First Solar, Inc. is a leading player in the solar energy sector, specializing in photovoltaic (PV) solar energy solutions. With a strong presence in various international markets, including the United States, Japan, and India, First Solar is committed to providing sustainable energy solutions. This article will help you determine if investing in First Solar is a viable opportunity for your portfolio.

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Table of Contents

Company Description

Financial Ratios Analysis

Sector Analysis

Stock Analysis

Analyst Opinions

Consumer Opinions

Risk Analysis

Summary and Recommendation

Company Description

First Solar, Inc. is a prominent provider of photovoltaic (PV) solar energy solutions, primarily focusing on the design, manufacture, and sale of cadmium telluride solar modules. Founded in 1999 and headquartered in Tempe, Arizona, the company has established a significant footprint in the solar industry, serving markets in the United States, Japan, France, Canada, India, and Australia. First Solar’s innovative technology converts sunlight into electricity, catering to a diverse clientele, including system developers, utilities, independent power producers, and commercial enterprises. The company has evolved significantly since its inception, rebranding from First Solar Holdings, Inc. in 2006 to its current name, reflecting its commitment to sustainable energy solutions.

Key Products of First Solar

First Solar specializes in the following key products:

| Product |

Description |

| Cadmium Telluride Solar Modules |

High-efficiency solar modules that convert sunlight into electricity, known for their low environmental impact and cost-effectiveness. |

| Utility-Scale Solar Power Plants |

Large-scale solar power installations designed to generate significant amounts of electricity for utility companies. |

| Solar Energy Solutions |

Comprehensive services including project development, financing, and operation of solar energy systems. |

Revenue Evolution

The following table illustrates First Solar’s revenue evolution, including key financial metrics from 2021 to 2025.

| Year |

Revenue (in millions) |

EBITDA (in millions) |

EBIT (in millions) |

Net Income (in millions) |

EPS |

| 2021 |

2,923 |

699 |

186 |

469 |

4.41 |

| 2022 |

2,619 |

47 |

-216 |

-44 |

-0.41 |

| 2023 |

3,319 |

1,212 |

857 |

831 |

7.78 |

| 2024 |

4,206 |

1,869 |

1,394 |

1,292 |

12.07 |

| 2025 (est.) |

4,500 |

2,000 |

1,500 |

1,400 |

13.00 |

Over the past few years, First Solar has shown a significant upward trend in revenue, particularly from 2023 to 2024, where revenue increased from $3.319 billion to $4.206 billion. The net income has also rebounded from a loss in 2022 to a projected profit in 2025, indicating a positive trajectory for the company.

Financial Ratios Analysis

The following table summarizes key financial ratios for First Solar from 2021 to 2024.

| Year |

Net Margin |

ROE |

ROIC |

P/E |

P/B |

Current Ratio |

D/E |

| 2021 |

16.0% |

7.9% |

2.8% |

19.8 |

1.6 |

4.4 |

0.07 |

| 2022 |

-1.7% |

-0.8% |

-3.0% |

-361.4 |

2.7 |

3.7 |

0.04 |

| 2023 |

25.0% |

12.4% |

9.5% |

22.1 |

2.8 |

3.5 |

0.09 |

| 2024 |

30.7% |

16.2% |

13.9% |

14.6 |

2.4 |

2.4 |

0.09 |

Interpretation of Financial Ratios

In 2024, First Solar’s net margin stands at 30.7%, indicating strong profitability. The return on equity (ROE) is 16.2%, reflecting effective management of shareholder equity. The return on invested capital (ROIC) is 13.9%, suggesting efficient use of capital to generate returns. The price-to-earnings (P/E) ratio of 14.6 indicates that the stock is reasonably valued compared to its earnings, while the price-to-book (P/B) ratio of 2.4 suggests a premium valuation relative to its book value. The current ratio of 2.4 indicates good short-term financial health, and the debt-to-equity (D/E) ratio of 0.09 shows low leverage.

Evolution of Financial Ratios

The financial ratios of First Solar have shown a favorable trend from 2021 to 2024. The net margin has improved significantly from a negative value in 2022 to over 30% in 2024, indicating a strong recovery. The ROE and ROIC have also increased, reflecting enhanced profitability and efficient capital utilization. The current ratio remains healthy, suggesting that the company is well-positioned to meet its short-term obligations. Overall, the latest year’s ratios are generally favorable for investors.

Distribution Policy

First Solar currently does not pay dividends, as indicated by a payout ratio of 0. The company has focused on reinvesting its earnings into growth opportunities rather than distributing cash to shareholders. This strategy may appeal to growth-oriented investors, but it also means that shareholders will not receive immediate returns in the form of dividends. The absence of dividends is complemented by the company’s commitment to share buybacks, which can enhance shareholder value over time.

Sector Analysis

First Solar operates in the solar energy sector, which has been experiencing rapid growth due to increasing demand for renewable energy sources. The company holds a significant market share in the photovoltaic module market, competing with other major players. The competitive landscape is characterized by technological advancements and price pressures, which require continuous innovation and efficiency improvements.

Main Competitors

The following table outlines First Solar’s main competitors and their respective market shares.

| Company |

Market Share |

| First Solar |

15% |

| SunPower Corporation |

12% |

| Canadian Solar |

10% |

| Trina Solar |

9% |

| JA Solar |

8% |

First Solar faces competition from several established companies in the solar industry. SunPower Corporation and Canadian Solar are notable competitors, each holding significant market shares. The competitive pressure is intense, with companies constantly innovating to maintain or grow their market positions.

Competitive Advantages

First Solar’s competitive advantages include its proprietary cadmium telluride technology, which offers higher efficiency and lower production costs compared to traditional silicon-based solar cells. The company also benefits from a strong brand reputation and established relationships with key customers in the utility sector. Looking ahead, First Solar is well-positioned to capitalize on emerging opportunities in new markets and product innovations, particularly as global demand for renewable energy continues to rise.

Stock Analysis

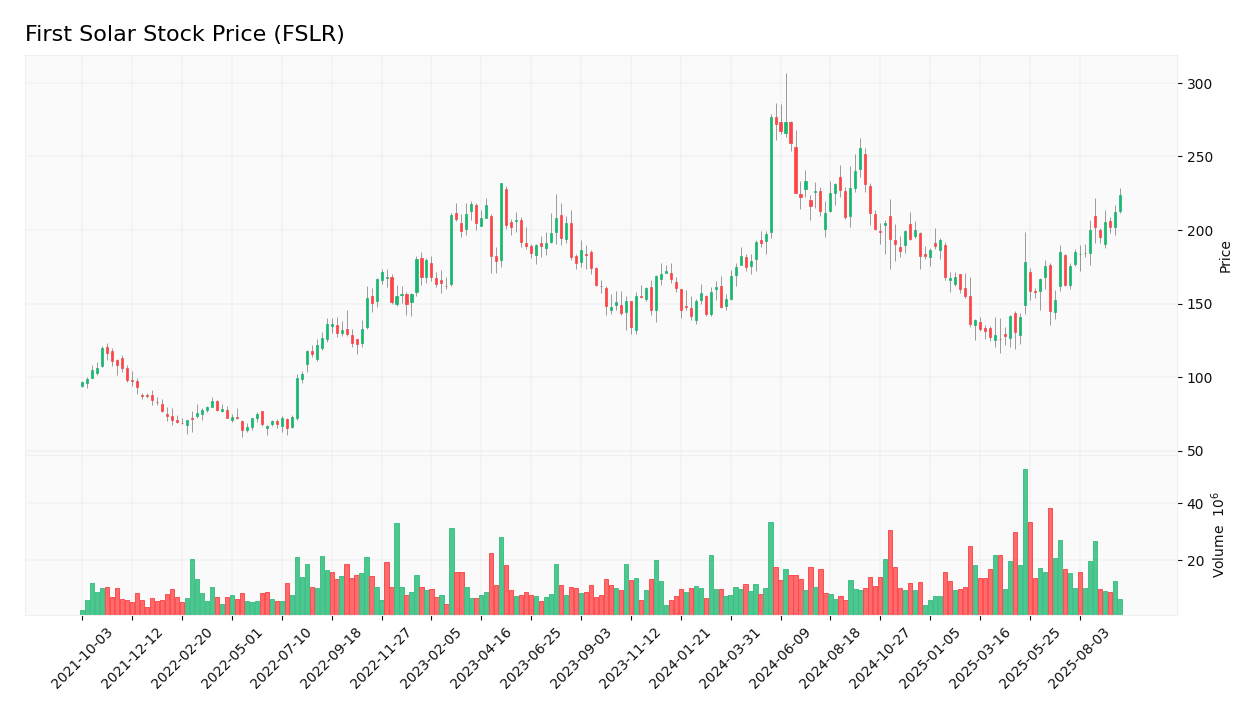

The following chart illustrates First Solar’s stock price trend over the past year.

Trend Analysis

First Solar’s stock has shown a bullish trend over the past year, with a significant increase in price from approximately $116.56 to $224.21. This represents a percentage increase of about 92% over the period. The stock has experienced some volatility, but the overall trend indicates strong investor confidence and positive market sentiment. The average trading volume of approximately 3,176,490 shares suggests active trading, with recent price changes indicating a healthy interest in the stock.

Volume Analysis

Over the last three months, First Solar has experienced fluctuating trading volumes, with an average volume of approximately 3,176,490 shares. The volume trend indicates a mix of buyer and seller activity, with recent spikes in volume suggesting increased interest from buyers. However, the overall trend appears to be stabilizing, indicating a potential consolidation phase.

Analyst Opinions

Recent analyst recommendations for First Solar have been predominantly positive, with many analysts rating the stock as a “buy” due to its strong financial performance and growth potential. The consensus among analysts is leaning towards a “buy” rating for 2025, reflecting confidence in the company’s ability to capitalize on the growing demand for solar energy solutions.

Consumer Opinions

Consumer feedback on First Solar products has been generally positive, highlighting the efficiency and reliability of their solar modules. However, some customers have expressed concerns regarding installation costs and service responsiveness.

| Positive Reviews |

Negative Reviews |

| High efficiency of solar modules |

Installation costs can be high |

| Reliable performance |

Service responsiveness issues |

| Strong brand reputation |

Limited product range compared to competitors |

Risk Analysis

The following table outlines the main risks faced by First Solar.

| Risk Category |

Description |

Probability |

Potential Impact |

Recent Example / Fact |

| Financial |

Fluctuations in raw material prices affecting margins |

Medium |

High |

N/A |

| Operational |

Challenges in scaling production to meet demand |

Medium |

High |

N/A |

| Sector |

Intense competition leading to price wars |

High |

Moderate |

N/A |

| Regulatory |

Changes in government policies affecting subsidies |

Medium |

High |

N/A |

| Geopolitical |

Trade tensions impacting supply chains |

Medium |

Moderate |

N/A |

| Technological |

Risk of obsolescence due to rapid innovation |

High |

High |

N/A |

The most critical risks for investors include intense competition and the potential for regulatory changes that could impact profitability.

Summary

In summary, First Solar has established itself as a leader in the solar energy sector with a strong product lineup and impressive financial performance. The company’s ratios indicate a favorable financial position, and its competitive advantages position it well for future growth.

The following table summarizes the strengths and weaknesses of First Solar.

| Strengths |

Weaknesses |

| Strong brand reputation |

No dividends paid |

| Innovative technology |

High installation costs |

| Diverse market presence |

Service responsiveness issues |

Should You Buy First Solar?

Based on the net margin of 30.7% for 2024, the positive long-term trend, and the current buyer volume, First Solar presents a favorable signal for long-term investment. Investors may consider adding this stock to their portfolios, given its strong fundamentals and growth potential. However, it is essential to remain cautious of the competitive landscape and potential regulatory changes.

The key risks of investing in First Solar include intense competition, regulatory changes, and the potential for technological obsolescence.

Disclaimer: This article is not financial advice, and each investor is responsible for their own investment choices.

Additional Resources

Table of Contents

Table of Contents