Home > Analyses > Real Estate > Host Hotels & Resorts, Inc.

Host Hotels & Resorts, Inc. redefines luxury hospitality by owning and managing some of the most prestigious lodging properties in the world. As the largest lodging real estate investment trust (REIT) with a portfolio spanning 74 U.S. and several international hotels, it partners with top-tier brands like Marriott and Ritz-Carlton to deliver exceptional guest experiences. Known for its disciplined capital strategy and market influence, Host Hotels prompts a critical question: does its current valuation reflect robust growth potential in a dynamic travel sector?

Table of contents

Business Model & Company Overview

Host Hotels & Resorts, Inc., founded in 1980 and headquartered in Bethesda, MD, stands as the largest lodging real estate investment trust (REIT) in the US. Its portfolio comprises 74 properties domestically and five internationally, totaling approximately 46,100 rooms. The company’s core mission revolves around owning and managing luxury and upper-upscale hotels, creating a cohesive ecosystem through partnerships with premium brands such as Marriott®, Ritz-Carlton®, and Hyatt®.

The company’s revenue engine is driven by rental income from its extensive hotel properties, supplemented by non-controlling interests in joint ventures both in the US and abroad. This balance between direct ownership and strategic partnerships fuels cash flow across key markets in the Americas, Europe, and Asia. Host Hotels & Resorts’ disciplined capital allocation and asset management form a strong economic moat, positioning it as a defining force in shaping the future of the global lodging industry.

Financial Performance & Fundamental Metrics

This analysis reviews Host Hotels & Resorts, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investor value.

Income Statement

The following table presents Host Hotels & Resorts, Inc. (HST) income statement figures for fiscal years 2020 through 2024, expressed in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.62B | 2.89B | 4.91B | 5.31B | 5.68B |

| Cost of Revenue | 1.13B | 1.40B | 2.20B | 2.46B | 2.65B |

| Operating Expenses | 1.44B | 1.74B | 1.94B | 2.02B | 2.16B |

| Gross Profit | 487M | 1.49B | 2.71B | 2.85B | 3.03B |

| EBITDA | -138M | 851M | 1.49B | 1.67B | 1.70B |

| EBIT | -803M | 89M | 825M | 975M | 936M |

| Interest Expense | 158M | 191M | 156M | 187M | 215M |

| Net Income | -732M | -11M | 633M | 740M | 697M |

| EPS | -1.05 | -0.0155 | 0.89 | 1.04 | 0.99 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-02-22 | 2024-02-28 | 2025-02-26 |

Income Statement Evolution

Host Hotels & Resorts, Inc. (HST) showed strong revenue growth of 250.9% from 2020 to 2024, with a more moderate 7.0% increase in the last year. Net income followed a similar positive trajectory, rising nearly 195% over the period but declining 5.0% in the most recent year. Margins improved overall, with gross margin at 53.4% and net margin at 12.3%, although recent net margin growth was negative.

Is the Income Statement Favorable?

In 2024, HST reported revenue of $5.68B and net income of $697M, reflecting a net margin of 12.3%. Despite a 4.0% decline in EBIT and a nearly 12% drop in net margin year-over-year, key profitability measures remain favorable. Interest expense is well controlled at 3.8% of revenue. The overall income statement quality is assessed as favorable, supported by steady operating efficiency and positive long-term growth trends.

Financial Ratios

The following table presents key financial ratios for Host Hotels & Resorts, Inc. over the fiscal years 2020 to 2024, providing insight into profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -45% | -0.4% | 13% | 14% | 12% |

| ROE | -12% | -0.2% | 9% | 11% | 11% |

| ROIC | -6% | -0.2% | 6% | 7% | 7% |

| P/E | -14.1 | -1123 | 18.1 | 18.7 | 17.6 |

| P/B | 1.63 | 1.92 | 1.71 | 2.08 | 1.86 |

| Current Ratio | 1.55 | 1.66 | 0.96 | 1.07 | 0.65 |

| Quick Ratio | 1.55 | 1.66 | 0.96 | 1.07 | 0.65 |

| D/E | 0.97 | 0.85 | 0.71 | 0.72 | 0.85 |

| Debt-to-Assets | 48% | 44% | 39% | 39% | 43% |

| Interest Coverage | -6.0 | -1.3 | 5.0 | 4.4 | 4.1 |

| Asset Turnover | 0.13 | 0.23 | 0.40 | 0.43 | 0.44 |

| Fixed Asset Turnover | 0.16 | 0.27 | 0.48 | 0.52 | 0.50 |

| Dividend Yield | 3.1% | 0% | 1.3% | 4.0% | 6.0% |

Evolution of Financial Ratios

From 2020 to 2024, Host Hotels & Resorts, Inc. saw a recovery in profitability with Return on Equity (ROE) improving from negative in 2020 and 2021 to about 10.55% in 2024, though growth has somewhat stabilized recently. The Current Ratio declined significantly from above 1.5 in 2020 to 0.65 in 2024, indicating reduced short-term liquidity. Debt-to-Equity Ratio remained relatively steady around 0.85, showing consistent leverage levels.

Are the Financial Ratios Favorable?

In 2024, profitability metrics like net margin (12.26%) and WACC (7.5%) are favorable, yet ROE and ROIC are neutral, reflecting moderate returns. Liquidity ratios, including current and quick ratios at 0.65, are unfavorable, suggesting potential short-term liquidity concerns. Leverage ratios such as debt-to-equity (0.85) and debt-to-assets (43.25%) are neutral, indicating balanced debt levels. Efficiency ratios like asset turnover (0.44) and fixed asset turnover (0.5) are unfavorable, while dividend yield near 6% is neutral. Overall, the ratios present a slightly unfavorable financial profile.

Shareholder Return Policy

Host Hotels & Resorts, Inc. maintains a consistent dividend policy with a payout ratio slightly above 100% in 2024 and a dividend yield near 6%, supported by free cash flow coverage of approximately 63%. The company also engages in share buybacks, balancing distributions with capital expenditure coverage.

This approach, combining dividends and buybacks, reflects a commitment to returning capital while managing leverage and cash flow prudently. The near-full payout ratio suggests careful monitoring is required to ensure sustainable long-term shareholder value without risking excessive cash outflows.

Score analysis

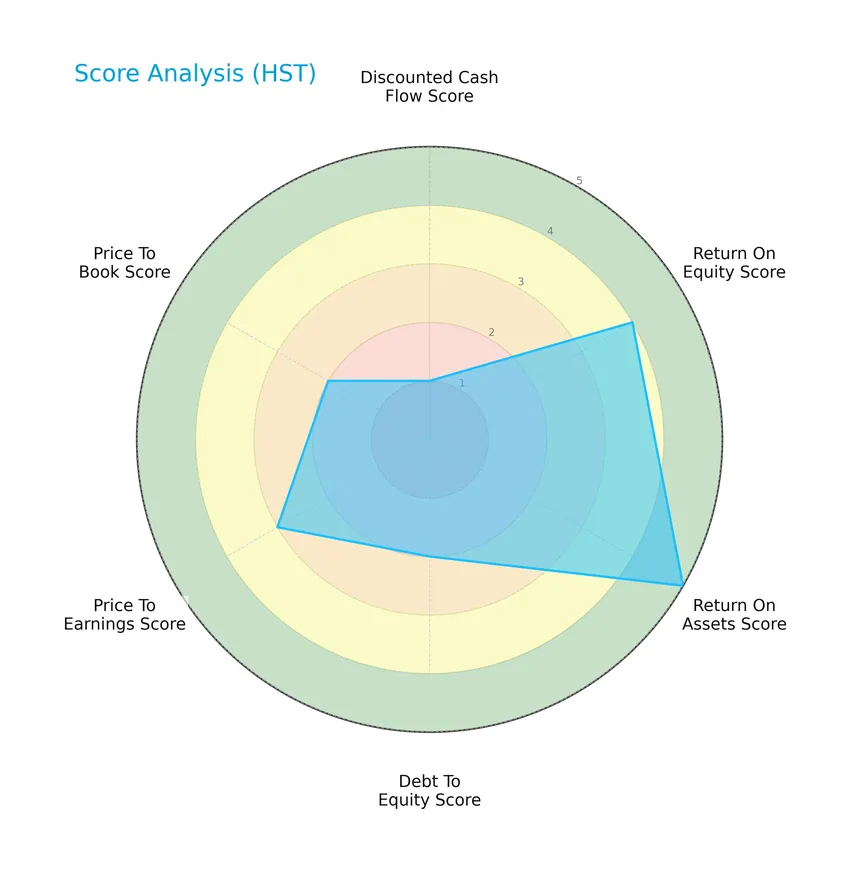

The following radar chart illustrates key financial scores for Host Hotels & Resorts, Inc., offering a snapshot of valuation and performance metrics:

The company shows a very favorable return on assets score of 5 and a favorable return on equity score of 4. However, the discounted cash flow score is very unfavorable at 1. Debt to equity, price to earnings, and price to book scores are moderate, indicating some balance between risk and valuation.

Analysis of the company’s bankruptcy risk

Host Hotels & Resorts, Inc. is positioned in the grey zone according to its Altman Z-Score, indicating a moderate probability of financial distress and bankruptcy risk:

Is the company in good financial health?

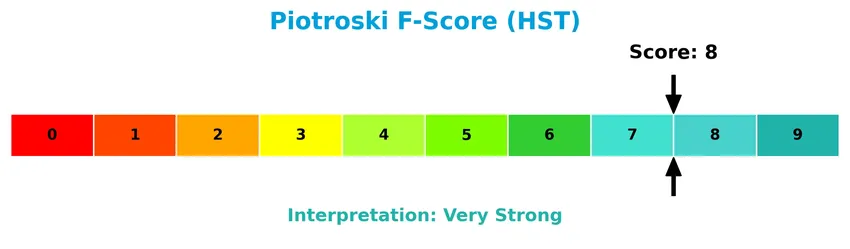

The Piotroski Score diagram highlights strong financial health indicators for the company:

With a Piotroski Score of 8, Host Hotels & Resorts, Inc. demonstrates very strong financial strength, reflecting solid profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This section provides an overview of the company’s sector, including its strategic positioning, revenue by segment, key products, and main competitors. I will assess whether the company holds a competitive advantage relative to its industry peers through factors such as its market presence and operational strengths.

Strategic Positioning

Host Hotels & Resorts, Inc. concentrates primarily on the U.S. lodging market, generating over $5.5B in domestic revenue in 2024, with limited international exposure of $101M. Its portfolio focuses on luxury and upper-upscale hotels, deriving the majority of revenue from occupancy ($3.4B) and food and beverage ($1.7B) segments.

Revenue by Segment

This pie chart illustrates Host Hotels & Resorts, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting key business areas and their respective contributions.

In 2024, Occupancy remains the dominant revenue driver at $3.43B, showing steady growth since 2020, reflecting strong hotel room demand. Food and Beverage revenue also increased to $1.72B, indicating expanding ancillary services. The Hotel Other segment contributes $542M, maintaining a smaller but stable share. Overall, Host Hotels & Resorts demonstrates a recovery and expansion trend post-pandemic with a balanced but occupancy-focused revenue base.

Key Products & Brands

The table below outlines Host Hotels & Resorts, Inc.’s key products and brand partnerships driving its revenue streams:

| Product | Description |

|---|---|

| Occupancy | Revenue generated from hotel room bookings across 74 U.S. properties and 5 international locations. |

| Food and Beverage | Income from dining and catering services within the hotel properties. |

| Hotel, Other | Additional hotel-related revenue including services beyond room occupancy and food & beverage. |

| Brand Partnerships | Collaborations with premium hotel brands such as Marriott®, Ritz-Carlton®, Westin®, Sheraton®, W®, St. Regis®, The Luxury Collection®, Hyatt®, Fairmont®, Hilton®, Swissôtel®, ibis®, and Novotel®. |

Host Hotels & Resorts focuses primarily on lodging and associated services, with significant revenue from occupancy and food and beverage segments, supported by partnerships with leading luxury and upscale hotel brands.

Main Competitors

There are 31 competitors in the sector; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Welltower Inc. | 128.3B |

| Prologis, Inc. | 119.7B |

| American Tower Corporation | 81.8B |

| Equinix, Inc. | 74.5B |

| Simon Property Group, Inc. | 60.1B |

| Digital Realty Trust, Inc. | 53.3B |

| Realty Income Corporation | 52.7B |

| CBRE Group, Inc. | 47.7B |

| Public Storage | 45.3B |

| Crown Castle Inc. | 38.6B |

Host Hotels & Resorts, Inc. ranks 24th among its 31 competitors, with a market cap about 10.02% that of the leader, Welltower Inc. The company is positioned below both the average market cap of the top 10 competitors (70.2B) and the sector median (24.6B). It maintains a 5.64% market cap distance to its nearest competitor above, indicating a moderate gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does HST have a competitive advantage?

Host Hotels & Resorts, Inc. currently does not present a clear competitive advantage as it is shedding value with a ROIC below its WACC, despite a growing ROIC trend. The overall moat status is slightly unfavorable, indicating value destruction even as profitability improves.

Looking ahead, the company benefits from its extensive portfolio of 74 U.S. properties and five international hotels, partnered with premium brands like Marriott, Ritz-Carlton, and Hilton. This positions HST to potentially leverage new market opportunities and asset management strategies to enhance future returns.

SWOT Analysis

This SWOT analysis summarizes Host Hotels & Resorts, Inc.’s key strengths, weaknesses, opportunities, and threats to guide investors in their decision-making.

Strengths

- Largest lodging REIT with 74 US and 5 international properties

- Strong partnerships with premium hotel brands

- Favorable gross and net margin performance

Weaknesses

- High debt level with moderate interest coverage

- Unfavorable current and quick ratios indicating liquidity constraints

- Asset turnover below industry average

Opportunities

- Growing profitability trend with expanding ROIC

- Expanding US market revenue and room inventory

- Potential for international expansion and joint ventures

Threats

- Economic downturns impacting travel and occupancy rates

- Rising interest rates increasing financing costs

- Intense competition in luxury and upper-upscale hotel segments

Overall, Host Hotels & Resorts holds a strong market position supported by premium brand partnerships and improving profitability. However, liquidity concerns and leverage require cautious risk management. Growth opportunities lie in expanding room capacity and international presence, while economic and interest rate risks remain key threats to monitor in the company’s strategic planning.

Stock Price Action Analysis

The weekly stock chart for Host Hotels & Resorts, Inc. (HST) illustrates price movements and volume trends over the past 12 months:

Trend Analysis

Over the past 12 months, HST’s stock price declined by 10.74%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 20.95 and a low of 13.14, with volatility reflected in a 1.59 standard deviation. Recent weeks show a modest recovery of 4.82% with low volatility (0.48 std dev).

Volume Analysis

Trading volumes have increased overall, with near-equal buyer (49.88%) and seller participation historically. In the recent 2.5-month period, volume is buyer-driven (65.3% buyer dominance) and rising, suggesting stronger investor interest and positive market engagement during this recovery phase.

Target Prices

Analysts present a moderately optimistic target consensus for Host Hotels & Resorts, Inc.

| Target High | Target Low | Consensus |

|---|---|---|

| 21 | 18 | 19.4 |

The target prices suggest a potential upside from the current levels, with a consensus around 19.4, indicating cautious confidence among analysts.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding Host Hotels & Resorts, Inc. (HST).

Stock Grades

Here is a summary of recent stock grades for Host Hotels & Resorts, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Neutral | 2026-01-22 |

| Truist Securities | Upgrade | Buy | 2026-01-09 |

| Truist Securities | Maintain | Hold | 2025-12-04 |

| Evercore ISI Group | Downgrade | In Line | 2025-11-11 |

| JP Morgan | Maintain | Neutral | 2025-11-07 |

| Compass Point | Upgrade | Buy | 2025-11-07 |

| UBS | Maintain | Neutral | 2025-09-22 |

| Truist Securities | Maintain | Hold | 2025-09-03 |

| Wells Fargo | Maintain | Overweight | 2025-08-27 |

| Stifel | Maintain | Buy | 2025-07-31 |

The grades show a mixed but generally positive stance, with multiple upgrades to buy and several neutral or hold ratings. The consensus among analysts remains a buy, reflecting moderate confidence in the stock’s prospects.

Consumer Opinions

Host Hotels & Resorts, Inc. enjoys a mixed but generally positive sentiment among consumers, reflecting on both its strengths in hospitality and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Consistently high-quality accommodations.” | “Customer service can be slow during peak times.” |

| “Great loyalty program benefits and rewards.” | “Some properties feel outdated and need renovation.” |

| “Wide range of locations to choose from.” | “Pricing can be high compared to competitors.” |

Overall, consumers appreciate Host Hotels & Resorts for its quality stays and loyalty perks, though service delays and property upkeep are recurring concerns. Addressing these could improve overall satisfaction.

Risk Analysis

Below is a summary table presenting key risk categories, their descriptions, probabilities, and potential impacts on Host Hotels & Resorts, Inc.:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Exposure to fluctuations in hotel industry demand and economic cycles | Medium | High |

| Liquidity Risk | Current and quick ratios below 1, indicating possible short-term liquidity issues | Medium | Medium |

| Financial Risk | Moderate debt levels and interest coverage ratio imply manageable but present debt risk | Medium | Medium |

| Operational Risk | Dependence on premium brand partnerships and property management efficiency | Low | Medium |

| Regulatory Risk | Changes in real estate or hospitality regulations affecting operations | Low | Medium |

| Bankruptcy Risk | Altman Z-Score in grey zone suggests moderate risk of financial distress | Medium | High |

The most significant risks for HST are market volatility impacting hotel occupancy and revenues, and financial distress indicated by the Altman Z-Score of 1.84, which lies in the grey zone. Despite a strong Piotroski score of 8, liquidity remains a concern with current ratios under 1. Careful monitoring of economic conditions and financial metrics is advisable.

Should You Buy Host Hotels & Resorts, Inc.?

Host Hotels & Resorts, Inc. appears to be delivering improving profitability and operational efficiency, supported by a moderately favorable leverage profile despite some value erosion. While its competitive moat could be seen as slightly unfavorable, the overall moderate rating of B suggests a balanced financial health profile.

Strength & Efficiency Pillars

Host Hotels & Resorts, Inc. exhibits solid profitability with a net margin of 12.26% and a return on equity (ROE) of 10.55%, reflecting steady income generation relative to shareholder equity. The company’s Piotroski Score of 8 underscores very strong financial health, highlighting effective operational management and balance sheet strength. However, its return on invested capital (ROIC) at 6.79% trails its weighted average cost of capital (WACC) of 7.5%, indicating that the firm is currently not creating value but is showing a growing ROIC trend. The Altman Z-Score of 1.84 places the company in the grey zone, suggesting moderate financial distress risk but not imminent bankruptcy.

Weaknesses and Drawbacks

Host Hotels & Resorts faces several headwinds, notably its liquidity position with a current ratio and quick ratio both at 0.65, signaling potential short-term solvency pressures. The stock’s valuation metrics are moderate, with a price-to-earnings (P/E) ratio of 17.65 and a price-to-book (P/B) ratio of 1.86, which may indicate limited upside relative to peers. Operational efficiency is a concern, as asset turnover (0.44) and fixed asset turnover (0.5) are unfavorable, suggesting underutilization of assets. Additionally, a bearish overall price trend with a 10.74% decline over the longer term reflects market skepticism, despite recent buyer dominance.

Our Verdict about Host Hotels & Resorts, Inc.

Host Hotels & Resorts presents a fundamentally mixed profile with favorable profitability and financial strength balanced against liquidity challenges and moderate valuation. The bearish long-term trend contrasts with a recent buyer-dominant period, which might suggest emerging positive momentum. Despite this, the company could benefit from a cautious, wait-and-see approach to identify a more opportune entry point, given the combination of value-destroying ROIC and short-term market pressures.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Why The Story Around Host Hotels & Resorts (HST) Is Shifting After New Analyst Targets – Yahoo Finance (Jan 24, 2026)

- Assessing Host Hotels & Resorts (HST) Valuation After Earnings Beat And $400 Million Notes Offering – simplywall.st (Jan 23, 2026)

- What to Expect From Host Hotels & Resorts’ Q4 2025 Earnings Report – Barchart.com (Jan 22, 2026)

- Host Hotels & Resorts: An Investment-Grade Leader In Its Luxury Niche (NASDAQ:HST) – Seeking Alpha (Jan 20, 2026)

- Host Hotels & Resorts stock hits 52-week high at $18.72 – Investing.com (Jan 21, 2026)

For more information about Host Hotels & Resorts, Inc., please visit the official website: hosthotels.com