Home > Analyses > Industrials > Howmet Aerospace Inc.

Howmet Aerospace shapes the future of flight and transportation with cutting-edge engineered solutions. Its advanced airfoils, fastening systems, and forged wheels power leading aerospace engines and commercial vehicles worldwide. Renowned for innovation and precision, Howmet stands as a pillar in industrial machinery. As market dynamics shift, I ask: does Howmet’s robust portfolio and operational excellence still justify its premium valuation and growth expectations in 2026?

Table of contents

Business Model & Company Overview

Howmet Aerospace Inc., founded in 1888 and headquartered in Pittsburgh, Pennsylvania, commands a leading position in engineered solutions for aerospace and transportation. It integrates four core segments—Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels—into a cohesive ecosystem that supports aircraft engines, commercial transport, and defense applications worldwide. This extensive portfolio reflects a mission focused on advanced manufacturing excellence across multiple industrial machineries.

The company’s revenue engine balances precision hardware with engineered components, supplying airfoils, fasteners, forgings, and wheels across Americas, Europe, and Asia. This diversified stream anchors recurring demand from aerospace giants and transportation fleets alike. Howmet Aerospace’s economic moat stems from its high-spec manufacturing capabilities and critical role in the global aerospace supply chain, positioning it as a durable force shaping the industry’s future.

Financial Performance & Fundamental Metrics

I will analyze Howmet Aerospace Inc.’s income statement, key financial ratios, and dividend payout policy to uncover its core operational strengths and risks.

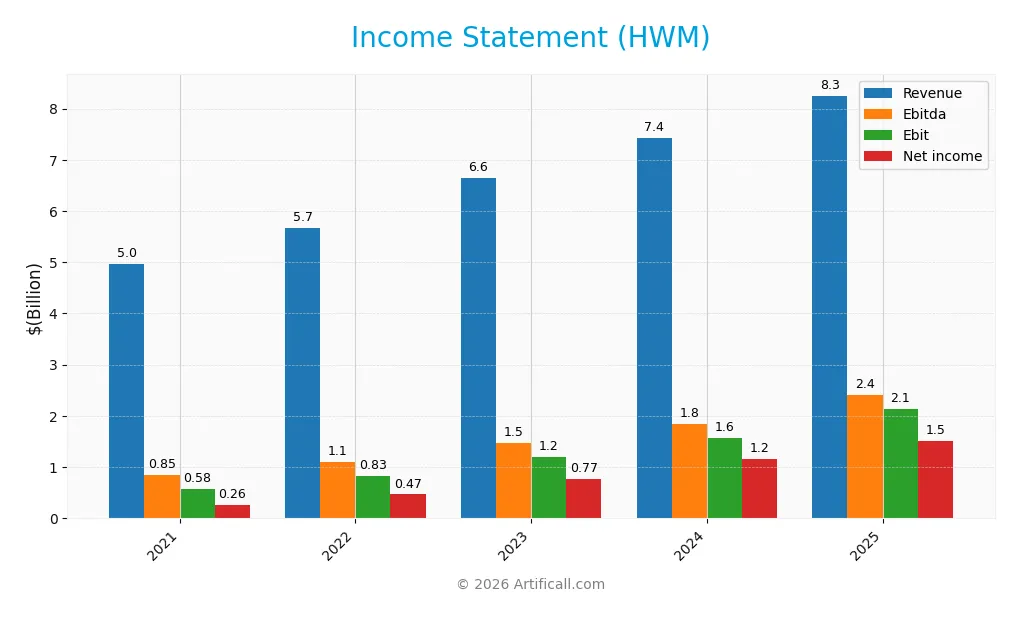

Income Statement

The table below summarizes Howmet Aerospace Inc.’s key income statement figures for fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 4.97B | 5.66B | 6.64B | 7.43B | 8.25B |

| Cost of Revenue | 3.84B | 4.31B | 5.03B | 5.38B | 5.72B |

| Operating Expenses | 268M | 320M | 369M | 380M | 407M |

| Gross Profit | 1.13B | 1.35B | 1.61B | 2.05B | 2.54B |

| EBITDA | 853M | 1.10B | 1.46B | 1.84B | 2.41B |

| EBIT | 583M | 835M | 1.19B | 1.57B | 2.13B |

| Interest Expense | 259M | 229M | 218M | 182M | 151M |

| Net Income | 258M | 469M | 765M | 1.16B | 1.51B |

| EPS | 0.60 | 1.12 | 1.85 | 2.83 | 3.73 |

| Filing Date | 2022-02-14 | 2023-02-14 | 2024-02-13 | 2025-02-14 | 2026-02-12 |

Income Statement Evolution

Howmet Aerospace’s revenue grew steadily from $5.0B in 2021 to $8.3B in 2025, marking a 66% increase over five years. Net income surged even faster, rising nearly fivefold to $1.5B. Margins improved significantly, with gross and net margins expanding, reflecting enhanced cost control and operational leverage.

Is the Income Statement Favorable?

The 2025 income statement shows robust fundamentals. Gross margin stands at a healthy 30.7%, and EBIT margin reached 25.8%, both favorable compared to industry norms. Interest expense remains low at 1.8% of revenue, supporting strong net margin of 18.3%. Earnings per share growth of 32% year-over-year underscores operational strength and capital efficiency.

Financial Ratios

The following table summarizes key financial ratios for Howmet Aerospace Inc. over the last five fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 5.2% | 8.3% | 11.5% | 15.5% | 18.3% |

| ROE | 7.4% | 13.0% | 18.9% | 25.4% | 28.2% |

| ROIC | 7.7% | 9.1% | 11.0% | 15.5% | 18.2% |

| P/E | 53.0 | 35.0 | 29.2 | 38.6 | 54.9 |

| P/B | 3.9 | 4.6 | 5.5 | 9.8 | 15.5 |

| Current Ratio | 2.18 | 2.12 | 1.86 | 2.17 | 2.13 |

| Quick Ratio | 1.07 | 1.04 | 0.87 | 0.98 | 1.09 |

| D/E | 1.24 | 1.19 | 0.95 | 0.76 | 0.57 |

| Debt-to-Assets | 43% | 42% | 37% | 33% | 27% |

| Interest Coverage | 3.3x | 4.5x | 5.7x | 9.2x | 14.1x |

| Asset Turnover | 0.49 | 0.55 | 0.64 | 0.71 | 0.74 |

| Fixed Asset Turnover | 2.02 | 2.43 | 2.70 | 2.92 | 3.18 |

| Dividend Yield | 0.14% | 0.27% | 0.33% | 0.24% | 0.22% |

Evolution of Financial Ratios

Return on Equity (ROE) steadily increased from 7.35% in 2021 to 28.17% in 2025, reflecting improved profitability. The Current Ratio remained stable, fluctuating around 2.1 to 2.2, indicating consistent liquidity. Debt-to-Equity Ratio declined from 1.24 in 2021 to 0.57 in 2025, showing reduced leverage and strengthened financial structure.

Are the Financial Ratios Fovorable?

In 2025, profitability ratios such as net margin (18.27%) and ROE (28.17%) are favorable, outperforming many sector peers. Liquidity ratios, including current (2.13) and quick (1.09), remain solid. Leverage ratios like debt-to-assets (27.28%) are favorable, while debt-to-equity (0.57) is neutral. Market multiples such as P/E (54.93) and P/B (15.47) appear stretched, with dividend yield (0.22%) also unfavorable. Overall, ratios are generally favorable with caution on valuation metrics.

Shareholder Return Policy

Howmet Aerospace Inc. maintains a consistent dividend policy with a payout ratio near 12% in 2025 and a modest dividend yield of 0.22%. The dividend per share has steadily increased from 0.044 in 2021 to 0.448 in 2025, supported by coverage ratios exceeding 2.9, indicating sustainable free cash flow backing dividends.

The company also engages in share buybacks, complementing its return strategy. This balanced approach of dividend payments and buybacks appears aligned with preserving long-term shareholder value, given Howmet’s solid profitability and cash flow metrics, while avoiding excessive distributions that could strain financial flexibility.

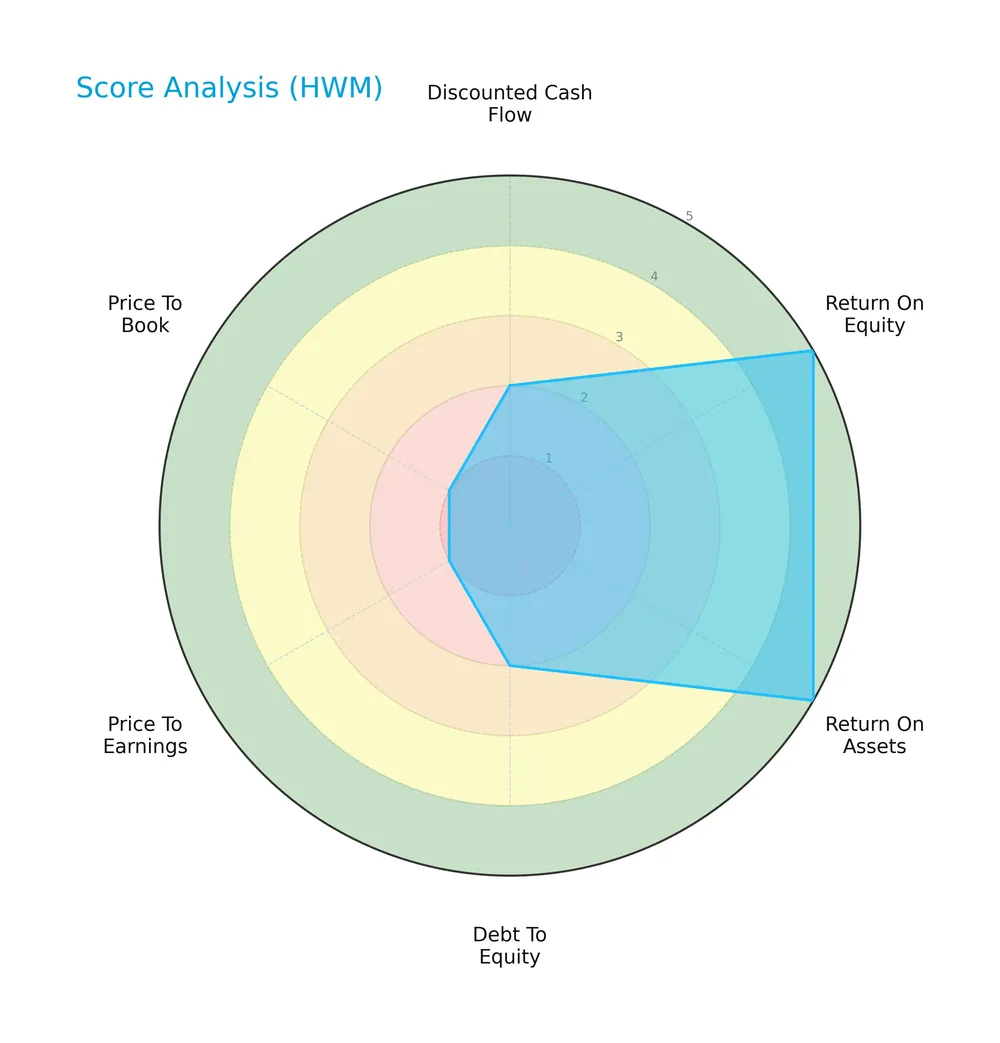

Score analysis

The radar chart below displays Howmet Aerospace Inc.’s key valuation and profitability scores:

Howmet Aerospace scores very favorably on return on equity and assets, reflecting strong profitability. However, its discounted cash flow and debt-to-equity scores are unfavorable, indicating capital structure concerns. Valuation metrics—price-to-earnings and price-to-book—register very unfavorable, suggesting the stock may be expensive relative to earnings and book value.

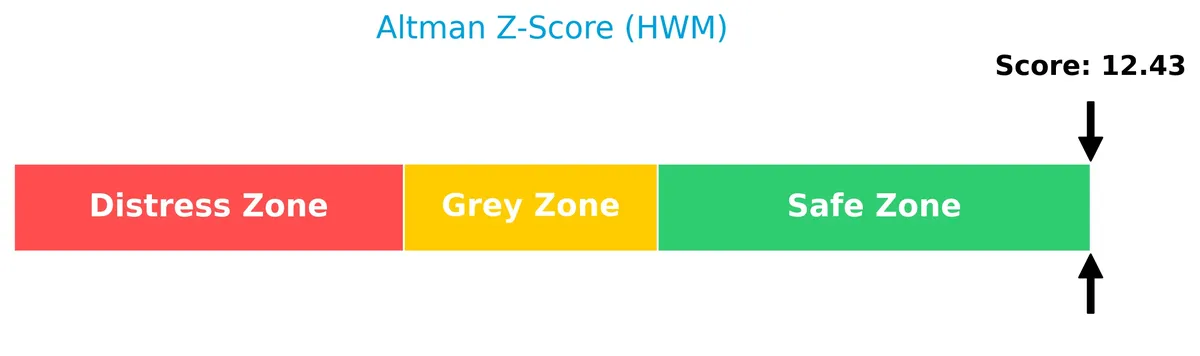

Analysis of the company’s bankruptcy risk

The Altman Z-Score positions Howmet Aerospace firmly in the safe zone, signaling low bankruptcy risk and financial stability:

Is the company in good financial health?

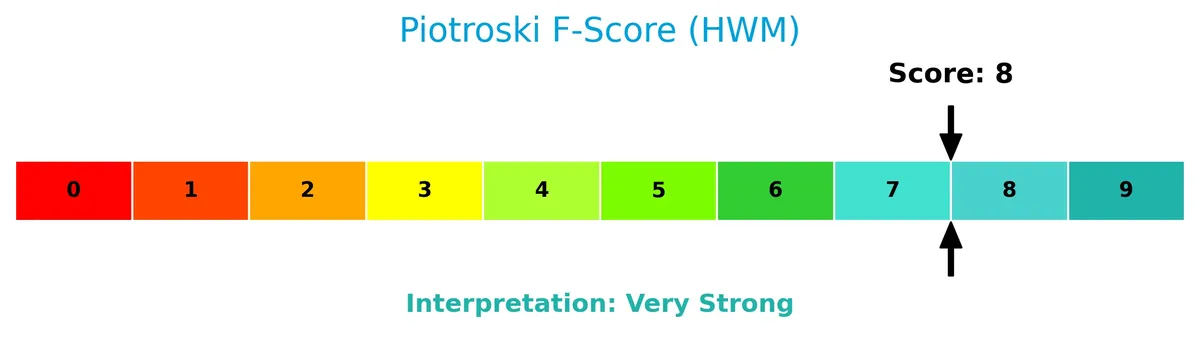

The Piotroski Score diagram highlights Howmet Aerospace’s robust financial condition:

With a Piotroski Score of 8, Howmet Aerospace shows very strong financial health. This implies solid profitability, efficient asset use, and prudent leverage management, reinforcing a positive financial profile.

Competitive Landscape & Sector Positioning

This sector analysis examines Howmet Aerospace Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Howmet Aerospace holds a competitive advantage over its industry peers.

Strategic Positioning

Howmet Aerospace diversifies across four product segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels. It operates globally, generating significant revenue from the United States, Europe, and Asia, reflecting a broad geographic footprint in aerospace and transportation industries.

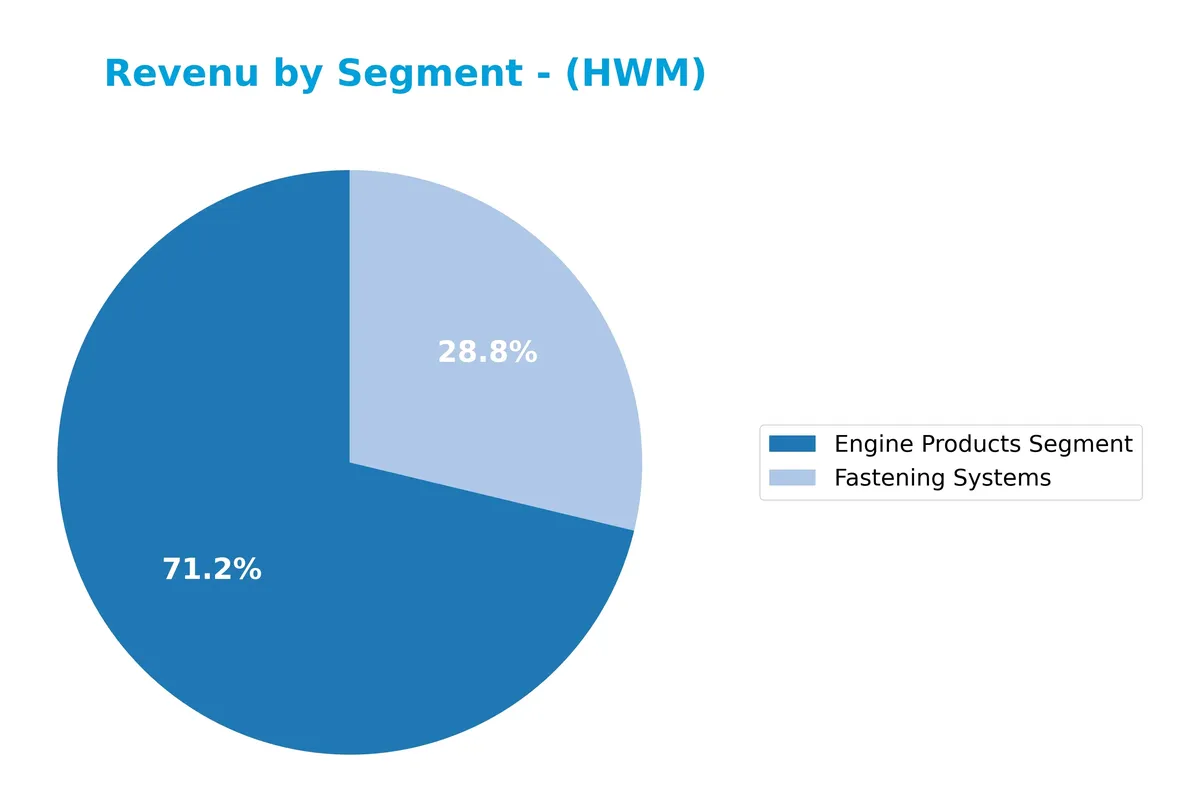

Revenue by Segment

This pie chart illustrates Howmet Aerospace Inc.’s revenue distribution by segment for the fiscal year 2025, highlighting relative contributions across its main business units.

In 2025, the Engine Products Segment drives the business with $4.3B, showing robust growth from $3.7B in 2024. Fastening Systems contributes $1.7B, also expanding steadily. Notably, Structure Systems and Wheel Systems are absent this year, indicating a strategic shift or consolidation risk. The concentration in two segments suggests a focused portfolio but raises questions on diversification compared to prior years.

Key Products & Brands

The table below outlines Howmet Aerospace’s primary products and their core features:

| Product | Description |

|---|---|

| Engine Products Segment | Airfoils, seamless rolled rings, rotating and structural parts mainly for aircraft engines and industrial gas turbines. |

| Fastening Systems | Aerospace fastening systems and fasteners for commercial transportation and industrial markets. |

| Engineered Structures | Titanium ingots, mill products for aerospace and defense, plus aluminum and nickel forgings and assemblies. |

| Forged Wheels | Forged aluminum wheels and related products for heavy-duty trucks and commercial transportation. |

Howmet Aerospace delivers engineered solutions across aerospace and transportation sectors. Its diverse segments support aircraft engines, defense applications, and commercial vehicles, reflecting broad industry exposure.

Main Competitors

Howmet Aerospace Inc. faces competition from 24 companies in its sector. The table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eaton Corporation plc | 127.1B |

| Parker-Hannifin Corporation | 114.2B |

| Howmet Aerospace Inc. | 85.2B |

| Emerson Electric Co. | 76.3B |

| Illinois Tool Works Inc. | 73.0B |

| Cummins Inc. | 71.9B |

| AMETEK, Inc. | 48.3B |

| Roper Technologies, Inc. | 46.8B |

| Rockwell Automation, Inc. | 44.8B |

| Symbotic Inc. | 35.9B |

Howmet Aerospace ranks 3rd among 24 competitors, with a market cap at 79.2% of the sector leader, Eaton Corporation. The company stands above both the average market cap of the top 10 (72.4B) and the median for its sector (32.4B). It holds a 13.4% market cap premium over its nearest rival, Emerson Electric, illustrating a solid competitive position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Howmet Aerospace Inc. have a competitive advantage?

Howmet Aerospace demonstrates a very favorable competitive advantage, consistently creating value with an ROIC exceeding WACC by 8.8% and a strong upward ROIC trend. Its diversified industrial machinery segments and global footprint underpin this sustainable profitability.

Looking ahead, Howmet’s expansion in aerospace engineered solutions and forged wheels positions it well to capture growth in defense, transportation, and advanced manufacturing markets. The company’s broad geographic reach supports new product adoption and market penetration opportunities.

SWOT Analysis

This analysis highlights Howmet Aerospace Inc.’s key strategic factors shaping its competitive position and future prospects.

Strengths

- strong global footprint with diversified aerospace and transportation segments

- robust profitability with 18% net margin

- growing ROIC well above WACC indicating value creation

Weaknesses

- high valuation metrics with PE of 54.9 and PB of 15.5

- low dividend yield at 0.22% limiting income appeal

- moderate debt-to-equity ratio warrants monitoring

Opportunities

- expanding aerospace demand driven by global air travel recovery

- technological innovation in engineered structures and advanced materials

- potential to increase market share in emerging economies

Threats

- cyclical volatility in industrial machinery sector

- geopolitical risks affecting supply chains and international sales

- raw material cost inflation pressuring margins

Howmet Aerospace’s strong operational performance and sustainable competitive advantage position it well for growth. However, valuation risks and external uncertainties require cautious portfolio weighting.

Stock Price Action Analysis

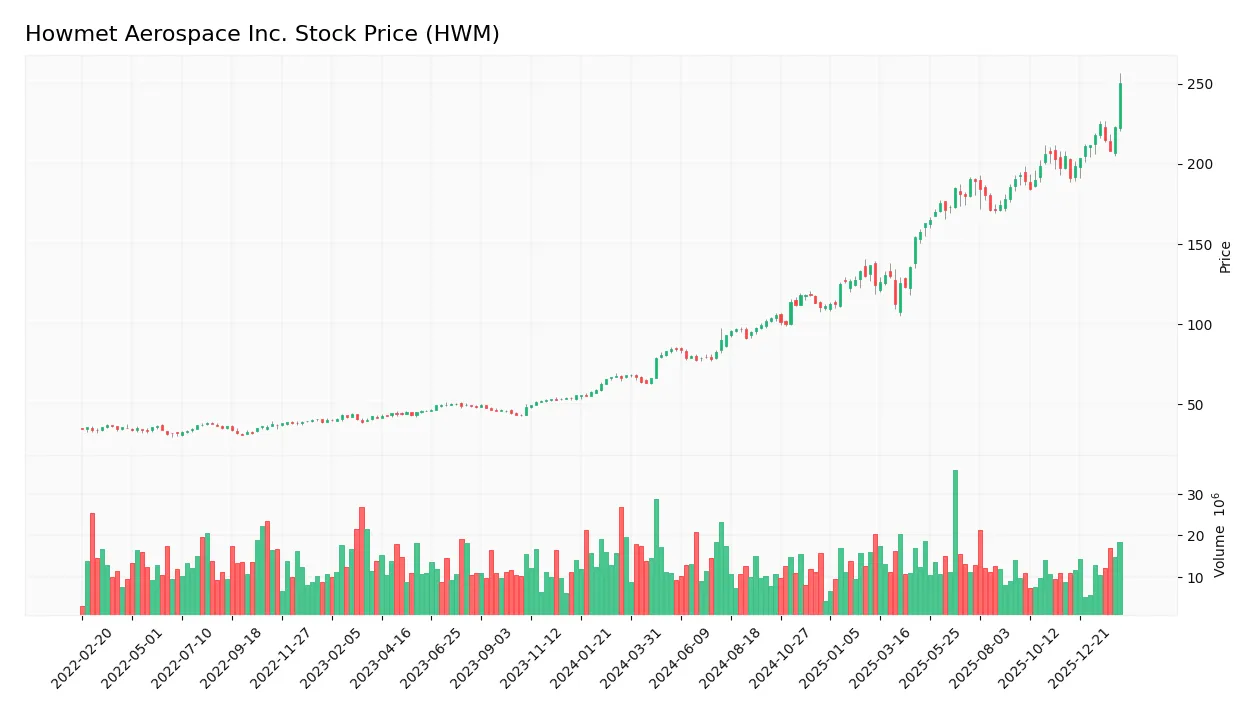

The weekly stock chart of Howmet Aerospace Inc. (HWM) highlights significant price movement and volatility over the analyzed period:

Trend Analysis

Over the past two years, HWM’s stock price surged 267.42%, marking a clear bullish trend with accelerating momentum. The price ranged from a low of 63.41 to a high of 250.21, reflecting considerable volatility with a 48.78 standard deviation. The recent three-month period shows a 22.3% rise and steady upward slope of 3.37.

Volume Analysis

Trading volume is decreasing overall, with buyers accounting for 62.25%. In the recent three months, buyer dominance strengthened to 71.85%, indicating strongly buyer-driven activity. This suggests growing investor confidence despite lower market participation in volume terms.

Target Prices

Analysts present a confident target consensus for Howmet Aerospace Inc., reflecting strong upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 209 | 290 | 259.63 |

The target range signals robust growth expectations, with a consensus price notably above current levels. This suggests optimism about Howmet’s strategic positioning and market opportunities.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback on Howmet Aerospace Inc. (HWM) performance and reputation.

Stock Grades

Here is the latest verified analyst grading data for Howmet Aerospace Inc., reflecting consistent market views:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Susquehanna | Maintain | Positive | 2026-02-13 |

| Citigroup | Maintain | Buy | 2026-01-13 |

| B of A Securities | Maintain | Buy | 2025-11-14 |

| JP Morgan | Maintain | Overweight | 2025-11-10 |

| BTIG | Maintain | Buy | 2025-11-03 |

| Goldman Sachs | Maintain | Buy | 2025-11-03 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Truist Securities | Maintain | Buy | 2025-10-15 |

The consensus overwhelmingly favors a Buy rating, with 19 out of 23 analysts endorsing the stock. Neutral and hold ratings are minimal, indicating strong confidence with limited dissent among top-tier firms.

Consumer Opinions

Howmet Aerospace Inc. commands a mix of admiration and critique from its customer base, reflecting its complex market position.

| Positive Reviews | Negative Reviews |

|---|---|

| “High-quality aerospace components with reliable performance.” | “Occasional delays in order fulfillment disrupt project timelines.” |

| “Strong customer support that addresses technical inquiries promptly.” | “Pricing feels steep compared to some competitors.” |

| “Innovative materials that improve efficiency and durability.” | “Limited customization options for specialized needs.” |

Overall, consumers praise Howmet’s product quality and support but often flag delivery delays and pricing as key concerns. The company must balance premium offerings with improved service consistency to maintain loyalty.

Risk Analysis

Below is a summary table highlighting Howmet Aerospace’s key risk categories, their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | High P/E (55x) and P/B (15.5x) suggest overvaluation risk | High | High |

| Market Volatility | Beta of 1.26 indicates above-market price swings | Medium | Medium |

| Debt Management | Moderate debt-to-equity (0.57) with neutral rating | Medium | Medium |

| Dividend Yield | Low dividend yield (0.22%) may deter income-focused investors | High | Low |

| Industry Cyclicality | Aerospace demand sensitive to economic cycles | Medium | High |

The most pressing risks are valuation and market volatility. Howmet’s steep P/E and P/B ratios diverge sharply from industrial sector averages, signaling expensive stock price levels prone to correction. The company’s beta above 1.2 confirms heightened sensitivity to broader market swings. Despite strong profitability and balance sheet safeguards, cyclical industry pressures and modest dividend returns add layers of caution for investors.

Should You Buy Howmet Aerospace Inc.?

Howmet Aerospace appears to be a profitable company with robust and growing return on invested capital, suggesting strong value creation. Its leverage profile seems manageable, supporting operational efficiency. The overall B rating indicates a very favorable financial health profile, despite mixed valuation metrics.

Strength & Efficiency Pillars

Howmet Aerospace Inc. delivers robust profitability with a net margin of 18.27%, a return on equity of 28.17%, and a return on invested capital (ROIC) of 18.19%. Importantly, the company’s ROIC surpasses its weighted average cost of capital (WACC) at 9.4%, confirming it as a clear value creator. This efficiency is bolstered by a very favorable Piotroski score of 8, indicating strong financial health and operational improvements. Historically in aerospace manufacturing, such ROIC trends signal a sustainable competitive advantage.

Weaknesses and Drawbacks

The company’s valuation metrics raise caution. Its price-to-earnings ratio stands at 54.93, and price-to-book ratio at 15.47, both flagged as unfavorable and suggesting a premium valuation that may limit upside. Although leverage is moderate with a debt-to-equity ratio of 0.57, the premium multiples imply high market expectations. Investors should be mindful that such valuation levels may invite volatility if growth slows or market sentiment shifts.

Our Final Verdict about Howmet Aerospace Inc.

Howmet Aerospace Inc. presents a fundamentally strong profile with favorable profitability and value creation metrics. The bullish overall stock trend and strong buyer dominance in recent trading periods suggest positive market sentiment. However, premium valuation multiples might temper immediate enthusiasm. This profile may appear attractive for long-term exposure but suggests a cautious approach to timing entries given current price levels.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Freemont Management S.A. Decreases Stake in Howmet Aerospace Inc. $HWM – MarketBeat (Feb 13, 2026)

- Howmet Aerospace: Premium Valuation Justified By Rare Multi-Year Growth (NYSE:HWM) – Seeking Alpha (Feb 13, 2026)

- Howmet Aerospace Inc. (NYSE:HWM) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 13, 2026)

- Howmet Aerospace Reports Fourth Quarter and Full Year 2025 Results – PR Newswire (Feb 12, 2026)

- Susquehanna Raises Price Target for Howmet Aerospace (HWM) to $2 – GuruFocus (Feb 13, 2026)

For more information about Howmet Aerospace Inc., please visit the official website: howmet.com