Home > Analyses > Technology > GLOBALFOUNDRIES Inc.

GLOBALFOUNDRIES Inc. powers the digital world by manufacturing the critical semiconductors that drive everything from smartphones to advanced computing systems. As a leading player in the semiconductor foundry industry, GFS is renowned for its cutting-edge wafer fabrication technologies and diverse product portfolio, including microprocessors and RF modems. With innovation and quality at its core, the company shapes the future of electronics. But as market dynamics evolve, the key question remains: does GLOBALFOUNDRIES’ current performance support its long-term growth and valuation?

Table of contents

Business Model & Company Overview

GLOBALFOUNDRIES Inc., founded in 2009 and headquartered in Malta, New York, stands as a leading semiconductor foundry in the global technology sector. Its integrated circuit manufacturing ecosystem powers a wide array of electronic devices through products like microprocessors, power management units, and microelectromechanical systems. This comprehensive portfolio reflects the company’s commitment to advancing semiconductor innovation and meeting diverse industry demands.

The company’s revenue engine hinges on a balanced mix of mainstream wafer fabrication services and advanced semiconductor technologies, catering to clients across the Americas, Europe, and Asia. By combining cutting-edge manufacturing with a broad product range, GLOBALFOUNDRIES creates substantial value within the semiconductor supply chain. Its robust market position and diverse global footprint constitute a formidable economic moat, shaping the future of semiconductor manufacturing worldwide.

Financial Performance & Fundamental Metrics

In this section, I analyze GLOBALFOUNDRIES Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

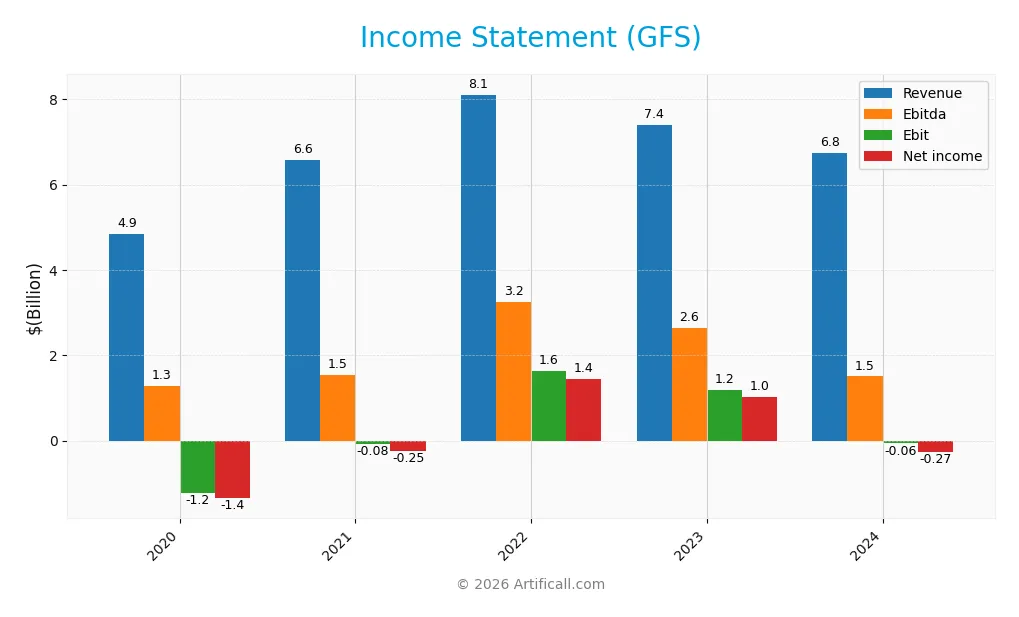

Income Statement

The table below presents GLOBALFOUNDRIES Inc.’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 4.85B | 6.59B | 8.11B | 7.39B | 6.75B |

| Cost of Revenue | 5.56B | 5.57B | 5.87B | 5.29B | 5.10B |

| Operating Expenses | 944M | 1.07B | 1.07B | 972M | 1.87B |

| Gross Profit | -712M | 1.01B | 2.24B | 2.10B | 1.65B |

| EBITDA | 1.29B | 1.54B | 3.25B | 2.64B | 1.50B |

| EBIT | -1.23B | -77M | 1.62B | 1.19B | -64M |

| Interest Expense | 154M | 114M | 117M | 137M | 145M |

| Net Income | -1.35B | -250M | 1.45B | 1.02B | -265M |

| EPS | -2.54 | -0.49 | 2.69 | 1.85 | -0.48 |

| Filing Date | 2020-12-31 | 2022-03-31 | 2023-04-14 | 2024-04-29 | 2025-03-20 |

Income Statement Evolution

GLOBALFOUNDRIES Inc. experienced an overall revenue growth of 39.15% from 2020 to 2024, yet revenue declined by 8.69% in the last year. Net income showed a positive growth trend of 80.37% over the period but turned negative in 2024 with a net loss of $265M. Gross margin remained favorable at 24.46%, while EBIT and net margins deteriorated, reflecting margin pressure and operating losses in the latest year.

Is the Income Statement Favorable?

The 2024 income statement reveals unfavorable fundamentals, marked by an EBIT margin of -0.95% and a net margin of -3.93%. Revenue and gross profit both declined compared to 2023, alongside a steep drop in EBIT and earnings per share. Despite favorable interest expense and a solid gross margin, overall expenses and losses outweighed gains, leading to a net loss and a negative outlook on profitability for the year.

Financial Ratios

The table below presents key financial ratios for GLOBALFOUNDRIES Inc. (GFS) across the fiscal years 2020 to 2024, providing insights into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -27.8% | -3.8% | 17.9% | 13.8% | -3.9% |

| ROE | -18.8% | -3.1% | 14.6% | 9.2% | -2.5% |

| ROIC | -15.0% | -0.5% | 7.5% | 6.8% | -1.5% |

| P/E | -18.3 | -131.4 | 20.1 | 32.8 | -89.5 |

| P/B | 3.44 | 4.12 | 2.93 | 3.01 | 2.20 |

| Current Ratio | 1.58 | 1.67 | 1.73 | 2.04 | 2.11 |

| Quick Ratio | 1.09 | 1.32 | 1.33 | 1.56 | 1.57 |

| D/E | 0.39 | 0.31 | 0.29 | 0.25 | 0.22 |

| Debt-to-Assets | 22.7% | 16.2% | 16.0% | 15.3% | 13.8% |

| Interest Coverage | -10.7 | -0.5 | 10.0 | 8.2 | -1.5 |

| Asset Turnover | 0.39 | 0.44 | 0.45 | 0.41 | 0.40 |

| Fixed Asset Turnover | 0.59 | 0.76 | 0.77 | 0.73 | 0.82 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Over the period, GLOBALFOUNDRIES Inc. experienced a decline in Return on Equity (ROE), turning negative in 2024 at -2.46%, indicating weakening profitability. The Current Ratio improved slightly to 2.11, reflecting better short-term liquidity. The Debt-to-Equity Ratio decreased to 0.22, suggesting reduced leverage. Overall, profitability margins deteriorated, with net profit margin falling to -3.93% in 2024.

Are the Financial Ratios Favorable?

In 2024, liquidity ratios such as the Current Ratio (2.11) and Quick Ratio (1.57) were favorable, indicating solid short-term financial health. Leverage ratios, including Debt-to-Equity (0.22) and Debt-to-Assets (13.81%), were also positive. However, profitability metrics like ROE (-2.46%), net margin (-3.93%), and interest coverage (-0.44) were unfavorable. Efficiency ratios, such as Asset Turnover (0.4) and Fixed Asset Turnover (0.82), also showed weakness. Overall, the financial ratios present an unfavorable picture.

Shareholder Return Policy

GLOBALFOUNDRIES Inc. (GFS) does not pay dividends, reflecting recent net losses and a reinvestment strategy likely focused on growth and operational improvement. Despite no dividend payout, the company maintains free cash flow coverage and does not engage in share buybacks.

This approach suggests prioritization of capital allocation towards business development rather than immediate shareholder returns. Such a policy may support sustainable long-term value creation if reinvestments drive future profitability and market position enhancement.

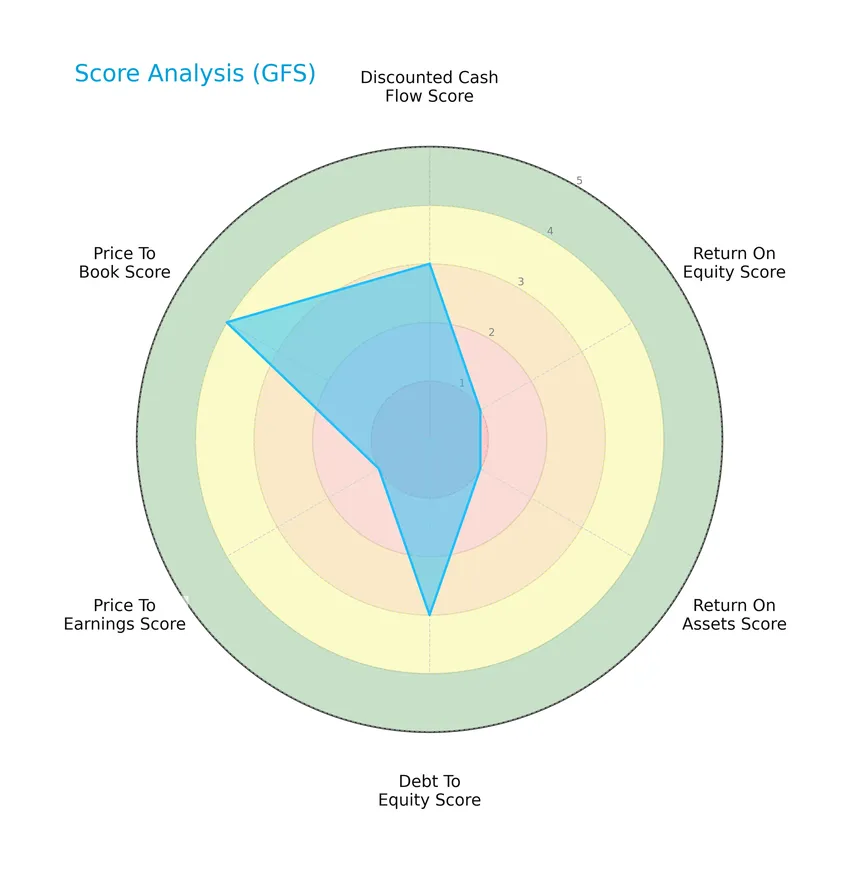

Score analysis

The radar chart below presents a comprehensive view of GLOBALFOUNDRIES Inc.’s key financial scores across various evaluation metrics:

GLOBALFOUNDRIES shows moderate results in discounted cash flow and debt-to-equity ratios, but very unfavorable scores in return on equity, return on assets, and price-to-earnings. The price-to-book ratio remains favorable, highlighting mixed financial signals.

Analysis of the company’s bankruptcy risk

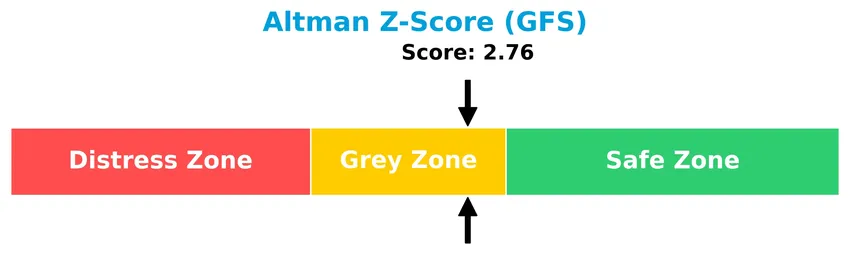

The Altman Z-Score places GLOBALFOUNDRIES in the grey zone, indicating a moderate risk of bankruptcy and potential financial vulnerability:

Is the company in good financial health?

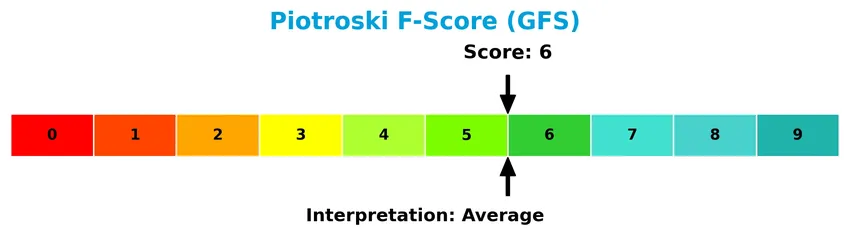

The Piotroski Score diagram illustrates GLOBALFOUNDRIES’ financial health based on nine fundamental criteria:

With a Piotroski Score of 6, the company is considered to have average financial health, suggesting moderate strength but room for improvement in profitability and efficiency measures.

Competitive Landscape & Sector Positioning

This sector analysis will examine GLOBALFOUNDRIES Inc.’s strategic positioning, revenue breakdown, key products, and main competitors. I will assess whether GLOBALFOUNDRIES holds a competitive advantage within the semiconductor industry.

Strategic Positioning

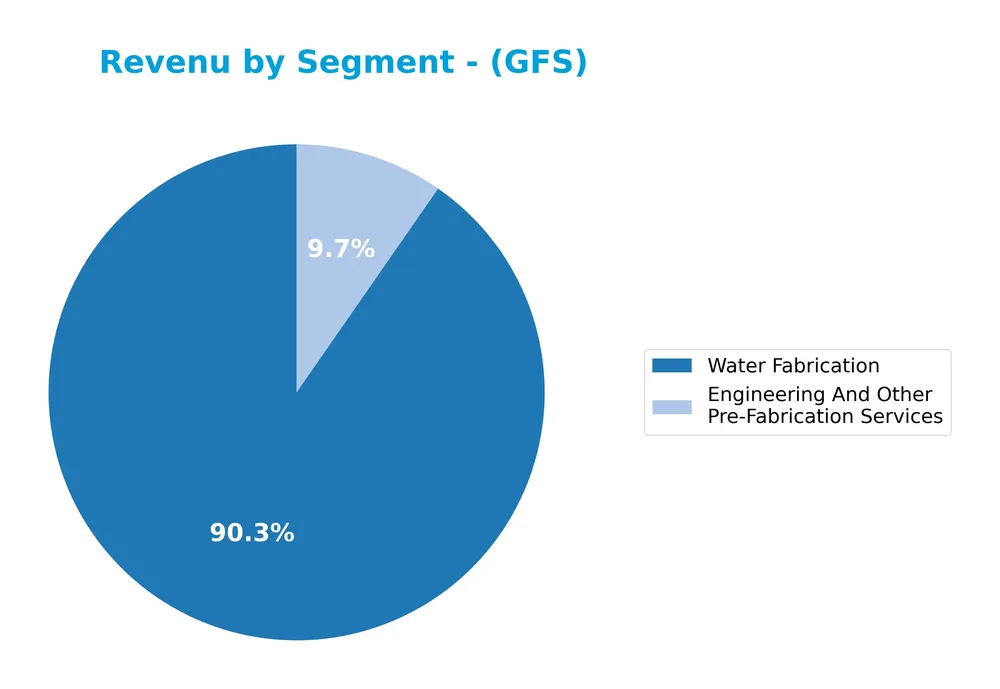

GLOBALFOUNDRIES Inc. maintains a concentrated product portfolio focused on semiconductor wafer fabrication and related engineering services, generating over $6B annually from wafer fabrication alone. Geographically, it diversifies moderately with significant revenue from the US ($3.7B in 2024), EMEA ($1.4B), and other regions ($1.6B), reflecting a balanced yet US-centric exposure.

Revenue by Segment

The pie chart illustrates GLOBALFOUNDRIES Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contributions of key business areas.

In 2024, Water Fabrication remains the dominant revenue driver at 6.1B, despite a decline from 7.6B in 2022, indicating some slowdown in this core segment. Engineering And Other Pre-Fabrication Services showed steady growth, reaching 652M, which slightly diversifies the revenue base. The concentration risk is notable, as Water Fabrication still accounts for the majority of revenue, suggesting investor attention should consider exposure to this main segment.

Key Products & Brands

The following table outlines GLOBALFOUNDRIES Inc.’s key products and services along with their descriptions:

| Product | Description |

|---|---|

| Integrated Circuits | Semiconductor devices enabling various electronic devices, including microprocessors, mobile application processors, and more. |

| Microprocessors | Core processing units used in computing devices. |

| Mobile Application Processors | Chips designed specifically for mobile device applications. |

| Baseband Processors | Processors handling communication functions in wireless devices. |

| Network Processors | Specialized processors managing data traffic in networking equipment. |

| Radio Frequency Modems | Components enabling wireless communication by modulating and demodulating signals. |

| Microcontrollers | Integrated circuits used for controlling electronic systems. |

| Power Management Units | Devices regulating power distribution within electronic systems. |

| Microelectromechanical Systems | Miniaturized mechanical and electro-mechanical elements integrated into semiconductor devices. |

| Mainstream Wafer Fabrication Services | Manufacturing services for producing semiconductor wafers used in integrated circuits. |

| Engineering And Other Pre-Fabrication Services | Support services related to the development and preparation of semiconductor fabrication. |

| Wafer Fabrication | The core manufacturing process of semiconductor wafers, a major revenue segment. |

GLOBALFOUNDRIES Inc. offers a wide range of semiconductor products and wafer fabrication services essential to electronic devices, reflecting a diversified portfolio across integrated circuit manufacturing and supporting engineering services.

Main Competitors

There are 38 competitors in the semiconductors industry; below is a table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NVIDIA Corporation | 4.6T |

| Broadcom Inc. | 1.6T |

| Taiwan Semiconductor Manufacturing Company Limited | 1.6T |

| ASML Holding N.V. | 415B |

| Advanced Micro Devices, Inc. | 363B |

| Micron Technology, Inc. | 353B |

| Lam Research Corporation | 232B |

| Applied Materials, Inc. | 214B |

| QUALCOMM Incorporated | 185B |

| Intel Corporation | 173B |

GLOBALFOUNDRIES Inc. ranks 23rd among 38 competitors in the semiconductor sector, with a market capitalization approximately 0.52% that of the leader, NVIDIA. The company is positioned below both the average market cap of the top 10 competitors (975B) and the sector median (31B). Its market cap is roughly 2.79% less than the next closest competitor above it, indicating a modest gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does GFS have a competitive advantage?

GLOBALFOUNDRIES Inc. currently presents a slightly unfavorable competitive advantage, as its ROIC is below its WACC by nearly 12%, indicating value destruction despite a growing profitability trend. The company’s gross margin of 24.46% is favorable, but persistent negative net and EBIT margins constrain overall financial performance.

Looking ahead, GLOBALFOUNDRIES operates in the semiconductor foundry industry with offerings including microprocessors and wafer fabrication services, serving markets such as the US, Europe, and other regions. Opportunities may arise from its expanding ROIC trend and ongoing presence in diverse geographic markets, though recent revenue declines signal challenges to address.

SWOT Analysis

This SWOT analysis highlights GLOBALFOUNDRIES Inc.’s key internal and external factors to guide investment decisions.

Strengths

- Global footprint with strong US market presence

- Favorable gross margin at 24.46%

- Solid liquidity ratios with current ratio 2.11 and low debt-to-equity 0.22

Weaknesses

- Negative EBIT and net margins

- Declining revenue and gross profit in the last year

- Unfavorable returns on equity and assets

Opportunities

- Growing ROIC trend indicates improving profitability

- Expanding semiconductor demand for diverse applications

- Potential to leverage wafer fabrication technologies

Threats

- High beta of 1.485 indicating market volatility risk

- Intense semiconductor industry competition

- Macroeconomic pressures impacting capital spending

Overall, GLOBALFOUNDRIES shows operational strengths and improving profitability trends but faces significant margin pressures and recent revenue declines. Strategic focus should prioritize margin recovery and innovation to capitalize on growing semiconductor demand while mitigating competitive and market risks.

Stock Price Action Analysis

The weekly stock chart below illustrates GLOBALFOUNDRIES Inc. (GFS) price movements over the past 12 months, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, GFS stock declined by 23.01%, indicating a bearish trend with accelerating downward momentum. The stock traded between a high of 55.66 and a low of 31.54, with a standard deviation of 6.35 reflecting notable volatility during this period.

Volume Analysis

In the last three months, trading volume has been increasing but slightly seller-dominant, with sellers accounting for 56.74% of volume. This suggests cautious investor sentiment, with increased market participation but prevailing selling pressure over buyers.

Target Prices

The consensus target prices for GLOBALFOUNDRIES Inc. indicate a moderately optimistic outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 40 | 37 | 38.5 |

Analysts expect GLOBALFOUNDRIES shares to trade between $37 and $40, with a consensus around $38.5, reflecting steady confidence in the stock’s potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback concerning GLOBALFOUNDRIES Inc. (GFS).

Stock Grades

Here is a summary of recent verified stock grades for GLOBALFOUNDRIES Inc. from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Neutral | 2026-01-15 |

| Wedbush | Downgrade | Neutral | 2025-12-31 |

| B of A Securities | Maintain | Underperform | 2025-12-04 |

| Wedbush | Maintain | Outperform | 2025-11-13 |

| JP Morgan | Maintain | Neutral | 2025-11-13 |

| Citigroup | Maintain | Neutral | 2025-11-13 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-13 |

| B of A Securities | Downgrade | Underperform | 2025-10-13 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-06 |

The overall trend indicates a cautious stance, with multiple firms maintaining neutral ratings and a few downgrades to underperform. Notably, some firms continue to rate the stock as outperform, reflecting mixed but generally moderate sentiment.

Consumer Opinions

Consumer sentiment about GLOBALFOUNDRIES Inc. (GFS) reflects a mix of appreciation for its technological advancements and concerns over supply chain delays.

| Positive Reviews | Negative Reviews |

|---|---|

| “GFS consistently delivers cutting-edge semiconductor solutions that meet industry standards.” | “Occasional delays in order fulfillment affect project timelines.” |

| “Their customer support is responsive and knowledgeable, aiding smooth implementation.” | “Pricing can be higher compared to competitors in some product lines.” |

| “Innovative product roadmap shows strong commitment to future technologies.” | “Limited availability of certain chip sizes restricts flexibility.” |

Overall, consumers praise GLOBALFOUNDRIES for its innovation and strong support, while noting supply chain issues and pricing as areas needing improvement.

Risk Analysis

Below is a summary table highlighting key risks associated with GLOBALFOUNDRIES Inc. (GFS) for investors to consider:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-3.93%), negative ROE (-2.46%), and negative ROIC (-1.47%) indicate ongoing profitability challenges. | High | High |

| Bankruptcy Risk | Altman Z-Score of 2.76 places the company in the grey zone, signaling moderate bankruptcy risk. | Moderate | High |

| Market Volatility | Beta of 1.485 suggests above-average stock price volatility relative to the market. | High | Medium |

| Liquidity | Favorable current ratio (2.11) and quick ratio (1.57) mitigate short-term liquidity concerns. | Low | Low |

| Debt Levels | Low debt-to-equity ratio (0.22) and debt-to-assets (13.81%) moderate financial leverage risk. | Low | Medium |

| Earnings Quality | Unfavorable interest coverage (-0.44) and asset turnover (0.4) imply operational inefficiencies and earnings risk. | High | Medium |

| Dividend Policy | No dividend yield, limiting income for investors seeking dividends. | High | Low |

The most significant risks for GLOBALFOUNDRIES are its ongoing profitability issues and moderate bankruptcy risk, as reflected by negative margins and an Altman Z-Score in the grey zone. Market volatility also poses a notable risk due to a high beta. However, the company benefits from solid liquidity and relatively low leverage, which somewhat cushions these risks. Investors should remain cautious, monitoring operational improvements and financial stability closely.

Should You Buy GLOBALFOUNDRIES Inc.?

GLOBALFOUNDRIES Inc. appears to exhibit improving profitability amidst a slightly unfavorable moat, suggesting some value erosion but rising operational efficiency. Its leverage profile seems manageable, supported by a moderate credit risk rating and an overall C+ score, indicating a cautious investment profile.

Strength & Efficiency Pillars

GLOBALFOUNDRIES Inc. exhibits moderate financial health with an Altman Z-Score of 2.76, placing it in the grey zone and indicating a moderate bankruptcy risk. The Piotroski score of 6 suggests average financial strength. Its debt-to-equity ratio of 0.22 and current ratio of 2.11 reflect solid liquidity and manageable leverage. However, profitability metrics are weak, with a negative ROE of -2.46% and ROIC of -1.47%, both trailing the WACC of 10.43%, signaling the company is currently destroying value despite a positive trend in ROIC.

Weaknesses and Drawbacks

The company faces significant challenges, including an unfavorable net margin of -3.93% and declining revenue growth of -8.69% over the past year, which pressure earnings and operational efficiency. Market sentiment is cautious, with recent trading showing slight seller dominance at 43.26% buyer volume and a bearish overall stock trend marked by a 23.01% price decline. Additionally, the negative interest coverage ratio (-0.44) raises concerns about the company’s ability to meet interest obligations, while a moderate P/B ratio of 2.2 and a very unfavorable P/E score suggest valuation risks and investor wariness.

Our Verdict about GLOBALFOUNDRIES Inc.

The long-term fundamental profile for GLOBALFOUNDRIES Inc. appears unfavorable due to persistent profitability struggles and value destruction. Despite recent positive momentum in ROIC and a bounce in price with a 25.73% gain since November 2025, the slight seller dominance and bearish overall trend suggest caution. Therefore, while the company might appear to have some recovery potential, recent market pressure indicates a wait-and-see approach could be prudent before considering exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- GlobalFoundries Inc.’s (NASDAQ:GFS) Shares Bounce 28% But Its Business Still Trails The Industry – simplywall.st (Jan 22, 2026)

- GLOBALFOUNDRIES Inc (GFS) Stock Price Up 6.69% on Jan 20 – GuruFocus (Jan 20, 2026)

- GlobalFoundries (GFS) stock price slides nearly 5% into weekend as chip trade turns jumpy – TechStock² (Jan 24, 2026)

- GLOBALFOUNDRIES Inc. (GFS): A Bull Case Theory – Insider Monkey (Jan 19, 2026)

- At US$36.87, Is GlobalFoundries Inc. (NASDAQ:GFS) Worth Looking At Closely? – Yahoo Finance (Jan 05, 2026)

For more information about GLOBALFOUNDRIES Inc., please visit the official website: globalfoundries.com