Home > Analyses > Basic Materials > International Flavors & Fragrances Inc.

International Flavors & Fragrances Inc. (IFF) crafts the scents and tastes that shape everyday experiences worldwide. Its leadership spans specialty chemicals, blending natural and synthetic ingredients to serve top-tier perfumes, personal care, and food brands. Renowned for innovation and quality, IFF drives trends in multiple consumer sectors. As market dynamics evolve, I question whether IFF’s robust fundamentals still support its premium valuation and long-term growth prospects.

Table of contents

Business Model & Company Overview

International Flavors & Fragrances Inc., founded in 1833 and headquartered in New York City, commands a leading role in the specialty chemicals sector. It delivers a cohesive ecosystem of natural and synthetic ingredients that enrich consumer products across cosmetics, food, and pharmaceuticals. Its diverse portfolio spans Nourish, Scent, Health & Biosciences, and Pharma Solutions segments, unified by innovation in flavors, fragrances, and functional ingredients.

The company’s revenue engine balances specialty food ingredients, fragrance compounds, and biotech products, generating recurring demand from global markets in the Americas, Europe, and Asia. This diversified approach cushions against volatility and strengthens its pricing power. I see its broad market reach and unique product mix as a durable economic moat, positioning it to shape the future of sensory and health-related consumer goods.

Financial Performance & Fundamental Metrics

I analyze International Flavors & Fragrances Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

Income Statement

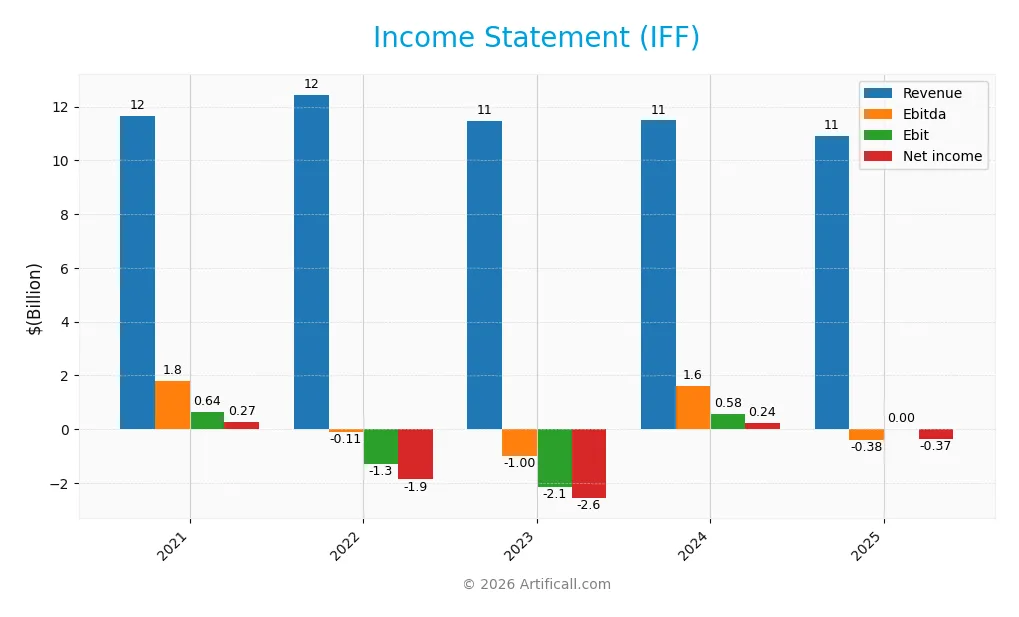

The table below summarizes International Flavors & Fragrances Inc.’s key income statement metrics for the fiscal years 2021 through 2025.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 11.7B | 12.4B | 11.5B | 11.5B | 10.9B |

| Cost of Revenue | 7.9B | 8.3B | 7.8B | 7.4B | 6.95B |

| Operating Expenses | 3.15B | 5.48B | 5.79B | 3.36B | 2.53B |

| Gross Profit | 3.7B | 4.15B | 3.68B | 4.12B | 3.94B |

| EBITDA | 1.8B | -110M | -996M | 1.6B | -382M |

| EBIT | 643M | -1.29B | -2.14B | 583M | 0 |

| Interest Expense | 289M | 336M | 380M | 305M | 229M |

| Net Income | 268M | -1.87B | -2.57B | 243M | -374M |

| EPS | 1.10 | -7.20 | -10.06 | 0.95 | -1.46 |

| Filing Date | 2022-02-28 | 2023-02-27 | 2024-02-28 | 2025-02-28 | 2026-02-11 |

Income Statement Evolution

Between 2021 and 2025, International Flavors & Fragrances’ revenue declined by 6.6%, with a 5.2% drop in the latest year. Gross profit followed suit, shrinking 4.5% last year, reflecting margin compression. EBIT swung from positive in 2021 to zero in 2025, while net income turned negative, signaling deteriorating profitability and unfavorable margin trends.

Is the Income Statement Favorable?

In 2025, IFF reported $10.9B revenue and a 36.2% gross margin, which remains favorable. However, operating income hit zero and net margin was negative at -3.4%, driven by $229M interest expense and high operating costs. Earnings per share dropped to -$1.46. The fundamentals appear unfavorable, with profitability under pressure despite stable gross margins.

Financial Ratios

The table below presents key financial ratios for International Flavors & Fragrances Inc. (IFF) over recent fiscal years, highlighting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 2.3% | -15.0% | -22.3% | 2.1% | -3.4% |

| ROE | 1.3% | -10.6% | -17.6% | 1.8% | 0 |

| ROIC | 1.3% | -4.1% | -7.5% | 2.6% | 0 |

| P/E | 137x | -14.3x | -8.0x | 89.1x | -46.1x |

| P/B | 1.74x | 1.51x | 1.41x | 1.56x | 0 |

| Current Ratio | 1.92 | 1.99 | 1.67 | 1.84 | 0 |

| Quick Ratio | 1.23 | 1.11 | 0.97 | 1.32 | 0 |

| D/E | 0.58 | 0.67 | 0.74 | 0.69 | 0 |

| Debt-to-Assets | 31% | 33% | 35% | 34% | 0 |

| Interest Coverage | 2.0x | -3.9x | -5.6x | 2.5x | -1.7x |

| Asset Turnover | 0.29 | 0.35 | 0.37 | 0.40 | 0 |

| Fixed Asset Turnover | 2.26 | 2.50 | 2.32 | 2.65 | 0 |

| Dividend Yield | 1.8% | 3.0% | 4.0% | 2.4% | 2.4% |

Evolution of Financial Ratios

From 2021 to 2025, International Flavors & Fragrances Inc. saw fluctuations in key ratios. Return on Equity (ROE) declined to zero by 2025, indicating no profitability. The Current Ratio, an indicator of liquidity, dropped to zero in 2025, signaling potential short-term financial stress. Debt-to-Equity Ratio improved to zero in 2025, suggesting reduced leverage or reporting gaps.

Are the Financial Ratios Favorable?

In 2025, profitability metrics such as net margin (-3.43%) and ROE (0%) were unfavorable, reflecting weak earnings. Liquidity ratios like current and quick ratios at zero raise red flags. Leverage ratios, including debt-to-equity and debt-to-assets, were favorable at zero, but this may indicate incomplete data. Market valuation metrics, including price-to-earnings and dividend yield (2.37%), were favorable. Overall, 57% of ratios were unfavorable, rendering the financial position cautious.

Shareholder Return Policy

International Flavors & Fragrances Inc. pays a dividend with a yield around 2.37% in 2025, despite a negative net income and payout ratio below -100%. Dividend coverage by free cash flow is weak, indicating potential sustainability concerns.

The company also conducts share buybacks, but operating cash flow margins remain negative. This distribution strategy poses risks to long-term value unless profitability and cash flow improve significantly.

Score analysis

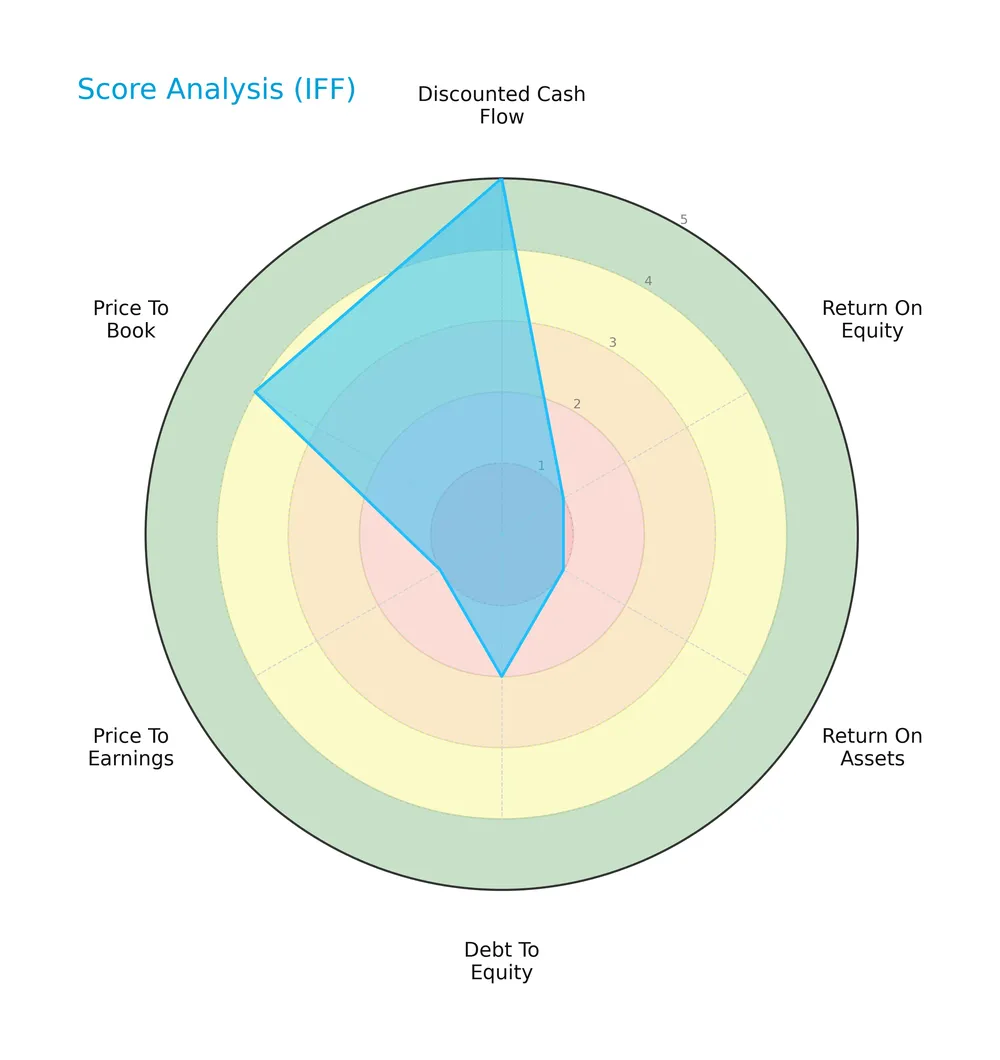

The radar chart below illustrates International Flavors & Fragrances Inc.’s key valuation and performance scores:

The company scores very favorably on discounted cash flow (5) and price-to-book (4). However, profitability metrics like return on equity (1) and return on assets (1) are very unfavorable. Debt-to-equity (2) and price-to-earnings (1) also show weakness.

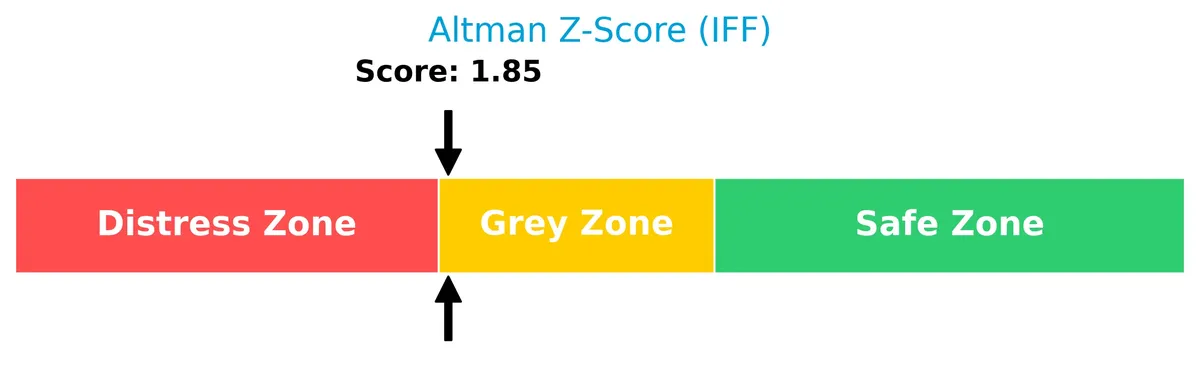

Analysis of the company’s bankruptcy risk

International Flavors & Fragrances Inc. sits in the Altman Z-Score grey zone, indicating moderate bankruptcy risk:

Is the company in good financial health?

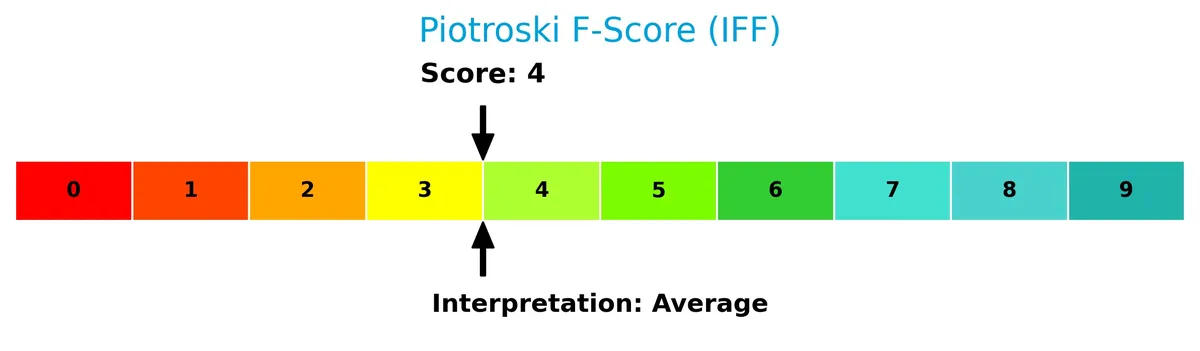

The Piotroski Score diagram highlights the company’s financial strength based on nine key criteria:

With a Piotroski Score of 4, the company’s financial health is average, suggesting mixed signals on profitability, leverage, and efficiency.

Competitive Landscape & Sector Positioning

This sector analysis reviews International Flavors & Fragrances Inc.’s strategic positioning, revenue breakdown, key products, and main competitors. It details the company’s competitive advantages and provides a comprehensive SWOT analysis. I will evaluate whether the company holds a sustainable competitive edge over its peers.

Strategic Positioning

International Flavors & Fragrances Inc. maintains a diversified product portfolio across Nourish, Scent, Health & Biosciences, and Pharma Solutions segments. Its geographic exposure spans North America, EMEA, Asia, and Latin America, reflecting broad global reach and balanced regional revenue distribution.

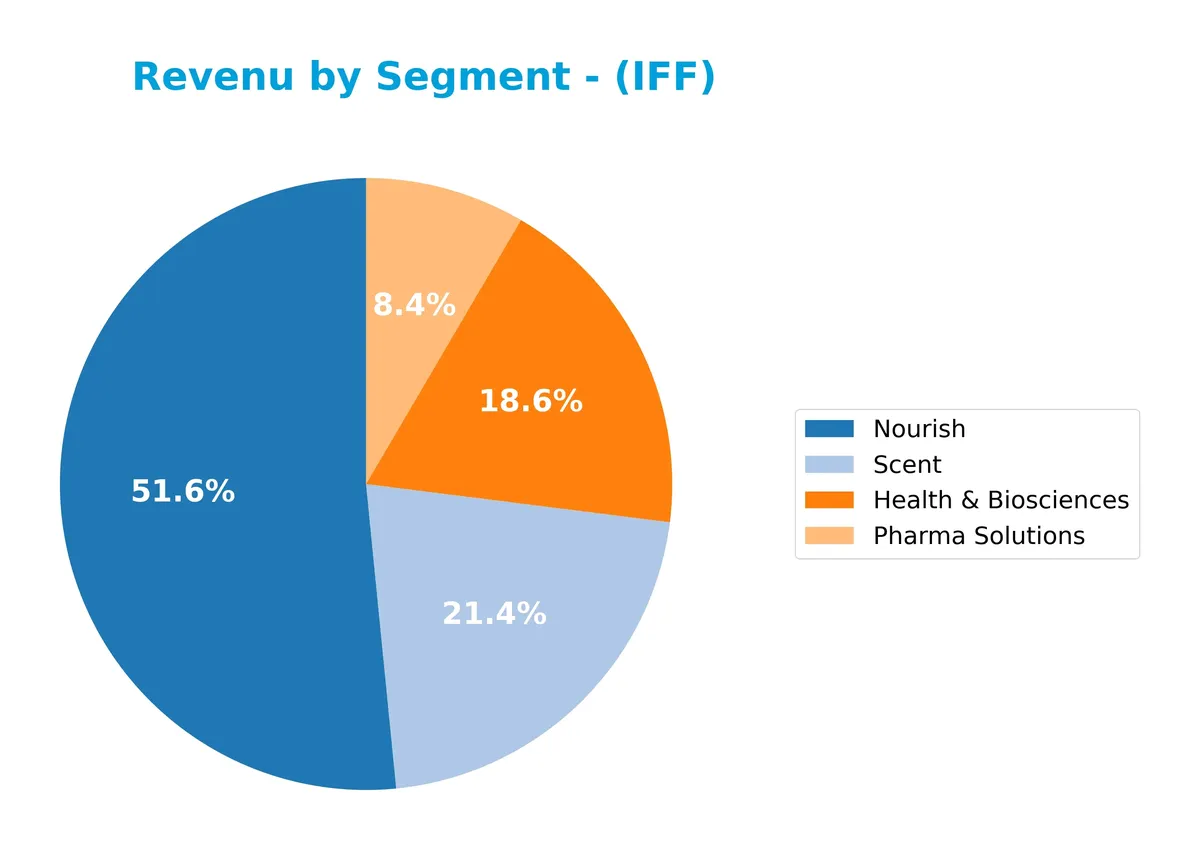

Revenue by Segment

The pie chart illustrates International Flavors & Fragrances Inc.’s revenue distribution by segment for fiscal year 2024, highlighting the contribution of Nourish, Pharma Solutions, Scent, and Health & Biosciences.

Nourish dominates with $5.9B, reinforcing its role as the core business driver. Health & Biosciences and Scent contribute $2.1B and $2.4B, respectively, showing stable demand. Pharma Solutions remains the smallest at $961M but consistent. The 2024 data suggests slight concentration risk in Nourish, amid modest shifts in the other segments, signaling steady but cautious expansion.

Key Products & Brands

The table below outlines International Flavors & Fragrances Inc.’s main product segments and their core descriptions:

| Product | Description |

|---|---|

| Nourish | Natural and plant-based specialty food ingredients including flavor compounds, savory solutions, and inclusions. Also provides natural antioxidants and anti-microbials for beverages, sweets, and dairy products. |

| Scent | Fragrance compounds comprising fine and consumer fragrances, synthetic and natural ingredients, and cosmetic active ingredients for personal care products. |

| Health & Biosciences | Enzymes, food cultures, probiotics, and specialty ingredients for health-related applications. |

| Pharma Solutions | Cellulosics and seaweed-based pharmaceutical excipients for oral care and pharmaceutical products. |

International Flavors & Fragrances operates diversified segments spanning food ingredients, fragrances, health ingredients, and pharmaceutical excipients, serving global consumer and industrial markets.

Main Competitors

Nine competitors operate in the Chemicals – Specialty sector, with the table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Linde plc | 200B |

| The Sherwin-Williams Company | 81.5B |

| Ecolab Inc. | 74.4B |

| Air Products and Chemicals, Inc. | 56B |

| PPG Industries, Inc. | 23.4B |

| International Flavors & Fragrances Inc. | 17.4B |

| DuPont de Nemours, Inc. | 17.1B |

| Albemarle Corporation | 16.9B |

| LyondellBasell Industries N.V. | 14.3B |

International Flavors & Fragrances Inc. ranks 6th among its competitors. Its market cap is roughly 10.4% that of the leader, Linde plc. The company sits below both the top 10 average market cap of 55.7B and the sector median of 23.4B. It maintains a 12.19% premium over its closest competitor above, showing a moderate gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does IFF have a competitive advantage?

International Flavors & Fragrances Inc. does not clearly demonstrate a competitive advantage based on available data. Its declining ROIC trend and unfavorable income statement metrics suggest challenges in generating sustainable economic profits.

Looking ahead, IFF’s diverse segments covering natural ingredients, fragrances, health biosciences, and pharma solutions offer potential growth opportunities. Expansion in emerging markets and innovation in plant-based and specialty ingredients could support future competitiveness.

SWOT Analysis

This SWOT analysis highlights International Flavors & Fragrances Inc.’s core strategic factors shaping its competitive position.

Strengths

- diversified product segments

- strong global presence across key regions

- consistent dividend yield

Weaknesses

- declining revenue and profitability trends

- unfavorable net margin and ROIC

- weak liquidity and interest coverage ratios

Opportunities

- growth in natural and plant-based ingredients

- expanding demand in emerging markets

- innovation in cosmetic and health biosciences

Threats

- intense competition in specialty chemicals

- raw material cost volatility

- regulatory pressures on ingredients

IFF’s strengths in diversification and global reach are offset by persistent profitability challenges and liquidity risks. Strategic focus must prioritize innovation and market expansion while managing cost and regulatory threats.

Stock Price Action Analysis

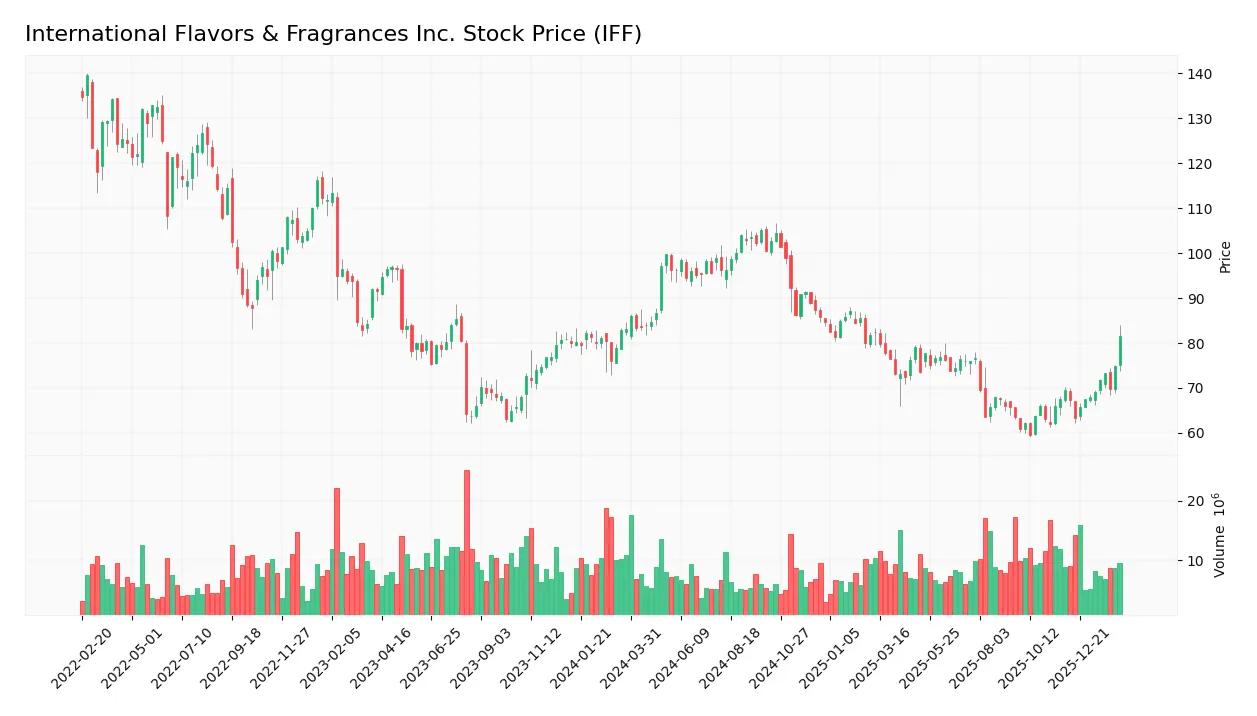

The weekly stock chart for International Flavors & Fragrances Inc. (IFF) highlights price movements and volume trends over the past 12 months:

Trend Analysis

Over the past 12 months, IFF’s stock price declined by 1.9%, indicating a neutral trend by the defined threshold. The trend shows acceleration despite the slight overall decrease. The price fluctuated widely, hitting a high of 105.12 and a low of 59.55, reflecting significant volatility with a 12.82 standard deviation.

Volume Analysis

Trading volume over the last three months is increasing, driven strongly by buyers who account for 70.34% of activity. This buyer dominance suggests robust investor interest and growing market participation in this period, signaling positive sentiment despite the broader neutral price trend.

Target Prices

Analysts set a clear target consensus for International Flavors & Fragrances Inc. (IFF).

| Target Low | Target High | Consensus |

|---|---|---|

| 71 | 85 | 78.5 |

The target range indicates moderate upside potential from current levels. Analysts generally expect steady gains reflecting confidence in IFF’s market position.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst grades and consumer feedback to provide a balanced view of IFF’s market perception.

Stock Grades

Here are the recent grades for International Flavors & Fragrances Inc. from well-known financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Outperform | 2026-02-12 |

| Argus Research | Maintain | Buy | 2026-01-22 |

| Citigroup | Maintain | Buy | 2026-01-21 |

| UBS | Maintain | Neutral | 2026-01-12 |

| Barclays | Maintain | Overweight | 2025-11-07 |

| UBS | Maintain | Neutral | 2025-11-06 |

| B of A Securities | Maintain | Buy | 2025-10-14 |

| Argus Research | Maintain | Buy | 2025-10-07 |

| UBS | Maintain | Neutral | 2025-10-06 |

| Citigroup | Maintain | Buy | 2025-10-06 |

The consensus overwhelmingly favors a Buy rating, supported by multiple maintained Buy and Outperform grades. Neutral ratings persist primarily from UBS, reflecting some cautious stance amid broad positive sentiment.

Consumer Opinions

International Flavors & Fragrances Inc. inspires a mix of admiration and constructive critique from its customers.

| Positive Reviews | Negative Reviews |

|---|---|

| “IFF’s product quality consistently impresses with rich, authentic scents.” | “Pricing feels steep compared to some competitors.” |

| “Their innovation in natural ingredients sets them apart in the industry.” | “Occasional delays in customer service response times.” |

| “IFF’s sustainability efforts align well with my values as a consumer.” | “Limited availability of certain niche fragrances.” |

Overall, consumers praise IFF’s innovation and product quality. However, pricing and customer service speed emerge as recurring concerns. This feedback signals room to enhance customer experience without compromising brand strength.

Risk Analysis

Below is a summary table highlighting key risks facing International Flavors & Fragrances Inc. (IFF):

| Category | Description | Probability | Impact |

|---|---|---|---|

| Profitability Risk | Negative net margin (-3.43%) signals ongoing operational challenges. | High | High |

| Liquidity Risk | Current and quick ratios at zero indicate potential short-term cash issues. | High | Medium |

| Financial Distress | Altman Z-score of 1.85 places IFF in the grey zone, signaling bankruptcy risk. | Medium | High |

| Return on Capital | Zero ROE and ROIC reflect poor capital efficiency and value destruction. | High | High |

| Market Volatility | Beta near 1.04 suggests stock price closely tracks market swings. | Medium | Medium |

| Interest Coverage | Interest coverage at zero warns of difficulty servicing debt obligations. | Medium | High |

| Valuation Concern | Negative P/E ratio (-46.13) may reflect earnings volatility or one-offs. | Medium | Medium |

IFF faces significant profitability and liquidity risks, as reflected by negative margins and poor liquidity ratios. The Altman Z-score in the grey zone warns of moderate financial distress risk. Interest coverage and returns on equity remain critical concerns. Investors should weigh these risks against the company’s market position in specialty chemicals.

Should You Buy International Flavors & Fragrances Inc.?

International Flavors & Fragrances Inc. appears to show weak profitability with declining ROIC and average financial strength. Despite a manageable leverage profile, its overall B- rating suggests cautious value creation, warranting careful monitoring amid a grey zone Altman Z-Score.

Strength & Efficiency Pillars

International Flavors & Fragrances Inc. shows a favorable gross margin of 36.16%, indicating solid operational efficiency. Interest expense remains low at 2.1%, helping contain financing costs. However, the company reports a negative net margin (-3.43%), zero return on equity, and zero ROIC, signaling weak profitability and value destruction. The unavailability of WACC and ROIC data prevents confirming value creation. Operational margins hold some merit, but overall profitability and capital efficiency remain significant concerns.

Weaknesses and Drawbacks

IFF resides in the Altman Z-Score grey zone with a score of 1.85, implying moderate bankruptcy risk and financial vulnerability. Profitability metrics are weak, with a negative net margin and unfavorable ROE. The current ratio and quick ratio are zero, signaling liquidity constraints. Despite a favorable P/E of -46.13 (likely due to losses), valuation remains complicated by deteriorating income growth and a declining asset turnover. These factors create short-term headwinds and elevate solvency risks.

Our Final Verdict about International Flavors & Fragrances Inc.

Despite pockets of operational efficiency, IFF’s grey zone Altman Z-Score and poor profitability suggest caution. The company’s financial health remains fragile, making its profile highly speculative. Investors might consider waiting for clearer signs of margin recovery and balance sheet stabilization before committing capital. Recent buyer dominance could hint at optimism, but fundamental risks prevail.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Is Wall Street Bullish or Bearish on International Flavors & Fragrances Stock? – Yahoo Finance (Feb 12, 2026)

- International Flavors & Fragrances Inc (IFF) Q4 2025 Earnings Ca – GuruFocus (Feb 12, 2026)

- Mizuho Issues Positive Forecast for International Flavors & Fragrances (NYSE:IFF) Stock Price – MarketBeat (Feb 12, 2026)

- International Flavors & Fragrances up after annual forecasts in line with expectations – TradingView (Feb 12, 2026)

- International Flavors Q4 Earnings Miss Estimates, Sales Dip Y/Y – The Globe and Mail (Feb 12, 2026)

For more information about International Flavors & Fragrances Inc., please visit the official website: iff.com