Home > Analyses > Industrials > Global Payments Inc.

Global Payments Inc. transforms how millions conduct transactions daily, powering seamless payments across the Americas, Europe, and Asia-Pacific. As a recognized leader in payment technology and software solutions, it offers a diverse portfolio spanning merchant services, issuer platforms, and consumer financial products. Known for innovation and reliability, Global Payments shapes industry standards while expanding its market influence. The key question for investors now is whether its solid fundamentals continue to support attractive growth and valuation opportunities in a competitive landscape.

Table of contents

Business Model & Company Overview

Global Payments Inc., founded in 1967 and headquartered in Atlanta, Georgia, stands as a leading player in the specialty business services industry. It offers a cohesive ecosystem of payment technology and software solutions covering card, electronic, check, and digital payments. Its comprehensive portfolio spans Merchant Solutions, Issuer Solutions, and Business and Consumer Solutions, supporting diverse verticals globally across the Americas, Europe, and Asia-Pacific.

The company’s revenue engine balances hardware, software, and recurring services, generating value through authorization, settlement, software tools, and financial services like payroll and prepaid cards. This multi-segment approach, combined with strategic presence in key global markets, fortifies its competitive advantage. Global Payments’ integrated platform and extensive market reach create a durable economic moat, shaping the future of payment technologies worldwide.

Financial Performance & Fundamental Metrics

In this section, I analyze Global Payments Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and shareholder value.

Income Statement

The table below summarizes Global Payments Inc.’s income statement figures for the fiscal years 2020 through 2024, expressed in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 7.42B | 8.52B | 8.98B | 9.65B | 10.11B |

| Cost of Revenue | 3.65B | 3.77B | 3.78B | 3.73B | 3.76B |

| Operating Expenses | 2.56B | 2.99B | 3.22B | 3.71B | 4.06B |

| Gross Profit | 3.77B | 4.75B | 5.20B | 5.93B | 6.35B |

| EBITDA | 2.69B | 3.23B | 2.43B | 3.74B | 4.52B |

| EBIT | 901M | 1.34B | 652M | 1.83B | 2.51B |

| Interest Expense | 344M | 334M | 449M | 660M | 634M |

| Net Income | 585M | 965M | 111M | 986M | 1.57B |

| EPS | 1.95 | 3.30 | 0.41 | 3.78 | 6.18 |

| Filing Date | 2021-02-19 | 2022-02-18 | 2023-02-17 | 2024-02-14 | 2025-02-14 |

Income Statement Evolution

Global Payments Inc. demonstrated steady revenue growth from 2020 to 2024, with a 36.13% increase overall and a 4.68% rise in the latest year, reflecting a neutral pace. Net income surged 168.66% across the period, supported by a significant 52.12% net margin expansion last year. Gross margins remained favorable at 62.79%, and EBIT margin improved to 24.85%, signaling enhanced operational efficiency despite a slight unfavorable trend in operating expenses relative to revenue growth.

Is the Income Statement Favorable?

In 2024, Global Payments reported $10.1B in revenue and $1.57B in net income, with a net margin of 15.54%, classified as favorable. EBITDA reached $4.52B, and EBIT grew 36.89% year-over-year, underscoring robust profitability. Interest expense at 6.27% of revenue was neutral, while EPS rose 63.4% to $6.18. Overall, the fundamentals appear favorable, reflecting strong earnings growth and margin improvement in the most recent fiscal year.

Financial Ratios

The following table presents key financial ratios for Global Payments Inc. (GPN) over the last five fiscal years, reflecting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 7.9% | 11.3% | 1.2% | 10.2% | 15.5% |

| ROE | 2.1% | 3.8% | 0.5% | 4.3% | 7.0% |

| ROIC | 2.6% | 3.6% | 2.3% | 4.2% | 4.6% |

| P/E | 110.3 | 41.0 | 245.1 | 33.6 | 18.1 |

| P/B | 2.36 | 1.54 | 1.23 | 1.44 | 1.28 |

| Current Ratio | 1.01 | 1.06 | 0.92 | 0.99 | 0.97 |

| Quick Ratio | 1.01 | 1.06 | 0.92 | 0.99 | 0.97 |

| D/E | 0.36 | 0.47 | 0.64 | 0.76 | 0.75 |

| Debt-to-Assets | 22.1% | 26.7% | 31.9% | 34.4% | 35.9% |

| Interest Coverage | 3.5x | 5.3x | 4.4x | 3.4x | 3.6x |

| Asset Turnover | 0.17 | 0.19 | 0.20 | 0.19 | 0.22 |

| Fixed Asset Turnover | 4.70 | 5.05 | 4.88 | 4.41 | 4.44 |

| Dividend Yield | 0.36% | 0.66% | 1.00% | 0.79% | 0.89% |

Evolution of Financial Ratios

Global Payments Inc. (GPN) saw its Return on Equity (ROE) fluctuate, peaking in 2024 at 7.05%, yet remaining generally modest. The Current Ratio trended downward from above 1.0 in 2021 to 0.97 in 2024, indicating a slight decline in short-term liquidity. Meanwhile, the Debt-to-Equity Ratio remained stable around 0.75, suggesting consistent leverage without significant shifts in financial risk.

Are the Financial Ratios Favorable?

In 2024, profitability showed mixed signals with a favorable net margin of 15.54% but an unfavorable ROE of 7.05% and ROIC at 4.58%. Liquidity ratios were neutral to unfavorable, with a current ratio below 1.0 and a quick ratio rated neutral at 0.97. Leverage remained neutral with a debt-to-equity ratio of 0.75 and interest coverage at 3.96. Efficiency was challenged by an unfavorable asset turnover of 0.22, though fixed asset turnover was favorable at 4.44. Overall, the global ratios evaluation is slightly unfavorable, reflecting more weaknesses than strengths.

Shareholder Return Policy

Global Payments Inc. maintains a consistent dividend policy with a payout ratio around 16% in 2024 and a modest yield near 0.89%. Dividends per share have increased steadily, supported by robust free cash flow coverage exceeding 80%. The company also engages in share buybacks, balancing distributions with capital expenditures.

This approach reflects a cautious distribution aligned with sustainable long-term value creation. The relatively low payout ratio and strong cash flow coverage suggest manageable risk of over-distribution, while share repurchases complement dividend returns to enhance shareholder value.

Score analysis

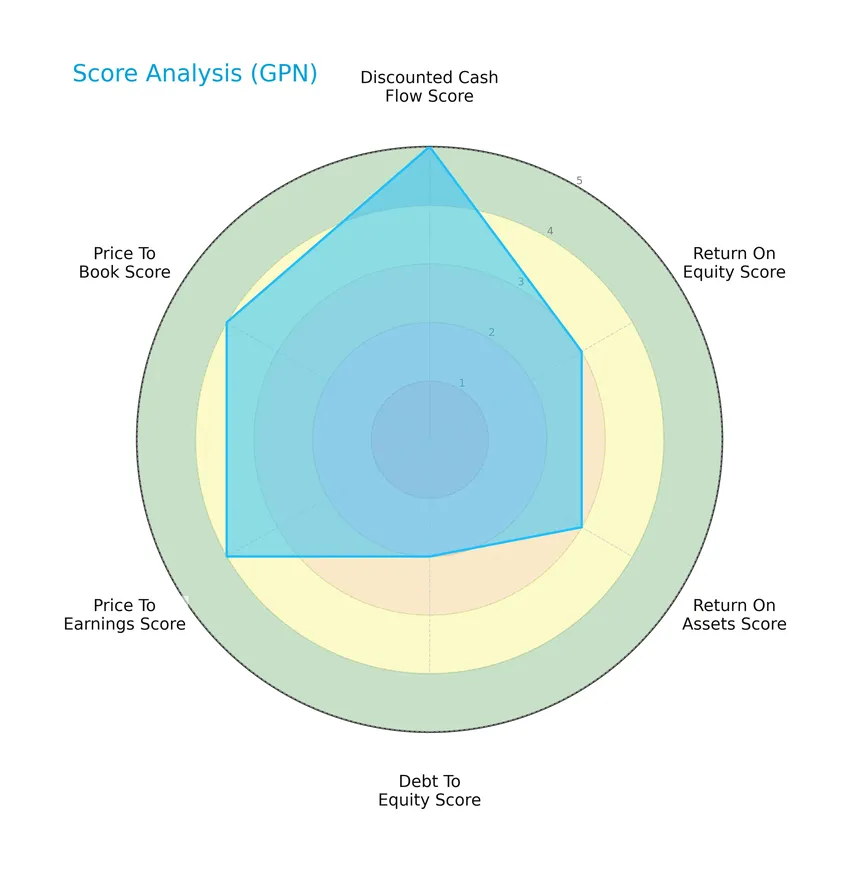

The following radar chart presents an overview of Global Payments Inc.’s key financial scores for investor consideration:

Global Payments Inc. shows a very favorable discounted cash flow score of 5, while return on equity and assets both hold moderate scores at 3. The debt-to-equity score is moderate at 2, with favorable valuations reflected in price-to-earnings and price-to-book scores of 4 each.

Analysis of the company’s bankruptcy risk

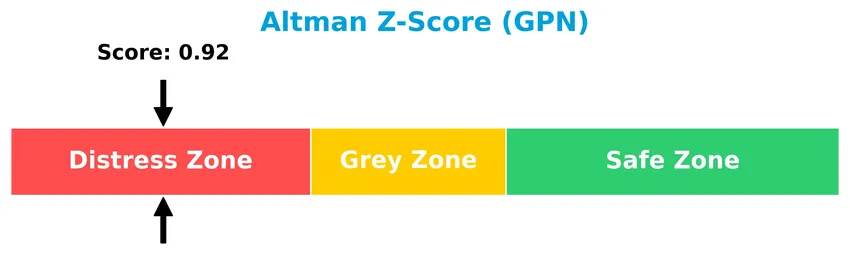

Global Payments Inc.’s Altman Z-Score indicates a high risk of financial distress, placing the company in the distress zone:

Is the company in good financial health?

Here is the Piotroski Score diagram illustrating the company’s financial health status:

With a Piotroski Score of 7, Global Payments Inc. is considered to have strong financial health, suggesting solid fundamentals despite other risk factors evident in its bankruptcy risk score.

Competitive Landscape & Sector Positioning

This sector analysis will examine Global Payments Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether the company holds a competitive advantage over its peers in the specialty business services industry.

Strategic Positioning

Global Payments Inc. maintains a diversified product portfolio across Merchant, Issuer, and Business and Consumer Solutions segments, with dominant revenue from Merchant Solutions at $7.7B in 2024. Geographically, it focuses heavily on North America, generating $8.1B, while maintaining smaller but consistent operations in Europe and Asia Pacific.

Revenue by Segment

This pie chart illustrates Global Payments Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contribution of each business unit.

In 2024, the Merchant Solutions Segment remains the dominant revenue driver with $7.7B, showing steady growth from $7.2B in 2023. The Issuer Solutions Segment also contributed significantly at $2.5B, continuing its gradual increase. The Business and Consumer Solutions Segment was no longer reported in 2024, indicating a possible strategic shift or reclassification. Overall, the company’s revenue concentration in Merchant Solutions suggests a strong focus on merchant services with consistent expansion.

Key Products & Brands

The table below summarizes Global Payments Inc.’s main products and brand offerings by segment:

| Product | Description |

|---|---|

| Merchant Solutions Segment | Provides authorization, settlement, funding, customer support, chargeback resolution, terminal rental, payment security, billing, and reporting services. Offers enterprise software, point-of-sale solutions, analytics, payroll, and human capital management services across various verticals. |

| Issuer Solutions Segment | Delivers card portfolio management platforms for financial institutions and retailers, plus commercial payments and ePayables solutions for businesses and governments. |

| Business and Consumer Solutions Segment (Netspend) | Offers reloadable prepaid debit and payroll cards, demand deposit accounts, and other financial services targeting underbanked consumers and businesses. |

Global Payments operates through three core segments focusing on payment processing, card portfolio management, and prepaid financial services, catering to a diverse client base across multiple regions.

Main Competitors

There are 3 competitors in the sector; below is a table listing the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Cintas Corporation | 74.5B |

| Thomson Reuters Corporation | 59.4B |

| Global Payments Inc. | 18.5B |

Global Payments Inc. ranks 3rd among its competitors by market capitalization, holding about 24% of the top player’s scale. The company is positioned below both the average market cap of the top 10 (50.8B) and the median market cap in the sector (59.4B). There is a significant 233.47% gap between Global Payments and the next competitor above, highlighting a notable scale difference.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does GPN have a competitive advantage?

Global Payments Inc. currently shows a slightly unfavorable competitive position as it is shedding value with a ROIC below its WACC, despite a strong upward trend in profitability. The company’s consistent revenue and net income growth, along with favorable margins, indicate operational strength but not yet a sustainable economic moat.

Looking ahead, GPN’s diverse payment technology and software solutions across multiple regions, including expanding presence in Europe and Asia-Pacific, offer growth opportunities. Its focus on innovative merchant, issuer, and consumer payment platforms provides potential to improve its competitive standing over time.

SWOT Analysis

This SWOT analysis highlights Global Payments Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to guide strategic investment decisions.

Strengths

- strong revenue growth with 36% over 5 years

- favorable gross margin at 62.79%

- diversified global payment technology solutions

Weaknesses

- low ROE at 7.05%

- slightly unfavorable liquidity ratios

- Altman Z-score in distress zone

Opportunities

- expanding digital payment adoption globally

- growth in underbanked markets with Netspend brand

- increasing profitability trend in ROIC

Threats

- intense competition in payment processing

- regulatory and compliance risks worldwide

- economic downturn impact on transaction volumes

Overall, Global Payments shows robust growth and solid margins but faces profitability efficiency and liquidity challenges. The company’s strategy should focus on improving capital returns and risk management while leveraging expanding digital payment trends to capture new market segments.

Stock Price Action Analysis

The following weekly chart illustrates Global Payments Inc. (GPN) stock price movements over the past 12 months with key highs and lows highlighted:

Trend Analysis

Over the past 12 months, GPN’s stock price declined by 42.19%, indicating a strong bearish trend with accelerating downward momentum. The price ranged from a high of 133.66 to a low of 69.46, reflecting significant volatility with a standard deviation of 16.55. The recent 2.5-month period shows a neutral trend with a minor decline of 1.08% and low volatility.

Volume Analysis

In the last three months, trading volume has been increasing overall, with a total of 1.38B shares traded year-to-date. However, recent activity from November 2025 to January 2026 shows slightly seller-dominant volume at 45.31% buyer presence, suggesting cautious investor sentiment and a modest shift toward selling pressure amid rising market participation.

Target Prices

The target price consensus for Global Payments Inc. (GPN) reflects moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 109 | 80 | 95.43 |

Analysts expect the stock to trade between $80 and $109, with an average target near $95, indicating cautious optimism about its near-term performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding Global Payments Inc. (GPN) performance and outlook.

Stock Grades

Here is a summary of the latest verified stock grades for Global Payments Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Seaport Global | Upgrade | Buy | 2026-01-14 |

| Truist Securities | Maintain | Hold | 2025-11-13 |

| RBC Capital | Maintain | Sector Perform | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Keybanc | Downgrade | Sector Weight | 2025-10-22 |

| Evercore ISI Group | Maintain | In Line | 2025-08-08 |

| Keybanc | Maintain | Overweight | 2025-08-07 |

| RBC Capital | Maintain | Sector Perform | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| JP Morgan | Maintain | Neutral | 2025-08-07 |

The overall trend indicates a predominance of hold and sector perform ratings, with a recent upgrade by Seaport Global to a buy. Keybanc’s downgrade from overweight to sector weight in late 2025 contrasts with previous positive stances, reflecting some cautious reassessment.

Consumer Opinions

Consumers have expressed a mixed but generally positive sentiment towards Global Payments Inc., reflecting both satisfaction with its services and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Reliable payment processing with minimal downtime.” | “Customer support can be slow during peak hours.” |

| “User-friendly platform that integrates well with POS systems.” | “Fees seem higher compared to competitors.” |

| “Consistent transaction speed and security measures.” | “Occasional glitches during system updates.” |

Overall, customers appreciate Global Payments Inc. for its reliability and ease of use, but recurring concerns include customer service responsiveness and fee structures.

Risk Analysis

Below is a summary table presenting key risk categories, their descriptions, and assessments of their probability and impact on Global Payments Inc.:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Risk | Low ROE (7.05%) and ROIC (4.58%) indicate moderate efficiency in generating returns. | Medium | Medium |

| Liquidity Risk | Current ratio below 1 (0.97) suggests potential short-term liquidity constraints. | Medium | Medium |

| Market Risk | Stock price has high volatility range ($65.93 – $114.17) and beta below 1 (0.798). | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score of 0.92 places the company in the distress zone, signaling high bankruptcy risk. | High | High |

| Dividend Risk | Dividend yield is low (0.89%), which may impact income-focused investors if cut. | Low | Low |

| Operational Risk | Unfavorable asset turnover (0.22) may affect operational efficiency and profitability. | Medium | Medium |

| Debt Risk | Debt to equity ratio moderate (0.75) with neutral interest coverage (3.96 times). | Medium | Medium |

The most critical risk is the bankruptcy risk, as the Altman Z-Score signals financial distress despite a strong Piotroski score of 7. This indicates that while operational fundamentals are solid, solvency concerns remain significant, demanding cautious risk management. Investors should weigh this against the slightly unfavorable overall financial ratios and moderate liquidity risks.

Should You Buy Global Payments Inc.?

Global Payments Inc. appears to be a company with improving operational efficiency but a slightly unfavorable competitive moat, suggesting value destruction despite rising profitability. Its leverage profile could be seen as moderate, while the overall rating of A- indicates a generally favorable investment profile.

Strength & Efficiency Pillars

Global Payments Inc. exhibits solid profitability with a net margin of 15.54% and a favorable gross margin of 62.79%, underscoring its operational efficiency. Despite a modest ROE of 7.05% and ROIC of 4.58%, both metrics fall below the WACC of 5.36%, indicating the company is currently not a value creator. Financial health is mixed: a strong Piotroski score of 7 suggests robust fundamentals, yet the Altman Z-score of 0.92 places the company in the distress zone, signaling potential financial vulnerability.

Weaknesses and Drawbacks

Valuation metrics present a moderate risk profile, with a P/E of 18.15 considered neutral but leaving limited margin for error in a volatile market. The company’s current ratio of 0.97 is unfavorable, reflecting tight liquidity that may hinder short-term financial flexibility. Additionally, the bearish overall stock trend with a -42.19% price decline and recent seller dominance at 54.69% of volume presents headwinds, suggesting market participants are cautious amid rising uncertainty.

Our Verdict about Global Payments Inc.

The long-term fundamental profile of Global Payments Inc. is mixed to slightly unfavorable due to value destruction and financial distress signals. Despite favorable profitability margins and strong financial scores, the bearish technical trend coupled with recent seller dominance suggests that, despite some underlying strength, investors might consider a cautious, wait-and-see approach before increasing exposure, pending signs of improved market sentiment.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Global Payments Inc. (GPN): A Bull Case Theory – Yahoo Finance (Jan 19, 2026)

- Global Payments Inc. $GPN Shares Purchased by BIP Wealth LLC – MarketBeat (Jan 22, 2026)

- After Plunging 10.6% in 4 Weeks, Here’s Why the Trend Might Reverse for Global Payments (GPN) – Finviz (Jan 21, 2026)

- Global Payments Inc (GPN) Trading 3.81% Higher on Jan 21 – GuruFocus (Jan 22, 2026)

- GTCR Completes Sale of Worldpay to Global Payments – PR Newswire (Jan 12, 2026)

For more information about Global Payments Inc., please visit the official website: globalpaymentsinc.com