Home > Analyses > Technology > Fortinet, Inc.

Fortinet shapes the backbone of digital defense, safeguarding enterprises and governments worldwide. Its broad portfolio of integrated cybersecurity solutions—ranging from FortiGate firewalls to advanced endpoint protection—sets industry standards for innovation and reliability. Known for seamless automation and robust threat detection, Fortinet dominates the infrastructure software sector. As cyber risks evolve, I ask: do Fortinet’s fundamentals still justify its premium valuation and promise of sustained growth?

Table of contents

Business Model & Company Overview

Fortinet, Inc., founded in 2000 and headquartered in Sunnyvale, California, stands as a powerhouse in the cybersecurity ecosystem. It integrates hardware and software to defend networks globally. Its portfolio spans firewalls, threat prevention, secure switching, and endpoint protection, creating a cohesive shield across industries from telecommunications to healthcare. Fortinet’s scale reflects in its 14.5K employees driving innovation and market leadership.

The company’s revenue engine blends FortiGate hardware with diverse software licenses and recurring security subscriptions. This hybrid model fuels steady cash flow while expanding its footprint in the Americas, Europe, Asia, and beyond. Fortinet’s integrated solutions and strategic alliances, such as with Linksys, forge a robust economic moat. It shapes the future of cybersecurity by setting industry standards for comprehensive defense.

Financial Performance & Fundamental Metrics

I analyze Fortinet, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder return strategy.

Income Statement

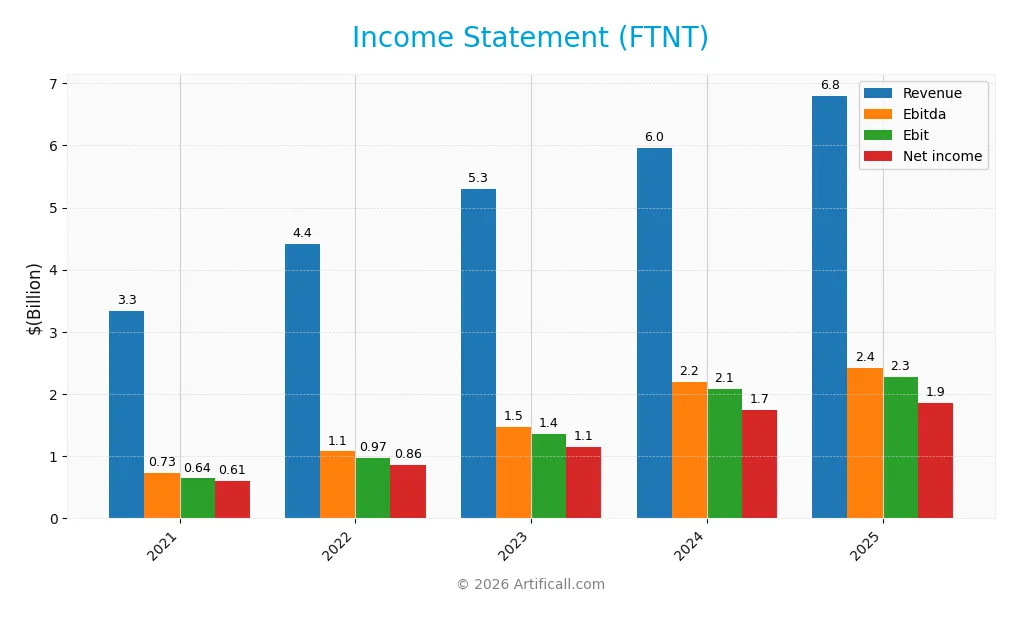

The table below presents Fortinet, Inc.’s income statement summary for fiscal years 2021 through 2025, reflecting key profitability and expense metrics.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 3.34B | 4.42B | 5.30B | 5.96B | 6.80B |

| Cost of Revenue | 783M | 1.08B | 1.24B | 1.16B | 1.30B |

| Operating Expenses | 1.91B | 2.36B | 2.83B | 2.99B | 3.42B |

| Gross Profit | 2.56B | 3.33B | 4.07B | 4.80B | 5.50B |

| EBITDA | 728M | 1.08B | 1.47B | 2.20B | 2.42B |

| EBIT | 643M | 974M | 1.35B | 2.08B | 2.27B |

| Interest Expense | 15M | 18M | 21M | 20M | 20M |

| Net Income | 607M | 857M | 1.15B | 1.75B | 1.85B |

| EPS | 0.74 | 1.08 | 1.47 | 2.28 | 2.44 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-02-26 | 2025-02-21 | 2026-02-05 |

Income Statement Evolution

Fortinet’s revenue more than doubled from 3.34B in 2021 to 6.80B in 2025, a 103% growth. Net income surged 205% to 1.85B over the same period. Gross and EBIT margins remained robust and stable, above 80% and 33% respectively. However, net margin growth slowed, contracting slightly in the last year despite overall margin improvement.

Is the Income Statement Favorable?

In 2025, Fortinet reported strong fundamentals with revenue growing 14.2% and EBIT up 9.3%, reflecting efficient cost control. Gross margin stood at 80.8%, supporting an EBIT margin of 33.4%. Interest expense remained minimal at 0.3% of revenue. Despite a slight 7% net margin decline, earnings per share rose 7.5%. Overall, the income statement trends are favorable and demonstrate solid profitability.

Financial Ratios

The table below summarizes key financial ratios for Fortinet, Inc. over the last five fiscal years, providing insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 18% | 19% | 22% | 29% | 27% |

| ROE | 78% | -304% | -248% | 117% | 150% |

| ROIC | 18% | 30% | 31% | 27% | 29% |

| P/E | 97 | 45 | 40 | 41 | 32 |

| P/B | 75 | -137 | -98 | 48 | 49 |

| Current Ratio | 1.55 | 1.24 | 1.19 | 1.47 | 1.17 |

| Quick Ratio | 1.48 | 1.15 | 1.06 | 1.39 | 1.09 |

| D/E | 1.26 | -3.52 | -2.14 | 0.67 | 0.81 |

| Debt-to-Assets | 17% | 16% | 14% | 10% | 10% |

| Interest Coverage | 44x | 54x | 59x | 90x | 104x |

| Asset Turnover | 0.56 | 0.71 | 0.73 | 0.61 | 0.65 |

| Fixed Asset Turnover | 4.86 | 4.92 | 5.08 | 4.41 | 4.20 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Fortinet’s Return on Equity (ROE) surged to 150% in 2025, reflecting sharp profitability gains. The Current Ratio declined from 1.55 in 2021 to 1.17 in 2025, signaling reduced liquidity. Debt-to-Equity ratio stabilized near 0.8 after volatile swings, indicating more consistent leverage management over the period.

Are the Financial Ratios Favorable?

In 2025, profitability ratios like net margin (27%) and ROE (150%) are strongly favorable, underscoring efficient capital use. Liquidity is neutral to favorable, with a current ratio of 1.17 and quick ratio above 1. Debt levels are moderate with a 9.6% debt-to-assets ratio. Market multiples such as P/E (32.5) and P/B (48.6) appear stretched, tempering overall optimism. The global view rates Fortinet’s ratios as slightly favorable.

Shareholder Return Policy

Fortinet, Inc. (FTNT) does not pay dividends, reflecting a strategic focus on reinvestment and growth. The company maintains a zero dividend payout ratio and yield, while prioritizing free cash flow generation and capital expenditures to support ongoing expansion.

The absence of dividend distributions aligns with FTNT’s high growth phase and emphasis on strengthening its business. Although no dividends are paid, the company does not engage in share buybacks, indicating a conservative capital allocation approach consistent with sustainable long-term shareholder value creation.

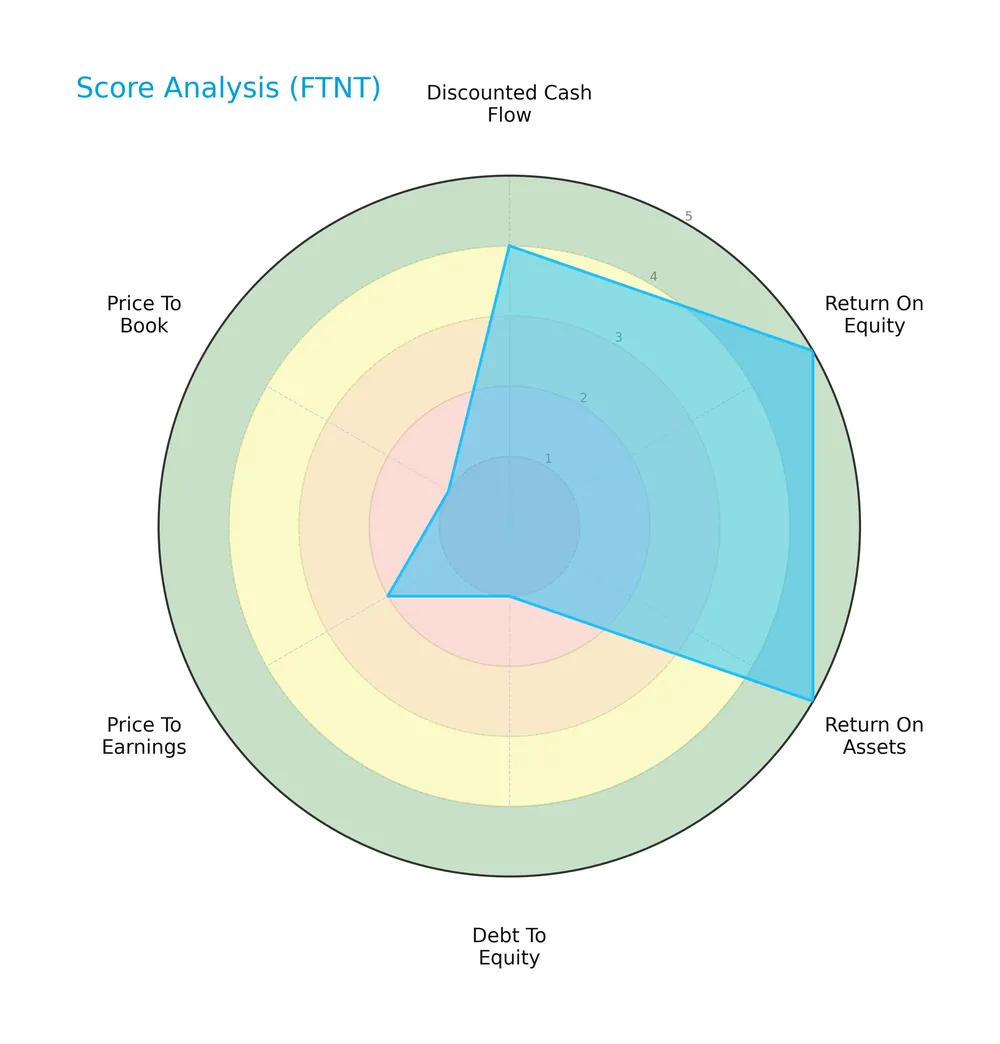

Score analysis

Below is a radar chart illustrating Fortinet, Inc.’s key financial metric scores for a comprehensive view:

Fortinet scores very favorably on return on equity and assets, indicating strong profitability. The discounted cash flow is favorable, but debt-to-equity, price-to-earnings, and price-to-book scores are weak, signaling valuation and leverage concerns.

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Fortinet safely above distress levels, suggesting a low bankruptcy risk:

Is the company in good financial health?

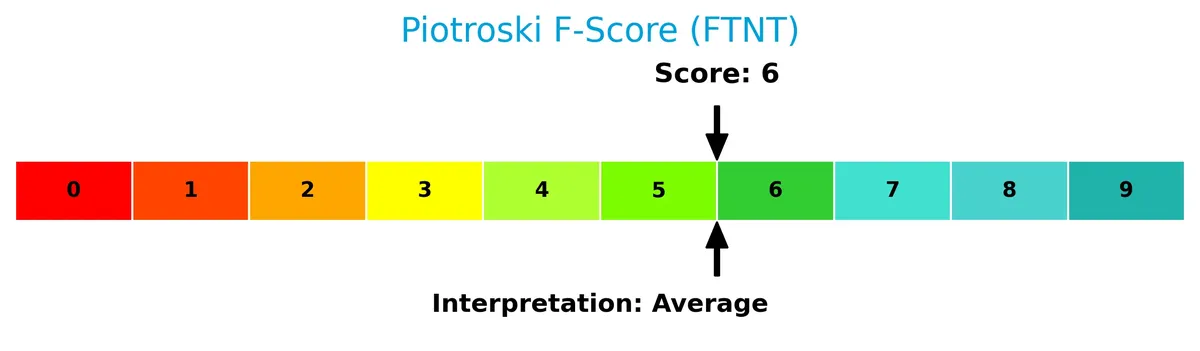

The Piotroski Score diagram outlines Fortinet’s moderate financial strength based on profitability, leverage, and efficiency:

A score of 6 indicates average financial health—better than weak but short of strong—reflecting some room for improvement in operational and financial metrics.

Competitive Landscape & Sector Positioning

This analysis examines Fortinet, Inc.’s position within the software infrastructure sector, focusing on its strategic and product segmentation. I will assess its competitive advantages relative to key industry peers.

Strategic Positioning

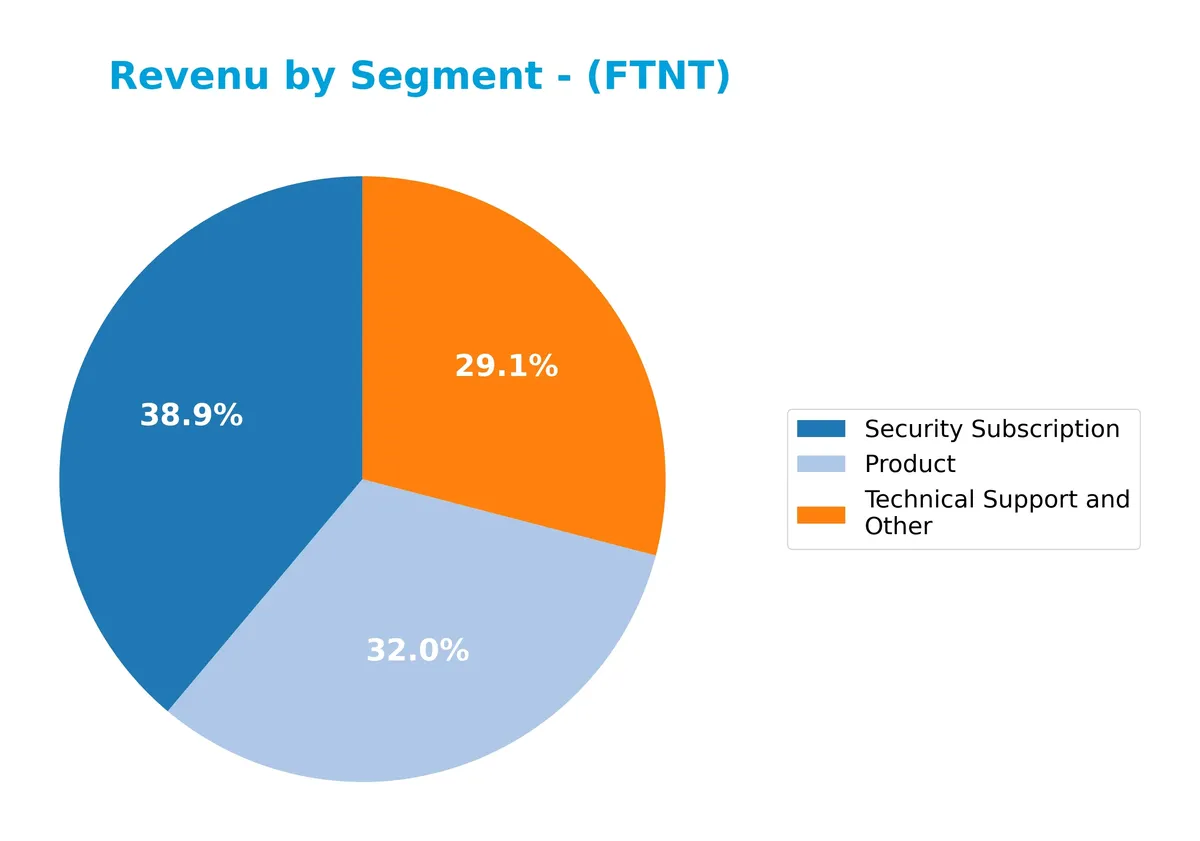

Fortinet, Inc. maintains a diversified product portfolio spanning hardware, software, subscriptions, and services, with 2024 revenues roughly balanced between products (1.9B) and security subscriptions (2.3B). Geographically, it achieves broad exposure across Americas (2.4B), EMEA (2.4B), and Asia Pacific (1.1B), reflecting a well-distributed global footprint.

Revenue by Segment

This pie chart illustrates Fortinet, Inc.’s revenue breakdown by segment for the fiscal year 2024, highlighting product, security subscription, and technical support streams.

Fortinet’s revenue shows robust growth in Security Subscription, reaching $2.3B in 2024, up from $1.9B in 2023, signaling strong recurring income. Product sales remain stable near $1.9B, while Technical Support climbs to $1.7B, reflecting growing demand for service excellence. The trend confirms a strategic shift toward subscription-based security, reducing concentration risk and enhancing predictable cash flow.

Key Products & Brands

Fortinet’s revenue sources span hardware products, security subscriptions, and support services, reflecting its diversified cybersecurity offerings:

| Product | Description |

|---|---|

| FortiGate Hardware and Software Licenses | Security and networking functions including firewall, intrusion prevention, VPN, anti-malware, application control, web filtering, and WAN acceleration. |

| FortiSwitch | Secure switching solutions connecting end devices to customer networks. |

| FortiAP | Secure wireless networking product family. |

| FortiExtender | Hardware appliance extending network connectivity. |

| FortiAnalyzer | Centralized network logging, analysis, and reporting solutions. |

| FortiManager | Centralized, scalable management for FortiGate products. |

| FortiWeb | Web application firewall solutions. |

| FortiMail | Secure email gateway solutions. |

| FortiSandbox | Proactive detection and mitigation technology. |

| FortiClient | Endpoint protection with anti-malware, exploit protection, web filtering, and application firewall. |

| FortiToken and FortiAuthenticator | Multi-factor authentication products safeguarding systems and data. |

| FortiEDR/XDR | Endpoint protection with machine-learning anti-malware and real-time post-infection defense. |

| Security Subscription | Recurring revenue from software updates, threat intelligence, and security services. |

| Technical Support and Other Services | Professional services, technical support, and training offerings. |

Fortinet’s product suite integrates hardware, software, and subscription services, enabling comprehensive cybersecurity solutions with recurring revenue growth. The balance between product sales and security subscriptions reflects a mature business model in infrastructure software.

Main Competitors

The sector includes 32 competitors; below is a table of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.5T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

Fortinet ranks 9th among its 32 competitors. It holds 1.8% of the market cap of the leader, Microsoft. The company is below the average market cap of the top 10 (508B) but above the median market cap of the sector (18.8B). It maintains an 8.9% gap with its closest rival above, Cloudflare.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Fortinet have a competitive advantage?

Fortinet demonstrates a clear competitive advantage, with a very favorable moat status supported by a 20% ROIC above WACC and a 63% rising ROIC trend. The company creates value efficiently, sustaining profitability through diverse cybersecurity solutions across global markets.

Looking ahead, Fortinet’s broad product portfolio and strategic alliances position it well to capture growth in expanding cybersecurity needs worldwide. Continued innovation in integrated security and network management solutions could drive further market penetration and revenue expansion.

SWOT Analysis

This analysis highlights Fortinet’s internal capabilities and external challenges to guide strategic decisions.

Strengths

- strong 80.8% gross margin

- ROIC of 28.8% far above WACC

- robust global revenue growth over 100% (2021-2025)

Weaknesses

- high PE ratio at 32.5 signals expensive valuation

- elevated PB ratio at 48.6 raises concern

- debt-to-equity score very unfavorable

Opportunities

- expanding cybersecurity demand globally

- strategic alliances enhancing product ecosystem

- rising adoption of integrated security solutions

Threats

- intense competition in cybersecurity sector

- rapid tech changes require ongoing innovation

- margin pressures from pricing wars

Fortinet’s impressive profitability and moat support its leadership in cybersecurity. Yet, valuation risks and fierce competition require disciplined capital allocation and innovation focus.

Stock Price Action Analysis

The weekly stock chart for Fortinet, Inc. (FTNT) reveals price movements and key levels over the past 12 months:

Trend Analysis

Over the past year, FTNT’s stock price increased 24.04%, signaling a bullish trend. Volatility remains elevated with a 15.07% standard deviation. The price peaked at 111.64 and bottomed at 56.51. However, recent upward momentum shows deceleration, indicating cautious strength.

Volume Analysis

In the last three months, trading volume has been decreasing. Sellers slightly outnumber buyers, with buyer dominance at 48.07%. This neutral buyer behavior and declining volume suggest subdued investor enthusiasm and lower market participation.

Target Prices

Analysts set a robust target consensus for Fortinet, Inc., signaling confidence in its growth prospects.

| Target Low | Target High | Consensus |

|---|---|---|

| 70 | 90 | 85 |

The target range suggests a positive outlook, with most analysts expecting Fortinet’s stock to appreciate significantly from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews Fortinet, Inc.’s analyst grades and consumer feedback to gauge market sentiment and product reception.

Stock Grades

Here is the latest snapshot of Fortinet, Inc.’s analyst grades from established firms as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Underweight | 2026-02-06 |

| Mizuho | Maintain | Underperform | 2026-02-06 |

| Wedbush | Maintain | Outperform | 2026-02-06 |

| Rosenblatt | Maintain | Buy | 2026-02-06 |

| RBC Capital | Maintain | Sector Perform | 2026-02-06 |

| Scotiabank | Downgrade | Sector Perform | 2026-02-02 |

| JP Morgan | Maintain | Underweight | 2026-01-30 |

| Rosenblatt | Upgrade | Buy | 2026-01-29 |

| TD Cowen | Upgrade | Buy | 2026-01-23 |

| Citigroup | Maintain | Neutral | 2026-01-13 |

The grading landscape exhibits a balance between cautious underweight and hold ratings, countered by several upgrades to buy and outperform. This mix signals varied analyst perspectives with no clear consensus shift.

Consumer Opinions

Fortinet, Inc. garners strong consumer loyalty thanks to its robust security solutions, though some users express concerns over pricing and complexity.

| Positive Reviews | Negative Reviews |

|---|---|

| Excellent threat detection with minimal false alarms | Higher cost compared to competitors |

| Reliable performance during high traffic periods | Steep learning curve for new users |

| Responsive customer support and timely updates | Occasional software glitches reported |

Overall, consumers praise Fortinet’s security effectiveness and support. However, pricing and usability pose consistent challenges, suggesting a trade-off between advanced features and user experience.

Risk Analysis

Below is a summary of Fortinet, Inc.’s key risks, categorized by type, with their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | High price-to-book (48.64) and price-to-earnings (32.48) ratios suggest the stock may be overvalued. | Medium | High |

| Competitive Risk | Intense competition in cybersecurity could pressure margins and market share. | Medium | Medium |

| Leverage Risk | Debt-to-equity ratio of 0.81 is moderate but debt service remains manageable given interest coverage of 113x. | Low | Medium |

| Liquidity Risk | Current ratio at 1.17 is adequate but close to the lower threshold, limiting short-term flexibility. | Medium | Medium |

| Market Risk | Beta near 1.05 indicates stock price moves close to market volatility, exposing investors to systemic risk. | High | Medium |

| Innovation Risk | Cybersecurity demands rapid innovation; failure to keep pace risks obsolescence. | Medium | High |

The most pressing concerns are valuation risk due to stretched multiples and market risk reflecting broader tech volatility. Despite strong profitability and a safe Altman Z-Score above 5.4, Fortinet’s average Piotroski score of 6 signals room for operational improvement amid competitive pressures. Investors should weigh these factors carefully before committing capital.

Should You Buy Fortinet, Inc.?

Fortinet appears to be a robust value creator with a durable competitive moat, supported by growing ROIC well above WACC. Despite a very favorable rating of B+, the company’s leverage profile could be seen as a notable risk factor.

Strength & Efficiency Pillars

Fortinet, Inc. exhibits robust profitability with a net margin of 27.26% and an exceptional return on equity of 149.77%. The company’s return on invested capital (ROIC) stands at 28.76%, significantly above its weighted average cost of capital (WACC) of 8.62%. This spread confirms Fortinet as a value creator, generating returns that exceed its capital costs. Operational efficiency is further underscored by a strong gross margin of 80.84% and an EBIT margin of 33.4%, reflecting disciplined cost management and solid pricing power.

Weaknesses and Drawbacks

Despite these strengths, Fortinet faces valuation concerns, with a high price-to-earnings ratio of 32.48 and an elevated price-to-book ratio of 48.64, suggesting a premium market valuation that may limit upside. The company’s debt-to-equity ratio is moderate at 0.81 but flagged as neutral, while liquidity metrics like a current ratio of 1.17 offer limited cushion against short-term obligations. Recent buyer dominance has waned to 48.07%, indicating neutral market sentiment and potential near-term volatility.

Our Final Verdict about Fortinet, Inc.

Fortinet presents a fundamentally strong profile with clear value creation and operational excellence. Its bullish long-term trend combined with solid financial metrics suggests it may appear attractive for long-term exposure. However, the recent neutral buyer behavior advises a cautious stance, as market momentum seems to be slowing. Investors might consider waiting for a more favorable entry point before committing capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Cybersecurity giant Fortinet adds $1B to buyback after $6.8B sales year – stocktitan.net (Feb 05, 2026)

- Fortinet Stock Jumps After Surprising Q4 Results And Outlook – Benzinga (Feb 06, 2026)

- Fortinet fourth quarter earnings beat driven by enterprise demand – Proactive financial news (Feb 06, 2026)

- Fortinet, Inc. (FTNT): A Bull Case Theory – Yahoo Finance (Feb 03, 2026)

- Fortinet, Inc. (NASDAQ:FTNT) Q4 2025 Earnings Call Transcript – Insider Monkey (Feb 06, 2026)

For more information about Fortinet, Inc., please visit the official website: fortinet.com