Home > Analyses > Financial Services > Everest Re Group, Ltd.

Everest Group shapes risk management for businesses worldwide, protecting assets that fuel global commerce. As a powerhouse in reinsurance and specialty insurance, it combines deep expertise with innovative underwriting across multiple continents. Renowned for its disciplined capital allocation and resilient balance sheet, Everest commands respect in the cyclical insurance sector. Yet, as market dynamics evolve, I question whether its current valuation fully reflects the company’s growth potential and risk exposure in 2026.

Table of contents

Business Model & Company Overview

Everest Group, Ltd., founded in 1973 and headquartered in Hamilton, Bermuda, commands a dominant position in the reinsurance and insurance sectors. It operates a cohesive ecosystem spanning property, casualty, and specialty lines, delivering comprehensive coverage through a blend of direct channels and brokers globally. The company’s strategic footprint extends across the Americas, Europe, and Asia, underpinning its core mission to provide tailored risk solutions worldwide.

The company’s revenue engine balances treaty and facultative reinsurance with admitted and non-admitted insurance products, creating a diversified and resilient income stream. Everest leverages a global network that includes markets like the United States, Bermuda, Canada, and multiple European countries. This broad presence, combined with its expertise in specialty and commercial insurance lines, builds a formidable economic moat that shapes the future of risk management in its industry.

Financial Performance & Fundamental Metrics

I analyze Everest Re Group’s income statement, key financial ratios, and dividend payout policy to assess its operational efficiency and shareholder value creation.

Income Statement

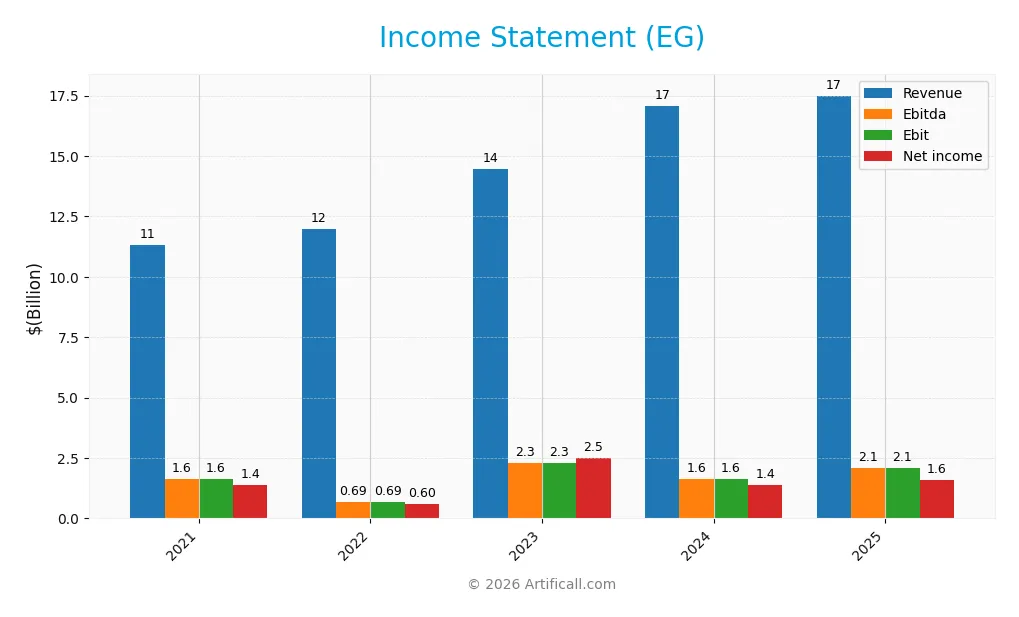

The following table summarizes Everest Re Group, Ltd.’s key income statement figures for fiscal years 2021 through 2025. All values are in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 11.3B | 12.0B | 14.5B | 17.1B | 17.5B |

| Cost of Revenue | 9.6B | 10.6B | 11.4B | 14.6B | 0 |

| Operating Expenses | 184M | 769M | 931M | 976M | 0 |

| Gross Profit | 1.7B | 1.4B | 3.1B | 2.5B | 0 |

| EBITDA | 1.6B | 689M | 2.3B | 1.6B | 2.1B |

| EBIT | 1.6B | 689M | 2.3B | 1.6B | 2.1B |

| Interest Expense | 70M | 101M | 134M | 149M | 151M |

| Net Income | 1.4B | 597M | 2.5B | 1.4B | 1.6B |

| EPS | 34.66 | 15.19 | 60.19 | 31.78 | 37.8 |

| Filing Date | 2021-12-31 | 2022-12-31 | 2024-02-28 | 2025-02-27 | 2026-02-04 |

Income Statement Evolution

Everest Re Group’s revenue grew 54.5% from 2021 to 2025, though the latest year showed a modest 2.5% increase. Net income rose 15.4% over the full period, but net margin declined by 25.3%. EBIT margin improved to 11.9%, reflecting better operational efficiency despite a steep drop in gross profit in 2025.

Is the Income Statement Favorable?

In 2025, Everest Re reported $17.5B revenue and $1.59B net income, with a net margin of 9.1%. EBIT margin and interest expense ratios indicate sound cost management. However, the 0% gross margin flags an anomaly or accounting change worth noting. Overall, 71% of income statement metrics are favorable, supporting a generally positive fundamental outlook.

Financial Ratios

The following table summarizes key financial ratios for Everest Re Group, Ltd. (EG) over the past five fiscal years, providing insight into profitability, efficiency, leverage, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 12% | 5.0% | 17% | 8.0% | 9.1% |

| ROE | 13.6% | 7.1% | 19.1% | 9.9% | 10.3% |

| ROIC | 3.4% | 1.1% | 91.7% | 58.5% | 16.8% |

| P/E | 7.8 | 21.6 | 5.8 | 11.3 | 0 |

| P/B | 1.06 | 1.53 | 1.11 | 1.12 | 0 |

| Current Ratio | 0 | 10.6 | 0 | 0 | 12.4 |

| Quick Ratio | 0 | 10.6 | 0 | 0 | 12.4 |

| D/E | 0.54 | 0.37 | 0.43 | 0.43 | 0.23 |

| Debt-to-Assets | 14.2% | 7.7% | 11.6% | 10.5% | 5.7% |

| Interest Coverage | 22.1 | 5.8 | 16.1 | 10.0 | 13.8 |

| Asset Turnover | 0.30 | 0.30 | 0.29 | 0.30 | 0.28 |

| Fixed Asset Turnover | 0 | 93.6 | 0 | 0 | 0 |

| Dividend Yield | 2.3% | 2.0% | 2.0% | 2.2% | 0 |

Note: Zero or missing data points indicate unavailable or inapplicable measurements for the respective years.

Evolution of Financial Ratios

Everest Re Group’s Return on Equity (ROE) showed fluctuations, peaking in 2023 before declining slightly by 2025 to 10.29%. The Current Ratio surged significantly in 2025 to 12.45, indicating strong liquidity. Debt-to-Equity Ratio steadily improved, falling to 0.23 in 2025, reflecting reduced leverage. Profitability margins stabilized, with net margin at 9.09% in 2025.

Are the Financial Ratios Fovorable?

In 2025, Everest Re demonstrates favorable leverage with a low debt-to-equity ratio of 0.23 and strong interest coverage at 13.79. Liquidity is mixed: a high current ratio signals excess assets but may indicate inefficiency. Profitability ratios like ROE and net margin are neutral, while return on invested capital (16.77%) and WACC (3.92%) are favorable. Efficiency metrics such as asset turnover remain unfavorable. Overall, 57% of key ratios are favorable.

Shareholder Return Policy

Everest Re Group, Ltd. maintains a dividend payout ratio around 18-24%, with dividends per share rising steadily from 6.29 to 7.82 over 2021-2025. The dividend yield has hovered near 2%, supported by free cash flow coverage and moderate payout policies.

No share buyback programs are reported during this period. The company’s consistent dividend payments, backed by solid earnings and cash flow, suggest a balanced approach toward shareholder returns that supports sustainable long-term value creation.

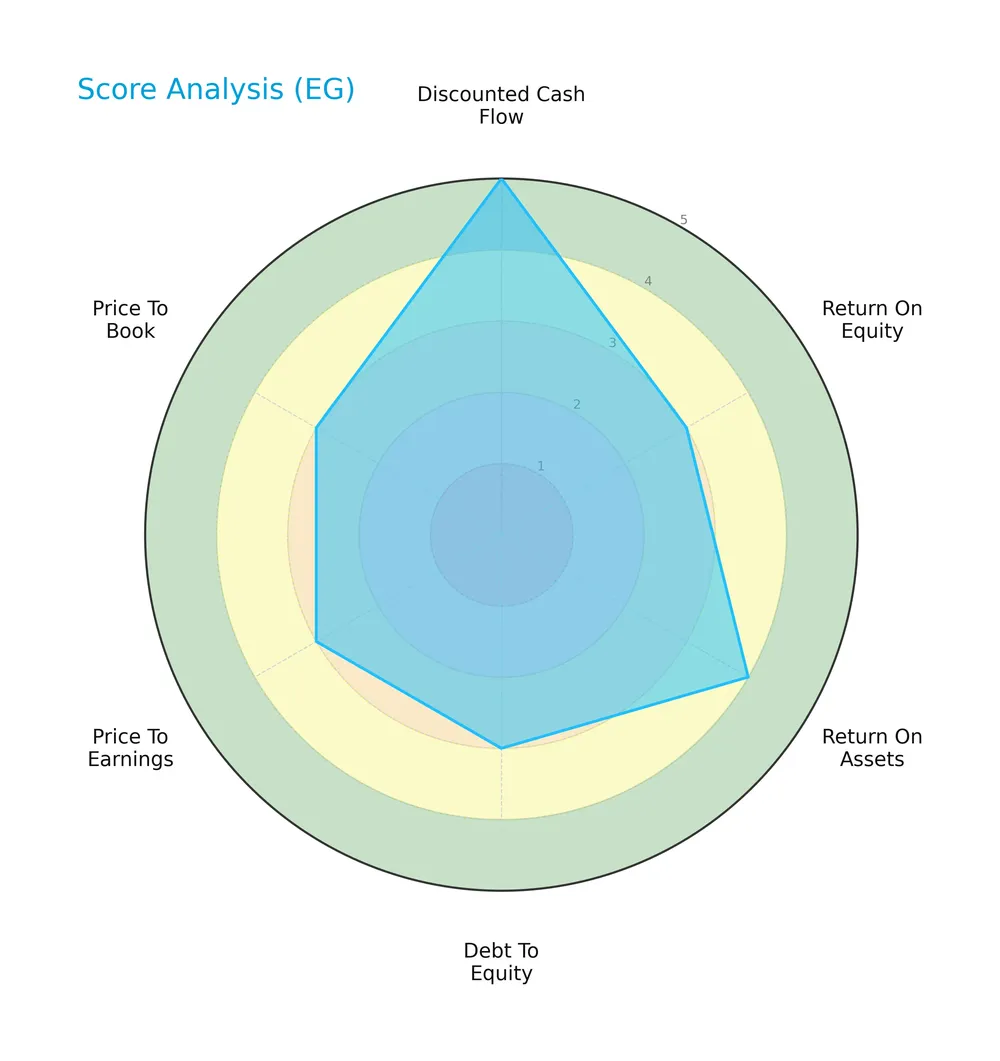

Score analysis

The radar chart below highlights key financial scores for Everest Re Group, Ltd., providing a snapshot of its valuation and profitability metrics:

Everest Re shows a very favorable discounted cash flow score of 5. Return on assets scores favorably at 4, while return on equity, debt to equity, price to earnings, and price to book all hold moderate scores of 3. This mix suggests balanced performance across profitability and valuation metrics.

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Everest Re in the distress zone, signaling a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

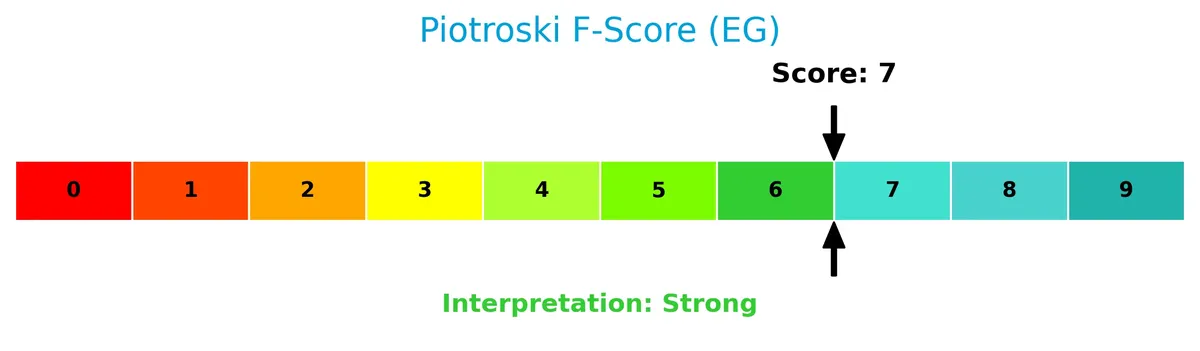

The Piotroski Score diagram below illustrates Everest Re’s financial health indicators:

With a strong Piotroski Score of 7, Everest Re demonstrates solid financial strength across profitability, leverage, liquidity, and efficiency measures, indicating generally robust fundamentals despite other risk signals.

Competitive Landscape & Sector Positioning

This analysis explores Everest Group, Ltd.’s strategic position within the insurance and reinsurance sector. It examines revenue streams, key products, and the main competitors shaping its market environment. I will assess whether Everest Group holds a competitive advantage over its peers based on these factors.

Strategic Positioning

Everest Group, Ltd. maintains a diversified portfolio across reinsurance and insurance segments, generating $11.4B and $3.6B in revenue respectively. It operates internationally, spanning the US, Bermuda, Europe, and Asia, balancing geographic exposure with specialty and commercial product lines.

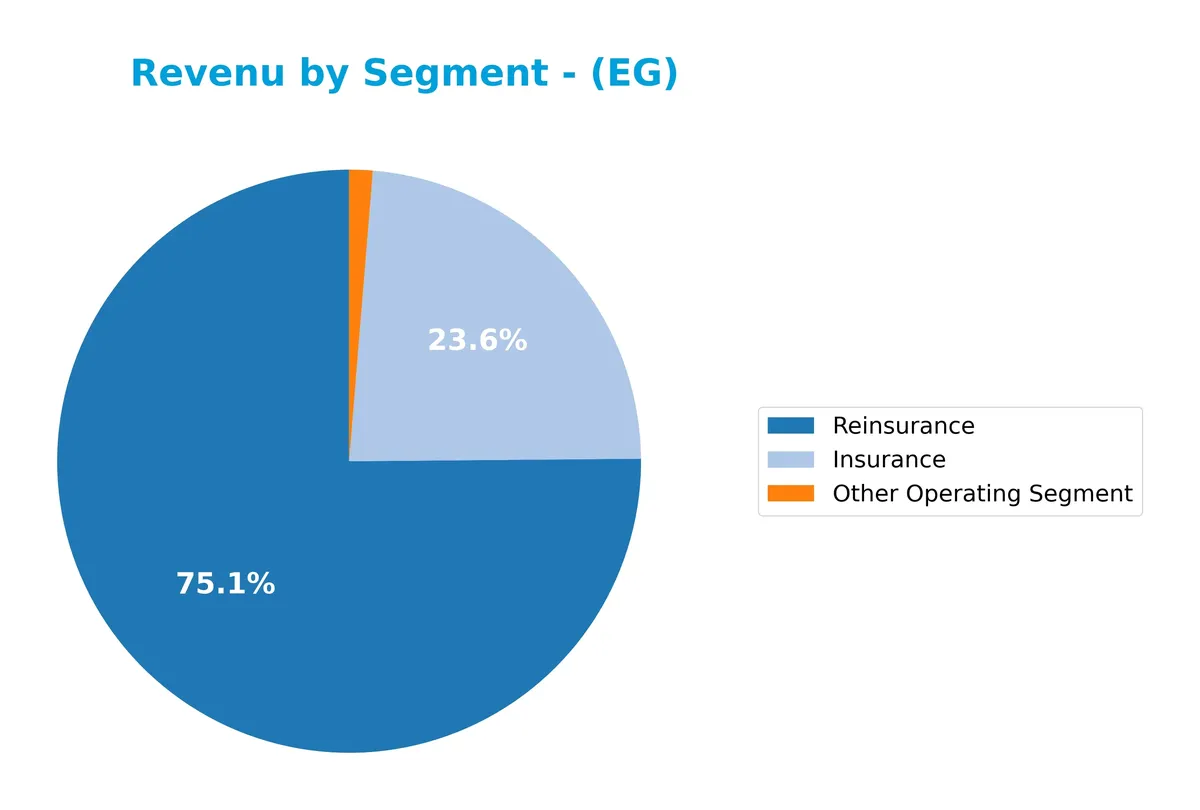

Revenue by Segment

This pie chart illustrates Everest Re Group’s revenue distribution by segment for the fiscal year 2024, highlighting the relative size of each business area.

In 2024, Reinsurance dominates Everest Re Group’s revenue with 11.4B, reflecting its core strength. Insurance contributes 3.6B, showing a solid secondary pillar. The Other Operating Segment is marginal at 197M, indicating limited diversification. The concentration in Reinsurance suggests high dependency, which could amplify exposure to sector volatility despite strong overall revenue generation.

Key Products & Brands

Everest Group, Ltd. offers a diverse range of reinsurance and insurance products across multiple global markets:

| Product | Description |

|---|---|

| Reinsurance Operations | Property and casualty reinsurance including specialty lines, offered via brokers and directly in key global regions. |

| Insurance Operations | Property and casualty insurance provided directly and through brokers in the U.S., Bermuda, Europe, and other markets. |

| Treaty and Facultative Reinsurance | Customized reinsurance solutions designed to cover specific risks for ceding companies. |

| Admitted and Non-Admitted Insurance | Various insurance products compliant with or outside standard regulatory frameworks, addressing diverse client needs. |

| Specialty Lines Coverage | Includes marine, aviation, surety, errors and omissions, directors’ and officers’ liability, medical malpractice, and others. |

| Commercial Property & Casualty Insurance | Offered through wholesale and retail brokers, surplus lines brokers, and program administrators. |

Everest Group’s portfolio balances large-scale reinsurance with specialized insurance products. Its global footprint spans North America, Europe, and select international markets, supporting a broad client base with tailored risk solutions.

Main Competitors

There are 71 competitors in the Financial Services sector, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Berkshire Hathaway Inc. | 1.07T |

| JPMorgan Chase & Co. | 886B |

| Visa Inc. | 672B |

| Mastercard Incorporated | 506B |

| Bank of America Corporation | 409B |

| Wells Fargo & Company | 310B |

| Morgan Stanley | 289B |

| The Goldman Sachs Group, Inc. | 287B |

| American Express Company | 260B |

| Citigroup Inc. | 221B |

Everest Re Group, Ltd. ranks 64th among 71 competitors by market capitalization. Its market cap is just 1.29% of the sector leader, Berkshire Hathaway Inc. Everest Re is well below both the average market cap of the top 10 (491B) and the median sector market cap (55B). It sits 45.92% below its nearest competitor above, highlighting a significant scale gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does Everest Re Group, Ltd. have a competitive advantage?

Everest Re Group demonstrates a very favorable competitive advantage with a ROIC exceeding WACC by 12.8%, signaling value creation and efficient capital use. Its growing ROIC trend further confirms increasing profitability and a sustainable economic moat in the reinsurance sector.

Looking ahead, Everest Re Group’s diversified product range and global reach offer opportunities to expand in specialty lines and emerging markets. Continued innovation in property and casualty insurance and reinsurance positions the company to leverage evolving industry demands and sustain its competitive edge.

SWOT Analysis

This analysis highlights Everest Group, Ltd.’s key internal and external factors shaping its strategic position.

Strengths

- Strong ROIC well above WACC

- Growing ROIC trend signals increasing profitability

- Very favorable moat and competitive advantage

Weaknesses

- Low Altman Z-Score signals financial distress risk

- Unfavorable gross margin and asset turnover

- High current ratio suggests inefficient asset use

Opportunities

- Expansion in global reinsurance markets

- Rising demand for specialty insurance products

- Opportunity to optimize operational efficiency

Threats

- Intense competition in reinsurance sector

- Macroeconomic volatility affecting underwriting results

- Regulatory changes impacting capital requirements

Everest Group demonstrates a durable competitive moat with robust profitability growth. However, financial health risks and operational inefficiencies require cautious management. Strategic focus should balance seizing global growth opportunities while shoring up balance sheet resilience.

Stock Price Action Analysis

The weekly stock chart illustrates Everest Re Group, Ltd.’s price movements over the last 100 weeks, highlighting key inflection points and volatility patterns:

Trend Analysis

Over the past two years, EG’s stock price declined by 16.41%, indicating a clear bearish trend with accelerating downside momentum. Price volatility is significant, with a 23.11 standard deviation. The stock reached a high of 407.04 and a low of 309.97, underscoring notable price swings.

Volume Analysis

Trading volumes have increased recently, with seller volume exceeding buyer volume at 53.4% over the last three months. Buyer activity remains neutral at 47.6%, suggesting cautious investor sentiment amid heightened market participation.

Target Prices

Analysts set a confident price range for Everest Re Group, Ltd., reflecting robust sector fundamentals.

| Target Low | Target High | Consensus |

|---|---|---|

| 332 | 377 | 353 |

The target prices indicate moderate upside potential. The consensus suggests solid confidence in Everest Re’s valuation within the reinsurance sector.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

I will examine Everest Re Group, Ltd. (EG) through analyst ratings and consumer feedback to assess market sentiment.

Stock Grades

Here are the latest verified stock grades from established financial institutions for Everest Re Group, Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-02-06 |

| Cantor Fitzgerald | Maintain | Neutral | 2026-01-14 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-13 |

| Barclays | Maintain | Overweight | 2026-01-08 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-06 |

| TD Cowen | Maintain | Hold | 2025-12-15 |

| Barclays | Maintain | Overweight | 2025-11-03 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-10-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-29 |

| Wolfe Research | Upgrade | Peer Perform | 2025-10-29 |

The consensus from these reputable firms leans toward a cautious stance, with most maintaining neutral to slightly positive grades. There is a consistent pattern of holding or moderate optimism, reflecting balanced expectations for Everest Re’s near-term prospects.

Consumer Opinions

Consumers express mixed sentiments about Everest Re Group, Ltd., reflecting both satisfaction and areas of concern.

| Positive Reviews | Negative Reviews |

|---|---|

| “Everest Re offers reliable claims processing with responsive customer service.” | “Premium costs seem higher than competitors for similar coverage.” |

| “The company’s underwriting expertise shows in tailored insurance solutions.” | “Some customers report delays in policy issuance during peak times.” |

| “Strong financial backing gives me confidence in long-term coverage stability.” | “Limited transparency on policy terms caused confusion initially.” |

Overall, Everest Re’s clients appreciate its dependable claims handling and underwriting strength. However, pricing and occasional service delays emerge as consistent pain points.

Risk Analysis

Below is a summary table highlighting key risks for Everest Re Group, Ltd., their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Distress | Altman Z-Score signals high bankruptcy risk, currently in distress zone (1.11). | High | High |

| Liquidity Concerns | Extremely high current ratio (12.45) may indicate inefficient asset use. | Medium | Medium |

| Operational Efficiency | Low asset turnover (0.28) suggests underutilization of assets versus peers. | Medium | Medium |

| Dividend Yield | Zero dividend yield could deter income-focused investors. | Low | Low |

| Market Volatility | Low beta (0.33) reduces stock price volatility risk but may limit upside. | Low | Low |

The most pressing risk is financial distress, as indicated by Everest’s Altman Z-score well below 1.8. This signals a moderate to high probability of financial instability despite a strong Piotroski score of 7. The unusually high current ratio suggests idle assets or cash, which could hamper returns. These factors contrast with the company’s favorable ROIC (16.77%) and low WACC (3.92%), underscoring the need for cautious capital allocation. Investors must weigh these risks against the company’s solid reinsurance franchise and industry position.

Should You Buy Everest Re Group, Ltd.?

Everest Re Group appears to be improving profitability with a durable moat supported by a growing ROIC well above WACC. Despite moderate leverage and distress-zone Altman Z-score, it suggests a profile of strong value creation and operational efficiency, rated A-.

Strength & Efficiency Pillars

Everest Re Group, Ltd. demonstrates operational resilience with an EBIT margin of 11.91% and a net margin of 9.09%. The company posts a solid ROIC of 16.77%, comfortably exceeding its WACC of 3.92%, confirming it as a clear value creator. ROE stands at a moderate 10.29%, reflecting stable profitability. These metrics show effective capital allocation and a sustainable competitive advantage, supported by a strong Piotroski score of 7, indicating robust financial health despite challenges.

Weaknesses and Drawbacks

The company is in financial distress, reflected by a low Altman Z-Score of 1.11, signaling a high bankruptcy risk. This solvency concern overshadows its profitability. Additionally, Everest Re’s current ratio is an alarming 12.45, which, while superficially suggesting liquidity, may indicate inefficient working capital management. The firm faces bearish market pressure with a 16.41% overall price decline and seller dominance at 54.31%, undermining near-term investor confidence. Asset turnover remains weak at 0.28, signaling underutilization of assets.

Our Final Verdict about Everest Re Group, Ltd.

Despite operational strengths and value creation, Everest Re Group’s financial distress makes the investment profile highly speculative. The low Altman Z-Score of 1.11 raises significant solvency concerns that could overshadow recent profitability gains. Investors may view this stock as too risky for conservative capital, warranting caution until the company stabilizes its balance sheet.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Everest Group Ltd (EG) Q4 2025 Earnings Call Highlights: Navigat – GuruFocus (Feb 05, 2026)

- Everest Group (EG) Q4 Earnings: What To Expect – Finviz (Feb 03, 2026)

- Everest Group (NYSE:EG) Reports Sales Below Analyst Estimates In Q4 CY2025 Earnings – TradingView (Feb 04, 2026)

- Vulcan Value Partners’ Investment Journey with Everest Group Ltd. (EG) – Yahoo Finance (Jan 27, 2026)

- It Might Not Be A Great Idea To Buy Everest Group, Ltd. (NYSE:EG) For Its Next Dividend – simplywall.st (Nov 21, 2025)

For more information about Everest Re Group, Ltd., please visit the official website: everestglobal.com