Home > Analyses > Healthcare > IDEXX Laboratories, Inc.

IDEXX Laboratories transforms animal and environmental health through cutting-edge diagnostic technologies. Its flagship veterinary testing products and reference lab services dominate companion animal care and livestock management. Known for innovation and quality, IDEXX sets industry standards while expanding into water quality and biomedical diagnostics. As the healthcare diagnostics space evolves rapidly, I ask: does IDEXX’s robust market position still justify its premium valuation and promise sustained growth?

Table of contents

Business Model & Company Overview

IDEXX Laboratories, Inc., founded in 1983 and headquartered in Westbrook, Maine, commands a dominant position in veterinary diagnostics and water testing. Its ecosystem integrates point-of-care instruments, rapid assay kits, and veterinary software, serving companion animals, livestock, and biomedical research. The company’s cohesive mission centers on advancing animal and environmental health through innovative diagnostic solutions.

IDEXX generates revenue by combining hardware sales with recurring consumables and software services, creating a steady income stream. Its global footprint spans the Americas, Europe, and Asia, addressing key markets with veterinary reference labs and water quality products. This blend of diversified offerings and international reach forms a durable economic moat, securing IDEXX’s leadership in shaping diagnostic standards worldwide.

Financial Performance & Fundamental Metrics

I will analyze IDEXX Laboratories, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and shareholder value.

Income Statement

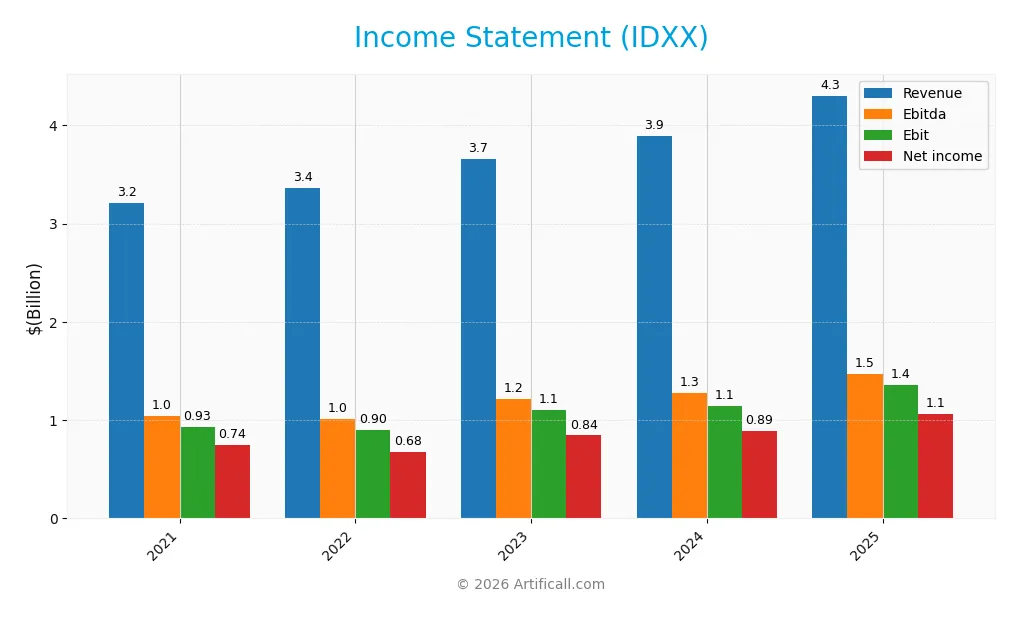

The table below presents IDEXX Laboratories, Inc.’s key income statement figures for fiscal years 2021 through 2025, showing growth and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 3.22B | 3.37B | 3.66B | 3.90B | 4.30B |

| Cost of Revenue | 1.33B | 1.36B | 1.47B | 1.52B | 1.64B |

| Operating Expenses | 957M | 1.11B | 1.09B | 1.25B | 1.30B |

| Gross Profit | 1.89B | 2.00B | 2.19B | 2.38B | 2.66B |

| EBITDA | 1.04B | 1.01B | 1.22B | 1.28B | 1.47B |

| EBIT | 932M | 900M | 1.10B | 1.14B | 1.36B |

| Interest Expense | 30M | 40M | 42M | 31M | 38M |

| Net Income | 745M | 679M | 845M | 888M | 1.06B |

| EPS | 8.74 | 8.12 | 10.17 | 10.77 | 13.17 |

| Filing Date | 2022-02-16 | 2023-02-16 | 2024-02-22 | 2025-02-21 | 2026-02-02 |

Income Statement Evolution

IDEXX Laboratories recorded steady revenue growth, rising 10.4% from 2024 to 2025 and 33.9% over five years. Net income expanded even faster, up 42.2% since 2021. Margins improved consistently, with gross margin at 61.8% and net margin reaching 24.6%, reflecting efficient cost management and strong operational leverage.

Is the Income Statement Favorable?

The 2025 income statement shows robust fundamentals, highlighted by a 31.7% EBIT margin and a controlled interest expense of 0.9% of revenue. Operating expenses scaled proportionally with revenue, supporting sustainable growth. EPS surged 22.6% year-over-year, confirming earnings quality. Overall, all key profitability and growth metrics rate favorable, indicating a strong and well-managed financial profile.

Financial Ratios

The following table summarizes key financial ratios for IDEXX Laboratories, Inc. over the past five fiscal years, providing a snapshot of profitability, liquidity, leverage, and market valuation:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 23% | 20% | 23% | 23% | 25% |

| ROE | 108% | 112% | 57% | 56% | 66% |

| ROIC | 42% | 32% | 33% | 34% | 41% |

| P/E | 75.3 | 50.2 | 54.6 | 38.4 | 51.1 |

| P/B | 81.3 | 56.0 | 31.1 | 21.4 | 33.8 |

| Current Ratio | 1.25 | 0.89 | 1.57 | 1.31 | 1.23 |

| Quick Ratio | 0.90 | 0.59 | 1.17 | 0.95 | 0.90 |

| D/E | 1.49 | 2.41 | 0.72 | 0.62 | 0.05 |

| Debt-to-Assets | 42% | 54% | 33% | 30% | 2% |

| Interest Coverage | 31.3 | 22.5 | 26.4 | 36.2 | 35.5 |

| Asset Turnover | 1.32 | 1.23 | 1.12 | 1.18 | 1.28 |

| Fixed Asset Turnover | 4.64 | 4.38 | 4.48 | 4.70 | 5.76 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

IDEXX Laboratories’ Return on Equity (ROE) showed strength, rising to 66% in 2025, reflecting robust profitability. The Current Ratio remained stable near 1.2, indicating consistent liquidity. Debt-to-Equity ratio declined sharply to 0.05, signaling improved financial leverage. Profit margins expanded moderately, underlining enhanced operational efficiency over the period.

Are the Financial Ratios Favorable?

In 2025, profitability metrics like ROE (66%), ROIC (41%), and net margin (24.6%) are favorable, outperforming typical sector benchmarks. Liquidity ratios, including current (1.23) and quick (0.9), are neutral, indicating adequate short-term resilience. Leverage is low with debt-to-equity at 0.05 and debt-to-assets at 2.24%, both favorable. Market multiples (PE 51.15, PB 33.75) and zero dividend yield appear unfavorable, tempering the overall positive financial profile.

Shareholder Return Policy

IDEXX Laboratories does not pay dividends, reflecting a strategic choice to reinvest earnings into growth opportunities. The company generates solid free cash flow, supporting operational needs and capital expenditures without returning cash directly to shareholders. Share buyback activity is not indicated in the data.

This approach aligns with a focus on long-term value creation by prioritizing reinvestment over cash distribution. While shareholders receive no immediate income, the retained earnings fund innovation and expansion, which historically supports sustainable growth in this sector.

Score analysis

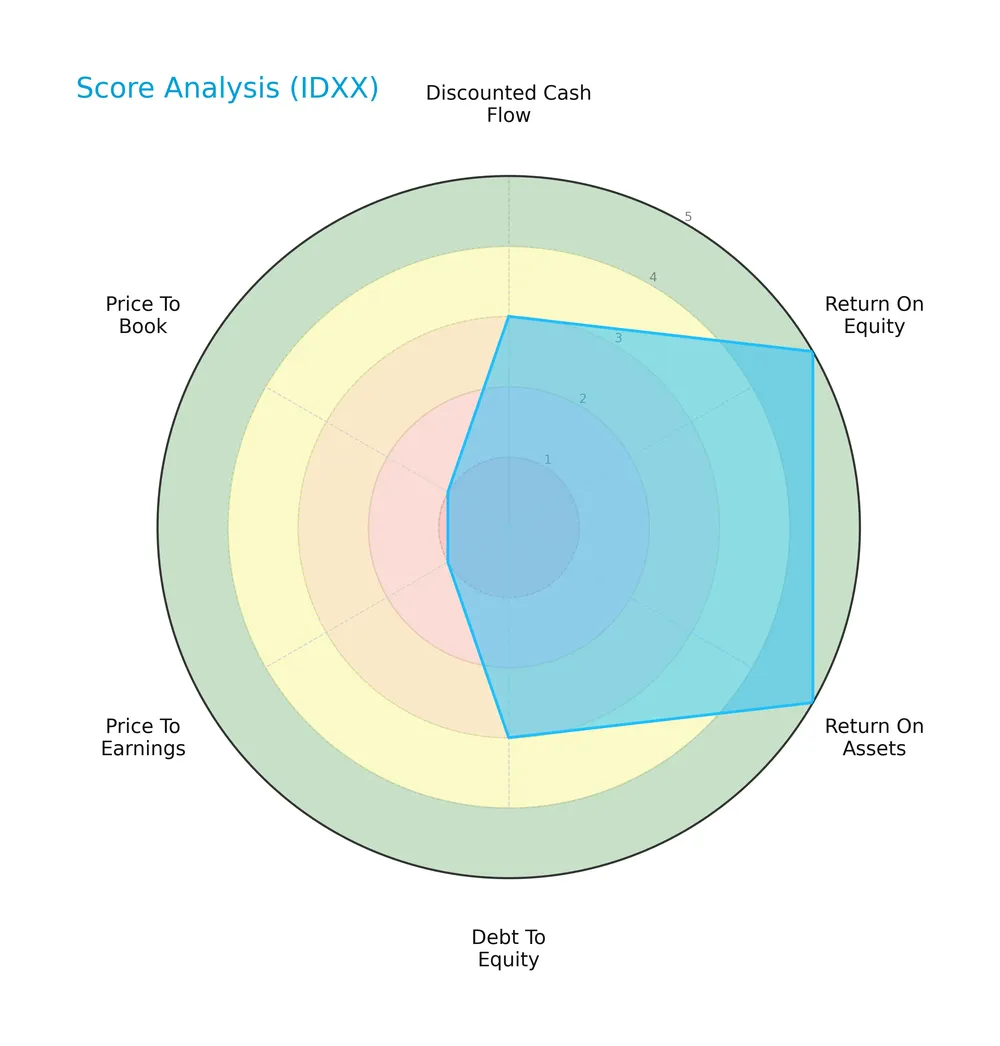

The radar chart below presents a comprehensive view of key financial scores for IDEXX Laboratories, Inc.:

IDEXX earns very favorable marks on return on equity and assets, signaling strong profitability. Moderate scores in discounted cash flow and debt-to-equity indicate balanced valuation and leverage. However, price-to-earnings and price-to-book ratios score very unfavorably, reflecting potential valuation concerns.

Analysis of the company’s bankruptcy risk

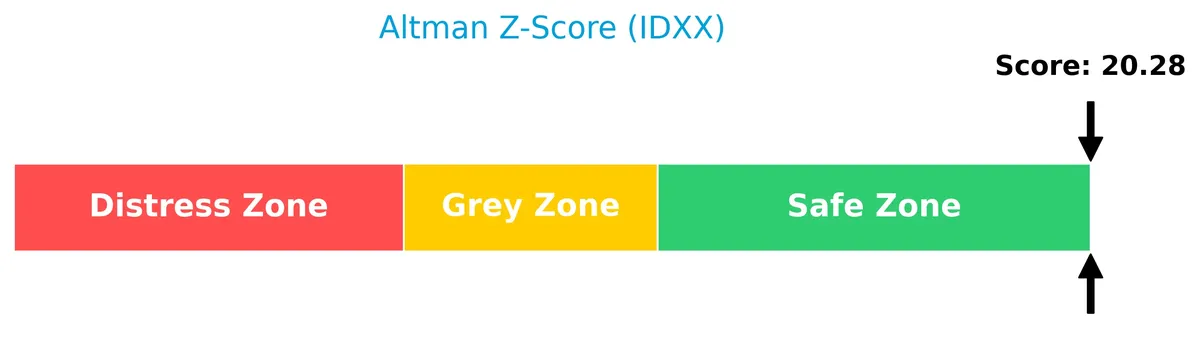

The Altman Z-Score places IDEXX firmly in the safe zone, indicating a very low risk of bankruptcy:

Is the company in good financial health?

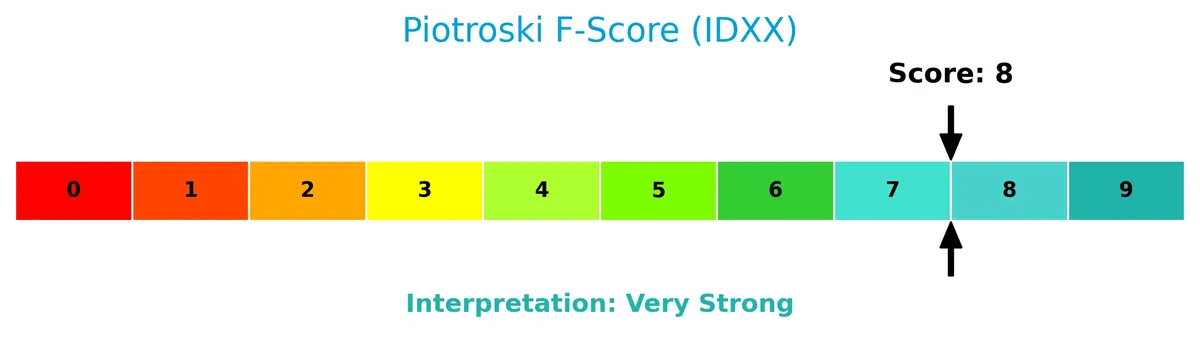

The Piotroski Score diagram highlights IDEXX’s strong financial health and operational efficiency:

A high Piotroski Score of 8 confirms the company’s robust financial condition, suggesting effective management and solid fundamentals.

Competitive Landscape & Sector Positioning

This sector analysis reviews IDEXX Laboratories, Inc.’s strategic positioning, revenue streams, and product portfolio. I will assess whether IDEXX holds a competitive advantage over its main industry rivals.

Strategic Positioning

IDEXX Laboratories concentrates on veterinary diagnostics and water testing with a balanced product-service revenue split near $2.2B products and $1.6B services in 2024. Its geographic exposure is diversified but U.S.-centric, generating $2.5B, while EMEA and Asia Pacific contribute $807M and $321M, respectively.

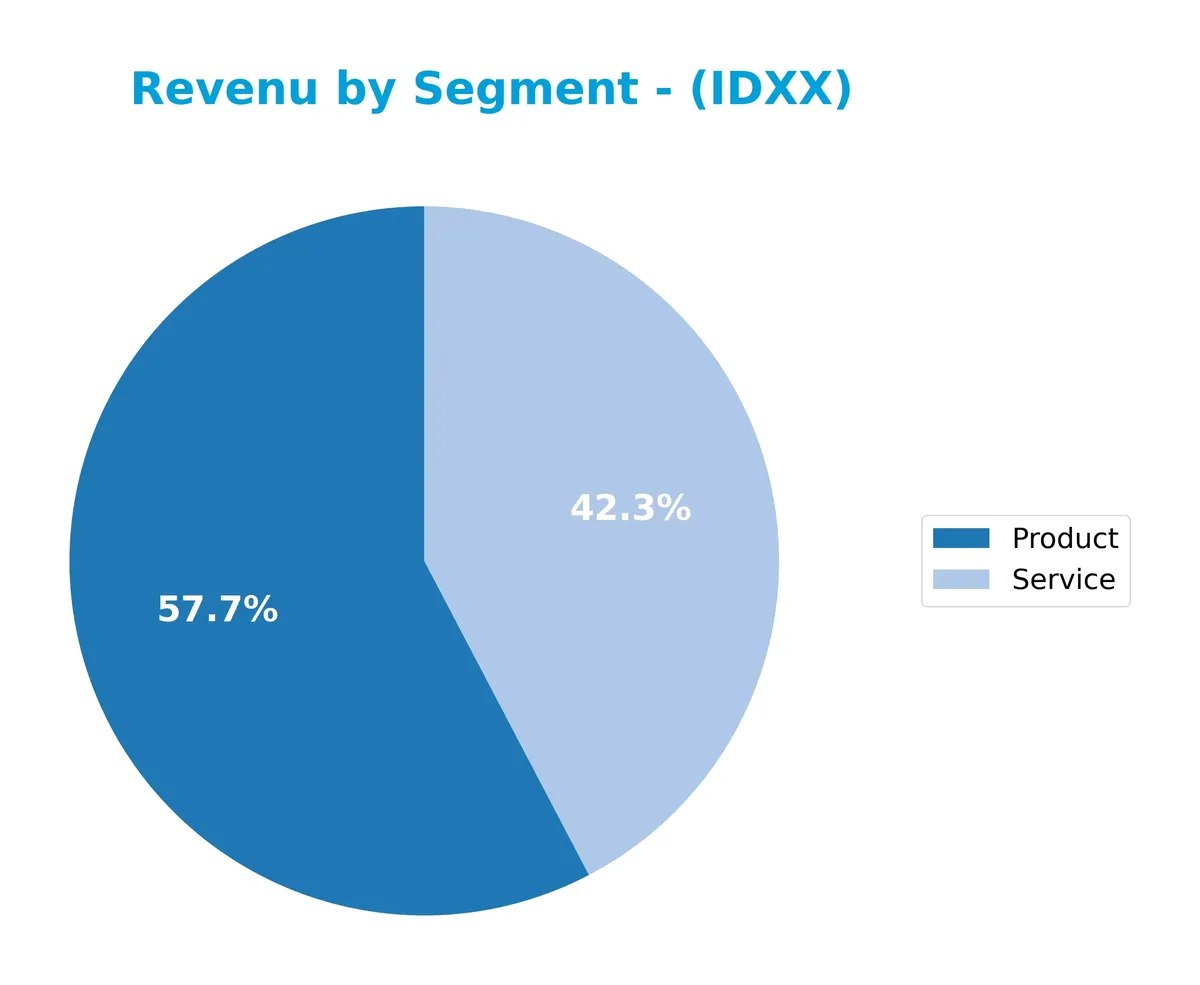

Revenue by Segment

The pie chart illustrates IDEXX Laboratories’ revenue breakdown by product and service segments for the fiscal year 2024. It highlights the relative contribution of each segment to the company’s total revenue.

In 2024, IDEXX’s business remains primarily driven by the Product segment with $2.25B, complemented by a strong Service segment at $1.65B. I observe steady growth in both, signaling balanced revenue streams. The Product segment slightly outpaces Services, showing a healthy product demand. This diversification reduces concentration risk and supports sustainable growth momentum in the latest fiscal year.

Key Products & Brands

The table below outlines IDEXX Laboratories’ main products and brands with their respective descriptions:

| Product | Description |

|---|---|

| Point-of-Care Veterinary Diagnostic Products | Instruments, consumables, and rapid assay test kits used in companion animal veterinary diagnostics. |

| Veterinary Reference Laboratory Services | Diagnostic and consulting services supporting veterinary practices worldwide. |

| Practice Management and Diagnostic Imaging Systems | Software and imaging services designed for veterinary clinics. |

| Livestock, Poultry, and Dairy Diagnostic Products | Diagnostic and health-monitoring products tailored for livestock, poultry, and dairy industries. |

| Water Testing Products | Tests such as Colilert, Colilert-18, and Colisure that detect coliforms and E. coli in water. |

| Human Point-of-Care Medical Diagnostics | Electrolytes and blood gas analyzers, including SARS-CoV-2 RT-PCR tests for human diagnostics. |

| Veterinary Software and Services | Software solutions and services for independent veterinary clinics and corporate groups. |

| SNAP Rapid Assay Test Kits | Rapid diagnostic kits widely used in veterinary practices for quick testing. |

| CAG Segment Products | Core animal health diagnostic products contributing significant revenue. |

IDEXX’s product portfolio spans veterinary diagnostics, laboratory services, and water testing. This diversified offering supports both animal health and environmental monitoring sectors.

Main Competitors

IDEXX Laboratories, Inc. faces 11 competitors in the Healthcare sector; here are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Thermo Fisher Scientific Inc. | 225B |

| Danaher Corporation | 165B |

| IDEXX Laboratories, Inc. | 53.5B |

| Agilent Technologies, Inc. | 39.1B |

| IQVIA Holdings Inc. | 38.4B |

| Mettler-Toledo International Inc. | 28.8B |

| Waters Corporation | 22.7B |

| Quest Diagnostics Incorporated | 19.4B |

| Revvity, Inc. | 11.6B |

| Charles River Laboratories International, Inc. | 10B |

IDEXX ranks 3rd among its competitors with a market cap at 22.9% of the leader, Thermo Fisher Scientific. It sits below the average market cap of the top 10 (61.3B) but above the sector median (28.8B). The company leads its next closest rival by a substantial 221% margin, illustrating a strong competitive position within the top tier.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does IDEXX have a competitive advantage?

IDEXX demonstrates a competitive advantage by consistently creating value, with an ROIC exceeding its WACC by 29.2%. This indicates efficient capital use, though its profitability shows a slight decline over recent years.

Looking ahead, IDEXX’s diverse diagnostic products and expanding global footprint, especially in the companion animal and water testing markets, position it to capitalize on emerging veterinary and environmental health opportunities.

SWOT Analysis

This analysis highlights IDEXX Laboratories’ key internal and external factors to guide strategic decisions.

Strengths

- strong gross margin at 61.8%

- high ROIC at 40.7% well above WACC

- robust revenue growth over 33% (2021-2025)

Weaknesses

- high valuation multiples (PE 51.15, PB 33.75)

- declining ROIC trend

- no dividend yield

Opportunities

- expanding global veterinary diagnostics market

- growth in water testing and human point-of-care segments

- increasing demand for rapid diagnostic technologies

Threats

- intensifying competition in diagnostics sector

- pricing pressure from healthcare cost containment

- regulatory risks and reimbursement changes

IDEXX’s strong profitability and growth underpin its competitive moat. Still, valuation and margin erosion call for cautious capital allocation. The company should leverage innovation and geographic expansion to offset competitive and regulatory threats.

Stock Price Action Analysis

The weekly chart illustrates IDEXX Laboratories, Inc.’s price movements over the past 12 months, highlighting key levels and volatility patterns:

Trend Analysis

Over the past 12 months, IDXX’s stock price rose 21.48%, indicating a bullish trend with decelerating momentum. The price ranged from a low of 390.94 to a high of 752.88. Despite high volatility (std. dev. 96.7), the trend remains positive but shows signs of slowing.

Volume Analysis

Trading volume is increasing, with a near-equal split between buyers (49.23%) and sellers (50.77%) overall. In the recent three months, seller dominance intensified (buyer share 36.51%), reflecting growing selling pressure and cautious investor sentiment.

Target Prices

Analysts present a bullish consensus for IDEXX Laboratories, reflecting strong confidence in its growth prospects.

| Target Low | Target High | Consensus |

|---|---|---|

| 730 | 830 | 789.29 |

The target range suggests upside potential of roughly 5-15% from current levels, indicating positive market sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding IDEXX Laboratories, Inc. (IDXX).

Stock Grades

Here are the latest verified analyst grades for IDEXX Laboratories, Inc., reflecting current market sentiment and recommendations:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-02-03 |

| UBS | Maintain | Neutral | 2026-02-03 |

| UBS | Maintain | Neutral | 2025-11-04 |

| JP Morgan | Maintain | Overweight | 2025-11-04 |

| BTIG | Maintain | Buy | 2025-11-04 |

| Morgan Stanley | Maintain | Overweight | 2025-11-04 |

| Stifel | Upgrade | Buy | 2025-10-31 |

| Morgan Stanley | Maintain | Overweight | 2025-08-15 |

| Piper Sandler | Maintain | Neutral | 2025-08-11 |

| JP Morgan | Maintain | Overweight | 2025-08-04 |

The consensus across top firms consistently favors a positive stance, with a majority holding Buy or Overweight ratings. Neutral opinions persist but Sell ratings remain minimal, indicating overall confidence in IDEXX’s prospects.

Consumer Opinions

IDEXX Laboratories consistently earns praise for its innovation and reliable diagnostic solutions, though some users note areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “IDEXX’s diagnostic tools deliver precise results quickly, boosting our clinic’s efficiency.” | “Customer service response times sometimes lag, causing delays in urgent support.” |

| “The software integration is seamless and user-friendly, simplifying daily workflows.” | “Pricing feels steep for smaller practices with tight budgets.” |

| “Product durability and accuracy stand out compared to competitors in the veterinary space.” | “Occasional technical glitches disrupt operations and require troubleshooting.” |

Overall, consumers appreciate IDEXX’s accuracy and innovation, vital in healthcare diagnostics. However, pricing and support responsiveness emerge as consistent challenges, suggesting areas where the company could enhance customer satisfaction.

Risk Analysis

Below is a table summarizing key risks facing IDEXX Laboratories, Inc. with their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E of 51.15 and P/B of 33.75 suggest stock is richly valued versus industry norms. | High | High |

| Market Volatility | Beta of 1.66 indicates above-average sensitivity to market swings, raising share price risk. | Medium | Medium |

| Liquidity Risk | Current ratio of 1.23 and quick ratio of 0.9 reflect moderate short-term liquidity buffer. | Medium | Low |

| Dividend Absence | Zero dividend yield limits income appeal and shareholder return diversification. | Medium | Low |

| Competitive Risk | Strong industry presence but innovation pace and pricing pressure could erode margins. | Medium | Medium |

| Regulatory Risk | Operating in medical diagnostics exposes IDEXX to evolving healthcare compliance requirements. | Medium | Medium |

The most pressing risk lies in IDEXX’s stretched valuation multiples, which challenge future return expectations. Market volatility, driven by a beta of 1.66, amplifies price swings, adding trading risk. Despite solid liquidity and robust financial health scores, investors should monitor valuation and market sensitivity closely.

Should You Buy IDEXX Laboratories, Inc.?

IDEXX appears to be a robustly profitable company with a slightly favorable moat, suggesting value creation despite a declining ROIC trend. Its leverage profile remains manageable, supporting a B+ rating indicative of very favorable financial health overall.

Strength & Efficiency Pillars

IDEXX Laboratories, Inc. demonstrates robust profitability with a net margin of 24.62% and a return on equity (ROE) at 65.99%, signaling strong shareholder returns. Its return on invested capital (ROIC) stands at 40.68%, well above the weighted average cost of capital (WACC) at 11.45%, confirming the company as a clear value creator. Financial health is solid, highlighted by an Altman Z-Score of 20.28, firmly in the safe zone, and a Piotroski score of 8, indicating very strong operational fundamentals. This combination underscores efficient capital allocation and stable growth.

Weaknesses and Drawbacks

IDEXX faces valuation challenges with a high price-to-earnings (P/E) ratio of 51.15 and a price-to-book (P/B) ratio of 33.75, both marked very unfavorable, suggesting the stock trades at a steep premium. Leverage is low and favorable, but liquidity ratios such as the current ratio of 1.23 and quick ratio of 0.9 are only neutral, potentially limiting short-term flexibility. Recent market dynamics reveal seller dominance with buyer volume at 36.51%, creating near-term headwinds amid an 11.34% price decline from late 2025 to early 2026.

Our Verdict about IDEXX Laboratories, Inc.

IDEXX’s long-term fundamentals are favorable, supported by strong profitability and financial health. However, despite a bullish overall trend, recent seller dominance and valuation premiums suggest a cautious stance. Investors might consider a wait-and-see approach for a better entry point, as the current price may reflect near-term market pressure rather than intrinsic value shifts. The profile may appear attractive for patient, long-term exposure but demands careful timing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- IDEXX Laboratories (IDXX) Positioned to Benefit from Growing Aging Pet Market – Yahoo Finance (Feb 05, 2026)

- IDEXX: A Great Business Trapped By A Demanding Valuation (NASDAQ:IDXX) – Seeking Alpha (Feb 04, 2026)

- Pet Stock Dives As Investors Await The ‘Puppy Boom’ Patients – Investor’s Business Daily (Feb 02, 2026)

- Why Is IDEXX Labs Stock Falling Today? – Benzinga (Feb 02, 2026)

- IDEXX Laboratories (IDXX) Positioned to Benefit from Growing Aging Pet Market – Yahoo! Finance Canada (Feb 05, 2026)

For more information about IDEXX Laboratories, Inc., please visit the official website: idexx.com