In a world where user experience dictates success, Figma, Inc. revolutionizes how design and development teams collaborate, transforming the creative process into a seamless journey. Known for its innovative browser-based tools, including Figma Design and FigJam, the company empowers professionals to turn ideas into reality with remarkable efficiency. As I analyze Figma’s current market position and growth trajectory, I invite you to consider whether its fundamentals justify the recent valuation and what this could mean for future investment opportunities.

Table of contents

Company Description

Figma, Inc. is a leading player in the software application industry, specializing in browser-based design tools that empower teams to create user interfaces efficiently. Founded in 2012 and headquartered in San Francisco, California, Figma has established itself as an essential resource for design and development teams through its innovative products, including Figma Design, Dev Mode, and FigJam. The company primarily operates in the U.S. market but has a global reach, serving a diverse clientele. Figma’s strategic focus on collaboration and integration has positioned it as a transformative force in the design ecosystem, fostering creativity and enhancing workflow across various industries.

Fundamental Analysis

In this section, I will examine Figma, Inc.’s income statement, key ratios, and payout policy to provide insights into its financial health and investment potential.

Income Statement

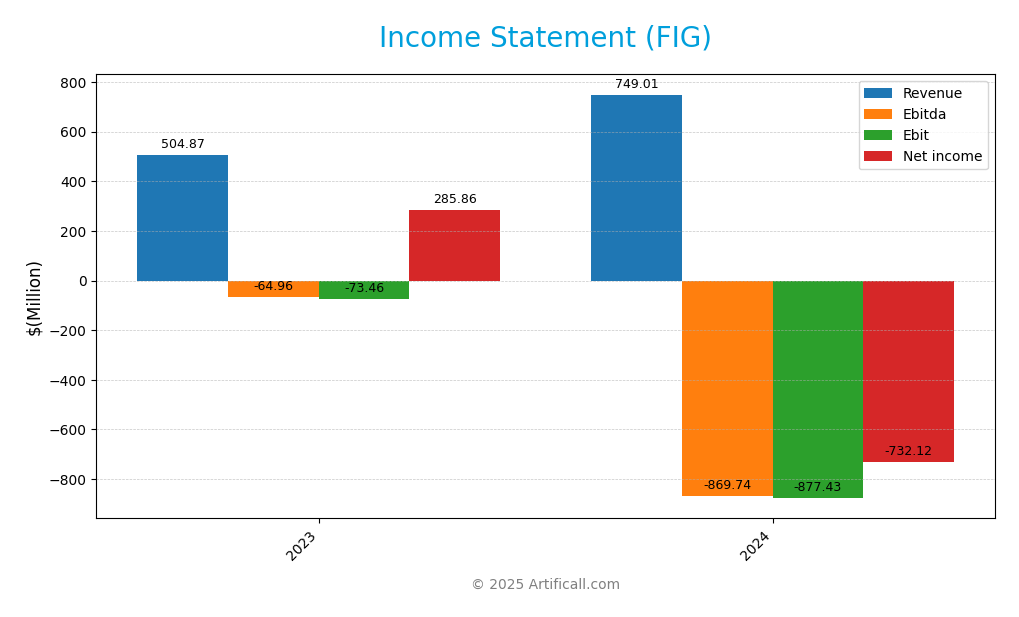

The table below summarizes Figma, Inc.’s income statement for the fiscal years 2023 and 2024, showcasing key financial metrics and performance indicators.

| Metrics | 2023 | 2024 |

|---|---|---|

| Revenue | 505M | 749M |

| Cost of Revenue | 45M | 88M |

| Operating Expenses | 534M | 1.54B |

| Gross Profit | 460M | 661M |

| EBITDA | -65M | -870M |

| EBIT | -73M | -877M |

| Interest Expense | 0 | 0 |

| Net Income | 286M | -732M |

| EPS | 0.64 | -3.11 |

| Filing Date | 2023-12-31 | 2024-12-31 |

In 2023, Figma recorded a strong revenue increase, rising from 505M to 749M in 2024, indicating robust growth. However, this growth came at a significant cost, as operating expenses surged from 534M to 1.54B, leading to a substantial net loss in 2024 of 732M compared to a profit of 286M in 2023. The company’s gross profit margin slightly decreased, reflecting higher costs eating into profitability. The drastic increase in operating expenses raises concerns about sustainability, and the negative EBITDA indicates ongoing challenges in achieving profitability despite revenue growth.

Financial Ratios

The table below summarizes the financial ratios for Figma, Inc. over the last two available years.

| Financial Ratios | 2023 | 2024 |

|---|---|---|

| Net Margin | 57.6% | -97.7% |

| ROE | 27.4% | -55.3% |

| ROIC | -6.9% | -65.2% |

| P/E | 181.1 | -70.7 |

| P/B | 49.6 | 39.1 |

| Current Ratio | 2.82 | 3.66 |

| Quick Ratio | 2.82 | 3.66 |

| D/E | 0.014 | 0.022 |

| Debt-to-Assets | 0.009 | 0.016 |

| Interest Coverage | 0 | 0 |

| Asset Turnover | 0.315 | 0.418 |

| Fixed Asset Turnover | 43.4 | 49.9 |

| Dividend Yield | 0% | 0% |

Interpretation of Financial Ratios

In 2024, Figma’s financial ratios indicate significant weaknesses, particularly in profitability metrics like net margin and ROE, both of which are negative. The company also shows an extremely high P/E ratio and a lack of interest coverage, suggesting that it may struggle to generate profits in the near future. The increase in the current and quick ratios indicates improved liquidity, but overall, the financial health appears precarious.

Evolution of Financial Ratios

Over the past two years, Figma has experienced drastic fluctuations in its financial ratios. While liquidity ratios improved significantly, profitability ratios deteriorated sharply, indicating a troubling trend that could raise red flags for potential investors.

Distribution Policy

Figma, Inc. does not currently pay dividends, primarily due to its focus on reinvestment for growth and development. The company is in a high-growth phase, prioritizing research and acquisitions to enhance its market position. Despite not offering dividends, Figma engages in share buybacks, signaling a commitment to returning value to shareholders. This strategy may align with sustainable long-term value creation, provided that the reinvestments lead to significant future returns.

Sector Analysis

Figma, Inc. operates within the Software – Application industry, offering innovative design tools that enhance collaboration among design and development teams, setting it apart from competitors.

Strategic Positioning

Figma, Inc. has carved out a significant niche within the software application industry, particularly in collaborative design tools. With a market cap of approximately $21.57 billion, the company maintains a competitive edge through its innovative offerings like Figma Design and FigJam, which are pivotal for design teams. Despite competitive pressures from established players and emerging startups, Figma’s focus on user-friendly, browser-based solutions allows it to effectively counter technological disruptions. As of now, it holds a promising market share that positions it favorably for future growth amid increasing demand for digital collaboration tools.

Key Products

Figma, Inc. offers a range of innovative products designed to enhance collaboration and streamline the design process for teams. Below is a summary of their key offerings:

| Product | Description |

|---|---|

| Figma Design | A collaborative design tool that enables teams to explore ideas, gather feedback, and build prototypes efficiently. |

| Dev Mode | A feature that allows developers to inspect designs and convert them into code without altering the original design file. |

| FigJam | An interactive whiteboard tool used for brainstorming, decision-making, and project alignment, all in one place. |

| Figma Slides | A presentation tool tailored for designers, enabling them to create visually appealing slides for their projects. |

| Figma Draw | A suite of illustration tools that allows users to create expressive and detailed designs. |

| Figma Buzz | A platform for publishing brand templates for social media assets, ads, and promotional materials. |

| Figma Sites | A tool for designing, prototyping, and publishing web pages seamlessly. |

| Figma Make | An AI-driven tool that assists in designing and generating functional prototypes quickly. |

These products reflect Figma’s commitment to enhancing design workflows and encouraging collaboration among teams in the technology sector.

Main Competitors

No verified competitors were identified from available data. However, I can provide an overview of Figma, Inc.’s estimated market share and competitive position. Figma operates within the Software – Application sector and is known for its collaborative design tools, which makes it a strong player in the design software market. Currently, its estimated market share is substantial, positioning it as a key player in the technology industry, specifically focusing on user interface design and prototyping solutions.

Competitive Advantages

Figma, Inc. possesses significant competitive advantages within the software application industry, primarily due to its innovative, browser-based design tools that facilitate collaboration among design and development teams. The ability to create and iterate on designs in real-time enhances productivity and fosters creativity. Looking ahead, Figma’s expansion into AI-driven features, like Figma Make, positions the company to tap into emerging trends. Additionally, the introduction of products such as Figma Slides and Figma Buzz opens up new markets, offering ample opportunities for growth. This strategic diversification strengthens Figma’s market presence and appeal to a broader client base.

SWOT Analysis

This analysis examines the strengths, weaknesses, opportunities, and threats facing Figma, Inc. to inform strategic decision-making.

Strengths

- Strong market position

- Innovative product offerings

- Collaborative design tools

Weaknesses

- Dependence on web-based platform

- Limited diversification

- Emerging competition

Opportunities

- Growing demand for design tools

- Expansion into new markets

- Integration of AI in design

Threats

- Intense competition in the software industry

- Rapid technological changes

- Economic downturns

Overall, the SWOT assessment indicates that Figma, Inc. possesses a robust foundation with significant growth potential. However, it must address its weaknesses and remain vigilant against external threats to sustain its competitive advantage and drive future growth.

Stock Analysis

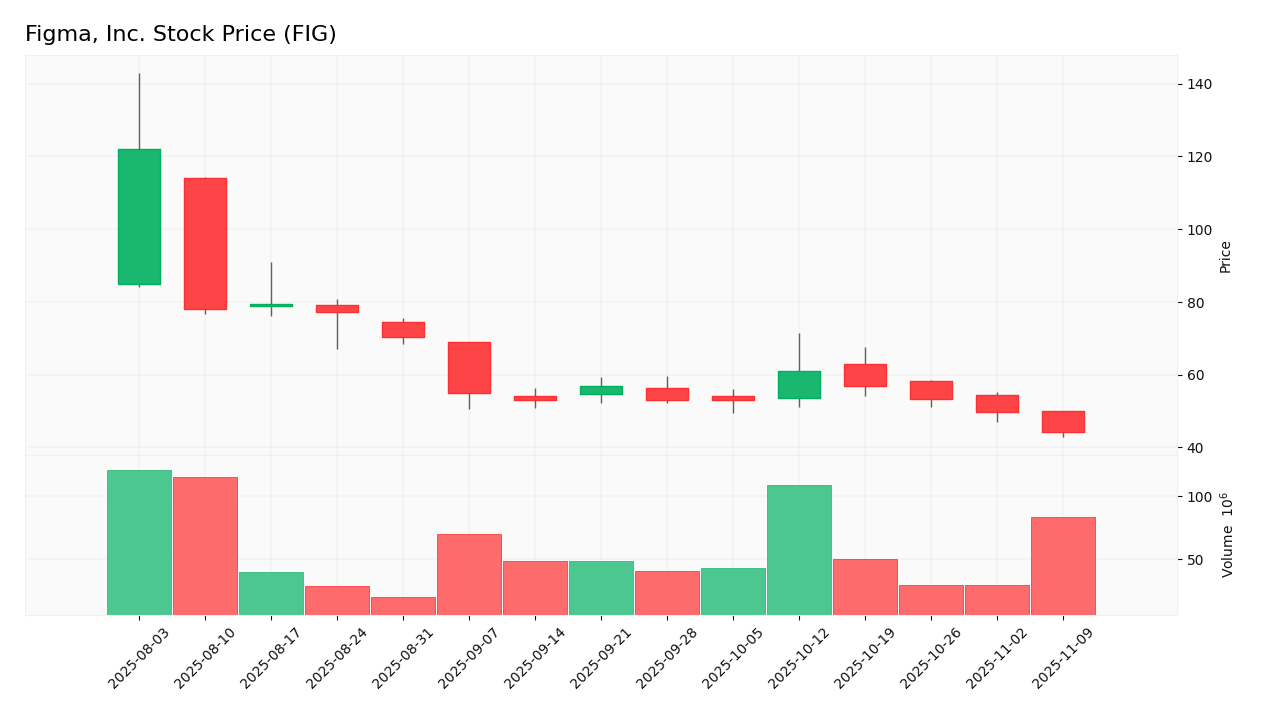

In analyzing Figma, Inc. (ticker: FIG), we observe significant price movements and trading dynamics over the past year, characterized by a pronounced bearish trend that has been accelerating.

Trend Analysis

Over the past year, Figma, Inc. has experienced a price change of -63.73%, indicating a bearish trend. Notably, the stock reached a high of 122.0 and a low of 44.25. The trend is marked by acceleration, suggesting a continued decline in price momentum. The standard deviation of 18.76 indicates a relatively high level of volatility, reflecting the uncertainty in market sentiment regarding this stock.

Volume Analysis

Examining trading volumes over the last three months, we see that the activity is predominantly seller-driven, with an average volume of 50.34M, which has been decreasing. The average sell volume stands at 37.23M compared to an average buy volume of 13.10M, resulting in a buyer volume proportion of only 26.03%. This suggests a bearish sentiment among investors, indicating a lack of confidence in the stock’s performance and market participation.

Analyst Opinions

Recent analyst recommendations for Figma, Inc. (FIG) reflect a mixed view. On November 7, 2025, analysts assigned a neutral rating of B-, indicating a cautious stance. Notably, the discounted cash flow analysis suggests a “Buy,” driven by strong growth potential. However, indicators like return on equity and price-to-earnings show “Strong Sell,” signaling concerns about profitability. Analysts recommend holding the stock overall, reflecting a consensus that leans towards caution rather than outright buy or sell. It is essential for investors to weigh these insights carefully when considering their positions.

Stock Grades

No verified stock grades were available from recognized analysts for Figma, Inc. (FIG). This absence of reliable grading data limits my ability to provide a comprehensive analysis of the stock’s current standing in the market. However, it is essential for investors to remain vigilant and consider other factors such as market trends and overall investor sentiment when evaluating potential investments in this company.

Target Prices

No verified target price data is available from recognized analysts for Figma, Inc. (FIG). This limitation indicates uncertainty in the market sentiment surrounding this stock.

Consumer Opinions

Consumer sentiment surrounding Figma, Inc. is a mixed bag, reflecting both enthusiasm and areas for improvement among its user base.

| Positive Reviews | Negative Reviews |

|---|---|

| “Figma’s collaboration tools are game-changers for our design team!” | “The learning curve can be steep for new users.” |

| “The interface is intuitive and user-friendly.” | “Performance issues during peak usage times.” |

| “Excellent customer support and resources available.” | “Pricing can be a bit high for small teams.” |

Overall, consumer feedback reveals that while users appreciate Figma’s innovative collaboration features and support, many express concerns about its steep learning curve and pricing structure.

Risk Analysis

In assessing the potential investment in Figma, Inc. (ticker: FIG), it is crucial to understand the various risks that may affect its performance. Below is a summary of the key risks associated with this company.

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for design software | High | High |

| Competitive Risk | Intense competition from established players | Medium | High |

| Regulatory Risk | Changes in data privacy laws affecting operations | Medium | Medium |

| Operational Risk | Potential disruptions in service delivery | Low | High |

| Technology Risk | Risk of obsolescence due to rapid tech changes | Medium | High |

Overall, the most significant risks to Figma involve market fluctuations and competition, both of which can heavily influence revenue and growth potential. As of late 2023, the design software industry is experiencing rapid innovation, which heightens the competitive landscape.

Should You Buy Figma, Inc.?

Figma, Inc. has faced significant financial challenges recently, with a net profit margin of -0.98% and an operating profit margin also in the negative. Despite a gross profit margin of 88.32%, the company has been struggling to convert sales into profit. The return on invested capital (ROIC) is negative, and the weighted average cost of capital (WACC) remains a concern. The long-term trend is bearish, and buyer volumes are low, intensifying the risk for investors.

Based on the current financial metrics, Figma does not appear favorable for long-term investment. With a net margin less than 0, I recommend waiting for improvements in the company’s fundamentals before considering any investments. The long-term trend is negative, which suggests caution, and the seller volumes indicate a lack of strong buyer interest at this time.

Specific risks to consider include intense competition in the design software industry and reliance on market conditions, which can heavily influence Figma’s performance.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- Figma: Good Update, But Valuation Too Excessive – Seeking Alpha (Nov 09, 2025)

- Figma (FIG): Revisiting Valuation After Prolonged Share Price Decline – Yahoo Finance (Nov 09, 2025)

- Figma delivers strong forecast as AI draws in more customers – CNBC (Nov 05, 2025)

- Figma (FIG) Q3 2025 Earnings Call Transcript – The Motley Fool (Nov 05, 2025)

- Figma (NYSE: FIG) posts record Q3 revenue of $274.2M, lifts full-year outlook – Stock Titan (Nov 05, 2025)

For more information about Figma, Inc., please visit the official website: figma.com