Home > Analyses > Healthcare > Incyte Corporation

Incyte Corporation transforms lives by pioneering cutting-edge therapies for complex cancers and immune disorders. Its flagship drug, JAKAFI, sets industry standards in treating rare blood diseases, while a robust pipeline fuels innovation across oncology and immunology. Known for strategic collaborations and scientific rigor, Incyte commands respect in biotechnology. As market dynamics shift, I ask: does Incyte’s current valuation fully reflect its growth potential and clinical promise?

Table of contents

Business Model & Company Overview

Incyte Corporation, founded in 1991 and headquartered in Wilmington, Delaware, stands as a biopharmaceutical leader specializing in proprietary therapeutics. Its core mission centers on pioneering treatments across oncology and hematology, creating an integrated ecosystem of innovative drugs like JAKAFI and PEMAZYRE that address diverse and critical medical needs. The company’s 2.6K-strong workforce fuels its robust pipeline and global collaborations, reinforcing its dominant industry stature.

Incyte’s revenue engine balances commercialized drugs with cutting-edge clinical-stage candidates, driving value through both established products and promising trials. Its footprint spans the Americas, Europe, and Asia, leveraging partnerships with pharmaceutical giants to accelerate growth. This strategic blend of innovation, market presence, and collaboration fortifies Incyte’s economic moat, positioning it as a key architect in the future of biotech therapeutics.

Financial Performance & Fundamental Metrics

I analyze Incyte Corporation’s income statement, key financial ratios, and dividend payout policy to assess its operational efficiency and shareholder value creation.

Income Statement

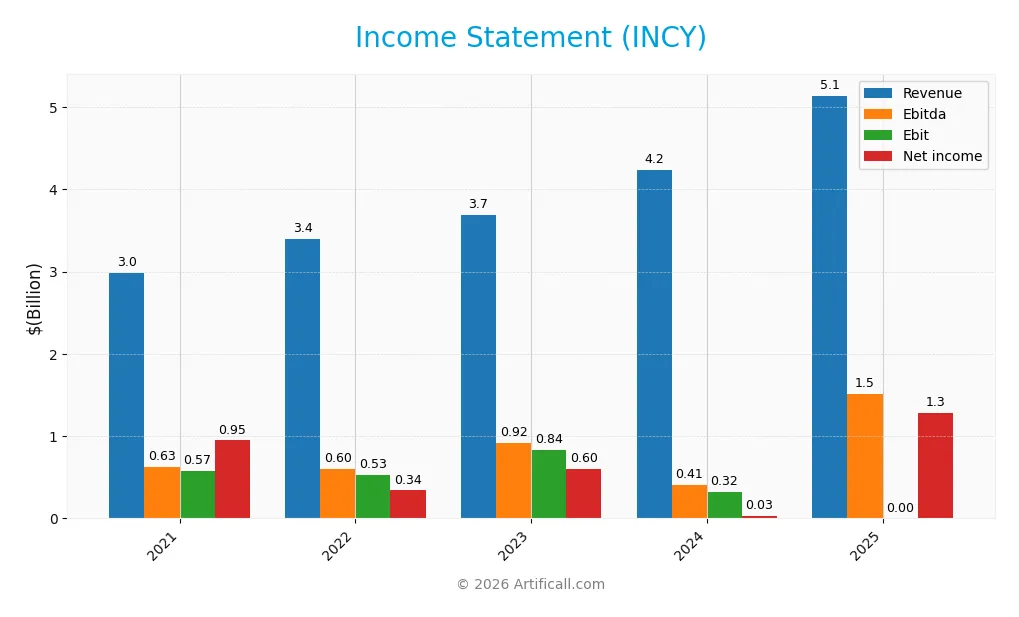

The table below summarizes Incyte Corporation’s key income statement figures over the past five fiscal years, reflecting revenue growth and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 2.99B | 3.39B | 3.70B | 4.24B | 5.14B |

| Cost of Revenue | 187M | 253M | 315M | 378M | 372M |

| Operating Expenses | 2.16B | 2.54B | 2.73B | 3.78B | 3.43B |

| Gross Profit | 2.80B | 3.14B | 3.38B | 3.86B | 4.77B |

| EBITDA | 630M | 600M | 919M | 408M | 1.51B |

| EBIT | 572M | 532M | 837M | 319M | 0 |

| Interest Expense | 2M | 3M | 3M | 2M | 2M |

| Net Income | 949M | 341M | 598M | 33M | 1.29B |

| EPS | 4.30 | 1.53 | 2.67 | 0.16 | 6.59 |

| Filing Date | 2022-02-08 | 2023-02-07 | 2024-02-16 | 2025-02-10 | 2026-02-10 |

Income Statement Evolution

From 2021 to 2025, Incyte’s revenue rose 72% to $5.1B, reflecting strong top-line growth. Net income expanded 36% to $1.29B over the period, despite a 21% decline in net margin. Gross margin remained robust near 93%, signaling efficient cost control, while EBIT margin collapsed to zero in 2025, indicating margin pressure at the operating level.

Is the Income Statement Favorable?

The 2025 income statement shows a solid $5.1B revenue and $1.29B net income, yielding a healthy 25% net margin. Favorable revenue and gross profit growth, alongside controlled operating expenses, support this strength. However, EBIT margin fell sharply to zero, highlighting operating profitability challenges. Overall, the fundamentals appear favorable but warrant monitoring for margin recovery risks.

Financial Ratios

The table below presents key financial ratios for Incyte Corporation over the last five fiscal years, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 31.8% | 10.0% | 16.2% | 0.8% | 25.0% |

| ROE | 25.2% | 7.8% | 11.5% | 0.9% | 18.5% |

| ROIC | 15.6% | 8.2% | 8.4% | 0.2% | 17.8% |

| P/E | 17.1 | 52.3 | 23.5 | 438.6 | 15.0 |

| P/B | 4.29 | 4.08 | 2.71 | 4.15 | 2.77 |

| Current Ratio | 3.65 | 3.54 | 3.75 | 1.97 | 0 |

| Quick Ratio | 3.62 | 3.50 | 3.69 | 1.94 | 0 |

| D/E | 0.01 | 0.01 | 0.01 | 0.01 | 0 |

| Debt-to-Assets | 0.9% | 0.7% | 0.6% | 0.8% | 0 |

| Interest Coverage | 334 | 225 | 255 | 35 | -624 |

| Asset Turnover | 0.61 | 0.58 | 0.54 | 0.78 | 0.74 |

| Fixed Asset Turnover | 3.97 | 4.43 | 4.76 | 5.34 | 6.78 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Return on Equity (ROE) showed a significant recovery by 2025, reaching 18.5%, after a low point near 1% in 2024. The Current Ratio was stable and healthy above 3.5 from 2021 to 2023 but dropped to zero in 2025, indicating a concerning liquidity shift. Debt-to-Equity remained consistently low, signaling minimal leverage and stable capital structure.

Are the Financial Ratios Favorable?

In 2025, profitability metrics like net margin (25%) and ROE (18.5%) were favorable, reflecting strong earnings versus equity. Leverage ratios, including debt-to-equity and debt-to-assets, were also favorable, indicating low financial risk. However, liquidity ratios were unfavorable due to a zero current ratio, raising caution. Market valuation ratios such as P/E were attractive at 15, while asset turnover was neutral, resulting in an overall favorable financial ratio profile.

Shareholder Return Policy

Incyte Corporation does not pay dividends, reflecting its focus on reinvestment and growth. The company has consistently reported a zero dividend payout ratio and yield, indicating a strategy centered on capital allocation toward operations rather than shareholder distributions.

Although share buyback data is not explicitly stated, the absence of dividends suggests prioritization of R&D and acquisitions. This approach aligns with sustainable long-term value creation, provided that operational margins and profitability remain strong, as evidenced by recent net profit margins near 25%.

Score analysis

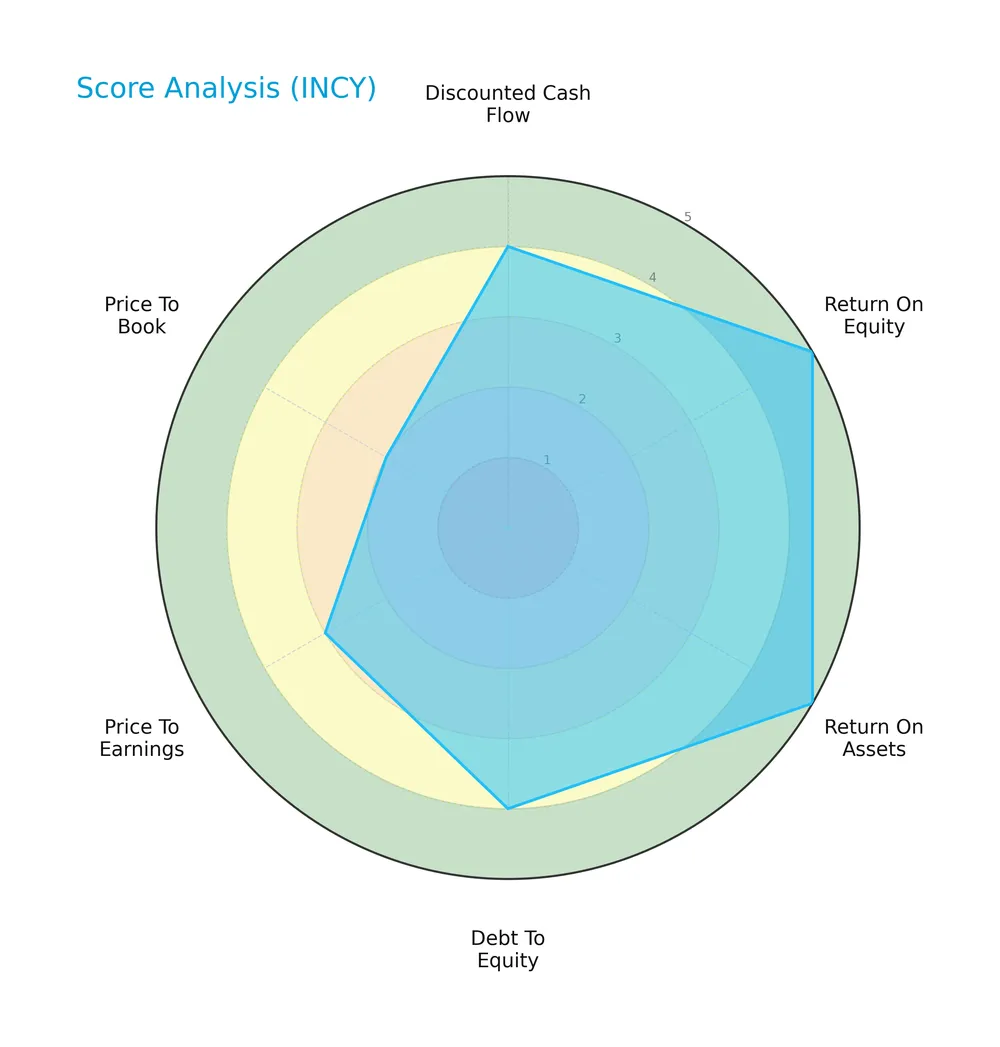

The radar chart below illustrates Incyte Corporation’s key financial scores across valuation and profitability metrics:

Incyte scores favorably in discounted cash flow (4) and debt-to-equity (4), with very strong returns on equity (5) and assets (5). Price-to-earnings is moderate (3), while price-to-book lags with an unfavorable score (2).

Is the company in good financial health?

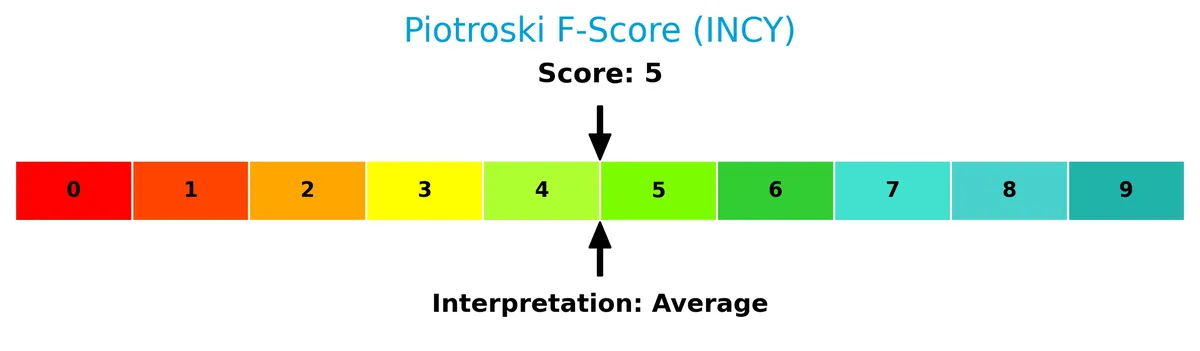

The Piotroski diagram highlights Incyte’s financial strength based on nine fundamental criteria:

With a Piotroski Score of 5, Incyte shows average financial health, indicating moderate strength but room to improve in profitability and efficiency metrics.

Competitive Landscape & Sector Positioning

This analysis explores Incyte Corporation’s strategic positioning within the biotechnology sector. It will review revenue streams, key products, and main competitors. I will assess whether Incyte holds a competitive advantage over its peers.

Strategic Positioning

Incyte concentrates its portfolio on proprietary therapeutics, led by JAKAFI with $3.2B revenue in 2024. It diversifies with kinase inhibitors and royalties across oncology and immunology. Geographically, the company relies heavily on the U.S. market, generating $4B, with growing but smaller European exposure at $260M.

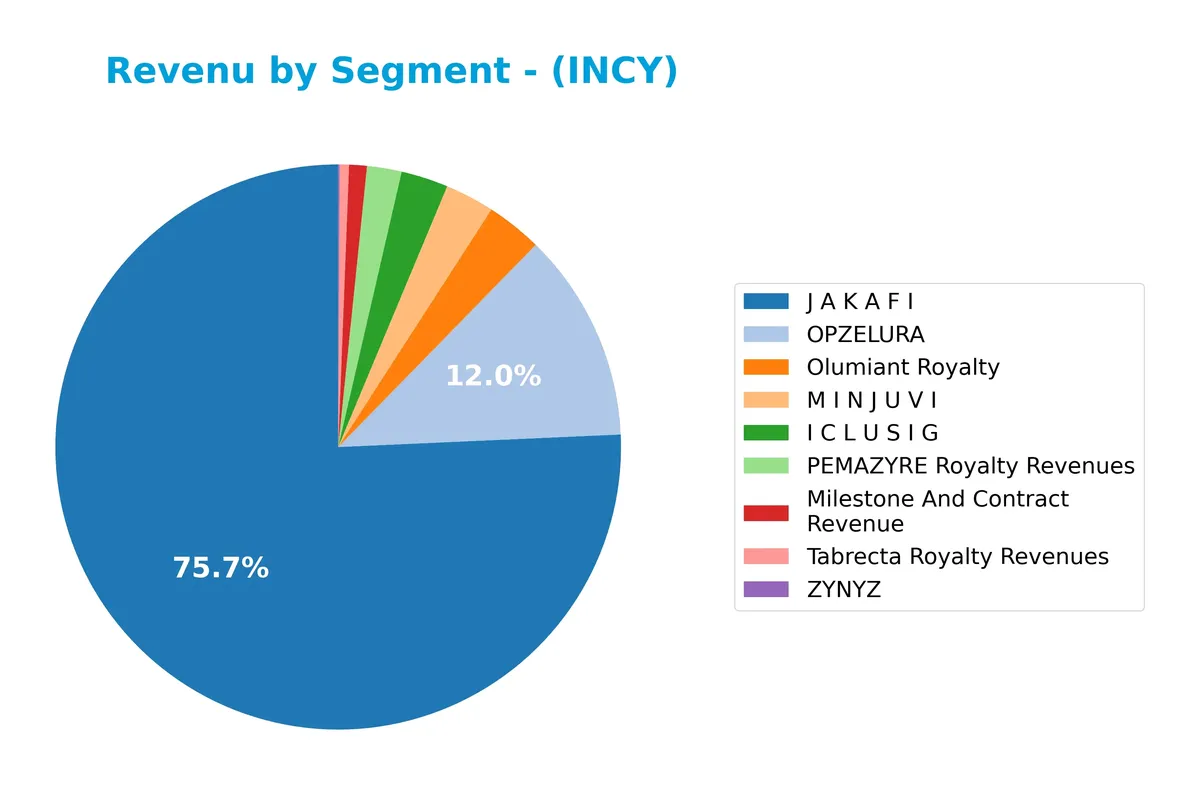

Revenue by Segment

The pie chart presents Incyte Corporation’s revenue distribution by product segment for fiscal year 2024, reflecting the company’s diversified biotech portfolio.

Jakafi dominates Incyte’s revenue with $3.2B, underscoring its pivotal role in the portfolio. Opzelura follows at $508M, showing strong growth momentum. Smaller segments like Iclusig ($114M) and Minjuvi ($119M) contribute but remain minor. Milestone and contract revenues have declined to $43M, signaling reduced one-time gains. The revenue concentration in Jakafi raises concentration risk, though recent expansions in Opzelura diversify growth avenues.

Key Products & Brands

The table below outlines Incyte Corporation’s key products and brands with their primary therapeutic uses:

| Product | Description |

|---|---|

| JAKAFI | Drug treating myelofibrosis and polycythemia vera, representing the largest revenue contributor. |

| PEMAZYRE | Fibroblast growth factor receptor kinase inhibitor targeting various liquid and solid tumors. |

| ICLUSIG | Kinase inhibitor for chronic myeloid leukemia and Philadelphia-chromosome positive acute lymphoblastic leukemia. |

| OPZELURA | Product with growing revenue, used in dermatological conditions (specific indications not detailed). |

| MINJUVI | Therapeutic product with notable revenue, specific indication not provided in the data. |

| Olumiant Royalty | Royalty revenue from Olumiant, a product developed externally but licensed to Incyte. |

| Tabrecta Royalty Revenues | Royalty income from Tabrecta, indicating a licensing or partnership arrangement. |

| Zynyz | Small revenue-generating product; detailed description not included. |

| Milestone And Contract Revenue | Income from partnership milestones and contracts, reflecting collaborations and licensing deals. |

Incyte’s portfolio centers on oncology and hematology, with JAKAFI as the flagship drug. The company derives significant royalties and contract revenues, showing diversified income streams from collaborations and licensing.

Main Competitors

Incyte Corporation faces competition from 5 key players, with the table highlighting the top 5 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Vertex Pharmaceuticals Incorporated | 116B |

| Regeneron Pharmaceuticals, Inc. | 80.2B |

| Incyte Corporation | 19.9B |

| Moderna, Inc. | 12.1B |

| Bio-Techne Corporation | 9.4B |

Incyte ranks 3rd among its competitors, with a market cap approximately 17% of the leader, Vertex Pharmaceuticals. The company sits below both the average market cap of the top 10 competitors (47.5B) and the median sector market cap (19.9B). It holds a solid 308% gap above its closest rival, Moderna, highlighting a meaningful scale advantage in third place.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does INCY have a competitive advantage?

Incyte Corporation demonstrates a sustainable competitive advantage, evidenced by its ROIC exceeding WACC by over 10%, with a positive ROIC growth trend. This indicates efficient capital use and consistent value creation.

Looking ahead, Incyte’s pipeline includes multiple clinical-stage products targeting cancers and chronic diseases, alongside strategic collaborations with leading pharmaceutical firms. These initiatives could expand its market reach and product portfolio.

SWOT Analysis

This SWOT analysis highlights Incyte Corporation’s core strategic factors shaping its current market stance and future trajectory.

Strengths

- strong revenue growth of 21% in 2025

- high gross margin at 92.8%

- ROIC of 17.8% well above WACC supports value creation

Weaknesses

- unfavorable EBIT margin at 0% signals operational challenges

- zero current and quick ratios pose liquidity risks

- no dividend yield limits income investor appeal

Opportunities

- expanding pipeline in oncology and immunology

- growing European market penetration

- collaborations with pharma leaders enhance R&D potential

Threats

- intense biotech competition pressures pricing

- regulatory hurdles could delay approvals

- dependency on a few key drugs raises concentration risk

Incyte’s strengths in innovation and financial performance offer a solid foundation. However, liquidity concerns and operational margins require close monitoring. The company’s strategy should balance aggressive R&D investment with prudent capital management to sustain its competitive moat.

Stock Price Action Analysis

The weekly stock chart for Incyte Corporation (INCY) shows price movements and volume trends over the past 12 months:

Trend Analysis

Over the past 12 months, INCY’s stock price rose 75.59%, indicating a strong bullish trend. Price volatility is high, with a 15.29 standard deviation. The highest price reached 108.39, the lowest was 51.68. However, recent months show a deceleration in upward momentum.

Volume Analysis

In the last three months, trading volume decreased. Buyer volume accounted for 46%, with sellers slightly dominant. This shift suggests cautious investor sentiment and reduced market participation during this recent period.

Target Prices

Analysts set a clear consensus on Incyte Corporation’s target prices, reflecting moderate optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 84 | 135 | 107.7 |

The target range from $84 to $135 shows expectations for solid upside potential, with a consensus near $108 signaling confidence in growth prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback related to Incyte Corporation (INCY).

Stock Grades

Here is a summary of recent verified analyst grades for Incyte Corporation from reputable firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2026-02-06 |

| Barclays | Maintain | Overweight | 2026-02-04 |

| Wells Fargo | Downgrade | Equal Weight | 2026-01-20 |

| TD Cowen | Maintain | Buy | 2026-01-13 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-06 |

| Mizuho | Upgrade | Outperform | 2025-12-08 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-08 |

| Wells Fargo | Maintain | Overweight | 2025-12-08 |

| Barclays | Maintain | Overweight | 2025-11-24 |

| Piper Sandler | Maintain | Overweight | 2025-11-04 |

The consensus shows a strong bias toward buying, with most firms maintaining overweight or buy ratings. A few hold ratings reflect cautious views, but no major sell actions appear.

Consumer Opinions

Investor sentiment around Incyte Corporation reflects a mix of optimism and caution, highlighting key areas of strength and potential concern.

| Positive Reviews | Negative Reviews |

|---|---|

| Innovative drug pipeline showing strong potential. | High R&D expenses impacting short-term profitability. |

| Solid clinical trial results boosting confidence. | Stock volatility causing investor uncertainty. |

| Strong partnerships enhancing market reach. | Concerns over regulatory hurdles delaying product launches. |

Overall, consumers praise Incyte’s innovation and clinical successes but remain wary of financial pressures and regulatory risks that could affect future growth.

Risk Analysis

Below is a summary table of key risks facing Incyte Corporation, including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Liquidity Risk | Current and quick ratios are 0, signaling potential short-term liquidity constraints. | High | High |

| Interest Coverage | Negative interest coverage raises concerns about ability to service debt if costs rise. | Medium | Medium |

| Regulatory Risk | Biotech firms face strict FDA approvals and potential clinical trial failures. | Medium | High |

| Market Volatility | Stock dropped 8.2% recently, reflecting sector sensitivity and macroeconomic pressures. | High | Medium |

| Competitive Risk | Intense competition in oncology drugs may pressure pricing and market share. | Medium | Medium |

| Collaboration Risk | Dependence on partnerships and clinical collaborations may delay or derail product launches. | Medium | Medium |

Liquidity issues stand out as the most immediate risk, with zero current and quick ratios indicating minimal buffer against cash flow shocks. Regulatory and clinical trial risks remain significant given the biotech sector’s inherent uncertainty. The recent sharp stock decline underscores sensitivity to market and sector dynamics. I advise close monitoring of liquidity metrics and pipeline progress.

Should You Buy Incyte Corporation?

Incyte appears to be a robust value creator with a durable competitive moat supported by growing ROIC exceeding WACC. Despite moderate leverage, its overall rating is strong (A), suggesting operational efficiency and prudent capital allocation could underpin financial resilience.

Strength & Efficiency Pillars

Incyte Corporation exhibits robust profitability, with a net margin of 25.03% and a return on equity (ROE) of 18.49%. Its return on invested capital (ROIC) stands at 17.82%, comfortably exceeding the weighted average cost of capital (WACC) of 7.69%. This gap confirms Incyte as a value creator, generating returns well above its capital costs. The company also maintains a very favorable moat status, driven by a growing ROIC trend of 14.37%, signaling a sustainable competitive advantage and efficient capital allocation.

Weaknesses and Drawbacks

While Incyte’s financial health appears solid, some red flags remain. The current and quick ratios are unavailable or unfavorable, indicating potential liquidity concerns. The interest coverage ratio is near zero, which may signal vulnerability to rising financing costs. Its price-to-book ratio of 2.77 is neutral but approaching a premium valuation. Recent trading shows slight seller dominance at 45.96% buyer volume, suggesting some short-term market pressure despite overall bullish momentum.

Our Final Verdict about Incyte Corporation

Incyte’s profile may appear attractive given its strong profitability and value creation. However, the slight seller dominance in the recent period calls for a cautious, wait-and-see approach. The company’s robust operational metrics and moat suggest long-term potential, but investors should monitor liquidity and market sentiment closely before allocating capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Why Incyte (INCY) Stock Is Nosediving – Yahoo Finance (Feb 10, 2026)

- Incyte (INCY) Reports Strong Q4 and Annual Revenue Growth – GuruFocus (Feb 10, 2026)

- Incyte Corporation Q4 Profit Increases, Beats Estimates – Nasdaq (Feb 10, 2026)

- Earnings call transcript: Incyte’s Q4 2025 revenue beats estimates, stock dips – Investing.com (Feb 10, 2026)

- Incyte (NASDAQ:INCY) Posts Quarterly Earnings Results, Misses Estimates By $0.16 EPS – MarketBeat (Feb 10, 2026)

For more information about Incyte Corporation, please visit the official website: incyte.com