Home > Analyses > Technology > Fortive Corporation

Fortive drives innovation in the essential tools and technologies powering industries worldwide. It shapes critical processes in manufacturing, healthcare, energy, and more through its diverse portfolio of professional hardware, software, and service brands like Fluke and Tektronix. Known for engineering reliability and precision, Fortive maintains a stronghold in technology-driven sectors. The key question now is whether its robust fundamentals can sustain growth amid evolving market dynamics in 2026.

Table of contents

Business Model & Company Overview

Fortive Corporation, founded in 2015 and headquartered in Everett, Washington, commands a leading position in the Hardware, Equipment & Parts sector. It delivers a cohesive ecosystem of professional and engineered products, software, and services. Its portfolio spans intelligent operating solutions, precision technologies, and advanced healthcare solutions, fostering innovation across manufacturing, healthcare, energy, and defense industries.

Fortive’s revenue engine balances hardware sales with software and recurring services, creating diverse value streams. It operates globally with strong market penetration in the Americas, Europe, and Asia. By integrating connected reliability tools with subscription-based management systems, Fortive builds a robust economic moat, shaping the future of industrial technology and asset management.

Financial Performance & Fundamental Metrics

I analyze Fortive Corporation’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder returns.

Income Statement

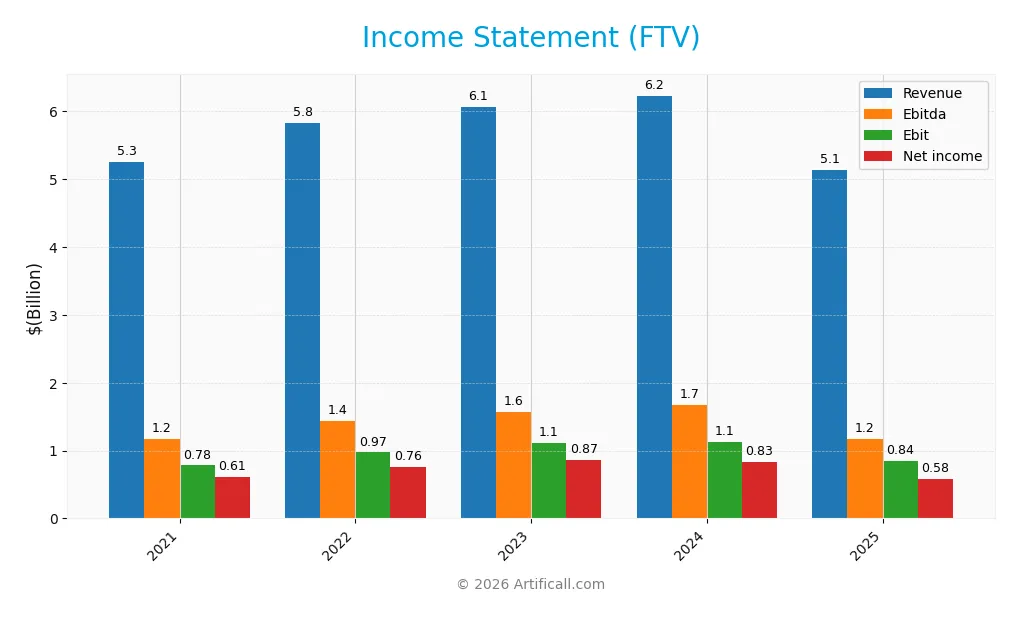

The table below summarizes Fortive Corporation’s key income statement metrics from 2021 through 2025, reflecting revenue, expenses, profits, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 5.25B | 5.83B | 6.07B | 6.23B | 5.14B |

| Cost of Revenue | 2.24B | 2.46B | 2.47B | 2.50B | 2.01B |

| Operating Expenses | 2.18B | 2.36B | 2.46B | 2.55B | 2.23B |

| Gross Profit | 3.01B | 3.36B | 3.59B | 3.73B | 3.13B |

| EBITDA | 1.18B | 1.44B | 1.57B | 1.67B | 1.17B |

| EBIT | 781M | 972M | 1.11B | 1.12B | 843M |

| Interest Expense | 103M | 98M | 124M | 153M | 121M |

| Net Income | 608M | 755M | 866M | 833M | 579M |

| EPS | 1.64 | 2.12 | 2.46 | 2.39 | 1.75 |

| Filing Date | 2022-03-01 | 2023-02-28 | 2024-02-27 | 2025-02-25 | 2026-02-04 |

Income Statement Evolution

Fortive’s revenue declined from 6.2B in 2024 to 5.1B in 2025, a sharp 17.5% drop. Net income fell 30%, from 833M to 579M, reflecting margin pressure. Gross margin remained favorable at 61%, but EBIT and net margins contracted, signaling reduced profitability and efficiency over the year.

Is the Income Statement Favorable?

In 2025, Fortive’s fundamentals show mixed signals. Margins remain solid with a 16.4% EBIT margin and an 11.3% net margin, both favorable by sector standards. However, falling revenue, profit declines, and a 2.3% interest expense ratio weigh on the outlook. Overall, the income statement trends are unfavorable, highlighting risks despite margin resilience.

Financial Ratios

The table below presents key financial ratios for Fortive Corporation (FTV) over the past five fiscal years, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 11.6% | 13.0% | 14.3% | 13.4% | 11.3% |

| ROE | 6.4% | 7.8% | 8.4% | 8.2% | 9.0% |

| ROIC | 5.0% | 6.1% | 6.5% | 6.7% | 7.4% |

| P/E | 33.0 | 22.9 | 22.6 | 23.7 | 30.2 |

| P/B | 2.1 | 1.8 | 1.9 | 1.9 | 2.7 |

| Current Ratio | 0.68 | 0.91 | 2.05 | 1.16 | 0.71 |

| Quick Ratio | 0.54 | 0.71 | 1.75 | 0.91 | 0.58 |

| D/E | 0.44 | 0.35 | 0.37 | 0.38 | 0.50 |

| Debt-to-Assets | 25.2% | 21.5% | 22.5% | 22.8% | 27.3% |

| Interest Coverage | 8.1x | 10.2x | 9.2x | 7.7x | 7.5x |

| Asset Turnover | 0.32 | 0.37 | 0.36 | 0.37 | 0.44 |

| Fixed Asset Turnover | 13.3 | 13.8 | 13.8 | 14.4 | 19.1 |

| Dividend Yield | 0.66% | 0.58% | 0.52% | 0.56% | 0.53% |

Evolution of Financial Ratios

Fortive’s Return on Equity (ROE) showed a modest decline to 8.98% in 2025 from higher levels earlier in the period. The Current Ratio decreased significantly to 0.71, indicating deteriorating liquidity. The Debt-to-Equity Ratio increased moderately but remained around 0.5, reflecting stable leverage. Profitability margins showed some contraction, with net margin dropping to 11.26%, signaling pressure on bottom-line performance.

Are the Financial Ratios Fovorable?

In 2025, Fortive’s profitability is mixed with a favorable net margin but an unfavorable ROE and price-to-earnings ratio (30.16). Liquidity ratios, including current and quick ratios, are unfavorable, suggesting tight short-term financial flexibility. Leverage metrics such as debt-to-equity (0.5) and interest coverage (7.0) are favorable, reflecting manageable debt levels. Efficiency is challenged by a low asset turnover (0.44), despite a strong fixed asset turnover (19.06). Overall, the ratio profile is slightly unfavorable.

Shareholder Return Policy

Fortive Corporation pays dividends consistently, with a payout ratio around 16% in 2025 and a modest dividend yield near 0.53%. The dividend per share has remained stable, supported by solid free cash flow coverage, indicating prudent capital allocation.

The company also engages in share buybacks, complementing its return policy. This balanced approach suggests Fortive aims for sustainable shareholder value, avoiding excessive distributions or buybacks that could strain financial flexibility.

Score analysis

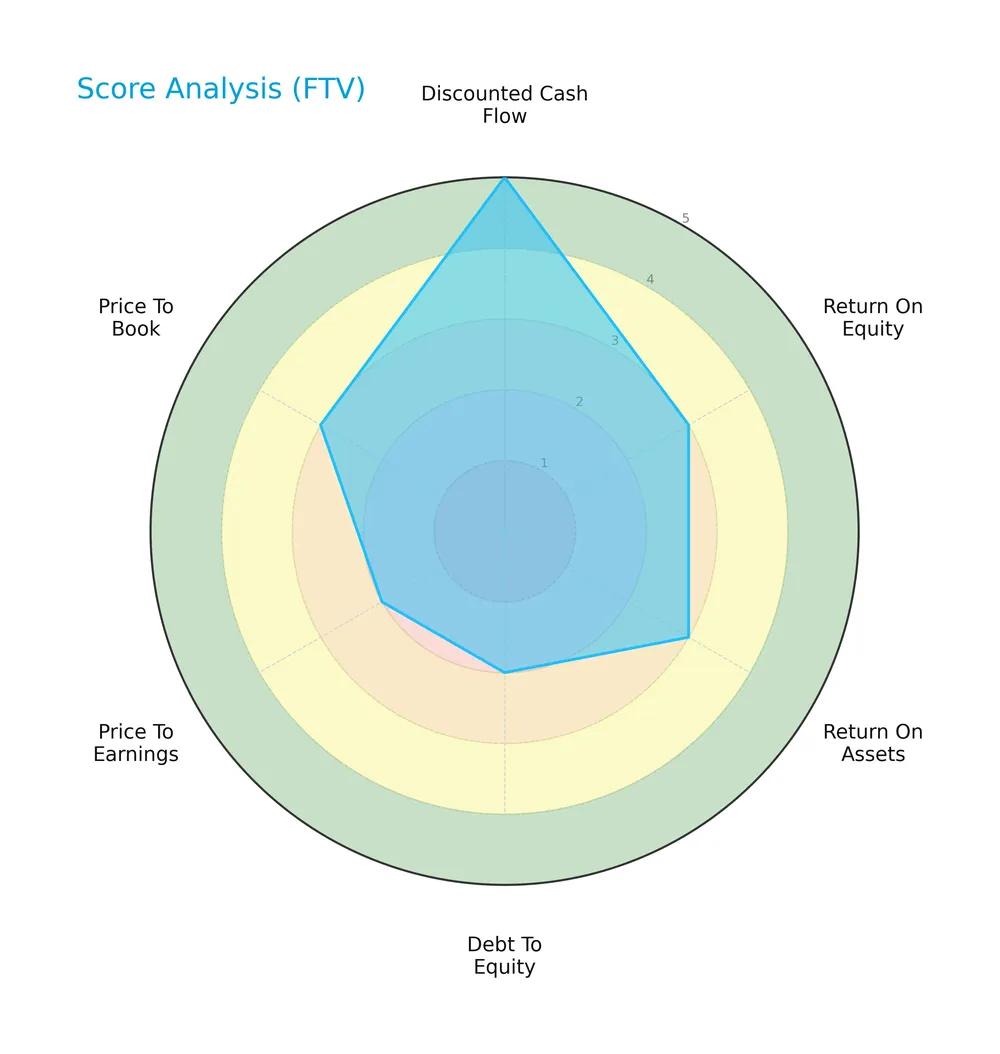

The following radar chart presents a comprehensive view of Fortive Corporation’s key financial scores:

Fortive shows a very favorable discounted cash flow score of 5, indicating strong intrinsic value. Other metrics like ROE, ROA, and price-to-book score are moderate at 3. Debt-to-equity and price-to-earnings scores lag slightly at 2, reflecting moderate leverage and valuation concerns.

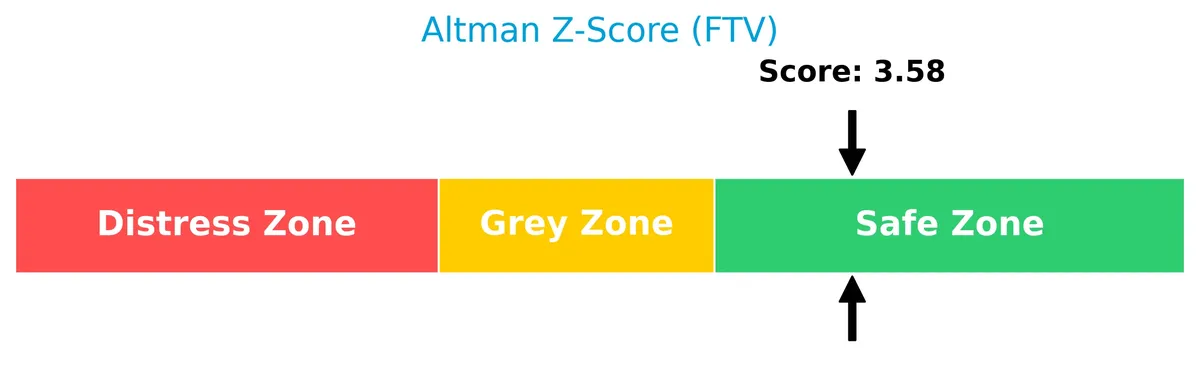

Analysis of the company’s bankruptcy risk

Fortive’s Altman Z-Score of 3.58 places it firmly in the safe zone, signaling low bankruptcy risk and solid financial stability:

Is the company in good financial health?

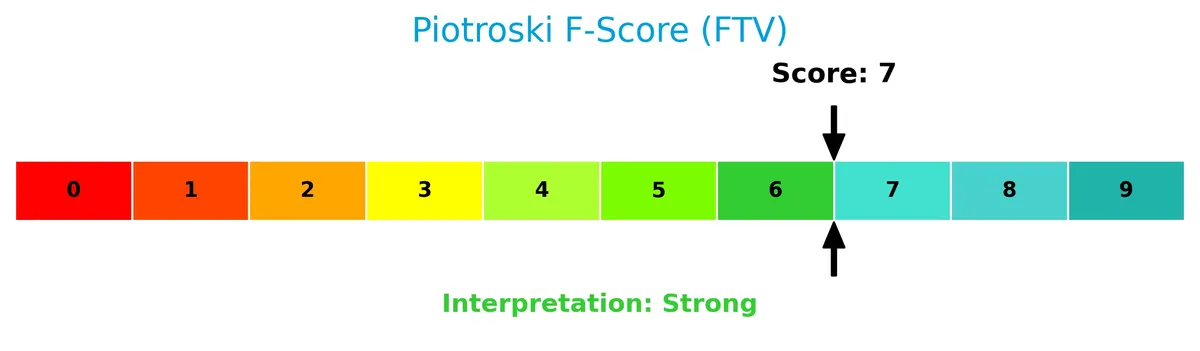

The Piotroski Score diagram highlights Fortive’s financial strength based on nine key criteria:

With a strong Piotroski Score of 7, Fortive demonstrates robust profitability, liquidity, and operational efficiency, suggesting sound overall financial health.

Competitive Landscape & Sector Positioning

This section analyzes Fortive Corporation’s strategic positioning, revenue segments, key products, and main competitors. I will evaluate whether Fortive holds a sustainable competitive advantage in its industry.

Strategic Positioning

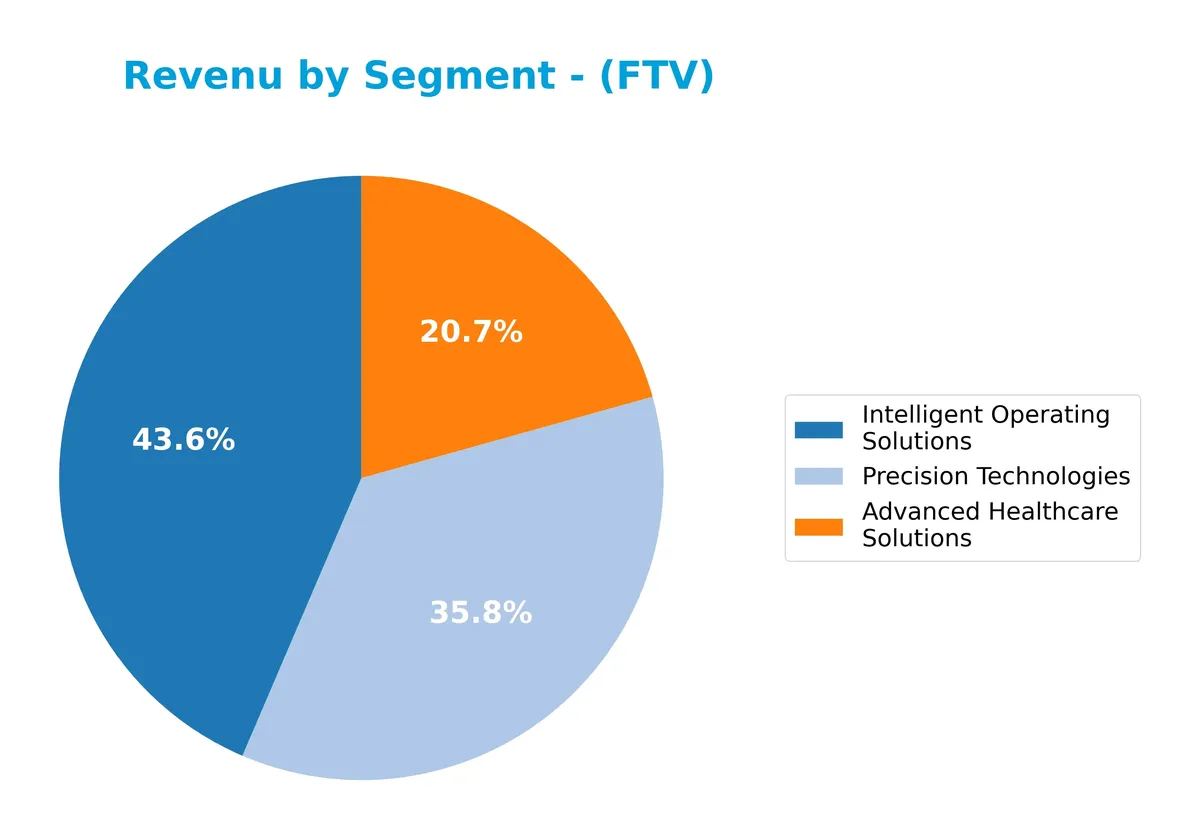

Fortive operates a diversified product portfolio across three segments: Intelligent Operating Solutions (2.7B), Precision Technologies (2.2B), and Advanced Healthcare Solutions (1.3B) as of 2024. Geographically, it relies primarily on the US market (3.4B), with significant exposure to other countries (2.2B) and China (0.65B), reflecting balanced yet US-centric global reach.

Revenue by Segment

This chart presents Fortive Corporation’s revenue breakdown by product segment for the full fiscal year 2024, highlighting contributions from key business units.

In 2024, Intelligent Operating Solutions leads with $2.7B, followed by Precision Technologies at $2.2B, and Advanced Healthcare Solutions at $1.3B. The steady growth in Intelligent Operating Solutions signifies its expanding moat. Advanced Healthcare Solutions shows a slight contraction, signaling potential concentration risks. Overall, the mix reveals a balanced portfolio with a tilt toward automation and precision technologies driving future growth.

Key Products & Brands

Fortive’s product portfolio spans three main segments, covering a diverse range of industrial and healthcare solutions:

| Product | Description |

|---|---|

| Intelligent Operating Solutions | Connected reliability tools, enterprise software for environment, health, safety, and quality, ruggedized test tools, calibration tools, portable gas detection; serves manufacturing, healthcare, utilities, and other industries. Marketed under ACCRUENT, FLUKE, GORDIAN, INDUSTRIAL SCIENTIFIC, INTELEX, PRUFTECHNIK, SERVICECHANNEL. |

| Precision Technologies | Electrical test and measurement instruments, energetic material devices, sensor and control systems for power, medical, aerospace, electronics, and industrial markets. Brands include ANDERSON-NEGELE, GEMS, SETRA, HENGSTLER-DYNAPAR, QUALITROL, PACIFIC SCIENTIFIC, KEITHLEY, TEKTRONIX. |

| Advanced Healthcare Solutions | Hardware and software for instrument reprocessing, tracking, biomedical test tools, radiation safety, asset management, and surgical inventory management systems. Brands include ASP, CENSIS, CENSITRAC, EVOTECH, FLUKE BIOMEDICAL, INVETECH, LANDAUER, RAYSAFE, STERRAD. |

Fortive’s diversified brands target critical industrial and healthcare applications, reinforcing its presence in technology-driven equipment and software markets.

Main Competitors

Fortive Corporation faces 20 competitors in its sector. Below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amphenol Corporation | 171B |

| Corning Incorporated | 77.7B |

| TE Connectivity Ltd. | 68.6B |

| Sandisk Corporation | 40.0B |

| Garmin Ltd. | 38.9B |

| Keysight Technologies, Inc. | 35.5B |

| Celestica Inc. | 34.0B |

| Coherent, Inc. | 28.7B |

| Jabil Inc. | 25.7B |

| Teledyne Technologies Incorporated | 24.4B |

Fortive ranks 11th among 20 competitors, holding about 12% of the leading market cap. It sits below both the average top 10 market cap of 54.5B and the sector median of 21.6B. Fortive maintains a 19.4% gap to the next competitor above, indicating a moderate distance from the top tier.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Fortive have a competitive advantage?

Fortive currently shows a slightly unfavorable competitive advantage as its ROIC remains below WACC, indicating value destruction despite a growing profitability trend. The company’s diverse portfolio spans hardware, software, and services across multiple industrial sectors, supporting operational resilience.

Looking ahead, Fortive’s broad brand lineup and expansion in software solutions and healthcare technologies offer opportunities for market penetration and innovation. Continued investment in connected tools and enterprise software could enhance its competitive positioning in evolving industrial and healthcare markets.

SWOT Analysis

This SWOT analysis highlights Fortive Corporation’s strategic position by examining internal strengths and weaknesses alongside external opportunities and threats.

Strengths

- Diverse portfolio across multiple industrial sectors

- Strong brand recognition with multiple established product lines

- Favorable margins and solid interest coverage

Weaknesses

- Declining revenue growth over recent years

- Weak liquidity ratios with current ratio below 1

- Slightly unfavorable ROIC vs. WACC indicating value destruction

Opportunities

- Expansion in emerging international markets outside the US and China

- Increasing demand for intelligent operating solutions and advanced healthcare tech

- Potential margin improvement from operational efficiencies

Threats

- Intense competition in hardware and industrial software sectors

- Economic sensitivity affecting capital equipment spending

- Currency and geopolitical risks impacting global sales

Fortive exhibits robust operational strengths but faces pressure from declining top-line growth and liquidity constraints. Strategic focus on international expansion and innovation is essential to counteract competitive and macroeconomic risks.

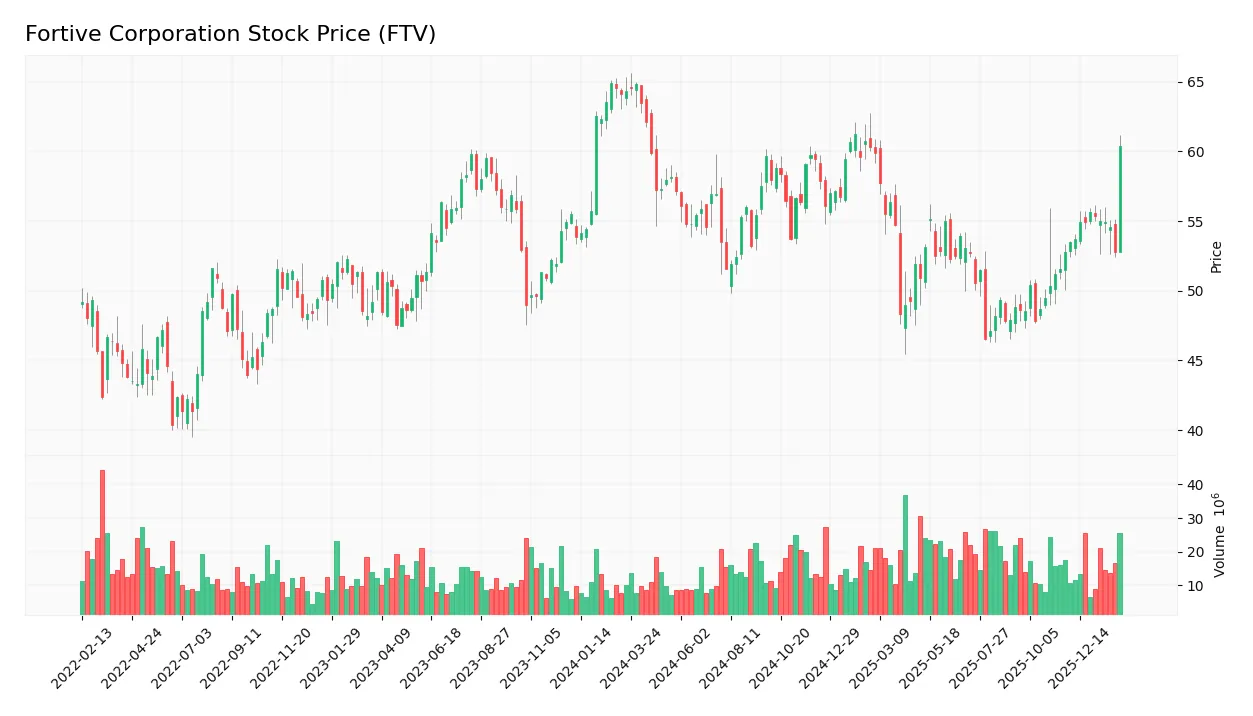

Stock Price Action Analysis

Below is the weekly stock price chart of Fortive Corporation (FTV), illustrating price movements and key levels over the past 100 weeks:

Trend Analysis

Over the past 12 months, Fortive’s stock price declined by 6.07%, indicating a bearish trend with accelerating downward momentum. The price fluctuated between a high of 64.82 and a low of 46.55, showing notable volatility with a standard deviation of 4.17.

Volume Analysis

Trading volume has been increasing overall, with buyers accounting for 53.33% of total activity, suggesting moderate buyer interest. However, in the recent 11-week period, sellers slightly dominated with 54.07% volume, implying cautious investor sentiment and mild selling pressure.

Target Prices

Analysts set a clear target consensus for Fortive Corporation, reflecting cautious optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 51 | 70 | 59.83 |

The target range suggests moderate upside potential with a consensus just under 60, indicating steady confidence without excessive risk appetite.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines Fortive Corporation’s recent analyst ratings alongside consumer feedback to provide balanced insights.

Stock Grades

Here is the latest summary of Fortive Corporation’s stock grades from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Wells Fargo | Maintain | Equal Weight | 2026-02-05 |

| JP Morgan | Downgrade | Underweight | 2026-01-16 |

| Mizuho | Downgrade | Underperform | 2026-01-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-22 |

| Citigroup | Maintain | Neutral | 2025-12-08 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-05 |

| Baird | Maintain | Outperform | 2025-11-04 |

| JP Morgan | Maintain | Neutral | 2025-10-30 |

| Truist Securities | Maintain | Hold | 2025-10-30 |

Recent ratings show a cautious stance, with several firms maintaining neutral or equal-weight grades. Some have downgraded Fortive, signaling increased risk or slowing momentum.

Consumer Opinions

Fortive Corporation evokes a mix of admiration and frustration among its customers, reflecting a complex brand experience.

| Positive Reviews | Negative Reviews |

|---|---|

| “Reliable product quality with consistent performance.” | “Customer service response times are slow.” |

| “Innovative solutions that improve operational efficiency.” | “Pricing is higher than competitors without clear added value.” |

| “Strong technical support that resolves issues effectively.” | “Some software updates caused unexpected disruptions.” |

Overall, consumers praise Fortive’s innovation and product reliability. However, recurring concerns about customer support responsiveness and pricing transparency could impact long-term loyalty.

Risk Analysis

Below is a summary table highlighting Fortive Corporation’s key risks, their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Liquidity Risk | Current ratio at 0.71 signals potential short-term liquidity stress, below industry norms. | High | Medium |

| Valuation Risk | Elevated P/E of 30.16 suggests shares may be overvalued relative to earnings growth prospects. | Medium | High |

| Profitability Risk | ROE at 8.98% underperforms compared to sector average, indicating weaker capital efficiency. | Medium | Medium |

| Market Volatility | Beta of 1.12 indicates sensitivity to market swings, increasing share price volatility. | Medium | Medium |

| Operational Risk | Asset turnover of 0.44 reflects inefficiencies in asset utilization, potentially capping growth. | Medium | Medium |

Fortive’s liquidity risk is the most immediate concern, with a current ratio significantly below 1, raising caution about meeting short-term obligations. The high P/E ratio increases valuation risk amid uncertain earnings momentum. However, the company’s Altman Z-Score firmly places it in the safe zone, reducing bankruptcy worries. Its Piotroski score of 7 reflects strong financial health. Investors must weigh these risks against Fortive’s solid market position and favorable debt metrics.

Should You Buy Fortive Corporation?

Fortive appears to be improving profitability with growing ROIC despite a slightly unfavorable moat, suggesting some value erosion. Its leverage profile remains moderate, supported by a solid Altman Z-Score and a strong Piotroski rating. Overall, the B+ rating could be seen as very favorable.

Strength & Efficiency Pillars

Fortive Corporation exhibits solid profitability with a net margin of 11.26% and a strong gross margin of 60.96%. Its Altman Z-Score of 3.58 places it firmly in the safe zone, indicating financial stability. The Piotroski Score of 7 further confirms its strong financial health. While ROIC at 7.44% slightly trails WACC at 8.26%, the company shows improving profitability trends and maintains a moderate debt-to-equity ratio of 0.5, underscoring prudent capital allocation.

Weaknesses and Drawbacks

The firm faces valuation pressure with a P/E ratio of 30.16, suggesting a premium that could limit upside. Liquidity remains a concern, as reflected in the low current ratio of 0.71 and quick ratio of 0.58, signaling potential short-term cash flow constraints. Additionally, revenue and earnings have declined sharply over the past year, with revenue down 17.48% and EPS down 26.27%. Recent slight seller dominance (45.93% buyer volume) hints at near-term market headwinds.

Our Verdict about Fortive Corporation

Fortive’s long-term fundamentals appear moderately favorable given its strong financial health and profitability metrics. However, ongoing revenue declines and liquidity risks weigh on the outlook. Despite recent seller dominance, the broader volume trend is increasing, which suggests cautious investors might consider waiting for a clearer technical confirmation before committing. The profile may appear suitable for investors with a tolerance for cyclical recovery and valuation risk.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- The Evolution of a Compounder: A Deep-Dive Into Fortive Corp (FTV) – FinancialContent (Feb 05, 2026)

- Fortive Corporation (NYSE:FTV) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 05, 2026)

- Fortive (NYSE:FTV) Stock Price Expected to Rise, Wells Fargo & Company Analyst Says – MarketBeat (Feb 05, 2026)

- Fortive (FTV) grows 10.6% on earnings blowout – MSN (Feb 05, 2026)

- Beyond The Numbers: 7 Analysts Discuss Fortive Stock – Benzinga (Feb 05, 2026)

For more information about Fortive Corporation, please visit the official website: fortive.com