Home > Analyses > Financial Services > Globe Life Inc.

Globe Life Inc. safeguards millions of American families with tailored life and supplemental health insurance. The company dominates the midmarket segment, delivering reliable whole life, term life, and annuity products. Known for steady innovation and disciplined risk management, Globe Life balances growth with resilience. As industry dynamics shift, I question whether its solid fundamentals continue to support its premium valuation and long-term growth prospects.

Table of contents

Business Model & Company Overview

Globe Life Inc., founded in 1979 and headquartered in McKinney, Texas, dominates the U.S. life insurance sector. It operates an integrated ecosystem of life and supplemental health insurance products, annuities, and investments tailored to lower middle and middle-income households. This focused approach underpins its strong market position and customer loyalty.

The company’s revenue engine blends recurring premiums from life and health insurance with annuity sales, balancing steady cash flow and growth potential. Globe Life’s footprint spans the Americas, with a strategic emphasis on the U.S. market. Its deep customer relationships and diversified product lines create a durable economic moat, shaping the future of affordable insurance solutions.

Financial Performance & Fundamental Metrics

I will analyze Globe Life Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and shareholder value.

Income Statement

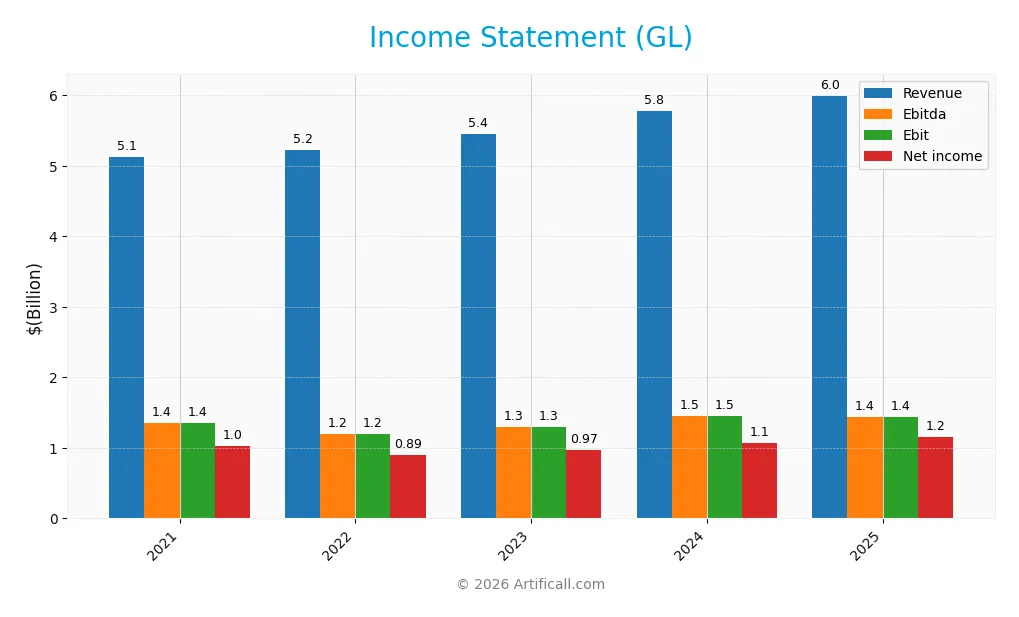

The table below summarizes Globe Life Inc.’s key income statement figures for the fiscal years 2021 through 2025, showing revenue and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 5.12B | 5.23B | 5.45B | 5.78B | 5.99B |

| Cost of Revenue | 3.43B | 3.69B | 3.81B | 3.91B | 0 |

| Operating Expenses | 412M | 439M | 446M | 544M | 0 |

| Gross Profit | 1.69B | 1.54B | 1.64B | 1.87B | 0 |

| EBITDA | 1.36B | 1.19B | 1.30B | 1.45B | 1.44B |

| EBIT | 1.36B | 1.19B | 1.30B | 1.45B | 1.44B |

| Interest Expense | 83M | 90M | 102M | 127M | 141M |

| Net Income | 1.03B | 894M | 971M | 1.07B | 1.16B |

| EPS | 7.30 | 9.13 | 10.21 | 11.99 | 14.27 |

| Filing Date | 2022-02-24 | 2023-02-23 | 2024-02-28 | 2025-02-26 | 2026-02-04 |

Income Statement Evolution

Globe Life Inc. posted steady revenue growth of 17.1% from 2021 to 2025, with a 3.7% increase in 2025 alone. Net income rose 12.6% over the period, supported by a 4.5% neutral net margin trend and a favorable EBIT margin near 24%. Gross profit shows an anomaly in 2025, reflecting zero reported values, signaling a reporting irregularity or classification change.

Is the Income Statement Favorable?

In 2025, Globe Life’s revenue reached $6B with net income at $1.16B, translating into a strong 19.4% net margin. Interest expenses remained low at 2.4% of revenue, supporting favorable profitability metrics. Despite a slight EBIT decline of 1.2%, EPS surged 17.8%, indicating efficient capital allocation. The zero gross profit figure marks a notable irregularity, but overall fundamentals appear favorable.

Financial Ratios

The following table summarizes key financial ratios for Globe Life Inc. over the past five fiscal years, illustrating profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 20.13% | 17.11% | 17.82% | 18.53% | 19.37% |

| ROE | 11.93% | 22.65% | 21.64% | 20.18% | N/A |

| ROIC | -87.5% | 8.03% | 5.22% | 14.35% | N/A |

| P/E | 9.28 | 13.20 | 11.92 | 8.74 | N/A |

| P/B | 1.11 | 2.99 | 2.58 | 1.76 | N/A |

| Current Ratio | 0.38 | 0.76 | 0.80 | 0.80 | N/A |

| Quick Ratio | 0.38 | 0.76 | 0.80 | 0.80 | N/A |

| D/E | 0.23 | 0.53 | 0.47 | 0.52 | N/A |

| Debt-to-Assets | 6.81% | 7.99% | 7.54% | 9.42% | N/A |

| Interest Coverage | 15.27 | 12.19 | 11.67 | 10.44 | N/A |

| Asset Turnover | 0.17 | 0.20 | 0.19 | 0.20 | N/A |

| Fixed Asset Turnover | 24.98 | 24.65 | 22.70 | 20.27 | N/A |

| Dividend Yield | 0.84% | 0.68% | 0.73% | 0.91% | 0.00% |

Evolution of Financial Ratios

From 2021 to 2024, Globe Life’s Return on Equity (ROE) showed steady improvement, peaking at 22.6% in 2022 before slightly declining to 20.2% in 2024. The Current Ratio remained below 1.0, indicating consistent liquidity constraints. Debt-to-Equity increased moderately from 0.23 in 2021 to around 0.52 in 2024, reflecting higher leverage but still within moderate risk thresholds. Profitability margins remained stable around 18-20%.

Are the Financial Ratios Favorable?

In 2025, profitability metrics such as net margin (19.37%) were favorable, demonstrating solid earnings efficiency. However, ROE and ROIC were reported as zero, marking a significant unfavorable signal for returns. Liquidity ratios were unfavorable due to lack of available data, raising red flags on short-term solvency. Leverage ratios like debt-to-equity and debt-to-assets were favorable, supported by a strong interest coverage ratio of 10.17. Overall, the financial ratios present a slightly unfavorable profile with mixed strengths and weaknesses.

Shareholder Return Policy

Globe Life Inc. maintains a consistent dividend policy with a payout ratio near 8% to 9%, and a dividend yield around 0.7% to 0.9%. The dividend per share has grown steadily from $0.78 in 2021 to $1.02 in 2025, supported by strong free cash flow coverage.

The company also engages in share buybacks, complementing dividends to return capital. This balanced approach, backed by solid profit margins and cash flow, suggests a sustainable distribution strategy aligned with long-term shareholder value creation.

Score analysis

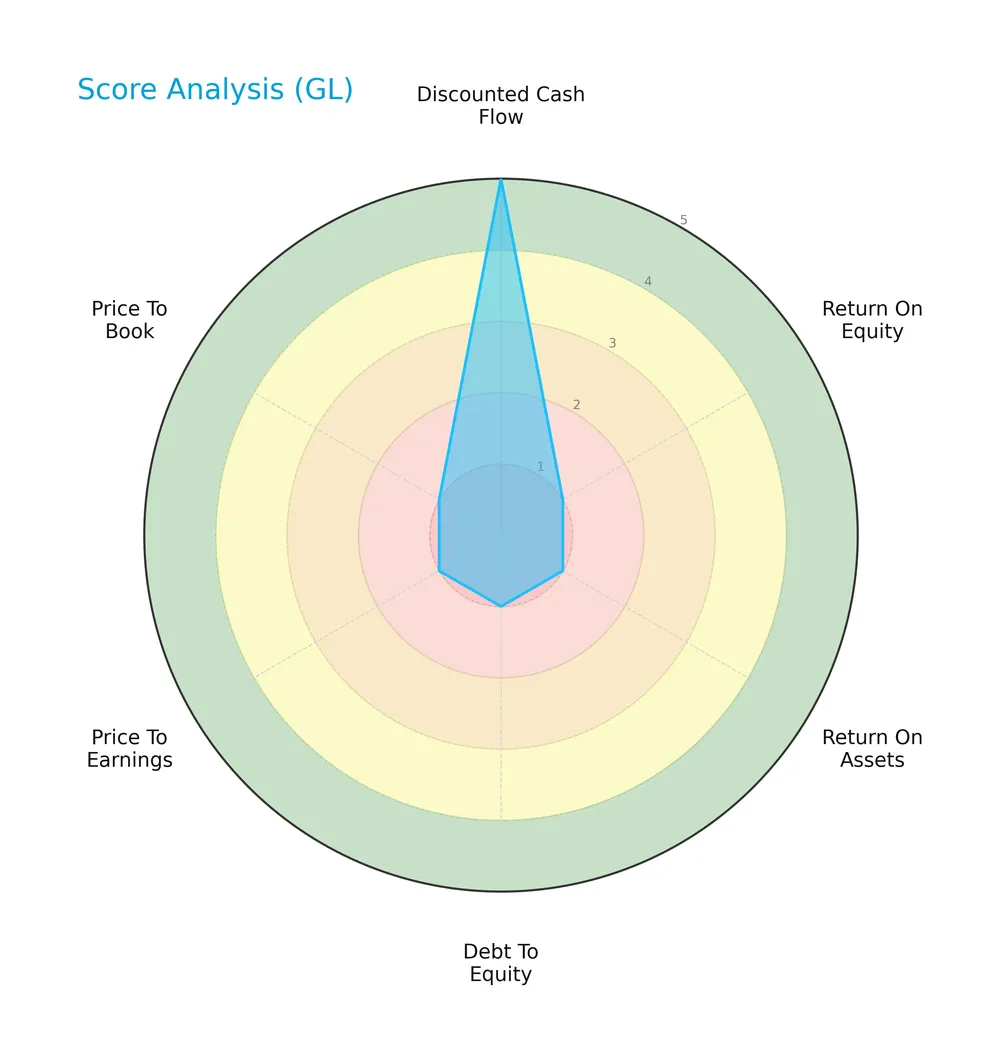

The following radar chart illustrates Globe Life Inc.’s key financial scores across valuation, profitability, and leverage metrics:

Globe Life Inc. scores very favorably on discounted cash flow with a 5, indicating strong intrinsic value. However, profitability and leverage scores—return on equity, return on assets, debt to equity, price-to-earnings, and price-to-book—are all very unfavorable at 1, reflecting significant weaknesses in earnings efficiency and capital structure.

Analysis of the company’s bankruptcy risk

Globe Life Inc. falls within the distress zone according to its Altman Z-Score, signaling a high probability of financial distress and bankruptcy risk:

Is the company in good financial health?

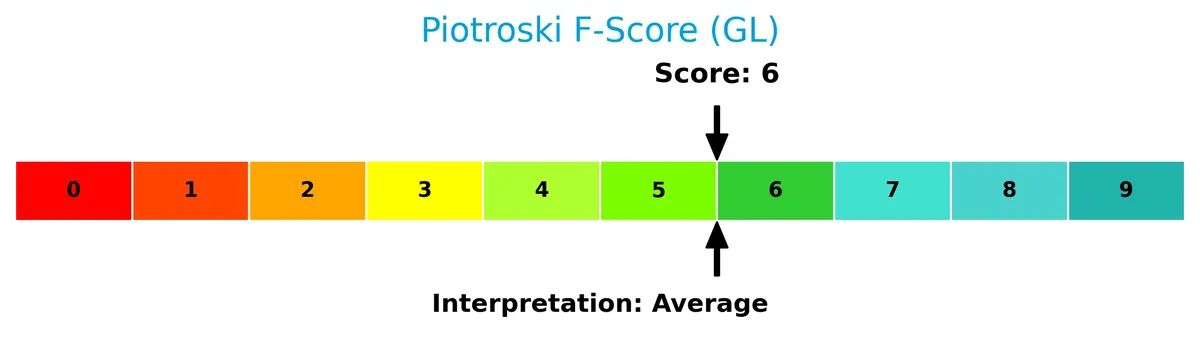

The Piotroski Score visualization provides insight into the company’s financial condition based on nine fundamental criteria:

With a Piotroski Score of 6, Globe Life Inc. exhibits average financial health. This suggests moderate strength in profitability, leverage, liquidity, and operational efficiency, though it does not rank among the strongest value investments.

Competitive Landscape & Sector Positioning

This section examines Globe Life Inc.’s strategic positioning, revenue segments, key products, and main competitors in the life insurance sector. I will assess whether Globe Life holds a competitive advantage relative to its industry peers.

Strategic Positioning

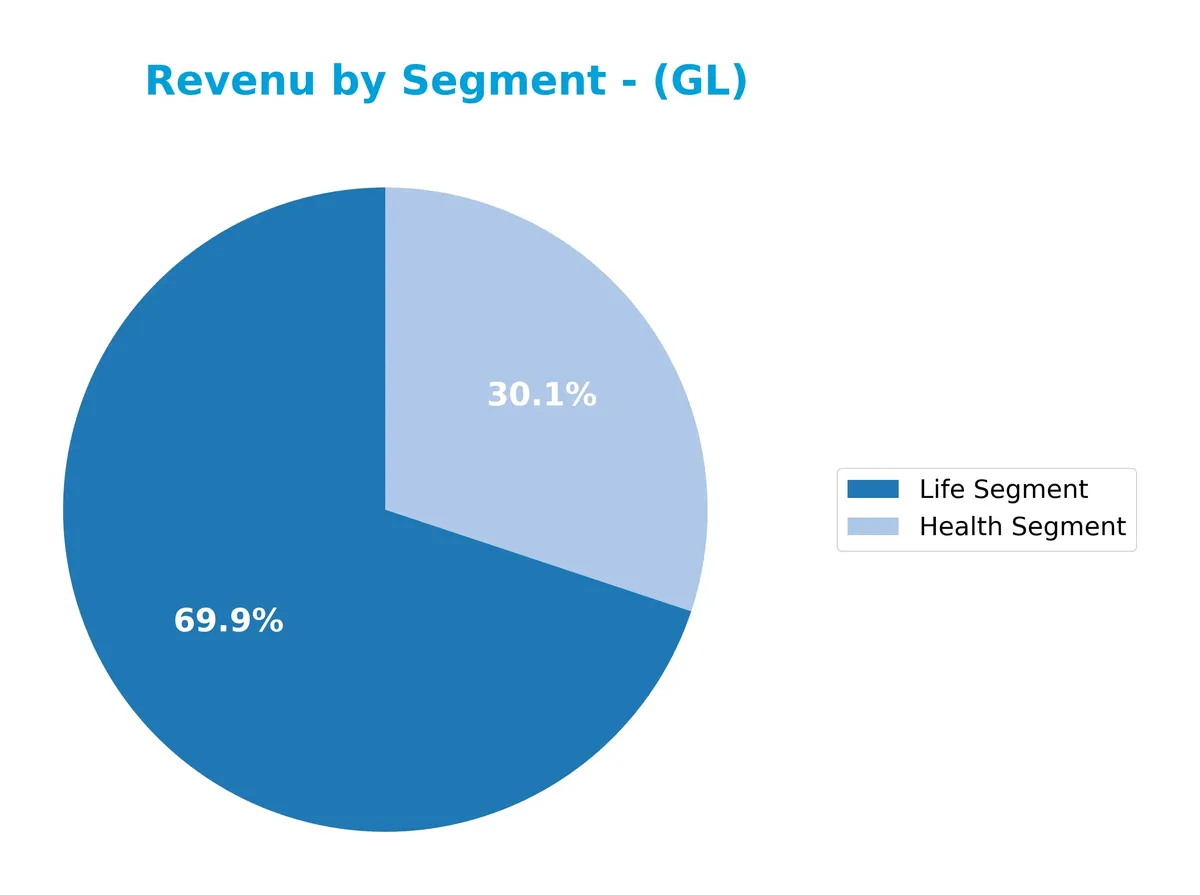

Globe Life Inc. maintains a concentrated product portfolio focused on life and supplemental health insurance, with life insurance generating over twice the revenue of health segments in 2024. Geographic exposure is U.S.-centric, targeting lower to middle-income households with limited diversification into annuities and investments.

Revenue by Segment

The pie chart illustrates Globe Life Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the company’s core business areas and their relative contributions.

Globe Life’s revenue in 2024 centers on the Life Segment at $3.26B, clearly the dominant driver. The Health Segment contributes $1.4B, showing steady growth and reinforcing its importance. Other segments, like Annuity and Investment, are either minimal or excluded, indicating a strategic focus on Life and Health. The recent year shows moderate acceleration in Health revenue, signaling a slightly broader concentration risk but stable core earnings.

Key Products & Brands

Globe Life Inc. offers a diverse range of insurance and annuity products primarily targeting middle-income households:

| Product | Description |

|---|---|

| Whole Life Insurance | Permanent life insurance providing lifetime coverage with fixed premiums and cash value growth. |

| Term Life Insurance | Life insurance with coverage for a specific term, typically more affordable than whole life. |

| Supplemental Health Insurance | Includes Medicare supplements, critical illness, and accident plans enhancing basic health coverage. |

| Annuities | Single-premium and flexible-premium deferred annuities designed for retirement income planning. |

| Investments | Investment-related products supporting the company’s insurance offerings and financial stability. |

Globe Life’s product mix balances recurring life insurance premiums with growing supplemental health policies and annuity offerings. This diversification supports steady revenue streams and risk management in the life insurance sector.

Main Competitors

There are 4 competitors in total, with the table listing the top 4 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Aflac Incorporated | 59.6B |

| MetLife, Inc. | 52.9B |

| Prudential Financial, Inc. | 40.2B |

| Globe Life Inc. | 11.0B |

Globe Life Inc. ranks 4th among its competitors with a market cap at 19.8% of the leader’s size. The company sits below both the average market cap of the top 10 (41B) and the sector median (47B). It trails its nearest competitor by a wide margin of 241%, highlighting a significant scale gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does GL have a competitive advantage?

Globe Life Inc. shows favorable profitability metrics with a strong EBIT margin of 24% and a net margin near 19%, indicating effective cost control in the life insurance sector. While ROIC versus WACC data is unavailable, the company’s ROIC trend is growing, suggesting improving capital efficiency over recent years.

Looking ahead, Globe Life’s focus on multiple insurance segments—life, supplemental health, and annuities—positions it to capitalize on demographic shifts and evolving consumer needs in the US market. Continued product diversification offers potential growth opportunities amid a stable regulatory environment.

SWOT Analysis

This analysis identifies Globe Life Inc.’s key internal and external factors impacting its strategic positioning.

Strengths

- strong EBIT margin at 23.96%

- favorable net margin of 19.37%

- growing EPS over five years by 94.88%

Weaknesses

- low liquidity ratios pose risk

- weak ROE and ROIC signal capital inefficiency

- Altman Z-score in distress zone

Opportunities

- expanding middle-income market for life insurance

- growing demand for supplemental health products

- potential to improve operational efficiency

Threats

- regulatory changes in insurance industry

- rising competition from insurtech firms

- economic downturn affecting premium payments

Globe Life benefits from solid profitability and EPS growth but faces liquidity and capital return challenges. The company must leverage market demand while managing financial risks to sustain its competitive edge.

Stock Price Action Analysis

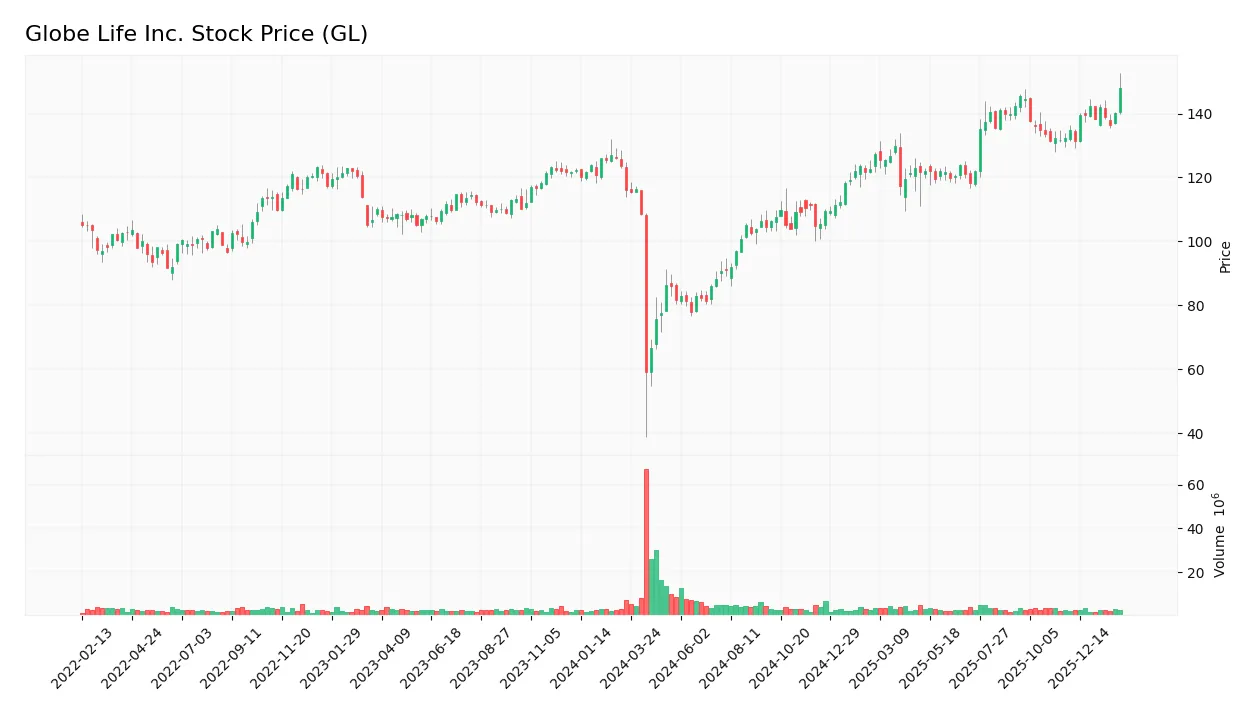

The weekly stock chart of Globe Life Inc. (GL) highlights price movements, volatility, and key highs and lows over the past 12 months:

Trend Analysis

Over the past year, GL’s stock price rose 27.6%, indicating a bullish trend with accelerating momentum. The price ranged from a low of 59.09 to a high of 148.06, reflecting significant volatility (std. dev. 20.13). Recent months show continued upward slope at 0.9 with moderate volatility (std. dev. 4.36).

Volume Analysis

Trading volume totals 555M shares, with buyer volume at 304M (54.78%) and seller volume at 245M, showing a slight buyer dominance overall amid decreasing volume. In the recent three months, buyer dominance strengthens to 70.01%, indicating strong buyer-driven activity despite a volume decline, suggesting cautious but optimistic investor sentiment.

Target Prices

Analysts set a confident target consensus for Globe Life Inc. (GL).

| Target Low | Target High | Consensus |

|---|---|---|

| 158 | 176 | 167 |

The target range between 158 and 176 reveals moderate upside potential. The consensus at 167 signals steady market confidence in GL’s growth trajectory.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Globe Life Inc.’s analyst ratings and consumer feedback to provide a comprehensive market perspective.

Stock Grades

Here are the latest verified stock grades for Globe Life Inc. from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-02-05 |

| TD Cowen | Maintain | Buy | 2025-12-11 |

| Morgan Stanley | Maintain | Overweight | 2025-11-17 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-10-28 |

| Truist Securities | Maintain | Buy | 2025-10-24 |

| Wells Fargo | Maintain | Overweight | 2025-10-24 |

| Wells Fargo | Maintain | Overweight | 2025-10-08 |

| Morgan Stanley | Maintain | Overweight | 2025-08-18 |

| Morgan Stanley | Upgrade | Overweight | 2025-08-05 |

| BMO Capital | Maintain | Market Perform | 2025-07-30 |

The overall trend shows consistent confidence with multiple “Overweight” and “Buy” ratings maintained or upgraded over the past year. The presence of several “Hold” and “Market Perform” grades tempers enthusiasm but consensus remains positive.

Consumer Opinions

Globe Life Inc. enjoys a mixed but generally favorable reputation among its customers, reflecting solid service with room for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Affordable premiums and straightforward coverage.” | “Claims process can be slow and frustrating.” |

| “Customer service representatives are friendly and helpful.” | “Limited policy options compared to competitors.” |

| “Easy online account management and payment system.” | “Some users experienced unexpected premium increases.” |

Consumers consistently praise Globe Life for its affordability and user-friendly service. However, recurring complaints about claim delays and limited product variety suggest areas requiring strategic attention.

Risk Analysis

Below is a summary table highlighting key risks for Globe Life Inc., their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score of 1.01 signals high bankruptcy risk, in distress zone. | High | Severe |

| Profitability | Zero ROE and ROIC indicate poor capital efficiency and returns. | Medium | High |

| Liquidity | Unavailable current and quick ratios raise red flags on short-term solvency. | Medium | Medium |

| Valuation Metrics | Favorable net margin but unfavorable P/E and P/B ratios suggest mixed signals. | Medium | Medium |

| Debt Management | Favorable debt-to-equity and interest coverage ratios indicate manageable debt. | Low | Low |

| Dividend Yield | Unfavorable dividend yield may deter income-focused investors. | Low | Low |

The most pressing risk is Globe Life’s Altman Z-Score in the distress zone, signaling a serious bankruptcy threat. Despite solid net margins and interest coverage, the company’s zero returns on equity and capital raise concerns about efficient capital allocation. Recent market volatility demands caution given these vulnerabilities.

Should You Buy Globe Life Inc.?

Globe Life Inc. appears to show improving operational efficiency with a growing ROIC trend, yet its leverage profile and profitability metrics suggest caution. While the debt situation seems substantial, the overall rating of C indicates a moderate investment profile that could be seen as a balance of risks and opportunities.

Strength & Efficiency Pillars

Globe Life Inc. posts a solid net margin of 19.37%, demonstrating effective cost control and profitability. The EBIT margin at 23.96% further confirms operational efficiency. Interest coverage stands robust at 10.17, signaling comfortable debt servicing capacity. Despite unavailable ROIC and WACC data, a 100% growth trend in ROIC suggests improving capital returns. While the Piotroski Score of 6 indicates average financial health, the Altman Z-Score of 1.01 warns of distress risk, highlighting mixed financial resilience.

Weaknesses and Drawbacks

Several red flags undermine Globe Life’s profile. The Altman Z-Score of 1.01 places the company in the distress zone, signaling elevated bankruptcy risk. Return on equity and return on assets scores are very unfavorable, reflecting weak capital efficiency. Valuation metrics are unavailable, but low current and quick ratios indicate liquidity concerns. Despite favorable debt-to-equity and debt-to-assets ratios, asset turnover is weak. The absence of dividend yield further reduces appeal for income-focused investors.

Our Verdict about Globe Life Inc.

Globe Life’s long-term fundamentals appear mixed, balancing solid profit margins against financial distress signals. The bullish overall trend and strong recent buyer dominance (70.01%) suggest positive market momentum. This dynamic might appear attractive for investors seeking growth but warrants caution due to liquidity and solvency risks. Therefore, the stock could merit consideration for long-term exposure with prudent risk management and timing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Is Globe Life (GL) Attractively Priced After Strong Multi Year Share Price Gains? – Yahoo Finance (Feb 05, 2026)

- Globe Life Inc. Reports Fourth Quarter and Full Year 2025 Results; EPS and Premiums Rise – AlphaStreet (Feb 05, 2026)

- Globe Life (NYSE:GL) Sets New 52-Week High – Here’s What Happened – MarketBeat (Feb 05, 2026)

- Earnings call transcript: Globe Life Q4 2025 misses forecasts, stock dips – Investing.com (Feb 05, 2026)

- JP Morgan Raises Price Target for Globe Life (GL) to $181 | GL S – GuruFocus (Feb 05, 2026)

For more information about Globe Life Inc., please visit the official website: globelifeinsurance.com