Home > Analyses > Consumer Cyclical > General Motors Company

General Motors redefines mobility by shaping how millions move daily with its diverse lineup of trucks, crossovers, and electric vehicles. The company commands industry respect through its iconic brands like Chevrolet and Cadillac, blending tradition with cutting-edge innovation in autonomous and connected car technologies. As GM navigates an electrified future, I question whether its current fundamentals fully capture the growth potential and risks embedded in this automotive transformation.

Table of contents

Business Model & Company Overview

General Motors Company, founded in 1908 and headquartered in Detroit, Michigan, stands as a dominant player in the global automotive industry. It designs, builds, and sells a broad portfolio of trucks, crossovers, cars, and parts under renowned brands like Chevrolet, Cadillac, and GMC. GM’s ecosystem integrates traditional vehicles with advanced safety, connectivity, and autonomous technologies, creating a comprehensive mobility platform across key regions including North America, Asia Pacific, and South America.

GM’s revenue engine balances robust vehicle sales with growing software-enabled services and financing operations. Its recurring connected services and autonomous vehicle segment complement traditional automobile sales, enhancing customer retention and monetization. This global footprint and diversified revenue mix underpin GM’s economic moat, positioning it to shape the future of mobility and withstand competitive pressures.

Financial Performance & Fundamental Metrics

I will analyze General Motors Company’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investor appeal.

Income Statement

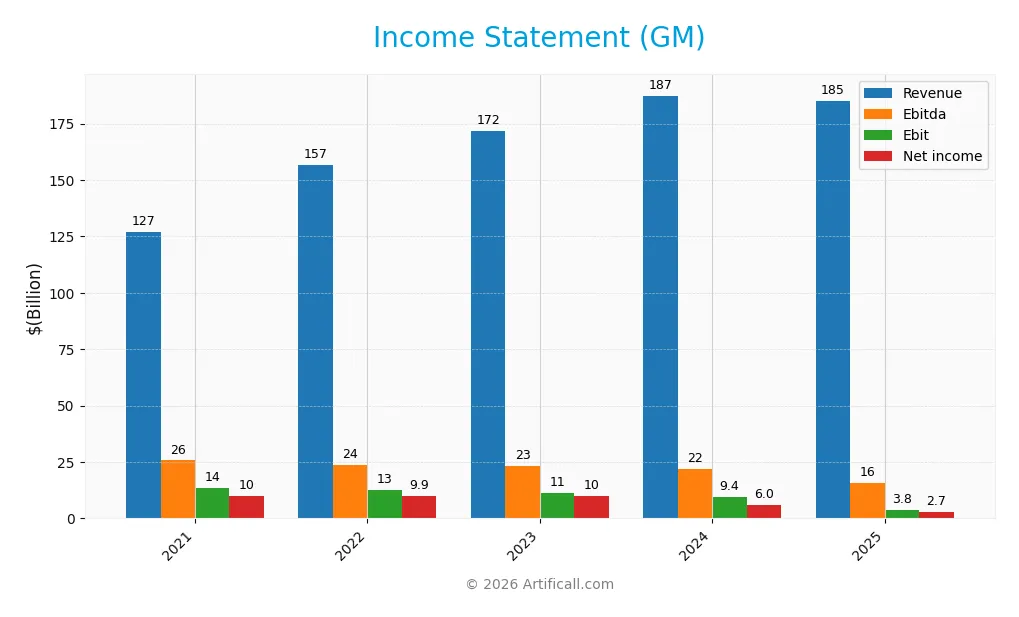

The table below presents General Motors Company’s key income statement figures for the fiscal years 2021 through 2025, all values in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 127B | 157B | 172B | 187B | 185B |

| Cost of Revenue | 109B | 136B | 153B | 164B | 173B |

| Operating Expenses | 8.55B | 10.7B | 9.84B | 10.6B | 8.69B |

| Gross Profit | 17.9B | 21.0B | 19.1B | 23.4B | 11.6B |

| EBITDA | 25.7B | 23.9B | 23.2B | 21.8B | 15.8B |

| EBIT | 13.7B | 12.6B | 11.3B | 9.37B | 3.84B |

| Interest Expense | 950M | 987M | 911M | 846M | 727M |

| Net Income | 10.0B | 9.93B | 10.1B | 6.01B | 2.70B |

| EPS | 6.78 | 6.17 | 7.35 | 6.45 | 3.33 |

| Filing Date | 2022-02-02 | 2023-01-31 | 2024-01-30 | 2025-01-28 | 2026-01-27 |

Income Statement Evolution

General Motors’ revenue grew 46% from 2021 to 2025 but dropped 1.3% in 2025 alone. Net income declined sharply by 73% over the five years and halved in 2025. Gross and net margins weakened significantly, reflecting margin compression despite relatively stable operating expenses as a share of revenue.

Is the Income Statement Favorable?

In 2025, GM reported revenue of $185B with a slim gross margin of 6.3% and a net margin of 1.5%, both neutral to weak by industry standards. EBIT fell 59% year-over-year, signaling operational challenges. Interest expense remained favorable at 0.39% of revenue. Overall, fundamentals appear unfavorable, with declining profitability and eroding earnings per share.

Financial Ratios

Below is a summary of key financial ratios for General Motors Company (GM) over recent fiscal years, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 7.9% | 6.3% | 5.9% | 3.2% | 1.5% |

| ROE | 16.8% | 14.7% | 15.8% | 9.5% | 4.4% |

| ROIC | 3.6% | 4.1% | 4.0% | 4.0% | 1.2% |

| P/E | 8.5x | 4.9x | 4.8x | 9.9x | 27.7x |

| P/B | 1.4x | 0.7x | 0.8x | 0.9x | 1.2x |

| Current Ratio | 1.1 | 1.1 | 1.1 | 1.1 | 1.2 |

| Quick Ratio | 0.9 | 0.9 | 0.9 | 1.0 | 1.0 |

| D/E | 1.8x | 1.7x | 1.9x | 2.1x | 2.1x |

| Debt-to-Assets | 45.1% | 43.8% | 44.9% | 46.7% | 46.3% |

| Interest Coverage | 9.8x | 10.5x | 10.2x | 15.1x | 4.0x |

| Asset Turnover | 0.52 | 0.59 | 0.63 | 0.67 | 0.66 |

| Fixed Asset Turnover | 1.6x | 2.0x | 2.1x | 2.2x | 2.2x |

| Dividend Yield | 0.2% | 0.8% | 1.2% | 1.1% | 0.9% |

Evolution of Financial Ratios

From 2021 to 2025, GM’s Return on Equity (ROE) steadily declined from 16.8% to 4.4%. The Current Ratio showed a mild improvement, rising from around 1.10 to 1.17, reflecting stable liquidity. Meanwhile, the Debt-to-Equity Ratio increased notably, reaching 2.13 in 2025, signaling higher leverage and potential risk in capital structure.

Are the Financial Ratios Favorable?

In 2025, GM’s profitability ratios, including net margin (1.46%) and ROE (4.41%), were unfavorable compared to sector norms. Liquidity appeared neutral to slightly favorable with a Current Ratio of 1.17 and Quick Ratio above 1. Debt levels were elevated (D/E at 2.13) and marked unfavorable, though interest coverage remained favorable at 5.29. Market valuation showed mixed signals, with a high P/E ratio (27.72) unfavorable, but a price-to-book ratio of 1.22 favorable. Overall, the financial ratios present a slightly unfavorable profile.

Shareholder Return Policy

General Motors maintains a modest dividend payout ratio of roughly 24% in 2025, with a dividend yield below 1%. Dividend payments have increased steadily from 0.13 in 2021 to 0.71 in 2025 per share. The company supports dividends with free cash flow coverage around 41%, indicating moderate sustainability.

GM also engages in share buybacks, complementing its dividend strategy. While payout levels remain conservative, free cash flow coverage below 50% signals caution. This balanced approach aims to support shareholder returns without jeopardizing capital allocation for growth or debt management.

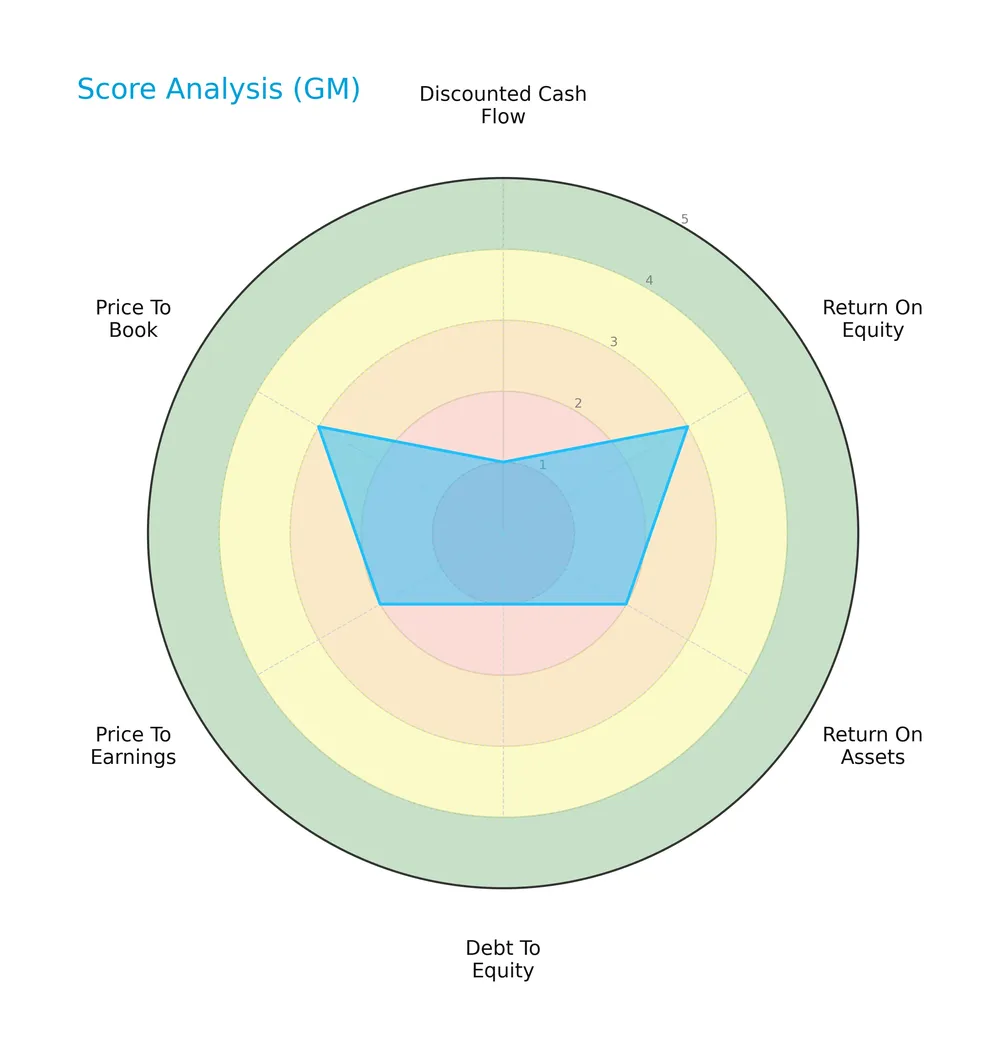

Score analysis

The following radar chart presents a comprehensive view of General Motors Company’s key financial scores:

General Motors shows moderate returns on equity and assets, with moderate valuations in price-to-earnings and price-to-book ratios. However, the discounted cash flow and debt-to-equity scores register as very unfavorable, indicating financial leverage concerns.

Analysis of the company’s bankruptcy risk

The Altman Z-Score places General Motors in the distress zone, signaling a higher probability of financial distress and potential bankruptcy risk:

Is the company in good financial health?

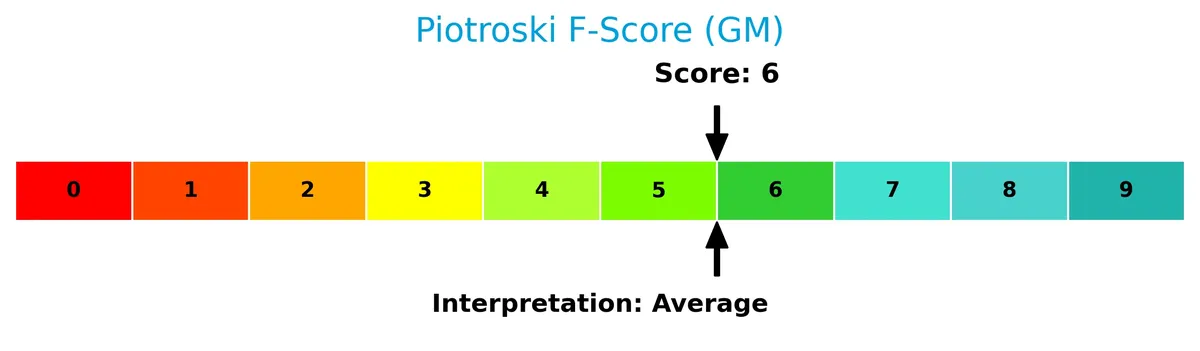

The Piotroski Score diagram illustrates General Motors’ average financial strength based on nine key criteria:

With a Piotroski score of 6, the company demonstrates moderate financial health, reflecting neither strong nor weak fundamentals in profitability, leverage, liquidity, and efficiency.

Competitive Landscape & Sector Positioning

This sector analysis examines General Motors Company’s strategic positioning, revenue segments, and key products. I will assess whether GM holds a competitive advantage over its main competitors.

Strategic Positioning

General Motors diversifies its revenue across automotive segments—GM North America dominates with $322B in 2025, complemented by GM Financial at $17B and international operations near $13.4B. Its geographic exposure heavily favors the U.S. ($138B), with a smaller but stable non-U.S. presence ($29.8B), reflecting a concentrated yet multi-brand portfolio spanning trucks, cars, and emerging autonomous technologies.

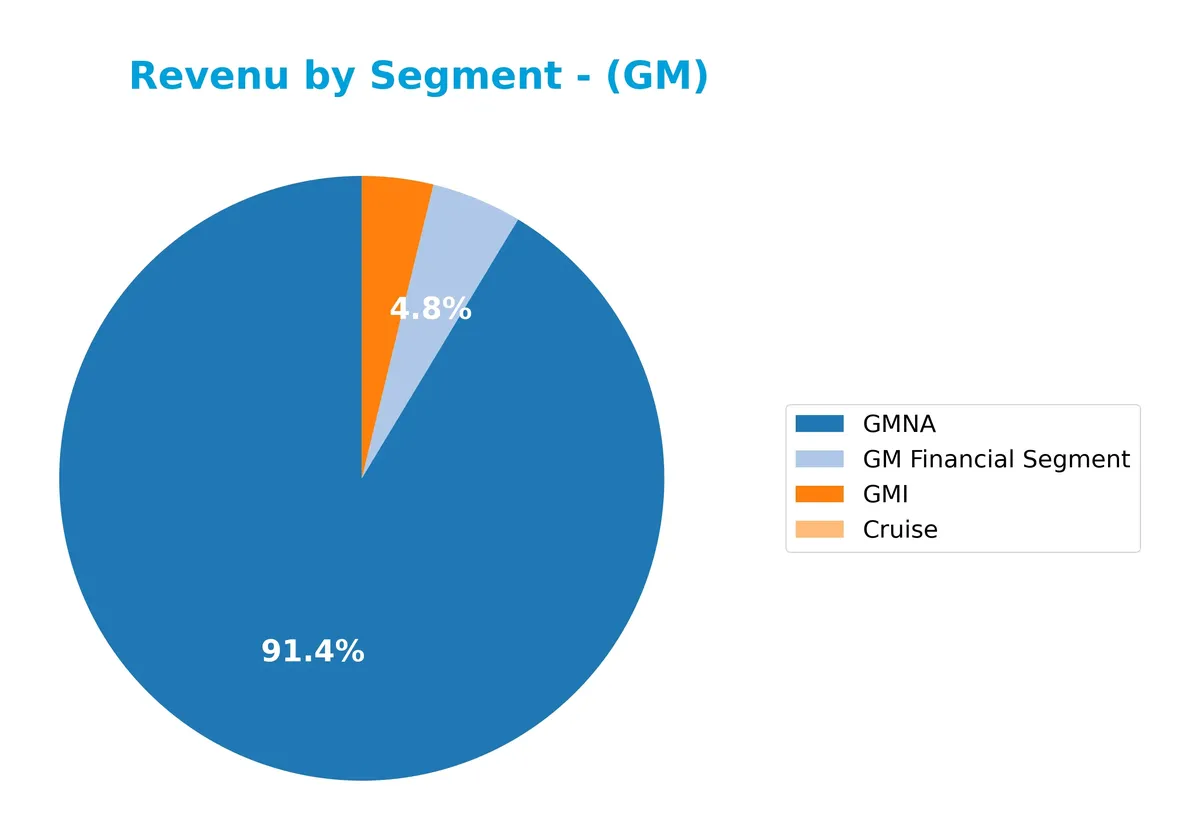

Revenue by Segment

This pie chart breaks down General Motors Company’s revenue by segment for the fiscal year 2025, illustrating the relative contribution of each business area.

In 2025, GMNA dominates revenue at 322B, underscoring its core automotive market strength. GM Financial Segment follows with 17B, showing steady growth over recent years. GMI contributes 13.4B but has declined since 2023, signaling potential challenges. Cruise revenue remains negligible at 1M, highlighting early-stage investment rather than scale. The business remains heavily concentrated in GMNA, indicating exposure to North American automotive market cycles.

Key Products & Brands

The table below summarizes General Motors’ key products and brand segments with descriptions:

| Product | Description |

|---|---|

| GM North America | Designs, builds, and sells trucks, crossovers, cars, and parts primarily in North America. |

| GM International | Markets vehicles under Buick, Cadillac, Chevrolet, GMC, Holden, Baojun, and Wuling brands. |

| Cruise | Develops and commercializes autonomous vehicle technology and related services. |

| GM Financial | Provides automotive financing, insurance, and related financial services to retail and fleets. |

General Motors operates through diverse automotive and financial segments. Its portfolio includes well-known vehicle brands and innovation in autonomous technology, supported by a significant financing arm.

Main Competitors

There are 3 competitors in the Auto – Manufacturers industry; the table below lists the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Tesla, Inc. | 1.41T |

| General Motors Company | 75.5B |

| Ford Motor Company | 52.2B |

General Motors ranks 2nd among its competitors. Its market cap is just 5.5% of Tesla’s, the leader. GM sits below the average market cap of the top 10 in the sector but above the sector median. It holds a substantial 1711% gap above its nearest rival, Ford.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does GM have a competitive advantage?

GM currently lacks a competitive advantage, as its return on invested capital (ROIC) falls significantly below its cost of capital. The company is shedding value and shows a sharply declining ROIC trend, indicating weakening profitability over 2021-2025.

Looking ahead, GM leverages its diverse brand portfolio and global footprint, with operations in North America, Asia Pacific, and other regions. Its focus on autonomous vehicle technology and connected services may offer growth opportunities in emerging automotive markets.

SWOT Analysis

This SWOT analysis highlights General Motors Company’s internal capabilities and external market conditions to guide strategic decisions.

Strengths

- Strong brand portfolio

- Extensive North American market presence

- Leading investments in autonomous and connected vehicle tech

Weaknesses

- Declining profitability metrics

- Negative ROIC vs. WACC trend

- High debt-to-equity ratio

Opportunities

- Growth in electric vehicle demand

- Expansion in emerging markets

- Software and subscription services growth

Threats

- Intense competition in auto sector

- Global supply chain disruptions

- Regulatory pressure on emissions

General Motors faces significant challenges with profitability erosion and leverage, but its diversified brand and tech focus offer growth levers. Strategic emphasis must balance cost control with innovation and market expansion to regain value creation.

Stock Price Action Analysis

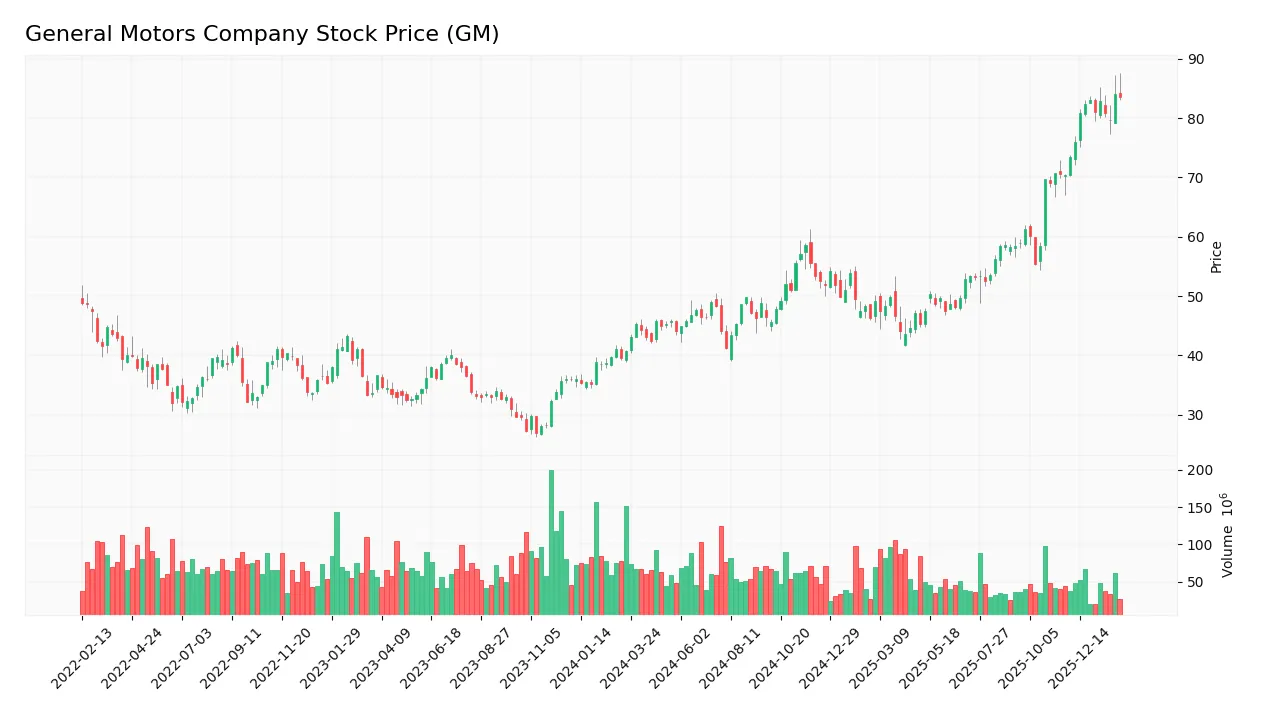

The weekly stock chart for General Motors Company (GM) illustrates price movements over the past 100 weeks, highlighting key support and resistance levels:

Trend Analysis

Over the past 12 months, GM’s stock price increased by 105.53%, indicating a strong bullish trend with acceleration. The stock ranged between a low of 40.69 and a high of 84.0. Price volatility is moderate, with a standard deviation of 11.34, supporting sustained upward momentum.

Volume Analysis

Over the last three months, trading volume has been decreasing despite buyer dominance at 67.21%. Buyers accounted for 335M shares versus 163M sellers, signaling positive investor sentiment but lower overall market participation. This suggests cautious optimism among shareholders.

Target Prices

Analysts set a clear target consensus for General Motors Company, reflecting moderate optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 55 | 110 | 89.93 |

The target range spans from 55 to 110, with consensus near 90, indicating expectations of steady growth balanced by some risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide insight into General Motors Company’s market perception.

Stock Grades

Here are the latest verified analyst grades for General Motors Company from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | Outperform | 2026-02-02 |

| Jefferies | Maintain | Hold | 2026-02-02 |

| Mizuho | Maintain | Outperform | 2026-01-28 |

| Wells Fargo | Maintain | Underweight | 2026-01-28 |

| UBS | Maintain | Buy | 2026-01-28 |

| Piper Sandler | Maintain | Overweight | 2026-01-28 |

| Deutsche Bank | Maintain | Hold | 2026-01-28 |

| Barclays | Maintain | Overweight | 2026-01-28 |

| RBC Capital | Maintain | Outperform | 2026-01-28 |

| Barclays | Maintain | Overweight | 2026-01-23 |

The consensus reflects a positive tilt with multiple Outperform and Buy ratings. A minority hold and underweight grades indicate some caution but no major downgrades.

Consumer Opinions

General Motors Company (GM) evokes mixed emotions from customers, reflecting its broad market reach and evolving product lineup.

| Positive Reviews | Negative Reviews |

|---|---|

| “Reliable vehicles with excellent safety features.” | “High maintenance costs over time.” |

| “Strong performance and innovative electric models.” | “Customer service response times can be slow.” |

| “Good resale value compared to competitors.” | “Infotainment system occasionally glitches.” |

Overall, consumers praise GM’s reliability and innovation, especially in electric vehicles. However, recurring issues include maintenance expenses and inconsistent customer service. This feedback signals areas for operational improvement.

Risk Analysis

Below is a summary of key risks facing General Motors Company, highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score of 1.25 places GM in the distress zone, signaling bankruptcy risk. | High | High |

| Profitability | Low net margin (1.46%) and ROIC (1.16%) well below WACC (5.92%) indicate weak returns. | High | Medium |

| Leverage | Debt-to-equity ratio at 2.13 is unfavorable, increasing financial risk. | Medium | High |

| Market Volatility | Beta of 1.365 shows above-average stock price sensitivity to market swings. | High | Medium |

| Dividend Yield | Low dividend yield (0.88%) may deter income-focused investors. | Medium | Low |

| Sector Cyclicality | Auto manufacturing faces cyclical demand and supply chain disruptions. | High | High |

GM’s most concerning risk is its financial distress signal from the Altman Z-Score, underscored by weak profitability and heavy leverage. Combined with sector cyclicality, these factors warrant caution despite favorable interest coverage and liquidity ratios.

Should You Buy General Motors Company?

General Motors appears to be burdened by a deteriorating competitive moat and substantial leverage, suggesting value destruction despite moderate profitability measures. While its rating of C+ reflects these challenges, the company’s financial profile could be seen as cautious rather than compelling.

Strength & Efficiency Pillars

General Motors Company displays modest financial health with a WACC of 5.92% favorably below its ROIC of 1.16%, indicating some value erosion rather than creation. Profitability metrics show a net margin of 1.46% and a ROE of 4.41%, both underwhelming compared to industry standards. Liquidity appears stable with a current ratio of 1.17 and a quick ratio of 1.01, offering reasonable short-term solvency. The Piotroski score of 6 suggests average financial strength, but the Altman Z-Score of 1.25 signals distress risk, highlighting vulnerability in financial stability.

Weaknesses and Drawbacks

GM faces significant challenges, including a high debt-to-equity ratio of 2.13, which elevates financial leverage risks and may pressure credit costs. The P/E ratio at 27.72 suggests a premium valuation that could deter risk-averse investors amid declining profitability. The net margin and ROIC both show unfavorable downward trends, with the company shedding value according to moat analysis. Additionally, a dividend yield of 0.88% appears low for income-focused investors. These factors collectively increase risk and signal caution despite stable liquidity ratios.

Our Verdict about General Motors Company

The company’s long-term fundamentals appear unfavorable, with value destruction and financial distress signals outweighing moderate strengths. However, the recent buyer dominance of 67.21% and a bullish overall stock trend suggest some market confidence. This profile might appear attractive for selective investors with a tolerance for volatility but suggests a cautious stance given persistent profitability and leverage concerns. Waiting for clearer operational improvements could be prudent.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Investors Heavily Search General Motors Company (GM): Here is What You Need to Know – Yahoo Finance (Feb 03, 2026)

- GM CFO: Loss of EV tax credit, lower production ‘blessing in disguise’ – Detroit Free Press (Feb 04, 2026)

- General Motors Just Raised Its Dividend 20%. Does That Make GM Stock a Buy? – Barchart.com (Feb 02, 2026)

- Stabilized Volume Boosted General Motors (GM) – Finviz (Feb 03, 2026)

- Celebrating GM Day in Michigan – General Motors (Sep 16, 2025)

For more information about General Motors Company, please visit the official website: gm.com