Home > Analyses > Industrials > IDEX Corporation

IDEX Corporation powers essential industries by delivering precision fluidics and engineered solutions that keep daily operations running smoothly worldwide. Its leadership spans three core segments—Fluid & Metering Technologies, Health & Science, and Fire & Safety—each known for innovative, high-quality products that industries depend on. IDEX’s broad impact and steady innovation position it as a vital industrial player. The key question now: does its financial strength still support its premium market valuation and growth outlook?

Table of contents

Business Model & Company Overview

IDEX Corporation, founded in 1987 and headquartered in Northbrook, Illinois, commands a dominant position in the industrial machinery sector. It operates through three synergistic segments—Fluid & Metering Technologies, Health & Science Technologies, and Fire & Safety/Diversified Products—delivering applied solutions that form a comprehensive ecosystem for fluid handling, precision components, and safety equipment worldwide.

The company’s revenue engine balances engineered hardware with specialized services, spanning positive displacement pumps, medical devices, and firefighting tools. IDEX sustains a strategic presence across the Americas, Europe, and Asia, serving diverse industries from pharmaceuticals to energy. Its economic moat rests on proprietary technology and a global footprint that shapes the future of industrial innovation.

Financial Performance & Fundamental Metrics

I analyze IDEX Corporation’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder return strategy.

Income Statement

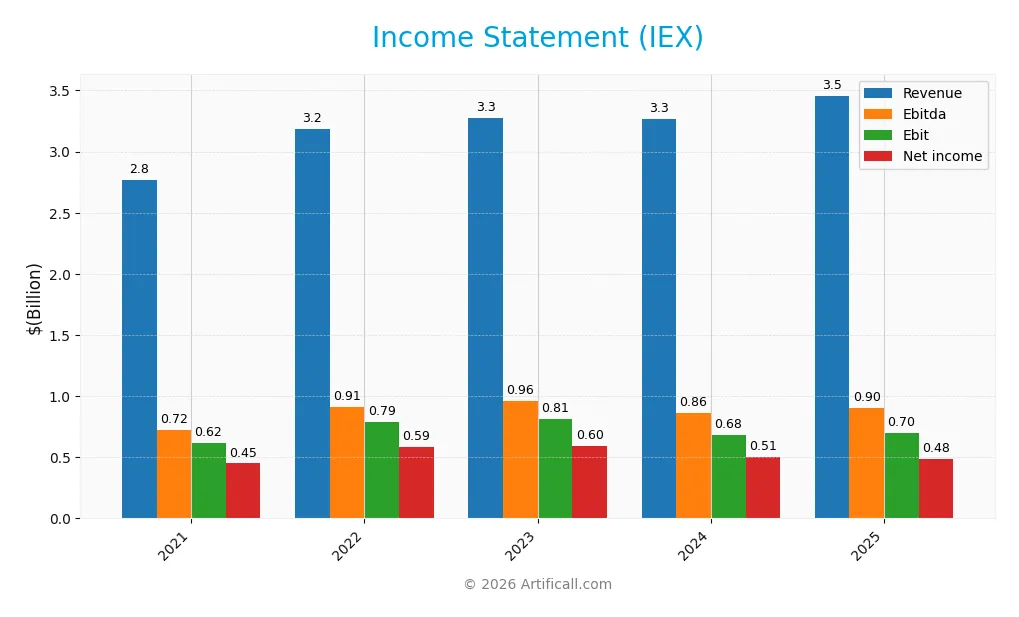

The table below presents IDEX Corporation’s key income statement figures for fiscal years 2021 through 2025 in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 2.76B | 3.18B | 3.27B | 3.27B | 3.46B |

| Cost of Revenue | 1.40B | 1.59B | 1.65B | 1.75B | 1.92B |

| Operating Expenses | 708M | 805M | 872M | 820M | 819M |

| Gross Profit | 1.36B | 1.59B | 1.62B | 1.52B | 1.54B |

| EBITDA | 721M | 910M | 964M | 859M | 904M |

| EBIT | 618M | 790M | 812M | 684M | 697M |

| Interest Expense | 38M | 41M | 52M | 45M | 64M |

| Net Income | 449M | 587M | 596M | 505M | 483M |

| EPS | 5.91 | 7.75 | 7.88 | 6.67 | 6.41 |

| Filing Date | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-20 | 2026-02-04 |

Income Statement Evolution

From 2021 to 2025, IDEX Corporation’s revenue grew 25% to $3.46B, reflecting steady expansion. Gross profit increased moderately, but gross margin remained stable at about 44.5%. Net income rose 7.5%, though net margin contracted by 14%, indicating margin pressure despite revenue gains. Operating expenses scaled proportionally with revenue, maintaining overall margin stability.

Is the Income Statement Favorable?

In 2025, IDEX posted a $483M net income on $3.46B revenue, yielding a 14% net margin, favorable versus industry benchmarks. EBIT margin held firm at 20.2%, supported by controlled interest expense at 1.9% of revenue. However, net margin and EPS declined slightly year-over-year, signaling short-term margin compression. Overall, fundamentals appear generally favorable with manageable risks.

Financial Ratios

The following table summarizes key financial ratios for IDEX Corporation (IEX) over the last five fiscal years, providing insight into profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 16% | 18% | 18% | 15% | 14% |

| ROE | 16% | 19% | 17% | 13% | 12% |

| ROIC | 11% | 12% | 11% | 9% | 9% |

| P/E | 40 | 29 | 28 | 31 | 28 |

| P/B | 6.41 | 5.69 | 4.63 | 4.18 | 3.33 |

| Current Ratio | 3.50 | 2.57 | 2.89 | 2.53 | 2.86 |

| Quick Ratio | 2.72 | 1.71 | 2.05 | 1.85 | 2.02 |

| D/E | 0.46 | 0.52 | 0.41 | 0.52 | 0.00 |

| Debt-to-Assets | 26% | 29% | 25% | 29% | 0.01% |

| Interest Coverage | 17.3 | 19.4 | 14.5 | 15.7 | 11.2 |

| Asset Turnover | 0.56 | 0.58 | 0.56 | 0.48 | 0.50 |

| Fixed Asset Turnover | 8.45 | 8.33 | 5.97 | 7.10 | 7.39 |

| Dividend Yield | 0.90% | 1.03% | 1.16% | 1.30% | 1.59% |

Evolution of Financial Ratios

Return on Equity (ROE) declined from 19.3% in 2022 to about 12.0% in 2025, indicating reduced profitability. The Current Ratio remained strong and stable, around 2.5 to 2.9, showing consistent liquidity. Debt-to-Equity Ratio significantly decreased to near zero in 2025, reflecting a sharp reduction in leverage and financial risk.

Are the Financial Ratios Favorable?

In 2025, profitability shows mixed signals with a favorable net profit margin of 14.0% but a neutral ROE near 12%. Liquidity ratios like Current (2.86) and Quick (2.02) ratios are favorable, indicating solid short-term financial health. Leverage is very low, with Debt-to-Equity near zero and a strong interest coverage ratio of 10.82. However, valuation metrics such as P/E (27.7) and Price-to-Book (3.33) are unfavorable, while asset turnover is below ideal, suggesting moderate operational efficiency. Overall, the ratios appear slightly favorable.

Shareholder Return Policy

IDEX Corporation maintains a dividend payout ratio near 40%, with a steady dividend per share rising from $2.12 in 2021 to $2.82 in 2025. The annual yield hovers around 1.5%, supported by free cash flow coverage exceeding 90%, indicating prudent distribution levels.

The company also engages in share buybacks, balancing capital return with reinvestment. This approach appears sustainable, aligning dividend payments and buybacks with robust cash flow generation, thus supporting long-term shareholder value without overextending financial resources.

Score analysis

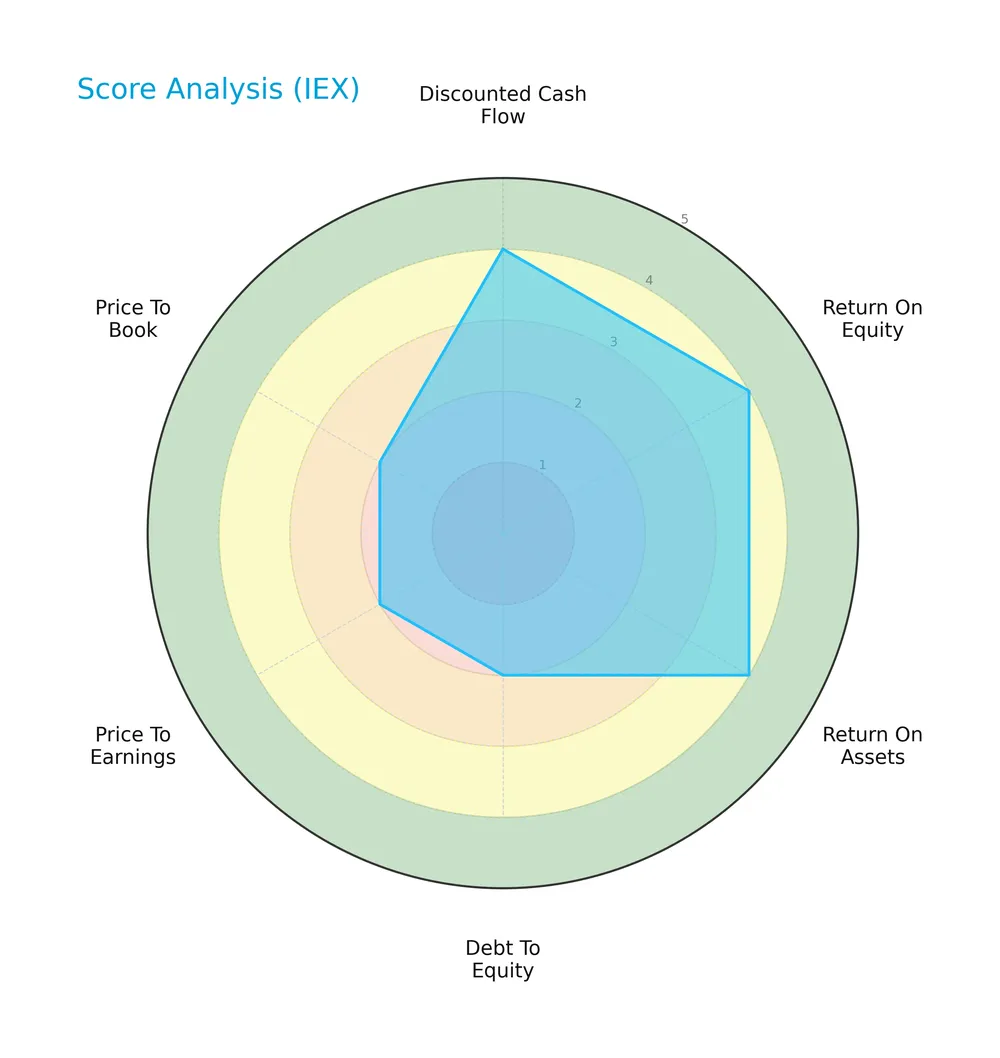

The radar chart below highlights IDEX Corporation’s key financial metric scores for a comprehensive view:

IDEX scores well on discounted cash flow, return on equity, and return on assets, all rated favorable at 4. Debt to equity, price to earnings, and price to book ratios show moderate scores of 2, indicating some caution in leverage and valuation metrics.

Analysis of the company’s bankruptcy risk

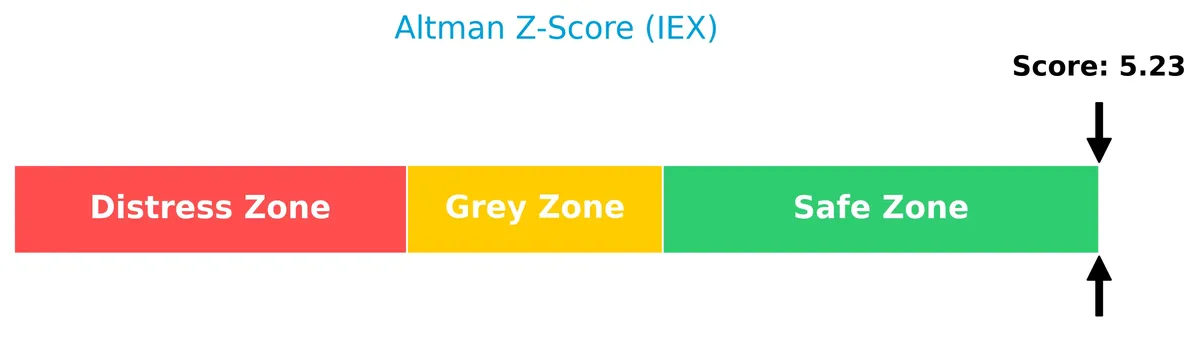

IDEX Corporation’s Altman Z-Score places it solidly in the safe zone, signaling low bankruptcy risk at this time:

Is the company in good financial health?

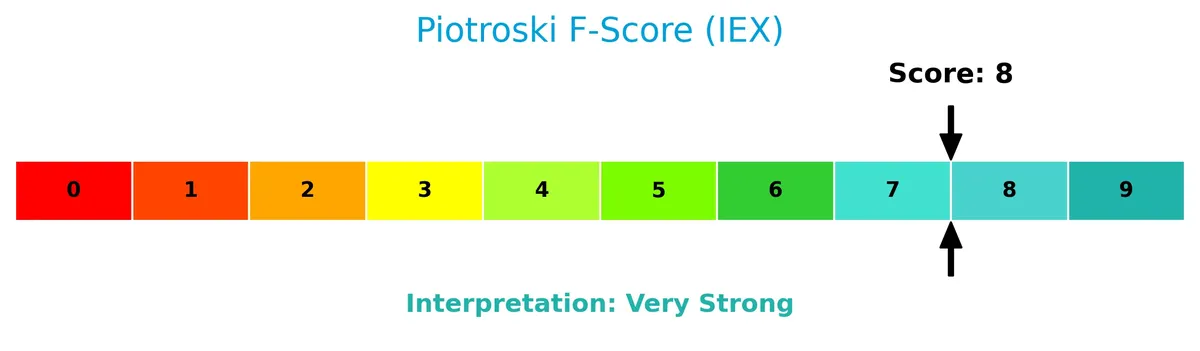

The Piotroski Score diagram below illustrates the strong financial health of IDEX Corporation:

With a Piotroski Score of 8, IDEX demonstrates very strong financial strength. This suggests robust profitability, efficient capital use, and solid balance sheet fundamentals.

Competitive Landscape & Sector Positioning

This analysis examines IDEX Corporation’s strategic positioning, revenue segments, and key products within the industrial machinery sector. I will assess whether IDEX holds a competitive advantage over its main competitors in these markets.

Strategic Positioning

IDEX Corporation maintains a diversified product portfolio across three segments: Fluid & Metering Technologies, Health & Science Technologies, and Fire & Safety/Diversified Products. Its geographic exposure spans primarily the U.S., Europe, and Asia, reflecting a balanced global footprint.

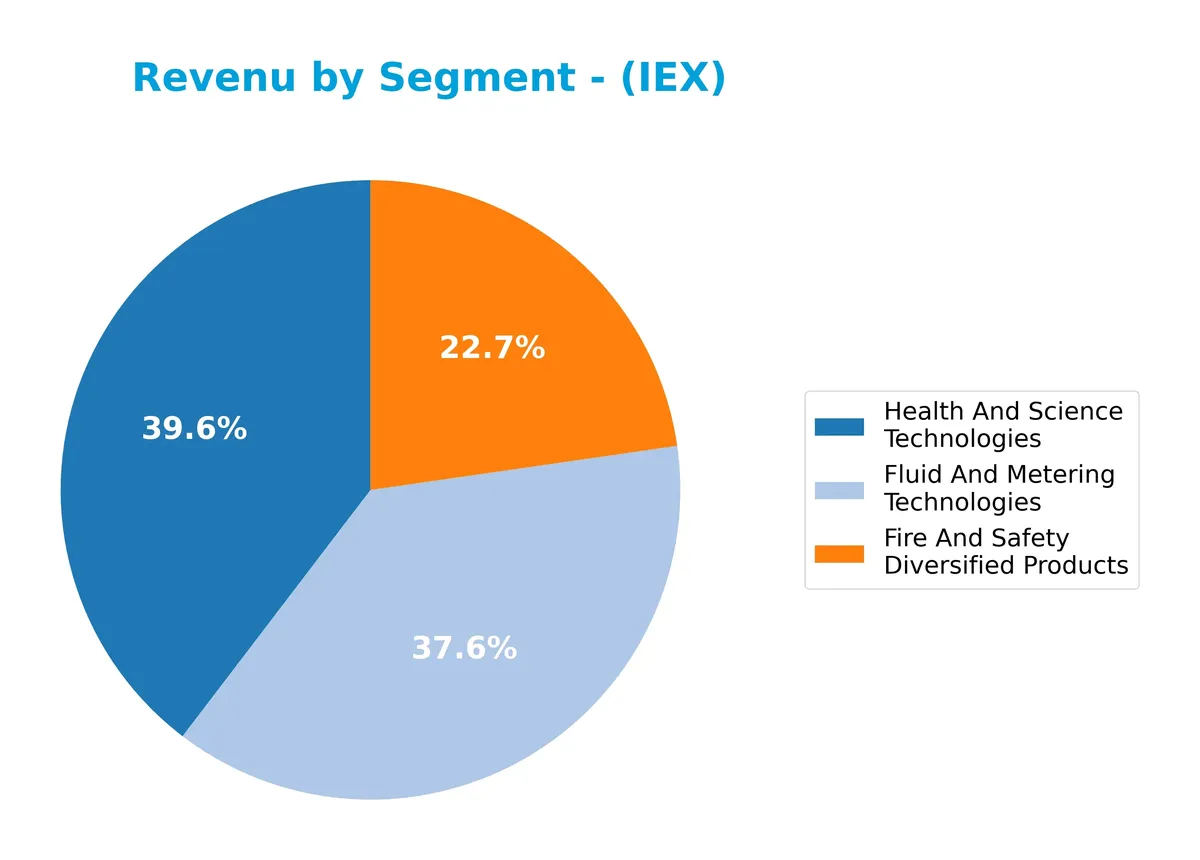

Revenue by Segment

This pie chart illustrates IDEX Corporation’s revenue distribution across its three main segments for the fiscal year 2024.

In 2024, Health And Science Technologies leads with $1.3B, followed closely by Fluid And Metering Technologies at $1.2B. Fire And Safety Diversified Products trails at $744M. Over recent years, Health And Science shows slight revenue contraction, while Fluid And Metering remains stable. Fire And Safety steadily grows, but the business still depends heavily on the top two segments, indicating moderate concentration risk.

Key Products & Brands

The table below outlines IDEX Corporation’s principal product segments and their descriptions:

| Product | Description |

|---|---|

| Fluid & Metering Technologies | Designs and produces positive displacement pumps, flow meters, injectors, and fluid-handling systems for food, chemical, industrial, water, agricultural, and energy sectors. |

| Health & Science Technologies | Develops precision fluidics, pumps, sealing solutions, medical devices, compressors, optical components, lab equipment, and photonic technologies serving pharmaceuticals, life sciences, cosmetics, research, and defense. |

| Fire & Safety/Diversified Products | Manufactures firefighting pumps, valves, rescue tools, lifting bags, stainless steel banding, clamping devices, and precision equipment for dispensing, metering, and mixing colorants and paints. |

IDEX’s product portfolio spans fluid control, health sciences, and fire safety equipment, reflecting diversified industrial applications with steady revenue contributions across segments.

Main Competitors

IDEX Corporation faces 24 competitors in its sector. The following table lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eaton Corporation plc | 127B |

| Parker-Hannifin Corporation | 114B |

| Howmet Aerospace Inc. | 85.2B |

| Emerson Electric Co. | 76.3B |

| Illinois Tool Works Inc. | 73B |

| Cummins Inc. | 71.9B |

| AMETEK, Inc. | 48.3B |

| Roper Technologies, Inc. | 46.8B |

| Rockwell Automation, Inc. | 44.8B |

| Symbotic Inc. | 35.9B |

IDEX Corporation ranks 16th among 24 competitors. Its market cap reaches 12.6% of the leader Eaton Corporation plc. IDEX sits below both the average market cap of the top 10 (72.4B) and the sector median (32.4B). It stands 7.66% below its closest rival above, indicating a moderate gap to the next competitor.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does IDEX have a competitive advantage?

IDEX does not present a competitive advantage as it is destroying value with a declining return on invested capital (ROIC) below its weighted average cost of capital (WACC). The negative ROIC trend reflects decreasing profitability and inefficient capital use over the 2021-2025 period.

Looking ahead, IDEX operates diverse segments in fluid and metering technologies, health and science, and fire and safety products, serving global markets including the U.S., Europe, and Asia. Future opportunities may arise from expanding product lines and geographic reach, although value creation remains a significant challenge.

SWOT Analysis

This SWOT analysis highlights IDEX Corporation’s key strategic factors to guide investor decisions.

Strengths

- diversified industrial segments

- strong liquidity ratios

- very strong Piotroski score

Weaknesses

- declining ROIC vs. WACC

- unfavorable net margin trend

- elevated valuation multiples

Opportunities

- expanding global markets

- innovation in fluidics and safety tech

- increasing demand in life sciences

Threats

- intense industry competition

- margin pressure risks

- macroeconomic uncertainty

IDEX shows solid operational strengths and growth potential but suffers from value destruction and margin erosion. Strategic focus must address profitability decline while leveraging innovation and global expansion.

Stock Price Action Analysis

The weekly stock chart below illustrates IDEX Corporation’s price fluctuations and trend dynamics over the past 12 months:

Trend Analysis

Over the past 12 months, IEX’s stock price declined by 11.26%, signaling a bearish trend. The trend shows acceleration with a high volatility of 22.69%. The price ranged between 244.02 and 158.26, reflecting marked downside pressure.

Volume Analysis

Trading volume is increasing, with buyers accounting for 56.36% overall. In the recent three months, buyer dominance surged to 77.1%, indicating strong buyer-driven activity and growing market participation.

Target Prices

Analysts project a solid upside for IDEX Corporation, reflecting confidence in its growth trajectory.

| Target Low | Target High | Consensus |

|---|---|---|

| 220 | 247 | 235.25 |

The target range from 220 to 247 suggests a bullish outlook. The consensus near 235 indicates steady appreciation potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding IDEX Corporation’s market performance and reputation.

Stock Grades

Here are the latest verified stock grades for IDEX Corporation from recognized analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Outperform | 2026-02-05 |

| DA Davidson | Maintain | Neutral | 2026-02-05 |

| Citigroup | Maintain | Buy | 2026-02-05 |

| TD Cowen | Maintain | Buy | 2026-02-05 |

| Stifel | Maintain | Buy | 2026-01-23 |

| Citigroup | Maintain | Buy | 2025-12-08 |

| RBC Capital | Maintain | Outperform | 2025-10-30 |

| Stifel | Maintain | Buy | 2025-10-20 |

| Oppenheimer | Maintain | Outperform | 2025-10-07 |

| DA Davidson | Maintain | Neutral | 2025-08-04 |

The consensus reflects a balance between buy and hold ratings, with no sell recommendations. Most analysts maintain positive views, favoring buy or outperform grades, signaling steady confidence in the stock.

Consumer Opinions

IDEX Corporation garners a mix of praise and critique from its user base, reflecting its performance and product reliability.

| Positive Reviews | Negative Reviews |

|---|---|

| “Reliable products that consistently perform.” | “Customer service response times need improvement.” |

| “Strong innovation in industrial solutions.” | “Pricing feels high compared to competitors.” |

| “Robust build quality and durable materials.” | “Limited availability of certain product lines.” |

Overall, consumers appreciate IDEX’s durable products and innovation. However, concerns about customer service and pricing recur frequently, signaling areas for strategic improvement.

Risk Analysis

The table below summarizes the key risks facing IDEX Corporation, including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E (27.73) and P/B (3.33) ratios suggest overvaluation relative to sector benchmarks. | Medium | High |

| Market Cyclicality | Industrial machinery demand is sensitive to economic cycles and global manufacturing trends. | High | Medium |

| Operational Risk | Asset turnover is low (0.5), indicating potential inefficiencies in asset utilization. | Medium | Medium |

| Competitive Risk | Pressure from innovation and pricing in fluid and safety technology markets. | Medium | Medium |

| Financial Stability | Very strong Altman Z-Score (5.23) and Piotroski Score (8) indicate low bankruptcy risk. | Low | Low |

I consider valuation risk the most concerning due to IEX’s premium multiples versus peers. The firm’s strong balance sheet and profitability offset liquidity and bankruptcy concerns. However, cyclical demand fluctuations remain a persistent threat amid global industrial uncertainties.

Should You Buy IDEX Corporation?

IDEX Corporation appears to be a moderately profitable company with declining operational efficiency and a deteriorating competitive moat, suggesting value erosion. Despite a manageable leverage profile and strong financial health scores, the overall rating stands at B+, reflecting a cautious but favorable analytical interpretation.

Strength & Efficiency Pillars

IDEX Corporation shows solid profitability with a net margin of 13.98% and a favorable gross margin of 44.51%. Its Altman Z-score of 5.23 places it safely above bankruptcy risk, while a Piotroski score of 8 indicates very strong financial health. The company maintains a robust current ratio of 2.86 and zero debt, reflecting excellent financial stability. Although ROIC at 8.65% slightly trails WACC at 8.72%, the firm exhibits efficient capital allocation and operational strength.

Weaknesses and Drawbacks

Valuation metrics pose notable concerns; a P/E ratio of 27.73 and P/B of 3.33 suggest a premium price that may limit upside. The company’s asset turnover stands at a low 0.5, hinting at underutilized assets and potential inefficiencies. Despite zero debt, the net margin growth declined by 14.02% over the period, signaling margin pressure. These factors could constrain near-term performance and raise valuation risk amid market volatility.

Our Verdict about IDEX Corporation

IDEX’s long-term fundamentals appear favorable given its strong financial health and profitability. Coupled with a recent buyer-dominant trend reflecting increased investor interest, the profile may appear attractive for long-term exposure. However, elevated valuation multiples and margin contraction suggest cautious optimism. Investors might consider a measured entry to balance potential rewards against valuation and efficiency headwinds.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Why IDEX (IEX) Is Up 8.1% After Q4 Earnings Beat And Record AI-Linked Orders – Yahoo Finance (Feb 05, 2026)

- Machina Capital S.A.S. Sells 6,176 Shares of IDEX Corporation $IEX – MarketBeat (Feb 05, 2026)

- IEX Q4 Deep Dive: Data Center Demand and HST Segment Drive Outperformance – Finviz (Feb 05, 2026)

- Beyond The Numbers: 4 Analysts Discuss IDEX Stock – Benzinga (Feb 05, 2026)

- IDEX Corporation (NYSE:IEX) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 05, 2026)

For more information about IDEX Corporation, please visit the official website: idexcorp.com