Home > Analyses > Consumer Defensive > Inter Parfums, Inc.

Inter Parfums, Inc. perfumes and personal fragrances shape daily experiences worldwide, blending luxury with everyday life. As a prominent player in the Household & Personal Products sector, Inter Parfums leverages an impressive portfolio of prestigious brands, including Coach, Jimmy Choo, and Montblanc, to maintain its reputation for innovation and quality. With a strong market presence spanning Europe and the U.S., the company continuously adapts to evolving consumer tastes. The key question for investors is whether Inter Parfums’ robust fundamentals can sustain its growth momentum in an increasingly competitive market.

Table of contents

Business Model & Company Overview

Inter Parfums, Inc., founded in 1982 and headquartered in New York City, stands as a dominant player in the Household & Personal Products industry. It crafts a cohesive ecosystem of fragrances and related products under prestigious brands such as Coach, Jimmy Choo, and Montblanc, blending luxury with broad market appeal. Operating through European and U.S.-based segments, it leverages an extensive portfolio to serve diverse retail channels globally.

The company’s revenue engine balances product manufacturing with marketing and distribution, tapping department stores, specialty shops, and e-commerce across the Americas, Europe, and Asia. This global footprint supports steady cash flow from both wholesale and retail avenues. Inter Parfums’ competitive advantage lies in its brand portfolio and strategic market presence, securing a durable economic moat that shapes the future of fragrance retail worldwide.

Financial Performance & Fundamental Metrics

In this section, I analyze Inter Parfums, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment appeal.

Income Statement

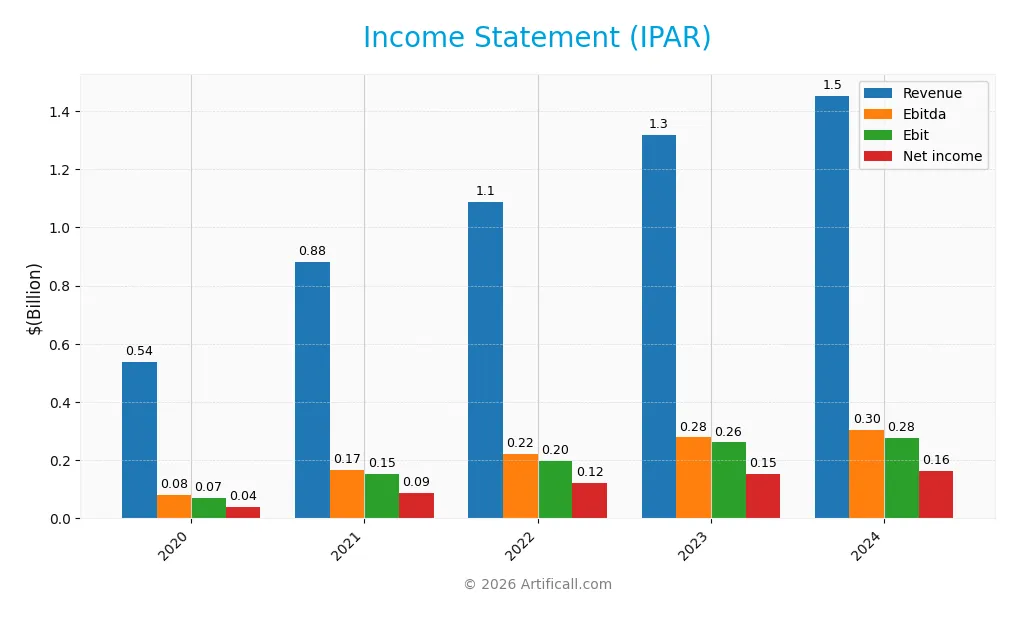

The following table presents Inter Parfums, Inc.’s income statement highlights for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 539M | 880M | 1.09B | 1.32B | 1.45B |

| Cost of Revenue | 208M | 323M | 392M | 479M | 525M |

| Operating Expenses | 261M | 409M | 500M | 588M | 653M |

| Gross Profit | 331M | 557M | 694M | 839M | 927M |

| EBITDA | 80M | 167M | 220M | 278M | 305M |

| EBIT | 71M | 154M | 198M | 261M | 276M |

| Interest Expense | 2M | 3M | 4M | 11M | 8M |

| Net Income | 38M | 87M | 121M | 153M | 164M |

| EPS | 1.21 | 2.76 | 3.80 | 4.77 | 5.13 |

| Filing Date | 2021-03-01 | 2022-03-01 | 2023-02-28 | 2024-02-27 | 2025-03-11 |

Income Statement Evolution

Between 2020 and 2024, Inter Parfums, Inc. (IPAR) demonstrated strong revenue growth, increasing from $539M to $1.45B, a 169% rise. Net income also surged by 330%, reaching $164M in 2024. Margins improved notably, with a gross margin at 63.85% and a favorable EBIT margin of 19.02%, reflecting efficient cost management despite operating expenses growing at the same rate as revenue.

Is the Income Statement Favorable?

For 2024, the fundamentals of IPAR’s income statement appear favorable, supported by increased EBITDA of $305M and an EPS growth of 7.79%. While net margin growth declined slightly by 2.32% year-over-year, the net margin remains healthy at 11.32%. Interest expenses are well controlled at 0.54% of revenue. Overall, 85.7% of income statement metrics show favorable trends, indicating solid operational performance.

Financial Ratios

The table below presents key financial ratios of Inter Parfums, Inc. (IPAR) over the last five fiscal years, providing insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 7.1% | 9.9% | 11.1% | 11.6% | 11.3% |

| ROE | 7.1% | 15.3% | 19.6% | 21.8% | 22.1% |

| ROIC | 6.7% | 11.7% | 15.1% | 17.4% | 18.4% |

| P/E | 49.9 | 38.7 | 25.4 | 30.2 | 25.6 |

| P/B | 3.6 | 5.9 | 5.0 | 6.6 | 5.7 |

| Current Ratio | 3.8 | 2.9 | 2.3 | 2.6 | 2.8 |

| Quick Ratio | 2.8 | 2.1 | 1.4 | 1.4 | 1.6 |

| D/E | 0.10 | 0.32 | 0.34 | 0.28 | 0.26 |

| Debt-to-Assets | 5.8% | 16.1% | 16.0% | 14.0% | 13.6% |

| Interest Coverage | 35.6 | 52.4 | 54.0 | 22.3 | 35.1 |

| Asset Turnover | 0.61 | 0.77 | 0.83 | 0.96 | 1.03 |

| Fixed Asset Turnover | 12.2 | 4.8 | 5.6 | 6.7 | 8.1 |

| Dividend Yield | 1.1% | 0.9% | 2.1% | 1.7% | 2.3% |

Evolution of Financial Ratios

From 2020 to 2024, Inter Parfums, Inc. (IPAR) showed a steady improvement in profitability with Return on Equity (ROE) rising from 7.13% to 22.07%. The Current Ratio remained robust, increasing from 3.85 in 2020 to 2.75 in 2024, indicating stable liquidity. The Debt-to-Equity ratio also improved, decreasing from 0.32 in 2021 to 0.26 in 2024, reflecting cautious leverage management.

Are the Financial Ratios Favorable?

In 2024, IPAR’s profitability ratios, including net margin (11.32%), ROE (22.07%), and return on invested capital (18.35%), are favorable, signaling efficient earnings generation. Liquidity ratios such as current ratio (2.75) and quick ratio (1.63) are also positive. Leverage is conservatively managed, with debt-to-equity at 0.26 and debt-to-assets at 13.62%. However, valuation metrics like price-to-earnings (25.63) and price-to-book (5.66) are unfavorable, tempering the overall assessment despite a very favorable global ratios opinion.

Shareholder Return Policy

Inter Parfums, Inc. maintains a consistent dividend policy with a payout ratio around 52-58% and a dividend yield near 2.3% in 2024. Dividends per share have steadily increased from $0.66 in 2020 to $3.00 in 2024, supported by strong free cash flow coverage and moderate repurchase activity.

This approach reflects a balanced distribution strategy that aligns dividend payments with earnings and cash flow generation, mitigating risk of unsustainable payouts. The policy supports sustainable long-term value creation while maintaining financial flexibility for growth investments.

Score analysis

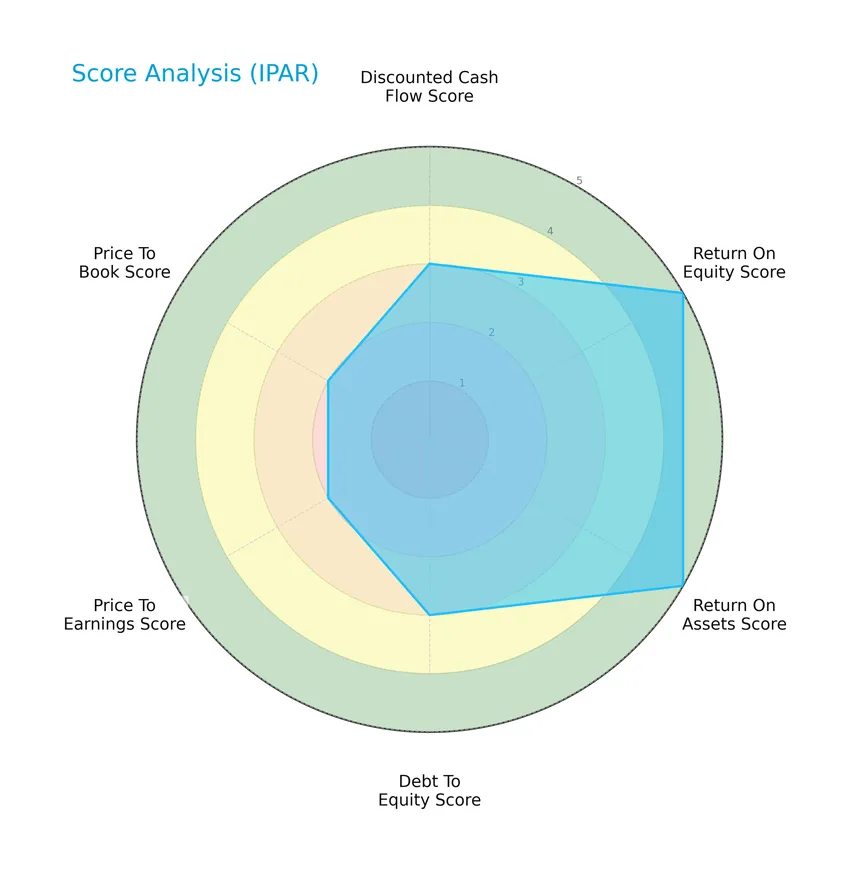

The following radar chart presents an overview of Inter Parfums, Inc.’s key financial scores to evaluate its investment characteristics:

Inter Parfums scores very favorably on return on equity and return on assets, indicating strong profitability. Discounted cash flow and debt-to-equity ratios are moderate, while price-to-earnings and price-to-book ratios show moderate valuation levels relative to peers.

Analysis of the company’s bankruptcy risk

Inter Parfums, Inc. is positioned well within the safe zone according to its Altman Z-Score, reflecting a low risk of bankruptcy and solid financial stability:

Is the company in good financial health?

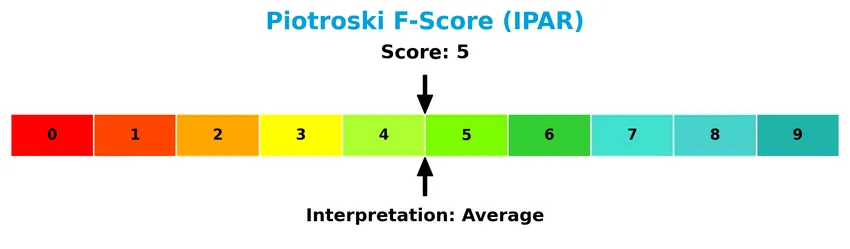

The Piotroski Score diagram below provides insight into the company’s financial strength based on multiple performance criteria:

With a Piotroski Score of 5, Inter Parfums demonstrates average financial health. This suggests moderate strength in profitability, leverage, liquidity, and efficiency, but with room for improvement compared to stronger firms.

Competitive Landscape & Sector Positioning

This sector analysis examines Inter Parfums, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether the company holds a competitive edge over its industry peers.

Strategic Positioning

Inter Parfums, Inc. maintains a diversified geographic presence with significant revenues across North America (over 500M in 2023), Europe (404M in 2023), and Asia (192M in 2023). The company operates primarily in fragrances under multiple brand names, balancing European and U.S.-based operations.

Revenue by Segment

The pie chart illustrates Inter Parfums, Inc.’s revenue distribution by segment for the fiscal year 2020, highlighting the contribution of different business areas during that period.

In 2020, revenue from the FranceMember segment was reported at 37.6M USD. This figure represents the total known segment revenue available for that year, indicating a focused revenue stream. Due to the limited segment data, it’s challenging to assess diversification or shifts, but the concentration in this segment suggests reliance on specific markets or products during the period.

Key Products & Brands

The following table outlines Inter Parfums, Inc.’s key products and brands in the fragrance and cosmetics market:

| Product | Description |

|---|---|

| Fragrance and Cosmetic Products | Manufactured, marketed, and distributed under multiple luxury and lifestyle brand names such as Boucheron, Coach, Jimmy Choo, Karl Lagerfeld, Kate Spade, Lanvin, Moncler, Montblanc, and others. |

| Brand Portfolio | Includes prestigious names like Rochas, Van Cleef & Arpels, Abercrombie & Fitch, Anna Sui, Dunhill, Ferragamo, GUESS, Hollister, Oscar de la Renta, and more. |

| Sales Channels | Products sold through department stores, specialty stores, duty free shops, beauty retailers, wholesalers, distributors, and e-commerce platforms. |

Inter Parfums, Inc. operates globally with a diverse portfolio of premium fragrance and cosmetic brands, leveraging multiple retail channels to reach its customers.

Main Competitors

There are 17 competitors in the sector, with the top 10 leaders by market capitalization listed below:

| Competitor | Market Cap. |

|---|---|

| The Procter & Gamble Company | 331B |

| Unilever PLC | 143B |

| Colgate-Palmolive Company | 62.6B |

| The Estée Lauder Companies Inc. | 38.5B |

| Kimberly-Clark Corporation | 33.7B |

| Kenvue Inc. | 33.2B |

| Church & Dwight Co., Inc. | 20.2B |

| The Clorox Company | 12.3B |

| e.l.f. Beauty, Inc. | 4.32B |

| Inter Parfums, Inc. | 2.7B |

Inter Parfums, Inc. ranks 10th among its 17 competitors, with a market cap approximately 1% that of the sector leader, The Procter & Gamble Company. The company’s valuation is below both the average market cap of the top 10 (68.2B) and the median market cap in the sector (4.3B). It is 36.4% smaller than the next competitor above, e.l.f. Beauty, indicating a noticeable gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does IPAR have a competitive advantage?

Inter Parfums, Inc. shows a clear competitive advantage, demonstrated by a very favorable moat status with a ROIC exceeding WACC by 9.06% and a strong upward ROIC trend of nearly 174%, indicating efficient capital use and value creation. The company’s favorable income statement metrics, including a gross margin of 63.85% and an EBIT margin of 19.02%, further support its solid profitability and operational strength.

Looking ahead, IPAR’s broad portfolio of luxury fragrance brands and its geographical diversification across Europe, North America, and Asia position it well for sustained growth. Continued expansion in international markets and the potential launch of new fragrance products represent key opportunities to enhance its market presence and capitalize on evolving consumer preferences.

SWOT Analysis

This SWOT analysis provides a clear overview of Inter Parfums, Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to guide investment decisions.

Strengths

- strong gross margin at 63.85%

- favorable net margin of 11.32%

- very favorable ROE at 22.07%

Weaknesses

- high price-to-book ratio at 5.66

- moderate price-to-earnings ratio at 25.63

- net margin growth declined slightly by -2.32% last year

Opportunities

- expanding international markets

- growing revenue at 169% over 5 years

- durable competitive advantage with growing ROIC

Threats

- high market competition in fragrances

- exposure to currency fluctuations

- rising operational expenses impacting margins

Inter Parfums, Inc. exhibits solid profitability and financial strength, supported by a durable competitive moat. However, valuation metrics suggest caution. Strategic focus on international expansion and cost management will be critical to sustain growth and mitigate emerging risks.

Stock Price Action Analysis

The weekly stock chart for Inter Parfums, Inc. (IPAR) over the past 12 months illustrates significant price fluctuations and trend shifts:

Trend Analysis

Over the past 12 months, IPAR’s stock price declined by 32.17%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 145.6 and a low of 80.61, with a high volatility level reflected by a 16.91 standard deviation.

Volume Analysis

In the last three months, trading volume for IPAR has been increasing, with buyers slightly dominant at 59.6%. This buyer-driven activity suggests growing investor interest and participation amid recent price recovery from November 2025 to January 2026.

Target Prices

The consensus target prices for Inter Parfums, Inc. reflect a moderately optimistic outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 112 | 103 | 107.5 |

Analysts expect the stock price to range between 103 and 112, with a consensus target of 107.5, indicating steady growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback concerning Inter Parfums, Inc. (IPAR) to provide a balanced perspective.

Stock Grades

The following table presents the latest verified stock grades for Inter Parfums, Inc. from recognized financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BWS Financial | Downgrade | Neutral | 2025-11-21 |

| Canaccord Genuity | Maintain | Buy | 2025-11-19 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Jefferies | Maintain | Buy | 2025-10-28 |

| BWS Financial | Maintain | Buy | 2025-10-22 |

| Canaccord Genuity | Maintain | Buy | 2025-10-21 |

| BWS Financial | Maintain | Buy | 2025-05-07 |

| Piper Sandler | Maintain | Overweight | 2025-04-24 |

| DA Davidson | Maintain | Buy | 2025-03-25 |

| BWS Financial | Maintain | Buy | 2025-03-17 |

Overall, the majority of recent grades remain positive with consistent “Buy” and “Overweight” ratings, though a recent downgrade by BWS Financial to “Neutral” introduces a note of caution in the consensus.

Consumer Opinions

Consumer sentiment around Inter Parfums, Inc. (IPAR) reflects a mix of appreciation for product quality and concerns about pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “The fragrances are long-lasting and unique.” | “Some products feel overpriced for the value.” |

| “Excellent packaging and presentation.” | “Limited availability of certain popular scents.” |

| “Great customer service experience.” | “Occasional inconsistencies in scent formulation.” |

Overall, consumers praise Inter Parfums for its high-quality, distinctive fragrances and attractive packaging, while pricing and occasional product availability issues are common points of criticism.

Risk Analysis

Below is a summary table outlining key risks associated with Inter Parfums, Inc. for investor consideration:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | Elevated P/E (25.63) and P/B (5.66) ratios may indicate overvaluation risk. | Medium | High |

| Competitive Pressure | Intense competition in the luxury fragrance market could affect margins. | Medium | Medium |

| Economic Sensitivity | Consumer spending dips during downturns may reduce product demand. | Medium | High |

| Supply Chain Disruptions | Global supply issues could delay product availability and increase costs. | Low | Medium |

| Currency Fluctuations | International operations expose company to foreign exchange risks. | Medium | Medium |

| Regulatory Changes | Changing regulations in cosmetics and fragrance industries could impact sales. | Low | Medium |

The most significant risks revolve around valuation concerns given the relatively high P/E and P/B ratios, which suggest cautious entry points. Additionally, economic cyclicality poses a substantial threat to revenue stability, especially in luxury consumer products. Inter Parfums’ strong financial health and risk metrics, including a safe Altman Z-Score of 6.61, provide some cushion against these risks, but investors should remain vigilant.

Should You Buy Inter Parfums, Inc.?

Inter Parfums, Inc. appears to be delivering robust profitability supported by a durable competitive moat with growing returns on invested capital. While its leverage profile is manageable, the overall rating of A- suggests a favorable but cautiously optimistic financial health profile.

Strength & Efficiency Pillars

Inter Parfums, Inc. exhibits robust profitability with a net margin of 11.32% and a return on equity (ROE) of 22.07%, underscoring efficient capital utilization. The company is a clear value creator, as its return on invested capital (ROIC) stands at 18.35%, well above the weighted average cost of capital (WACC) at 9.29%. Financial health indicators are strong, reflected by an Altman Z-score of 6.61, placing it comfortably in the safe zone, and a Piotroski score of 5, indicating moderate financial strength. These metrics collectively demonstrate operational efficiency and resilient financial stability.

Weaknesses and Drawbacks

Despite solid fundamentals, Inter Parfums faces valuation challenges with a price-to-earnings (P/E) ratio of 25.63 and a price-to-book (P/B) ratio of 5.66, both flagged as unfavorable, suggesting a premium valuation that may limit upside. While leverage ratios are moderate, the company’s debt-to-equity ratio at 0.26 and strong liquidity ratios (current ratio 2.75) mitigate solvency concerns. Market pressure is evident from a 32.17% overall price decline and seller dominance at 55.43% over the long term, posing short-term headwinds despite recent buyer dominance.

Our Verdict about Inter Parfums, Inc.

The long-term fundamental profile of Inter Parfums appears favorable, supported by strong profitability and financial health. However, the broader bearish stock trend and historical seller dominance suggest that despite recent buyer strength, investors might consider a cautious, wait-and-see approach pending a more definitive market recovery. The company’s profile may appear suited for those with a longer investment horizon willing to navigate valuation and market volatility risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Interparfums, Inc. (IPAR): A Bull Case Theory – Finviz (Jan 20, 2026)

- Interparfums Q4 Sales Rise 7% YoY, Key Brands Boost Growth – Yahoo Finance (Jan 22, 2026)

- Peter Lynch’s GARP Strategy Identifies INTERPARFUMS INC (NASDAQ:IPAR) as a Compelling Prospect – Chartmill (Jan 20, 2026)

- Interparfums Inc (IPAR) Shares Up 6.53% on Jan 22 – GuruFocus (Jan 22, 2026)

- Interparfums: Capital-Light Model Positions Stock For Growth Despite Near-Term Headwinds – Seeking Alpha (Dec 23, 2025)

For more information about Inter Parfums, Inc., please visit the official website: interparfumsinc.com