Home > Analyses > Healthcare > Insulet Corporation

Insulet Corporation revolutionizes diabetes care by delivering innovative, tubeless insulin management solutions that empower millions to live with greater freedom. As a leader in the medical devices industry, its flagship Omnipod System combines cutting-edge technology with user-friendly design, setting new standards for convenience and quality. With a strong reputation for innovation and expanding global reach, the key question now is whether Insulet’s growth prospects and fundamentals still justify its premium market valuation.

Table of contents

Business Model & Company Overview

Insulet Corporation, founded in 2000 and headquartered in Acton, Massachusetts, stands as a leader in the medical devices sector with a focused mission to improve diabetes management. Its core ecosystem revolves around the Omnipod System, a self-adhesive, tubeless insulin delivery device paired with a wireless personal diabetes manager, delivering convenience and innovation to insulin-dependent patients globally.

The company’s revenue engine is driven by a balanced mix of hardware sales from its disposable Omnipod devices and recurring revenues through ongoing supply and management services. Insulet maintains a strong strategic presence across the Americas, Europe, the Middle East, and Australia, leveraging independent distributors and pharmacy channels. This integrated model establishes a durable economic moat, reinforcing its pivotal role in shaping the future of diabetes care.

Financial Performance & Fundamental Metrics

This section provides a clear analysis of Insulet Corporation’s income statement, key financial ratios, and dividend payout policy to guide informed investment decisions.

Income Statement

The following table summarizes Insulet Corporation’s key income statement figures over the last five fiscal years, providing a clear view of the company’s financial performance trends.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 904M | 1.10B | 1.31B | 1.70B | 2.07B |

| Cost of Revenue | 322M | 347M | 500M | 537M | 626M |

| Operating Expenses | 531M | 626M | 768M | 940M | 1.14B |

| Gross Profit | 582M | 752M | 806M | 1.16B | 1.45B |

| EBITDA | 110M | 140M | 109M | 324M | 424M |

| EBIT | 55M | 82M | 46M | 251M | 343M |

| Interest Expense | 48M | 62M | 36M | 36M | 43M |

| Net Income | 6.8M | 16.8M | 4.6M | 206M | 418M |

| EPS | 0.11 | 0.25 | 0.066 | 2.96 | 5.97 |

| Filing Date | 2021-02-24 | 2022-02-24 | 2023-02-24 | 2024-02-23 | 2025-02-21 |

Income Statement Evolution

Between 2020 and 2024, Insulet Corporation’s revenue increased significantly by 129%, reaching $2.07B in 2024. Net income exhibited an even more pronounced rise of over 6,000%, culminating at $418M. Margins improved notably, with gross margin at nearly 70% and net margin exceeding 20%, reflecting enhanced profitability and operational efficiency over the period.

Is the Income Statement Favorable?

The 2024 income statement displays strong fundamentals, characterized by a 22% revenue growth and a 66% increase in net margin year-over-year. Operating expenses grew proportionally, supporting sustainable expansion. EBIT margin at 16.55% and a low interest expense ratio of 2.06% contribute to a favorable profitability profile, confirming robust financial health and efficient cost management.

Financial Ratios

The table below presents key financial ratios for Insulet Corporation (PODD) over the fiscal years 2020 to 2024, offering insight into profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 0.8% | 1.5% | 0.4% | 12.2% | 20.2% |

| ROE | 1.1% | 3.0% | 1.0% | 28.2% | 34.5% |

| ROIC | 2.1% | 5.6% | 0.9% | 9.7% | 11.7% |

| P/E | 2434 | 1072 | 4440 | 73 | 44 |

| P/B | 27.4 | 32.4 | 42.9 | 20.7 | 15.1 |

| Current Ratio | 6.0 | 5.8 | 3.6 | 3.5 | 3.5 |

| Quick Ratio | 5.2 | 4.4 | 2.6 | 2.6 | 2.7 |

| D/E | 1.78 | 2.31 | 3.01 | 1.98 | 1.17 |

| Debt-to-Assets | 57.5% | 62.8% | 63.6% | 56.0% | 46.1% |

| Interest Coverage | 1.1 | 2.0 | 1.0 | 6.1 | 7.2 |

| Asset Turnover | 0.48 | 0.54 | 0.58 | 0.66 | 0.67 |

| Fixed Asset Turnover | 1.83 | 2.01 | 2.09 | 2.45 | 2.73 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2020 to 2024, Insulet Corporation’s Return on Equity (ROE) improved notably, reaching 34.52% in 2024, signaling increased profitability. The Current Ratio remained relatively stable but declined slightly to 3.54 in 2024, indicating sustained liquidity though with some decrease. The Debt-to-Equity Ratio decreased from over 3.0 in 2022 to 1.17 in 2024, reflecting a reduction in leverage and improved financial structure.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (20.19%) and ROE (34.52%) are favorable, supported by strong interest coverage (8.03). Liquidity is mixed: the quick ratio is favorable at 2.73, but the current ratio is considered unfavorable at 3.54. Leverage ratios show a neutral to unfavorable stance, with debt-to-equity at 1.17. Market valuation ratios like P/E (43.74) and P/B (15.1) are unfavorable. Overall, the financial ratios present a neutral profile for investors.

Shareholder Return Policy

Insulet Corporation (PODD) does not pay dividends, reflecting a reinvestment strategy likely aligned with its growth phase. The absence of dividend payouts corresponds with a focus on operational expansion rather than immediate shareholder distributions.

The company’s policy includes no share buybacks, emphasizing capital retention for internal use. This approach supports sustainable long-term value creation by prioritizing growth and innovation over short-term returns.

Score analysis

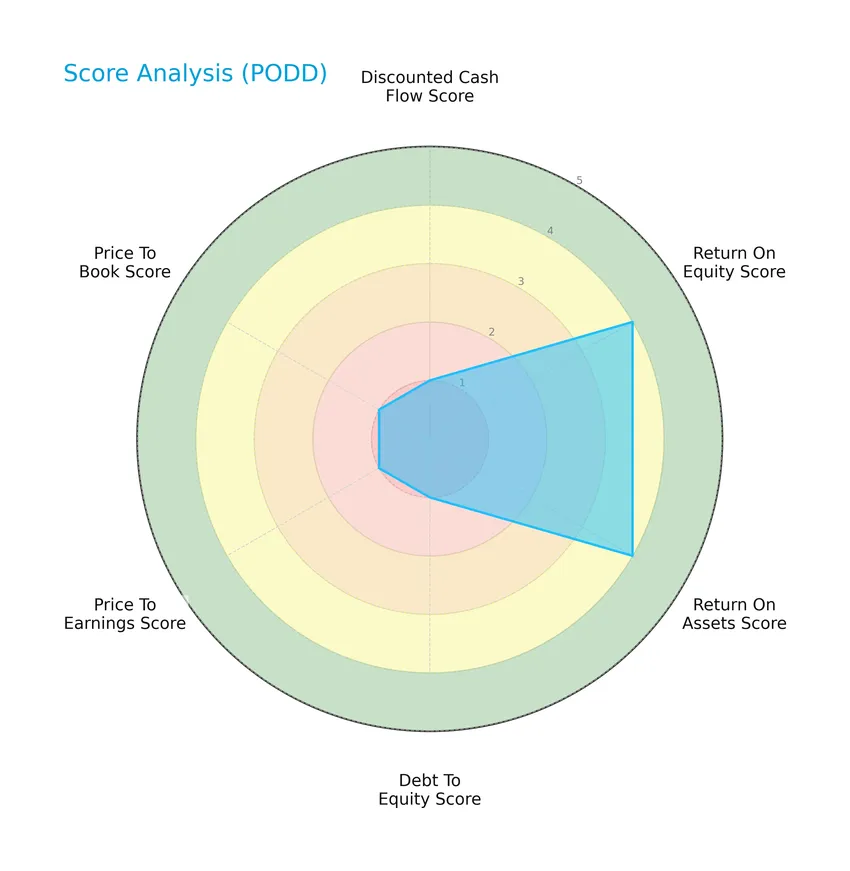

Here is a radar chart illustrating the key financial scores for Insulet Corporation:

The scores reveal a mixed financial profile: strong returns on equity and assets (both scoring 4), contrasted by very unfavorable valuations and leverage metrics, including discounted cash flow, debt-to-equity, price-to-earnings, and price-to-book scores, all rated 1.

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that Insulet Corporation is in the safe zone, suggesting a low risk of bankruptcy based on its financial ratios:

Is the company in good financial health?

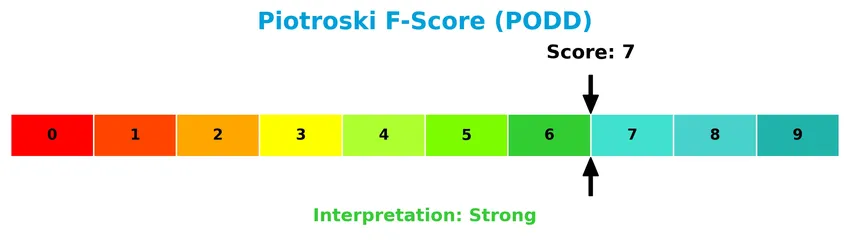

The Piotroski Score diagram highlights the company’s financial strength with a score indicating strong health:

With a Piotroski Score of 7, Insulet Corporation demonstrates solid financial health, reflecting strong profitability, liquidity, and operational efficiency. This score suggests a robust financial position relative to its peers.

Competitive Landscape & Sector Positioning

This sector analysis will examine Insulet Corporation’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Insulet holds a competitive advantage within the medical devices industry.

Strategic Positioning

Insulet Corporation concentrates on a specialized product portfolio centered on its Omnipod insulin delivery system, generating $2.07B in Drug Delivery and International Omnipod revenues in 2024. Geographically, it maintains a strong US presence with $1.55B revenue, alongside growing non-US markets at $523M, reflecting focused yet expanding exposure.

Revenue by Segment

This pie chart illustrates Insulet Corporation’s revenue distribution by segment for the fiscal year 2024, highlighting the contributions of Drug Delivery and International Omnipod.

In 2024, International Omnipod remains the dominant revenue driver at 2.03B USD, showing strong consistent growth since 2016. Drug Delivery contributes a much smaller portion, with 39M USD, reflecting a steady decline from previous years. The business is increasingly concentrated in its International Omnipod segment, which continues to accelerate, suggesting a focused growth strategy but also concentration risk.

Key Products & Brands

The following table summarizes Insulet Corporation’s main products and brands along with their descriptions:

| Product | Description |

|---|---|

| Omnipod System | A self-adhesive, disposable, tubeless insulin delivery device worn on the body for up to three days. |

| Personal Diabetes Manager | A wireless handheld device that serves as a companion to the Omnipod System for diabetes management. |

| Drug Delivery | Segment covering drug delivery products related to insulin-dependent diabetes treatment. |

| International Omnipod | Revenue segment representing sales of the Omnipod System outside the United States. |

Insulet Corporation primarily generates revenue through its Omnipod System and related diabetes management devices, with significant international sales growth in recent years.

Main Competitors

There are 10 main competitors in the Healthcare Medical – Devices sector; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Abbott Laboratories | 216B |

| Boston Scientific Corporation | 140B |

| Stryker Corporation | 133B |

| Medtronic plc | 123B |

| Edwards Lifesciences Corporation | 50B |

| DexCom, Inc. | 26B |

| STERIS plc | 25B |

| Insulet Corporation | 19.9B |

| Zimmer Biomet Holdings, Inc. | 17.8B |

| Align Technology, Inc. | 11.2B |

Insulet Corporation ranks 8th among its top 10 competitors by market capitalization, holding about 8.8% of the market cap of the sector leader Abbott Laboratories. It is positioned below both the average market cap of 76.3B for the top 10 and the sector median of 38.1B. The company maintains a 28.7% market cap gap with the next competitor above, indicating a significant difference in scale within this competitive landscape.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does PODD have a competitive advantage?

Insulet Corporation does not yet demonstrate a clear competitive advantage, as its return on invested capital (ROIC) remains below the weighted average cost of capital (WACC), indicating it is currently shedding value. However, the company shows a favorable trend with growing ROIC and robust income statement metrics, including a 20.19% net margin and a 22% revenue growth in the last year.

Looking ahead, Insulet’s expansion into non-US markets and ongoing sales of its Omnipod insulin delivery system suggest potential growth opportunities. The company’s strong product portfolio and international presence may support future profitability improvements and market penetration.

SWOT Analysis

This SWOT analysis highlights Insulet Corporation’s key internal and external factors to guide investment decisions.

Strengths

- strong revenue growth of 129% over 5 years

- high net margin at 20.19%

- innovative Omnipod insulin delivery system

Weaknesses

- high P/E ratio of 43.74 indicating expensive valuation

- debt-to-equity ratio of 1.17 signaling leverage risk

- no dividend yield limiting income investors

Opportunities

- expanding international sales with Non-US revenue growth

- growing global diabetes market demand

- potential to improve operational efficiencies further

Threats

- intense competition in medical devices sector

- regulatory and reimbursement challenges

- currency fluctuations impacting international sales

Insulet shows robust profitability and growth driven by innovation but carries valuation and leverage concerns. The strategy should focus on managing financial risks while capitalizing on global market expansion opportunities.

Stock Price Action Analysis

The weekly stock chart below illustrates Insulet Corporation’s price movements and volatility over the past 12 months:

Trend Analysis

Over the past 12 months, Insulet Corporation’s stock price increased by 60.47%, indicating a bullish trend. The price ranged between a low of 164.31 and a high of 348.43, with a standard deviation of 53.28, reflecting significant volatility. However, the trend shows deceleration recently, with a negative 15.08% change from November 2025 to January 2026.

Volume Analysis

Trading volume over the last three months has been decreasing, with seller dominance evident as sellers accounted for 75% of the volume. This seller-driven activity suggests waning investor confidence and reduced market participation for Insulet Corporation’s stock during this period.

Target Prices

The consensus among analysts for Insulet Corporation (PODD) shows a generally optimistic outlook with a solid target range.

| Target High | Target Low | Consensus |

|---|---|---|

| 450 | 274 | 378.9 |

Analysts expect PODD’s stock price to move within a range of 274 to 450, with a consensus target near 379, indicating confidence in its growth potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding Insulet Corporation’s performance and products.

Stock Grades

The following table presents the latest verified grades for Insulet Corporation from recognized financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Downgrade | Underweight | 2026-01-12 |

| Bernstein | Maintain | Outperform | 2026-01-09 |

| Truist Securities | Maintain | Buy | 2025-12-18 |

| Canaccord Genuity | Maintain | Buy | 2025-12-17 |

| Canaccord Genuity | Maintain | Buy | 2025-11-24 |

| BTIG | Maintain | Buy | 2025-11-21 |

| Truist Securities | Maintain | Buy | 2025-11-21 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| UBS | Upgrade | Buy | 2025-11-19 |

| BTIG | Maintain | Buy | 2025-11-13 |

Most analysts continue to favor Insulet with buy or outperform ratings, though Barclays recently downgraded to underweight, indicating some divergence in outlook among major firms. The overall consensus remains positive.

Consumer Opinions

Consumers of Insulet Corporation (PODD) generally express strong appreciation for the company’s innovative medical devices, though some concerns about product pricing and customer service remain.

| Positive Reviews | Negative Reviews |

|---|---|

| “The Omnipod system has transformed my diabetes management—it’s discreet and easy to use.” | “Customer support response times can be slow, which is frustrating during urgent issues.” |

| “I appreciate the waterproof design and the freedom it gives me during physical activities.” | “The cost of replacement pods is quite high and not always covered by insurance.” |

| “Setup and integration with my glucose monitor were straightforward and reliable.” | “Occasionally, pods fail prematurely, which disrupts my treatment schedule.” |

Overall, customers praise Insulet’s device innovation and usability, but frequently mention pricing and customer service as areas needing improvement.

Risk Analysis

Below is a summary table highlighting key risks related to Insulet Corporation, focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | High P/E (43.7) and P/B (15.1) ratios indicate potential overvaluation. | High | High |

| Financial Leverage | Debt-to-equity ratio of 1.17 suggests moderate leverage concerns. | Medium | Medium |

| Market Volatility | Beta of 1.4 shows above-average stock price fluctuations relative to market. | High | Medium |

| Liquidity Risk | Unfavorable current ratio (3.54) despite favorable quick ratio (2.73). | Medium | Medium |

| Competitive Risk | Intense competition in medical device sector could pressure margins. | Medium | High |

| Regulatory Risk | Changes in healthcare regulations may affect product approvals and sales. | Low | High |

The most critical risks for Insulet are valuation concerns due to stretched multiples and market volatility amplified by its beta of 1.4. Despite strong profitability and financial health scores, these factors may lead to price corrections. Investors should also monitor debt levels and regulatory developments closely.

Should You Buy Insulet Corporation?

Insulet Corporation appears to be exhibiting improving profitability with a growing ROIC, suggesting a slightly favorable competitive moat, while its leverage profile could be seen as substantial; overall, the company’s financial health might be interpreted as moderate with a C+ rating.

Strength & Efficiency Pillars

Insulet Corporation (PODD) exhibits solid profitability with a net margin of 20.19% and a return on equity (ROE) of 34.52%, underscoring efficient capital use. Its return on invested capital (ROIC) stands at 11.68%, comfortably above the weighted average cost of capital (WACC) at 9.96%, confirming the company as a value creator. Financial health indicators are robust, with an Altman Z-score of 9.05 placing it well within the safe zone and a strong Piotroski score of 7, which signals strong operational and financial strength over recent periods.

Weaknesses and Drawbacks

Despite its operational strengths, Insulet faces valuation headwinds. The price-to-earnings (P/E) ratio is elevated at 43.74, indicating a premium valuation that may not appeal to value-focused investors. The price-to-book (P/B) ratio at 15.1 further suggests the stock is priced high relative to its net assets. Leverage is a concern; the debt-to-equity ratio of 1.17 points to significant indebtedness, while a current ratio of 3.54 is marked unfavorable, implying potential liquidity management inefficiencies. Additionally, recent market activity is seller dominant with buyer volume at just 25.05%, creating short-term pressure.

Our Verdict about Insulet Corporation

Insulet’s long-term fundamental profile appears favorable due to strong profitability and financial stability, combined with its status as a value creator. However, despite a bullish overall stock trend with a 60.47% gain, the recent seller-dominant period suggesting a 15.08% price decline might caution investors. Therefore, while the company may appear attractive for long-term exposure, recent market pressure suggests a wait-and-see approach could be prudent for timing an entry.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Insulet Corporation $PODD Shares Sold by Teacher Retirement System of Texas – MarketBeat (Jan 24, 2026)

- Declining Stock and Solid Fundamentals: Is The Market Wrong About Insulet Corporation (NASDAQ:PODD)? – Yahoo Finance (Jan 05, 2026)

- Insulet Corporation $PODD Shares Sold by Baillie Gifford & Co. – MarketBeat (Jan 24, 2026)

- Is Insulet (PODD) the Future of Diabetes Management? – The Motley Fool (Jan 21, 2026)

- How (PODD) Movements Inform Risk Allocation Models – Stock Traders Daily (Jan 24, 2026)

For more information about Insulet Corporation, please visit the official website: insulet.com