Home > Analyses > Technology > indie Semiconductor, Inc.

indie Semiconductor, Inc. is transforming the automotive experience through cutting-edge semiconductor technologies that enhance safety, connectivity, and user interaction. As a key player in the automotive semiconductor industry, indie delivers innovative solutions for driver assistance, in-cabin wireless charging, infotainment, and electrification. Renowned for its advanced photonic components and software integration, the company stands at the forefront of automotive innovation. The critical question for investors is whether indie’s current fundamentals and market position justify its growth prospects and valuation in this rapidly evolving sector.

Table of contents

Business Model & Company Overview

indie Semiconductor, Inc., founded in 2007 and headquartered in Aliso Viejo, California, stands as a key player in the semiconductor industry. It delivers a cohesive ecosystem of automotive semiconductors and software solutions focused on advanced driver assistance systems, connected car technologies, and electrification applications. This portfolio integrates devices for parking assistance, in-cabin wireless charging, infotainment, LED lighting, and telematics, positioning the company at the forefront of automotive innovation.

The company’s revenue engine balances hardware components with software solutions, addressing diverse automotive needs across global markets including the Americas, Europe, and Asia. Its offerings extend into photonic components and optical communication technologies, creating value through high-performance, integrated systems. This strategic mix underpins indie Semiconductor’s competitive advantage, safeguarding its role in shaping the future of automotive electronics and connectivity.

Financial Performance & Fundamental Metrics

I will analyze indie Semiconductor, Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

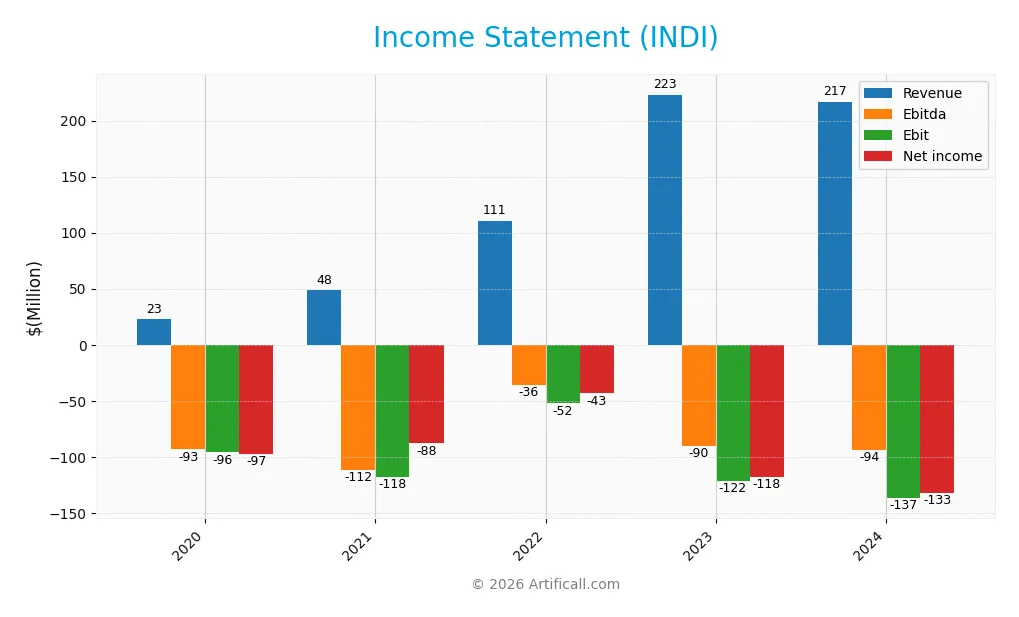

The table below summarizes the annual income statement figures for indie Semiconductor, Inc. (INDI) over the past five fiscal years, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 22.6M | 48.4M | 110.8M | 223.2M | 216.7M |

| Cost of Revenue | 13.0M | 28.7M | 60.5M | 278.3M | 126.4M |

| Operating Expenses | 28.8M | 94.5M | 169.4M | 80.3M | 260.4M |

| Gross Profit | 9.6M | 19.7M | 50.3M | -55.1M | 90.3M |

| EBITDA | -93.5M | -111.7M | -35.7M | -89.9M | -93.9M |

| EBIT | -96.1M | -117.7M | -52.4M | -121.8M | -137.0M |

| Interest Expense | 2.2M | 1.2M | 1.7M | 8.7M | 9.3M |

| Net Income | -97.5M | -88.0M | -43.4M | -117.6M | -132.6M |

| EPS | -0.78 | -1.10 | -0.37 | -0.81 | -0.76 |

| Filing Date | 2020-12-31 | 2022-04-11 | 2023-03-28 | 2024-02-29 | 2025-03-03 |

Income Statement Evolution

Between 2020 and 2024, indie Semiconductor, Inc. experienced a significant revenue increase of 858.35%, although revenue slightly declined by 2.91% from 2023 to 2024. Gross profit showed notable improvement, growing 263.85% year-over-year and achieving a favorable margin of 41.68%. However, net income remained negative, with a decline of 36.01% over the period, and net margin stayed unfavorable at -61.2%, despite a margin improvement of 85.81%.

Is the Income Statement Favorable?

In 2024, indie Semiconductor posted revenue of $217M but sustained a net loss of $133M, reflecting a net margin of -61.2%. Operating expenses exceeded revenue, contributing to an unfavorable EBIT margin of -63.22%. Interest expense was modest at 4.27% of revenue, considered favorable. While earnings per share improved slightly by 6.17%, the overall income statement presents mixed fundamentals, balancing favorable gross margin against continued net losses, resulting in a neutral evaluation.

Financial Ratios

The table below summarizes key financial ratios for indie Semiconductor, Inc. over recent fiscal years to facilitate comparative analysis:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -4.31 | -1.82 | -0.39 | -0.53 | -0.61 |

| ROE | 0.88 | -0.28 | -0.14 | -0.26 | -0.32 |

| ROIC | 0.24 | -0.17 | -0.21 | -0.19 | -0.19 |

| P/E | -16.95 | -9.53 | -15.94 | -10.01 | -5.35 |

| P/B | -14.98 | 2.68 | 2.21 | 2.64 | 1.70 |

| Current Ratio | 0.25 | 7.36 | 5.85 | 1.96 | 4.82 |

| Quick Ratio | 0.22 | 7.09 | 5.64 | 1.72 | 4.23 |

| D/E | -0.19 | 0.03 | 0.59 | 0.39 | 0.95 |

| Debt-to-Assets | 0.59 | 0.02 | 0.30 | 0.21 | 0.42 |

| Interest Coverage | -8.77 | -60.36 | -70.41 | -15.66 | -18.37 |

| Asset Turnover | 0.64 | 0.10 | 0.18 | 0.27 | 0.23 |

| Fixed Asset Turnover | 10.42 | 4.37 | 3.97 | 5.48 | 4.30 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

From 2021 to 2024, indie Semiconductor, Inc. experienced a decline in Return on Equity (ROE), worsening from -28.12% in 2021 to -31.73% in 2024, indicating increasing losses relative to equity. The Current Ratio showed a significant reduction from 7.36 in 2021 to 4.82 in 2024, although it remains high, signaling strong liquidity. The Debt-to-Equity Ratio increased notably, from 0.03 in 2021 to 0.95 in 2024, reflecting a higher reliance on debt financing. Profitability margins remained negative throughout, with net margins deteriorating to -61.2% in 2024.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (-61.2%), ROE (-31.73%), and return on invested capital (-19.25%) were unfavorable, indicating continued losses. Liquidity ratios showed mixed signals: the Current Ratio was unfavorable at 4.82, while the Quick Ratio was favorable at 4.23, reflecting good short-term asset coverage. Leverage ratios like Debt-to-Equity (0.95) and Debt-to-Assets (42.34%) were neutral, suggesting moderate debt levels. Efficiency was challenged with an unfavorable asset turnover of 0.23, but fixed asset turnover was favorable at 4.3. Overall, the global financial ratios evaluation for 2024 is unfavorable.

Shareholder Return Policy

indie Semiconductor, Inc. does not pay dividends, reflecting ongoing negative net income and a reinvestment focus. The company shows no dividend payout, yield, or per-share distribution, consistent with its high-growth phase and negative free cash flow per share.

While no share buyback programs are reported, this approach aligns with prioritizing R&D and operating investments. The lack of shareholder distributions appears consistent with sustainable long-term value creation given current financial challenges and strategic growth objectives.

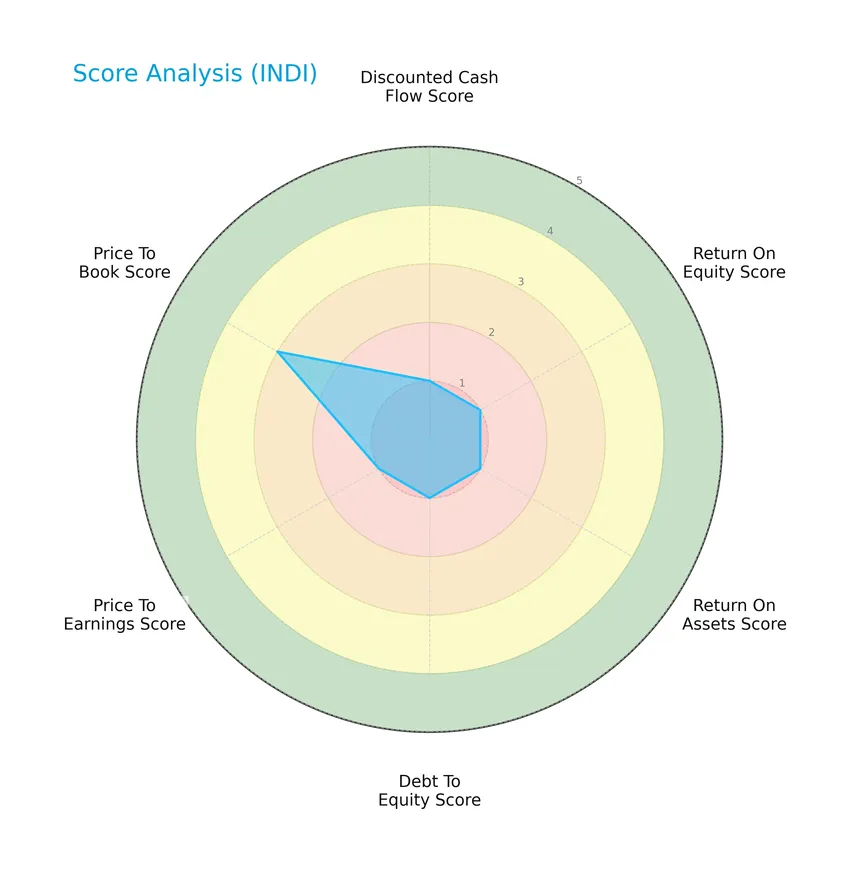

Score analysis

The radar chart below presents an overview of indie Semiconductor, Inc.’s key financial scores across valuation, profitability, and leverage metrics:

The scores indicate very unfavorable results for discounted cash flow, return on equity, return on assets, debt to equity, and price to earnings, each scoring 1. Price to book is slightly better at a moderate score of 3, reflecting some relative valuation support.

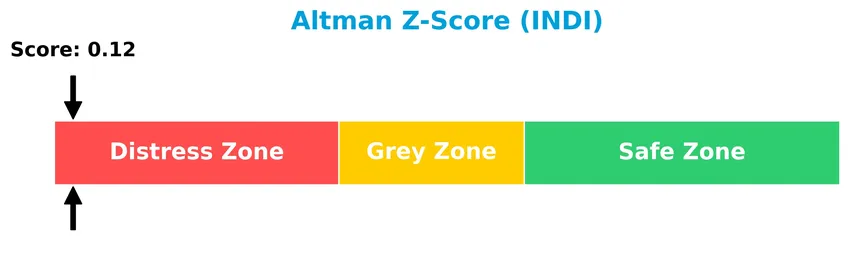

Analysis of the company’s bankruptcy risk

The Altman Z-Score places indie Semiconductor, Inc. in the distress zone, indicating a high probability of financial distress and bankruptcy risk:

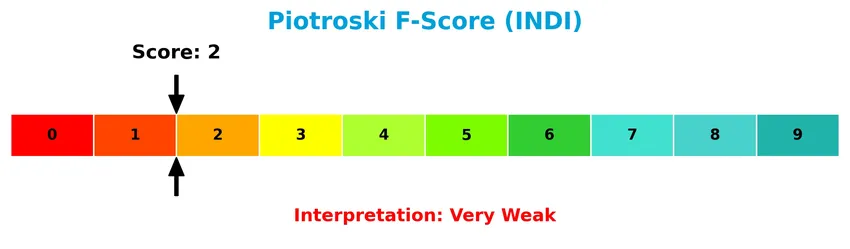

Is the company in good financial health?

The Piotroski Score chart provides insight into the company’s financial strength based on nine accounting criteria:

With a very weak Piotroski Score of 2, indie Semiconductor, Inc. shows poor financial health and limited indicators of operational or balance sheet improvement.

Competitive Landscape & Sector Positioning

This section provides an analysis of indie Semiconductor, Inc.’s sector positioning, including strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will evaluate whether indie Semiconductor holds a competitive advantage over its peers in the semiconductor industry.

Strategic Positioning

indie Semiconductor, Inc. focuses primarily on automotive semiconductors and software, with a product-dominant revenue mix reaching $203M in 2024 versus $14M in services. Geographically, it shows significant exposure to China ($98M) and the US ($38M), complemented by Europe and Asia Pacific markets, reflecting a moderately diversified global footprint.

Revenue by Segment

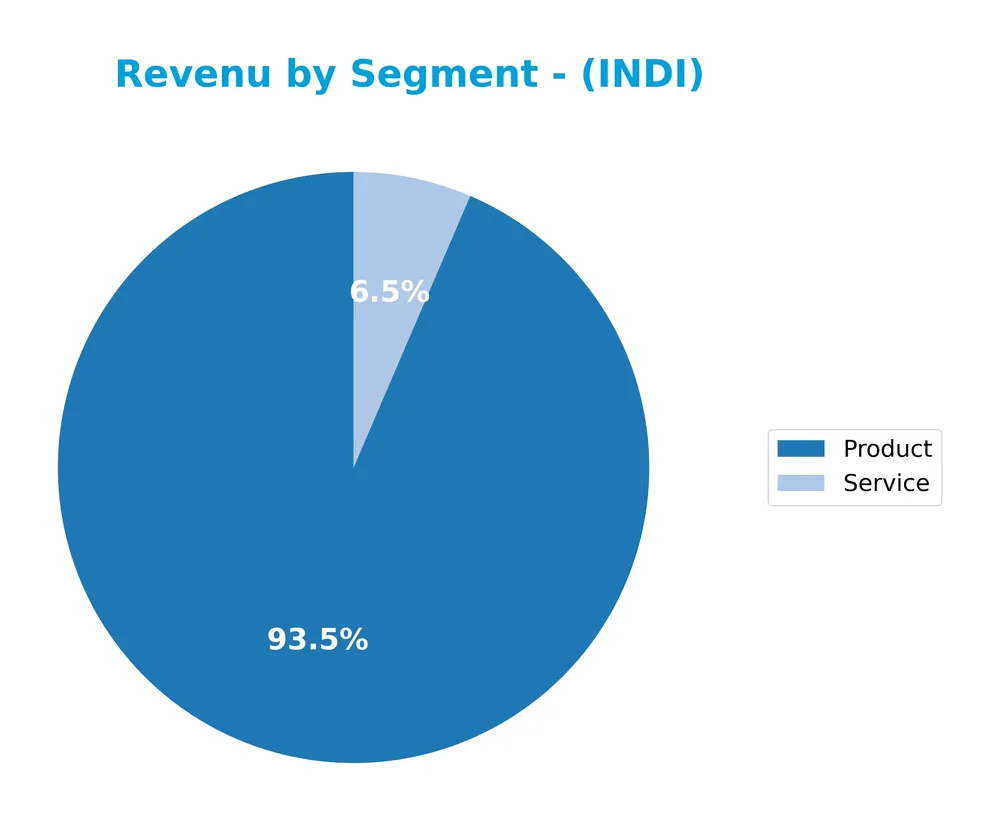

This pie chart illustrates indie Semiconductor, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the contributions from Service and Product lines.

The Product segment consistently dominates indie Semiconductor’s revenue, reaching $203M in 2024, showing strong growth since 2021. Meanwhile, Service revenue has fluctuated, peaking at $27.5M in 2023 before declining to $14M in 2024. The trend suggests increasing reliance on Product sales, with a recent slowdown in Service revenue, which may signal a shift in business focus or potential concentration risk.

Key Products & Brands

The table below presents indie Semiconductor, Inc.’s main products and brands along with their descriptions:

| Product | Description |

|---|---|

| Automotive Semiconductors | Devices supporting advanced driver assistance, connected car features, user experience, and electrification in vehicles. |

| Ultrasound Systems | Technology used for parking assistance applications in automobiles. |

| In-Cabin Wireless Charging | Solutions enabling wireless charging inside the vehicle cabin. |

| Infotainment & LED Lighting | Products enhancing user experience through entertainment and lighting systems. |

| Telematics & Cloud Access | Connectivity components facilitating vehicle communication and data access. |

| Photonic Components | Includes fiber Bragg gratings, low noise lasers, athermal and tunable packaging, photonic integration, and electronics for laser systems, optical sensing, and communication markets. |

indie Semiconductor focuses on automotive semiconductors and software solutions across a range of applications, including driver assistance, connectivity, and advanced photonic technologies, supporting the evolving automotive technology ecosystem.

Main Competitors

There are 38 competitors in the semiconductors industry, with the following table showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

indie Semiconductor, Inc. ranks 36th among 38 competitors, with a market cap just 0.02% of the leader NVIDIA. The company is positioned well below both the average market cap of the top 10 competitors (975B) and the sector median (31B). Its market cap is approximately 3.89% smaller than the next closest competitor above it, emphasizing a significant gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does INDI have a competitive advantage?

indie Semiconductor, Inc. does not currently present a competitive advantage as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company’s income statement shows a mixed performance with favorable gross margin but unfavorable EBIT and net margins, reflecting ongoing operational challenges.

Looking ahead, indie Semiconductor offers diversified automotive semiconductor and software solutions targeting advanced driver assistance, connected cars, and electrification applications, alongside photonic components for optical markets. These product lines and expanding geographic markets, including growth in Asia Pacific and Europe, may provide future opportunities, although profitability and value creation remain key concerns.

SWOT Analysis

This SWOT analysis highlights indie Semiconductor, Inc.’s key internal and external factors to guide strategic investment decisions.

Strengths

- strong revenue growth over 2020-2024

- diversified automotive semiconductor applications

- solid gross margin of 41.68%

Weaknesses

- negative net margin of -61.2%

- declining EBIT and net income

- very weak financial health scores (Altman Z-score, Piotroski)

Opportunities

- expanding electric vehicle market

- growth in connected car technologies

- increasing demand for advanced driver assistance systems

Threats

- intense semiconductor industry competition

- high beta indicating stock volatility

- geopolitical risks affecting key markets like China

Indie Semiconductor shows promising top-line growth and product diversity but struggles with profitability and financial stability. Its strategy should focus on improving operational efficiency and capital structure while leveraging growth trends in automotive electrification and connectivity. Caution is warranted due to significant financial weakness and market risks.

Stock Price Action Analysis

The weekly stock chart for indie Semiconductor, Inc. (INDI) illustrates price movements and volume trends over the past 12 months:

Trend Analysis

Over the past 12 months, INDI’s stock price declined by 34.84%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 7.43 and a low of 1.6, with a standard deviation of 1.34, reflecting significant volatility. Recent weeks show a smaller 4.49% decline with low volatility and a near-flat slope.

Volume Analysis

Trading volume has been increasing overall, totaling over 2B shares, with sellers slightly dominating at 52% historically. In the recent three months, seller dominance strengthened, with buyer volume at 38.93%, suggesting cautious or negative investor sentiment and higher market participation on the sell side.

Target Prices

The consensus target price for indie Semiconductor, Inc. (INDI) presents a clear outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 8 | 8 | 8 |

Analysts uniformly expect the stock to reach $8, indicating a stable and focused price target.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding indie Semiconductor, Inc. (INDI).

Stock Grades

Here are the most recent verified grades for indie Semiconductor, Inc. from established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Neutral | 2025-11-10 |

| Benchmark | Maintain | Buy | 2025-06-25 |

| Benchmark | Maintain | Buy | 2025-06-11 |

| Benchmark | Maintain | Buy | 2025-05-21 |

| Benchmark | Maintain | Buy | 2025-05-13 |

| Craig-Hallum | Maintain | Buy | 2025-05-13 |

| Keybanc | Maintain | Overweight | 2025-05-13 |

| Benchmark | Maintain | Buy | 2025-04-09 |

| Benchmark | Maintain | Buy | 2025-02-21 |

| Keybanc | Maintain | Overweight | 2025-02-21 |

The consensus across these grades leans clearly towards a Buy, with Benchmark consistently maintaining a Buy rating and Keybanc holding an Overweight stance, while UBS remains neutral, reflecting a generally positive outlook with some caution.

Consumer Opinions

Consumers have mixed feelings about indie Semiconductor, Inc., reflecting both appreciation for innovation and concerns over product consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “Impressive chip performance and energy efficiency.” | “Customer service response times could improve.” |

| “Innovative technology that meets automotive needs.” | “Occasional delays in product delivery.” |

| “Strong commitment to sustainability and quality.” | “Higher pricing compared to competitors.” |

Overall, customers praise indie Semiconductor for its cutting-edge technology and sustainability efforts, although some express frustration with service delays and pricing, indicating areas for potential improvement.

Risk Analysis

Below is a summary table presenting the key risks associated with indie Semiconductor, Inc., including their probability and potential impact on investment decisions:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Company is in financial distress with a low Altman Z-Score of 0.12 indicating bankruptcy risk | High | Very High |

| Profitability | Negative net margin (-61.2%) and poor return on equity (-31.73%) affect earnings stability | High | High |

| Market Volatility | High beta (2.54) implies stock price is highly sensitive to market fluctuations | High | Medium |

| Liquidity | Strong quick ratio (4.23) but unfavorable current ratio suggests mixed liquidity conditions | Medium | Medium |

| Debt Levels | Debt to equity near 1 and debt to assets at 42.34% pose moderate leverage risk | Medium | Medium |

| Operational Efficiency | Low asset turnover (0.23) shows inefficiency in using assets to generate revenue | Medium | Medium |

| Dividend Policy | No dividend payout, reducing appeal for income-focused investors | High | Low |

The most critical risks lie in the company’s financial distress and poor profitability metrics, reinforced by its Altman Z-Score in the distress zone and a very weak Piotroski Score of 2. These factors signal a high risk of bankruptcy and ongoing operational challenges. Investors should exercise caution given the company’s current financial instability and market volatility.

Should You Buy indie Semiconductor, Inc.?

Indie Semiconductor, Inc. appears to be facing significant challenges with deteriorating profitability and a very unfavorable competitive moat indicating value destruction. Despite a manageable debt profile, the overall C- rating and weak financial scores suggest a cautious analytical interpretation of its investment profile.

Strength & Efficiency Pillars

indie Semiconductor, Inc. shows pockets of operational strength, notably a robust gross margin of 41.68% and a quick ratio of 4.23, indicating solid short-term liquidity. The company’s fixed asset turnover at 4.3 suggests efficient use of tangible assets to generate revenue. However, key profitability metrics such as ROIC at -19.25% and ROE at -31.73% remain deeply negative, with ROIC well below the WACC of 11.61%, signaling that indie Semiconductor is currently not a value creator. Financial health metrics are concerning, as reflected by an Altman Z-score of 0.12 placing the firm in the distress zone, alongside a very weak Piotroski score of 2.

Weaknesses and Drawbacks

The company faces substantial headwinds. Its net margin is deeply negative at -61.2%, compounded by a negative EBIT margin of -63.22%, highlighting persistent profitability challenges. Valuation metrics show a negative P/E ratio (-5.35), which may reflect ongoing losses, while the P/B ratio of 1.7 signals a moderate premium that might not justify the risk. Leverage indicators reveal mixed signals with a neutral debt-to-equity ratio of 0.95, but an unfavorable interest coverage ratio of -14.8, indicating difficulty in servicing debt. Market dynamics are also adverse, with a bearish overall stock trend and seller dominance in recent trading (buyer dominance only 38.93%), creating short-term pressure on share price.

Our Verdict about indie Semiconductor, Inc.

The long-term fundamental profile of indie Semiconductor appears unfavorable due to persistent negative profitability and financial distress signals. Despite some operational efficiencies, the bearish technical trend and recent seller dominance suggest caution. Therefore, although the company might appear to have certain strengths, the current profile suggests a wait-and-see approach may be prudent before considering exposure, as market pressure and fundamental weaknesses persist.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Traders Purchase Large Volume of indie Semiconductor Put Options (NASDAQ:INDI) – MarketBeat (Jan 23, 2026)

- indie Sets Date for Fourth Quarter and 2025 Earnings Release and Conference Call – Business Wire (Jan 22, 2026)

- indie Semiconductor, Inc. (INDI) Closing in on Profitability amid Backlog Growth – Yahoo Finance (Nov 18, 2025)

- Indie Semiconductor: Loaded For The Next Wave (NASDAQ:INDI) – Seeking Alpha (Jan 06, 2026)

- Does indie Semiconductor (NASDAQ:INDI) Have A Healthy Balance Sheet? – simplywall.st (Jan 08, 2026)

For more information about indie Semiconductor, Inc., please visit the official website: indiesemi.com