Home > Analyses > Industrials > ESAB Corporation

ESAB Corporation powers the backbone of modern industry by delivering cutting-edge welding and cutting solutions that keep infrastructure and manufacturing moving forward. As a recognized leader in metal fabrication technology, ESAB blends innovation, quality, and digital transformation to serve diverse sectors like construction, energy, and transportation. With its strong market presence and continuous product advancements, the critical question for investors today is whether ESAB’s fundamentals continue to support its growth and valuation in an evolving industrial landscape.

Table of contents

Business Model & Company Overview

ESAB Corporation, founded in 2021 and headquartered in Wilmington, Delaware, commands a dominant position in the metal fabrication manufacturing sector. It delivers an integrated ecosystem of cutting, joining, and automated welding consumables and equipment, supported by advanced gas control solutions. Its comprehensive product suite spans electrodes, wires, fluxes, and cutting consumables, alongside portable to large-scale automated fabrication systems, all marketed under the ESAB brand to diverse sectors including construction, energy, and medical.

The company’s revenue engine balances hardware sales with digital software offerings that enhance productivity and enable remote operation monitoring. ESAB leverages a global footprint across the Americas, Europe, and Asia, distributing through independent channels and direct sales forces. This blend of consumables, equipment, and software fortifies its competitive advantage, forming a resilient economic moat that shapes the future of welding and fabrication industries.

Financial Performance & Fundamental Metrics

In this section, I analyze ESAB Corporation’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

The table below presents ESAB Corporation’s key income statement figures for the fiscal years 2020 through 2024, showing revenue, expenses, profits, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.95B | 2.43B | 2.59B | 2.77B | 2.74B |

| Cost of Revenue | 1.27B | 1.59B | 1.71B | 1.76B | 1.70B |

| Operating Expenses | 480M | 532M | 556M | 612M | 590M |

| Gross Profit | 682M | 838M | 886M | 1.02B | 1.04B |

| EBITDA | 299M | 405M | 435M | 509M | 531M |

| EBIT | 225M | 330M | 370M | 440M | 465M |

| Interest Expense | 0 | 0 | 38M | 85M | 65M |

| Net Income | 157M | 235M | 224M | 205M | 265M |

| EPS | 2.62 | 3.92 | 3.73 | 3.38 | 4.36 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2023-03-07 | 2024-02-29 | 2025-02-20 |

Income Statement Evolution

Between 2020 and 2024, ESAB Corporation’s revenue grew 40.55%, though it slightly declined 1.22% from 2023 to 2024. Gross profit increased steadily, supporting a favorable gross margin of 37.85%. Operating expenses grew slower than revenue, helping EBIT rise 5.72% year-over-year and maintain a strong EBIT margin near 17%. Net income surged 68.25% over five years, with net margin improving 19.71%.

Is the Income Statement Favorable?

In 2024, ESAB reported $2.74B revenue and a net income of $265M, reflecting a 9.66% net margin, marked as favorable. EPS rose 28.27% year-over-year to $4.36. Interest expense remained low at 2.37% of revenue. The company’s fundamentals show solid profitability and margin expansion, with 85.71% of income statement metrics rated favorable, indicating generally positive financial health in the latest fiscal year.

Financial Ratios

The following table presents key financial ratios for ESAB Corporation over the past five fiscal years, illustrating the company’s profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 8.1% | 9.7% | 8.6% | 7.4% | 9.7% |

| ROE | 6.3% | 9.6% | 16.6% | 12.8% | 15.0% |

| ROIC | 5.3% | 7.9% | 8.0% | 8.8% | 10.3% |

| P/E | 19.1 | 12.8 | 12.6 | 25.4 | 27.4 |

| P/B | 1.2 | 1.2 | 2.1 | 3.2 | 4.1 |

| Current Ratio | 1.75 | 1.62 | 1.64 | 1.61 | 1.82 |

| Quick Ratio | 1.07 | 0.91 | 0.95 | 0.98 | 1.18 |

| D/E | 0.04 | 0.04 | 1.0 | 0.70 | 0.66 |

| Debt-to-Assets | 2.9% | 3.2% | 35.0% | 29.2% | 28.8% |

| Interest Coverage | 0 | 0 | 8.7 | 4.8 | 6.9 |

| Asset Turnover | 0.58 | 0.70 | 0.69 | 0.72 | 0.68 |

| Fixed Asset Turnover | 4.9 | 6.2 | 6.9 | 7.1 | 7.1 |

| Dividend Yield | 0% | 0% | 0.21% | 0.26% | 0.23% |

Evolution of Financial Ratios

From 2020 to 2024, ESAB Corporation’s Return on Equity (ROE) showed an overall improving trend, rising notably to 14.97% in 2024 after some fluctuations. The Current Ratio increased steadily, reaching 1.82 in 2024, indicating enhanced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio stabilized around 0.66 in 2024, reflecting moderate leverage. Profitability margins demonstrated some stability, with net profit margin holding near 9.66%.

Are the Financial Ratios Favorable?

In 2024, ESAB’s profitability ratios presented a mixed picture: ROE and net margin were neutral, while return on invested capital (ROIC) was favorable at 10.3%. Liquidity ratios, including current and quick ratios, were favorable, suggesting strong short-term financial health. Leverage ratios were mostly neutral to favorable, with debt-to-assets at 28.84% rated favorable and debt-to-equity neutral. Efficiency ratios like fixed asset turnover were favorable, but valuation ratios such as price-to-earnings and price-to-book were unfavorable, contributing to an overall slightly favorable assessment of the company’s financial ratios.

Shareholder Return Policy

ESAB Corporation pays a modest dividend with a payout ratio around 6.4% in 2024 and a dividend yield below 0.3%. Dividend per share has steadily increased from $0.10 in 2022 to $0.28 in 2024, supported by solid free cash flow coverage and manageable capital expenditures. The company also engages in share buybacks, complementing its cash returns to shareholders.

The conservative dividend policy, combined with share repurchases, suggests a balanced approach to returning capital while maintaining financial flexibility. This distribution strategy appears sustainable, aligning with the company’s profitability margins and cash flow generation, thus supporting long-term shareholder value creation.

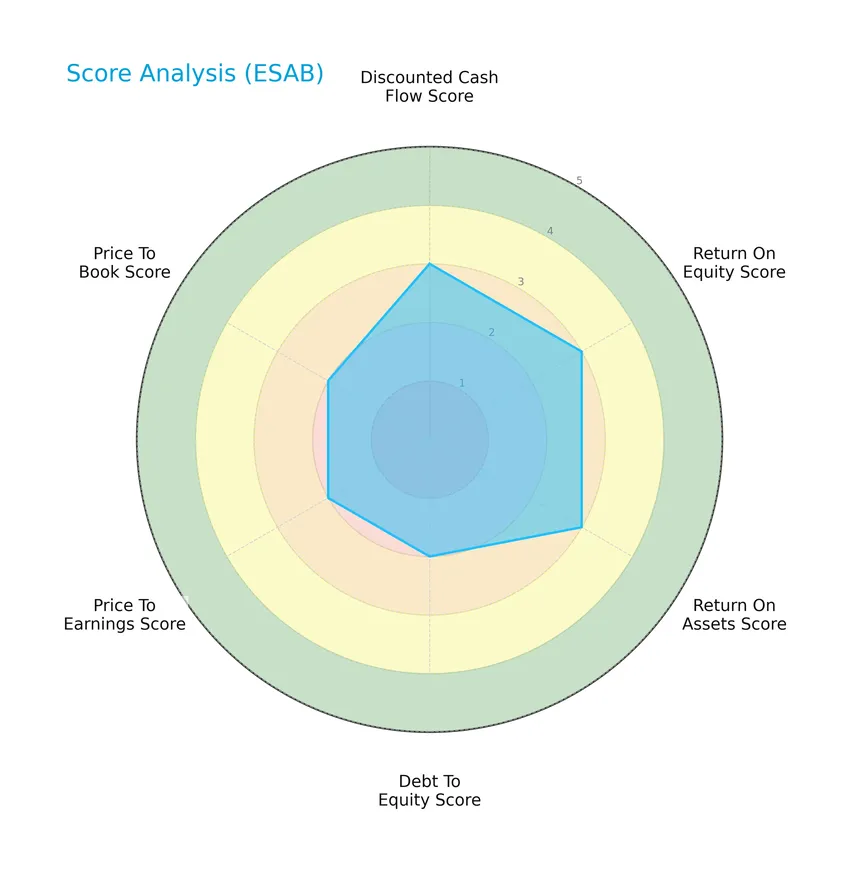

Score analysis

The following radar chart presents an overview of ESAB Corporation’s key financial scores across multiple valuation and performance metrics:

ESAB shows moderate scores in discounted cash flow, return on equity, and return on assets, each rated 3. Debt to equity, price to earnings, and price to book ratios are slightly lower at 2, reflecting a balanced but cautious financial profile overall.

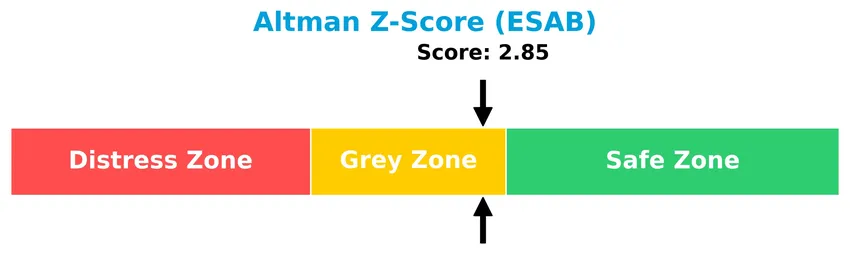

Analysis of the company’s bankruptcy risk

The Altman Z-Score of 2.85 places ESAB Corporation in the grey zone, indicating a moderate risk of financial distress and potential bankruptcy:

Is the company in good financial health?

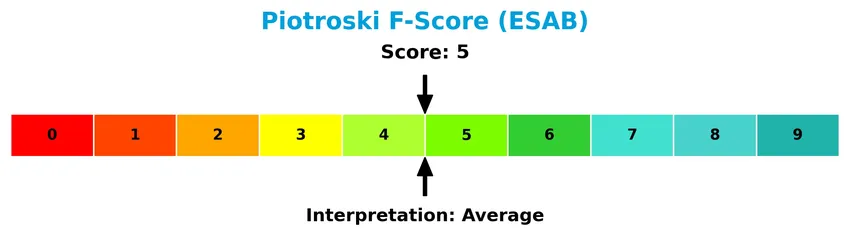

The Piotroski Score diagram below summarizes ESAB Corporation’s financial health assessment based on profitability, leverage, liquidity, and operational efficiency:

With a Piotroski Score of 5, ESAB’s financial health is considered average, suggesting neither strong nor weak fundamentals based on this metric.

Competitive Landscape & Sector Positioning

This section presents an analysis of ESAB Corporation’s sector, covering strategic positioning, revenue segments, key products, and competitors. I will assess whether ESAB holds a competitive advantage over its main rivals based on these factors.

Strategic Positioning

ESAB Corporation maintains a diversified product portfolio with significant revenue from Equipment Products (~1.85B in 2024) and Consumable Products (~893M in 2024), while its geographic exposure is balanced between the Americas (1.18B) and EMEA/APAC regions (1.56B), reflecting a broad industrial market reach.

Revenue by Segment

This pie chart presents the revenue distribution of ESAB Corporation by product segment for the fiscal years 2022 through 2024.

ESAB’s revenue is primarily driven by Equipment Products, which consistently generate around 1.85B to 1.92B annually. Consumable Products have shown steady growth from 740M in 2022 to 893M in 2024. The slight decline in Equipment Products revenue in 2024 to 1.85B suggests a mild slowdown, while the increase in Consumables highlights a gradual shift towards more balanced segment contributions.

Key Products & Brands

The following table presents ESAB Corporation’s main product categories and their descriptions:

| Product | Description |

|---|---|

| Consumable Products | Welding consumables including electrodes, cored and solid wires, fluxes, and cutting consumables like nozzles, shields, and tips made from various specialty materials. |

| Equipment Products | Fabrication technology equipment ranging from portable welding machines to large customized automated cutting and welding systems, plus gas control equipment and digital solutions. |

ESAB Corporation’s product portfolio centers on welding consumables and fabrication equipment, supporting multiple industries with both physical products and digital tools to enhance productivity and process monitoring.

Main Competitors

In the Industrials sector, specifically Manufacturing – Metal Fabrication, there are 2 competitors, with the top 10 leaders by market capitalization listed here:

| Competitor | Market Cap. |

|---|---|

| ESAB Corporation | 6.78B |

| Proto Labs, Inc. | 1.20B |

ESAB Corporation ranks 1st among its competitors with a market cap 8.06% above the top player benchmark. It is positioned well above the average market cap of the top 10 and the median sector market cap. The company has a significant lead over its closest rival, Proto Labs, with a distance to the next competitor below of -511.82%.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ESAB have a competitive advantage?

ESAB Corporation does not yet demonstrate a clear competitive advantage, as its return on invested capital (ROIC) remains below its weighted average cost of capital (WACC), indicating value is currently being shed. However, the company’s ROIC trend is growing, suggesting improving profitability and operational efficiency.

Looking ahead, ESAB’s broad product range in welding consumables, equipment, and digital solutions, combined with its presence across diverse sectors including construction, energy, and medical, offers opportunities for future growth. Expansion in emerging markets and continued development of automated and digital welding technologies may further support its competitive positioning.

SWOT Analysis

This SWOT analysis highlights ESAB Corporation’s strategic position by examining its internal strengths and weaknesses alongside external opportunities and threats.

Strengths

- strong profitability with favorable margins

- growing ROIC trend indicating improving returns

- diversified product range serving multiple industries

Weaknesses

- recent slight revenue decline

- moderate financial leverage with DE at 0.66

- high valuation multiples (PE and PB) signaling possible overpricing

Opportunities

- expansion in renewable energy markets

- digital welding solutions boosting customer productivity

- increasing infrastructure and construction demand

Threats

- competitive pressure in metal fabrication industry

- economic slowdown risks impacting capital spending

- raw material price volatility affecting costs

Overall, ESAB shows solid profitability and growth potential, supported by a growing ROIC and product diversification. However, investors should monitor valuation levels and revenue trends carefully while considering market expansion and competitive risks in the company’s strategy.

Stock Price Action Analysis

The following weekly stock chart displays ESAB Corporation’s price movements over the last 100 weeks, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, ESAB’s stock price increased by 21.94%, indicating a bullish trend with acceleration. The price ranged from a low of 91.98 to a high of 133.28, with volatility reflected by a standard deviation of 10.56. This confirms strong upward momentum in the period analyzed.

Volume Analysis

In the last three months, trading volume has been increasing but remains seller-dominant, with buyers accounting for 38.85% of activity. This suggests cautious investor sentiment, as sellers currently exert more influence despite growing market participation.

Target Prices

The consensus target prices for ESAB Corporation indicate a positive outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 150 | 140 | 146.2 |

Analysts expect ESAB’s stock price to trade in a range between 140 and 150, with a consensus target around 146, suggesting moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews analyst ratings and consumer feedback to present a comprehensive view of ESAB Corporation.

Stock Grades

Here is the latest summary of stock grades from recognized financial institutions for ESAB Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| JP Morgan | Maintain | Overweight | 2026-01-14 |

| Stifel | Maintain | Buy | 2025-12-16 |

| JP Morgan | Maintain | Overweight | 2025-10-30 |

| UBS | Maintain | Buy | 2025-10-20 |

| JP Morgan | Maintain | Overweight | 2025-10-14 |

| Loop Capital | Upgrade | Buy | 2025-08-22 |

| JP Morgan | Maintain | Overweight | 2025-08-07 |

| Oppenheimer | Maintain | Outperform | 2025-08-07 |

| Stifel | Upgrade | Buy | 2025-08-07 |

| Stifel | Maintain | Hold | 2025-07-21 |

The overall trend shows consistent confidence in ESAB, with multiple firms maintaining or upgrading to buy or overweight ratings. Stifel and Loop Capital notably upgraded their ratings in mid-2025, reinforcing a positive outlook among analysts.

Consumer Opinions

Consumer sentiment about ESAB Corporation reveals a mix of appreciation for product quality and concerns regarding customer service.

| Positive Reviews | Negative Reviews |

|---|---|

| “ESAB’s welding equipment is durable and reliable.” | “Customer support response times are often slow.” |

| “I appreciate the innovative features in their latest models.” | “Some replacement parts are expensive and hard to find.” |

| “Consistent performance in tough industrial environments.” | “Occasionally, user manuals lack clarity.” |

Overall, consumers praise ESAB for robust and innovative products, but recurring issues with customer support and part availability suggest areas for improvement.

Risk Analysis

Below is an overview of ESAB Corporation’s key risks, highlighting potential challenges based on likelihood and severity:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Price fluctuations due to economic cycles and industrial demand shifts | Medium | High |

| Valuation Concerns | Elevated P/E (27.37) and P/B (4.1) ratios may pressure stock price if earnings slow down | High | Medium |

| Competitive Pressure | Intense competition in metal fabrication and welding equipment markets | Medium | Medium |

| Supply Chain Disruptions | Risks from raw material availability and logistics delays impacting production | Medium | High |

| Technological Change | Need to innovate digital welding solutions to maintain market position | Medium | Medium |

| Financial Health | Altman Z-Score in grey zone (2.85) signals moderate bankruptcy risk; Piotroski Score average | Medium | Medium |

The most significant risks for ESAB in 2026 stem from market volatility and supply chain disruptions, which could heavily impact revenues and operations. Valuation metrics suggest the stock price may be sensitive to earnings fluctuations, warranting cautious position sizing. The company’s moderate financial health scores underscore the importance of monitoring liquidity and leverage closely.

Should You Buy ESAB Corporation?

ESAB Corporation appears to be in a grey zone of financial distress with moderate profitability and an improving return on invested capital suggesting slight operational efficiency gains. Despite a manageable leverage profile, its competitive moat seems only slightly favorable, reflecting growing but yet limited value creation. The overall rating of B- could be seen as very favorable, indicating cautious optimism tempered by moderate risk factors.

Strength & Efficiency Pillars

ESAB Corporation exhibits solid profitability with a net margin of 9.66% and a return on equity of 14.97%, reflecting moderate efficiency in generating shareholder returns. Its return on invested capital (ROIC) stands at a favorable 10.3%, exceeding the weighted average cost of capital (WACC) at 8.77%, confirming ESAB as a value creator. Financial health indicators are mixed but generally stable: the Altman Z-Score of 2.85 places the company in the grey zone, signaling moderate bankruptcy risk, while a Piotroski score of 5 suggests average financial strength. The company’s strong fixed asset turnover (7.06) and healthy interest coverage (7.16) further support operational efficiency.

Weaknesses and Drawbacks

Notwithstanding these strengths, ESAB faces valuation and market pressure concerns. Its price-to-earnings ratio at 27.37 and price-to-book ratio of 4.1 imply a premium valuation, which may constrain upside potential amid market volatility. The recent seller dominance, with buyers representing only 38.85% of volume, creates short-term headwinds despite an overall bullish trend. The debt-to-equity ratio of 0.66 is moderate but coupled with a dividend yield of just 0.23%, it may offer limited income appeal for yield-focused investors. These factors collectively suggest caution in the near term.

Our Verdict about ESAB Corporation

ESAB’s long-term fundamental profile appears favorable, supported by value creation and improving profitability. However, despite a bullish overall trend, the recent period’s seller dominance suggests a wait-and-see approach might be prudent to secure a more attractive entry point. The balance of moderate financial health signals with premium valuation metrics means the stock could appeal to investors with a tolerance for short-term volatility and a focus on medium- to long-term growth potential.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Massachusetts Financial Services Co. MA Has $31.18 Million Holdings in ESAB Corporation $ESAB – MarketBeat (Jan 23, 2026)

- ESAB stock price target raised to $148 by Oppenheimer on growth outlook – Investing.com (Jan 23, 2026)

- ESAB’s Near-Term Headwinds Transient, Flywheel Acceleration Likely, Oppenheimer Says – 富途资讯 (Jan 23, 2026)

- Assessing ESAB: Insights From 5 Financial Analysts – Benzinga (Jan 23, 2026)

- Technical Reactions to ESAB Trends in Macro Strategies – Stock Traders Daily (Jan 22, 2026)

For more information about ESAB Corporation, please visit the official website: esab.com