Home > Analyses > Technology > Fidelity National Information Services, Inc.

Fidelity National Information Services, Inc. (FIS) revolutionizes the financial technology landscape by powering critical payment and banking operations worldwide. As a dominant force in information technology services, FIS delivers cutting-edge solutions spanning merchant acquiring, core banking, and capital markets, earning a reputation for innovation and reliability. With a vast global footprint and continuous product evolution, the key question remains: does FIS’s current financial strength and market position support sustained growth and justify its valuation in 2026?

Table of contents

Business Model & Company Overview

Fidelity National Information Services, Inc. (FIS), founded in 1968 and headquartered in Jacksonville, Florida, stands as a leading player in the information technology services sector. The company’s ecosystem integrates Merchant Solutions, Banking Solutions, and Capital Market Solutions, delivering comprehensive technology platforms that empower merchants, banks, and capital markets firms globally. This cohesive mission revolves around providing seamless, scalable financial technology that supports diverse client needs.

FIS generates value through a balanced mix of software-led services and core processing hardware solutions, with significant recurring revenue streams from digital banking, payments, and risk management offerings. Its strategic footprint spans the Americas, Europe, and Asia, positioning it to capitalize on global financial technology trends. The company’s robust competitive advantage lies in its deep integration across financial systems and its ability to shape the future of digital commerce and banking.

Financial Performance & Fundamental Metrics

I will analyze Fidelity National Information Services, Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its financial health.

Income Statement

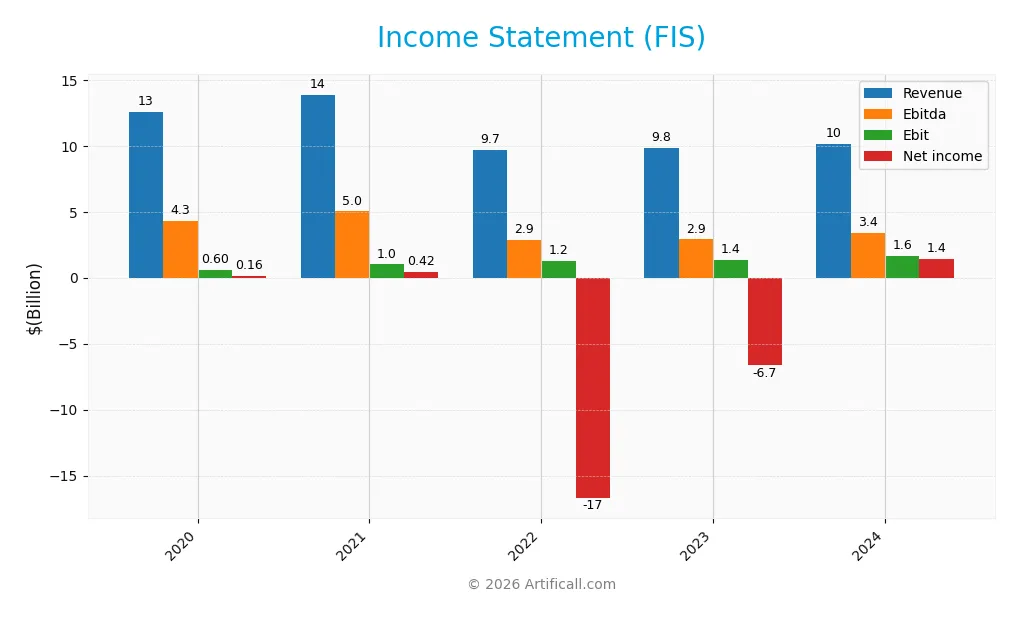

Below is the Income Statement for Fidelity National Information Services, Inc. (FIS) over the past five fiscal years, detailing key financial performance metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 12.6B | 13.9B | 9.7B | 9.8B | 10.1B |

| Cost of Revenue | 8.3B | 8.7B | 6.2B | 6.2B | 6.3B |

| Operating Expenses | 2.7B | 3.1B | 1.6B | 1.6B | 2.1B |

| Gross Profit | 4.2B | 5.2B | 3.5B | 3.7B | 3.8B |

| EBITDA | 4.3B | 5.0B | 2.9B | 2.9B | 3.4B |

| EBIT | 605M | 1.0B | 1.2B | 1.4B | 1.6B |

| Interest Expense | 339M | 216M | 298M | 713M | 351M |

| Net Income | 158M | 417M | -16.7B | -6.7B | 1.5B |

| EPS | 0.26 | 0.68 | -27.68 | -11.26 | 1.42 |

| Filing Date | 2021-02-18 | 2022-02-23 | 2023-02-27 | 2024-02-26 | 2025-02-13 |

Income Statement Evolution

From 2020 to 2024, Fidelity National Information Services, Inc. (FIS) experienced a revenue decline of 19.3%, while net income surged by 817.7%, reflecting significant improvement in profitability. The gross margin remained stable around 37.6%, and the EBIT margin improved to 16.3%. Notably, net margin growth exceeded 1,000%, indicating enhanced operational efficiency and cost control despite modest revenue growth in the last year.

Is the Income Statement Favorable?

In 2024, FIS reported revenue of $10.13B, up 3% year-over-year, with gross profit rising 4%. Operating expenses grew slightly faster than revenue, which is unfavorable, yet EBIT increased nearly 20%, demonstrating better core earnings. Net margin at 14.3% and EPS growth over 112% underpin a favorable income statement, supported by controlled interest expenses and a strong bottom line, signaling solid financial fundamentals.

Financial Ratios

The table below presents key financial ratios for Fidelity National Information Services, Inc. (FIS) over the last five fiscal years, providing insight into profitability, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 1.3% | 3.0% | -172.0% | -67.7% | 14.3% |

| ROE | 0.3% | 0.9% | -61.4% | -34.9% | 9.2% |

| ROIC | 1.3% | 1.5% | 2.3% | 3.6% | 4.0% |

| P/E | 554.2 | 161.2 | -2.5 | -5.3 | 30.8 |

| P/B | 1.78 | 1.42 | 1.51 | 1.86 | 2.85 |

| Current Ratio | 0.80 | 0.74 | 0.79 | 0.75 | 0.85 |

| Quick Ratio | 0.80 | 0.74 | 0.79 | 0.75 | 0.85 |

| D/E | 0.42 | 0.44 | 0.75 | 1.02 | 0.74 |

| Debt-to-Assets | 24.6% | 25.2% | 32.3% | 35.2% | 34.2% |

| Interest Coverage | 4.6 | 9.7 | 6.4 | 2.9 | 4.9 |

| Asset Turnover | 0.15 | 0.17 | 0.15 | 0.18 | 0.30 |

| Fixed Asset Turnover | 8.8 | 9.8 | 10.1 | 10.8 | 11.6 |

| Dividend Yield | 1.0% | 1.4% | 2.8% | 3.5% | 1.8% |

Evolution of Financial Ratios

From 2020 to 2024, Fidelity National Information Services, Inc. (FIS) saw its Return on Equity (ROE) fluctuate significantly, dropping sharply into negative territory before recovering to 9.24% in 2024, though still marked as unfavorable. The Current Ratio improved modestly from around 0.74-0.80 to 0.85 in 2024, remaining below 1 and considered unfavorable. The Debt-to-Equity ratio showed variability but settled near 0.74 in 2024, indicating a neutral leverage position. Profitability showed some recovery with net margins hitting 14.3% in 2024, a favorable sign.

Are the Financial Ratios Favorable?

In 2024, FIS’s profitability, represented by a 14.3% net margin, is favorable, while ROE and Return on Invested Capital (ROIC) remain unfavorable at 9.24% and 3.99%, respectively. Liquidity ratios are mixed, with a Current Ratio of 0.85 unfavorable and Quick Ratio neutral at the same level. Leverage ratios such as Debt-to-Equity (0.74) and Debt-to-Assets (34.16%) are neutral. Efficiency metrics show an unfavorable Asset Turnover of 0.3 but a favorable Fixed Asset Turnover of 11.56. Market valuation ratios like Price-to-Earnings (30.8) are unfavorable, while Price-to-Book (2.85) and Dividend Yield (1.79%) are neutral. Overall, the global ratios evaluation is slightly unfavorable.

Shareholder Return Policy

Fidelity National Information Services, Inc. maintains a dividend payout ratio of about 55% with a dividend per share rising moderately to $1.45 in 2024 and an annual yield near 1.8%. The company supports returns with share buybacks, funded by strong free cash flow coverage, minimizing risk of unsustainable distributions.

This balanced approach of dividends and buybacks aligns with sustainable long-term value creation, reflecting prudent capital allocation amid moderate profitability and stable cash generation.

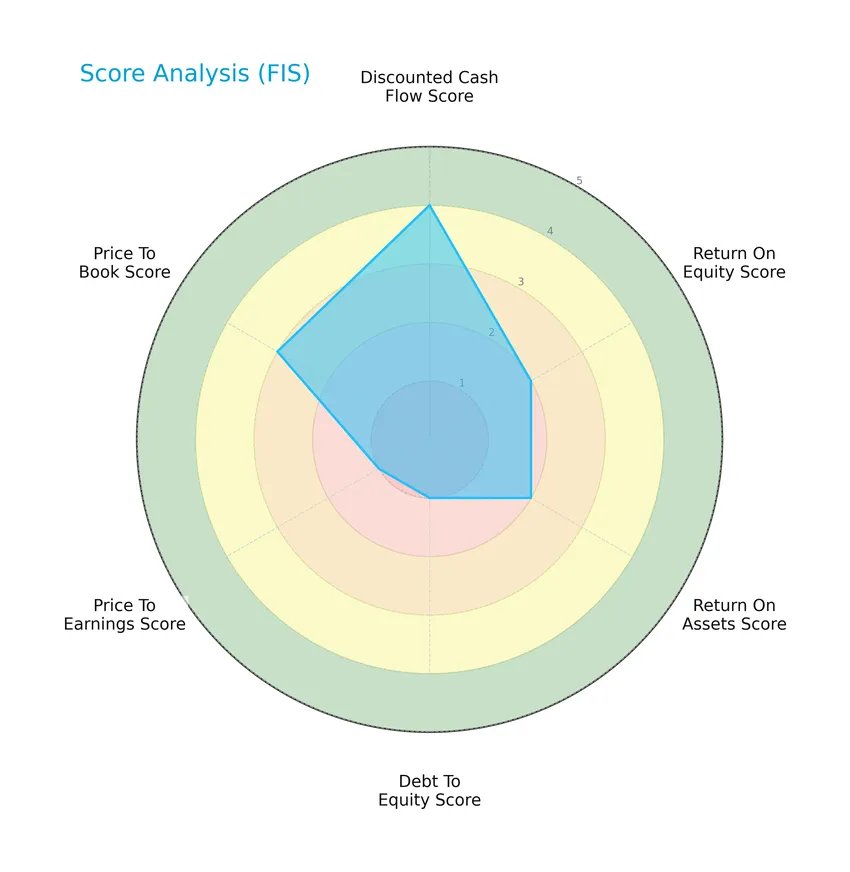

Score analysis

The radar chart below presents a comprehensive view of key financial scores for Fidelity National Information Services, Inc.:

FIS shows a favorable discounted cash flow score of 4, while profitability metrics such as return on equity and assets stand at moderate levels with scores of 2 each. However, leverage and valuation indicators, including debt-to-equity and price-to-earnings, are very unfavorable, scoring 1 each. The price-to-book ratio is moderate at 3.

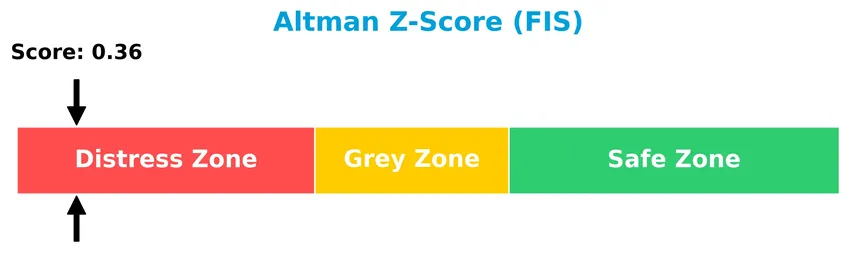

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that the company is in the distress zone, suggesting a high risk of financial distress and potential bankruptcy:

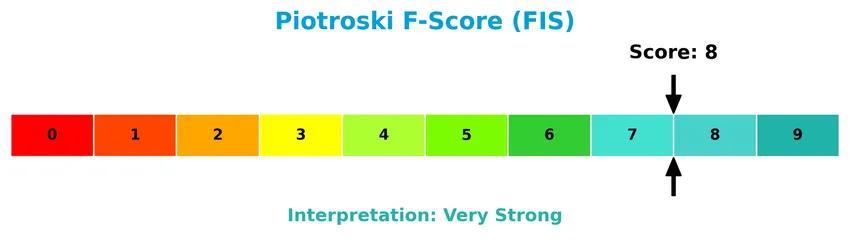

Is the company in good financial health?

The Piotroski diagram below illustrates the company’s financial strength based on multiple accounting criteria:

With a Piotroski Score of 8, Fidelity National Information Services, Inc. demonstrates very strong financial health, reflecting robust profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This section provides an analysis of Fidelity National Information Services, Inc.’s position within the information technology services sector. It will cover strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and a SWOT analysis. I will also assess whether the company holds a competitive advantage over its industry peers.

Strategic Positioning

Fidelity National Information Services, Inc. maintains a diversified product portfolio across Merchant, Banking, and Capital Market Solutions, with Banking Solutions generating the largest revenue (~6.9B in 2024). Geographically, the company has a concentrated North American exposure (~7.8B in 2024), with Non-North America contributing significantly less (~2.3B).

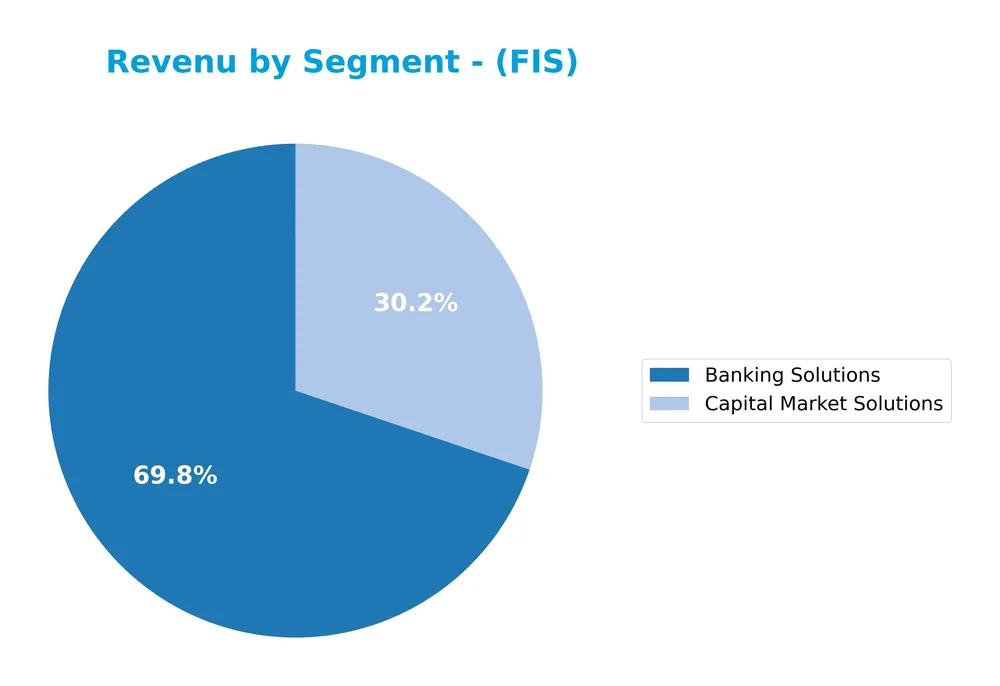

Revenue by Segment

The pie chart illustrates Fidelity National Information Services, Inc.’s revenue distribution by segment for the fiscal year 2024.

In 2024, Banking Solutions remained the dominant revenue driver with $6.9B, showing steady growth from previous years. Capital Market Solutions also increased to $3.0B, continuing its upward trend. Notably, the Merchant Solutions segment, significant in prior years, is absent in the latest data, indicating a possible strategic shift or divestiture. Overall, the company shows a concentration in Banking and Capital Market Solutions with moderate growth, but investors should monitor the impact of reduced segment diversity.

Key Products & Brands

The table below outlines the key products and brands offered by Fidelity National Information Services, Inc., along with their descriptions:

| Product | Description |

|---|---|

| Merchant Solutions | Enterprise acquiring, software-led small- to medium-sized businesses acquiring, and global e-commerce solutions. |

| Banking Solutions | Core processing and ancillary applications; digital solutions including Internet, mobile, and e-banking; fraud, risk management, and compliance solutions; electronic funds transfer and network services; card and retail payment solutions; wealth and retirement solutions; item processing and output services. |

| Capital Market Solutions | Securities processing and finance, global trading, asset management and insurance, and corporate liquidity solutions. |

Fidelity National Information Services, Inc. focuses on providing technology solutions across its three main segments: Merchant Solutions, Banking Solutions, and Capital Market Solutions, serving merchants, banks, and capital markets firms worldwide.

Main Competitors

There are 16 competitors in total, with the table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| International Business Machines Corporation | 272B |

| Accenture plc | 162B |

| Cognizant Technology Solutions Corporation | 39.9B |

| Fiserv, Inc. | 35.7B |

| Fidelity National Information Services, Inc. | 34.0B |

| Wipro Limited | 29.7B |

| Leidos Holdings, Inc. | 23.5B |

| Gartner, Inc. | 18.2B |

| CDW Corporation | 17.3B |

| Jack Henry & Associates, Inc. | 13.0B |

Fidelity National Information Services, Inc. ranks 5th among 16 competitors, with a market cap approximately 11.5% of the top player, IBM. The company is positioned below the average market cap of the top 10 competitors (64.6B) but remains above the sector median of 17.8B. It has a 13.8% market cap gap with the next closest competitor above it.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does FIS have a competitive advantage?

Fidelity National Information Services, Inc. shows a slight competitive disadvantage as its return on invested capital (ROIC) remains below its weighted average cost of capital (WACC), indicating value destruction despite improving profitability. The company benefits from a favorable income statement with strong margins and significant net margin growth over the last five years, yet it is currently shedding value overall.

Looking ahead, FIS is positioned to leverage opportunities through its diverse segments including Merchant Solutions, Banking Solutions, and Capital Market Solutions, with expanding digital and fraud management offerings. Continued growth in ROIC suggests potential for improved capital efficiency, supported by steady revenue streams primarily from North America and expanding global e-commerce and banking technologies.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors influencing Fidelity National Information Services, Inc. (FIS) to guide investment decisions.

Strengths

- strong net margin at 14.32%

- favorable EBIT margin growth of 19.85%

- large market cap of 31B USD

Weaknesses

- low ROE at 9.24%

- current ratio below 1 indicating liquidity pressure

- high P/E ratio at 30.8 suggesting overvaluation

Opportunities

- expanding digital banking solutions

- growth in non-North America revenue segment

- increasing demand for fraud and risk management services

Threats

- intense competition in fintech sector

- macroeconomic uncertainties impacting IT budgets

- regulatory compliance risks in multiple jurisdictions

FIS shows solid profitability and growth in operating income, supported by expanding digital and international services. However, liquidity concerns and valuation metrics require caution. Strategic focus on innovation and global expansion is essential to mitigate competitive and regulatory threats.

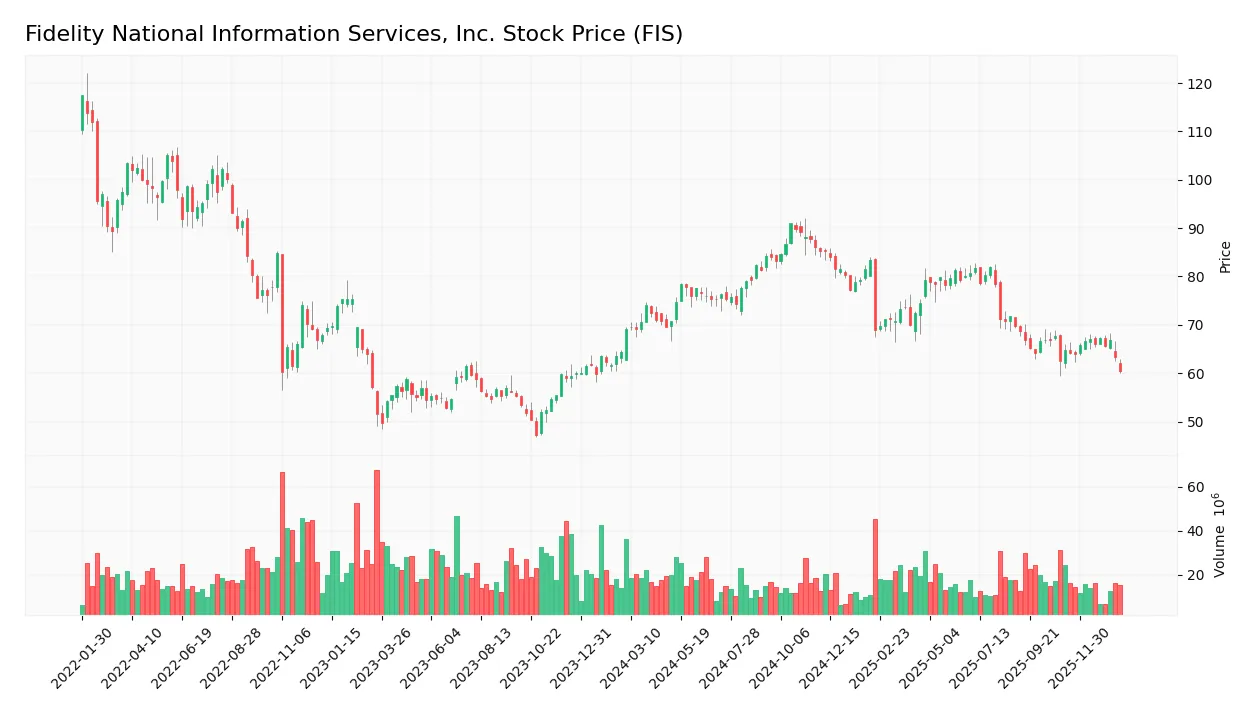

Stock Price Action Analysis

The weekly chart below illustrates Fidelity National Information Services, Inc. (FIS) stock price movements over the past 12 months, highlighting key fluctuations and overall performance:

Trend Analysis

Over the past 12 months, FIS stock price declined by 12.58%, indicating a bearish trend. The price moved from a high of 90.95 to a low of 60.5, with volatility measured by a 7.09 standard deviation. The trend shows deceleration, reflecting a slowing pace of decline in recent months.

Volume Analysis

In the last three months, trading volume has been decreasing, with buyer volume nearly equal to seller volume, showing neutral buyer dominance at 49.88%. This balanced activity suggests a lack of strong conviction from either side, indicating cautious investor sentiment and subdued market participation.

Target Prices

The consensus target price for Fidelity National Information Services, Inc. (FIS) indicates moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 85 | 69 | 76 |

Analysts expect FIS to trade around $76 on average, with a potential range between $69 and $85, reflecting cautious optimism about its near-term performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback related to Fidelity National Information Services, Inc. (FIS).

Stock Grades

Here is the latest overview of Fidelity National Information Services, Inc. (FIS) grades from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Truist Securities | Maintain | Hold | 2025-11-19 |

| RBC Capital | Maintain | Outperform | 2025-11-06 |

| JP Morgan | Maintain | Overweight | 2025-11-06 |

| UBS | Maintain | Buy | 2025-11-06 |

| Truist Securities | Maintain | Hold | 2025-10-24 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-10-01 |

| UBS | Upgrade | Buy | 2025-09-30 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-08-06 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Truist Securities | Maintain | Hold | 2025-07-17 |

The consensus shows a generally positive outlook with multiple “Buy” and “Outperform” ratings, while Truist Securities consistently maintains a “Hold” stance. UBS notably upgraded its grade from “Neutral” to “Buy” in late September 2025.

Consumer Opinions

Consumers generally express mixed feelings about Fidelity National Information Services, Inc., reflecting both appreciation for its innovation and concerns about service consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “Reliable payment processing with fast transactions.” | “Customer support can be slow to respond.” |

| “Innovative financial solutions that meet modern needs.” | “Occasional software glitches disrupt operations.” |

| “Strong security measures give me confidence.” | “Pricing is higher compared to competitors.” |

Overall, users praise FIS for its secure and innovative services, but recurring issues with customer support responsiveness and occasional technical glitches suggest areas for improvement.

Risk Analysis

The table below outlines key risks for Fidelity National Information Services, Inc., focusing on likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Altman Z-Score at 0.36 signals high bankruptcy risk (distress zone). | High | Very High |

| Profitability | Unfavorable ROE (9.24%) and ROIC (3.99%) may limit growth and returns. | Medium | Medium |

| Valuation | High P/E ratio (30.8) suggests overvaluation risk if earnings slow. | Medium | Medium |

| Liquidity | Current ratio below 1 (0.85) indicates potential short-term liquidity issues. | Medium | Medium |

| Debt Management | Debt to equity score very unfavorable, debt-to-assets at 34.16% (neutral). | Medium | Medium |

| Market Volatility | Beta near 0.94 shows sensitivity to market swings, with moderate volatility. | Medium | Medium |

The most critical risk is financial distress indicated by the Altman Z-Score well below 1.8, despite a strong Piotroski score of 8, reflecting operational strength. Investors should weigh the bankruptcy risk carefully against the company’s solid profitability metrics and moderate valuation.

Should You Buy Fidelity National Information Services, Inc.?

Fidelity National Information Services, Inc. appears to be navigating a challenging leverage profile with substantial debt, while its profitability suggests improving operational efficiency. Despite a slightly unfavorable moat due to value erosion, the firm’s overall C+ rating and strong Piotroski score indicate moderate investment appeal.

Strength & Efficiency Pillars

Fidelity National Information Services, Inc. exhibits solid profitability with a favorable net margin of 14.32% and an EBIT margin of 16.27%, indicating efficient cost management. The company’s Piotroski score of 8 signals very strong financial health, reinforcing operational robustness. However, with a return on invested capital (ROIC) of 3.99% below its weighted average cost of capital (WACC) at 6.58%, the company is currently a value destroyer despite increasing profitability trends. The Altman Z-score of 0.36 places it in the distress zone, highlighting financial risk concerns.

Weaknesses and Drawbacks

Valuation metrics present significant headwinds, with a P/E ratio of 30.8 reflecting a premium price that may not be justified by current earnings. The current ratio at 0.85 signals liquidity challenges, raising concerns about short-term financial flexibility. Leverage metrics are mixed, with a neutral debt-to-equity ratio of 0.74 but an unfavorable asset turnover of 0.3, suggesting inefficiencies in asset use. The bearish overall stock trend, with a 12.58% price decline and decelerating momentum, adds pressure, although recent buyer dominance is neutral at 49.88%.

Our Verdict about Fidelity National Information Services, Inc.

The long-term fundamental profile is unfavorable due to value destruction and financial distress signals, despite strong profitability metrics and a robust Piotroski score. Coupled with a bearish overall trend and neutral recent buyer behavior, Fidelity National Information Services, Inc. may appear risky for immediate investment. Despite long-term operational improvements, recent market pressure suggests a wait-and-see approach for a better entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Fidelity National Adds AI Leader Anil Chakravarthy As Investors Weigh Valuation – Sahm (Jan 24, 2026)

- With Strong Cash Flow, Fidelity National Information Services Stock Poised to Rise? – Trefis (Jan 24, 2026)

- Here’s What Wall Street Thinks About Fidelity National Information Services (FIS) – Yahoo Finance (Jan 19, 2026)

- Fidelity National Information Services (FIS) Expands Board with New Independent Director – GuruFocus (Jan 23, 2026)

- Fidelity National Information Services, Inc. $FIS Shares Sold by QRG Capital Management Inc. – MarketBeat (Jan 20, 2026)

For more information about Fidelity National Information Services, Inc., please visit the official website: fisglobal.com