Home > Analyses > Energy > First Solar, Inc.

First Solar, Inc. transforms sunlight into clean, affordable energy, powering communities across the globe with its cutting-edge photovoltaic technology. As a pioneer in the solar industry, First Solar leads with its innovative cadmium telluride modules, balancing efficiency and sustainability. Renowned for quality and scale, it serves a diverse clientele from utilities to commercial developers. As renewable energy demand accelerates, I explore whether First Solar’s strong fundamentals and market position justify its current valuation and growth outlook.

Table of contents

Business Model & Company Overview

First Solar, Inc., founded in 1999 and headquartered in Tempe, Arizona, stands as a dominant player in the solar energy industry. The company has built a cohesive ecosystem centered on designing, manufacturing, and selling cadmium telluride solar modules that efficiently convert sunlight into electricity. Serving a diverse client base including utilities, developers, and commercial operators, First Solar drives the global shift towards sustainable energy through its innovative photovoltaic solutions.

The company’s revenue engine balances hardware sales with ongoing service relationships across key markets in the United States, Japan, France, Canada, India, and Australia. By focusing on cost-efficient, scalable solar module production and comprehensive system support, First Solar secures robust demand and geographic reach. Its strong foothold in multiple continents underscores a strategic advantage, reinforcing a wide economic moat and a pivotal role in shaping the future of renewable energy worldwide.

Financial Performance & Fundamental Metrics

This section analyzes First Solar, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

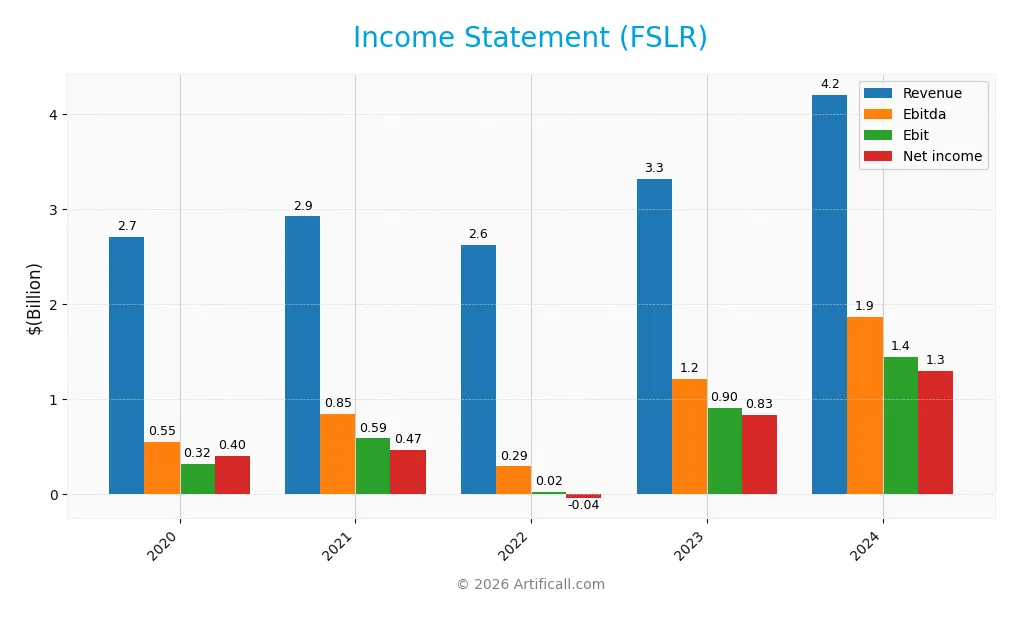

The following table presents First Solar, Inc.’s key income statement figures over the last five fiscal years, reflecting revenue, expenses, and profitability metrics.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 2.71B | 2.92B | 2.62B | 3.32B | 4.21B |

| Cost of Revenue | 2.03B | 2.19B | 2.55B | 2.02B | 2.35B |

| Operating Expenses | 363M | 143M | 97M | 443M | 463M |

| Gross Profit | 681M | 730M | 70M | 1.30B | 1.86B |

| EBITDA | 550M | 845M | 291M | 1.21B | 1.87B |

| EBIT | 317M | 585M | 21M | 904M | 1.45B |

| Interest Expense | 24M | 13M | 12M | 13M | 39M |

| Net Income | 398M | 469M | -44M | 831M | 1.29B |

| EPS | 3.76 | 4.41 | -0.41 | 7.78 | 12.07 |

| Filing Date | 2021-02-26 | 2022-03-01 | 2023-02-28 | 2024-02-27 | 2025-02-25 |

Income Statement Evolution

First Solar, Inc. demonstrated consistent revenue growth from 2020 to 2024, rising 55.14% overall with a notable 26.75% increase from 2023 to 2024. Net income surged significantly by 224.34% over the period, supported by improved net margins that more than doubled, reaching 30.72% in 2024. Both gross and EBIT margins showed favorable expansion, reflecting enhanced operational efficiency.

Is the Income Statement Favorable?

In 2024, First Solar exhibited strong fundamentals with revenues of $4.21B and a net income of $1.29B, yielding a robust net margin of 30.72%. The company’s EBIT margin stood at 34.36%, supported by controlled interest expenses at under 1% of revenue. Profitability metrics, including EPS growth of 55.3% year-over-year, reinforce a positive income statement profile with all key indicators rated favorable.

Financial Ratios

The following table presents key financial ratios for First Solar, Inc. (FSLR) over the fiscal years 2020 to 2024, illustrating profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 15% | 16% | -2% | 25% | 31% |

| ROE | 7% | 8% | -1% | 12% | 16% |

| ROIC | 5.0% | 7.2% | 1.9% | 8.7% | 12.4% |

| P/E | 26.3 | 19.8 | -361.4 | 22.1 | 14.6 |

| P/B | 1.90 | 1.55 | 2.73 | 2.75 | 2.36 |

| Current Ratio | 3.56 | 4.39 | 3.65 | 3.55 | 2.45 |

| Quick Ratio | 2.73 | 3.26 | 2.90 | 2.77 | 1.80 |

| D/E | 0.087 | 0.067 | 0.040 | 0.093 | 0.090 |

| Debt-to-Assets | 6.8% | 5.4% | 2.8% | 6.0% | 5.9% |

| Interest Coverage | 13.2 | 44.8 | -2.2 | 66.1 | 35.9 |

| Asset Turnover | 0.38 | 0.39 | 0.32 | 0.32 | 0.35 |

| Fixed Asset Turnover | 0.94 | 0.95 | 0.72 | 0.74 | 0.76 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Between 2020 and 2024, First Solar’s Return on Equity (ROE) improved significantly from 7.2% to 16.2%, reflecting enhanced profitability. The Current Ratio gradually declined from 4.39 in 2021 to 2.45 in 2024, indicating reduced but still strong liquidity. The Debt-to-Equity Ratio remained low and stable, around 0.09 in 2024, suggesting conservative leverage and financial stability.

Are the Financial Ratios Favorable?

In 2024, First Solar showed generally favorable financial ratios with a strong net margin of 30.7%, a healthy ROE of 16.2%, and a solid Return on Invested Capital (ROIC) at 12.4%. Liquidity ratios, including Current Ratio (2.45) and Quick Ratio (1.8), were favorable, while leverage remained conservative with a Debt-to-Equity Ratio of 0.09 and Debt-to-Assets at 5.9%. However, asset turnover ratios were unfavorable, indicating lower efficiency, and the absence of dividend yield was also noted. Overall, 64% of ratios were favorable, supporting a positive financial profile.

Shareholder Return Policy

First Solar, Inc. (FSLR) does not pay dividends, reflecting a reinvestment strategy likely focused on growth and innovation. The company currently reports negative free cash flow per share, indicating capital allocation prioritizes operations and capital expenditures over shareholder distributions.

No share buybacks are reported, suggesting retained earnings support long-term development rather than immediate shareholder returns. This approach aligns with sustainable value creation if growth investments translate into improved profitability and cash flow over time.

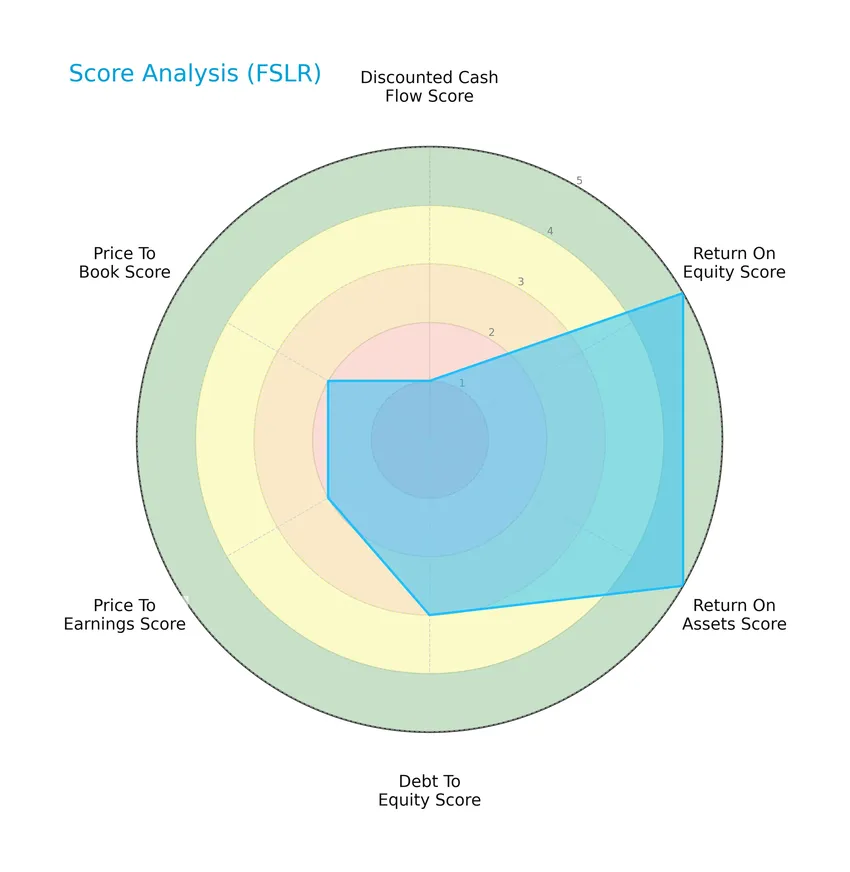

Score analysis

The following radar chart illustrates First Solar, Inc.’s key financial scores across various valuation and profitability metrics:

The company’s scores reveal very favorable returns on equity and assets, a moderate debt-to-equity ratio, and moderate price-to-earnings and price-to-book valuations. However, the discounted cash flow score is very unfavorable, reflecting caution in intrinsic valuation.

Analysis of the company’s bankruptcy risk

First Solar, Inc. exhibits a strong financial position with an Altman Z-Score well within the safe zone, indicating a low risk of bankruptcy:

Is the company in good financial health?

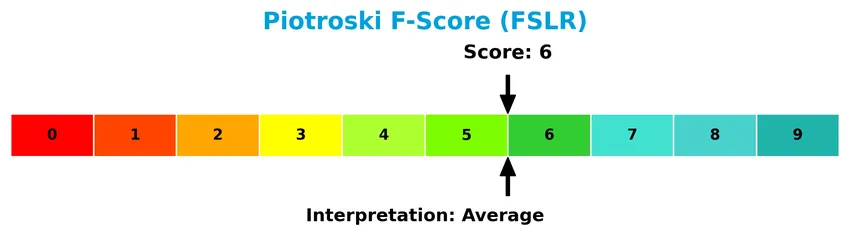

The Piotroski Score diagram provides insights into the company’s financial strength and operational efficiency:

With a Piotroski Score of 6, First Solar, Inc. demonstrates average financial health, suggesting moderate strength but room for improvement in key financial criteria.

Competitive Landscape & Sector Positioning

This section provides an overview of First Solar, Inc.’s sector, focusing on strategic positioning, revenue segments, key products, competitors, and competitive advantages. I will analyze whether First Solar holds a distinct competitive edge within the solar energy industry.

Strategic Positioning

First Solar, Inc. concentrates its product portfolio predominantly on photovoltaic solar modules, with revenue rising to $4.2B in 2024 from $3.3B in 2023. Geographically, the company maintains a diversified presence across the United States, India, France, and other international markets, with the US generating $3.9B in 2024.

Revenue by Segment

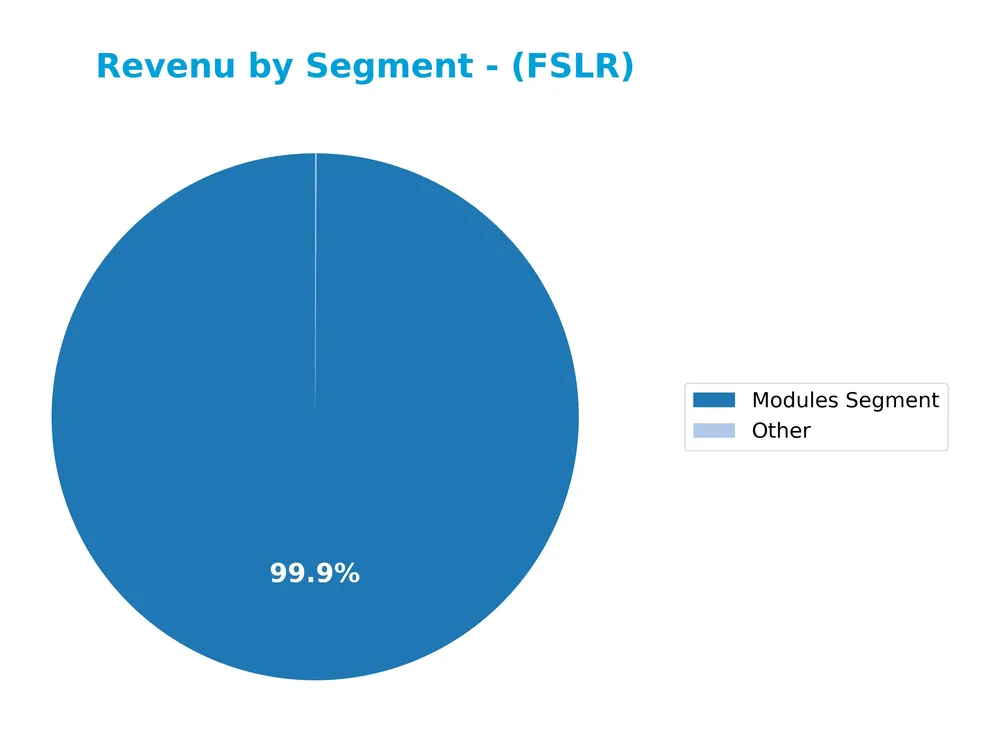

This pie chart illustrates First Solar, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the contributions of different business lines.

In 2024, First Solar’s revenue is overwhelmingly driven by the Modules Segment, which generated $4.2B, showing a strong growth compared to previous years. The “Other” segment remains minimal at $3.6M, indicating a heavy concentration of revenue in solar modules. Over recent years, the Modules Segment has consistently expanded, reflecting First Solar’s focus and expertise in module manufacturing, with limited diversification outside this core business.

Key Products & Brands

The table below presents First Solar, Inc.’s main products and brand descriptions:

| Product | Description |

|---|---|

| Cadmium Telluride Solar Modules | Photovoltaic (PV) solar modules designed, manufactured, and sold by First Solar that convert sunlight into electricity. |

| Solar Energy Solutions | Comprehensive solar energy solutions offered primarily in the United States and internationally, including Japan, France, Canada, India, and Australia. |

First Solar specializes in cadmium telluride solar modules, a core product driving its photovoltaic solar energy solutions globally. The company serves a diverse customer base including system developers, utilities, and commercial operators.

Main Competitors

There are 34 competitors in total, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Exxon Mobil Corporation | 517B |

| Chevron Corporation | 312B |

| ConocoPhillips | 120B |

| The Williams Companies, Inc. | 74.3B |

| Kinder Morgan, Inc. | 61.6B |

| SLB N.V. | 60.1B |

| EOG Resources, Inc. | 58.8B |

| Phillips 66 | 52.6B |

| Valero Energy Corporation | 51.6B |

| Marathon Petroleum Corporation | 49.6B |

First Solar, Inc. ranks 18th among 34 competitors in the energy sector’s solar industry. Its market capitalization is about 5.02% of the top player, Exxon Mobil. The company sits below both the average market cap of the top 10 competitors (136B) and the sector median (31.4B). It maintains a notable 28.39% gap from the next competitor above it, indicating a moderate distance in scale relative to its closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does FSLR have a competitive advantage?

First Solar, Inc. currently does not demonstrate a clear competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating the company is shedding value despite a growing ROIC trend. The overall moat status is slightly favorable, reflecting increasing profitability but no firm economic moat yet.

Looking ahead, First Solar serves multiple international markets including the United States, India, and France, with expanding revenue streams. Continued growth in ROIC and favorable income statement metrics suggest potential opportunities in solar energy solutions and new geographic expansions, which may improve its competitive positioning over time.

SWOT Analysis

This SWOT analysis highlights First Solar, Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to inform strategic investment decisions.

Strengths

- strong revenue growth (26.75% YoY)

- high net margin (30.72%)

- low debt-to-equity ratio (0.09)

Weaknesses

- asset turnover is low (0.35)

- no dividend yield (0%)

- weighted average cost of capital (WACC) above ROIC (11.18% vs 12.44%)

Opportunities

- expanding solar markets in India and US

- increasing global demand for renewable energy

- improving ROIC trend (+147%)

Threats

- intense industry competition

- regulatory and policy risks in key markets

- exposure to raw material price volatility

First Solar’s robust profitability and growth profile position it well to capitalize on global renewable energy trends, though operational efficiency and cost of capital concerns warrant attention. Strategic focus should emphasize scaling production and market penetration while managing competitive and regulatory risks.

Stock Price Action Analysis

The following weekly stock chart illustrates First Solar, Inc.’s price movements and volatility over the last 12 months:

Trend Analysis

Over the past 12 months, First Solar’s stock price increased by 53.21%, indicating a bullish trend with a deceleration phase. The price ranged between a low of 125.93 and a high of 276.74, showing significant volatility with a standard deviation of 41.37. However, recent weeks show a short-term decline of 9.52%, reflecting a mild negative slope.

Volume Analysis

In the last three months, trading volume has been increasing overall, with a total volume exceeding 1.6B shares historically. Recently, volume shows slight seller dominance at 53.47%, suggesting cautious investor sentiment and mild selling pressure. This volume trend indicates active market participation but a cautious stance among traders.

Target Prices

Analysts present a strong target consensus for First Solar, Inc., reflecting optimistic growth expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 330 | 150 | 278.36 |

The target prices suggest a bullish outlook with a high potential upside, while acknowledging some downside risk. Overall, analysts expect First Solar’s stock to appreciate significantly.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to First Solar, Inc. (FSLR).

Stock Grades

Here is the latest overview of First Solar, Inc. stock ratings from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2026-01-22 |

| Guggenheim | Maintain | Buy | 2026-01-08 |

| Jefferies | Downgrade | Hold | 2026-01-07 |

| Wells Fargo | Maintain | Overweight | 2025-12-19 |

| GLJ Research | Maintain | Buy | 2025-11-04 |

| UBS | Maintain | Buy | 2025-11-03 |

| Keybanc | Maintain | Underweight | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| TD Cowen | Maintain | Buy | 2025-10-31 |

| Roth Capital | Maintain | Buy | 2025-10-27 |

The consensus indicates a predominantly positive outlook with most firms maintaining Buy ratings, though there are some Hold and Underweight stances reflecting a range of views on valuation and risk.

Consumer Opinions

Consumers have mixed but generally favorable views on First Solar, Inc., reflecting its strong industry position and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “High-quality solar panels with excellent efficiency.” | “Customer service response times can be slow.” |

| “Innovative technology that leads the market.” | “Installation costs are higher than some competitors.” |

| “Reliable performance and durable products.” | “Limited availability in certain regions.” |

Overall, consumers praise First Solar for its advanced technology and product reliability, while noting concerns about customer service and regional availability.

Risk Analysis

Below is a concise table summarizing the key risk categories, their descriptions, probabilities, and potential impacts for First Solar, Inc.:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | High beta (1.597) indicates sensitivity to market swings, affecting stock price stability. | High | Medium |

| Technology Risk | Dependence on cadmium telluride solar tech may face competition or innovation challenges. | Medium | High |

| Regulatory Risk | Changes in renewable energy policies or tariffs in key markets (US, India, EU) could disrupt. | Medium | High |

| Supply Chain Risk | Global supply chain disruptions could delay manufacturing and delivery of solar modules. | Medium | Medium |

| Financial Risk | Unfavorable WACC (11.18%) suggests cost of capital pressure despite strong profitability. | Medium | Medium |

| Dividend Policy | No dividend yield may deter income-focused investors, impacting stock demand in some segments. | High | Low |

The most significant risks for First Solar are regulatory uncertainties in international markets and technology competition, both with medium probability but high impact. The company’s exposure to market volatility is also notable due to its elevated beta. Recent global shifts in trade policies and accelerating innovation in solar technology underscore these concerns.

Should You Buy First Solar, Inc.?

First Solar, Inc. appears to be delivering improving profitability with a slightly favorable moat characterized by growing ROIC, though it might be shedding value relative to WACC. Supported by a manageable leverage profile and a very favorable B+ rating, the company suggests a profile of moderate financial health and operational efficiency.

Strength & Efficiency Pillars

First Solar, Inc. posts a robust profitability profile, with a net margin of 30.72% and a return on equity (ROE) of 16.2%, underscoring efficient management of capital. Its return on invested capital (ROIC) registers at 12.44%, comfortably exceeding the weighted average cost of capital (WACC) at 11.18%, confirming the company as a value creator. Financial health is further reinforced by a strong Altman Z-Score of 5.16, placing it well within the safe zone, and a Piotroski Score of 6, indicating average but stable financial strength.

Weaknesses and Drawbacks

Despite favorable profitability and financial stability, valuation metrics suggest moderate caution. The price-to-earnings ratio at 14.6 is favorable, but the price-to-book ratio of 2.36 is neutral, potentially reflecting a market premium that limits upside. Leverage remains low with a debt-to-equity ratio of 0.09, and liquidity metrics such as a current ratio of 2.45 and quick ratio of 1.8 are strong, yet the company faces inefficiencies in asset utilization, with unfavorable asset turnover (0.35) and fixed asset turnover (0.76). Additionally, a dividend yield of 0% might deter income-focused investors.

Our Verdict about First Solar, Inc.

The long-term fundamental profile of First Solar appears favorable, driven by solid profitability and financial health, alongside evidence of value creation through ROIC exceeding WACC. However, recent price action is slightly seller dominant, with a 9.52% decline over the past months, suggesting short-term caution. Despite the overall bullish trend, this recent market pressure might warrant a wait-and-see approach to identify a more advantageous entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Strs Ohio Reduces Holdings in First Solar, Inc. $FSLR – MarketBeat (Jan 24, 2026)

- Investors Heavily Search First Solar, Inc. (FSLR): Here is What You Need to Know – Yahoo Finance (Jan 22, 2026)

- INVESTOR ALERT: Pomerantz Law Firm Investigates Claims On Behalf of Investors of First Solar, Inc. – FSLR – PR Newswire (Jan 22, 2026)

- US patent office upholds First Solar’s patents against third-party challenges – Reuters (Jan 20, 2026)

- Rakuten Investment Management Inc. Makes New Investment in First Solar, Inc. $FSLR – MarketBeat (Jan 24, 2026)

For more information about First Solar, Inc., please visit the official website: firstsolar.com