Home > Analyses > Financial Services > Interactive Brokers Group, Inc.

Interactive Brokers Group, Inc. revolutionizes global trading by seamlessly connecting investors to a vast array of financial markets through its advanced electronic platform. Known for its leadership in automated brokerage services, IBKR offers a comprehensive suite of products including stocks, options, futures, and cryptocurrencies, catering to both institutional and individual clients. Renowned for innovation and efficiency, the company continually shapes how trading is executed worldwide. But does its current market position and growth outlook still warrant a strong investment thesis?

Table of contents

Business Model & Company Overview

Interactive Brokers Group, Inc., founded in 1977 and headquartered in Greenwich, Connecticut, stands as a dominant player in the electronic brokerage industry. Its integrated platform facilitates seamless execution, clearance, and settlement across multiple asset classes including stocks, options, futures, foreign exchange, and cryptocurrencies. This cohesive ecosystem serves a diverse clientele ranging from institutional investors to individual traders, underpinning its core mission to provide efficient, technology-driven market access globally.

The company’s revenue engine balances transaction fees with custody, prime brokerage, and lending services, generating recurring income alongside electronic trade commissions. Interactive Brokers maintains a strategic footprint across the Americas, Europe, and Asia, leveraging electronic exchanges and market centers to maximize reach. Its robust technological infrastructure and diversified offerings create a formidable economic moat, positioning it to shape the future of global investment services.

Financial Performance & Fundamental Metrics

This section provides a comprehensive analysis of Interactive Brokers Group, Inc.’s income statement, key financial ratios, and dividend payout policy to guide investment decisions.

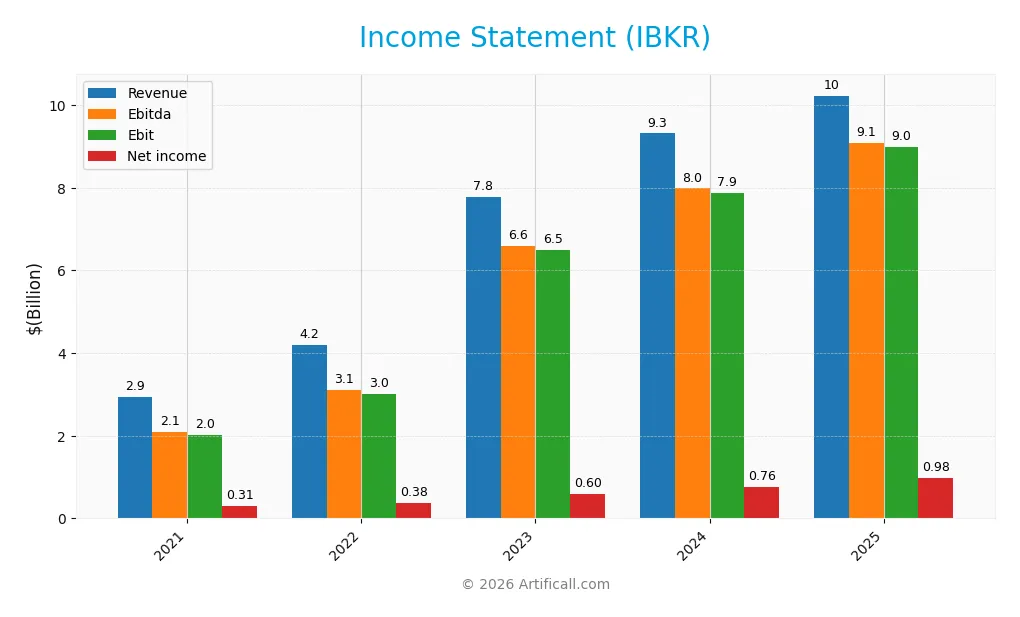

Income Statement

The table below summarizes Interactive Brokers Group, Inc.’s key income statement items over the past five fiscal years, illustrating revenue growth and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 2.94B | 4.19B | 7.79B | 9.32B | 10.23B |

| Cost of Revenue | 635M | 778M | 913M | 1.02B | 1.05B |

| Operating Expenses | 289M | 288M | 351M | 454M | 388M |

| Gross Profit | 2.31B | 3.41B | 6.87B | 8.30B | 9.19B |

| EBITDA | 2.09B | 3.11B | 6.60B | 7.99B | 9.09B |

| EBIT | 2.01B | 3.02B | 6.51B | 7.89B | 8.99B |

| Interest Expense | 224M | 1.02B | 3.44B | 4.19B | 4.22B |

| Net Income | 308M | 380M | 600M | 755M | 984M |

| EPS | 0.82 | 0.95 | 1.43 | 1.75 | 2.23 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2023-12-31 | 2025-02-27 | 2026-01-20 |

Income Statement Evolution

From 2021 to 2025, Interactive Brokers Group, Inc. demonstrated strong revenue growth, increasing from 2.94B to 10.23B, a 248% rise over the period. Net income also rose significantly from 308M to 984M, reflecting a 219% increase. Gross and EBIT margins remained favorable, around 89.78% and 87.86% respectively, indicating consistent operational efficiency despite a slight decline in net margin over the period.

Is the Income Statement Favorable?

In 2025, fundamentals appear generally favorable with revenue growth of 9.83% and an EBIT increase of 14%, supporting a strong operating performance. The net margin improved by 18.66%, and EPS surged 28.32%, reflecting solid profitability gains. However, a notable 41.23% interest expense ratio remains unfavorable, which could pressure net income. Overall, 85.71% of income statement metrics were positive, underscoring a predominantly favorable financial position.

Financial Ratios

The table below summarizes key financial ratios for Interactive Brokers Group, Inc. (IBKR) over the last five fiscal years, providing a clear view of profitability, valuation, liquidity, leverage, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 10.48% | 9.06% | 7.71% | 8.10% | 127.67% |

| ROE | 12.86% | 13.34% | 16.74% | 17.64% | 0% |

| ROIC | 8.31% | 13.91% | 23.32% | 21.81% | 0% |

| P/E | 24.29 | 19.13 | 14.51 | 25.30 | 8.41 |

| P/B | 3.12 | 2.55 | 2.43 | 4.46 | 0 |

| Current Ratio | 1.14 | 1.09 | 1.12 | 1.16 | 0 |

| Quick Ratio | 1.14 | 1.09 | 1.12 | 1.16 | 0 |

| D/E | 4.93 | 3.15 | 3.17 | 3.80 | 0 |

| Debt-to-Assets | 10.81% | 7.78% | 8.86% | 10.83% | 0% |

| Interest Coverage | 9.00 | 3.07 | 1.90 | 1.87 | -0.42 |

| Asset Turnover | 0.03 | 0.04 | 0.06 | 0.06 | 0 |

| Fixed Asset Turnover | 0 | 0 | 0 | 0 | 0 |

| Dividend Yield | 0.51% | 0.55% | 0.48% | 0.48% | 0.47% |

Evolution of Financial Ratios

Over the period, Return on Equity (ROE) was not reported for 2025, indicating a possible data gap or zero value, while the Current Ratio data for 2025 is missing, contrasting with stable values around 1.1 in prior years. The Debt-to-Equity Ratio was zero in 2025, marking a significant decline from previous high levels above 3. Profitability showed mixed signals, with net profit margin unusually high at 127.67% in 2025, suggesting an anomaly or accounting adjustment.

Are the Financial Ratios Favorable?

In 2025, the net margin and price-to-earnings (PE) ratio were favorable, with a strong net margin of 127.67% and PE at 8.41. However, ROE, return on invested capital (ROIC), and current and quick ratios were unfavorable or zero, indicating liquidity and profitability concerns. The debt-to-equity and debt-to-assets ratios were favorable at zero, implying low leverage. Interest coverage was neutral at 2.13, while asset turnover and dividend yield were unfavorable. Overall, 57.14% of key ratios were unfavorable, leading to an unfavorable global evaluation.

Shareholder Return Policy

Interactive Brokers Group, Inc. pays a modest dividend with a payout ratio around 4% in 2025, maintaining a dividend yield near 0.47%. Dividend per share has shown a gradual increase over recent years, supported by free cash flow, while share buybacks are not explicitly reported.

This conservative dividend approach, combined with sustainable payout levels, suggests a balanced policy aimed at preserving capital for reinvestment or debt management. The measured distribution appears aligned with long-term value creation without risking financial strain.

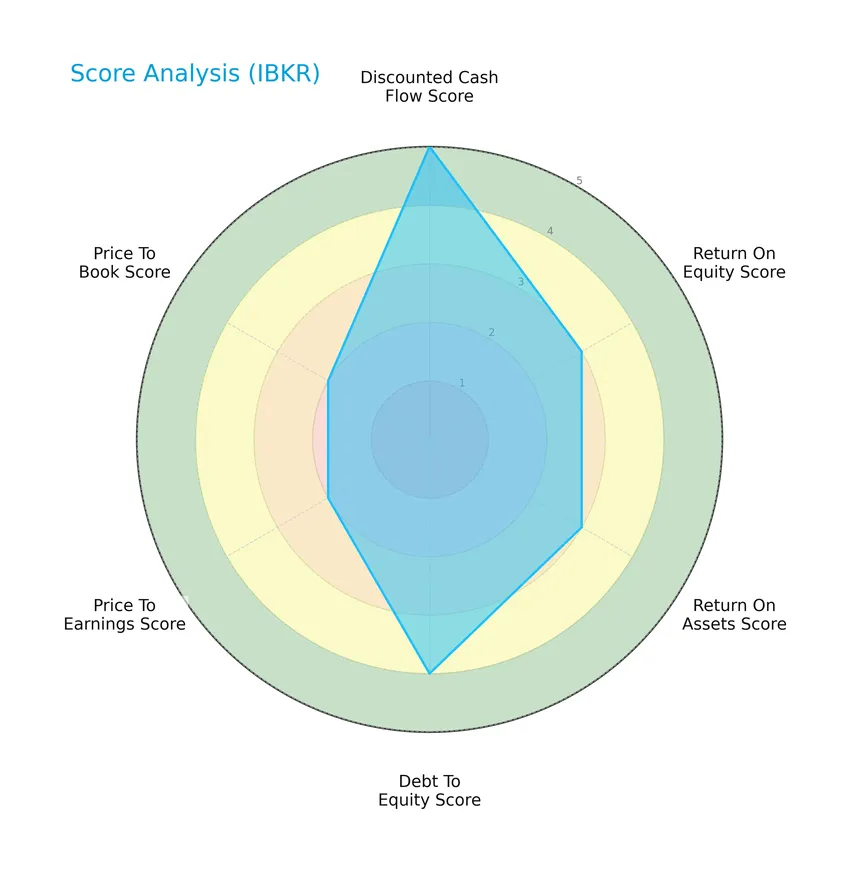

Score analysis

Here is a radar chart highlighting Interactive Brokers Group, Inc.’s key financial scores across various valuation and performance metrics:

Interactive Brokers shows a very favorable discounted cash flow score of 5 and a favorable debt to equity score of 4. The return on equity, return on assets, price to earnings, and price to book scores hold moderate ratings ranging from 2 to 3, indicating balanced but mixed financial signals.

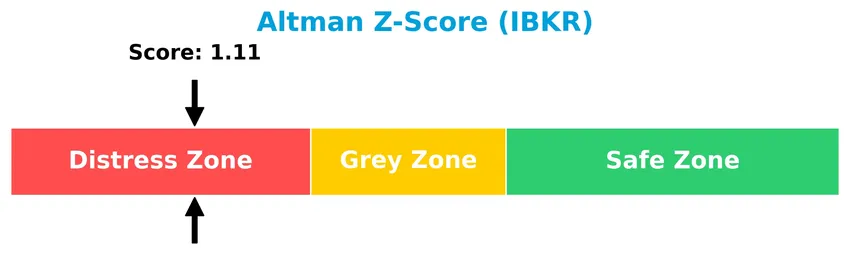

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Interactive Brokers Group, Inc. in the distress zone, suggesting a higher risk of financial distress and potential bankruptcy:

Is the company in good financial health?

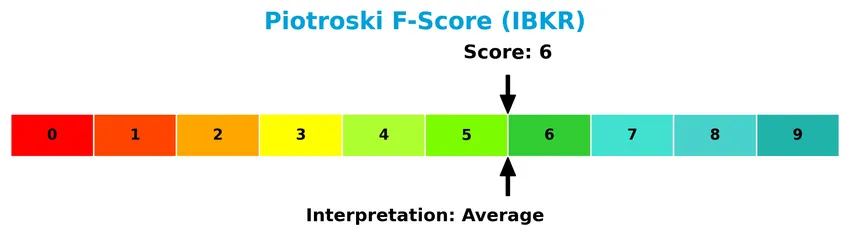

The Piotroski Score diagram offers insights into the company’s financial health based on nine fundamental criteria:

With a Piotroski Score of 6 categorized as average, Interactive Brokers demonstrates moderate financial strength, indicating neither strong nor weak fundamentals at this time.

Competitive Landscape & Sector Positioning

This sector analysis will explore Interactive Brokers Group, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether the company holds a competitive advantage over its industry peers.

Strategic Positioning

Interactive Brokers Group, Inc. operates a diversified product portfolio including stocks, options, futures, forex, bonds, ETFs, precious metals, and cryptocurrencies, serving both institutional and individual clients. Geographically, it generates significant revenue from the US (3.59B in 2024) and substantial international exposure (1.6B), reflecting a broad global footprint.

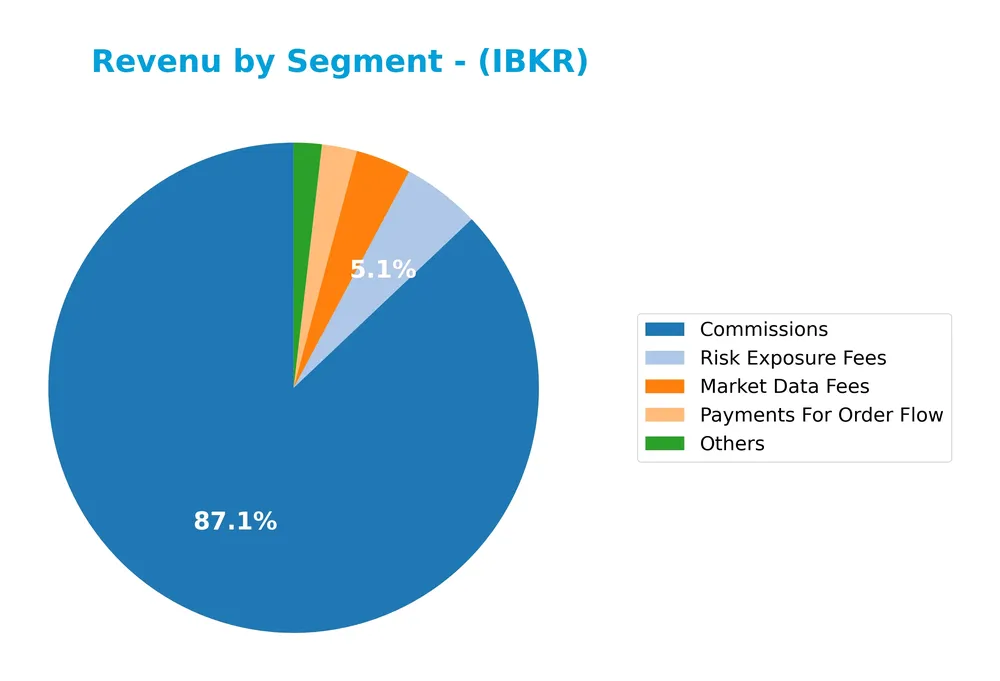

Revenue by Segment

The pie chart illustrates Interactive Brokers Group, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the company’s diverse income sources.

In 2024, Commissions dominated with $1.7B, showing strong growth compared to prior years. Risk Exposure Fees also increased significantly to $100M, reflecting higher market risk activity. Market Data Fees and Payments for Order Flow remained smaller but stable contributors at $71M and $45M, respectively. The Others category at $36M is minor. Overall, revenue is concentrated in Commissions, with an upward trend in risk-related fees, suggesting more volatile trading conditions.

Key Products & Brands

The table below presents Interactive Brokers Group, Inc.’s main products and services with brief descriptions:

| Product | Description |

|---|---|

| Execution, Clearance & Settlement | Automated electronic brokerage services for stocks, options, futures, forex, bonds, mutual funds, ETFs, metals, and cryptocurrencies. |

| Custody & Service Accounts | Custody and account services for hedge funds, mutual funds, ETFs, registered investment advisors, proprietary trading groups, introducing brokers, and individual investors. |

| Prime Brokerage & Margin Lending | Securities lending, margin lending, and prime brokerage services for institutional and individual customers. |

| Market Data Fees | Fees charged for access to real-time and historical market data. |

| Payments for Order Flow | Revenues generated from directing customer orders to market makers or other liquidity providers. |

| Risk Exposure Fees | Fees related to risk management and exposure on client positions. |

| Commissions | Charges based on executed trades across various asset classes. |

Interactive Brokers Group, Inc. operates a diverse range of electronic brokerage and financial services, generating revenues primarily from commissions, market data fees, and risk exposure charges. Their offerings cater to both institutional and individual investors across global markets.

Main Competitors

There are 71 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Berkshire Hathaway Inc. | 1.07T |

| JPMorgan Chase & Co. | 886B |

| Visa Inc. | 672B |

| Mastercard Incorporated | 506B |

| Bank of America Corporation | 409B |

| Wells Fargo & Company | 310B |

| Morgan Stanley | 289B |

| The Goldman Sachs Group, Inc. | 287B |

| American Express Company | 260B |

| Citigroup Inc. | 221B |

Interactive Brokers Group, Inc. ranks 18th among 71 competitors, with a market cap at 12.5% of the largest player, Berkshire Hathaway Inc. The company stands below the average market cap of the top 10 competitors (491B) but above the sector median (55B). It has a 7.43% gap to its next closest competitor above, indicating a moderate distance in market capitalization within its peer group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does IBKR have a competitive advantage?

Interactive Brokers Group, Inc. currently does not present a competitive advantage as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), with a declining ROIC trend indicating value destruction. Despite strong income statement metrics such as a gross margin of 89.78% and EBIT margin of 87.86%, the company’s economic moat remains very unfavorable.

Looking ahead, IBKR shows potential for growth through expanding revenue in both U.S. and international markets, with non-U.S. revenue rising steadily to $1.6B in 2024. The company’s diversified offering across stocks, options, futures, forex, and cryptocurrencies could provide new opportunities to capture market share and enhance profitability in evolving financial ecosystems.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Interactive Brokers Group, Inc. (IBKR) to guide investment decisions.

Strengths

- strong market position with $134B market cap

- diverse global revenue streams

- high gross and EBIT margins

Weaknesses

- declining ROIC and value destruction

- unfavorable liquidity ratios

- interest expense burden at 41%

Opportunities

- expanding international client base

- growing digital trading adoption

- innovation in cryptocurrency and fintech services

Threats

- regulatory changes in financial services

- intense competition in brokerage industry

- market volatility impacting trading volumes

Overall, IBKR possesses solid market strength and profitability but faces challenges in capital efficiency and liquidity. Strategic focus on innovation and global expansion may mitigate risks from regulatory and competitive pressures.

Stock Price Action Analysis

The following weekly stock chart for Interactive Brokers Group, Inc. (IBKR) reflects price movements and volatility over the recent period:

Trend Analysis

Over the past 12 months, IBKR’s stock price increased by 180.88%, indicating a strong bullish trend accompanied by acceleration. The price ranged from a low of 26.86 to a high of 77.58, with a relatively high volatility of 14.72%. The recent 2.5-month period shows a 9.98% gain with steady upward momentum (slope 0.79) and moderate volatility at 4.44%.

Volume Analysis

Trading volume is increasing overall, with total buyer volume at 1.7B shares (56.3%) surpassing seller volume at 1.3B shares. In the recent 2.5 months, buyer dominance intensified to 64.63%, indicating a buyer-driven market. This elevated participation suggests positive investor sentiment and growing confidence in the stock.

Target Prices

Analysts present a cautiously optimistic target consensus for Interactive Brokers Group, Inc.

| Target High | Target Low | Consensus |

|---|---|---|

| 91 | 80 | 84 |

The target prices indicate moderate upside potential, with a consensus around 84, suggesting steady confidence in the stock’s performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest grades and consumer feedback regarding Interactive Brokers Group, Inc. (IBKR).

Stock Grades

Here are the recent stock grades from reputable analysts for Interactive Brokers Group, Inc., reflecting current market views:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BMO Capital | Maintain | Outperform | 2026-01-21 |

| Barclays | Maintain | Overweight | 2026-01-21 |

| Barclays | Maintain | Overweight | 2026-01-08 |

| Barclays | Maintain | Overweight | 2025-12-12 |

| Barclays | Maintain | Overweight | 2025-10-17 |

| BMO Capital | Maintain | Outperform | 2025-10-17 |

| Barclays | Maintain | Overweight | 2025-10-08 |

| Barclays | Maintain | Overweight | 2025-07-18 |

| Piper Sandler | Maintain | Overweight | 2025-07-18 |

| Piper Sandler | Maintain | Overweight | 2025-07-15 |

The grades consistently show a positive outlook with “Outperform” and “Overweight” ratings maintained across multiple updates. The consensus among analysts remains a “Buy,” indicating steady confidence in the stock’s prospects.

Consumer Opinions

Consumers generally appreciate Interactive Brokers Group, Inc. (IBKR) for its advanced trading tools but express concerns over its complexity for beginners.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent platform with low commissions and fast execution.” | “The platform is overwhelming for new traders.” |

| “Wide range of assets and global market access.” | “Customer support can be slow to respond.” |

| “Robust research tools and reliable order execution.” | “Interface feels outdated and not very intuitive.” |

Overall, users praise IBKR for cost efficiency and comprehensive features but frequently note a steep learning curve and customer service delays as key drawbacks.

Risk Analysis

Below is a summary table of key risks facing Interactive Brokers Group, Inc., including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score at 1.11 signals distress zone, indicating moderate to high bankruptcy risk. | High | High |

| Profitability | Unfavorable ROE and ROIC ratios despite strong net margin, suggesting operational inefficiencies. | Medium | Medium |

| Liquidity | Unfavorable current and quick ratios point to possible short-term liquidity constraints. | Medium | Medium |

| Market Volatility | Beta of 1.24 indicates stock price more volatile than market, raising investment risk. | Medium | Medium |

| Dividend Yield | Low dividend yield (0.47%) may reduce attractiveness for income-focused investors. | Low | Low |

The most concerning risk is the financial distress signal from the Altman Z-Score, reflecting potential solvency challenges despite a favorable market cap of $134B. Combined with mixed profitability and liquidity metrics, investors should exercise caution and monitor quarterly financials closely.

Should You Buy Interactive Brokers Group, Inc.?

Interactive Brokers Group, Inc. appears to be characterized by moderate profitability and a deteriorating competitive moat, with declining ROIC suggesting value destruction. Despite a manageable leverage profile and a B+ overall rating indicating favorable conditions, its Altman Z-Score signals financial distress, implying cautious analytical interpretation.

Strength & Efficiency Pillars

Interactive Brokers Group, Inc. exhibits strong profitability with a net margin of 127.67%, indicating exceptional operational efficiency. Although the company’s ROE and ROIC are currently at 0%, reflecting challenges in generating returns on equity and invested capital, its debt-to-equity ratio and debt-to-assets metrics are favorable, suggesting solid financial health. The Piotroski score stands at 6, reflecting average financial strength, while the Altman Z-score of 1.11 places the company in the distress zone, signaling elevated bankruptcy risk. Overall, despite some weaknesses, the company maintains efficiency pillars in profitability and leverage management.

Weaknesses and Drawbacks

The firm’s valuation is moderate with a price-to-earnings ratio of 8.41, which is favorable, but limited data on price-to-book ratio and current liquidity ratios (both at 0 and unfavorable) raise concerns about short-term financial flexibility. The Altman Z-score in the distress zone (1.11) and a moderate Piotroski score (6) highlight potential financial instability. Interest expense is high at 41.23%, which could pressure margins, and the company’s declining ROIC versus a WACC of 12.04% suggests value destruction rather than creation. These factors present notable risks, particularly in terms of financial health and capital efficiency.

Our Verdict about Interactive Brokers Group, Inc.

The long-term fundamental profile of Interactive Brokers Group, Inc. appears mixed to unfavorable due to financial distress signals and lack of value creation. However, the bullish overall stock trend combined with recent buyer dominance (64.63%) and accelerating price momentum suggests cautious optimism. Despite underlying financial weaknesses, the technical strength may indicate potential entry points, though investors might consider a wait-and-see approach to balance risk and reward.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Tracking How The Interactive Brokers Group (IBKR) Story Shifts With New Price Targets – Yahoo Finance (Jan 24, 2026)

- Here’s How Much $100 Invested In Interactive Brokers Group 15 Years Ago Would Be Worth Today – Sahm (Jan 24, 2026)

- 4.4M client accounts, $780B in equity: Inside Interactive Brokers’ Q4 – Stock Titan (Jan 20, 2026)

- Interactive Brokers Group, Inc. (NASDAQ:IBKR) Given Average Recommendation of “Moderate Buy” by Analysts – MarketBeat (Jan 21, 2026)

- Interactive Brokers Group Inc. (NASDAQ:IBKR) Q4 2025 Earnings Beat Estimates on Strong Trading and Interest Income – Chartmill (Jan 20, 2026)

For more information about Interactive Brokers Group, Inc., please visit the official website: interactivebrokers.com