Home > Analyses > Healthcare > Henry Schein, Inc.

Henry Schein, Inc. revolutionizes healthcare delivery by seamlessly connecting dental and medical practitioners with essential products and cutting-edge technology. As a dominant force in medical distribution, Henry Schein offers a comprehensive portfolio ranging from infection-control supplies to advanced practice management software. Renowned for its innovation and commitment to quality, the company continuously shapes the healthcare ecosystem. The critical question for investors now is whether Henry Schein’s strong fundamentals still support its current valuation and future growth prospects.

Table of contents

Business Model & Company Overview

Henry Schein, Inc., founded in 1932 and headquartered in Melville, NY, stands as a leading distributor in the medical and dental healthcare sector. Its ecosystem integrates a broad range of products and services, from dental supplies and infection-control items to advanced technology solutions, serving dental practitioners, physician offices, and institutional health clinics globally. This cohesive mission to support healthcare providers underpins its dominant industry position.

The company’s revenue engine balances tangible medical and dental products with recurring software and value-added services, including practice management systems and financial solutions. Operating across the Americas, Europe, and Asia, Henry Schein leverages this diversified portfolio to generate steady cash flow. Its economic moat lies in a comprehensive service offering that cements long-term client relationships, shaping the future of healthcare distribution worldwide.

Financial Performance & Fundamental Metrics

This section analyzes Henry Schein, Inc.’s income statement, key financial ratios, and dividend payout policy to evaluate its overall financial health and investor appeal.

Income Statement

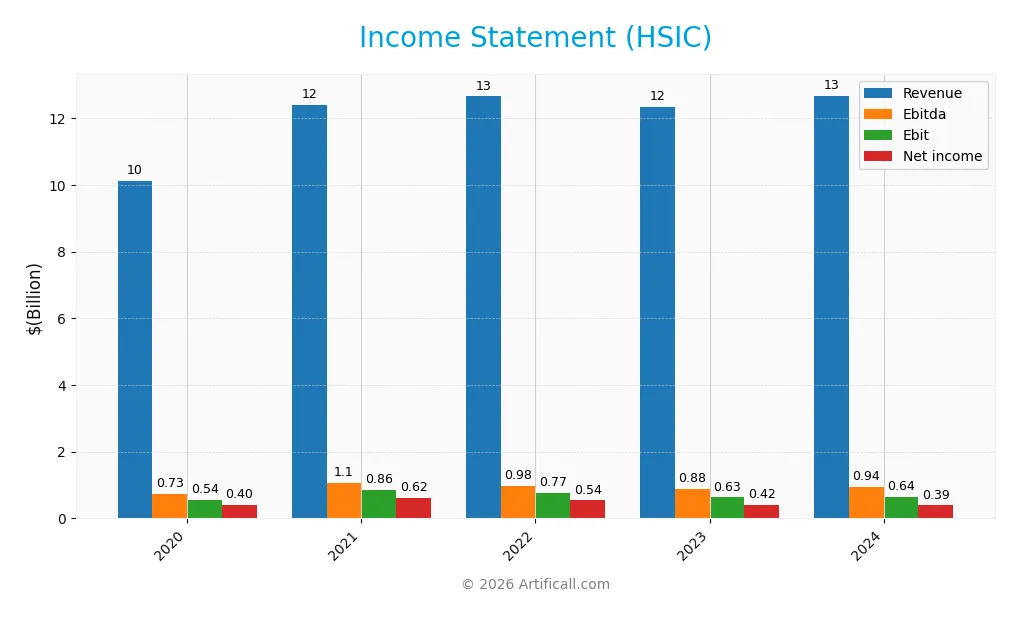

The following table summarizes Henry Schein, Inc.’s key income statement figures for fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 10.12B | 12.40B | 12.65B | 12.34B | 12.67B |

| Cost of Revenue | 7.30B | 8.73B | 8.99B | 8.69B | 8.91B |

| Operating Expenses | 2.25B | 2.82B | 2.71B | 2.94B | 3.04B |

| Gross Profit | 2.81B | 3.67B | 3.65B | 3.65B | 3.77B |

| EBITDA | 727M | 1.07B | 977M | 877M | 941M |

| EBIT | 541M | 858M | 765M | 629M | 644M |

| Interest Expense | 41M | 28M | 44M | 87M | 131M |

| Net Income | 402M | 624M | 538M | 416M | 390M |

| EPS | 2.82 | 4.51 | 3.95 | 3.18 | 3.07 |

| Filing Date | 2021-02-17 | 2022-02-15 | 2023-02-21 | 2024-02-28 | 2025-02-25 |

Income Statement Evolution

Henry Schein, Inc. showed a 25.24% revenue growth over 2020-2024, yet growth slowed to 2.71% in 2024. Gross profit edged up 3.12% in the last year, supporting a stable gross margin near 29.7%. Meanwhile, net income declined by 3.04% over the period and dipped 8.72% in 2024, reflecting pressure on net margins which shrank by 22.58% overall.

Is the Income Statement Favorable?

In 2024, Henry Schein reported $12.67B revenue and $390M net income, yielding a 3.08% net margin classified as neutral. The EBIT margin stood at 5.08%, also neutral, while interest expense was favorable at 1.03% of revenue. Despite solid top-line growth, pressures on profitability and net margin contraction suggest mixed fundamentals, with the overall income statement evaluation deemed unfavorable.

Financial Ratios

The following table presents key financial ratios for Henry Schein, Inc. (HSIC) over recent fiscal years, providing a snapshot of profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 3.97% | 5.03% | 4.25% | 3.37% | 3.08% |

| ROE | 12.0% | 18.2% | 15.6% | 11.4% | 11.5% |

| ROIC | 8.05% | 10.4% | 11.0% | 6.68% | 6.73% |

| P/E | 23.7 | 17.4 | 20.2 | 23.8 | 22.9 |

| P/B | 2.85 | 3.17 | 3.15 | 2.71 | 2.63 |

| Current Ratio | 1.66 | 1.67 | 1.79 | 1.67 | 1.42 |

| Quick Ratio | 1.00 | 0.86 | 0.91 | 1.00 | 0.78 |

| D/E | 0.30 | 0.36 | 0.43 | 0.75 | 0.85 |

| Debt-to-Assets | 12.9% | 14.3% | 17.4% | 25.9% | 28.1% |

| Interest Coverage | 13.7 | 31.0 | 21.3 | 8.21 | 5.56 |

| Asset Turnover | 1.30 | 1.46 | 1.47 | 1.17 | 1.24 |

| Fixed Asset Turnover | 16.0 | 17.9 | 19.0 | 15.0 | 15.4 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Henry Schein, Inc. (HSIC) saw its Return on Equity (ROE) decline from 18.2% in 2021 to 11.5% in 2024, reflecting a slowdown in profitability. The Current Ratio decreased from 1.79 in 2022 to 1.42 in 2024, indicating reduced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio increased from 0.36 in 2021 to 0.85 in 2024, showing higher leverage over the period.

Are the Financial Ratios Favorable?

In 2024, profitability metrics like net margin (3.08%) are rated unfavorable, while ROE (11.5%) and return on invested capital (6.73%) are neutral. Liquidity is mixed with a neutral current ratio (1.42) but an unfavorable quick ratio (0.78). Leverage ratios are generally neutral to favorable, with a debt-to-assets ratio of 28.1% rated favorable. Market valuation ratios such as P/E (22.9) and P/B (2.63) are neutral, leading to a slightly favorable overall ratio assessment.

Shareholder Return Policy

Henry Schein, Inc. (HSIC) does not pay dividends, reflecting a strategic focus on reinvestment and growth rather than immediate shareholder payouts. Despite the absence of dividends, the company consistently generates positive free cash flow, which supports operational stability and potential capital allocation flexibility.

The company does not currently engage in share buybacks according to the latest data, indicating a conservative capital return approach. This policy aligns with sustaining long-term value creation by prioritizing reinvestment over distributions, which may benefit shareholders if executed with disciplined capital management.

Score analysis

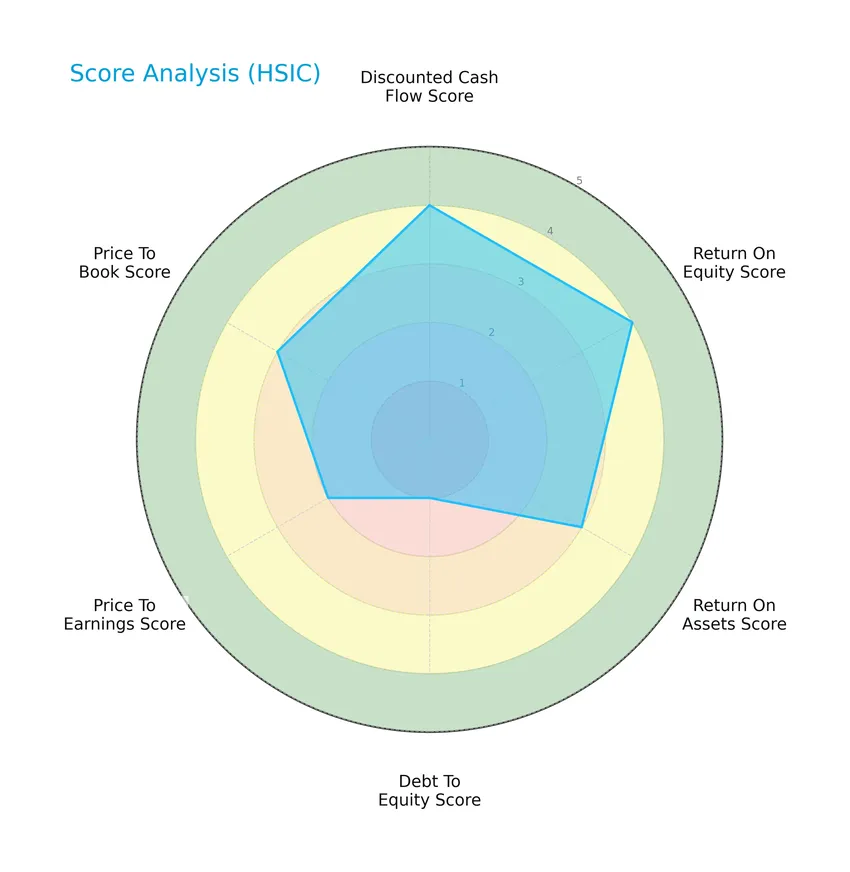

The following radar chart presents key financial scores to evaluate Henry Schein, Inc.’s overall financial profile:

Henry Schein, Inc. shows favorable scores in discounted cash flow and return on equity, moderate scores for return on assets, price-to-earnings, and price-to-book ratios, but a very unfavorable debt-to-equity score, indicating higher leverage risk.

—

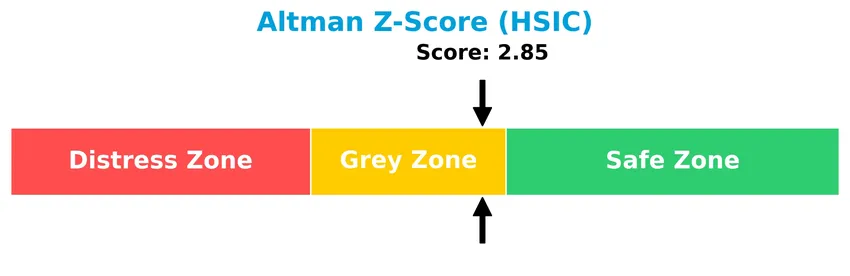

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Henry Schein, Inc. in the grey zone, suggesting a moderate risk of bankruptcy based on its financial ratios:

—

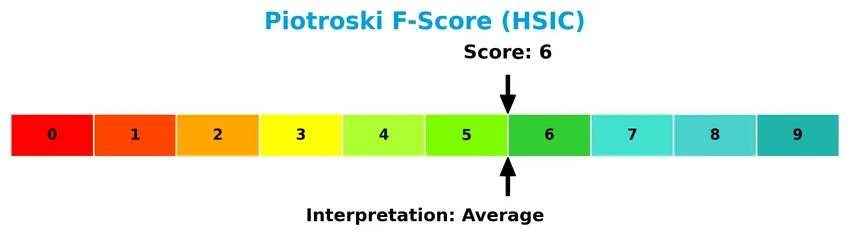

Is the company in good financial health?

The Piotroski Score diagram illustrates the company’s financial strength based on profitability, leverage, liquidity, and efficiency:

With a score of 6 classified as average, Henry Schein, Inc. demonstrates moderate financial health but does not reach the thresholds typically associated with very strong financial stability.

Competitive Landscape & Sector Positioning

This sector analysis examines Henry Schein, Inc.’s strategic positioning, revenue segments, key products, and main competitors within the healthcare industry. I will assess whether Henry Schein holds a competitive advantage over its peers based on these factors.

Strategic Positioning

Henry Schein, Inc. maintains a diversified product portfolio with a dominant Healthcare Distribution segment generating over $12.6B in 2018 and a growing Technology segment at $509M. Geographically, its revenue is balanced between the U.S. ($8.3B) and international markets ($4.9B), reflecting broad exposure.

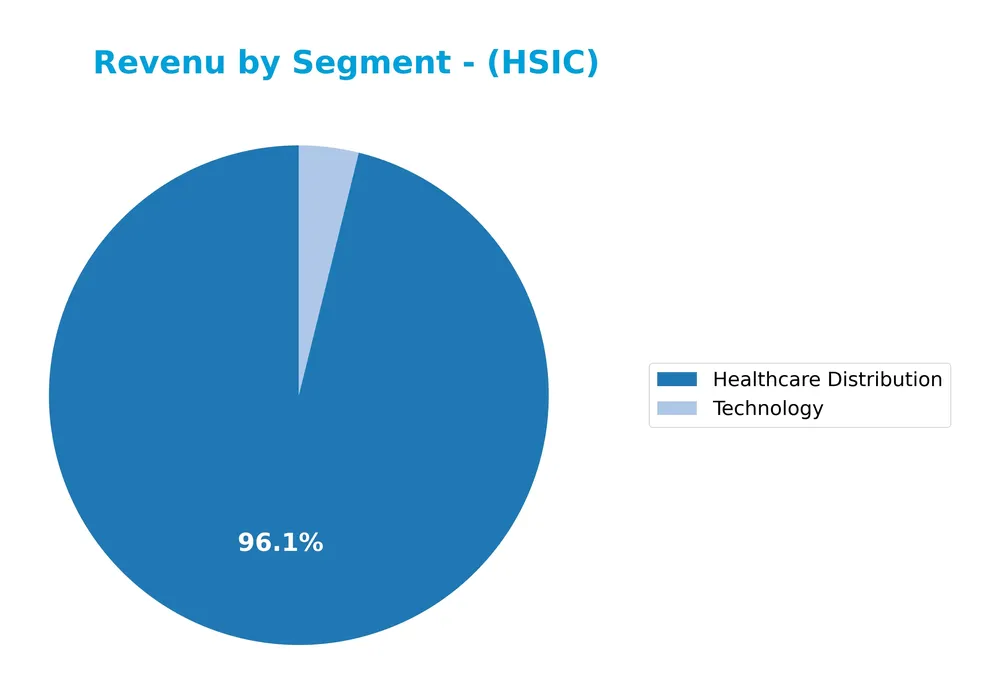

Revenue by Segment

This pie chart illustrates the revenue distribution of Henry Schein, Inc. across its main business segments for the fiscal year 2018.

In 2018, Healthcare Distribution was the dominant segment, generating $12.7B, reflecting steady growth from $8.3B in 2011. The Technology segment contributed significantly less at $510M but also showed consistent increase since 2011’s $251M. The business remains heavily concentrated in Healthcare Distribution, which drives overall revenue growth. No abrupt shifts occurred, indicating stable segment performance with moderate expansion in both areas.

Key Products & Brands

The table below highlights Henry Schein, Inc.’s main products and brand segments with their respective descriptions:

| Product | Description |

|---|---|

| Healthcare Distribution | Dental products (infection-control, handpieces, implants, X-ray equipment, PPE, repair services), medical products (pharmaceuticals, vaccines, surgical products, diagnostics, vitamins). |

| Technology and Value-Added Services | Software and technology solutions including practice management systems, financial services, e-services, hardware, continuing education, consulting for dental and medical practitioners. |

Henry Schein’s portfolio centers on comprehensive healthcare distribution and advanced technology services, serving dental and medical markets with a broad range of products and value-added solutions.

Main Competitors

There are 4 main competitors in the Healthcare Medical – Distribution sector, with the table listing the top 4 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| McKesson Corporation | 103B |

| Cencora, Inc. | 66B |

| Cardinal Health, Inc. | 49B |

| Henry Schein, Inc. | 9.4B |

Henry Schein, Inc. ranks 4th among its competitors with a market capitalization representing 9.1% of the leader’s (McKesson Corporation). The company is positioned below both the average market cap of the top 10 (57B) and the median sector market cap (57B). It maintains a significant gap of +422% to its closest competitor above, Cardinal Health.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does HSIC have a competitive advantage?

Henry Schein, Inc. currently does not present a competitive advantage as it is shedding value, with a declining return on invested capital (ROIC) that falls below its weighted average cost of capital (WACC). The company’s profitability trend is very unfavorable, indicating decreasing efficiency in using invested capital and overall value destruction.

Looking ahead, Henry Schein operates in the healthcare distribution and technology sectors, offering dental and medical products alongside software and value-added services. Future opportunities could arise from expanding its technology and value-added services segment and entering new markets, although recent growth and margin trends have been mixed.

SWOT Analysis

This SWOT analysis highlights key internal and external factors affecting Henry Schein, Inc. to guide informed investment decisions.

Strengths

- Strong market presence in healthcare distribution

- Diverse product and service portfolio

- Favorable gross margin and asset turnover ratios

Weaknesses

- Declining net margin and ROIC

- Negative net income growth over recent years

- Low dividend yield and unfavorable quick ratio

Opportunities

- Expansion in international markets

- Growth in technology and value-added healthcare services

- Increasing demand for digital dental and medical solutions

Threats

- Intense competition in medical distribution

- Regulatory changes in healthcare sector

- Economic downturn impacting healthcare spending

Overall, Henry Schein shows solid operational strengths and growth potential in technology services but faces profitability challenges and value destruction. Strategic focus on margin improvement and international expansion is essential to enhance shareholder value.

Stock Price Action Analysis

The weekly stock chart of Henry Schein, Inc. (HSIC) illustrates recent price movements and trend developments over the past 12 months:

Trend Analysis

Over the past 12 months, HSIC’s stock price increased by 0.43%, indicating a bullish trend according to the defined threshold. The trend shows acceleration, with the highest price reaching 80.0 and the lowest at 62.98. The standard deviation of 3.94 suggests moderate volatility during this period.

Volume Analysis

In the last three months, trading volume has been increasing, driven strongly by buyers. Buyer volume accounted for 71.95%, significantly outweighing seller volume. This buyer dominance signals heightened investor interest and positive market participation in recent weeks.

Target Prices

The consensus target price for Henry Schein, Inc. (HSIC) reflects moderate optimism among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 90 | 79 | 84 |

Analysts expect HSIC’s stock to trade within a range of $79 to $90, with a consensus price of $84, indicating steady confidence in its future performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews analyst ratings and consumer feedback to provide an overview of Henry Schein, Inc.’s market perception.

Stock Grades

Here is the latest overview of Henry Schein, Inc. stock grades from established financial institutions and their recent actions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Mizuho | Maintain | Neutral | 2026-01-20 |

| JP Morgan | Maintain | Overweight | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| Morgan Stanley | Maintain | Underweight | 2025-11-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-05 |

| Barrington Research | Maintain | Outperform | 2025-11-05 |

The consensus leans toward a cautious stance with a mix of Overweight, Outperform, and Neutral ratings, reflecting moderate confidence but also some divergence in outlook among analysts. The consensus grade is Hold, indicating balanced sentiment on the stock’s near-term potential.

Consumer Opinions

Consumers of Henry Schein, Inc. express a mix of satisfaction and concerns, reflecting diverse experiences with the company’s products and services.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable product quality and consistent supply chain | Customer service response times can be slow |

| User-friendly online ordering platform | Pricing sometimes higher compared to competitors |

| Wide range of dental and medical supplies | Occasional delays in shipping reported |

| Helpful technical support and knowledgeable staff | Some users noted issues with order accuracy |

Overall, consumers appreciate Henry Schein’s product reliability and comprehensive selection but point to customer service delays and pricing as areas needing improvement. Consistent supply and support remain key strengths.

Risk Analysis

Below is a summary table highlighting key risks associated with Henry Schein, Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score in grey zone indicates moderate bankruptcy risk amid mixed liquidity metrics. | Medium | High |

| Profitability | Unfavorable net margin (3.08%) limits earnings growth potential despite neutral ROE/ROIC. | High | Medium |

| Debt Management | Very unfavorable debt-to-equity score suggests elevated leverage concerns despite moderate debt ratios. | Medium | High |

| Market Volatility | Beta of 0.88 indicates moderate sensitivity to market swings; price range shows recent decline. | Medium | Medium |

| Dividend Policy | No dividend yield may deter income-focused investors and affect stock attractiveness. | High | Low |

| Operational Efficiency | Favorable asset turnover contrasts with unfavorable quick ratio, signaling working capital issues. | Medium | Medium |

The most critical risks for Henry Schein currently stem from its moderate bankruptcy risk (Altman Z-Score ~2.85) and leverage concerns, which could impact financial flexibility. Profit margin weakness and absence of dividends may reduce appeal for investors seeking growth or income stability. These factors warrant cautious portfolio inclusion with strong risk management.

Should You Buy Henry Schein, Inc.?

Henry Schein, Inc. appears to be a company with moderate profitability and operational efficiency but faces a very unfavorable competitive moat due to declining value creation. Despite a substantial leverage profile, its overall rating could be seen as a cautiously favorable B, reflecting mixed financial health.

Strength & Efficiency Pillars

Henry Schein, Inc. exhibits moderate profitability with a return on equity of 11.49% and a net margin of 3.08%. Its weighted average cost of capital stands at 6.98%, slightly above the return on invested capital of 6.73%, indicating the company is currently not a value creator but operating close to capital efficiency. Financial health is mixed, with an Altman Z-Score of 2.85 placing it in the grey zone, suggesting moderate bankruptcy risk, and a Piotroski score of 6, reflecting average financial strength. The company maintains favorable asset turnover metrics, supporting operational efficiency.

Weaknesses and Drawbacks

Henry Schein’s financial leverage shows neutrality with a debt-to-equity ratio of 0.85, but liquidity concerns arise from a quick ratio of 0.78, which is unfavorable for short-term obligations. Valuation metrics such as a price-to-earnings ratio of 22.89 and price-to-book of 2.63 reflect moderate market expectations but may limit upside amid mixed profitability trends. The firm’s net margin growth is negative both annually (-8.72%) and over the longer term (-22.58%), underscoring profitability pressure, while the absence of dividend yield may deter income-focused investors.

Our Verdict about Henry Schein, Inc.

The long-term fundamental profile of Henry Schein is slightly favorable, supported by operational efficiencies and moderate financial health. Given the bullish stock trend and strong recent buyer dominance at 71.95%, the technical signals complement the fundamentals. This profile may appear attractive for investors seeking exposure to a company with improving market momentum, although caution is warranted given the profitability headwinds and liquidity concerns.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Henry Schein Schedules Q4 2025 Earnings Call – Dentistry Today (Jan 23, 2026)

- Dilation Capital Management LP Invests $5.11 Million in Henry Schein, Inc. $HSIC – MarketBeat (Jan 22, 2026)

- Palmetto Grain Brokerage – – Palmetto Grain Brokerage (Jan 20, 2026)

- How Investors Are Reacting To Henry Schein (HSIC) New CEO Pick And Exclusive CitoCBC Deal – simplywall.st (Jan 22, 2026)

- Mixed Strategic Drivers Led Upslope Capital Management to Pick Henry Schein (HSIC) – Yahoo Finance (Jan 19, 2026)

For more information about Henry Schein, Inc., please visit the official website: henryschein.com