Home > Analyses > Technology > GoDaddy Inc.

GoDaddy Inc. powers the digital presence of millions, transforming how small businesses and individuals establish and grow their online identities. As a leading force in cloud-based technology and domain registration, GoDaddy offers a comprehensive suite of hosting, security, marketing, and payment solutions renowned for innovation and reliability. With its strong market influence and evolving product ecosystem, I explore whether GoDaddy’s current fundamentals support its valuation and future growth potential in an increasingly competitive landscape.

Table of contents

Business Model & Company Overview

GoDaddy Inc., founded in 2014 and headquartered in Tempe, Arizona, stands as a dominant player in the software infrastructure sector. It offers a cohesive ecosystem centered on cloud-based technology products, enabling customers to establish and grow their digital presence. From domain registration to hosting and security solutions, GoDaddy serves a diverse clientele including small businesses, developers, and domain investors worldwide.

The company’s revenue engine balances a broad portfolio of hardware-enabled services like POS devices with recurring software and managed hosting subscriptions. Its strategic footprint spans the Americas, Europe, and Asia, supporting global digital commerce and marketing needs. GoDaddy’s economic moat lies in its integrated platform that shapes the future of online identity and business management.

Financial Performance & Fundamental Metrics

I will analyze GoDaddy Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

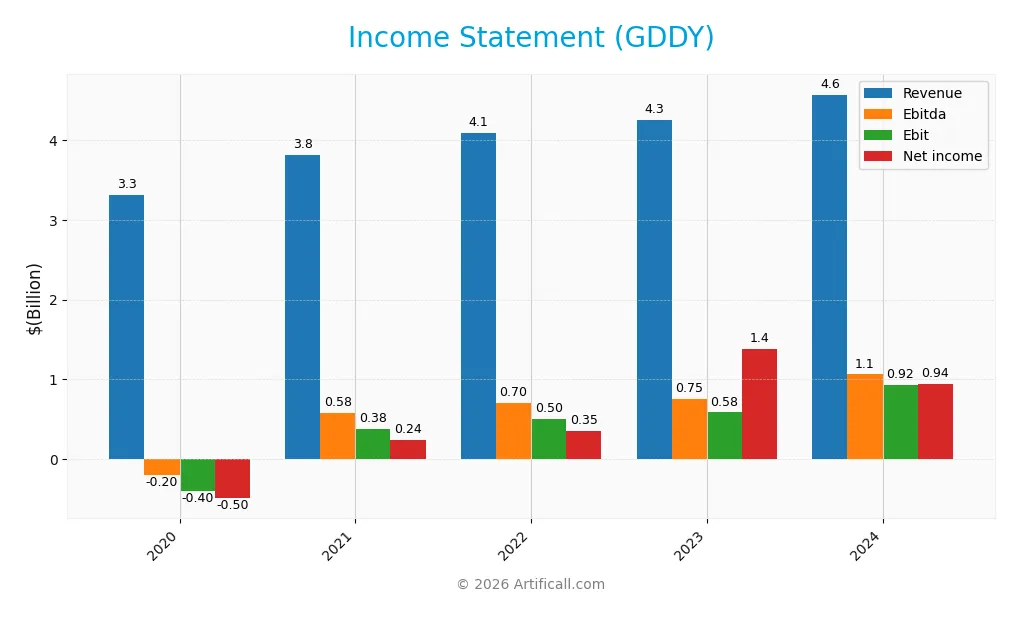

The table below presents GoDaddy Inc.’s key income statement figures for the fiscal years 2020 through 2024, illustrating the company’s revenue, expenses, profitability, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 3.32B | 3.82B | 4.09B | 4.25B | 4.57B |

| Cost of Revenue | 1.16B | 1.37B | 1.48B | 1.57B | 1.65B |

| Operating Expenses | 1.89B | 2.06B | 2.11B | 2.13B | 2.03B |

| Gross Profit | 2.16B | 2.44B | 2.61B | 2.68B | 2.92B |

| EBITDA | -201M | 579M | 697M | 754M | 1.06B |

| EBIT | -404M | 380M | 503M | 583M | 924M |

| Interest Expense | 91M | 126M | 146M | 179M | 158M |

| Net Income | -495M | 242M | 352M | 1.37B | 937M |

| EPS | -2.93 | 1.44 | 2.22 | 9.27 | 6.63 |

| Filing Date | 2021-02-19 | 2022-02-17 | 2023-02-16 | 2024-02-29 | 2025-02-20 |

Income Statement Evolution

GoDaddy Inc. showed steady revenue growth of 37.9% from 2020 to 2024, with a 7.5% increase in 2024 alone, reflecting a neutral short-term momentum. Net income surged 289.2% over the period but declined 36.6% in 2024, indicating volatility in profitability despite generally improving net margins. Gross and EBIT margins remained favorable, supporting solid operational efficiency.

Is the Income Statement Favorable?

In 2024, GoDaddy posted $4.57B revenue and $937M net income, with a 20.5% net margin, indicating healthy profitability. EBIT margin at 20.2% and interest expense at 3.46% of revenue reflect efficient cost management. However, net income and EPS fell compared to 2023, showing some earnings pressure. Overall, fundamentals appear favorable, supported by strong margin metrics and positive longer-term growth trends.

Financial Ratios

The table below presents key financial ratios for GoDaddy Inc. over the fiscal years 2020 to 2024, providing insight into profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -15% | 6% | 9% | 32% | 20% |

| ROE | 38.4% | 3.0% | -1.1% | 22.1% | 135.4% |

| ROIC | 6.5% | 7.3% | 10.8% | 11.1% | 16.0% |

| P/E | -28.3 | 58.8 | 33.7 | 11.5 | 29.8 |

| P/B | -1084 | 174.4 | -35.8 | 253.1 | 40.3 |

| Current Ratio | 0.56 | 0.78 | 0.64 | 0.47 | 0.72 |

| Quick Ratio | 0.56 | 0.78 | 0.64 | 0.47 | 0.72 |

| D/E | -258 | 50 | -12 | 63 | 5.6 |

| Debt-to-Assets | 52% | 55% | 57% | 52% | 47% |

| Interest Coverage | 3.0 | 3.0 | 3.4 | 3.1 | 5.6 |

| Asset Turnover | 0.52 | 0.51 | 0.59 | 0.56 | 0.56 |

| Fixed Asset Turnover | 8.3 | 11.6 | 13.2 | 17.3 | 22.2 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Over the period, GoDaddy Inc.’s Return on Equity (ROE) showed significant volatility, peaking at 135.37% in 2024 after lower or negative values in prior years. The Current Ratio demonstrated fluctuations but remained below 1, indicating challenges in liquidity management. The Debt-to-Equity Ratio improved from extreme negative or very high values to 5.63 in 2024, reflecting a reduction in leverage risk. Profitability margins generally improved, with the net margin reaching 20.49% in 2024.

Are the Financial Ratios Favorable?

In 2024, GoDaddy’s profitability ratios, including ROE, net margin, and return on invested capital, are favorable, exceeding typical benchmarks. Liquidity ratios such as current and quick ratios are unfavorable, both below 1, suggesting potential short-term liquidity constraints. Leverage remains high, with a debt-to-equity ratio of 5.63 considered unfavorable, though debt-to-assets ratio is neutral at 47.29%. Market valuation metrics, including price-to-earnings and price-to-book ratios, are unfavorable, indicating possibly stretched market expectations. Overall, the financial ratios present a neutral global opinion with balanced favorable and unfavorable aspects.

Shareholder Return Policy

GoDaddy Inc. does not pay dividends, with a dividend payout ratio consistently at 0 and no dividend yield. The company appears to focus on reinvestment, supported by positive free cash flow per share and operating cash flow coverage, while also engaging in share buybacks.

This strategy suggests a prioritization of growth and capital allocation over immediate income distribution. The absence of dividends combined with share repurchases may support sustainable long-term shareholder value, provided the company maintains its profitability and cash flow generation.

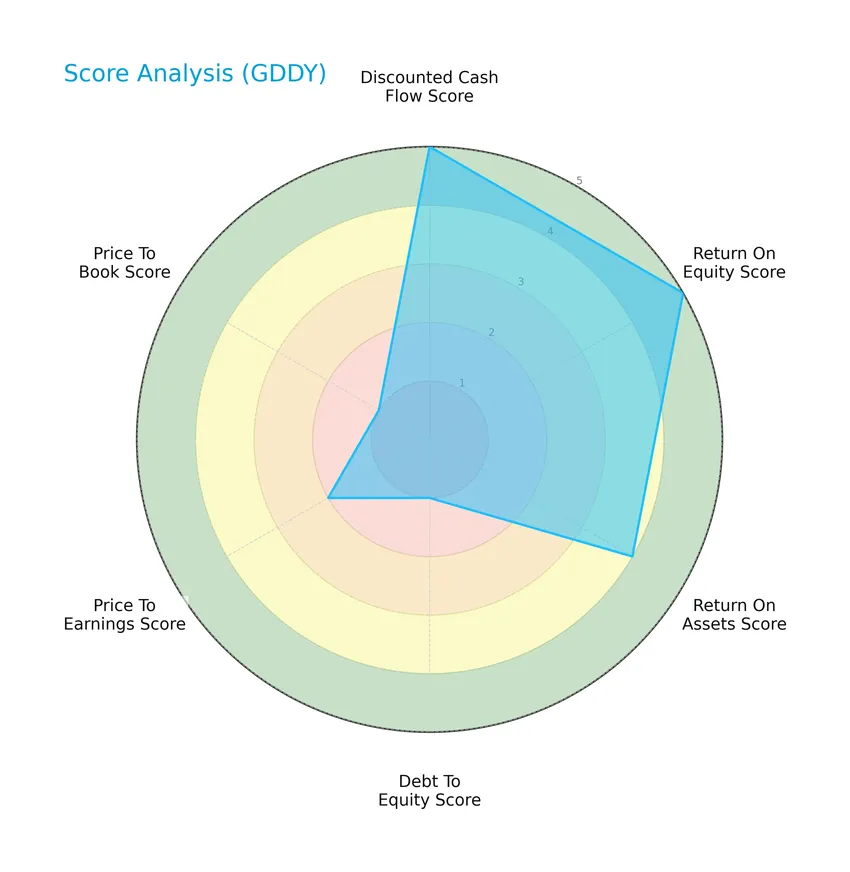

Score analysis

The following radar chart presents an overview of GoDaddy Inc.’s key financial scores for investor consideration:

GoDaddy Inc. shows very favorable scores in discounted cash flow and return on equity, alongside a favorable return on assets. However, it faces very unfavorable ratings for debt to equity and price to book, with moderate scores in price to earnings.

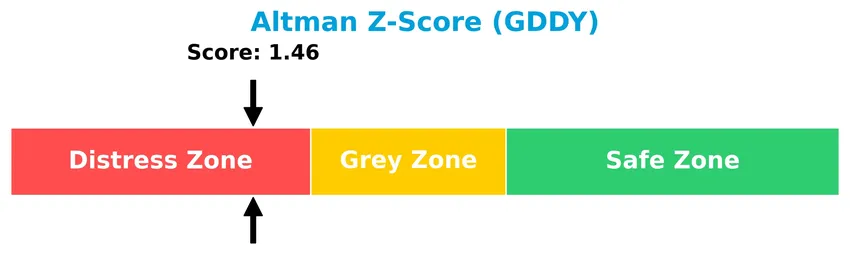

Analysis of the company’s bankruptcy risk

The Altman Z-Score places GoDaddy Inc. in the distress zone, indicating a higher risk of financial distress and potential bankruptcy:

Is the company in good financial health?

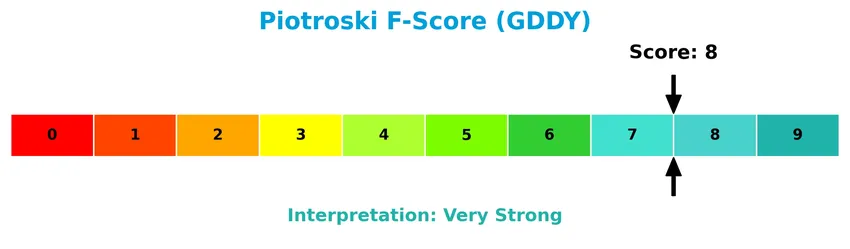

The Piotroski Score diagram provides insight into GoDaddy Inc.’s financial strength and operational efficiency:

With a very strong Piotroski Score of 8, GoDaddy Inc. demonstrates solid financial health and robust fundamentals, suggesting good management of profitability, leverage, liquidity, and efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will explore GoDaddy Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT profile. I will assess whether GoDaddy holds a competitive advantage relative to its industry peers.

Strategic Positioning

GoDaddy Inc. maintains a diversified product portfolio focused on Core Platform and Applications & Commerce, with revenues of $4.57B in 2024. Geographically, it has significant exposure in the US ($3.11B) and internationally ($1.46B), targeting small businesses with cloud-based infrastructure and digital presence solutions.

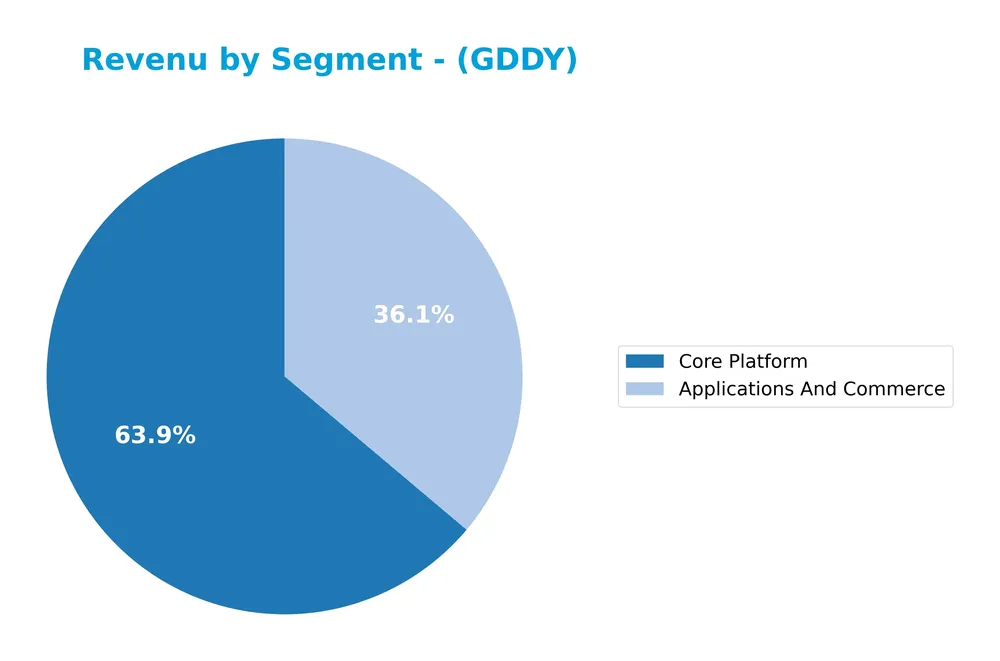

Revenue by Segment

This pie chart illustrates GoDaddy Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the company’s key business areas.

GoDaddy’s revenue is primarily driven by its Core Platform segment, which reached $2.92B in 2024, showing steady growth from $1.93B in 2022. Applications and Commerce also contributed significantly with $1.65B, nearly doubling since 2022’s $795M. This trend indicates an increasing focus on integrated digital solutions, with the Core Platform maintaining dominance and Applications and Commerce accelerating, reducing concentration risk through segment diversification.

Key Products & Brands

The following table summarizes GoDaddy Inc.’s main products and brands by category and description:

| Product | Description |

|---|---|

| Domain Name Registration | Enables customers to establish their digital identity by registering domain names. |

| Shared Website Hosting | Provides hosting with applications like web analytics, SSL certificates, and WordPress support. |

| Virtual Private and Dedicated Servers | Offers customizable server configurations tailored to customer applications and growth needs. |

| Managed Hosting | Includes setup, monitoring, maintenance, security, and patching of software and servers. |

| Security Products | Suite of tools designed to secure customers’ online presence. |

| Websites + Marketing | DIY mobile-optimized online tool for building websites and e-commerce stores. |

| Marketing Tools and SEO | Tools and services to acquire and engage customers, create content, and optimize search engine visibility. |

| Social Media Management | Services to manage and enhance social media presence. |

| Business Applications | Microsoft Office 365, email accounts, email marketing, and Internet-based telephony services. |

| Online Store Capabilities | Enables customers to transact business directly on their websites. |

| GoDaddy Payments and POS | Payment facilitator services and point-of-sale devices and software. |

GoDaddy’s product portfolio spans domain registration, hosting services, security, marketing tools, business applications, and payment solutions, catering primarily to small businesses, individuals, developers, and domain investors.

Main Competitors

There are 32 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

GoDaddy Inc. ranks 17th among 32 competitors, with a market cap approximately 0.41% that of the sector leader, Microsoft Corporation. The company’s size is below both the average market cap of the top 10 competitors (508B) and the sector median (19B). It maintains a 47.14% gap to the next competitor above, indicating a notable distance from immediate rivals in terms of scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does GDDY have a competitive advantage?

GoDaddy Inc. presents a competitive advantage, demonstrated by a very favorable moat status with ROIC exceeding WACC by 8.6% and a strong ROIC growth trend of 147%, indicating efficient use of invested capital and value creation. Its income statement is broadly favorable, with a gross margin of 63.9% and EBIT margin of 20.2%, supporting consistent profitability and operational efficiency.

The company’s future outlook includes expanding its cloud-based technology products and services for small businesses, developers, and individuals, with offerings spanning domain registration, hosting, security, marketing, and payment solutions. Growth opportunities lie in international markets and new digital presence tools, positioning GoDaddy to leverage evolving online business needs globally.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors impacting GoDaddy Inc.’s strategic position and investment potential.

Strengths

- strong market presence in domain registration and hosting

- favorable gross margin of 63.88%

- very favorable return on equity at 135.37%

Weaknesses

- high debt-to-equity ratio of 5.63

- low liquidity with current ratio at 0.72

- unfavorable valuation metrics (PE 29.76, PB 40.28)

Opportunities

- expanding international revenue with 1.46B non-US sales in 2024

- growth in cloud-based and security products

- increasing demand for online business tools and e-commerce solutions

Threats

- intense competition in software infrastructure sector

- pressure on net margin and EPS growth in the past year

- potential financial distress indicated by Altman Z-score in distress zone

Overall, GoDaddy demonstrates strong profitability and a durable competitive advantage, supported by robust revenue growth and expanding global presence. However, elevated leverage and valuation concerns require careful risk management. Strategic focus on innovation and international expansion could mitigate threats and sustain growth.

Stock Price Action Analysis

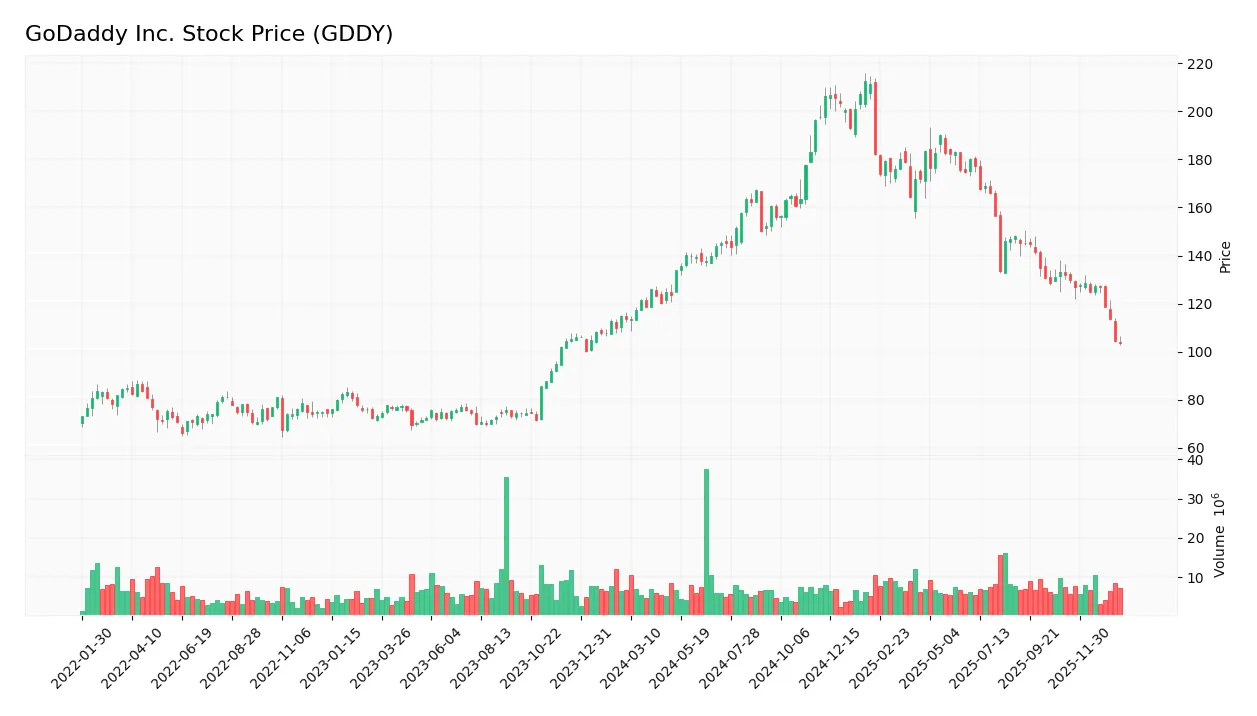

The following weekly chart illustrates GoDaddy Inc. (GDDY) stock price movements over the past 100 weeks, highlighting key highs and lows during this period:

Trend Analysis

Over the past 12 months, GDDY’s stock price declined by 8.81%, indicating a bearish trend. The price dropped from a high of 212.65 to a low of 103.7 with a deceleration in the downward momentum. The standard deviation is elevated at 27.54, reflecting notable volatility during this timeframe.

Volume Analysis

Trading volumes have been increasing overall, with buyer activity representing 54.08% of total volume, suggesting moderate buyer interest. However, in the recent period from November 2025 to January 2026, seller dominance intensified with only 29.61% buyer participation, indicating growing selling pressure and cautious investor sentiment.

Target Prices

The consensus target prices for GoDaddy Inc. indicate a generally optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 182 | 70 | 143.33 |

Analysts expect GoDaddy’s stock price to range broadly, with a consensus target around 143, suggesting potential upside from current levels but also notable risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback regarding GoDaddy Inc. (GDDY) performance and services.

Stock Grades

Here is the latest compilation of GoDaddy Inc. stock grades from prominent financial institutions, reflecting their current stance:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-08 |

| Jefferies | Maintain | Hold | 2026-01-05 |

| B. Riley Securities | Maintain | Buy | 2025-10-31 |

| Evercore ISI Group | Maintain | In Line | 2025-10-31 |

| Benchmark | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Citigroup | Maintain | Buy | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-06 |

The overall sentiment remains cautiously positive with a majority of Buy and Overweight ratings, while several firms maintain neutral or hold positions, indicating a balanced outlook without recent grade revisions.

Consumer Opinions

Consumers have mixed feelings about GoDaddy Inc., reflecting both appreciation for its services and concerns over certain aspects.

| Positive Reviews | Negative Reviews |

|---|---|

| User-friendly interface and easy domain management. | Customer support can be slow and unresponsive. |

| Competitive pricing and frequent promotional offers. | Upselling tactics feel aggressive at times. |

| Reliable uptime and fast website loading speeds. | Some users experience billing issues and hidden fees. |

Overall, GoDaddy is praised for its intuitive platform and reliability, but recurring complaints focus on customer service delays and transparency in pricing. Investors should weigh these factors when considering the company’s growth potential.

Risk Analysis

Below is a summary table presenting key risks related to GoDaddy Inc. (GDDY), including their probability and potential impact on the company:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score of 1.46 indicates financial distress risk, suggesting vulnerability to liquidity issues. | Medium | High |

| Leverage | Very unfavorable debt-to-equity ratio (5.63) increases financial risk and limits flexibility. | High | High |

| Valuation | High price-to-book (40.28) and price-to-earnings (29.76) ratios raise concerns of overvaluation. | Medium | Medium |

| Liquidity | Current and quick ratios at 0.72 indicate weak short-term liquidity and potential cash flow constraints. | High | Medium |

| Market Volatility | Beta near 1 (0.95) shows stock price sensitivity to market swings, affecting investor returns. | Medium | Medium |

| Competitive Pressure | Intense competition in cloud and web services could impact growth and margins. | Medium | Medium |

The most concerning risks are GoDaddy’s financial distress indication via its Altman Z-Score and its high leverage level, which may restrict operational flexibility during downturns. Despite strong profitability metrics and a very strong Piotroski score of 8, the company’s liquidity constraints and valuation multiples warrant caution. Investors should monitor debt levels and market conditions closely when considering GoDaddy stock.

Should You Buy GoDaddy Inc.?

GoDaddy Inc. appears to be delivering improving profitability and demonstrates a durable competitive moat supported by growing ROIC, suggesting strong value creation. Despite a challenging leverage profile and distress-level Altman Z-score, its overall B+ rating could be seen as very favorable for operational efficiency.

Strength & Efficiency Pillars

GoDaddy Inc. demonstrates solid profitability with a net margin of 20.49% and an impressive return on equity of 135.37%. The company’s return on invested capital (ROIC) stands at 16.02%, comfortably exceeding its weighted average cost of capital (WACC) of 7.43%, confirming GoDaddy as a clear value creator. Financial health is supported by a robust Piotroski Score of 8, indicating very strong fundamentals, although the Altman Z-Score of 1.46 places it in the distress zone, signaling some caution on bankruptcy risk. Overall, these metrics highlight operational efficiency and value generation.

Weaknesses and Drawbacks

GoDaddy faces notable challenges in valuation and leverage. Its price-to-earnings ratio of 29.76 and an extremely high price-to-book ratio of 40.28 suggest the stock is trading at a premium, raising concerns about overvaluation. The company’s debt-to-equity ratio is alarmingly high at 5.63, reflecting significant leverage, while liquidity ratios such as the current and quick ratios both sit at a weak 0.72, indicating potential short-term financial strain. Additionally, recent market activity reveals seller dominance with only 29.61% buyer volume, creating headwinds that may pressure the stock price further.

Our Verdict about GoDaddy Inc.

GoDaddy’s long-term fundamental profile appears favorable, driven by strong profitability and clear value creation. However, the bearish overall and recent price trends, coupled with seller dominance in the last quarter, suggest that despite its underlying strengths, a cautious wait-and-see approach might be prudent to identify a more opportune entry point. The premium valuation and heavy leverage also imply elevated risk that investors should carefully monitor.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Wall Street Tout’s GoDaddy Inc. (GDDY) Growth Metrics on Airo AI Offerings Prospects – Yahoo Finance (Dec 28, 2025)

- GoDaddy Inc. Reports Third Quarter 2025 Financial Results – PR Newswire (Oct 30, 2025)

- Assessing GoDaddy (GDDY) Valuation After Recent Share Price Weakness – Sahm (Jan 17, 2026)

- The Truth About GoDaddy Inc: Is GDDY the Sleeper Tech Stock Everyone’s Sleeping On? – AD HOC NEWS (Jan 18, 2026)

- Down 8.3% in 4 Weeks, Here’s Why GoDaddy (GDDY) Looks Ripe for a Turnaround – Finviz (Jan 09, 2026)

For more information about GoDaddy Inc., please visit the official website: godaddy.com