Home > Analyses > Industrials > Hyster-Yale Materials Handling, Inc.

Hyster-Yale Materials Handling, Inc. powers the backbone of global logistics and manufacturing by engineering rugged lift trucks and advanced material handling solutions that keep industries moving efficiently. As a recognized leader in agricultural machinery and industrial equipment, the company drives innovation with its diverse portfolio, including hydrogen fuel-cell technologies. With a strong market presence and a reputation for quality, the key question is whether Hyster-Yale’s fundamentals justify its current valuation and growth prospects in an evolving industrial landscape.

Table of contents

Business Model & Company Overview

Hyster-Yale Materials Handling, Inc., founded in 1991 and headquartered in Cleveland, Ohio, stands as a dominant player in the agricultural machinery sector. The company’s core mission revolves around designing, manufacturing, and servicing a comprehensive ecosystem of lift trucks, attachments, and aftermarket parts under well-recognized brands like Hyster and Yale. This integrated approach supports a wide range of industries, from manufacturing to government agencies, reinforcing its strong market presence.

The company’s revenue engine balances hardware sales—such as frames, masts, and transmissions—with aftermarket parts and services, creating a steady stream of recurring income. Hyster-Yale strategically operates across the Americas, Europe, and Asia, leveraging its global footprint to serve diverse clients. Its robust portfolio, including hydrogen fuel-cell technology, cements a competitive advantage and builds a resilient economic moat that shapes the future of material handling worldwide.

Financial Performance & Fundamental Metrics

This section analyzes Hyster-Yale Materials Handling, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and shareholder returns.

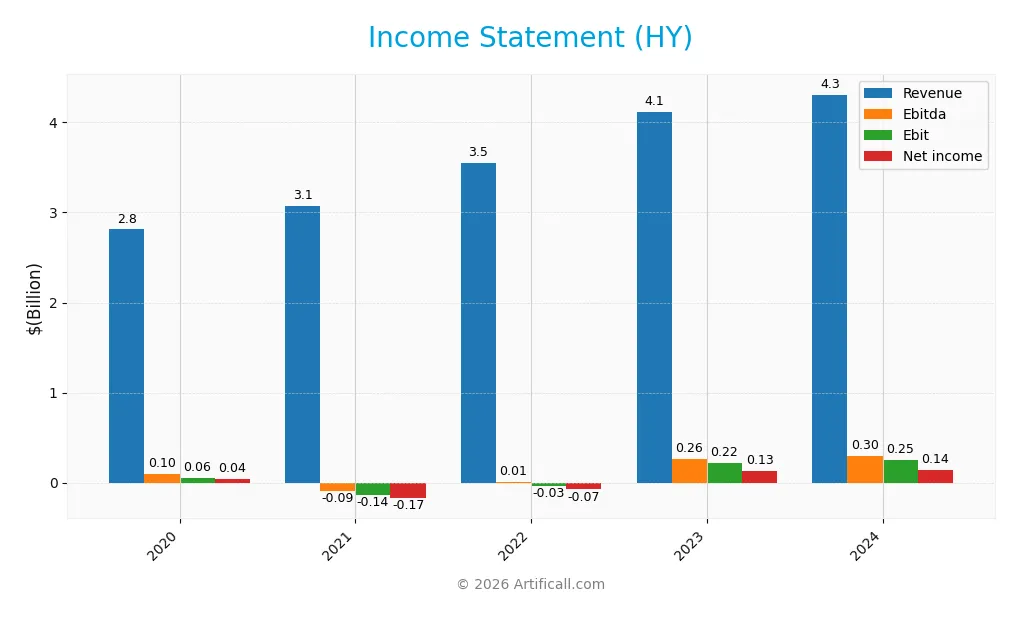

Income Statement

The table below presents the annual income statement figures for Hyster-Yale Materials Handling, Inc. (ticker: HY) over the last five fiscal years, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 2.81B | 3.08B | 3.55B | 4.12B | 4.31B |

| Cost of Revenue | 2.35B | 2.71B | 3.11B | 3.33B | 3.41B |

| Operating Expenses | 416M | 516M | 473M | 577M | 651M |

| Gross Profit | 465M | 363M | 434M | 786M | 896M |

| EBITDA | 99M | -93M | 9.4M | 263M | 300M |

| EBIT | 56M | -139M | -34M | 218M | 253M |

| Interest Expense | 14M | 16M | 28M | 37M | 34M |

| Net Income | 37M | -173M | -74M | 126M | 142M |

| EPS | 2.21 | -10.29 | -4.38 | 7.35 | 8.16 |

| Filing Date | 2021-02-24 | 2022-02-28 | 2023-02-27 | 2024-02-27 | 2025-02-25 |

Income Statement Evolution

From 2020 to 2024, Hyster-Yale Materials Handling, Inc. saw a 53.2% growth in revenue, reaching $4.31B in 2024. Net income rose substantially by 283.56% over this period, lifting net margins by 150.36%. Gross margins improved favorably to 20.79%, while EBIT and net margins remained neutral, reflecting steady operational efficiency alongside moderate revenue expansion.

Is the Income Statement Favorable?

In 2024, fundamentals appear generally favorable with a 4.61% revenue growth and a strong 13.99% gross profit increase. EBIT rose 15.8%, supported by consistent gross margin and controlled interest expenses at 0.78% of revenue. Net margin at 3.3% improved by 8.04%, alongside an 11.05% EPS growth, indicating effective cost management despite a slight unfavorable trend in operating expense growth relative to revenue.

Financial Ratios

The following table presents key financial ratios for Hyster-Yale Materials Handling, Inc. (HY) over the fiscal years 2020 to 2024, reflecting the company’s profitability, efficiency, liquidity, leverage, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 1.3% | -5.6% | -2.1% | 3.1% | 3.3% |

| ROE | 6.0% | -48.4% | -36.3% | 32.3% | 30.0% |

| ROIC | 3.8% | -13.6% | -4.0% | 13.1% | 13.6% |

| P/E | 26.9 | -4.0 | -5.8 | 8.5 | 6.2 |

| P/B | 1.6 | 1.9 | 2.1 | 2.7 | 1.9 |

| Current Ratio | 1.49 | 1.22 | 1.09 | 1.22 | 1.35 |

| Quick Ratio | 0.82 | 0.52 | 0.49 | 0.55 | 0.64 |

| D/E | 0.47 | 1.45 | 2.70 | 1.47 | 1.14 |

| Debt-to-Assets | 15.6% | 26.3% | 27.3% | 27.5% | 26.7% |

| Interest Coverage | 3.6 | -9.8 | -1.4 | 5.6 | 7.2 |

| Asset Turnover | 1.51 | 1.56 | 1.75 | 1.98 | 2.12 |

| Fixed Asset Turnover | 8.3 | 9.3 | 11.4 | 13.1 | 14.0 |

| Dividend Yield | 2.1% | 3.1% | 5.1% | 2.1% | 2.7% |

Evolution of Financial Ratios

Return on Equity (ROE) improved significantly, rising from negative levels in 2021 and 2022 to 29.95% in 2024, indicating a strong recovery in profitability. The Current Ratio showed a steady increase from 1.09 in 2022 to 1.35 in 2024, reflecting enhanced liquidity. Meanwhile, the Debt-to-Equity Ratio declined from a high of 2.70 in 2022 to 1.14 in 2024, suggesting a reduction in financial leverage and improved balance sheet stability.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as ROE (29.95%) and Return on Invested Capital (13.59%) were favorable, while the net profit margin remained low at 3.3%, considered unfavorable. Liquidity ratios presented a mixed picture: the Current Ratio at 1.35 was neutral, but the Quick Ratio at 0.64 was unfavorable. Leverage metrics were mixed as well; the Debt-to-Equity ratio was unfavorable at 1.14, but Debt-to-Assets at 26.7% and interest coverage ratio at 7.48 were favorable. Efficiency ratios like asset turnover (2.12) and fixed asset turnover (14.05) were strong, supporting a generally favorable overall assessment.

Shareholder Return Policy

Hyster-Yale Materials Handling, Inc. pays dividends with a payout ratio around 17%, a steady dividend per share near 1.37 USD, and an annual yield of about 2.7%. The dividend coverage by free cash flow appears solid, though share buyback activity is not explicitly mentioned.

This payout approach, supported by positive net margins and adequate free cash flow, suggests a balanced distribution strategy. It appears aligned with sustainable long-term shareholder value creation, minimizing risks of over-distribution or excessive repurchases.

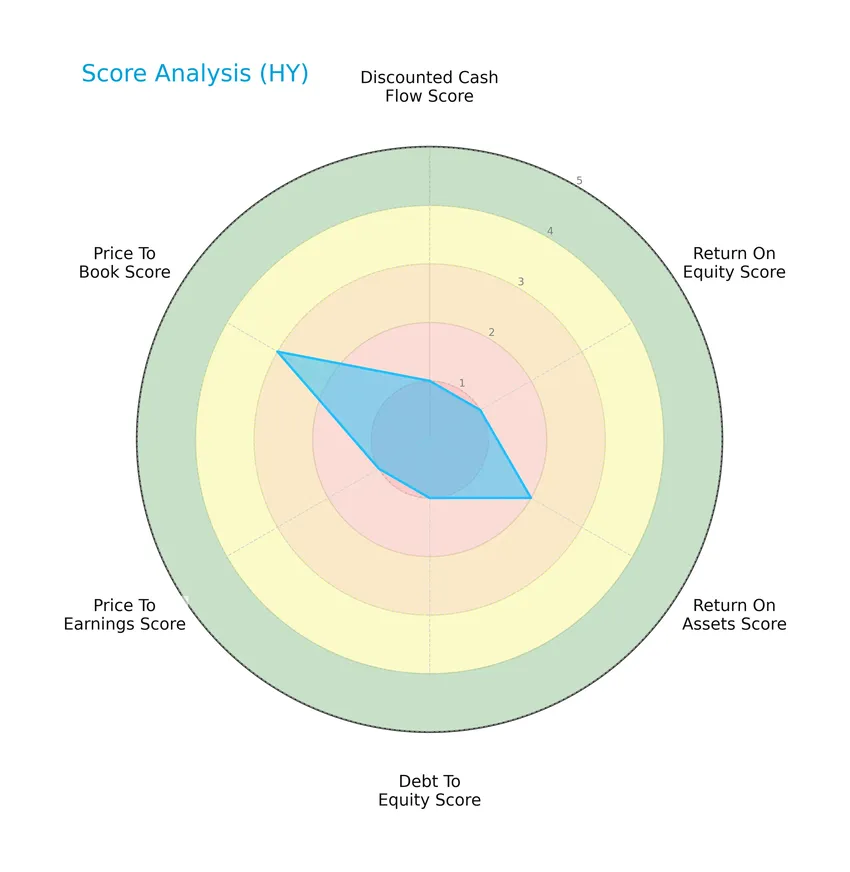

Score analysis

The following radar chart presents a comprehensive view of Hyster-Yale Materials Handling, Inc.’s key financial scores:

The company’s scores indicate generally very unfavorable valuations in discounted cash flow, return on equity, debt-to-equity, and price-to-earnings metrics. Return on assets and price-to-book ratios show moderate standings, reflecting mixed operational efficiency and valuation perspectives.

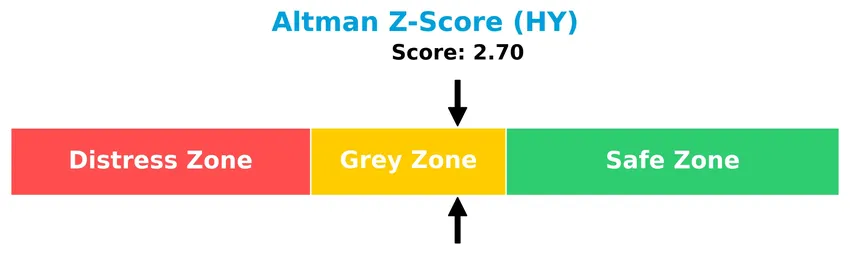

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Hyster-Yale Materials Handling, Inc. in the grey zone, indicating a moderate risk of bankruptcy and financial uncertainty:

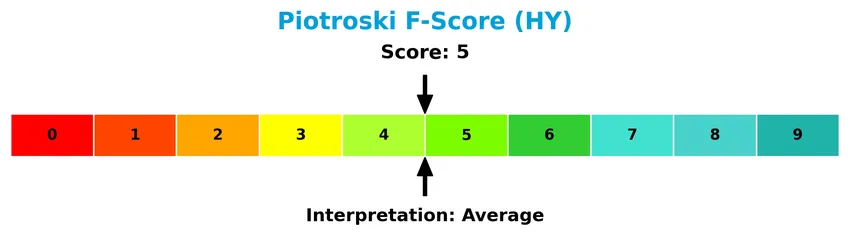

Is the company in good financial health?

The Piotroski Score diagram below illustrates the company’s current financial strength assessment:

With a Piotroski Score of 5, Hyster-Yale Materials Handling, Inc. is classified as having average financial health, suggesting a balanced but not particularly strong position in terms of profitability, leverage, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will examine Hyster-Yale Materials Handling, Inc.’s strategic positioning, revenue breakdown, key products, main competitors, and competitive advantages. I will assess whether the company holds a competitive edge over its industry peers based on these factors.

Strategic Positioning

Hyster-Yale Materials Handling, Inc. maintains a concentrated product portfolio centered on lift trucks and related components, with growing aftermarket parts and fuel-cell technologies. Geographically, it focuses mainly on the Americas, generating over $3.2B in revenue, with significant but smaller exposure to EMEA at $708M in 2024.

Revenue by Segment

This pie chart illustrates the revenue distribution of Hyster-Yale Materials Handling, Inc. by segment for the fiscal year 2024.

In 2024, “Other revenue” accounted for $355M, reflecting a modest increase from $311M in 2023. Earlier years show the “Lift truck business” as the dominant segment, consistently generating over $2.4B to $3.3B from 2015 to 2022. “Bolzoni,” “JAPIC,” and “Nuvera” contributed smaller amounts, with Bolzoni growing from $115M in 2016 to $356M in 2022. The recent data highlights a shift toward categorizing revenue under “Other revenue,” suggesting possible segment restructuring or consolidation.

Key Products & Brands

The table below outlines Hyster-Yale Materials Handling, Inc.’s primary products and brand offerings:

| Product | Description |

|---|---|

| Lift Truck Business | Designs, engineers, manufactures, sells, and services lift trucks worldwide under the Hyster and Yale brand names. |

| Bolzoni | Produces and distributes attachments, forks, and lift tables for material handling equipment. |

| JAPIC | A brand involved in product offerings, specific description not detailed. |

| Nuvera | Designs, manufactures, and sells hydrogen fuel-cell stacks and engines. |

| Other Revenue | Represents additional revenue sources not detailed under main product lines. |

Hyster-Yale’s key products focus on lift trucks and material handling attachments marketed primarily under the Hyster, Yale, and Bolzoni brands, alongside specialized fuel-cell technology under the Nuvera name. The diversified portfolio supports various industrial and commercial sectors globally.

Main Competitors

There are 5 competitors in the Agricultural – Machinery industry; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Caterpillar Inc. | 280.3B |

| Deere & Company | 126.2B |

| PACCAR Inc | 58.6B |

| Hyster-Yale Materials Handling, Inc. | 527M |

| Columbus McKinnon Corporation | 496M |

Hyster-Yale Materials Handling ranks 4th among its competitors with a market cap approximately 0.21% of the leader, Caterpillar Inc. The company is positioned below both the average market cap of the top 10 competitors (93.2B) and the median market cap in the sector (58.6B). Notably, it has a significant gap of +9751.5% compared to the next competitor above it.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does HY have a competitive advantage?

Hyster-Yale Materials Handling, Inc. presents a competitive advantage, demonstrated by a very favorable moat status with a ROIC exceeding WACC by 5.5% and a strong upward ROIC trend of 254%, indicating efficient capital use and value creation. The company’s gross margin of 20.79% and consistent income statement growth further support its durable profitability in the agricultural machinery industry.

Looking ahead, Hyster-Yale is positioned to leverage opportunities in the hydrogen fuel-cell market and expand its product offerings in port equipment and rough terrain forklifts. Its established presence in the Americas and EMEA regions, coupled with favorable growth in gross profit and earnings per share, suggests potential for sustained market penetration and innovation-driven revenue expansion.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Hyster-Yale Materials Handling, Inc., aiding investors in understanding its strategic position.

Strengths

- Strong brand portfolio with Hyster and Yale

- Favorable gross margin of 20.79%

- Durable competitive advantage with growing ROIC

Weaknesses

- Moderate net margin at 3.3%

- Elevated debt-to-equity ratio at 1.14

- Quick ratio below 1 indicating liquidity concerns

Opportunities

- Expanding hydrogen fuel cell technology

- Growing aftermarket parts sales

- Revenue growth of 53.2% over 5 years

Threats

- High beta of 1.44 indicating stock volatility

- Competition in industrial machinery sector

- Economic sensitivity of manufacturing customers

Overall, Hyster-Yale shows solid operational strengths and a durable moat with expanding profitability, but it faces margin pressure and liquidity risks. The company’s growth opportunities in alternative energy and aftermarket services suggest a strategic focus on innovation and diversification to mitigate competitive and economic threats.

Stock Price Action Analysis

The weekly stock chart of Hyster-Yale Materials Handling, Inc. (HY) over the past 12 months shows significant price fluctuations and trend developments:

Trend Analysis

Over the past year, HY’s stock price declined by 41.41%, indicating a bearish trend with accelerating downward momentum. The price ranged from a high of 78.14 to a low of 28.15, with a high volatility marked by a standard deviation of 13.72. This trend reflects a strong negative pressure on the stock.

Volume Analysis

In the last three months, trading volume has been increasing, but seller volume (4.63M) exceeded buyer volume (3.03M), with buyers accounting for only 39.56%. This seller dominance suggests cautious or negative investor sentiment and heightened market participation favoring selling pressure.

Target Prices

The consensus target price for Hyster-Yale Materials Handling, Inc. stands firm at $40.

| Target High | Target Low | Consensus |

|---|---|---|

| 40 | 40 | 40 |

Analysts uniformly expect the stock to reach $40, indicating a stable outlook with limited variation in price targets.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the grades and consumer feedback related to Hyster-Yale Materials Handling, Inc. (HY).

Stock Grades

Here is a concise overview of the recent stock grades from recognized analysts for Hyster-Yale Materials Handling, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth MKM | Maintain | Buy | 2024-11-06 |

| Roth MKM | Maintain | Buy | 2024-08-08 |

| Roth MKM | Maintain | Buy | 2024-06-07 |

| Northland Capital Markets | Upgrade | Outperform | 2024-06-05 |

| Northland Capital Markets | Downgrade | Market Perform | 2024-05-10 |

| Roth MKM | Maintain | Buy | 2024-05-09 |

| EF Hutton | Maintain | Buy | 2023-05-04 |

| EF Hutton | Maintain | Buy | 2023-05-03 |

| EF Hutton | Maintain | Buy | 2023-03-01 |

| EF Hutton | Maintain | Buy | 2022-03-02 |

The grades show a consistent buy rating from Roth MKM and EF Hutton, while Northland Capital Markets has shown some fluctuation between market perform and outperform within 2024. The consensus among analysts is a buy, supported by three buy and three hold ratings with a single sell.

Consumer Opinions

Consumers have mixed but insightful perspectives on Hyster-Yale Materials Handling, Inc., reflecting both satisfaction and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Durable and reliable equipment that withstands heavy use. | Customer service response times can be slow. |

| Strong performance in material handling efficiency. | Spare parts availability sometimes limited. |

| Good value for the price with solid build quality. | Occasional technical glitches reported in software. |

Overall, consumers appreciate Hyster-Yale’s durable and efficient equipment but express concerns about customer support and parts availability, indicating a need for enhanced service responsiveness.

Risk Analysis

Below is a table summarizing the key risks associated with Hyster-Yale Materials Handling, Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Moderate risk of financial distress indicated by Altman Z-Score in the grey zone (2.70). | Medium | High |

| Profitability | Low net margin (3.3%) and unfavorable quick ratio (0.64) may pressure cash flow and earnings. | High | Medium |

| Leverage | Debt-to-equity ratio of 1.14 is unfavorable, increasing financial risk during downturns. | Medium | High |

| Market Volatility | Beta of 1.44 suggests higher stock price volatility compared to market averages. | High | Medium |

| Valuation | Very unfavorable price-to-earnings and return on equity scores may indicate undervaluation risks. | Medium | Medium |

| Operational Risks | Exposure to industrial and agricultural machinery markets which can be cyclical and competitive. | Medium | Medium |

The most significant risks stem from moderate financial distress signals and leverage concerns, despite favorable return on equity and coverage ratios. Given the company’s position in cyclical industrial sectors, investors should monitor liquidity and debt levels carefully.

Should You Buy Hyster-Yale Materials Handling, Inc.?

Hyster-Yale appears to demonstrate improving operational efficiency and value creation supported by a durable competitive moat and growing ROIC, while its leverage profile remains substantial. Despite an average profitability profile, the overall rating could be seen as moderate, suggesting cautious consideration.

Strength & Efficiency Pillars

Hyster-Yale Materials Handling, Inc. demonstrates solid profitability and value creation, with a return on equity of 29.95% and a return on invested capital (ROIC) of 13.59%. Notably, its ROIC exceeds the weighted average cost of capital (WACC) of 8.08%, confirming the company as a value creator. Financial health indicators are mixed: the Altman Z-Score of 2.70 places the firm in the grey zone, signaling moderate bankruptcy risk, while the Piotroski Score of 5 suggests average financial strength. Operational efficiency is further supported by a favorable debt-to-assets ratio of 26.7% and strong asset turnover metrics.

Weaknesses and Drawbacks

Despite these strengths, several metrics indicate caution. The company’s debt-to-equity ratio stands at an unfavorable 1.14, highlighting elevated leverage risk. Liquidity is a concern, with a quick ratio of 0.64 falling below the optimal threshold, increasing short-term solvency risk. Valuation appears reasonable with a P/E of 6.24 (favorable) and a neutral P/B of 1.87; however, the recent seller dominance—buyers account for only 39.56% of volume between November 2025 and January 2026—exerts downward pressure on the stock amid a broader bearish trend with a -41.41% price change since 2024.

Our Verdict about Hyster-Yale Materials Handling, Inc.

The company’s long-term fundamental profile appears favorable due to its value-creating ability and improving profitability metrics. However, the recent seller-dominant market behavior amid an accelerating bearish trend suggests caution. Despite underlying financial strengths, this environment may warrant a wait-and-see approach before committing capital, as the stock could face continued short-term headwinds despite its attractive fundamentals.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- HYSTER-YALE ANNOUNCES COST REDUCTION ACTIONS AMID CHALLENGING MARKET CONDITIONS – PR Newswire (Nov 19, 2025)

- Hyster-Yale Materials Handling, Limbach, Astec, American Woodmark, and Meritage Homes Stocks Trade Down, What You Need To Know – FinancialContent (Jan 23, 2026)

- Short Interest in Hyster-Yale, Inc. (NYSE:HY) Decreases By 19.4% – MarketBeat (Jan 19, 2026)

- Liquidity Mapping Around (HY) Price Events – Stock Traders Daily (Jan 23, 2026)

- Professional Tools and Equipment Stocks Q3 Highlights: Hyster-Yale Materials Handling (NYSE:HY) – Yahoo Finance (Nov 24, 2025)

For more information about Hyster-Yale Materials Handling, Inc., please visit the official website: hyster-yale.com