Home > Analyses > Healthcare > Humana Inc.

Humana Inc. transforms healthcare by delivering comprehensive medical and specialty insurance plans that millions rely on daily. It dominates the U.S. healthcare plans sector with a robust portfolio spanning retail, group, and healthcare services. Known for innovation and quality, Humana shapes patient experiences and provider relationships. As the healthcare landscape evolves, I ask: do Humana’s fundamentals sustain its valuation, and what growth avenues remain untapped?

Table of contents

Business Model & Company Overview

Humana Inc., founded in 1961 and headquartered in Louisville, Kentucky, stands as a dominant player in the U.S. healthcare plans industry. It operates a comprehensive ecosystem spanning Retail, Group and Specialty, and Healthcare Services segments. This ecosystem integrates medical and supplemental benefit plans with pharmacy, provider, and home health services, serving roughly 22M members across various insurance and support programs.

Humana’s revenue engine combines commercial fully insured medical plans with specialty products and administrative services for individuals, employer groups, and government contracts. Its strategic presence across the U.S. healthcare market leverages Medicare, Medicaid, and military service contracts. This competitive advantage cements Humana’s role in shaping the future of integrated health and well-being solutions.

Financial Performance & Fundamental Metrics

I analyze Humana Inc.’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder returns.

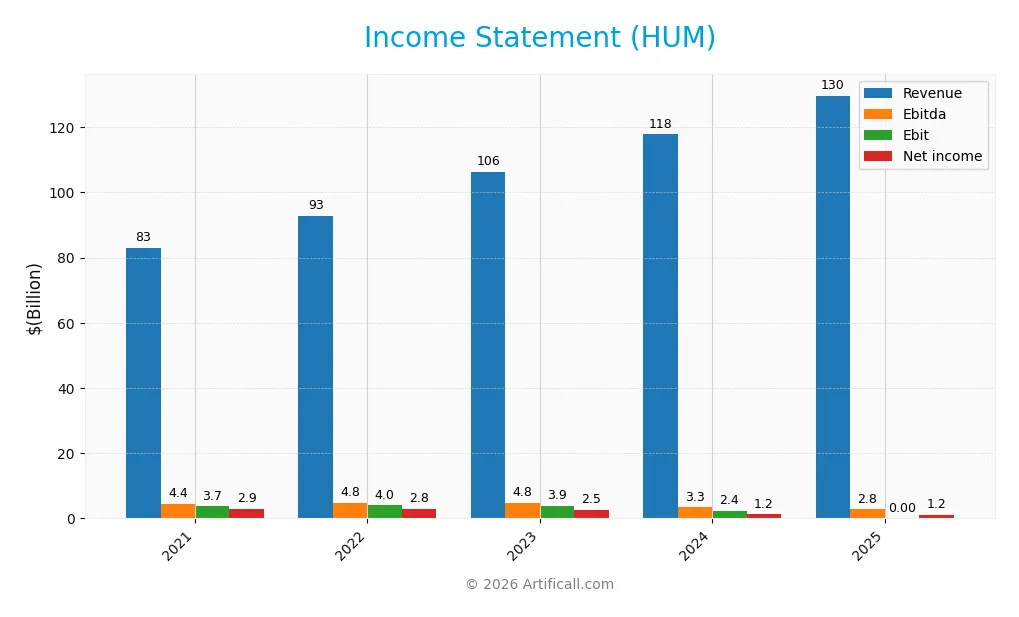

Income Statement

The table below summarizes Humana Inc.’s income statement metrics over the last five fiscal years, reflecting key profitability and expense trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 83.1B | 92.9B | 106.4B | 117.8B | 129.7B |

| Cost of Revenue | 0 | 0 | 0 | 0 | 0 |

| Operating Expenses | 79.7B | 89.3B | 103.0B | 116.0B | 127.0B |

| Gross Profit | 83.1B | 92.9B | 106.4B | 117.8B | 0 |

| EBITDA | 4.39B | 4.81B | 4.79B | 3.35B | 2.77B |

| EBIT | 3.68B | 3.97B | 3.88B | 2.38B | 0 |

| Interest Expense | 326M | 401M | 493M | 660M | 631M |

| Net Income | 2.93B | 2.81B | 2.49B | 1.21B | 1.19B |

| EPS | 22.79 | 22.20 | 20.09 | 10.01 | 9.87 |

| Filing Date | 2022-02-17 | 2023-02-16 | 2024-02-15 | 2025-02-20 | 2026-02-11 |

Income Statement Evolution

Humana Inc. posted steady revenue growth from 83B in 2021 to 130B in 2025, a 56% rise. However, net income declined sharply, falling nearly 60% over this period. Margins deteriorated significantly, with gross and EBIT margins collapsing to zero in 2025, highlighting margin pressure despite top-line expansion.

Is the Income Statement Favorable?

In 2025, Humana’s revenue grew 10.1%, but net income slipped slightly to 1.19B, yielding a thin 0.92% net margin, classified as neutral. Interest expense remained manageable at 0.49% of revenue. Yet, the sharp margin compression and falling EPS reflect weak profitability fundamentals. Overall, the income statement trends toward unfavorable conditions.

Financial Ratios

The table below presents Humana Inc.’s key financial ratios for the fiscal years 2021 through 2025, highlighting profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 3.53% | 3.02% | 2.34% | 1.02% | 0.92% |

| ROE | 18.24% | 18.33% | 15.31% | 7.37% | 0% |

| ROIC | — | — | — | — | 0% |

| P/E | 20.35 | 23.08 | 22.78 | 25.34 | 25.97 |

| P/B | 3.71 | 4.23 | 3.49 | 1.87 | 0 |

| Current Ratio | 0 | 0 | 0 | 0 | 0 |

| Quick Ratio | 0 | 0 | 0 | 0 | 0 |

| D/E | 0.66 | 0.59 | 0.63 | 0.68 | 0 |

| Debt-to-Assets | 23.76% | 20.98% | 21.70% | 23.98% | 0% |

| Interest Coverage | 10.29 | 8.90 | 6.86 | 2.61 | 4.29 |

| Asset Turnover | 1.87 | 2.16 | 2.26 | 2.53 | 0 |

| Fixed Asset Turnover | 22.14 | 24.86 | 30.05 | 39.56 | 0 |

| Dividend Yield | 0.59% | 0.61% | 0.76% | 1.41% | 1.39% |

Evolution of Financial Ratios

Humana Inc.’s profitability ratios, including net profit margin and operating margins, showed a downward trend from 2021 through 2025. Return on equity (ROE) notably declined to zero by 2025, indicating profitability challenges. The debt-to-equity ratio remained stable or fell to zero in the latest year, reflecting reduced leverage or reporting gaps. Liquidity ratios were consistently unavailable or zero, limiting trend analysis.

Are the Financial Ratios Favorable?

In 2025, Humana’s financial ratios present an unfavorable overall profile. Profitability metrics like net margin (0.92%) and ROE (0%) are weak compared to industry averages. Liquidity ratios are absent, signaling a red flag for short-term financial health. Debt ratios appear favorable, showing low leverage. Market multiples such as the price-to-earnings ratio (25.97) are high and flagged unfavorable. Dividend yield is neutral at 1.39%.

Shareholder Return Policy

Humana Inc. maintains a consistent dividend policy, with a payout ratio averaging around 36% in 2025 and a dividend yield near 1.4%. The dividend per share has steadily increased over recent years, supported by free cash flow coverage and moderate capital expenditure.

The company also engages in share buybacks, complementing dividends to return capital to shareholders. This balanced approach supports sustainable long-term value creation, reflecting prudent capital allocation without risking excessive distributions.

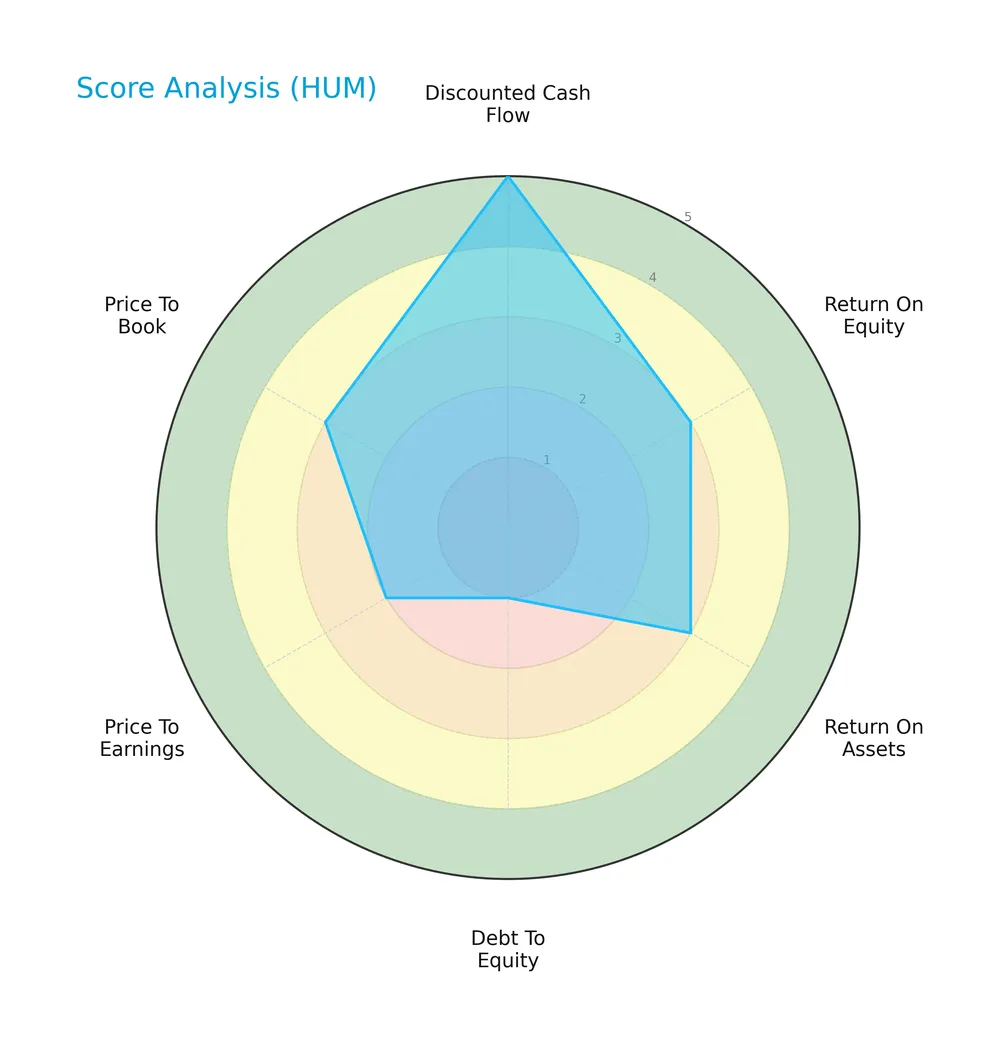

Score analysis

The following radar chart presents key financial scores to assess Humana Inc.’s valuation and operational efficiency:

Humana’s discounted cash flow score ranks very favorable at 5. Return on equity and assets show moderate strength at 3 each. Debt to equity is a significant weakness, scoring only 1. Valuation metrics price-to-earnings and price-to-book register unfavorable to moderate scores.

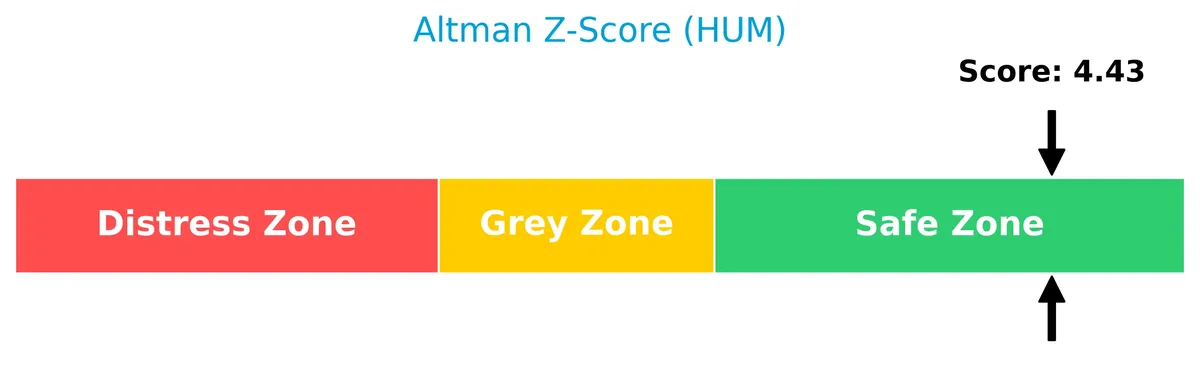

Analysis of the company’s bankruptcy risk

Humana’s Altman Z-Score firmly places it in the safe zone, indicating low bankruptcy risk and strong financial stability:

Is the company in good financial health?

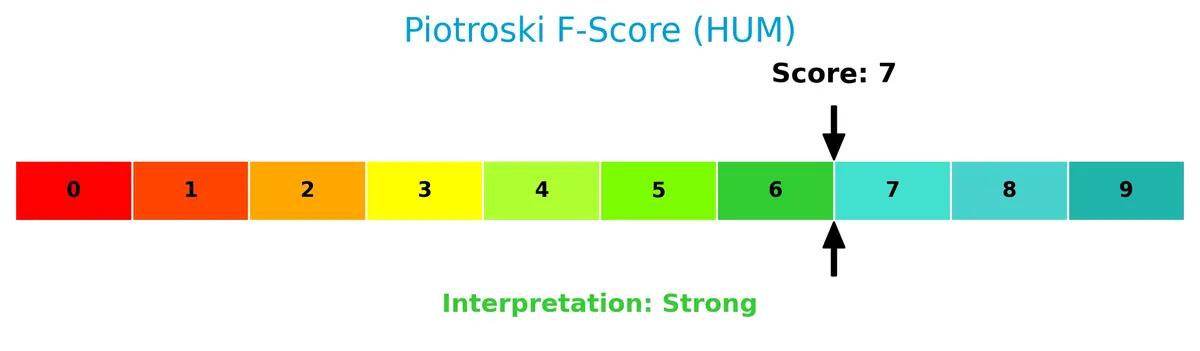

The Piotroski Score diagram illustrates Humana’s solid financial health with a strong score of 7:

A score of 7 suggests Humana maintains good profitability, liquidity, and operational efficiency. This level generally reflects strong financial fundamentals, supporting resilience in various market conditions.

Competitive Landscape & Sector Positioning

This sector analysis examines Humana Inc.’s strategic positioning, revenue segments, product offerings, and main competitors. I will evaluate whether Humana holds a sustainable competitive advantage within the healthcare plans industry.

Strategic Positioning

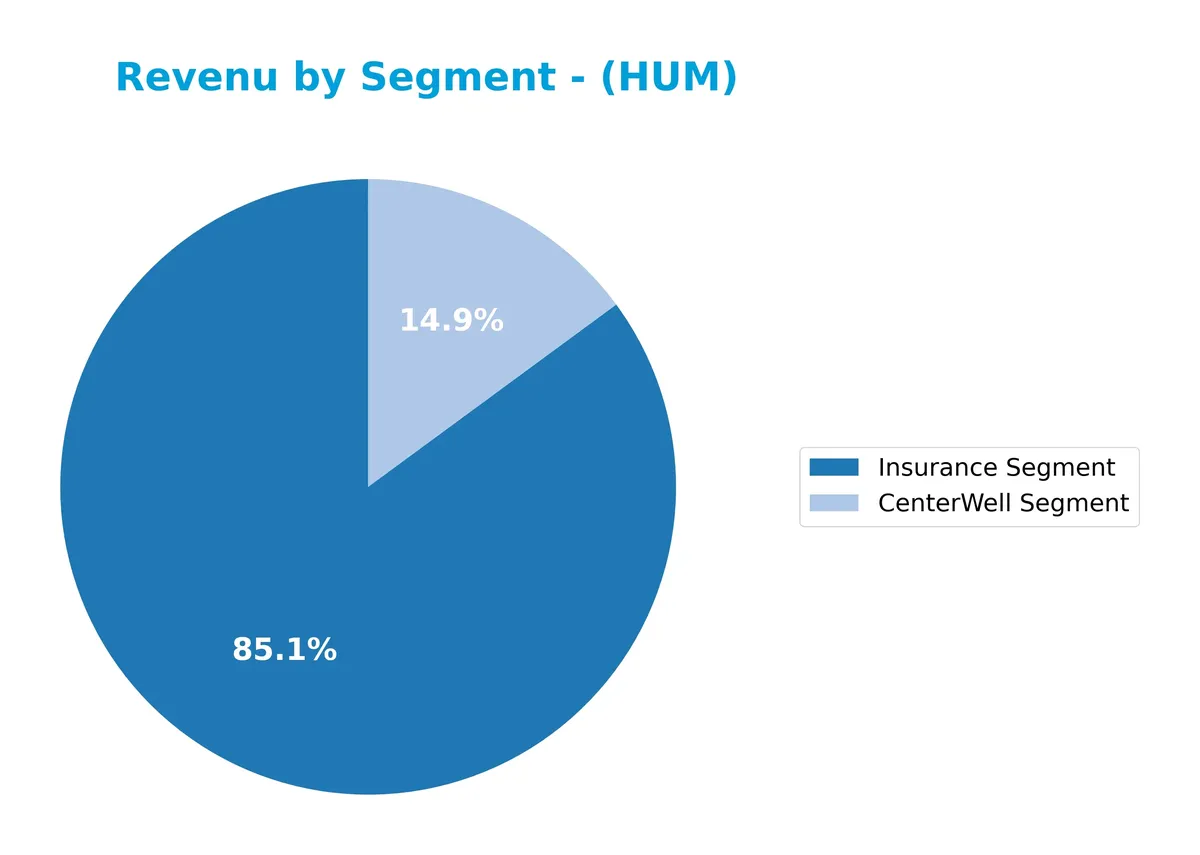

Humana Inc. concentrates primarily on the U.S. healthcare market, offering diversified products across insurance and healthcare services. Its 2024 revenue split shows $114B from insurance and $20B from CenterWell healthcare services, reflecting a focused yet multi-segment approach within medical and specialty plans.

Revenue by Segment

The pie chart illustrates Humana Inc.’s revenue breakdown by segment for the fiscal year 2024, highlighting the contribution of each business unit to total sales.

In 2024, Humana’s Insurance Segment dominates with $114B, up from $103B in 2023, reflecting strong core operations. CenterWell Segment shows solid growth, reaching $20B from $18.4B the prior year, signaling expansion in healthcare services. The shift from multiple smaller segments to a concentrated two-segment model indicates strategic focus and potential concentration risk, but also clearer operational strengths.

Key Products & Brands

The table below outlines Humana Inc.’s primary products and brands along with their descriptions:

| Product | Description |

|---|---|

| Retail Segment | Medical and supplemental benefit plans to individuals, including commercial fully insured medical and specialty insurance benefits. |

| Group and Specialty | Insurance products for employer groups, including dental, vision, and other supplemental health benefits. |

| Healthcare Services | Pharmacy solutions, provider services, home health and other services to health plan members and third parties. |

| CenterWell Segment | Healthcare services segment, encompassing home health and related care solutions. |

| Insurance Segment | Commercial and government health insurance plans, including Medicare and Medicaid contracts. |

Humana operates a diversified portfolio of health and well-being products. Its offerings span retail insurance, group plans, specialty benefits, and comprehensive healthcare services, reflecting a broad approach to the U.S. healthcare market.

Main Competitors

There are 7 competitors in the Healthcare Medical – Healthcare Plans sector. The table lists the top 7 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| UnitedHealth Group Incorporated | 305B |

| CVS Health Corporation | 102B |

| Elevance Health Inc. | 79B |

| Cigna Corporation | 75B |

| Humana Inc. | 32B |

| Centene Corporation | 21B |

| Molina Healthcare, Inc. | 10B |

Humana Inc. ranks 5th among these competitors. Its market cap is just 6.9% of UnitedHealth Group’s, the sector leader. Humana sits below the average top-10 market cap of 89B and below the sector median of 74.6B. It holds a significant 253% market cap gap above its closest rival, Centene Corporation.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does HUM have a competitive advantage?

Humana Inc. does not present a clearly identifiable competitive advantage based on available data. Its ROIC compared to WACC is unavailable, and the company’s income statement shows mostly unfavorable profitability trends.

Looking ahead, Humana’s diverse segments and contracts with government programs offer growth opportunities. Expansion in specialty products and healthcare services may support future market positioning despite current profitability challenges.

SWOT Analysis

This SWOT analysis highlights Humana Inc.’s key strategic factors to inform investment decisions.

Strengths

- strong Medicare and Medicaid contracts

- diversified healthcare services

- stable dividend yield

Weaknesses

- declining net margin and profitability

- unfavorable income and ratio trends

- weak liquidity ratios

Opportunities

- growing U.S. healthcare demand

- expansion in specialty and home health services

- technology-driven operational improvements

Threats

- regulatory changes in healthcare

- intense industry competition

- economic pressures on insurance premiums

Humana’s strengths lie in its specialized contracts and service diversity, but profitability erosion and liquidity issues are red flags. Strategic focus should leverage growth in specialty care while managing regulatory and competitive risks.

Stock Price Action Analysis

The weekly chart illustrates Humana Inc.’s stock price movements and volatility over the past 12 months:

Trend Analysis

Humana’s stock declined sharply by 49.68% over the past year, indicating a clear bearish trend. The price dropped from a high of 392.63 to a low of 175.4, with volatility measured by a 46.35 standard deviation. The downtrend shows deceleration, suggesting the pace of decline has slowed.

Volume Analysis

Trading volume has increased overall, but the last three months show seller dominance with 70.8M shares sold versus 30.8M bought, a buyer share of just 29.65%. This signals weak investor demand and persistent selling pressure, reflecting cautious or negative market sentiment.

Target Prices

Analysts present a clear target consensus for Humana Inc., reflecting bullish expectations.

| Target Low | Target High | Consensus |

|---|---|---|

| 174 | 345 | 277.5 |

The target range indicates a broad valuation spectrum, with a consensus price suggesting significant upside potential relative to current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Humana Inc.’s recent analyst grades and consumer feedback to offer a balanced perspective.

Stock Grades

Here is the latest verified rating summary from established financial institutions for Humana Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Downgrade | Underweight | 2026-02-02 |

| Wells Fargo | Downgrade | Equal Weight | 2026-01-07 |

| Barclays | Maintain | Equal Weight | 2026-01-05 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Jefferies | Upgrade | Buy | 2025-12-05 |

| Barclays | Maintain | Equal Weight | 2025-11-25 |

| Truist Securities | Maintain | Hold | 2025-11-10 |

| Deutsche Bank | Maintain | Hold | 2025-11-07 |

| B of A Securities | Maintain | Neutral | 2025-10-10 |

| Mizuho | Maintain | Outperform | 2025-10-09 |

The recent trend reveals a cautious shift with notable downgrades from Morgan Stanley and Wells Fargo. Most grades cluster around neutral to hold, signaling tempered confidence amid mixed analyst outlooks.

Consumer Opinions

Consumer sentiment around Humana Inc. reflects a nuanced balance between service satisfaction and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent customer service with prompt responses.” | “Long wait times for claim processing.” |

| “Comprehensive coverage options tailored to my needs.” | “Premiums have increased sharply over the last year.” |

| “User-friendly online portal simplifies managing my plan.” | “Limited provider network in rural areas.” |

Overall, consumers praise Humana’s customer service and plan flexibility. However, recurring complaints about claim delays and rising costs suggest challenges in operational efficiency and pricing strategy.

Risk Analysis

Below is a summary of key risks affecting Humana Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Profitability Risk | Net margin below 1% signals weak profitability despite scale; pressure on earnings persists. | Medium | High |

| Liquidity Risk | Current and quick ratios at zero indicate potential short-term liquidity constraints. | Medium | Medium |

| Debt Risk | Favorable debt-to-equity and debt-to-assets ratios reduce financial leverage concerns. | Low | Low |

| Valuation Risk | Price-to-earnings ratio near 26 is high relative to healthcare peers, raising valuation risk. | Medium | Medium |

| Operational Risk | Unfavorable ROE and ROIC reflect inefficiencies in capital allocation and asset use. | Medium | High |

| Market Risk | Low beta (0.44) suggests limited volatility but may reduce upside in strong market rallies. | Low | Low |

The most pressing risks are Humana’s weak profitability and operational inefficiencies, which limit returns despite a strong Altman Z-score (4.43, safe zone) and a solid Piotroski score (7, strong). Liquidity concerns warrant caution, but manageable debt levels provide a buffer. The recent 3.25% share price decline underscores market sensitivity to these factors.

Should You Buy Humana Inc.?

Humana Inc. appears to be a moderately profitable company with signs of improving operational efficiency and a resilient income quality profile. While its debt leverage profile could be seen as substantial, the firm’s overall rating of B suggests a very favorable value creation potential.

Strength & Efficiency Pillars

Humana Inc. operates with a solid financial footing, evidenced by an Altman Z-Score of 4.43, placing it comfortably in the safe zone. The company boasts a strong Piotroski score of 7, signaling robust financial health. Although specific ROIC and WACC data are unavailable, the safe solvency position and strong operational cash flow suggest efficient capital allocation. Despite modest net margins of 0.92%, Humana maintains favorable interest expenses at 0.49%, supporting stable operational performance.

Weaknesses and Drawbacks

Humana faces valuation and liquidity challenges that temper its investment appeal. The price-to-earnings ratio stands at 25.97, reflecting a relatively high valuation that could limit upside. Liquidity ratios are notably weak, with current and quick ratios at zero, posing risks to short-term financial flexibility. Seller dominance at 70.35% in the recent period creates near-term market pressure. Furthermore, unfavorable trends in net margin growth (-10.61% over one year) and earnings per share (-1.4%) highlight operational headwinds.

Our Final Verdict about Humana Inc.

Humana’s financial solidity and strong Piotroski score suggest a fundamentally sound company. However, the bearish price trend, significant seller dominance, and liquidity red flags imply caution. Despite long-term strength, recent market pressures and valuation concerns suggest a wait-and-see approach for a more favorable entry point. Investors might consider monitoring liquidity improvements before committing capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Humana stock down on disappointing 2026 outlook (HUM:NYSE) – Seeking Alpha (Feb 11, 2026)

- Humana (HUM) Q4 Earnings: What To Expect – Yahoo Finance (Feb 10, 2026)

- Why Is Humana Stock Falling Wednesday? – Humana (NYSE:HUM) – Benzinga (Feb 11, 2026)

- Humana Inc (HUM) Q4 2025 Earnings Call Highlights: Strong EPS Pe – GuruFocus (Feb 11, 2026)

- Humana Reports Fourth Quarter 2025 Financial Results; Provides Full Year 2026 Financial Guidance – Business Wire (Feb 11, 2026)

For more information about Humana Inc., please visit the official website: humana.com