Home > Analyses > Financial Services > FactSet Research Systems Inc.

FactSet Research Systems Inc. powers the investment decisions of some of the world’s most influential financial professionals by delivering integrated data and analytics that shape market strategies daily. As a stalwart in the financial data and analytics sector, FactSet stands out for its comprehensive workflow solutions that serve portfolio managers, asset managers, and wealth advisors globally. Renowned for innovation and reliability, the company’s tools are deeply embedded in critical financial processes. Yet, as market dynamics evolve, the key question remains: does FactSet’s current valuation fully reflect its growth prospects and fundamental strengths?

Table of contents

Business Model & Company Overview

FactSet Research Systems Inc., founded in 1978 and headquartered in Norwalk, Connecticut, stands as a leading provider in the financial data and analytics sector. Its integrated ecosystem spans research, analytics, trading, content, technology solutions, and wealth management, serving portfolio managers, investment banks, asset managers, and other financial professionals globally. With a market cap of 10.7B USD, FactSet has built a comprehensive platform that supports the critical workflows of the investment community across the Americas, Europe, the Middle East, Africa, and Asia Pacific.

FactSet’s revenue engine balances recurring software subscriptions and high-value content services, delivering seamless financial information and analytical applications worldwide. Its presence in key global markets ensures diversified exposure and steady demand from institutional clients. The company’s competitive advantage lies in its ability to provide integrated, customizable solutions, establishing a durable economic moat that shapes the future of financial data services.

Financial Performance & Fundamental Metrics

This section provides a fundamental analysis of FactSet Research Systems Inc., focusing on its income statement, key financial ratios, and dividend payout policy.

Income Statement

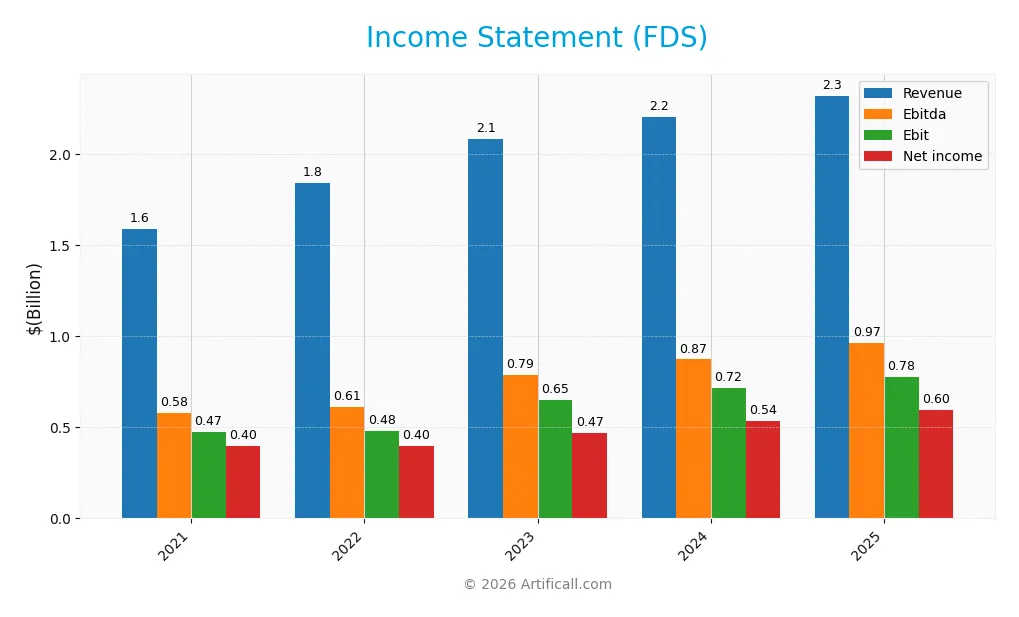

This table summarizes FactSet Research Systems Inc.’s key income statement figures over the last five fiscal years, illustrating revenue, expenses, profits, and earnings per share (EPS).

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 1.59B | 1.84B | 2.09B | 2.20B | 2.32B |

| Cost of Revenue | 786M | 871M | 973M | 1.01B | 1.10B |

| Operating Expenses | 331M | 497M | 483M | 490M | 476M |

| Gross Profit | 805M | 973M | 1.11B | 1.19B | 1.22B |

| EBITDA | 581M | 610M | 788M | 873M | 966M |

| EBIT | 474M | 479M | 650M | 717M | 777M |

| Interest Expense | 8.2M | 35.7M | 66.3M | 65.8M | 56.3M |

| Net Income | 400M | 397M | 468M | 537M | 597M |

| EPS | 10.56 | 10.48 | 12.26 | 14.11 | 15.74 |

| Filing Date | 2021-10-22 | 2022-10-21 | 2023-10-27 | 2024-10-29 | 2025-10-22 |

Income Statement Evolution

From 2021 to 2025, FactSet Research Systems Inc. demonstrated a favorable revenue growth of 45.89%, with a moderate 5.39% increase from 2024 to 2025. Net income growth was similarly positive, rising 49.41% over the period and 5.47% year-over-year. Margins remained stable and favorable, with the gross margin near 52.7%, EBIT margin around 33.5%, and net margin at 25.7%, indicating consistent profitability.

Is the Income Statement Favorable?

The 2025 fiscal year shows strong fundamentals with revenue of $2.32B and net income of $597M, translating into a net margin of 25.7%. EBIT margin improved to 33.5%, supported by controlled operating expenses and a favorable interest expense ratio of 2.43%. Earnings per share rose 11.8% year-over-year to $15.74, reinforcing solid profitability and operational efficiency. Overall, the income statement presents a favorable financial position.

Financial Ratios

The following table presents key financial ratios for FactSet Research Systems Inc. (FDS) over the fiscal years 2021 to 2025, reflecting profitability, liquidity, leverage, and market valuation metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 25% | 22% | 22% | 24% | 26% |

| ROE | 39% | 30% | 29% | 28% | 27% |

| ROIC | 21% | 12% | 14% | 16% | 16% |

| P/E | 36.0 | 41.3 | 35.6 | 29.9 | 23.7 |

| P/B | 14.2 | 12.3 | 10.3 | 8.4 | 6.5 |

| Current Ratio | 2.96 | 1.99 | 1.59 | 1.25 | 1.40 |

| Quick Ratio | 2.91 | 1.99 | 1.59 | 1.25 | 1.40 |

| D/E | 0.85 | 1.67 | 1.14 | 0.82 | 0.71 |

| Debt-to-Assets | 39% | 55% | 46% | 39% | 36% |

| Interest Coverage | 58.0 | 13.3 | 9.50 | 10.7 | 13.3 |

| Asset Turnover | 0.72 | 0.46 | 0.53 | 0.54 | 0.54 |

| Fixed Asset Turnover | 4.30 | 7.67 | 9.15 | 10.3 | 11.2 |

| Dividend Yield | 0.82% | 0.77% | 0.83% | 0.94% | 1.13% |

Evolution of Financial Ratios

From 2021 to 2025, FactSet Research Systems Inc. exhibited a generally stable return on equity (ROE), peaking at 39.3% in 2021 and moderating to 27.3% in 2025. The current ratio declined steadily from 2.96 in 2021 to 1.40 in 2025, indicating reduced short-term liquidity. The debt-to-equity ratio improved from a high 1.67 in 2022 to a more moderate 0.71 in 2025, reflecting better leverage management. Profitability margins showed slight fluctuations but remained robust overall.

Are the Financial Ratios Favorable?

In 2025, FactSet’s profitability ratios such as net margin (25.7%) and ROE (27.3%) were favorable, supported by a strong interest coverage ratio of 13.8. Liquidity ratios presented a mixed picture: the quick ratio was favorable at 1.4, while the current ratio was neutral. Leverage ratios, including debt-to-equity at 0.71 and debt-to-assets at 36.2%, were neutral. Market valuation metrics showed a neutral price-to-earnings ratio (23.7) but an unfavorable price-to-book ratio (6.48). Overall, the financial ratios are slightly favorable with a balanced risk profile.

Shareholder Return Policy

FactSet Research Systems Inc. maintains a consistent dividend payout ratio around 27%, with dividend per share rising steadily to 4.22 USD in 2025, yielding approximately 1.13%. The dividend is well covered by free cash flow, supported by stable operating margins and moderate leverage, with no mention of share buybacks.

This steady dividend distribution alongside strong free cash flow coverage indicates a balanced approach to returning capital, supporting sustainable long-term value creation for shareholders without apparent overextension in repurchases or payouts.

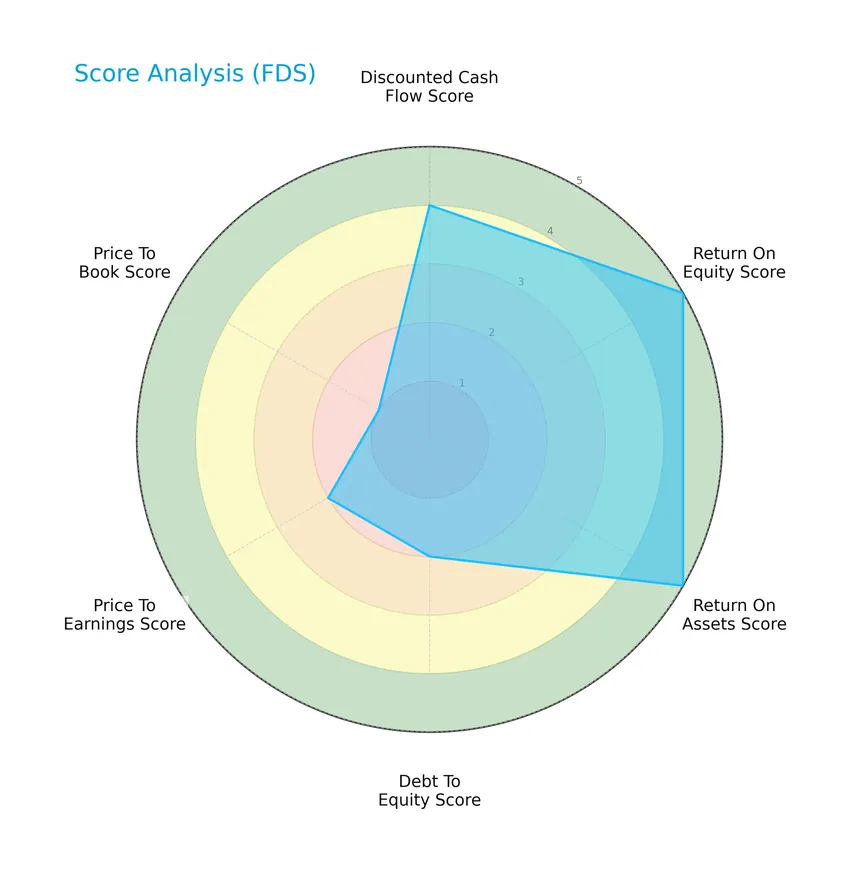

Score analysis

The radar chart below displays key financial scores for FactSet Research Systems Inc., highlighting strengths and weaknesses across valuation and profitability metrics:

FactSet shows very favorable scores in return on equity (5) and return on assets (5), with a favorable discounted cash flow score (4). However, valuation metrics like price-to-book (1) and price-to-earnings (2) are less appealing, while debt-to-equity sits at a moderate level (2).

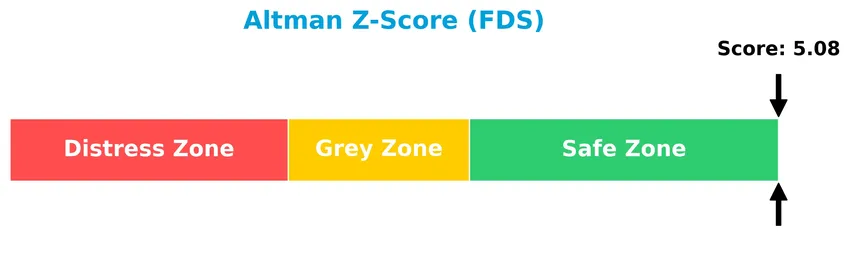

Analysis of the company’s bankruptcy risk

FactSet Research Systems Inc. is positioned in the safe zone according to its Altman Z-Score, indicating a low risk of bankruptcy and strong financial stability:

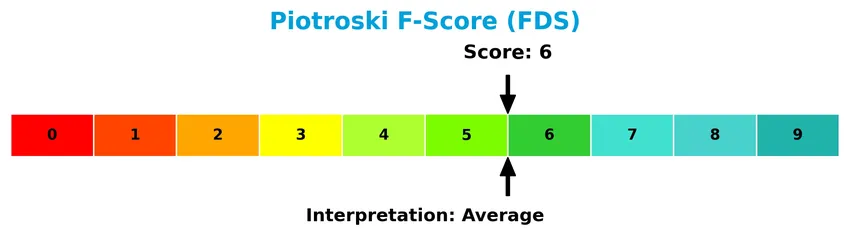

Is the company in good financial health?

The Piotroski Score diagram provides insight into the company’s financial health based on profitability, leverage, and efficiency factors:

With a Piotroski Score of 6, FactSet demonstrates average financial health, suggesting reasonable strength but room for improvement in certain operational or balance sheet areas.

Competitive Landscape & Sector Positioning

This section examines FactSet Research Systems Inc.’s strategic position within the financial services sector. We will analyze revenue by segment, key products, main competitors, and competitive advantages. The goal is to assess whether FactSet holds a competitive edge over its industry peers.

Strategic Positioning

FactSet Research Systems Inc. operates a geographically diversified business with significant revenue from the United States (approximately 1.42B in 2025), Europe (349M), and the United Kingdom (231M). The company focuses on integrated financial data and analytics, serving multiple financial sectors globally.

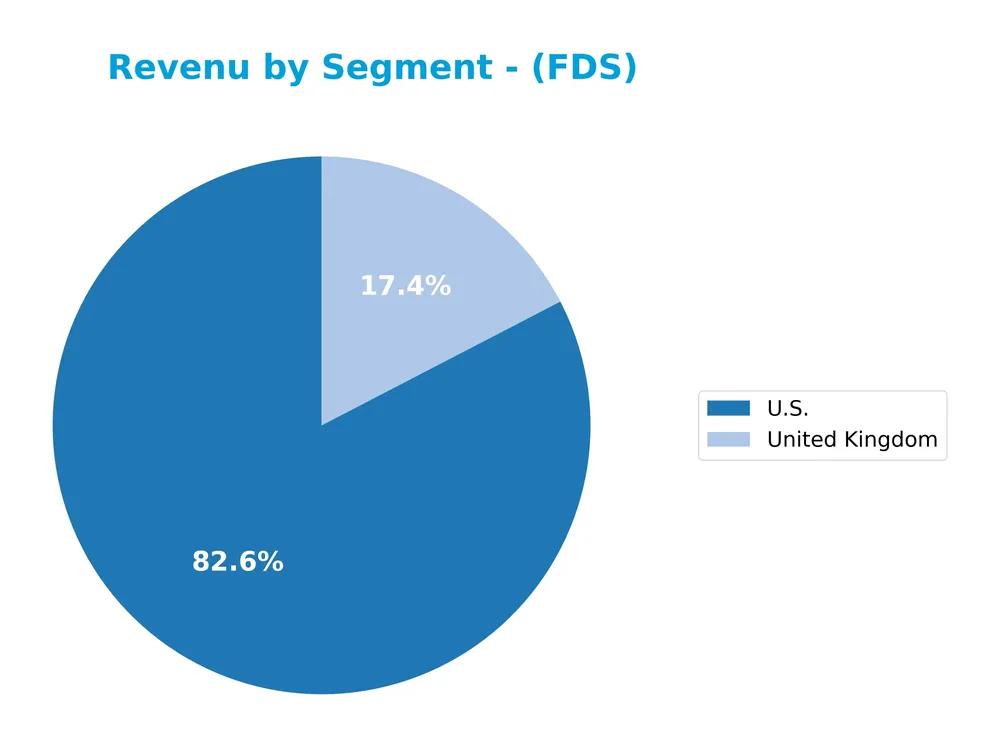

Revenue by Segment

The pie chart illustrates FactSet Research Systems Inc.’s revenue distribution by geographic segment for the fiscal year 2011.

In 2011, the U.S. market was the dominant revenue driver with approximately 498M USD, significantly surpassing the United Kingdom segment, which contributed around 105M USD. This concentration indicates a strong reliance on the U.S. market, highlighting geographic risk if diversification does not improve in subsequent years. The data suggests a clear regional focus without notable shifts within this fiscal period.

Key Products & Brands

The following table outlines FactSet Research Systems Inc.’s main products and brand offerings:

| Product | Description |

|---|---|

| Research, Analytics and Trading | Integrated financial information and analytical applications supporting investment workflows. |

| Content and Technology Solutions | Data delivery platforms and technology tools tailored for financial professionals. |

| Wealth | Solutions designed for wealth advisors and asset managers to optimize portfolio management. |

FactSet delivers comprehensive financial data and analytics through its core products, serving diverse clients such as portfolio managers, investment banks, and wealth advisors globally.

Main Competitors

FactSet Research Systems Inc. faces competition from 9 companies in its sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| S&P Global Inc. | 155.2B |

| CME Group Inc. | 97.2B |

| Intercontinental Exchange, Inc. | 91.7B |

| Moody’s Corporation | 89.7B |

| Coinbase Global, Inc. | 60.5B |

| Nasdaq, Inc. | 55.5B |

| MSCI Inc. | 43.7B |

| Cboe Global Markets, Inc. | 25.9B |

| FactSet Research Systems Inc. | 10.8B |

FactSet ranks 9th among its competitors by market capitalization, with a market cap approximately 6.9% that of the leader, S&P Global. The company is below both the average market cap of the top 10 competitors (70.0B) and the sector median (60.5B). It shows a significant gap of +142.02% to the next competitor above, Cboe Global Markets.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does FDS have a competitive advantage?

FactSet Research Systems Inc. presents a competitive advantage, as it generates returns on invested capital (ROIC) exceeding its weighted average cost of capital (WACC) by over 9%, indicating value creation despite a declining ROIC trend. Its profitability metrics remain favorable, with gross margin at 52.7% and net margin at 25.7%, supporting efficient capital use and consistent earnings growth.

Looking ahead, FactSet’s expansion across key regions such as the United States, Europe, and the United Kingdom, alongside steady revenue increases, suggests opportunities to deepen market penetration. Future prospects may include leveraging integrated financial information and analytics to enhance product offerings and capture emerging markets within the financial data and analytics sector.

SWOT Analysis

This analysis highlights FactSet Research Systems Inc.’s key internal and external factors to guide investment decisions.

Strengths

- strong profitability with 25.7% net margin

- favorable EBIT margin at 33.5%

- consistent revenue and net income growth over 45% since 2021

Weaknesses

- high price-to-book ratio indicating overvaluation risk

- moderate debt-to-equity ratio of 0.71

- limited geographic revenue diversification, heavy US dependence

Opportunities

- expansion in growing international markets like Europe and UK

- increasing demand for integrated financial analytics

- leveraging technology to enhance product offerings

Threats

- intense competition in financial data services

- regulatory changes in financial sectors

- economic downturns impacting client budgets

FactSet demonstrates solid profitability and growth, supported by a strong market position. However, valuation concerns and geographic concentration require cautious monitoring. Strategically, expanding international presence and innovation are key to mitigate competitive and regulatory risks.

Stock Price Action Analysis

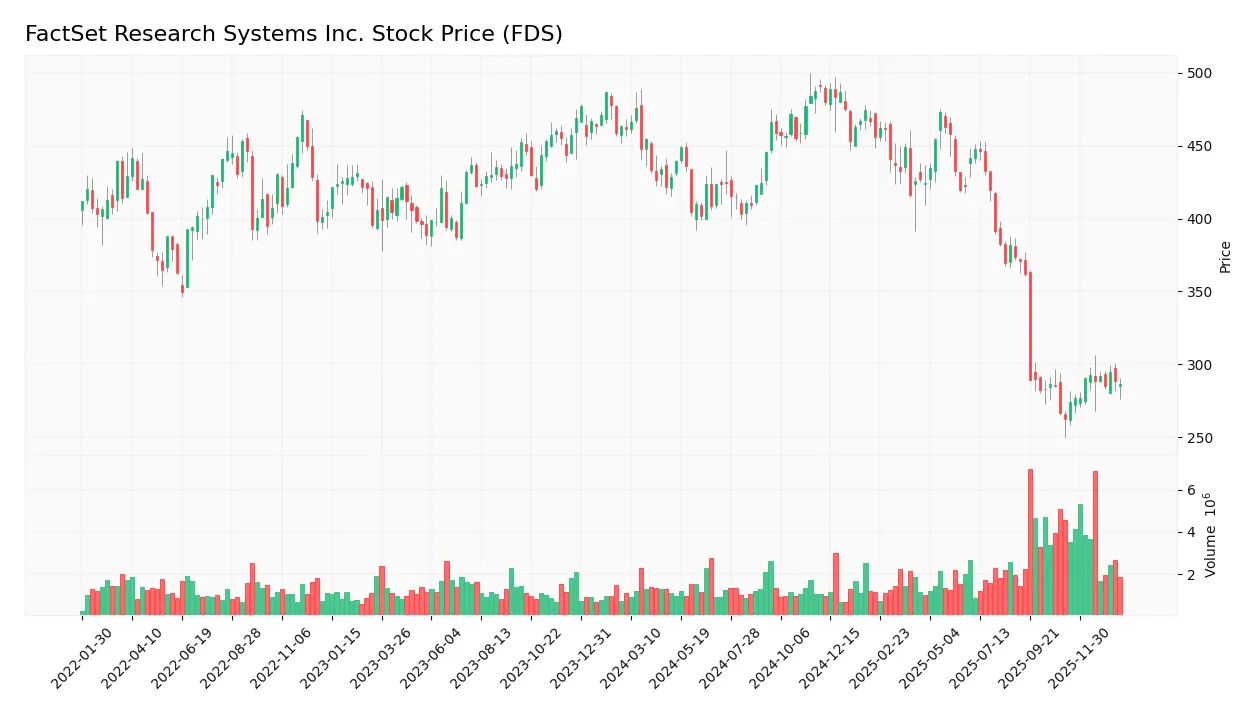

The following weekly stock chart illustrates FactSet Research Systems Inc. (FDS) price movements and key levels over the past year:

Trend Analysis

Over the past 12 months, FactSet’s stock price declined by 37.86%, indicating a bearish trend with acceleration. The price moved from a high of 490.67 to a low of 262.6, showing heightened volatility with a standard deviation of 66.7. A recent shorter-term period from November 2025 to January 2026 shows a 9.17% gain, reflecting a moderate upward slope of 1.95 and lower volatility at 9.1.

Volume Analysis

Trading volume for FDS is increasing overall with total activity of 215M shares. In the recent three months, buyer volume slightly dominates at 57.82%, with 24.6M shares versus 17.9M seller shares. This upward volume trend suggests growing investor interest and a moderately positive market participation bias.

Target Prices

The consensus target prices for FactSet Research Systems Inc. indicate a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 321 | 253 | 296.89 |

Analysts expect the stock price to range between 253 and 321, with a consensus target near 297, reflecting moderate confidence in upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest grades and consumer feedback related to FactSet Research Systems Inc. (FDS).

Stock Grades

Here is the latest overview of stock grades for FactSet Research Systems Inc. from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Underweight | 2026-01-14 |

| Evercore ISI Group | Maintain | In Line | 2026-01-08 |

| BMO Capital | Maintain | Market Perform | 2025-12-22 |

| Goldman Sachs | Maintain | Sell | 2025-12-19 |

| RBC Capital | Maintain | Sector Perform | 2025-12-19 |

| Stifel | Maintain | Hold | 2025-12-19 |

| Morgan Stanley | Upgrade | Equal Weight | 2025-12-17 |

| Wells Fargo | Maintain | Underweight | 2025-12-05 |

| UBS | Upgrade | Buy | 2025-09-22 |

| Barclays | Maintain | Underweight | 2025-09-19 |

The consensus from these grades largely centers on a hold position, with several firms maintaining neutral or underweight stances. Notably, UBS and Morgan Stanley have recently upgraded their ratings, reflecting some positive reassessment amid otherwise cautious sentiment.

Consumer Opinions

Consumers of FactSet Research Systems Inc. (FDS) often express a mix of satisfaction with its data accuracy and concerns about pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “FactSet’s data analytics are incredibly precise.” | “The subscription cost is quite high for small firms.” |

| “User interface is intuitive and easy to navigate.” | “Customer support can be slow to respond during peak times.” |

| “Integration with other financial tools is seamless.” | “Some advanced features require steep learning curves.” |

Overall, FactSet receives praise for its reliable data and user-friendly platform, but users frequently mention high costs and occasional support delays as areas for improvement.

Risk Analysis

Below is a concise summary of the main risk categories affecting FactSet Research Systems Inc. and their estimated probability and impact levels:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Exposure to financial market volatility affecting stock price fluctuations | Medium | High |

| Valuation Risk | Elevated Price-to-Book ratio indicating potential overvaluation | High | Medium |

| Credit Risk | Moderate debt-to-equity ratio and debt to assets may affect financial health | Medium | Medium |

| Operational Risk | Dependence on technology and data integrity for service delivery | Low | High |

| Regulatory Risk | Changes in financial regulations impacting data and analytics services | Low | Medium |

Market and valuation risks are the most pertinent for investors currently. FactSet’s stock trades at a high PB ratio (6.48), signaling possible overvaluation, while market volatility can influence its performance despite solid fundamentals. The company’s Altman Z-Score of 5.08 places it safely away from bankruptcy risk, though investors should monitor valuation metrics cautiously.

Should You Buy FactSet Research Systems Inc.?

FactSet appears to be generating robust value creation with a slightly favorable competitive moat, despite declining profitability trends. Its leverage profile remains moderate, supporting a B+ rating that suggests a very favorable overall financial health, though some caution might be warranted.

Strength & Efficiency Pillars

FactSet Research Systems Inc. exhibits robust profitability and financial health, with a net margin of 25.72% and a return on equity (ROE) of 27.31%, signaling efficient capital use. Its return on invested capital (ROIC) stands at 16.1%, comfortably exceeding the weighted average cost of capital (WACC) of 6.84%, marking the company as a clear value creator. The Altman Z-Score of 5.08 places FactSet well within the safe zone, indicating low bankruptcy risk, while a Piotroski score of 6 reflects average but stable financial strength.

Weaknesses and Drawbacks

Despite its strengths, FactSet faces challenges on valuation and leverage metrics. The price-to-book (P/B) ratio at 6.48 is notably high and unfavorable, suggesting the stock may be overvalued relative to its book value, increasing downside risk. The price-to-earnings (P/E) ratio of 23.71 is moderate yet implies a premium valuation that could limit near-term upside. Leverage remains moderate with a debt-to-equity ratio of 0.71, and a current ratio of 1.4 signals only neutral short-term liquidity, which may pressure the company if economic conditions deteriorate.

Our Verdict about FactSet Research Systems Inc.

FactSet’s long-term fundamental profile is favorable, underpinned by strong profitability and value creation metrics. However, the overall stock trend remains bearish with a -37.86% price change over the period, despite recent slight buyer dominance and a 9.17% price uptick. This suggests that despite solid fundamentals, recent market pressure might warrant a cautious, wait-and-see approach for investors seeking an optimal entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Y Intercept Hong Kong Ltd Purchases 76,322 Shares of FactSet Research Systems Inc. $FDS – MarketBeat (Jan 24, 2026)

- FactSet Research stock: Is FDS underperforming the financial sector? – MSN (Jan 21, 2026)

- A Look At FactSet Research Systems (FDS) Valuation After ESOP Shelf Registration And Slower Revenue Growth – simplywall.st (Jan 22, 2026)

- FactSet Enters Multiyear Market Data Partnership With Barclays – Nasdaq (Jan 22, 2026)

- Is It Time To Reassess FactSet Research Systems (FDS) After A 37% One-Year Share Price Fall – Yahoo Finance (Jan 06, 2026)

For more information about FactSet Research Systems Inc., please visit the official website: factset.com