratio | 1.71 | 1.35 | 1.67 | 1.51 | 1.28 |

| Quick Ratio | 1.27 | 0.97 | 1.19 | 1.09 | 1.02 |

| D/E | 0.64 | 0.69 | 0.71 | 0.72 | 0.70 |

| Debt-to-Assets | 23.0% | 24.5% | 25.4% | 25.7% | 27.2% |

| Interest Coverage | 3.41 | 4.35 | 2.82 | 1.11 | -7.58 |

| Asset Turnover | 0.77 | 0.88 | 0.81 | 0.82 | 0.66 |

| Fixed Asset Turnover | 1.79 | 1.95 | 1.78 | 1.85 | 1.64 |

| Dividend Yield | 4.3% | 5.3% | 5.1% | 3.4% | 4.7% |

Evolution of Financial Ratios

International Paper’s Return on Equity (ROE) declined sharply to -23.7% in 2025, marking a significant downturn in profitability. The Current Ratio decreased moderately to 1.28, indicating slightly reduced liquidity but remaining above 1. Debt-to-Equity held steady near 0.7, showing stable leverage despite worsening earnings performance.

Are the Financial Ratios Fovorable?

Profitability ratios in 2025 are unfavorable, with negative net margin and ROE signaling operational challenges. Liquidity ratios show mixed signals: quick ratio is favorable at 1.02, but current ratio remains neutral. Leverage is moderate, with a debt-to-assets ratio of 27.2% viewed favorably. Market valuation ratios like price-to-book at 1.4 and dividend yield near 4.7% appear favorable, supporting a slightly favorable overall ratios assessment.

Shareholder Return Policy

International Paper Company maintains a dividend payout despite negative net income in 2025, with a dividend yield near 4.7% and dividends per share stable around $1.85. The payout ratio turns negative, indicating dividends exceed earnings, raising concerns about sustainability.

The company also conducts share buybacks, supporting shareholder returns amid earnings pressure. However, negative free cash flow coverage signals risk in maintaining distributions long term. This policy reflects a commitment to shareholder value but may strain financial flexibility if profitability does not recover.

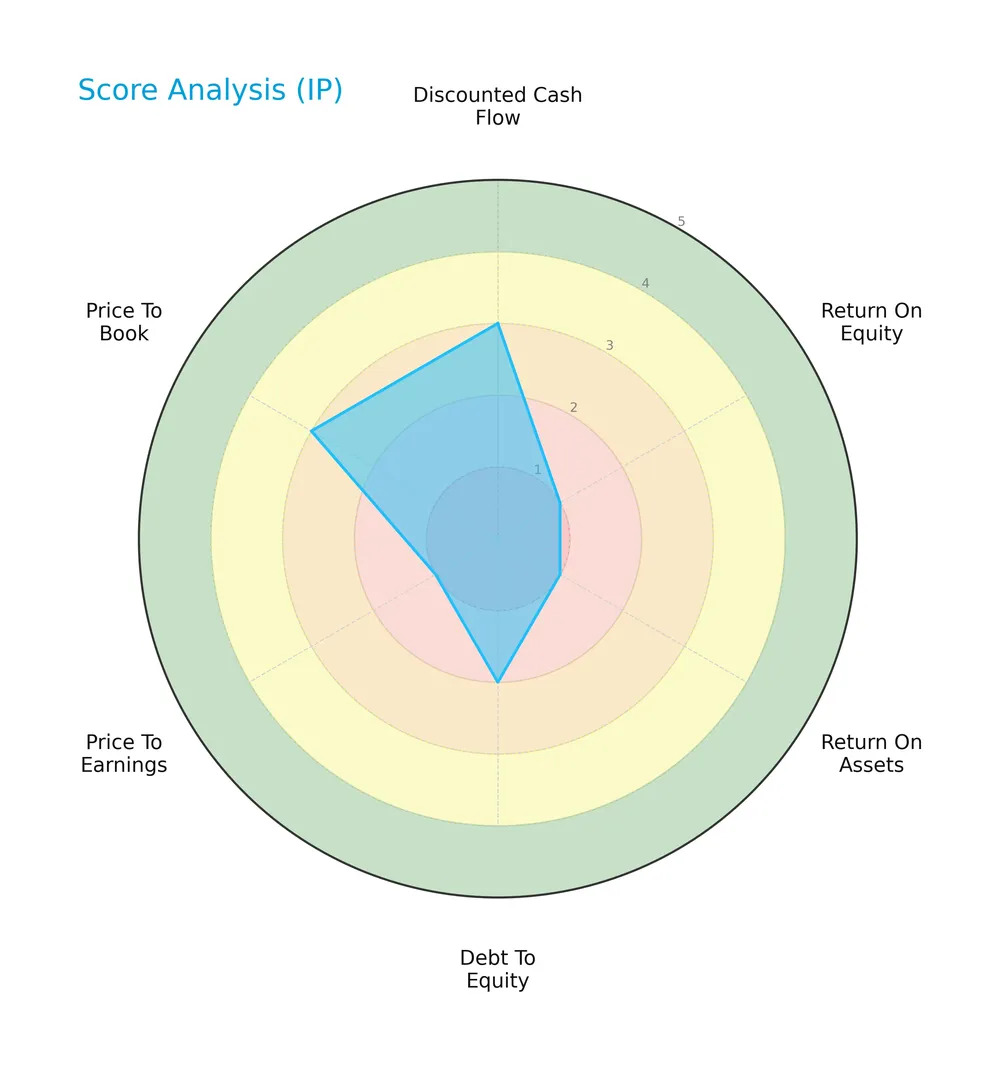

Score analysis

Below is a radar chart illustrating the company’s key financial metric scores for a clear comparative view:

The discounted cash flow and price-to-book scores offer moderate signals. However, return on equity, return on assets, and price-to-earnings scores are very unfavorable. Debt-to-equity stands at a moderate level, reflecting mixed financial strength.

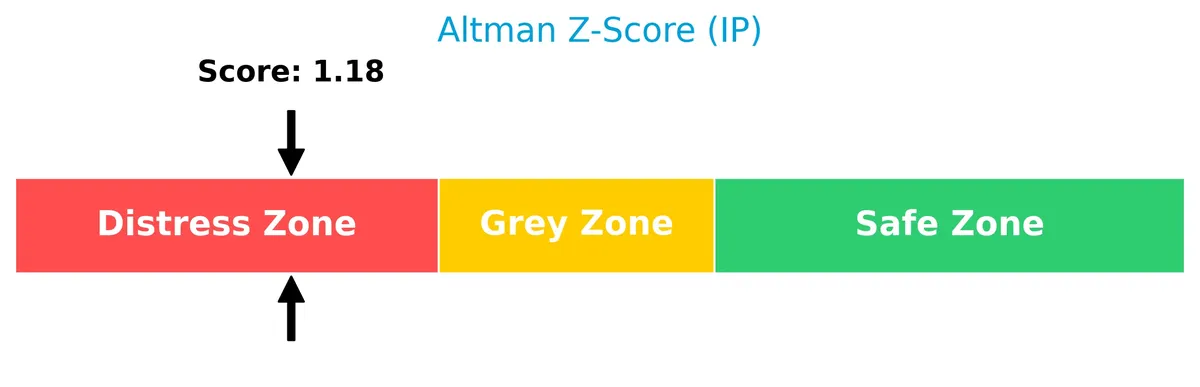

Analysis of the company’s bankruptcy risk

The Altman Z-Score places the company in the distress zone, indicating a high risk of bankruptcy based on financial ratios:

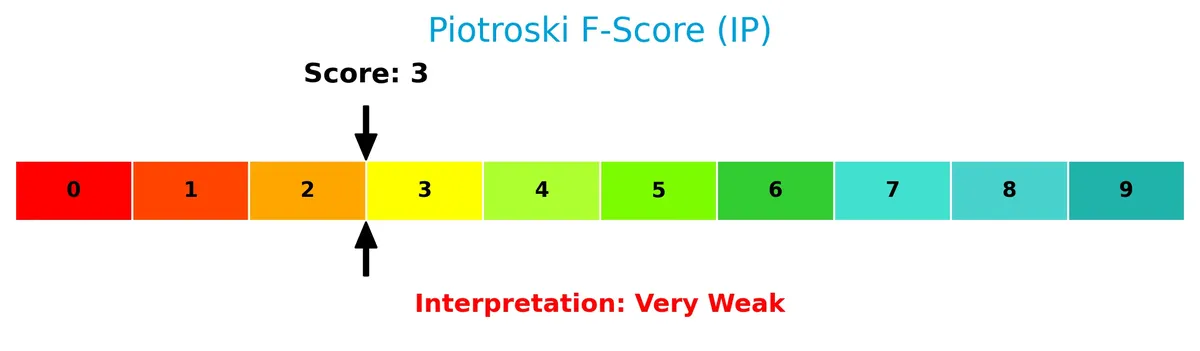

Is the company in good financial health?

This Piotroski diagram highlights the company’s financial condition based on nine criteria:

With a Piotroski score of 3, the company shows very weak financial health, signaling significant challenges in profitability, leverage, and liquidity metrics.

Competitive Landscape & Sector Positioning

This analysis examines International Paper Company’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether International Paper holds a competitive advantage within the packaging and containers sector.

Strategic Positioning

International Paper concentrates on Industrial Packaging, generating $14.3B in North America and $1.35B in EMEA in 2024. Its Global Cellulose Fibers segment contributes $2.79B. The company maintains broad geographic exposure, focusing heavily on the US market with $16.3B revenue.

Revenue by Segment

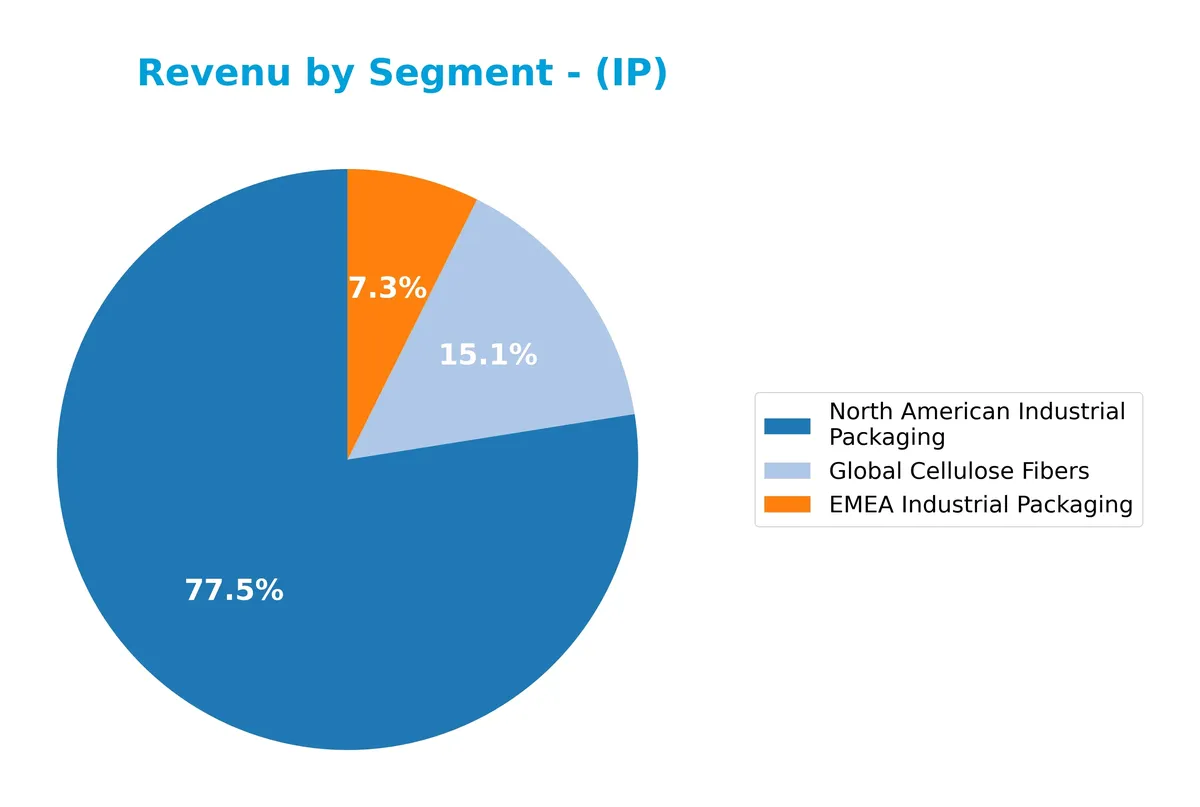

This pie chart illustrates International Paper Company’s revenue distribution by segment for the fiscal year 2024, highlighting the company’s core business areas and their relative scale.

In 2024, North American Industrial Packaging dominates with $14.3B revenue, underscoring its role as the main growth engine. Global Cellulose Fibers contributes $2.8B, showing slight contraction from prior years. EMEA Industrial Packaging generates $1.35B, indicating a stable but smaller presence. Recent trends reveal a concentration risk in North America, while other segments face mild declines or stagnation.

Key Products & Brands

International Paper Company operates through key product lines and brands as detailed below:

| Product | Description |

|---|---|

| North American Industrial Packaging | Produces containerboards such as linerboard, medium, whitetop, recycled linerboard, recycled medium, and saturating kraft. |

| EMEA Industrial Packaging | Manufactures industrial packaging products similar to North America, serving Europe, Middle East, and Africa regions. |

| Global Cellulose Fibers | Supplies fluff, market, and specialty pulps used in absorbent hygiene products, tissue, non-woven products, and industrial applications. |

International Paper’s revenue predominantly stems from industrial packaging in North America and EMEA, while Global Cellulose Fibers supports diverse hygiene and industrial markets. This product mix reflects its broad geographic reach and sector exposure.

Main Competitors

There are 5 competitors in total, with the table below listing the top 5 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| International Paper Company | 21.3B |

| Smurfit Westrock Plc | 20.7B |

| Amcor plc | 19.4B |

| Packaging Corporation of America | 19.0B |

| Ball Corporation | 14.3B |

International Paper Company ranks 1st among its 5 competitors. Its market cap exceeds the leader’s scale by 10.24%, positioning it above both the average market cap of the top 10 (18.9B) and the sector median (19.4B). The company leads with a 13.3% gap to the closest competitor below.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does IP have a competitive advantage?

International Paper Company currently lacks a competitive advantage, as it consistently destroys value with a negative ROIC compared to WACC and a sharply declining profitability trend. Its 2021-2025 ROIC performance signals inefficient capital use and sustained value erosion.

Looking ahead, IP operates across diverse global markets with potential in industrial packaging and cellulose fibers, serving multiple industries. Future growth may hinge on expanding product lines and tapping emerging markets in Asia and the Americas beyond the U.S.

SWOT Analysis

This analysis highlights International Paper Company’s internal capabilities and external market conditions to guide strategic decisions.

Strengths

- Leading position in packaging and cellulose fibers

- Diverse geographic presence with strong US base

- Solid dividend yield of 4.7%

Weaknesses

- Negative net margin at -14.12%

- Declining ROIC indicates value destruction

- Low Piotroski score reflects weak financial strength

Opportunities

- Growing demand for sustainable packaging

- Expansion potential in emerging markets

- Innovation in specialty pulps for hygiene products

Threats

- Intense industry competition

- Economic cyclicality impacting demand

- Rising raw material and energy costs

International Paper faces significant profitability challenges despite strong market presence. Its strategy must prioritize operational efficiency and innovation to regain value and leverage growth in sustainable packaging.

Stock Price Action Analysis

The following weekly stock chart illustrates International Paper Company’s price movement and volatility over the past 12 months:

Trend Analysis

Over the past year, the stock price rose 22.06%, confirming a bullish trend with acceleration. The price ranged between 33.83 and 60.09, showing moderate volatility at a 6.1% standard deviation. Recent months maintain a positive slope of 0.52 with a 17.79% gain, signaling sustained upward momentum.

Volume Analysis

Trading volumes have increased overall, with 51.74% buyer dominance historically. However, in the recent three months, sellers slightly outpaced buyers (52.15%), indicating neutral buyer behavior. This suggests cautious investor sentiment amid rising market participation.

Target Prices

Analysts project a moderate upside for International Paper Company, reflecting cautious optimism in the sector.

| Target Low | Target High | Consensus |

|---|---|---|

| 40 | 57.8 | 48.3 |

The target range suggests analysts expect steady growth, with a consensus price indicating potential appreciation above current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst grades and consumer feedback regarding International Paper Company (IP).

Stock Grades

Here are the latest verified stock grades from leading financial institutions for International Paper Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-02-02 |

| UBS | Downgrade | Neutral | 2026-02-02 |

| RBC Capital | Maintain | Outperform | 2026-01-30 |

| Wells Fargo | Upgrade | Equal Weight | 2026-01-30 |

| UBS | Maintain | Buy | 2026-01-12 |

| Truist Securities | Maintain | Buy | 2026-01-06 |

| Argus Research | Maintain | Buy | 2025-12-22 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| Citigroup | Maintain | Buy | 2025-11-03 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

The majority of grades remain positive, with several firms maintaining Buy or Outperform ratings. However, UBS’s recent downgrade to Neutral and Wells Fargo’s upgrade to Equal Weight suggest some cautious reassessment among analysts.

Consumer Opinions

Consumer sentiment around International Paper Company (IP) reflects a blend of appreciation and frustration.

| Positive Reviews | Negative Reviews |

|---|---|

| Durable, high-quality paper products | Occasional delays in delivery |

| Strong commitment to sustainability | Customer service response times |

| Competitive pricing in bulk orders | Packaging sometimes inconsistent |

Overall, customers praise IP for product quality and eco-friendly practices. However, delivery and service responsiveness remain areas needing improvement. Addressing these could enhance customer loyalty significantly.

Risk Analysis

Below is a summary table highlighting key risks facing International Paper Company (IP) in 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | IP’s Altman Z-Score of 1.18 signals distress, indicating elevated bankruptcy risk. | High | Severe |

| Profitability | Negative net margin (-14.12%) and ROE (-23.71%) reflect persistent operational losses. | High | High |

| Interest Coverage | Interest coverage ratio at -8.01 warns of struggles to meet debt costs, raising default risk. | Medium | High |

| Market Volatility | Beta of 1.07 suggests stock price moves slightly more than the market, increasing volatility. | Medium | Medium |

| Dividend Sustainability | Dividend yield at 4.7% with weak earnings poses risk of payout cuts if earnings don’t improve. | Medium | Medium |

| Debt Levels | Debt-to-assets ratio of 27.18% is manageable but needs monitoring given weak profitability. | Low | Medium |

The most alarming risks are the financial distress indicators and ongoing losses, which threaten IP’s viability. The Altman Z-Score places it in the distress zone, a rare and serious warning. Negative profitability ratios highlight operational inefficiencies. Interest coverage below zero signals urgent capital allocation challenges. Investors should approach with caution, as these factors combined raise significant default and dividend cut risks despite a stable debt load.

Should You Buy International Paper Company?

International Paper appears to be shedding value with a declining profitability moat and a leverage profile that suggests moderate risk. While operational efficiency is weak and financial health scores are low, the overall rating of C could be seen as reflecting significant investment challenges.

Strength & Efficiency Pillars

International Paper Company shows moderate financial health with a current ratio of 1.28 and a quick ratio of 1.02, indicating adequate liquidity. Its debt-to-assets ratio at 27.18% is favorable, reflecting controlled leverage. The company sustains a reasonable dividend yield of 4.7%, appealing to income-focused investors. Although the weighted average cost of capital stands at a favorable 7.16%, the return on invested capital is negative at -7.64%, signaling value destruction rather than creation. Altman Z-score at 1.18 places the firm in the distress zone, while a Piotroski score of 3 suggests very weak financial strength.

Weaknesses and Drawbacks

IP suffers from significant profitability issues, with a net margin of -14.12% and an ROE of -23.71%, both unfavorable. The negative EBIT margin (-11.97%) and steep declines in earnings per share (-527%) and net income (-300%) over recent years highlight operational challenges. Interest coverage is deeply negative (-8.01), raising concerns about servicing debt. Valuation metrics are mixed; a negative P/E ratio indicates losses, but the P/B ratio of 1.4 is moderate. Recent market activity shows seller dominance at 52.15%, introducing short-term price pressure despite an overall bullish trend.

Our Verdict about International Paper Company

International Paper’s long-term fundamental profile leans unfavorable due to persistent negative profitability and financial distress signals. Despite a bullish overall price trend and improving volume momentum, recent seller dominance might suggest caution. This combination means the stock may appear risky for immediate entry but could offer opportunities if operational turnarounds materialize and financial health improves.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- International Paper (IP) Is Up 7.7% After Deep Restructuring Amid Heavy 2025 Losses – What’s Changed – simplywall.st (Feb 05, 2026)

- International Paper to Create Two Independent Public Companies and Reports Full-Year and Fourth Quarter 2025 Results – PR Newswire (Jan 29, 2026)

- International Paper to split into 2 companies – Packaging Dive (Jan 29, 2026)

- International Paper Company to Close in Union Gap, 102 Jobs Leaving – News Talk KIT (Feb 03, 2026)

- International Paper to Split Into Two Listed Companies – Bloomberg (Jan 29, 2026)

For more information about International Paper Company, please visit the official website: internationalpaper.com