Home > Analyses > Consumer Cyclical > Genuine Parts Company

Genuine Parts Company powers vital industries by delivering essential automotive and industrial replacement parts worldwide. Its footprint spans hybrid vehicles to heavy machinery, servicing repair shops, fleet operators, and manufacturers with trusted, high-quality products. I’ve seen Genuine Parts leverage its scale and innovation to maintain leadership in the specialty retail sector amid evolving market demands. The key question now: does Genuine Parts’ strong legacy and operational breadth still justify its current valuation and future growth prospects?

Table of contents

Business Model & Company Overview

Genuine Parts Company, founded in 1928 and headquartered in Atlanta, Georgia, commands a dominant position in the specialty retail sector. It operates a vast ecosystem supplying automotive and industrial replacement parts. Its products serve diverse vehicles and machinery, from hybrid cars to heavy-duty equipment, creating a comprehensive network that supports repair shops, fleet operators, and industrial clients.

The company generates revenue through a balanced mix of product sales and value-added services, including repairs and manufacturing of custom components. Genuine Parts Company maintains a strategic footprint across the Americas, Europe, and Asia, ensuring global market penetration. Its competitive advantage lies in a broad distribution network and service integration, building a durable economic moat that shapes the aftermarket parts industry’s future.

Financial Performance & Fundamental Metrics

I analyze Genuine Parts Company’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder returns.

Income Statement

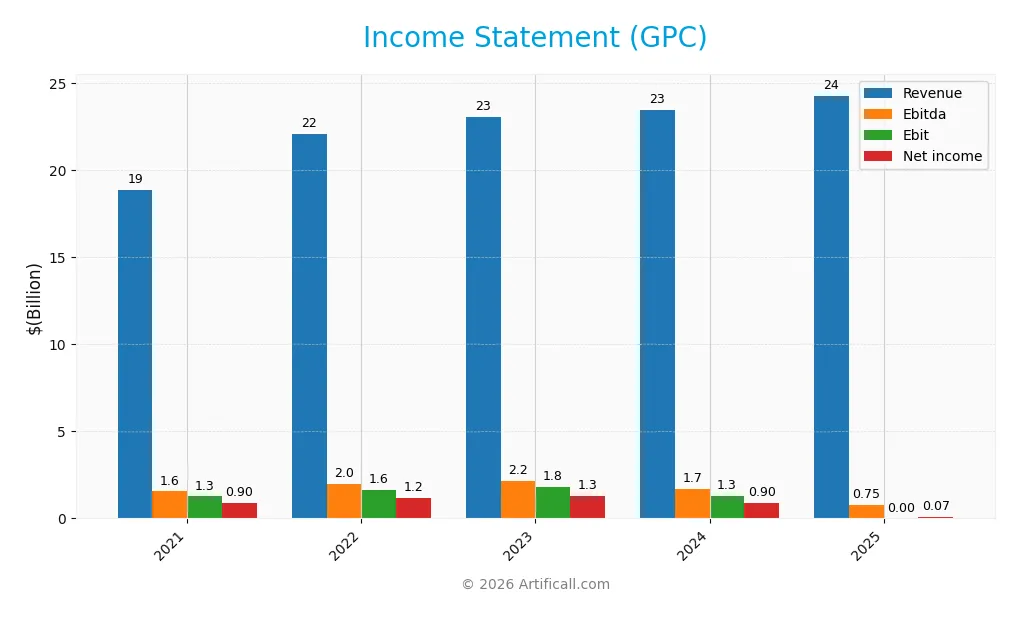

Below is Genuine Parts Company’s income statement summary for fiscal years 2021 through 2025, showing key profitability and expense metrics essential for financial analysis.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 18.9B | 22.1B | 23.1B | 23.5B | 24.3B |

| Cost of Revenue | 12.2B | 14.4B | 14.8B | 14.9B | 15.4B |

| Operating Expenses | 5.5B | 6.1B | 6.5B | 7.1B | 7.9B |

| Gross Profit | 6.6B | 7.7B | 8.3B | 8.5B | 8.9B |

| EBITDA | 1.6B | 2.0B | 2.2B | 1.7B | 0.8B |

| EBIT | 1.3B | 1.6B | 1.8B | 1.3B | 0.0B |

| Interest Expense | 62M | 74M | 64M | 97M | 164M |

| Net Income | 899M | 1.2B | 1.3B | 904M | 66M |

| EPS | 6.27 | 8.36 | 9.38 | 6.49 | 0.47 |

| Filing Date | 2022-02-17 | 2023-02-23 | 2024-02-22 | 2025-02-21 | 2026-02-17 |

Income Statement Evolution

Genuine Parts Company’s revenue grew moderately by 3.46% in 2025, continuing a favorable 28.77% rise over five years. Gross profit margin held steady at 36.79%, but operating expenses grew at the same pace as revenue, pressuring earnings. EBIT and net income margins declined sharply, highlighting deteriorating profitability despite top-line growth.

Is the Income Statement Favorable?

In 2025, GPC reported a slim net margin of 0.27%, a steep drop from prior years. EBIT margin fell to zero, reflecting a significant operational challenge. Interest expense remains low and favorable at 0.67% of revenue. Overall, the income statement reveals weak fundamentals and margin compression, signaling an unfavorable profitability profile entering 2026.

Financial Ratios

The following table summarizes key financial ratios for Genuine Parts Company (GPC) from 2021 to 2025, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 4.8% | 5.4% | 5.7% | 3.8% | 0.3% |

| ROE | 25.7% | 31.2% | 29.9% | 20.8% | 1.5% |

| ROIC | 11.2% | 13.4% | 12.6% | 9.8% | 7.8% |

| P/E | 22.4x | 20.8x | 14.8x | 18.0x | 259.1x |

| P/B | 5.8x | 6.5x | 4.4x | 3.7x | 3.9x |

| Current Ratio | 1.18 | 1.15 | 1.23 | 1.16 | 1.08 |

| Quick Ratio | 0.59 | 0.57 | 0.63 | 0.51 | 0.46 |

| D/E | 0.92 | 1.10 | 1.11 | 1.32 | 1.48 |

| Debt-to-Assets | 22.3% | 25.2% | 27.2% | 29.8% | 31.4% |

| Interest Coverage | 18.7x | 21.8x | 27.1x | 14.9x | 5.9x |

| Asset Turnover | 1.31 | 1.34 | 1.29 | 1.22 | 1.17 |

| Fixed Asset Turnover | 8.25 | 9.09 | 8.00 | 6.31 | 5.71 |

| Dividend Yield | 2.3% | 2.0% | 2.7% | 3.4% | 3.3% |

Evolution of Financial Ratios

From 2021 to 2025, Genuine Parts Company’s Return on Equity declined sharply from 25.7% to 1.5%, indicating weakening profitability. The Current Ratio showed a modest decrease from 1.18 to 1.08, suggesting slightly reduced liquidity but still near stability. Debt-to-Equity Ratio rose from 0.92 to 1.48, reflecting increasing leverage and higher financial risk.

Are the Financial Ratios Favorable?

In 2025, profitability ratios such as ROE (1.49%) and net margin (0.27%) are unfavorable, signaling low returns for shareholders. Liquidity is mixed: Current Ratio (1.08) is neutral, but Quick Ratio (0.46) is unfavorable. Leverage remains high with Debt-to-Equity at 1.48, also unfavorable. Efficiency ratios like Asset Turnover (1.17) and Fixed Asset Turnover (5.71) are favorable. The high P/E ratio (259) and Price-to-Book (3.86) are unfavorable, while the dividend yield (3.3%) stands out as favorable. Overall, the ratios paint a slightly unfavorable financial picture.

Shareholder Return Policy

Genuine Parts Company maintains a steady dividend payout ratio near 8.55%, with a 2025 dividend per share of $4.06 and a yield of 3.3%. Share buybacks complement dividends, supported by free cash flow coverage of roughly 47%, indicating moderate distribution sustainability.

While dividend payments remain consistent, the relatively low payout ratio and balanced capital allocation suggest focus on long-term growth. However, coverage below 50% warrants caution on excessive distributions or buybacks, as it may pressure cash reserves under adverse conditions.

Score analysis

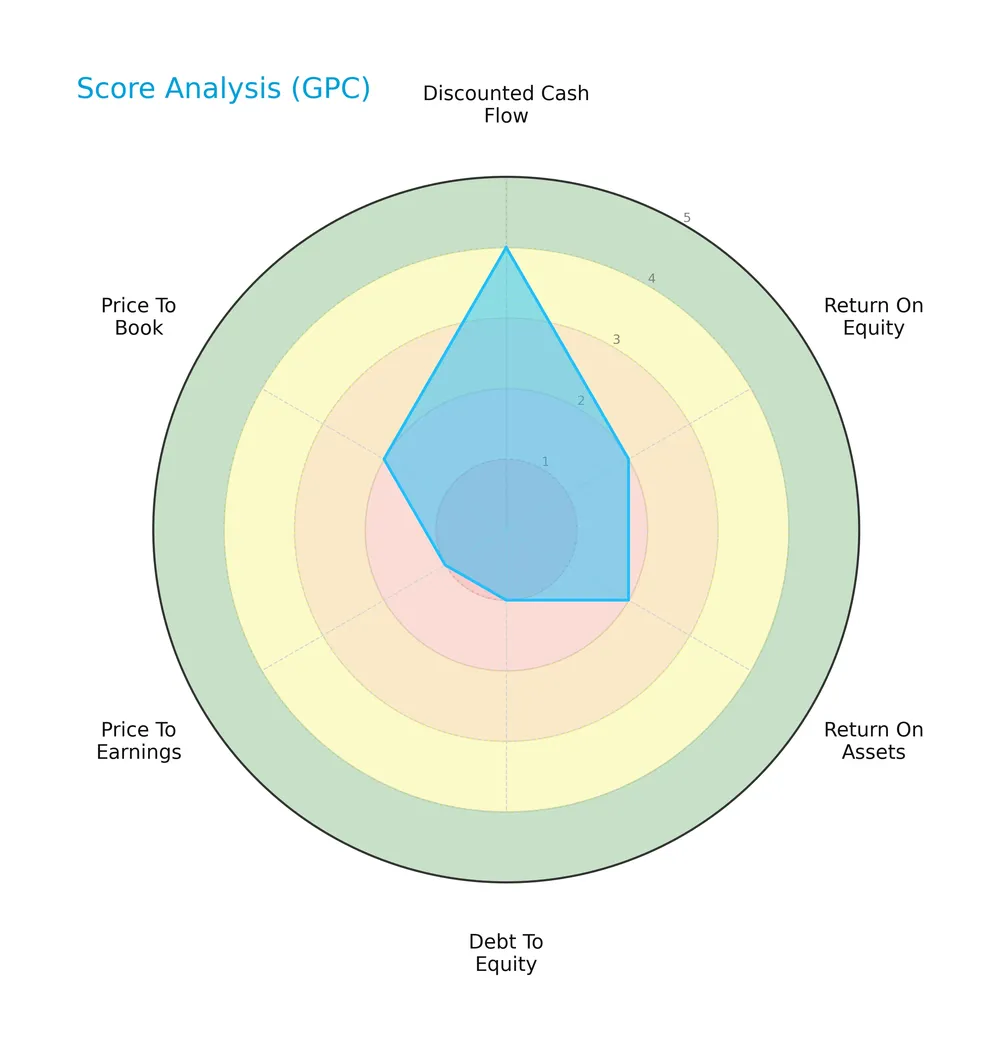

The following radar chart illustrates Genuine Parts Company’s key financial scores for investor assessment:

Genuine Parts Company shows a favorable discounted cash flow score of 4, but its profitability scores—return on equity and assets—are both low at 2. Debt-to-equity and price-to-earnings scores are very unfavorable at 1, highlighting leverage and valuation concerns. The price-to-book score is also unfavorable at 2.

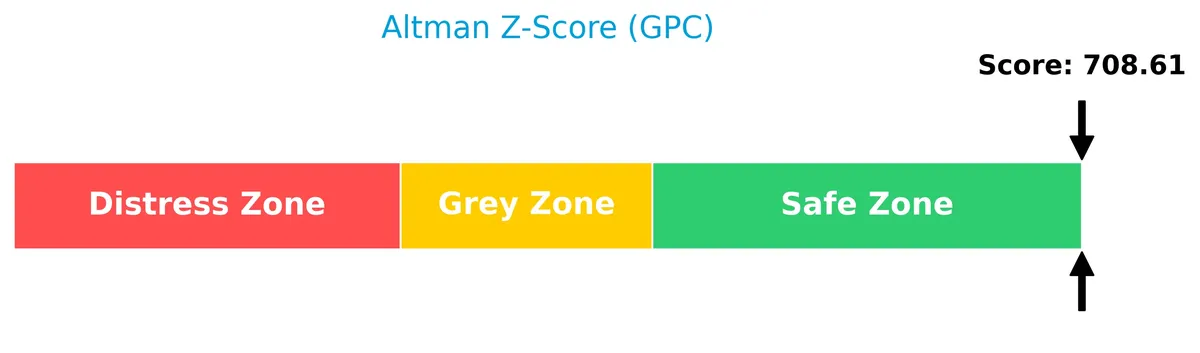

Analysis of the company’s bankruptcy risk

Genuine Parts Company’s Altman Z-Score indicates it is well within the safe zone, signaling minimal bankruptcy risk at this time:

Is the company in good financial health?

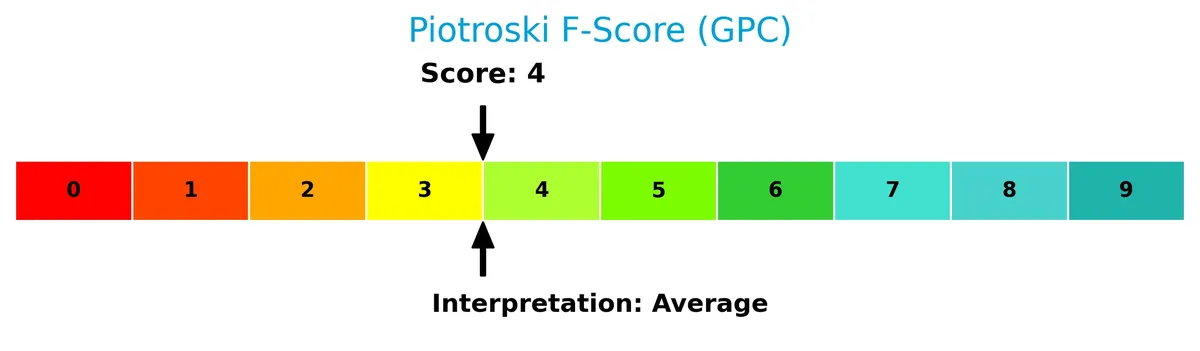

The Piotroski Score diagram below provides insight into the company’s financial strength based on nine critical criteria:

With a Piotroski Score of 4, Genuine Parts Company falls into the average category. This suggests moderate financial health, indicating neither strong resilience nor significant weakness in its fundamentals.

Competitive Landscape & Sector Positioning

This section examines Genuine Parts Company’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Genuine Parts Company holds a competitive advantage over its peers.

Strategic Positioning

Genuine Parts Company maintains a diversified product portfolio, primarily split between Automotive Parts (14.8B in 2024) and Industrial Parts (8.7B). Geographically, it operates across the US (15.3B), Europe (3.8B), Canada (2B), and Australasia (2.3B), reflecting broad international exposure.

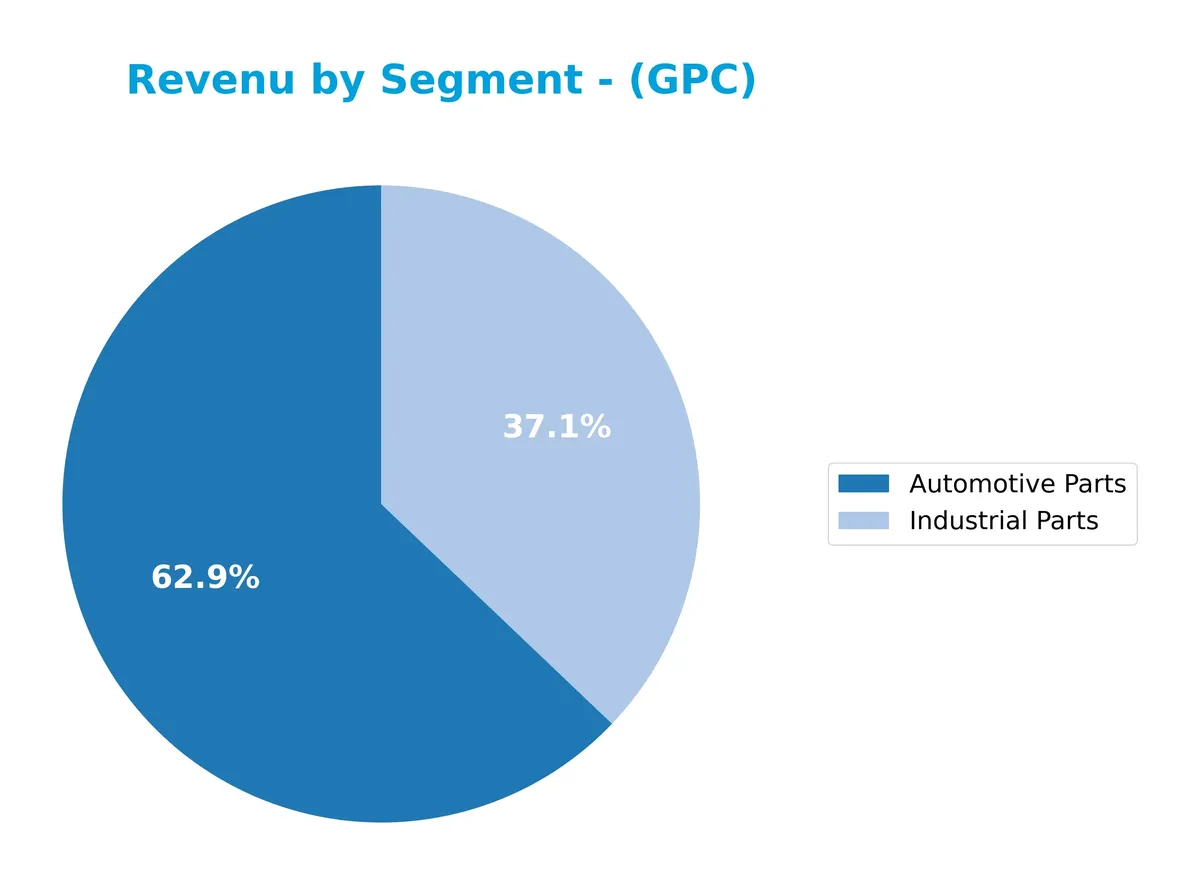

Revenue by Segment

The pie chart illustrates Genuine Parts Company’s revenue distribution by segment for the fiscal year 2024, highlighting Automotive and Industrial Parts contributions.

Automotive Parts lead with $14.8B, reflecting steady growth since 2020. Industrial Parts follow at $8.7B, showing slower expansion and slight volatility. The business increasingly relies on Automotive Parts, signaling concentration risk but also benefiting from resilient demand in vehicle maintenance. Industrial Parts growth decelerated, indicating potential headwinds in industrial markets. This mix underscores Genuine Parts’ strategic focus on automotive aftermarket strength.

Key Products & Brands

The following table summarizes Genuine Parts Company’s main product lines and their descriptions:

| Product | Description |

|---|---|

| Automotive Parts | Distributes replacement parts for hybrid, electric, trucks, SUVs, motorcycles, farm and heavy-duty vehicles, and related supplies. |

| Industrial Parts | Provides bearings, power transmission products, automation components, hoses, safety supplies, and material handling equipment. |

Genuine Parts Company operates primarily through two segments: automotive and industrial parts. The company serves diverse customers, including repair shops, fleet operators, OEMs, and various industries across multiple countries.

Main Competitors

This sector features 10 main competitors, with the following table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amazon.com, Inc. | 2.4T |

| Alibaba Group Holding Limited | 340B |

| PDD Holdings Inc. | 159B |

| MercadoLibre, Inc. | 102B |

| eBay Inc. | 39B |

| Ulta Beauty, Inc. | 28B |

| Tractor Supply Company | 27B |

| Williams-Sonoma, Inc. | 23B |

| Genuine Parts Company | 17B |

| Best Buy Co., Inc. | 15B |

Genuine Parts Company ranks 9th among its peers with a market cap at just 0.72% of the leader, Amazon.com. It sits below both the average top 10 market cap of 317B and the sector median of 33.6B. The company maintains a 31.46% gap above its nearest competitor, Williams-Sonoma, signaling a modest cushion despite its smaller scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does GPC have a competitive advantage?

Genuine Parts Company currently lacks a clear competitive advantage, as its ROIC falls below WACC, indicating value erosion and declining profitability. The company’s margin pressures and unfavorable EBIT trends reinforce this position.

Looking ahead, GPC operates across diverse global markets and offers automotive parts for hybrid and electric vehicles, suggesting potential growth opportunities in evolving sectors and geographies.

SWOT Analysis

This SWOT analysis summarizes Genuine Parts Company’s key strategic factors to clarify its current market position.

Strengths

- diversified automotive and industrial parts portfolio

- strong market presence in US and Europe

- stable dividend yield of 3.3%

Weaknesses

- declining ROIC signaling value erosion

- weak EBIT and net margin growth

- high debt-to-equity ratio of 1.48

Opportunities

- growth in electric and hybrid vehicle parts

- expansion in emerging markets like Australasia

- increasing demand for industrial automation products

Threats

- intense competition in specialty retail

- margin pressure from rising operating expenses

- risk of economic downturn impacting cyclical demand

Genuine Parts Company benefits from diversification and geographic reach but faces profitability challenges and rising leverage. Strategic focus should target margin improvement and capturing growth in electric vehicle parts and industrial automation to offset headwinds.

Stock Price Action Analysis

The weekly chart illustrates Genuine Parts Company’s stock price movements over the past 12 months, highlighting key highs, lows, and trend shifts:

Trend Analysis

Over the past 12 months, GPC’s stock price declined by 18.84%, confirming a bearish trend with accelerating downward momentum. The price ranged between a high of 162.39 and a low of 113.61. Recent weeks show a mild recovery with a 3.46% drop over two and a half months, indicating some deceleration in the decline.

Volume Analysis

In the last three months, trading volume increased with buyer dominance at 60.01%, signaling stronger buying interest. Total traded volume rose, reflecting heightened market participation and potential accumulation despite the broader bearish price trend.

Target Prices

Analysts set a solid target consensus for Genuine Parts Company (GPC).

| Target Low | Target High | Consensus |

|---|---|---|

| 140 | 175 | 159 |

The target prices suggest moderate upside potential, reflecting confidence in GPC’s steady performance and sector resilience.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Genuine Parts Company’s performance through analyst ratings and consumer feedback to gauge market sentiment.

Stock Grades

Here are the latest verified stock grades from leading financial institutions for Genuine Parts Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Buy | 2026-02-12 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-11 |

| Evercore ISI Group | Maintain | Outperform | 2026-02-10 |

| Goldman Sachs | Upgrade | Neutral | 2025-11-13 |

| JP Morgan | Maintain | Overweight | 2025-10-23 |

| Truist Securities | Maintain | Buy | 2025-10-22 |

| UBS | Maintain | Neutral | 2025-10-10 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-01 |

| Evercore ISI Group | Maintain | Outperform | 2025-08-26 |

| Loop Capital | Maintain | Buy | 2025-07-24 |

The consensus leans toward a Hold, reflecting a balanced view between Buy and Hold ratings. Notably, Evercore ISI Group consistently rates the stock as Outperform, signaling confidence in its performance.

Consumer Opinions

Genuine Parts Company (GPC) enjoys a generally favorable reputation among its customers, reflecting its long-standing presence in the automotive parts sector.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable product availability and wide selection | Occasional delays in shipping |

| Friendly and knowledgeable store staff | Some customers report higher-than-expected prices |

| Consistent quality of parts | Limited online support and website usability issues |

Consumers consistently praise GPC for product reliability and helpful service. However, shipping delays and pricing concerns appear as recurring drawbacks. Improving e-commerce functionality could enhance the overall customer experience.

Risk Analysis

The following table summarizes Genuine Parts Company’s key risks, assessing their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | Elevated debt-to-equity ratio (1.48) raises solvency concerns during economic downturns. | Medium | High |

| Profitability | Weak net margin (0.27%) and ROE (1.49%) signal ongoing operational efficiency challenges. | High | Medium |

| Liquidity | Low quick ratio (0.46) indicates limited short-term asset coverage for immediate liabilities. | Medium | Medium |

| Valuation | Extremely high P/E ratio (259x) suggests overvaluation risk amid market volatility. | High | High |

| Interest Coverage | Interest coverage at zero flags potential difficulty servicing debt if earnings weaken further. | Medium | High |

| Market Volatility | Beta below 1 (0.74) implies relative stability but limits upside in bullish cycles. | Low | Low |

Profitability and valuation risks dominate. The 14.5% share price decline in 2026 reflects market concerns about stretched valuation relative to weak earnings. The company’s safe Altman Z-Score (708) reduces bankruptcy fears but does not eliminate financial risks. I see Genuine Parts Company’s heavy reliance on debt and slim margins as the most pressing red flags for cautious investors.

Should You Buy Genuine Parts Company?

Genuine Parts Company appears to have weakening profitability and a slightly unfavorable moat due to declining ROIC. Despite a manageable leverage profile, its overall rating of C+ suggests cautious value creation, supported by stable bankruptcy risk but average financial strength.

Strength & Efficiency Pillars

Genuine Parts Company maintains a gross margin of 36.79%, indicating solid operational efficiency in managing production costs. Its asset turnover of 1.17 and fixed asset turnover of 5.71 demonstrate effective use of assets to generate revenue. With a weighted average cost of capital (WACC) at 6% and a return on invested capital (ROIC) of 7.81%, the firm marginally exceeds its cost of capital, though the modest spread suggests limited value creation. Dividend yield at 3.3% adds income appeal despite weak profitability metrics.

Weaknesses and Drawbacks

The company faces significant challenges, reflected in an unfavorable net margin of 0.27% and a return on equity (ROE) of just 1.49%, signaling weak profitability. Its price-to-earnings ratio at 259.07 and price-to-book ratio at 3.86 indicate a stretched valuation, exposing investors to premium risk. Leverage is elevated with a debt-to-equity ratio of 1.48, and liquidity concerns arise from a low quick ratio of 0.46, increasing short-term financial risk. The bearish overall stock trend and recent price decline (-3.46%) add technical headwinds.

Our Final Verdict about Genuine Parts Company

Despite operating in the safe zone per Altman Z-Score (708.6), Genuine Parts Company’s deteriorating profitability and stretched valuation suggest caution. The firm’s fundamentals are under pressure, and although recent buyer dominance hints at potential recovery, the bearish price trend warrants a wait-and-see stance. This profile might appear suitable for investors seeking income but remains risky for those prioritizing growth or capital preservation.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Genuine Parts Company Announces Plan to Separate Automotive and Industrial Businesses Into Two Industry-Leading Public Companies – PR Newswire (Feb 17, 2026)

- NAPA Owner Genuine Parts Plans to Split Into Two Companies – The Wall Street Journal (Feb 17, 2026)

- Genuine Parts to split into industrial and auto businesses; sees weak FY26 profit – CNBC (Feb 17, 2026)

- Genuine Parts (GPC) Stock Trades Down, Here Is Why – Yahoo Finance (Feb 17, 2026)

- Genuine Parts falls after earnings, business separation update (GPC:NYSE) – Seeking Alpha (Feb 17, 2026)

For more information about Genuine Parts Company, please visit the official website: genpt.com