Home > Analyses > Industrials > Illinois Tool Works Inc.

Illinois Tool Works shapes the backbone of global manufacturing with precision-engineered components that power countless industries. From automotive assemblies to advanced food equipment, ITW’s innovation fuels production lines worldwide. It commands a diverse portfolio spanning welding, polymers, and specialty products, underscoring its industrial leadership and operational resilience. As market dynamics evolve, I ask: does ITW’s solid foundation still justify its premium valuation and promising growth trajectory?

Table of contents

Business Model & Company Overview

Illinois Tool Works Inc., founded in 1912 and headquartered in Glenview, Illinois, stands as a global leader in the industrial machinery sector. Its core business integrates seven diverse segments—from Automotive OEM components to Food Equipment and Welding—creating a synergistic ecosystem that addresses varied industrial needs with precision and innovation. The company’s scale and specialization underscore its dominant role in serving automotive, construction, and industrial markets worldwide.

The company’s revenue engine balances hardware manufacturing with software-enabled test and measurement solutions, alongside recurring services like equipment maintenance and consumables supply. Illinois Tool Works commands a strategic presence across the Americas, Europe, and Asia, distributing directly and via distributors. Its competitive advantage stems from a diversified portfolio and deep customer integration, cementing a durable economic moat that shapes industrial innovation globally.

Financial Performance & Fundamental Metrics

I analyze Illinois Tool Works Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

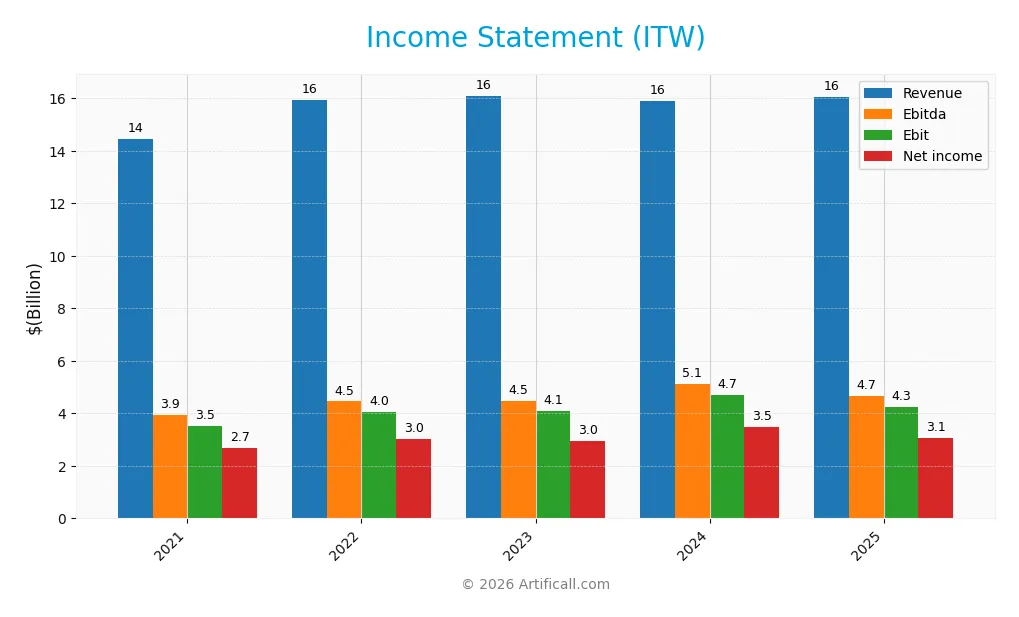

Income Statement

The table below summarizes Illinois Tool Works Inc.’s key income statement figures for the fiscal years 2021 through 2025, reflecting revenue, expenses, profit, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 14.5B | 15.9B | 16.1B | 15.9B | 16.0B |

| Cost of Revenue | 8.6B | 9.6B | 9.4B | 8.9B | 8.9B |

| Operating Expenses | 2.4B | 2.6B | 2.6B | 2.7B | 2.9B |

| Gross Profit | 5.8B | 6.4B | 6.7B | 6.9B | 7.1B |

| EBITDA | 3.9B | 4.5B | 4.5B | 5.1B | 4.6B |

| EBIT | 3.5B | 4.0B | 4.1B | 4.7B | 4.3B |

| Interest Expense | 202M | 203M | 266M | 283M | 292M |

| Net Income | 2.7B | 3.0B | 3.0B | 3.5B | 3.1B |

| EPS | 8.55 | 9.80 | 9.77 | 11.75 | 10.52 |

| Filing Date | 2022-02-11 | 2023-02-10 | 2024-02-09 | 2025-02-14 | 2026-02-13 |

Income Statement Evolution

Illinois Tool Works (ITW) showed a modest revenue growth of 0.92% in 2025, slowing compared to a 10.99% increase over 2021-2025. Net income declined 12.9% in 2025 but grew 13.81% over the full period. Gross margin remained stable around 44%, while net margin slightly contracted, reflecting margin pressures despite solid operating efficiency.

Is the Income Statement Favorable?

In 2025, ITW’s fundamentals remain favorable with a 44.1% gross margin and a 26.54% EBIT margin, both strong by industrial standards. Interest expense is controlled at 1.82% of revenue, supporting a 19.11% net margin. However, recent declines in net income and EPS growth signal caution amid a challenging environment. Overall, the income statement displays resilient profitability but highlights near-term margin headwinds.

Financial Ratios

The table below summarizes key financial ratios for Illinois Tool Works Inc. (ITW) over the last five fiscal years, reflecting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 19% | 19% | 18% | 22% | 19% |

| ROE | 74% | 98% | 98% | 105% | 95% |

| ROIC | 21% | 24% | 25% | 27% | 24% |

| P/E | 29 | 22 | 27 | 22 | 23 |

| P/B | 21 | 22 | 26 | 23 | 22 |

| Current Ratio | 1.84 | 1.41 | 1.33 | 1.36 | 1.21 |

| Quick Ratio | 1.35 | 0.95 | 0.97 | 0.99 | 0.89 |

| D/E | 2.17 | 2.57 | 2.78 | 2.44 | 2.78 |

| Debt-to-Assets | 49% | 52% | 54% | 54% | 56% |

| Interest Coverage | 17.2 | 18.7 | 15.2 | 15.1 | 14.4 |

| Asset Turnover | 0.90 | 1.03 | 1.04 | 1.06 | 0.99 |

| Fixed Asset Turnover | 7.99 | 8.62 | 7.24 | 6.91 | 7.19 |

| Dividend Yield | 1.9% | 2.3% | 2.0% | 2.3% | 2.5% |

Evolution of Financial Ratios

Over the period, Return on Equity (ROE) showed strong improvement, peaking at 105% in 2024 before slightly dipping to 95% in 2025. The Current Ratio steadily declined from 1.84 in 2021 to 1.21 in 2025, indicating reduced liquidity. Debt-to-Equity Ratio increased from 2.17 in 2021 to 2.78 in 2025, signaling rising leverage. Profitability remained solid, with net margins consistently near 19–22%.

Are the Financial Ratios Favorable?

In 2025, profitability ratios including ROE (95%) and net margin (19.1%) are favorable, reflecting efficient capital use and earnings quality. Liquidity ratios, such as the Current Ratio (1.21) and Quick Ratio (0.89), are neutral, suggesting adequate short-term coverage but tighter than prior years. Leverage is unfavorable, with Debt-to-Equity at 2.78 and Debt-to-Assets at 55.5%, raising credit risk concerns. Market valuation ratios show mixed signals, with a neutral P/E of 23.5 but an unfavorable Price-to-Book ratio above 22. Overall, the financial profile is slightly favorable but warrants careful risk monitoring.

Shareholder Return Policy

Illinois Tool Works maintains a consistent dividend policy, with a payout ratio around 54-58% and a dividend yield near 2.5% in 2025. The company supports dividends through free cash flow and also engages in share buybacks, balancing distributions with capital allocation.

This approach reflects a stable commitment to returning capital while preserving cash flow for operations. The dividend coverage and buyback activity suggest sustainable long-term shareholder value creation, though leverage ratios warrant monitoring for financial prudence.

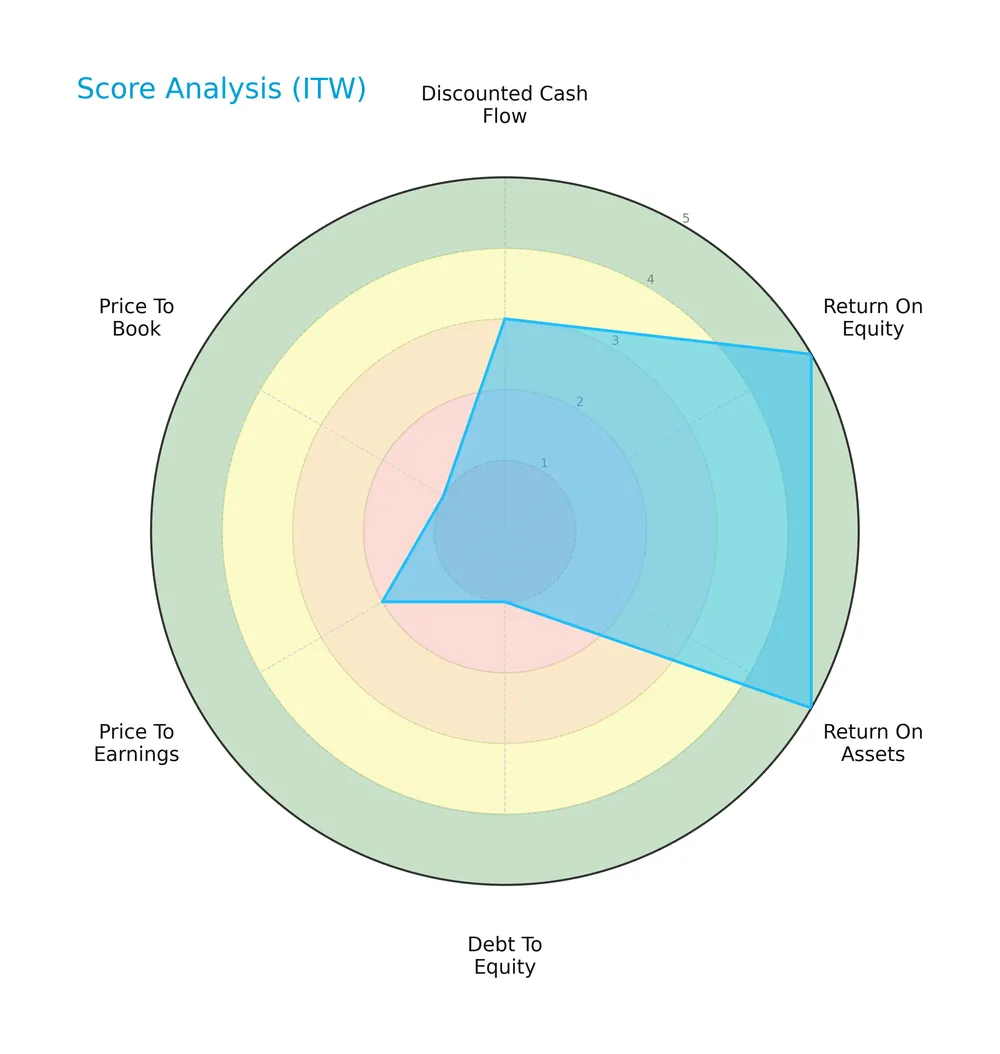

Score analysis

The radar chart below displays key valuation and financial performance scores for Illinois Tool Works Inc.:

Illinois Tool Works shows strong profitability with top scores in ROE and ROA at 5 each. However, its leverage and valuation metrics lag, with very unfavorable debt-to-equity and price-to-book scores of 1. The discounted cash flow and price-to-earnings scores remain moderate to unfavorable.

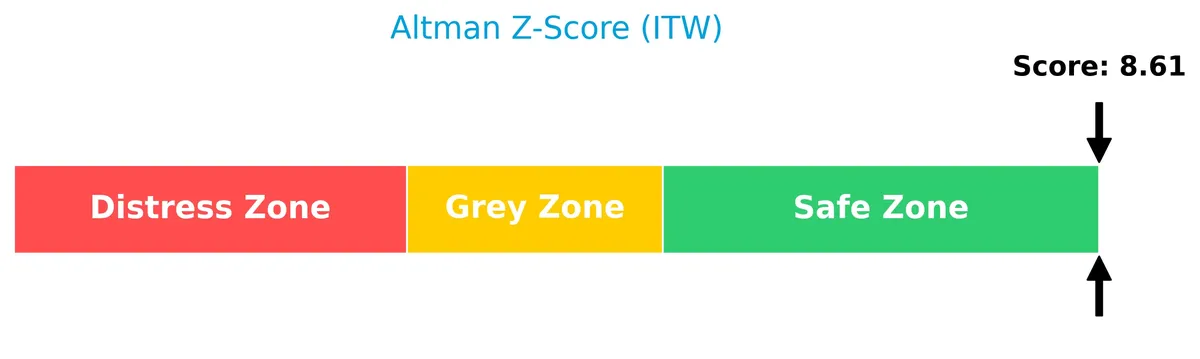

Analysis of the company’s bankruptcy risk

Illinois Tool Works’ Altman Z-Score places it firmly in the safe zone, indicating a low risk of bankruptcy:

Is the company in good financial health?

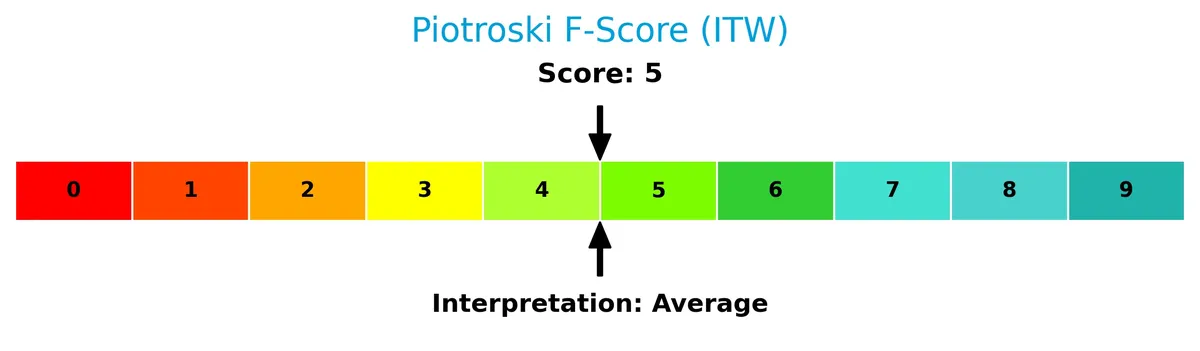

The Piotroski Score diagram provides insight into Illinois Tool Works’ overall financial strength:

With a Piotroski Score of 5, the company shows average financial health. This score suggests moderate strength but leaves room for improvement in profitability, leverage, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis explores Illinois Tool Works Inc.’s strategic positioning, revenue segments, key products, competitors, and competitive advantages. I will assess whether ITW holds a sustainable competitive edge over its main industry rivals.

Strategic Positioning

Illinois Tool Works Inc. maintains a highly diversified portfolio across seven industrial segments, including Automotive OEM, Food Equipment, and Welding. Geographically, it generates substantial revenue in North America and Europe, with growing exposure in Asia Pacific, reflecting broad market reach and balanced sector exposure.

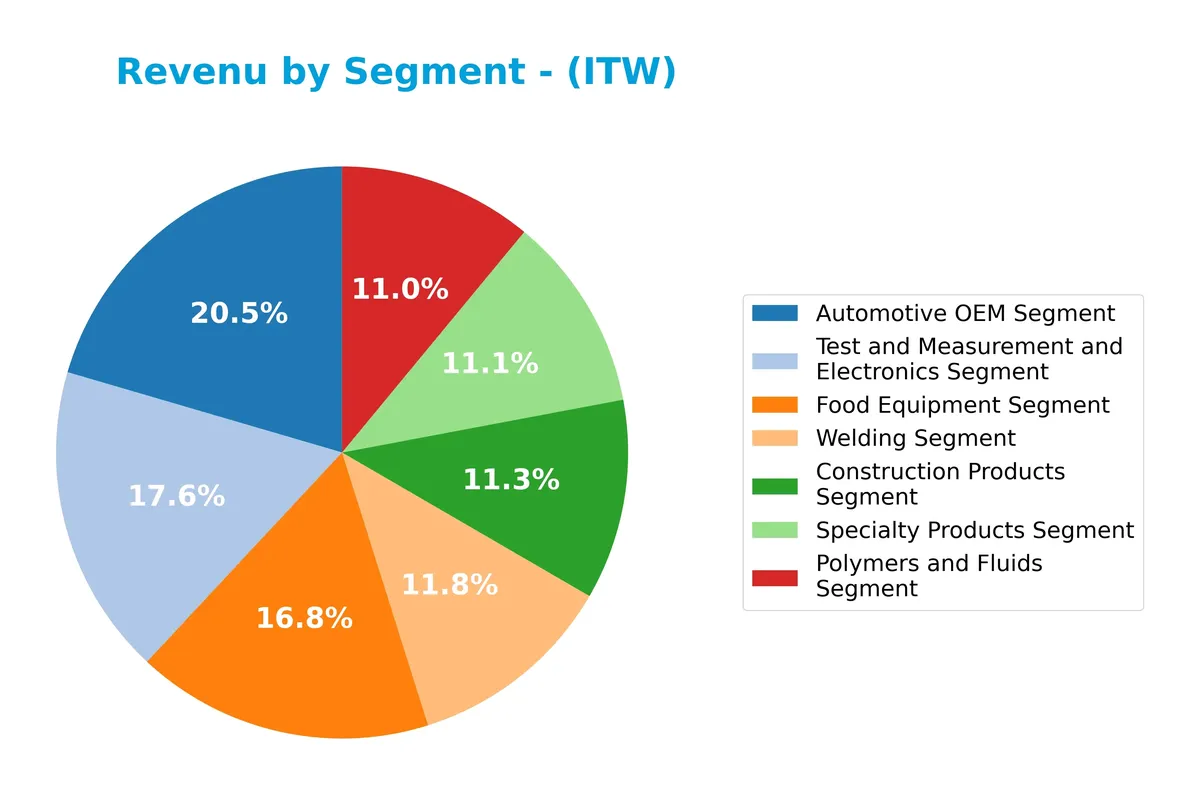

Revenue by Segment

This pie chart illustrates Illinois Tool Works Inc.’s revenue breakdown by segment for fiscal year 2025, highlighting the contributions of each business unit to the total sales.

In 2025, the Automotive OEM segment leads with $3.29B, closely followed by Test and Measurement and Electronics at $2.83B. Food Equipment also generates significant revenue at $2.70B. Construction Products and Welding segments show moderate scale, while Specialty Products and Polymers and Fluids remain steady. The recent year sees slight growth in Automotive OEM, signaling a stable core driver, while other segments hold steady without major shifts, indicating balanced diversification with moderate concentration risk.

Key Products & Brands

Illinois Tool Works Inc. operates through seven diverse segments, each offering specialized industrial products and equipment:

| Product | Description |

|---|---|

| Automotive OEM Segment | Plastic and metal components, fasteners, and assemblies for automobiles, light trucks, and industrial uses. |

| Food Equipment Segment | Warewashing, refrigeration, cooking, food processing equipment, ventilation, pollution control, and services. |

| Test & Measurement and Electronics | Equipment, consumables, and software for material testing, electronics production, and microelectronics. |

| Welding Segment | Arc welding equipment, metal arc welding consumables, and related accessories. |

| Polymers & Fluids Segment | Adhesives, sealants, lubrication, cutting fluids, and polymers for auto aftermarket maintenance and appearance. |

| Construction Products Segment | Engineered fastening systems for residential, renovation, and commercial construction markets. |

| Specialty Products Segment | Beverage packaging equipment, product coding and marking equipment, and appliance components and fasteners. |

These segments reflect ITW’s broad industrial exposure, serving automotive, food service, construction, and general industrial markets globally.

Main Competitors

There are 24 competitors in total; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eaton Corporation plc | 127B |

| Parker-Hannifin Corporation | 114B |

| Howmet Aerospace Inc. | 85B |

| Emerson Electric Co. | 76B |

| Illinois Tool Works Inc. | 73B |

| Cummins Inc. | 72B |

| AMETEK, Inc. | 48B |

| Roper Technologies, Inc. | 47B |

| Rockwell Automation, Inc. | 45B |

| Symbotic Inc. | 36B |

Illinois Tool Works Inc. ranks 5th among its 24 competitors. Its market cap is 69% of the top player Eaton Corporation. The company sits above both the average market cap of the top 10 (72B) and the sector median (32B). It maintains a 12.6% gap from its nearest larger rival, Emerson Electric.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ITW have a competitive advantage?

Illinois Tool Works Inc. presents a clear competitive advantage, demonstrated by a very favorable moat status and a ROIC exceeding its WACC by nearly 16%, signaling strong value creation. The company’s growing ROIC trend further confirms its ability to sustain profitability above industry cost of capital.

Looking ahead, ITW leverages diversified segments across automotive, food equipment, and industrial markets, positioning it well for expansion. Opportunities in emerging geographic regions and innovation in specialty products may support future growth despite recent revenue softness.

SWOT Analysis

This analysis highlights Illinois Tool Works Inc.’s key internal and external factors to inform strategic decisions.

Strengths

- strong ROIC of 24.5% well above WACC

- diversified industrial product segments

- solid net margin at 19.1%

Weaknesses

- high debt-to-equity ratio at 2.78

- elevated price-to-book ratio at 22.32

- modest recent revenue growth under 1%

Opportunities

- expanding in Asia Pacific and Europe markets

- innovation in industrial automation

- growing aftermarket services

Threats

- rising raw material costs

- global economic slowdown risks

- intense competition in machinery sector

Illinois Tool Works shows a robust competitive moat and profitability but must address leverage and valuation concerns. Strategic focus on geographic expansion and innovation can offset macroeconomic headwinds.

Stock Price Action Analysis

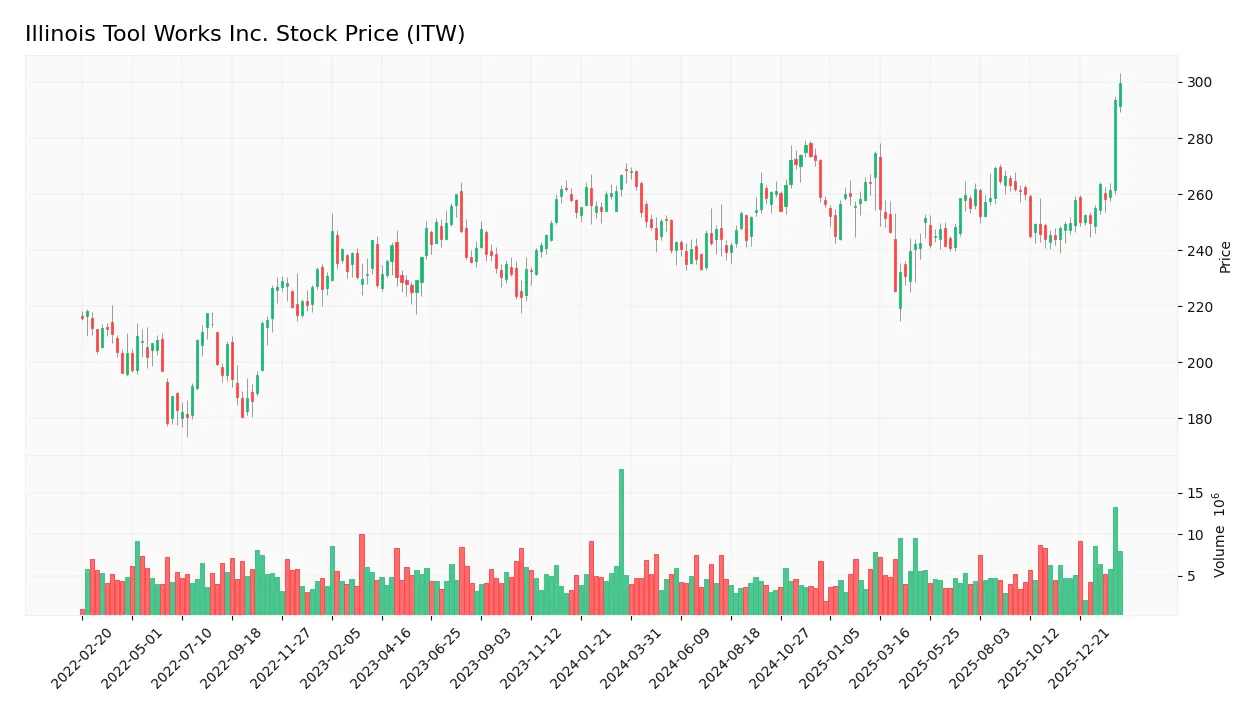

The weekly stock chart for Illinois Tool Works Inc. (ITW) illustrates price movements and trend shifts over the past 12 months:

Trend Analysis

Over the past 12 months, ITW’s stock rose 11.52%, reflecting a bullish trend with acceleration. Price ranged from a low of 225.57 to a high of 299.6. Volatility is moderate with a standard deviation of 12.23, indicating fluctuating but upward momentum.

Volume Analysis

Trading volume has increased, totaling 623M shares over the last three months. Buyer volume leads at 53.4%, signaling buyer-driven activity. Recent periods show stronger buyer dominance at 76%, suggesting growing investor confidence and market participation.

Target Prices

Analysts present a confident target consensus for Illinois Tool Works Inc. (ITW).

| Target Low | Target High | Consensus |

|---|---|---|

| 253 | 285 | 272.29 |

The target price range reflects bullish expectations, with consensus pointing to a solid upside near 272. This indicates strong analyst confidence in ITW’s growth prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide insights into Illinois Tool Works Inc.’s market perception.

Stock Grades

Here are the latest verified analyst grades for Illinois Tool Works Inc. from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Underweight | 2026-02-09 |

| Citigroup | Maintain | Neutral | 2026-02-04 |

| Wells Fargo | Maintain | Underweight | 2026-02-04 |

| Wells Fargo | Maintain | Underweight | 2026-01-07 |

| Goldman Sachs | Downgrade | Sell | 2025-12-16 |

| B of A Securities | Upgrade | Neutral | 2025-11-18 |

| Barclays | Maintain | Underweight | 2025-10-27 |

| Wells Fargo | Maintain | Underweight | 2025-10-27 |

| Truist Securities | Maintain | Hold | 2025-10-27 |

| Truist Securities | Maintain | Hold | 2025-10-08 |

The overall grading trend leans toward cautious sentiment, with multiple underweight and hold ratings prevailing. Notably, Goldman Sachs recently downgraded the stock to Sell, while B of A Securities offered a neutral upgrade, reflecting mixed analyst views.

Consumer Opinions

Illinois Tool Works Inc. receives mixed consumer feedback reflecting its strong industrial reputation and occasional operational challenges.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable product quality and durability | Customer service response times lag |

| Strong innovation in industrial tools | Pricing perceived as high |

| Efficient and timely delivery | Limited product availability in some regions |

Consumers consistently praise ITW’s product reliability and innovation. However, recurring concerns about customer service and pricing suggest areas needing improvement to enhance overall satisfaction.

Risk Analysis

Below is a summary table outlining key risks facing Illinois Tool Works Inc. in 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Leverage Risk | High debt-to-equity ratio (2.78) and debt-to-assets (55.54%) increase financial leverage. | Medium | High |

| Valuation Risk | Unfavorable price-to-book ratio (22.32) suggests potential overvaluation. | Medium | Medium |

| Liquidity Risk | Current ratio (1.21) and quick ratio (0.89) are neutral but warrant monitoring. | Low | Medium |

| Market Volatility | Beta of 1.159 implies above-market volatility sensitivity. | Medium | Medium |

| Earnings Variability | Moderate Piotroski score (5) signals average financial strength and earnings stability. | Medium | Medium |

Leverage risk stands out as the most concerning. Illinois Tool Works carries significant debt relative to equity and assets, which could pressure the balance sheet during economic downturns. The firm’s Altman Z-score of 8.61, however, indicates a safe zone for bankruptcy risk today. Valuation risks also warrant caution given the stretched price-to-book multiple. Overall, the company balances solid profitability and operational efficiency against financial leverage risks.

Should You Buy Illinois Tool Works Inc.?

Illinois Tool Works Inc. appears to be a robust value creator with a very favorable moat, supported by growing ROIC well above WACC. Despite a challenging leverage profile, the company’s overall rating is B, suggesting moderate financial strength balanced with operational efficiency.

Strength & Efficiency Pillars

Illinois Tool Works Inc. exhibits strong operational efficiency with a robust net margin of 19.11% and a return on equity of 95.07%. Its return on invested capital (ROIC) stands at 24.49%, significantly above the weighted average cost of capital (WACC) of 8.5%, confirming the company as a clear value creator. The firm’s growing ROIC trend further signals a sustainable competitive advantage. These metrics underscore Illinois Tool Works’ ability to generate attractive returns and create shareholder value consistently.

Weaknesses and Drawbacks

While Illinois Tool Works operates efficiently, it carries notable financial risks. The debt-to-equity ratio of 2.78 and debt-to-assets at 55.54% highlight elevated leverage, which could strain financial flexibility in downturns. The price-to-book ratio is an alarming 22.32, suggesting the stock trades at a steep premium relative to its book value. Although the current ratio at 1.21 is acceptable, it offers limited liquidity cushion. These factors introduce caution, especially amid market volatility or rising interest rates.

Our Final Verdict about Illinois Tool Works Inc.

Illinois Tool Works presents a fundamentally solid profile with strong profitability and value creation metrics. The company’s bullish long-term stock trend and dominant recent buyer activity might appear attractive for long-term exposure. However, investors should weigh the elevated leverage and valuation premium carefully. The overall profile suggests potential upside but calls for a balanced, risk-aware approach given the financial leverage and rich multiples.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Does Illinois Tool Works’ (ITW) Rising Payout and Buybacks Redefine Its Capital Allocation Priorities? – simplywall.st (Feb 16, 2026)

- When Should You Buy Illinois Tool Works Inc. (NYSE:ITW)? – Yahoo Finance (Feb 14, 2026)

- Decoding Illinois Tool Works Inc (ITW): A Strategic SWOT Insight – GuruFocus (Feb 14, 2026)

- PNC Financial Services Group Inc. Sells 186,852 Shares of Illinois Tool Works Inc. $ITW – MarketBeat (Feb 15, 2026)

- Illinois Tool Works: Cyclical Recovery And Structural Growth Improvements Should Drive Upside – Seeking Alpha (Feb 13, 2026)

For more information about Illinois Tool Works Inc., please visit the official website: itw.com