Home > Analyses > Technology > Fiserv, Inc.

Fiserv, Inc. powers the digital backbone of global payments and financial services, shaping how millions transact daily. Its cloud-based Clover platform and comprehensive payment solutions redefine merchant and banking experiences. Known for innovation and robust security, Fiserv dominates a critical niche in fintech infrastructure. As the industry evolves rapidly, I ask whether Fiserv’s current fundamentals support its valuation and growth prospects in this competitive, technology-driven arena.

Table of contents

Business Model & Company Overview

Fiserv, Inc. stands as a global leader in information technology services focused on payment and financial solutions. Founded in 1984 and headquartered in Milwaukee, Wisconsin, it integrates point-of-sale, digital commerce, and financial management into a seamless ecosystem. This approach drives innovation for banks, merchants, and corporate clients worldwide, leveraging platforms like Clover to unify cloud-based business management with powerful security tools.

The company’s revenue engine balances hardware-driven merchant acquiring with software and recurring digital payment services. It operates across the Americas, Europe, and Asia, delivering card processing, fraud protection, and digital banking products. Fiserv’s competitive advantage lies in its broad market reach and integrated offerings, creating a durable economic moat that shapes the future of global financial technology.

Financial Performance & Fundamental Metrics

I will analyze Fiserv, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value.

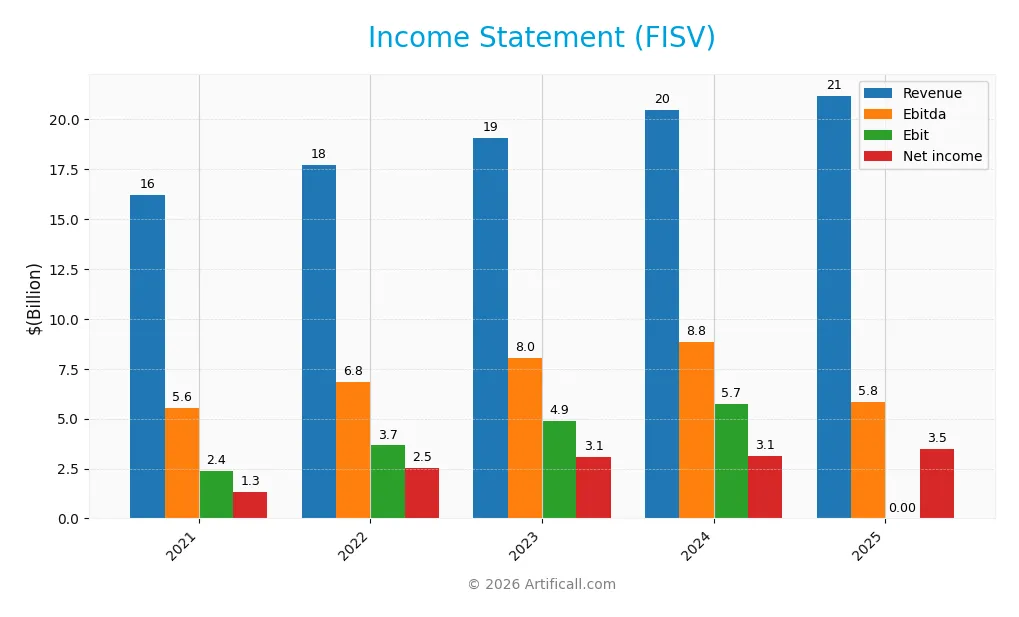

Income Statement

Below is Fiserv, Inc.’s income statement summary for fiscal years 2021 through 2025. It highlights key profitability and expense metrics critical for financial analysis.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 16.2B | 17.7B | 19.1B | 20.5B | 21.2B |

| Cost of Revenue | 8.1B | 8.0B | 7.7B | 8.0B | 0 |

| Operating Expenses | 5.8B | 6.0B | 6.4B | 6.6B | 6.9B |

| Gross Profit | 8.1B | 9.7B | 11.4B | 12.4B | 0 |

| EBITDA | 5.6B | 6.8B | 8.0B | 8.8B | 5.8B |

| EBIT | 2.4B | 3.7B | 4.9B | 5.7B | 0 |

| Interest Expense | 696M | 746M | 1.0B | 1.2B | 1.5B |

| Net Income | 1.3B | 2.5B | 3.1B | 3.1B | 3.5B |

| EPS | 2.01 | 3.94 | 5.02 | 5.41 | 6.34 |

| Filing Date | 2021-12-31 | 2022-12-31 | 2023-12-31 | 2025-02-20 | 2026-02-10 |

Income Statement Evolution

Fiserv’s revenue grew steadily from $16.2B in 2021 to $21.2B in 2025, a 30.6% increase over five years. Net income surged 161% to $3.48B, boosting net margins to a favorable 16.4%. However, gross profit and EBIT margins deteriorated sharply in 2025, indicating pressure on core profitability despite top-line gains.

Is the Income Statement Favorable?

The 2025 income statement shows mixed fundamentals. Revenue growth of 3.6% was moderate, but gross profit and EBIT declined significantly, signaling margin compression. Interest expense improved, supporting net margin expansion and a 17.8% EPS increase. Overall, the income statement reflects solid bottom-line growth amid operational challenges, resulting in a generally favorable assessment.

Financial Ratios

The table below presents key financial ratios for Fiserv, Inc. (FISV) over the fiscal years 2021 to 2025, highlighting profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 8.2% | 14.3% | 16.1% | 15.3% | 16.4% |

| ROE | 4.3% | 8.2% | 10.3% | 11.6% | – |

| ROIC | 3.1% | 5.3% | 6.9% | 8.7% | – |

| P/E | 51.6 | 25.7 | 26.5 | 38.0 | 10.6 |

| P/B | 2.22 | 2.11 | 2.72 | 4.39 | 0 |

| Current Ratio | 1.03 | 1.04 | 1.04 | 1.06 | 0 |

| Quick Ratio | 1.03 | 1.04 | 1.04 | 1.06 | 0 |

| D/E | 0.69 | 0.70 | 0.80 | 0.92 | 0 |

| Debt-to-Assets | 27.9% | 25.7% | 26.3% | 32.3% | 0 |

| Interest Coverage | 3.3x | 5.0x | 5.0x | 4.7x | -3.9x |

| Asset Turnover | 0.21 | 0.21 | 0.21 | 0.27 | 0 |

| Fixed Asset Turnover | 9.31 | 9.06 | 6.85 | 8.62 | 0 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Fiserv’s Return on Equity (ROE) and Current Ratio data are absent for 2025, indicating no reported figures. Historically, ROE showed gradual improvement from 4.3% in 2021 to 11.6% in 2024, while the Current Ratio remained stable around 1.03 to 1.06. Debt-to-Equity Ratio slightly increased from 0.69 in 2021 to 0.92 in 2024, showing moderate leverage growth. Profitability improved steadily, with net profit margin rising from 8.2% in 2021 to 16.4% in 2025.

Are the Financial Ratios Favorable?

In 2025, profitability metrics like net margin (16.4%) and price-to-earnings ratio (10.6) appear favorable. However, liquidity ratios such as Current and Quick Ratios are zero, signaling unfavorable conditions or missing data. Leverage ratios including Debt-to-Equity and Debt-to-Assets remain favorable at zero, while interest coverage is negative, indicating financial stress. Overall, 57% of ratios are unfavorable, 36% favorable, leading to an overall unfavorable assessment.

Shareholder Return Policy

Fiserv, Inc. does not pay dividends, reflecting a reinvestment strategy likely aimed at supporting growth and innovation. The company also does not engage in share buybacks, focusing resources elsewhere rather than returning cash to shareholders directly.

This approach aligns with long-term value creation if reinvestment generates returns above the cost of capital. However, absence of distributions means shareholders rely entirely on capital gains, which requires sustained operational and financial performance.

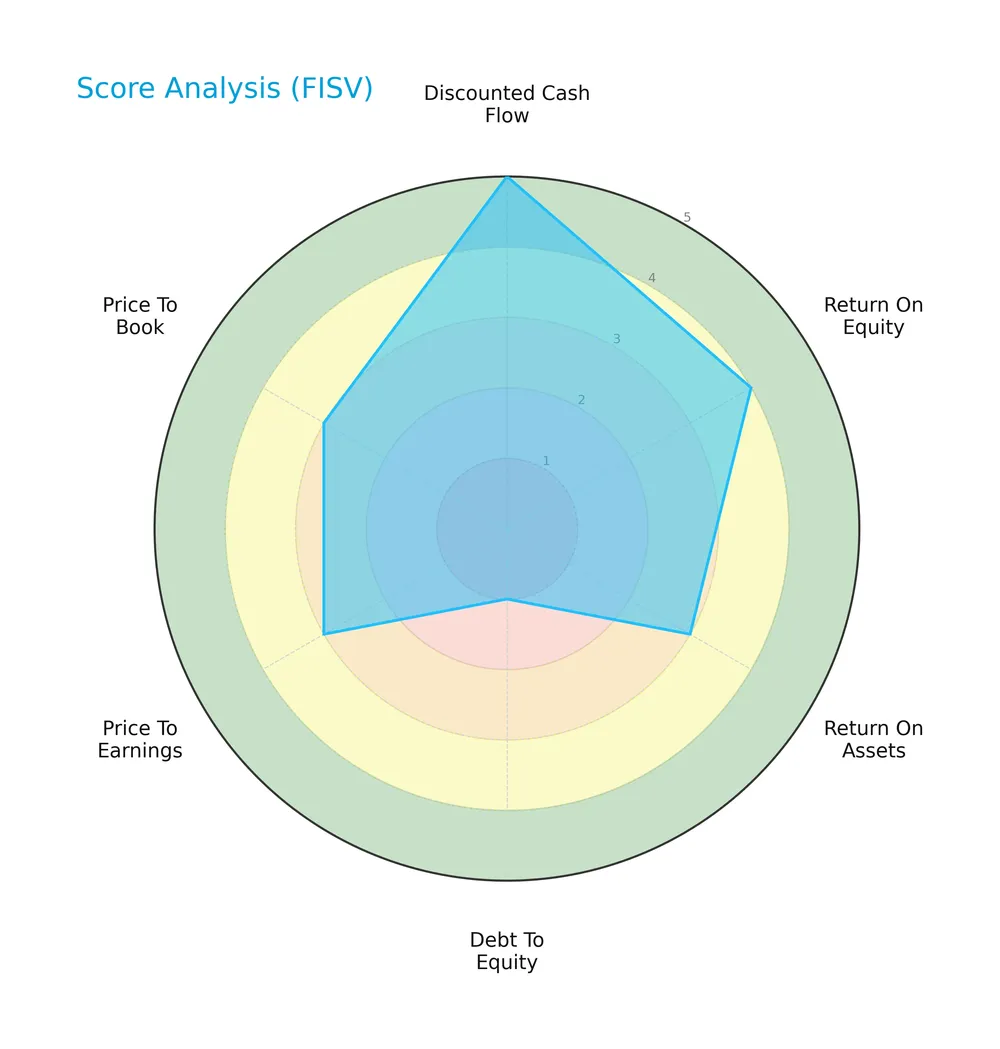

Score analysis

The radar chart below illustrates Fiserv, Inc.’s key financial scores across valuation, profitability, and leverage metrics:

Fiserv scores very favorably on discounted cash flow at 5 and shows favorable return on equity at 4. Return on assets and valuation multiples hover at moderate levels of 3. The debt-to-equity score is very unfavorable at 1, indicating high leverage risk.

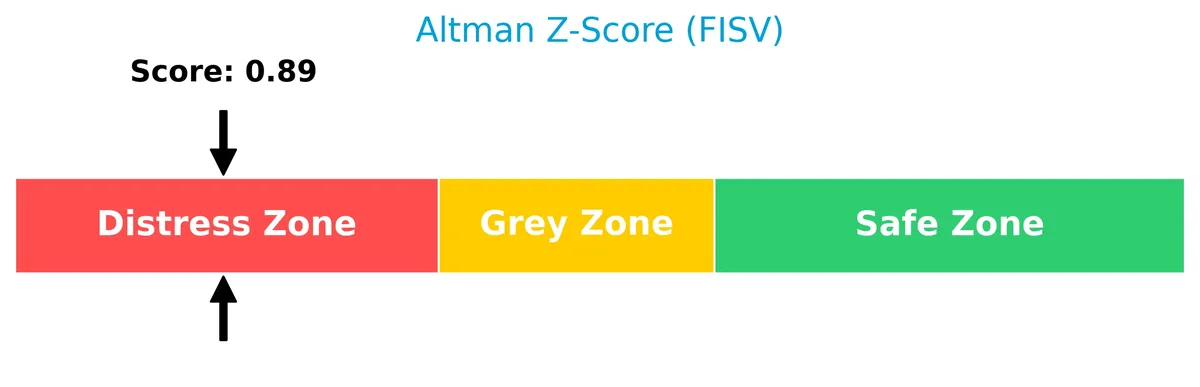

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Fiserv in the distress zone, signaling a high probability of financial distress and bankruptcy risk:

Is the company in good financial health?

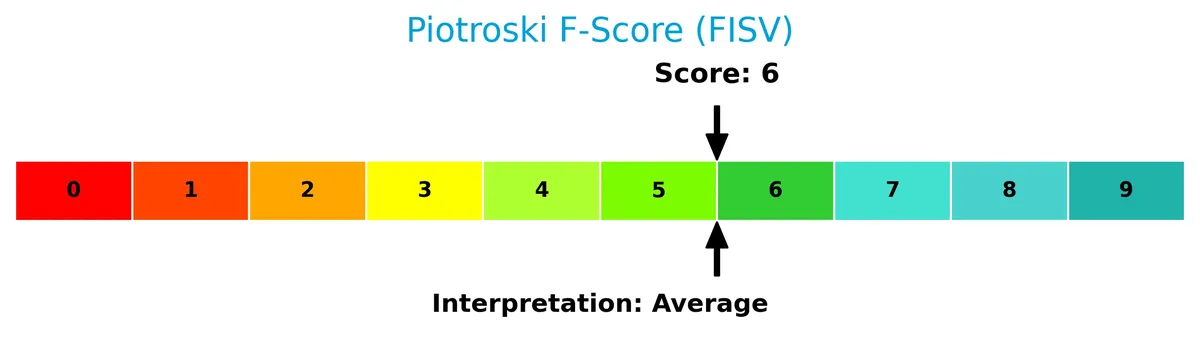

The Piotroski Score diagram provides insight into Fiserv’s financial strength and operational efficiency:

Fiserv’s Piotroski Score of 6 rates as average, suggesting moderate financial health with room for improvement in profitability and balance sheet strength.

Competitive Landscape & Sector Positioning

This section analyzes Fiserv, Inc.’s strategic positioning, revenue streams, key products, and main competitors in the technology sector. I will assess whether Fiserv holds a competitive advantage over its industry peers.

Strategic Positioning

Fiserv, Inc. operates with a diversified product portfolio across three segments: Acceptance, Fintech, and Payments. Its revenue mix shows significant scale in processing and services, complemented by product offerings. Geographic exposure is primarily US-focused, with minor international revenues from Asia Pacific, EMEA, and Latin America.

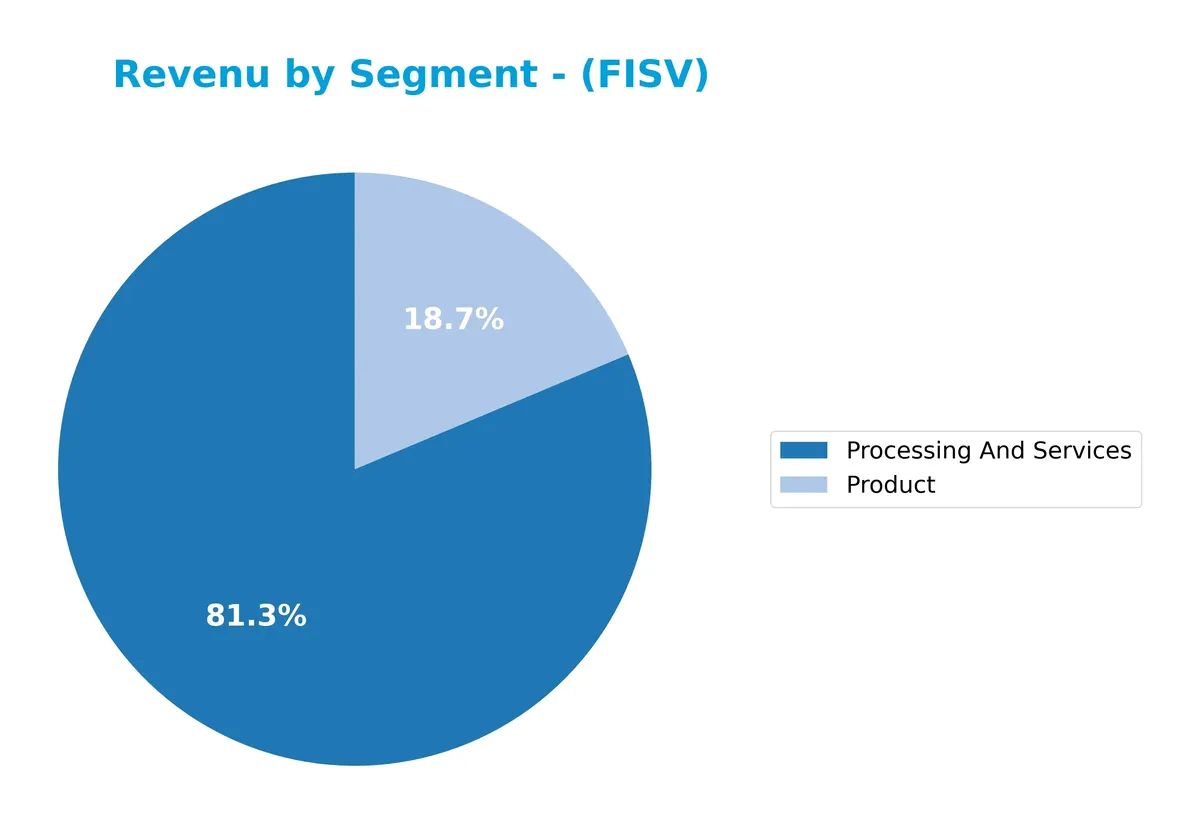

Revenue by Segment

This pie chart displays Fiserv, Inc.’s revenue distribution across key segments for the fiscal year 2024, highlighting their relative contributions to total sales.

In 2024, “Processing And Services” dominates revenue with $16.6B, underscoring its role as the business’s backbone. The “Product” segment contributed $3.8B, signaling diversification. Comparing prior years shows a shift from multiple smaller segments to a streamlined focus, which may concentrate risk but also enhances operational clarity. The recent acceleration in “Processing And Services” revenue confirms its critical importance in Fiserv’s growth strategy.

Key Products & Brands

Fiserv generates revenue from diverse financial technology and payment services, segmented by product lines and business units:

| Product | Description |

|---|---|

| Acceptance Segment | Point-of-sale merchant acquiring, digital commerce, mobile payments, security, Clover POS and platform solutions. |

| Fintech Segment | Digital banking, customer deposit and loan accounts, risk management, professional services, and consulting. |

| Payments And Industry Products Segment | Debit, credit, prepaid card processing, card production, print services, bill payment, and digital payment software. |

| Processing | Core transaction processing services supporting payments and financial operations. |

| Hardware, Print, And Card Production | Physical card manufacturing, printing, and related output solutions like postage. |

| Professional Services | Consulting and implementation services supporting fintech and payment solutions. |

| Software Maintenance | Support and maintenance for proprietary financial software products. |

| License And Termination Fees | Fees related to software licensing and contract terminations. |

| Product and Service, Other | Miscellaneous products and services not classified under primary segments. |

Fiserv’s product portfolio reflects a broad footprint across payment processing, fintech services, and hardware production. The company integrates software platforms with physical and digital payment solutions, serving banks, merchants, and financial institutions globally.

Main Competitors

Fiserv, Inc. operates in a competitive landscape with 16 notable players; below is a list of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| International Business Machines Corporation (IBM) | 272B |

| Accenture plc (ACN) | 162B |

| Cognizant Technology Solutions Corporation (CTSH) | 40B |

| Fiserv, Inc. (FISV) | 36B |

| Fidelity National Information Services, Inc. (FIS) | 34B |

| Wipro Limited (WIT) | 30B |

| Leidos Holdings, Inc. (LDOS) | 23B |

| Gartner, Inc. (IT) | 18B |

| CDW Corporation (CDW) | 17B |

| Jack Henry & Associates, Inc. (JKHY) | 13B |

Fiserv ranks 4th among its top 10 competitors. Its market cap is about 12.5% of IBM’s, the sector leader. Fiserv is below the average market cap of the top 10 players (64.6B) but above the sector median (17.8B). It holds a 17.4% market cap advantage over its nearest larger rival, Cognizant.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Fiserv have a competitive advantage?

Fiserv shows a mixed competitive profile with favorable net margin and EPS growth but unfavorable gross and EBIT margins. The company’s ROIC trend is declining, and the ROIC versus WACC data is unavailable, limiting clear moat assessment.

Looking ahead, Fiserv leverages its diverse segments—Acceptance, Fintech, Payments—and cloud-based platforms like Clover. Expansion in digital banking and fraud protection services offers potential growth in evolving financial technology markets.

SWOT Analysis

This SWOT analysis highlights Fiserv’s key internal and external factors shaping its competitive position and strategic outlook.

Strengths

- Strong net margin of 16.4%

- Diversified payment technology segments

- Solid revenue growth of 30.6% over 5 years

Weaknesses

- Declining ROIC trend

- Distress zone Altman Z-Score

- Weak liquidity ratios (current and quick)

Opportunities

- Expansion in digital payments and fintech

- Growth in emerging markets

- Strategic partnerships with financial institutions

Threats

- Intense competition in fintech sector

- Regulatory and cybersecurity risks

- Pressure on operating expenses and margins

Fiserv’s strengths in margin and growth contrast with its weakening returns and liquidity risks. The company must leverage fintech trends while managing competitive and regulatory pressures to restore financial health.

Stock Price Action Analysis

The weekly stock chart of Fiserv, Inc. (FISV) highlights key price movements and volatility patterns over the past 12 months:

Trend Analysis

Over the past year, FISV’s stock price declined sharply by 59.95%, marking a clear bearish trend with accelerating downside momentum. The price ranged between a high of 235.69 and a low of 60.0, reflecting significant volatility with a standard deviation of 48.8. Recent weeks show a mild 1.82% rise but remain neutral given the slight negative slope.

Volume Analysis

Trading volume has increased overall, totaling approximately 2.57B shares, with sellers accounting for 56.1%. In the last three months, volume remains elevated but slightly seller-dominant at 54.4%, indicating cautious investor sentiment and moderate market participation favoring selling pressure.

Target Prices

Analysts set a wide target price range for Fiserv, reflecting mixed market sentiment.

| Target Low | Target High | Consensus |

|---|---|---|

| 62 | 180 | 105.61 |

The consensus target price of 105.61 suggests moderate upside potential, but the broad range indicates uncertainty about near-term performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest grades and consumer feedback regarding Fiserv, Inc. (FISV) from market analysts and users.

Stock Grades

Here are the latest verified analyst grades for Fiserv, Inc., reflecting recent rating changes and trends:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Tigress Financial | Maintain | Buy | 2025-12-31 |

| Mizuho | Maintain | Outperform | 2025-12-22 |

| Keybanc | Downgrade | Sector Weight | 2025-10-30 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-10-30 |

| Argus Research | Downgrade | Hold | 2025-10-30 |

| Morgan Stanley | Downgrade | Equal Weight | 2025-10-30 |

| UBS | Downgrade | Neutral | 2025-10-30 |

| Truist Securities | Downgrade | Hold | 2025-10-30 |

| JP Morgan | Maintain | Overweight | 2025-10-30 |

| RBC Capital | Maintain | Outperform | 2025-10-30 |

The overall trend shows a cautious shift with multiple downgrades from Buy/Outperform to Hold/Neutral or Sector Weight in late 2025, though several firms retain positive ratings. This suggests mixed sentiment amid evolving market conditions for Fiserv.

Consumer Opinions

Consumers express a mix of admiration and frustration toward Fiserv, Inc.’s services.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable transaction processing with minimal downtime. | Customer support response times are often slow. |

| Intuitive user interface simplifies financial management. | Occasional software glitches disrupt workflow. |

| Strong security measures reassure users about data safety. | Pricing can be high for small businesses. |

Overall, users praise Fiserv’s reliability and security but frequently cite slow customer service and software issues as pain points. Pricing concerns also recur among smaller clients.

Risk Analysis

Below is a summary table highlighting the key risks facing Fiserv, Inc. as of 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score at 0.89 signals high bankruptcy risk, placing Fiserv in distress zone. | High | High |

| Liquidity | Unfavorable current and quick ratios indicate weak short-term liquidity. | Medium | Medium |

| Profitability | Zero ROE and ROIC despite favorable net margin suggest inefficient capital use. | Medium | Medium |

| Leverage | Very unfavorable debt-to-equity score and negative interest coverage ratio. | Medium | High |

| Market Volatility | Beta of 0.78 shows moderate sensitivity to market swings. | Low | Low |

| Dividend Policy | No dividend yield may deter income-focused investors. | Low | Low |

The highest risks stem from Fiserv’s poor financial health, especially its Altman Z-Score in the distress zone, indicating elevated bankruptcy probability. Additionally, liquidity and leverage weaknesses exacerbate financial vulnerability. Despite a favorable net margin and P/E ratio, the company’s inability to generate returns on equity or capital raises red flags. Traders should watch these metrics closely amid evolving market conditions.

Should You Buy Fiserv, Inc.?

Fiserv appears to be a company with moderate profitability and improving operational efficiency, while its competitive moat might be eroding given declining ROIC trends. Despite a substantial leverage profile and distress zone Altman Z-Score, the overall B+ rating suggests a cautiously favorable investment profile.

Strength & Efficiency Pillars

Fiserv, Inc. shows operational resilience with a net margin of 16.42%, reflecting solid profitability. Interest expense at -7.04% also supports earnings stability. Despite an unavailable ROIC and WACC, the favorable net margin and moderate revenue growth (3.6% in the last year, 30.61% overall) indicate efficiency in core operations. However, the lack of data on ROIC versus WACC limits confirmation of value creation. Still, its EPS growth of 17.84% last year signals improving shareholder returns.

Weaknesses and Drawbacks

The company is in financial distress, as evidenced by an Altman Z-Score of 0.89, well below the 1.8 distress threshold, indicating a high bankruptcy risk. This risk overshadows other profitability metrics. Additionally, the debt-to-equity ratio is very unfavorable, raising concerns about leverage. The current and quick ratios are also unfavorable, signaling potential liquidity issues. Market pressure persists with a slightly seller-dominant recent trend (45.6% buyer volume), adding short-term volatility and uncertainty.

Our Final Verdict about Fiserv, Inc.

Despite operational profitability, Fiserv, Inc.’s Altman Z-Score firmly places it in the distress zone, making the investment profile highly speculative. The solvency risk overrides positive earnings growth and margins. Investors should consider this risk carefully, as the company may appear too risky for conservative capital at this stage. A cautious approach remains prudent until financial health improves.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Fiserv Reports Fourth Quarter and Full Year 2025 Results – Fiserv (Feb 10, 2026)

- Fiserv’s earnings beat expectations with recovery from stock plunge – Yahoo Finance (Feb 10, 2026)

- Fiserv to Release Fourth Quarter Earnings Results on February 10, 2026 – Fiserv (Feb 10, 2026)

- Fiserv: Signs Of Stability After A Disastrous Year (NASDAQ:FISV) – Seeking Alpha (Feb 10, 2026)

- Fiserv Inc (FISV) Q4 2025 Earnings Call Highlights: Stable Revenue and Strategic Progress Amid Challenges – GuruFocus (Feb 10, 2026)

For more information about Fiserv, Inc., please visit the official website: fiserv.com