Home > Analyses > Consumer Cyclical > Hasbro, Inc.

Hasbro transforms childhood and family entertainment by shaping how millions engage with play and imagination. The company commands the leisure sector with iconic brands like Wizards of the Coast and a diverse portfolio spanning toys, games, and digital experiences. Known for innovation and quality, Hasbro leverages its intellectual property to fuel growth across entertainment and consumer products. As 2026 unfolds, I ask: do Hasbro’s fundamentals still support its premium market valuation and future expansion?

Table of contents

Business Model & Company Overview

Hasbro, Inc., founded in 1923 and headquartered in Pawtucket, Rhode Island, stands as a dominant player in the leisure industry. It operates a cohesive ecosystem spanning toys, games, entertainment, and digital content. Its portfolio includes action figures, role-playing games, and multimedia entertainment, unified by a mission to engage consumers across multiple play and storytelling experiences worldwide.

The company’s revenue engine balances physical products with digital and entertainment offerings. Hasbro generates value through consumer products sales, licensing of intellectual property, and digital gaming via Wizards of the Coast. It maintains a strategic presence across the Americas, Europe, and Asia, leveraging retail and e-commerce channels. This competitive advantage creates a resilient economic moat, shaping the future of play and entertainment globally.

Financial Performance & Fundamental Metrics

I will analyze Hasbro, Inc.’s income statement, key financial ratios, and dividend payout policy to evaluate its profitability, efficiency, and shareholder returns.

Income Statement

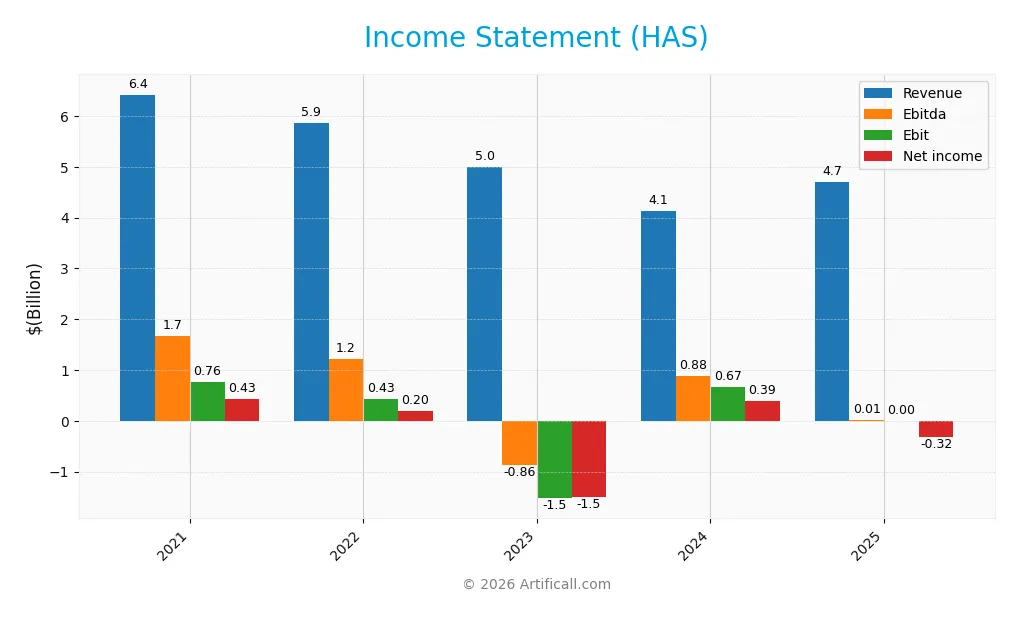

This table summarizes Hasbro, Inc.’s key income statement figures over the past five fiscal years, highlighting revenue trends, profitability, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 6.42B | 5.86B | 5.00B | 4.14B | 4.70B |

| Cost of Revenue | 2.55B | 2.40B | 2.13B | 1.46B | 1.36B |

| Operating Expenses | 3.11B | 3.04B | 4.41B | 1.98B | 702.5M |

| Gross Profit | 3.87B | 3.45B | 2.87B | 2.67B | 3.34B |

| EBITDA | 1.67B | 1.22B | -863M | 881M | 11.1M |

| EBIT | 762M | 433M | -1.52B | 668M | 0 |

| Interest Expense | 180M | 171M | 186M | 171M | 163M |

| Net Income | 429M | 204M | -1.49B | 386M | -322M |

| EPS | 3.11 | 1.47 | -10.73 | 2.77 | -2.3 |

| Filing Date | 2022-02-23 | 2023-02-22 | 2024-02-13 | 2025-02-27 | 2026-02-10 |

Income Statement Evolution

Hasbro’s revenue declined by 27% from 2021 to 2025, despite a 14% rebound in 2025 alone. Gross profit followed suit, shrinking overall but improving by 25% last year, lifting the gross margin to a favorable 71%. However, the net margin plunged into negative territory, reflecting deteriorating profitability and margin compression.

Is the Income Statement Favorable?

The 2025 income statement shows mixed fundamentals. Revenue and gross margin improved, but operating income barely broke even, and net income was a loss of $322M, driven by high interest expense and other adjustments. Earnings per share turned negative at -$2.30. Overall, the key margins and bottom line signal unfavorable financial health despite top-line growth.

Financial Ratios

The table below summarizes key financial ratios for Hasbro, Inc. from 2021 to 2025, highlighting profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 6.7% | 3.5% | -29.8% | 9.3% | -6.9% |

| ROE | 14.2% | 7.2% | -140.2% | 33.3% | -57.0% |

| ROIC | 7.3% | 4.3% | -26.7% | 11.0% | 0.3% |

| P/E | 33 | 42 | -4.7 | 20 | -36 |

| P/B | 4.6 | 3.0 | 6.5 | 6.7 | 20.5 |

| Current Ratio | 1.52 | 1.37 | 1.13 | 1.60 | 1.38 |

| Quick Ratio | 1.29 | 1.06 | 0.97 | 1.40 | 1.24 |

| D/E | 1.34 | 1.41 | 3.29 | 2.95 | 4.89 |

| Debt-to-Assets | 40.5% | 43.1% | 53.5% | 53.8% | 49.9% |

| Interest Coverage | 4.25 | 2.38 | -8.26 | 4.03 | 0.07 |

| Asset Turnover | 0.64 | 0.63 | 0.76 | 0.65 | 0.85 |

| Fixed Asset Turnover | 15.2 | 13.9 | 15.0 | 13.7 | 19.0 |

| Dividend Yield | 2.7% | 4.6% | 5.6% | 5.0% | 3.4% |

Evolution of Financial Ratios

Hasbro’s Return on Equity (ROE) plunged sharply to -57.0% in 2025 from positive levels in prior years, signaling deteriorating profitability. The Current Ratio has remained relatively stable around 1.3 to 1.6, indicating consistent liquidity. However, the Debt-to-Equity Ratio escalated to nearly 4.9, reflecting increased leverage and financial risk over the period.

Are the Financial Ratios Fovorable?

In 2025, Hasbro’s profitability ratios, including net margin and ROE, are unfavorable, showing losses and weak returns. Liquidity is mixed: the current ratio is neutral but the quick ratio is favorable at 1.24. Leverage ratios, especially debt-to-equity at 4.89, are unfavorable, raising solvency concerns. Efficiency metrics like asset turnover are neutral, while fixed asset turnover and dividend yield remain favorable. Overall, the financial ratios portray a slightly unfavorable outlook.

Shareholder Return Policy

Hasbro, Inc. maintains a steady dividend with a payout ratio around 100% in 2024 and a yield near 5%. Despite a net loss in 2025, the company continued paying dividends and engaged in share buybacks, supported by free cash flow coverage exceeding 90%.

This approach indicates a commitment to shareholder returns, though the negative earnings and high leverage pose risks to sustainability. The balance between dividends and buybacks requires careful monitoring to ensure long-term value creation amid profitability challenges.

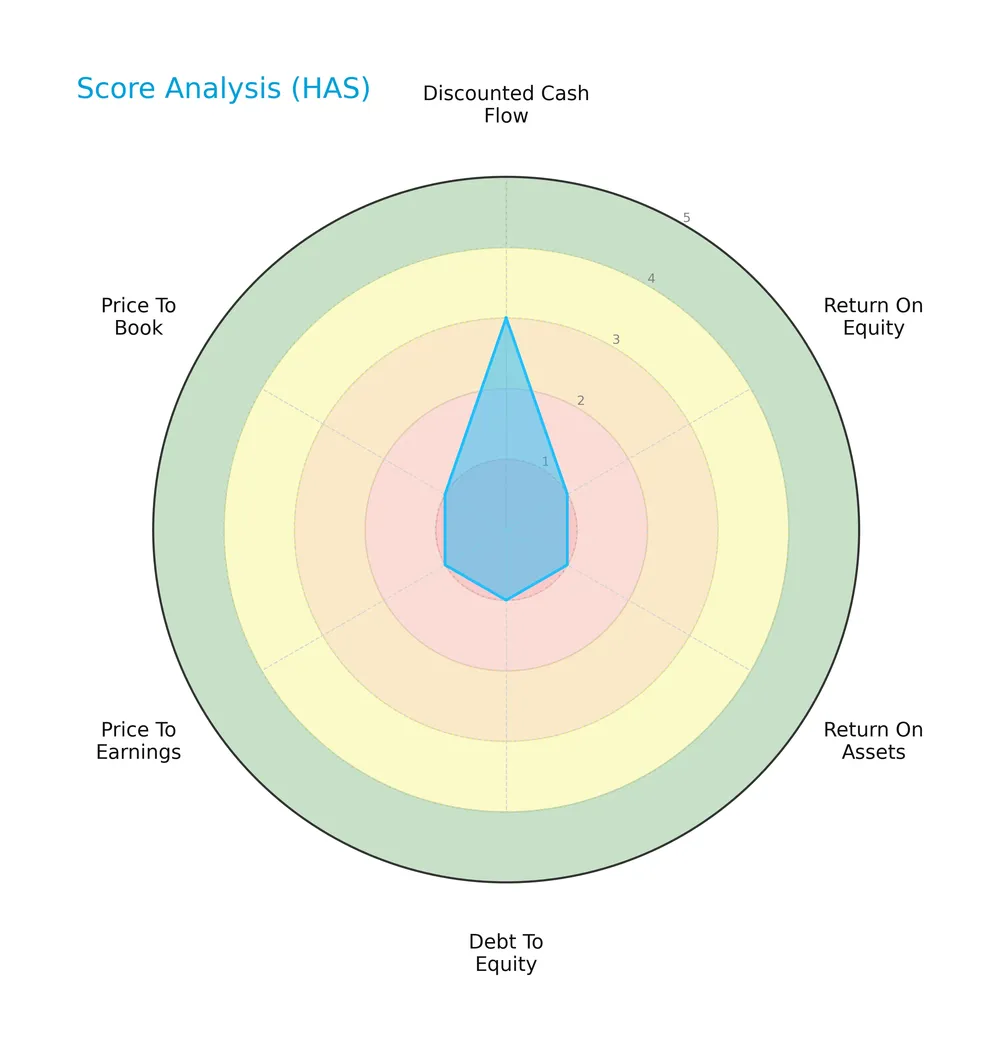

Score analysis

The radar chart below illustrates Hasbro, Inc.’s key financial scores across valuation, profitability, and leverage metrics:

Hasbro’s discounted cash flow score registers moderate strength at 3. However, its return on equity, return on assets, debt to equity, price to earnings, and price to book scores all rank very unfavorable at 1, signaling weak profitability and valuation metrics.

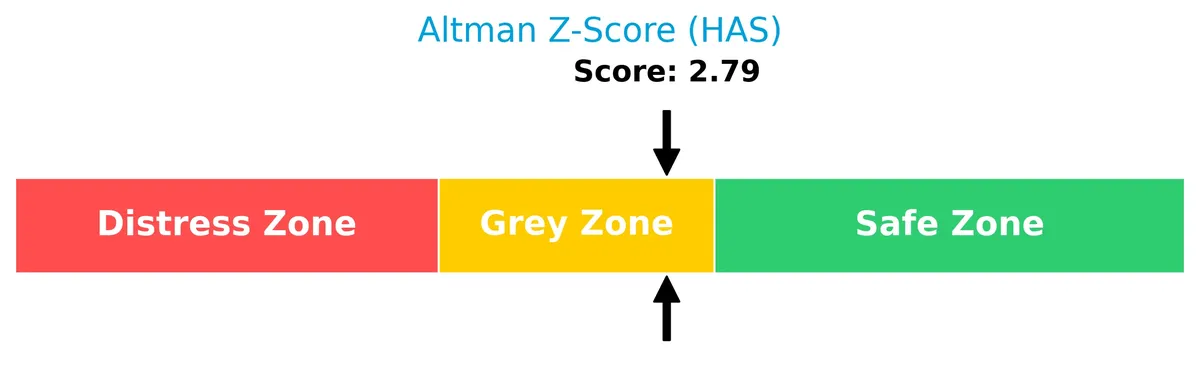

Analysis of the company’s bankruptcy risk

Hasbro’s Altman Z-Score places it in the grey zone, indicating a moderate risk of bankruptcy and financial distress:

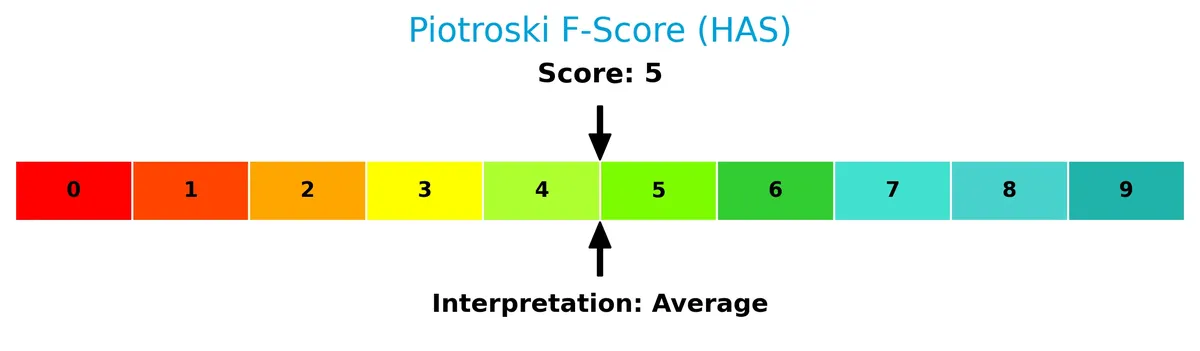

Is the company in good financial health?

The Piotroski Score diagram highlights Hasbro’s financial health assessment based on nine key criteria:

With a Piotroski Score of 5, Hasbro ranks as average in financial strength. This score suggests mixed signals on profitability, liquidity, and operational efficiency, reflecting neither strong nor weak fundamentals.

Competitive Landscape & Sector Positioning

This sector analysis examines Hasbro, Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Hasbro holds a competitive advantage over its industry peers.

Strategic Positioning

Hasbro maintains a diversified product portfolio spanning Consumer Products, Digital Gaming, and Entertainment segments. Geographically, the company balances revenue between the U.S. and Canada (2.6B in 2024) and International markets (1.5B), reflecting a moderate global footprint in the leisure industry.

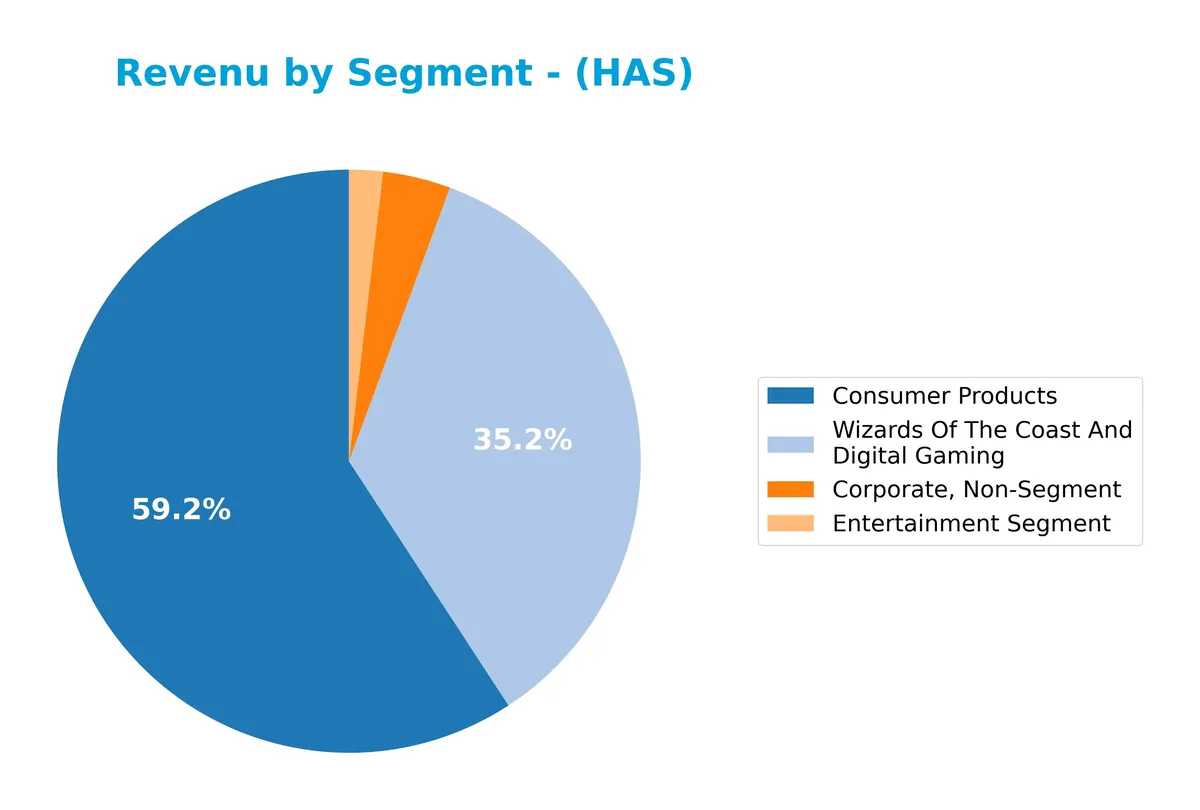

Revenue by Segment

This pie chart illustrates Hasbro, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contributions of its main business areas.

Consumer Products remains the dominant revenue driver at 2.54B in 2024, though it shows a clear decline from prior years. Wizards of the Coast and Digital Gaming holds steady at 1.51B, signaling consistent demand in digital and collectible gaming. The Entertainment Segment contracts sharply to just 80M, revealing a significant slowdown. The 2024 figures highlight a concentration risk as revenue increasingly relies on fewer segments.

Key Products & Brands

Hasbro’s main revenue streams derive from distinct product and entertainment categories:

| Product | Description |

|---|---|

| Consumer Products | Toys and games including action figures, dolls, play sets, preschool toys, plush products, and licensed apparels. |

| Wizards of the Coast and Digital Gaming | Trading card, role-playing, and digital games based on Hasbro and Wizards of the Coast brands. |

| Entertainment Segment | Development, production, and distribution of films, scripted and unscripted TV, digital content, and live shows. |

Hasbro generates significant revenue from consumer products and digital gaming, while its entertainment segment supports brand promotion and diversification.

Main Competitors

There are 2 competitors in total; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Carnival Corporation & plc | 40.6B |

| Hasbro, Inc. | 11.6B |

Hasbro ranks 2nd among its competitors with a market cap at 36% of the leader, Carnival Corporation & plc. It stands below both the average market cap of the top 10 and the sector median, showing a significant 178% gap to its closest rival above. This highlights Hasbro’s smaller scale in the Leisure industry within Consumer Cyclical.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Hasbro have a competitive advantage?

Hasbro currently does not demonstrate a competitive advantage, as its return on invested capital (ROIC) falls significantly below its weighted average cost of capital (WACC), indicating value destruction. The company’s ROIC has declined sharply over the 2021-2025 period, reflecting decreasing profitability and inefficient capital use.

Looking ahead, Hasbro’s expansion into digital gaming and entertainment content through its Wizards of the Coast segment offers potential growth opportunities. Continued development of licensed products and new markets could improve long-term prospects, though current financial metrics highlight caution.

SWOT Analysis

This analysis highlights Hasbro’s internal capabilities and external market conditions to guide strategic decisions.

Strengths

- Strong brand portfolio

- Diverse product lines

- Robust international presence

Weaknesses

- Negative net margin

- Declining ROIC

- High debt-to-equity ratio

Opportunities

- Growth in digital gaming

- Expansion in emerging markets

- Licensing new entertainment content

Threats

- Intense industry competition

- Supply chain disruptions

- Changing consumer preferences

Hasbro’s strong brand and global reach provide a solid base. However, value destruction and financial weakness require strategic focus on innovation and cost control to mitigate risks.

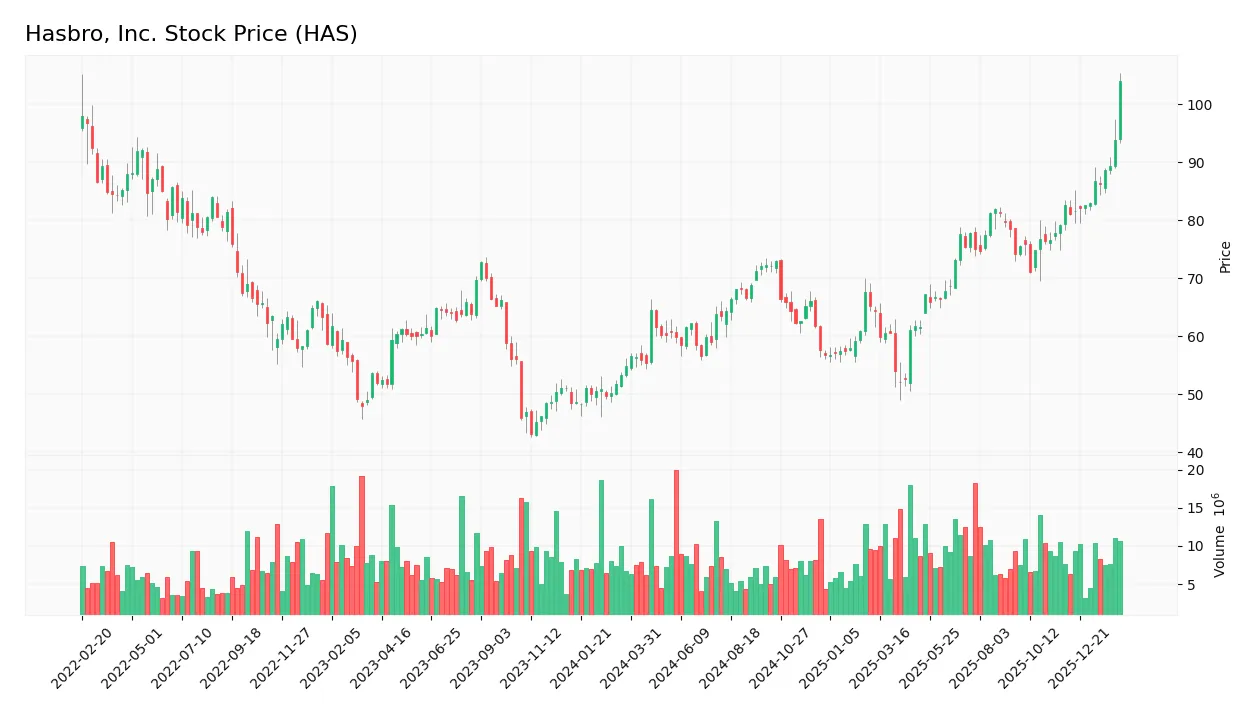

Stock Price Action Analysis

The weekly stock chart below illustrates Hasbro, Inc.’s price movement over the past 100 weeks, highlighting key highs, lows, and trend shifts:

Trend Analysis

Over the past 100 weeks, Hasbro’s stock rose 89.64%, indicating a strong bullish trend with accelerating momentum. The price ranged from a low of 52.04 to a high of 104.0, showing notable volatility with a standard deviation of 10.21. Recent weeks maintained an upward slope of 1.58, confirming sustained buying interest.

Volume Analysis

Trading volume over three months is increasing, driven predominantly by buyers who represent 84.91% of activity. This strong buyer dominance suggests robust investor confidence and heightened market participation, reinforcing the bullish price trend observed in recent periods.

Target Prices

Analysts present a confident target consensus for Hasbro, Inc., reflecting moderate upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 99 | 105 | 102.33 |

The target prices suggest a stable outlook with a narrow range, indicating measured optimism among analysts for Hasbro’s near-term performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst grades and consumer feedback to provide a balanced perspective on Hasbro, Inc. (HAS).

Stock Grades

Here is the latest summary of Hasbro, Inc. stock grades from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth Capital | Maintain | Buy | 2026-02-04 |

| Morgan Stanley | Maintain | Overweight | 2026-02-02 |

| UBS | Maintain | Buy | 2026-01-07 |

| UBS | Maintain | Buy | 2025-11-14 |

| Citigroup | Maintain | Buy | 2025-10-24 |

| B of A Securities | Maintain | Buy | 2025-09-29 |

| UBS | Maintain | Buy | 2025-08-13 |

| JP Morgan | Maintain | Overweight | 2025-07-24 |

| Roth Capital | Maintain | Buy | 2025-07-24 |

| Morgan Stanley | Maintain | Overweight | 2025-07-24 |

The consensus among these firms shows a consistent Buy or Overweight rating with no recent downgrades. This steady endorsement reflects confidence in Hasbro’s outlook amid market conditions.

Consumer Opinions

Consumers express a mix of enthusiasm and frustration regarding Hasbro, Inc.’s product lineup and customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| “Innovative toy designs keep my kids engaged.” | “Pricing feels steep compared to competitors.” |

| “Strong brand nostalgia and quality materials.” | “Occasional delays in customer support response.” |

| “Consistent product availability in stores.” | “Limited diversity in new product themes.” |

Overall, Hasbro gains praise for its creativity and brand strength but faces criticism over pricing and customer service responsiveness. These issues could impact long-term brand loyalty if unaddressed.

Risk Analysis

The table below summarizes key risks facing Hasbro, Inc., highlighting likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Profitability Risk | Negative net margin (-6.86%) and ROE (-57%) signal ongoing earnings issues. | High | High |

| Leverage Risk | Debt-to-equity ratio of 4.89 indicates heavy reliance on debt financing. | Medium | High |

| Liquidity Risk | Current ratio of 1.38 is adequate but not robust, with interest coverage at 0. | Medium | Medium |

| Valuation Risk | Price-to-book ratio of 20.54 suggests possible overvaluation. | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score of 2.78 places the company in the grey zone for distress. | Medium | High |

| Operational Risk | Dependence on licensed products and entertainment content increases volatility. | Medium | Medium |

Profitability and leverage risks dominate. Negative returns and high debt raise solvency concerns. The grey zone Altman Z-Score warns of moderate bankruptcy risk. Interest coverage at zero further underscores funding stress. Careful monitoring is essential.

Should You Buy Hasbro, Inc.?

Analytically, Hasbro appears to be in a challenging phase with declining profitability and a deteriorating moat, suggesting value destruction. Its leverage profile shows significant stress, reflected in a cautious debt outlook. The overall rating could be seen as a C-, indicating a very unfavorable investment profile despite moderate operational efficiency.

Strength & Efficiency Pillars

Hasbro, Inc. shows operational resilience with a strong gross margin of 71.03%, indicating effective cost control. Its weighted average cost of capital (6.07%) remains favorable, but the return on invested capital (0.3%) falls dramatically short, signaling value destruction rather than creation. The negative net margin of -6.86% and return on equity of -57.01% reflect operational challenges. Despite solid top-line growth of 13.7% over the past year, the company struggles to convert revenue into profit efficiently.

Weaknesses and Drawbacks

The Altman Z-Score of 2.79 places Hasbro in the grey zone, signaling moderate bankruptcy risk that investors cannot ignore. The company’s debt-to-equity ratio at 4.89 is alarmingly high, exposing it to financial leverage risks. A price-to-book ratio of 20.54 suggests an expensive valuation relative to its assets, while a negative P/E ratio (-36.02) reflects net losses. Interest coverage at zero highlights the inability to comfortably service debt, compounding solvency concerns.

Our Final Verdict about Hasbro, Inc.

Hasbro’s fundamentals present a mixed picture. The company’s operational margins and growth offer some optimism, but its financial leverage and solvency risks temper enthusiasm. The stock’s bullish long-term trend and strong buyer dominance might appear promising. However, the grey zone Z-Score and expensive valuation suggest a cautious, wait-and-see approach. This profile may appear suitable only for investors willing to accept elevated risk.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Hasbro, Inc. (NASDAQ:HAS) Plans Quarterly Dividend of $0.70 – MarketBeat (Feb 10, 2026)

- Hasbro Inc (HAS) Q4 2025 Earnings Call Highlights: Record Revenu – GuruFocus (Feb 10, 2026)

- Hasbro Q4 Earnings and Revenues Beat Estimates, Stock Up – TradingView (Feb 10, 2026)

- Hasbro (NASDAQ: HAS) 2025 results: MAGIC growth, $1B buyback and 2026 targets – stocktitan.net (Feb 10, 2026)

- Hasbro: Q4 Earnings Snapshot – WKYC (Feb 10, 2026)

For more information about Hasbro, Inc., please visit the official website: hasbro.com