Home > Analyses > Technology > Garmin Ltd.

Garmin Ltd. transforms how we explore, navigate, and stay connected, embedding cutting-edge technology into everyday adventures and professional pursuits. As a global pioneer in GPS-enabled devices across fitness, aviation, marine, and automotive sectors, Garmin is renowned for its innovation, reliability, and comprehensive product ecosystem. With a robust market presence and diverse portfolio, I explore whether Garmin’s current fundamentals support its valuation and growth prospects in an evolving tech landscape.

Table of contents

Business Model & Company Overview

Garmin Ltd., founded in 1989 and headquartered in Schaffhausen, Switzerland, stands as a leader in the hardware, equipment, and parts industry. Its core mission revolves around delivering a cohesive ecosystem of wireless devices that span fitness, outdoor adventure, aviation, marine, and automotive sectors. This integrated approach unites wearables, navigation, and communication tools, solidifying Garmin’s position across diverse markets.

The company’s revenue engine blends hardware sales with embedded software platforms and recurring services, such as Garmin Connect and Connect IQ, enhancing user engagement. Operating globally across the Americas, Europe, and Asia, Garmin leverages a broad distribution network including retailers, OEMs, and online channels. Its sustained competitive advantage lies in its ability to innovate across multiple segments, securing a durable economic moat in a competitive technology landscape.

Financial Performance & Fundamental Metrics

I will analyze Garmin Ltd.’s income statement, key financial ratios, and dividend payout policy to provide a clear picture of its fundamental strength.

Income Statement

This table presents Garmin Ltd.’s key income statement figures for the fiscal years 2020 through 2024, reflecting revenue, expenses, profit, and earnings per share in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 4.19B | 4.98B | 4.86B | 5.23B | 6.30B |

| Cost of Revenue | 1.71B | 2.09B | 2.05B | 2.22B | 2.60B |

| Operating Expenses | 1.43B | 1.67B | 1.78B | 1.91B | 2.10B |

| Gross Profit | 2.48B | 2.89B | 2.81B | 3.00B | 3.70B |

| EBITDA | 1.18B | 1.37B | 1.19B | 1.27B | 1.77B |

| EBIT | 1.05B | 1.22B | 1.03B | 1.09B | 1.59B |

| Interest Expense | 0 | 0 | 0 | 0 | 0 |

| Net Income | 992M | 1.08B | 974M | 1.29B | 1.41B |

| EPS | 5.19 | 5.63 | 5.06 | 6.74 | 7.35 |

| Filing Date | 2021-02-17 | 2022-02-16 | 2023-02-22 | 2024-11-29 | 2025-02-19 |

Income Statement Evolution

From 2020 to 2024, Garmin Ltd. demonstrated consistent revenue growth, rising by 50.41% overall and 20.44% in the last year alone. Net income increased by 42.24% over the period, though the net margin saw a slight decline of 5.43%, with a 9.13% decrease in the most recent year. Gross and EBIT margins remained favorable, indicating stable profitability despite margin pressures.

Is the Income Statement Favorable?

In 2024, Garmin’s income statement showed strong fundamentals, with a gross margin of 58.7% and an EBIT margin of 25.31%, both favorable. The company recorded zero interest expense, supporting robust net margins at 22.41%. While net margin growth was unfavorable in the last year, overall income and EPS growth remained strong, reflecting a generally favorable financial position for investors.

Financial Ratios

The table below presents key financial ratios for Garmin Ltd. (ticker: GRMN) over the fiscal years 2020 to 2024, offering a clear overview of the company’s profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 24% | 22% | 20% | 25% | 22% |

| ROE | 18% | 18% | 16% | 18% | 18% |

| ROIC | 16% | 17% | 14% | 15% | 16% |

| P/E | 23.0 | 24.2 | 18.3 | 19.1 | 28.5 |

| P/B | 4.15 | 4.28 | 2.86 | 3.51 | 5.13 |

| Current Ratio | 3.15 | 2.94 | 3.26 | 3.41 | 3.54 |

| Quick Ratio | 2.50 | 2.10 | 2.01 | 2.38 | 2.56 |

| D/E | 0.01 | 0.01 | 0.02 | 0.02 | 0.02 |

| Debt-to-Assets | 1.1% | 0.9% | 1.5% | 1.3% | 1.7% |

| Interest Coverage | 0 | 0 | 0 | 0 | 0 |

| Asset Turnover | 0.60 | 0.63 | 0.63 | 0.61 | 0.65 |

| Fixed Asset Turnover | 4.41 | 4.31 | 3.78 | 3.82 | 4.49 |

| Dividend Yield | 1.97% | 1.88% | 3.82% | 2.27% | 1.42% |

Evolution of Financial Ratios

Garmin Ltd.’s Return on Equity (ROE) remained relatively stable, fluctuating slightly around 18% from 2020 to 2024, indicating consistent profitability. The Current Ratio showed a gradual increase, reaching 3.54 in 2024, signaling improved liquidity. Meanwhile, the Debt-to-Equity Ratio stayed very low and stable near 0.02, reflecting minimal reliance on debt financing over the period.

Are the Financial Ratios Favorable?

In 2024, Garmin’s profitability ratios such as net margin (22.41%) and ROE (17.98%) are favorable, supported by a strong return on invested capital (16.28%). Liquidity is mixed: a high current ratio (3.54) is rated unfavorable, while the quick ratio (2.56) is favorable. Leverage ratios, including debt-to-equity (0.02) and debt-to-assets (1.69%), are favorable, indicating low debt risk. Market valuation ratios like P/E (28.5) and P/B (5.13) are unfavorable, while asset turnover (0.65) is neutral, culminating in a generally favorable overall financial ratio profile.

Shareholder Return Policy

Garmin Ltd. maintains a consistent dividend payout, with a payout ratio around 40-70% and a dividend yield ranging from 1.4% to 3.8% over recent years. The dividend per share has generally increased, supported by strong free cash flow coverage and prudent capital expenditure management. Share buybacks are not explicitly mentioned in the data.

The dividend policy appears sustainable given Garmin’s solid profitability margins and robust cash flow generation. This approach aligns with a balanced allocation of capital, supporting shareholder returns while preserving financial flexibility for ongoing operations and investments.

Score analysis

The following radar chart summarizes Garmin Ltd.’s key financial scores across valuation, profitability, and leverage metrics:

Garmin shows a very favorable return on assets (score 5) and favorable return on equity (score 4) and debt-to-equity (score 4). Valuation metrics such as price-to-earnings and price-to-book scores are moderate at 2, as is the discounted cash flow score at 3.

Analysis of the company’s bankruptcy risk

Garmin Ltd.’s Altman Z-Score places it well within the safe zone, indicating a low risk of bankruptcy:

Is the company in good financial health?

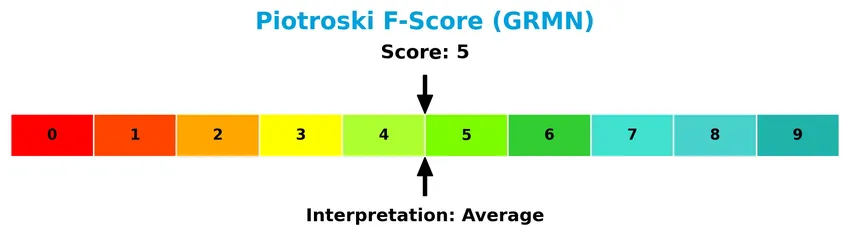

The Piotroski Score diagram illustrates Garmin Ltd.’s current financial strength based on nine accounting criteria:

With a Piotroski score of 5, Garmin is considered to have average financial health, reflecting a moderate level of financial strength according to this metric.

Competitive Landscape & Sector Positioning

This sector analysis will explore Garmin Ltd.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also examine a SWOT analysis to provide a comprehensive view of the company’s market standing. The aim is to determine whether Garmin holds a competitive advantage over its peers in the technology sector.

Strategic Positioning

Garmin Ltd. maintains a diversified product portfolio across Fitness, Outdoor, Marine, Aviation, and Automotive Mobile segments, with Fitness and Outdoor leading revenues at over $1.7B and $1.9B respectively in 2024. Geographically, it operates broadly across Americas ($3B), EMEA ($2.3B), and Asia Pacific ($940M), reflecting balanced global exposure.

Revenue by Segment

This pie chart illustrates Garmin Ltd.’s revenue distribution by product segment for the fiscal year 2024, highlighting the relative contribution of each business area.

In 2024, the Outdoor segment led revenue generation with $1.96B, followed by Fitness at $1.77B and Marine at $1.07B. Aviation and Automotive Mobile contributed $877M and $611M respectively. The data shows a steady growth trend especially in Fitness and Outdoor segments, indicating strong consumer demand. Automotive Mobile exhibited notable acceleration, signaling potential diversification, while core segments remain robust with manageable concentration risk.

Key Products & Brands

The following table summarizes Garmin Ltd.’s main product lines and brand segments with their descriptions:

| Product | Description |

|---|---|

| Fitness | Running and multi-sport watches, cycling products, activity trackers, smartwatches, accessories, and Garmin Connect platforms. |

| Outdoor | Adventure watches, outdoor handhelds, golf devices, mobile apps, dog tracking and training devices. |

| Aviation | Aircraft avionics including flight decks, navigation, communication, flight control, safety systems, and portable GPS. |

| Marine Segment | Chartplotters, multi-function displays, fish finders, sonar, autopilot, radars, sensors, communication radios, sailing products. |

| Automotive Mobile | Embedded computing models, infotainment systems, personal navigation devices, and cameras for automotive applications. |

Garmin Ltd.’s portfolio spans diverse segments from fitness and outdoor activities to aviation, marine, and automotive markets, reflecting its broad expertise in wireless device design and manufacturing.

Main Competitors

There are 20 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amphenol Corporation | 171B |

| Corning Incorporated | 77.7B |

| TE Connectivity Ltd. | 68.6B |

| Sandisk Corporation | 40.0B |

| Garmin Ltd. | 38.9B |

| Keysight Technologies, Inc. | 35.5B |

| Celestica Inc. | 34.0B |

| Coherent, Inc. | 28.7B |

| Jabil Inc. | 25.7B |

| Teledyne Technologies Incorporated | 24.4B |

Garmin Ltd. ranks 5th among its competitors with a market cap approximately 23% of the sector leader, Amphenol Corporation. It sits below the average market cap of the top 10 competitors (54.4B) but above the sector median (21.6B). The company is positioned closely with a marginal 0.82% gap to the next competitor above, highlighting a competitive stance within this segment.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Garmin have a competitive advantage?

Garmin Ltd. presents a competitive advantage, evidenced by its favorable ROIC exceeding WACC by 7.68% and stable profitability, signaling efficient capital use and consistent value creation. The company’s gross margin of 58.7% and EBIT margin of 25.31% further support its strong operational efficiency within the hardware and equipment sector.

Looking ahead, Garmin’s diverse product portfolio across fitness, outdoor, aviation, marine, and automotive segments positions it well for growth in multiple geographic markets, including the Americas, EMEA, and Asia Pacific. Continued innovation in connected devices and expanding digital platforms offer opportunities to leverage its established market presence and drive future revenue growth.

SWOT Analysis

This SWOT analysis highlights Garmin Ltd.’s key internal strengths and weaknesses alongside external opportunities and threats to inform strategic decision-making.

Strengths

- strong brand presence in multiple segments

- robust profitability with 22.41% net margin

- global diversified revenue streams

Weaknesses

- relatively high PE and PB ratios indicate premium valuation

- moderate Piotroski score suggests room for financial improvement

- current ratio below ideal level signals liquidity constraints

Opportunities

- expanding wearable tech and fitness markets

- growth potential in Asia Pacific and emerging markets

- innovation in avionics and marine technology segments

Threats

- intense competition from tech giants and niche players

- supply chain disruptions impacting hardware production

- currency fluctuations affecting international revenue

Garmin’s strong profitability and diversification provide a solid foundation, but premium valuation and liquidity ratios warrant caution. Strategic focus on innovation and geographic expansion, balanced against competitive and operational risks, will be key for sustained growth.

Stock Price Action Analysis

The following weekly chart illustrates Garmin Ltd. (GRMN) stock price movements over the past 100 weeks, highlighting key price fluctuations and trend phases:

Trend Analysis

Over the past 12 months, Garmin Ltd. stock price increased by 50.02%, indicating a bullish trend with acceleration. The price ranged from a low of 137.43 to a high of 257.06, supported by a high volatility level with a standard deviation of 28.94. Recent weeks show a smaller 2.49% rise with moderate volatility (6.24), maintaining an upward slope of 1.36.

Volume Analysis

In the last three months, trading volume is increasing with a total of 50.9M shares traded, where buyer volume accounts for 55.8%. However, the recent period from November 2025 to January 2026 shows seller dominance with only 36.1% buyer volume, suggesting cautious investor sentiment amid rising market participation.

Target Prices

The consensus target prices for Garmin Ltd. indicate a moderately optimistic outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 310 | 193 | 240 |

Analysts expect Garmin’s stock to trade between 193 and 310, with an average target price around 240, reflecting balanced confidence in growth prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents an analysis of grades and consumer feedback regarding Garmin Ltd. to inform investors.

Stock Grades

Here is a summary of the latest stock grades from established financial institutions for Garmin Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Upgrade | Equal Weight | 2026-01-16 |

| Tigress Financial | Maintain | Strong Buy | 2025-12-19 |

| Longbow Research | Upgrade | Buy | 2025-12-03 |

| Morgan Stanley | Maintain | Underweight | 2025-10-30 |

| Barclays | Maintain | Underweight | 2025-10-30 |

| Tigress Financial | Maintain | Strong Buy | 2025-09-30 |

| Morgan Stanley | Maintain | Underweight | 2025-09-19 |

| Morgan Stanley | Maintain | Underweight | 2025-07-31 |

| Barclays | Maintain | Underweight | 2025-07-31 |

| JP Morgan | Maintain | Neutral | 2025-07-17 |

Grades show a mixed but generally cautious stance with several underweight ratings maintained by major firms, balanced by some upgrades to buy and strong buy from other analysts. The consensus remains a “Hold,” reflecting moderate investor confidence.

Consumer Opinions

Garmin Ltd. continues to garner a loyal customer base, but opinions reveal a mix of enthusiasm and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Excellent GPS accuracy and reliable tracking | Battery life could be longer on some models |

| User-friendly interface with robust features | Occasional software glitches reported |

| Durable and rugged design for outdoor use | Higher price point compared to competitors |

| Great customer support and regular updates | Limited compatibility with some third-party apps |

Overall, consumers appreciate Garmin’s precision and durability, while concerns mainly focus on battery performance and software issues. The brand’s strong customer service partly mitigates these drawbacks.

Risk Analysis

Below is a concise table summarizing the main risks associated with Garmin Ltd. that investors should consider carefully:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | Elevated P/E (28.5) and P/B (5.13) ratios suggest potential overvaluation risk. | Medium | High |

| Competitive Pressure | Intense competition in hardware and wearable tech sectors may erode market share and margins. | Medium | Medium |

| Supply Chain | Disruptions in global supply chains could affect production and delivery schedules. | Low | Medium |

| Technological Obsolescence | Rapid tech changes require continuous innovation and investment to stay relevant. | Medium | High |

| Regulatory Changes | Changes in international trade policies or tech regulations could increase costs or limit markets. | Low | Medium |

| Currency Fluctuations | Exposure to multiple currencies may impact earnings due to exchange rate volatility. | Medium | Medium |

The most significant risks stem from Garmin’s relatively high valuation metrics and the need to continuously innovate to maintain its competitive edge. Despite a strong balance sheet and a safe Altman Z-Score (13.88), investors should monitor market conditions and tech trends closely.

Should You Buy Garmin Ltd.?

Garmin Ltd. appears to be delivering robust profitability supported by a favorable competitive moat characterized by stable value creation, while its leverage profile seems manageable. Despite moderate efficiency scores, the overall financial health suggests an A- rating, indicating a cautiously positive outlook.

Strength & Efficiency Pillars

Garmin Ltd. exhibits a robust profitability profile with a net margin of 22.41%, an ROE of 17.98%, and a ROIC of 16.28%. Importantly, the ROIC substantially exceeds its WACC of 8.6%, confirming Garmin as a clear value creator. The company’s financial health is solid, underscored by an Altman Z-Score of 13.88, placing it well within the safe zone, and a Piotroski score of 5, indicating average but stable fundamentals. These metrics collectively reflect efficient capital use and a resilient operational model.

Weaknesses and Drawbacks

On the valuation front, Garmin faces challenges with a high P/E ratio of 28.5 and a P/B of 5.13, suggesting the stock trades at a premium that may limit upside potential. Although Garmin’s debt-to-equity ratio is very low at 0.02, signaling conservative leverage, its current ratio stands at 3.54, considered unfavorable, possibly indicating excess current assets that could be better optimized. Recent market behavior shows a seller dominance with 36.09% buyer volume, introducing short-term pressure despite the longer-term bullish trend.

Our Verdict about Garmin Ltd.

Garmin’s long-term fundamentals appear favorable, supported by strong profitability and financial health metrics. However, despite an overall bullish price trend, recent seller dominance suggests caution. Investors might consider a wait-and-see approach for a more favorable entry point, balancing Garmin’s solid value creation against near-term market headwinds.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Garmin Ltd (NYSE:GRMN) Combines Strong Fundamentals with Bullish Technical Setup – Chartmill (Jan 24, 2026)

- Garmin Ltd (GRMN) Trading Down 3.23% on Jan 20 – GuruFocus (Jan 20, 2026)

- Garmin unveils revolutionary Xero L60i laser rangefinder with superior optics, GPS and onboard mapping technology – PR Newswire (Jan 20, 2026)

- Garmin Ltd. schedules fourth quarter 2025 earnings call – Yahoo Finance (Jan 14, 2026)

- Barclays Upgrades Garmin (GRMN) – Nasdaq (Jan 16, 2026)

For more information about Garmin Ltd., please visit the official website: garmin.com