Home > Analyses > Financial Services > Erie Indemnity Company

Erie Indemnity Company quietly shapes the insurance landscape by delivering trusted coverage and exceptional service to millions of policyholders. As a key player in the insurance brokerage industry, Erie stands out for its innovative underwriting approach and strong agent network, driving consistent quality and customer loyalty. With a solid market presence and prudent risk management, the question remains: does Erie’s current valuation fully reflect its potential for sustainable growth in a competitive market?

Table of contents

Business Model & Company Overview

Erie Indemnity Company, founded in 1925 and headquartered in Erie, Pennsylvania, stands as a dominant player in the insurance brokerage industry. Operating as the managing attorney-in-fact for Erie Insurance Exchange subscribers across the US, the company delivers a cohesive ecosystem that integrates sales, underwriting, policy issuance, and renewal services. Its mission revolves around providing comprehensive support to policyholders through a blend of agent compensation, advertising, and IT services, ensuring a seamless insurance experience.

The company’s revenue engine balances underwriting and policy processing with robust customer and administrative services, creating value through recurring insurance policy renewals and agent-driven sales. While its core operations are US-focused, Erie Indemnity’s business model exemplifies a competitive advantage through its integrated service approach. This strong operational foundation builds a resilient economic moat, positioning it to influence the future landscape of insurance brokerage.

Financial Performance & Fundamental Metrics

This section analyzes Erie Indemnity Company’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and shareholder value.

Income Statement

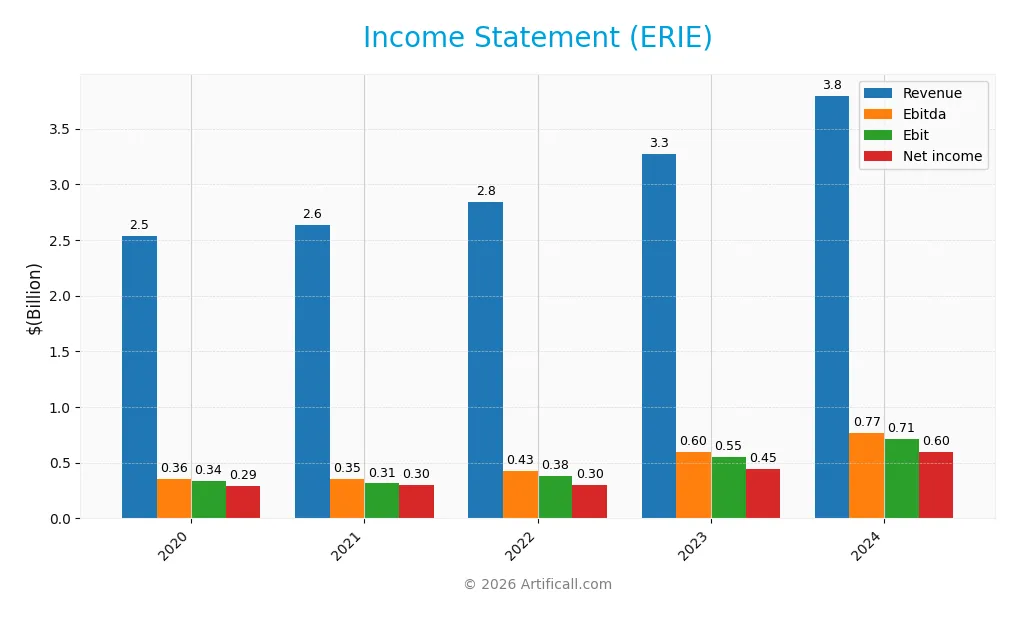

The table below presents Erie Indemnity Company’s key income statement figures for the fiscal years 2020 through 2024 in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 2.54B | 2.63B | 2.84B | 3.27B | 3.80B |

| Cost of Revenue | 2.20B | 2.32B | 2.46B | 2.75B | 3.12B |

| Operating Expenses | 0 | 0 | 0 | 0 | 0 |

| Gross Profit | 338M | 318M | 376M | 520M | 676M |

| EBITDA | 358M | 351M | 428M | 600M | 766M |

| EBIT | 337M | 314M | 382M | 553M | 710M |

| Interest Expense | 731K | 4.13M | 2.01M | 0 | 0 |

| Net Income | 293M | 298M | 299M | 446M | 600M |

| EPS | 6.3 | 6.4 | 6.41 | 9.58 | 12.89 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-03-01 | 2024-02-26 | 2025-02-27 |

Income Statement Evolution

From 2020 to 2024, Erie Indemnity Company’s revenue increased by 49.6% to $3.8B, with net income more than doubling, up 104.7% to $600M. Gross margin remained stable at 17.8%, while operating efficiency improved, reflected in an EBIT margin of 18.7%. Net margin also expanded to 15.8%, indicating healthier profitability alongside solid top-line growth.

Is the Income Statement Favorable?

The 2024 income statement shows favorable fundamentals, with a 16.1% revenue increase and a 30% surge in gross profit year-over-year. Operating expenses grew proportionally, maintaining margin stability. EBIT and net margin growth of 28.4% and 15.9%, respectively, alongside a 34.6% EPS rise, underline robust operational performance. Overall, 92.9% of income statement metrics are rated favorable, supporting a positive financial outlook.

Financial Ratios

The table below presents key financial ratios for Erie Indemnity Company over the fiscal years 2020 to 2024, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 12% | 11% | 11% | 14% | 16% |

| ROE | 25% | 22% | 21% | 27% | 30% |

| ROIC | -43% | 16% | 19% | 23% | 26% |

| P/E | 44 | 30 | 38 | 35 | 32 |

| P/B | 11 | 7 | 8 | 9 | 10 |

| Current Ratio | 0 | 1.21 | 1.10 | 1.31 | 1.43 |

| Quick Ratio | 0 | 1.21 | 1.11 | 1.31 | 1.43 |

| D/E | 0.08 | 0.07 | 0.08 | 0 | 0.004 |

| Debt-to-Assets | 4.5% | 4.2% | 5.5% | 0 | 0.3% |

| Interest Coverage | 463 | 77 | 187 | 0 | 0 |

| Asset Turnover | 1.20 | 1.17 | 1.27 | 1.32 | 1.31 |

| Fixed Asset Turnover | 9.56 | 7.03 | 6.86 | 7.39 | 7.39 |

| Dividend Yield | 2.1% | 2.2% | 1.8% | 1.4% | 1.2% |

Evolution of Financial Ratios

Between 2020 and 2024, Erie Indemnity Company saw a consistent improvement in Return on Equity (ROE), rising from 24.7% to 30.2%, indicating enhanced profitability. The Current Ratio increased steadily from around 1.21 in 2021 to 1.43 in 2024, reflecting improved liquidity. Meanwhile, the Debt-to-Equity Ratio remained very low, dropping to nearly zero by 2024, demonstrating a significant reduction in financial leverage.

Are the Financial Ratios Favorable?

In 2024, Erie’s profitability metrics, including a 15.82% net margin and 30.21% ROE, were favorable, supported by strong returns on invested capital. Liquidity ratios showed a balanced position with a Current Ratio of 1.43 (neutral) and a Quick Ratio also at 1.43 (favorable). The company’s leverage remains minimal with a near-zero debt-to-equity ratio and low debt-to-assets at 0.26%, which is favorable. However, valuation ratios such as Price-to-Earnings (31.7) and Price-to-Book (9.58) were unfavorable, reflecting high market expectations. Overall, 71.43% of ratios were favorable, confirming a generally positive financial stance.

Shareholder Return Policy

Erie Indemnity Company maintains a dividend payout ratio around 40%, with dividends per share rising steadily to 5.14 in 2024 and a modest yield near 1.25%. Dividend payments are well covered by free cash flow, supporting sustainable distributions without excessive repurchase activity.

The company’s balanced approach, combining consistent dividends and manageable payout ratios, aligns with prudent capital allocation. This policy appears designed to foster long-term shareholder value through reliable income and financial stability.

Score analysis

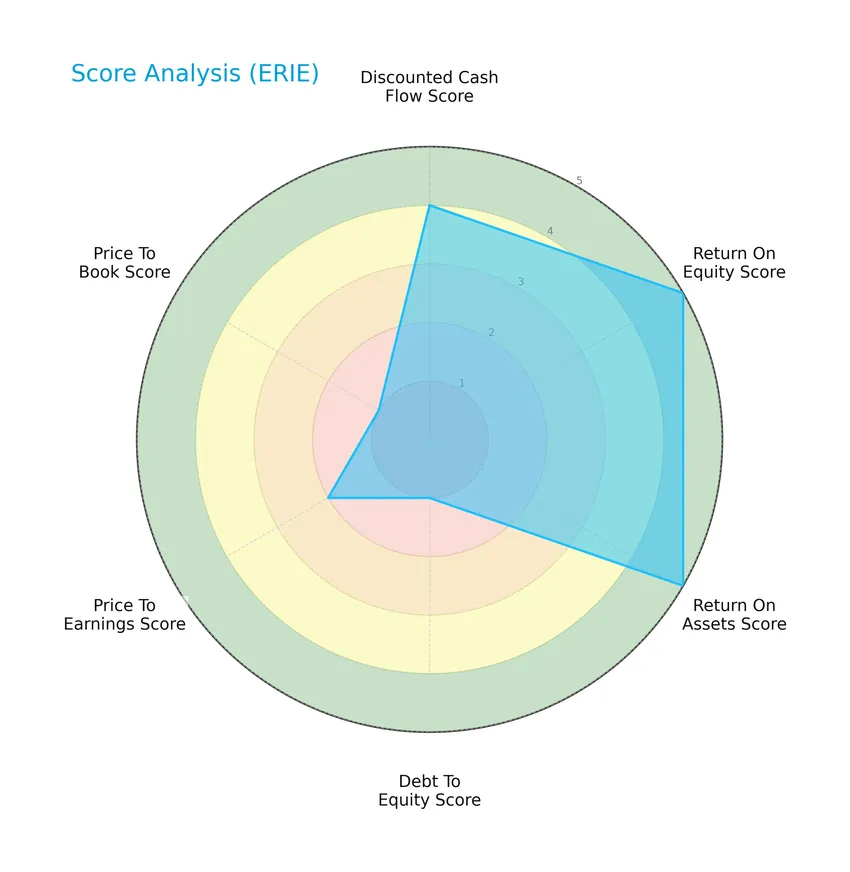

The following radar chart presents an overview of key financial scores reflecting the company’s valuation, profitability, and leverage metrics:

Erie Indemnity Company shows strong profitability with very favorable scores in return on equity (5) and return on assets (5). Its discounted cash flow score is favorable (4), while valuation metrics like price-to-earnings (2) and price-to-book (1) scores are moderate to very unfavorable. The debt-to-equity score is notably very unfavorable (1), indicating higher leverage risk.

Analysis of the company’s bankruptcy risk

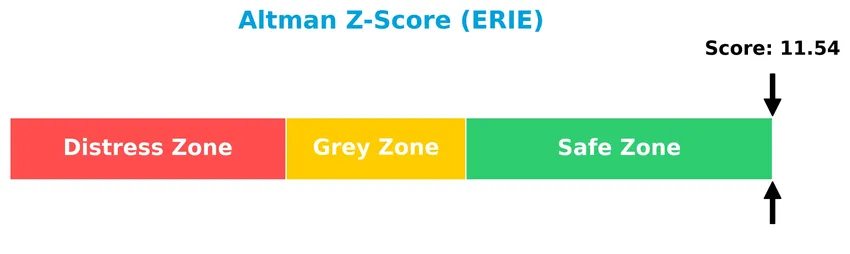

The Altman Z-Score places Erie Indemnity Company well within the safe zone, indicating a very low risk of bankruptcy:

Is the company in good financial health?

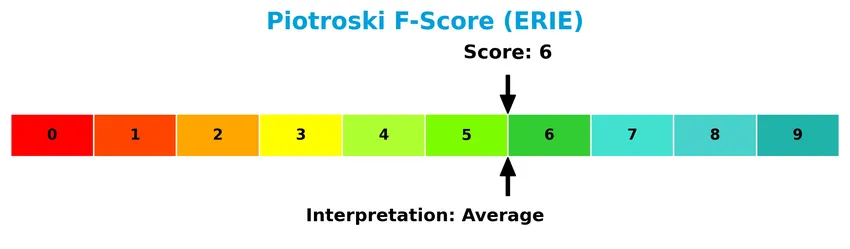

The Piotroski Score diagram below illustrates the company’s financial strength based on nine fundamental criteria:

With a Piotroski Score of 6, the company is classified as having average financial health, reflecting solid but not outstanding fundamentals in profitability, leverage, and efficiency.

Competitive Landscape & Sector Positioning

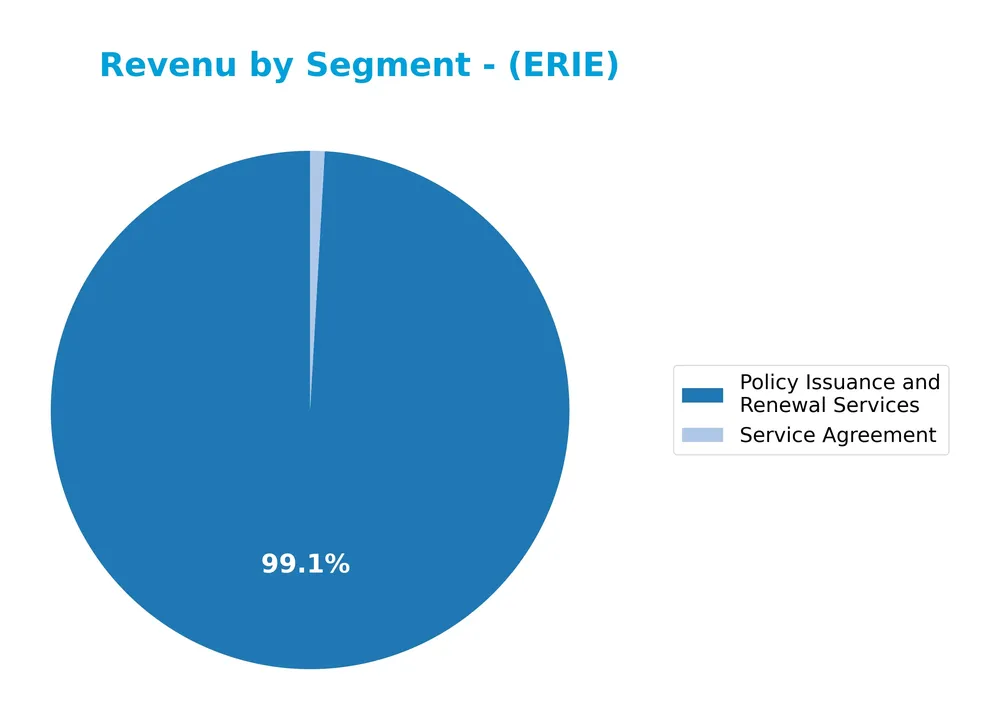

This sector analysis of Erie Indemnity Company will examine its strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also assess whether Erie Indemnity holds a competitive advantage over its industry peers.

Strategic Positioning

Erie Indemnity Company maintains a concentrated product portfolio focused primarily on policy issuance and renewal services, generating over $2.8B in 2024. Its operations are concentrated in the US, with supplementary service agreements contributing marginally, reflecting a specialized, geographically focused business model.

Revenue by Segment

This pie chart illustrates Erie Indemnity Company’s revenue distribution by product segment for the fiscal year 2024.

In 2024, Policy Issuance and Renewal Services dominate the revenue mix with 2.89B, showing steady growth from 2.44B in 2023 and 2.09B in 2022. Service Agreement revenue remains minimal at 26M, consistent over recent years. The concentration in the primary segment highlights Erie’s focus on core insurance services, with no significant shifts in smaller segments, indicating stable but concentrated revenue streams.

Key Products & Brands

The table below summarizes Erie Indemnity Company’s key products and services as of the latest fiscal years:

| Product | Description |

|---|---|

| Policy Issuance and Renewal Services | Provides underwriting, policy issuance, and renewal services to policyholders on behalf of Erie Insurance Exchange. |

| Service Agreement | Includes sales-related services such as agent compensation, sales and advertising support, customer services, administrative support, and IT services. |

Erie Indemnity Company mainly generates revenue through policy issuance and renewal services, complemented by various service agreements supporting sales and administrative functions. These offerings reflect the company’s role as a managing attorney-in-fact for Erie Insurance Exchange.

Main Competitors

There are 6 competitors in the Insurance – Brokers industry, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Marsh & McLennan Companies, Inc. | 89.8B |

| Aon plc | 74.4B |

| Arthur J. Gallagher & Co. | 65.7B |

| Willis Towers Watson Public Limited Company | 32.3B |

| Brown & Brown, Inc. | 26.5B |

| Erie Indemnity Company | 12.8B |

Erie Indemnity Company ranks 6th among its 6 competitors in market capitalization. Its market cap is approximately 14.2% of the leader, Marsh & McLennan Companies, Inc. Erie is positioned below both the average market cap of the top 10 competitors (50.3B) and the sector median (49.0B). The company has a significant 108% market cap gap with its nearest competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does ERIE have a competitive advantage?

Erie Indemnity Company demonstrates a durable competitive advantage, supported by a very favorable moat status and a ROIC significantly above its WACC, indicating efficient capital use and value creation. Its growing ROIC trend over 2020-2024 confirms increasing profitability and sustained economic profits.

Looking ahead, Erie’s future outlook includes potential opportunities in its core insurance brokerage operations, supported by steady revenue and net income growth, as well as favorable margins. Expansion possibilities may arise through enhanced underwriting, policy issuance services, and targeted marketing efforts within the U.S. insurance market.

SWOT Analysis

This SWOT analysis summarizes Erie Indemnity Company’s key internal strengths and weaknesses alongside external opportunities and threats to inform strategic investment decisions.

Strengths

- strong profitability with 15.82% net margin

- very favorable ROE at 30.21%

- durable competitive advantage with growing ROIC

- robust revenue growth of 16.1% in 2024

- zero debt and strong liquidity ratios

Weaknesses

- high valuation multiples with PE of 31.72 and PB of 9.58

- moderate Piotroski score indicating average financial strength

- limited dividend yield at 1.25%

- dependence on US insurance market

- concentrated geographic presence

Opportunities

- expanding insurance brokerage market

- leverage technology for underwriting efficiency

- growth in demand for personalized insurance products

- potential to increase digital sales channels

- opportunities to improve financial strength score

Threats

- intense competition in insurance brokerage sector

- regulatory changes impacting underwriting

- economic downturns reducing insurance demand

- rising claims costs affecting profitability

- market volatility impacting valuation multiples

Erie Indemnity Company demonstrates solid financial health and competitive advantages, supported by strong margins and growth. However, its high valuation and moderate financial strength score warrant caution. Investors should weigh the growth opportunities against sector risks and valuation before adding it to their portfolios.

Stock Price Action Analysis

The upcoming weekly stock chart for Erie Indemnity Company (ERIE) illustrates price movements and volume trends over the past 12 months:

Trend Analysis

Over the past 12 months, ERIE’s stock price declined by 31.77%, indicating a bearish trend with accelerating downward momentum. The price ranged between a high of 542.86 and a low of 275.85, with volatility marked by a standard deviation of 62.02. Recent weeks also show a continued negative slope of -1.31.

Volume Analysis

In the last three months, trading volume has increased overall, with buyers accounting for 39.84% of activity, indicating seller dominance. This suggests cautious investor sentiment and potential selling pressure despite rising market participation.

Target Prices

No verified target price data is available from recognized analysts for Erie Indemnity Company. Market sentiment appears cautious but lacks consensus forecasts at this time.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback regarding Erie Indemnity Company (ERIE) performance and reputation.

Stock Grades

No verified stock grades were available from recognized analysts for Erie Indemnity Company (ERIE). As a result, there is no current consensus or detailed grading data to inform on its stock performance or market sentiment.

Consumer Opinions

Consumer sentiment around Erie Indemnity Company reflects a mix of appreciation for its customer service and reservations about pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| “Excellent claims support with quick responses.” | “Premiums have increased noticeably over the years.” |

| “Friendly and knowledgeable agents.” | “Limited discount options compared to competitors.” |

| “Reliable coverage that provides peace of mind.” | “The online portal could be more user-friendly.” |

Overall, Erie Indemnity is praised for its responsive service and reliable coverage. However, some customers express concerns about rising premiums and digital experience, suggesting areas for improvement.

Risk Analysis

Below is an overview of the key risks facing Erie Indemnity Company, considering their likelihood and potential impact on investors:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Stock price fluctuation influenced by broader market trends | Medium | Medium |

| Valuation Risk | Elevated P/E (31.7) and P/B (9.58) ratios may suggest overvaluation | High | High |

| Competition Risk | Intense competition in insurance brokerage sector | Medium | Medium |

| Regulatory Risk | Changes in insurance regulations affecting underwriting practices | Low | Medium |

| Credit Risk | Exposure to policyholder default or claim losses | Low | Low |

| Dividend Yield Risk | Modest dividend yield (1.25%) may limit income appeal | Medium | Low |

| Leverage Risk | Very low debt levels reduce financial risk | Low | Low |

| Financial Health | Strong Altman Z-Score (11.54) and ROE (30.2%) indicate stability | Low | Low |

The most significant risks relate to valuation, with Erie’s high P/E and P/B ratios signaling potential overvaluation, increasing downside risk amid market volatility. However, the company’s strong financial health and low leverage mitigate bankruptcy risk, supporting cautious optimism for investors.

Should You Buy Erie Indemnity Company?

Erie Indemnity Company appears to be delivering robust profitability with a durable competitive moat supported by growing ROIC, suggesting strong value creation. Despite a challenging leverage profile, the overall B+ rating reflects a very favorable financial position, indicating a balanced risk-return profile.

Strength & Efficiency Pillars

Erie Indemnity Company demonstrates robust profitability with a net margin of 15.82% and a return on equity of 30.21%, reflecting efficient capital use. Its return on invested capital (ROIC) stands at 25.61%, significantly above the weighted average cost of capital (WACC) at 5.6%, confirming the company as a clear value creator. Financial health is solid, supported by a strong Altman Z-Score of 11.54, well within the safe zone, and an average Piotroski score of 6, suggesting stable fundamentals. Operational efficiency is further exemplified by favorable asset turnover ratios and zero debt-to-equity, underscoring financial prudence.

Weaknesses and Drawbacks

Valuation metrics raise caution; a high price-to-earnings ratio of 31.72 and an elevated price-to-book ratio of 9.58 suggest the stock trades at a premium, potentially limiting upside. Despite strong financial health, the company faces leverage concerns as indicated by a very unfavorable debt-to-equity score in the rating evaluation, though actual debt levels are minimal. Market pressure is evident with a bearish overall stock trend showing a 31.77% price decline and a recent seller dominance phase where buyers accounted for only 39.84% of volume. This short-term weakness may reflect market skepticism or profit-taking.

Our Verdict about Erie Indemnity Company

Erie Indemnity Company’s long-term fundamental profile appears favorable, underscored by strong profitability, value creation, and financial stability. However, despite this enduring strength, the recent seller dominance and bearish price trend suggest a wait-and-see approach might be prudent. Investors could consider monitoring for a more attractive entry point before committing, as the current valuation and market dynamics may introduce near-term volatility.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Erie Indemnity Co. Cl A stock underperforms Friday when compared to competitors – MarketWatch (Jan 23, 2026)

- F&G Annuities & Life, Old Republic International, and Erie Indemnity Shares Plummet, What You Need To Know – Yahoo Finance (Jan 23, 2026)

- Erie Indemnity’s Q4 2025 earnings: What to expect – MSN (Jan 23, 2026)

- Erie Indemnity (ERIE) Valuation Check After Mixed Recent Returns And Premium P/E Multiple – simplywall.st (Jan 21, 2026)

- Erie Indemnity (ERIE) Valuation Check After Mixed Recent Returns And Premium P/E Multiple – Sahm (Jan 21, 2026)

For more information about Erie Indemnity Company, please visit the official website: erieinsurance.com