Home > Analyses > Industrials > Equifax Inc.

Equifax Inc. transforms how businesses and consumers access and manage critical financial information every day. As a global leader in credit data and workforce solutions, Equifax drives innovation in identity verification, fraud prevention, and credit analytics. Its comprehensive services span multiple industries and continents, underpinning countless financial decisions worldwide. Amid evolving data privacy concerns and economic shifts, I explore whether Equifax’s robust fundamentals still justify its premium valuation and growth prospects in 2026.

Table of contents

Business Model & Company Overview

Equifax Inc., founded in 1899 and headquartered in Atlanta, Georgia, stands as a dominant player in consulting services with a focus on information solutions and business process automation. Its core mission integrates consumer, commercial, and workforce data into a comprehensive ecosystem that supports credit scoring, identity verification, and fraud prevention globally. With 15K employees, Equifax serves diverse industries including financial services, healthcare, and government, reinforcing its strategic importance across sectors.

The company’s revenue engine balances subscription-based data services and transaction-driven solutions across its Workforce Solutions, U.S. Information Solutions, and International segments. Equifax’s footprint spans the Americas, Europe, and Asia, delivering critical insights that drive credit decisions, risk management, and marketing strategies. I see its economic moat rooted in proprietary data assets and advanced analytics, securing Equifax’s role in shaping the future of information-driven decision-making.

Financial Performance & Fundamental Metrics

I analyze Equifax Inc.’s income statement, key financial ratios, and dividend payout policy to reveal its core profitability and shareholder value dynamics.

Income Statement

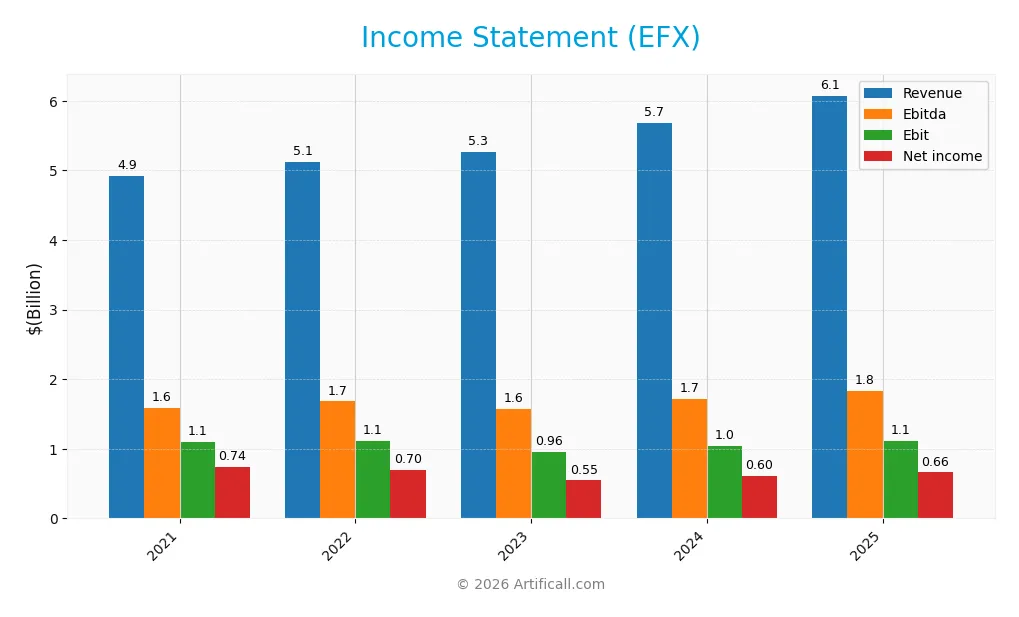

The table below presents Equifax Inc.’s key income statement figures for fiscal years 2021 through 2025, reported in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 4.92B | 5.12B | 5.27B | 5.68B | 6.07B |

| Cost of Revenue | 1.98B | 2.18B | 2.34B | 2.52B | 3.37B |

| Operating Expenses | 1.81B | 1.89B | 2.00B | 2.12B | 1.61B |

| Gross Profit | 2.94B | 2.95B | 2.93B | 3.16B | 2.71B |

| EBITDA | 1.58B | 1.68B | 1.58B | 1.72B | 1.83B |

| EBIT | 1.09B | 1.11B | 0.96B | 1.04B | 1.11B |

| Interest Expense | 146M | 183M | 241M | 229M | 212M |

| Net Income | 744M | 696M | 545M | 604M | 660M |

| EPS | 6.11 | 5.69 | 4.44 | 4.88 | 5.36 |

| Filing Date | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-20 | 2026-02-04 |

Income Statement Evolution

Equifax’s revenue rose 23.4% from 2021 to 2025, though growth slowed to 6.9% in 2025. Net income declined 11.3% over the period, reflecting margin pressure. Gross margin fell, with a notable 14.3% drop in gross profit in 2025. However, EBIT margin improved to 18.2%, signaling better operating efficiency despite cost fluctuations.

Is the Income Statement Favorable?

In 2025, Equifax reported a revenue of $6.07B and net income of $660M, yielding a 10.9% net margin, slightly improved from prior years. Operating expenses grew in line with revenue, supporting an EBIT increase of 6.5%. Interest expense remained favorable at 3.5% of revenue. Overall, the fundamentals appear favorable, with solid margins and controlled costs, though net income trends warrant monitoring.

Financial Ratios

The following table summarizes Equifax Inc.’s key financial ratios from 2021 to 2025, illustrating profitability, liquidity, leverage, valuation, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 15.1% | 13.6% | 10.4% | 10.6% | 10.9% |

| ROE | 20.8% | 17.6% | 12.0% | 12.6% | 14.3% |

| ROIC | 9.4% | 7.6% | 6.4% | 7.3% | 7.7% |

| P/E | 48.0 | 34.2 | 55.7 | 52.2 | 40.5 |

| P/B | 10.0 | 6.0 | 6.7 | 6.6 | 5.8 |

| Current Ratio | 0.49 | 0.68 | 0.67 | 0.75 | 0.60 |

| Quick Ratio | 0.49 | 0.68 | 0.67 | 0.75 | 0.60 |

| D/E | 1.48 | 1.46 | 1.26 | 1.04 | 1.11 |

| Debt-to-Assets | 48.0% | 50.1% | 46.5% | 42.6% | 42.9% |

| Interest Coverage | 7.8 | 5.8 | 3.9 | 4.5 | 5.2 |

| Asset Turnover | 0.45 | 0.44 | 0.43 | 0.48 | 0.51 |

| Fixed Asset Turnover | 3.74 | 3.23 | 2.87 | 3.00 | 3.14 |

| Dividend Yield | 0.53% | 0.80% | 0.63% | 0.61% | 0.87% |

Evolution of Financial Ratios

Return on Equity (ROE) showed a gradual decline from 20.76% in 2021 to 14.34% in 2025, indicating slowed profitability growth. The Current Ratio fluctuated but remained below 1.0, peaking at 0.75 in 2024 and falling to 0.60 in 2025, signaling ongoing liquidity constraints. The Debt-to-Equity Ratio decreased from 1.48 in 2021 to 1.11 in 2025, reflecting modest deleveraging.

Are the Financial Ratios Favorable?

In 2025, profitability ratios were mixed: net margin at 10.87% is favorable, while ROE and ROIC align neutrally with the company’s weighted average cost of capital (WACC) of 9.75%. Liquidity ratios, including Current and Quick Ratios around 0.6, are unfavorable, suggesting limited short-term asset coverage. Leverage remains high with a Debt-to-Equity of 1.11. Market valuation ratios like P/E of 40.48 and P/B of 5.81 are unfavorable, signaling expensive stock pricing relative to earnings and book value. Overall, roughly 43% of ratios are unfavorable, 21% favorable, and 36% neutral, indicating a slightly unfavorable financial profile.

Shareholder Return Policy

Equifax Inc. consistently pays dividends with a payout ratio around 35% and a dividend yield near 0.87% in 2025. The company supports distributions with robust free cash flow coverage and engages in share buybacks, reflecting a balanced capital allocation approach.

This dividend policy, coupled with share repurchases, indicates a commitment to returning capital while maintaining operational cash flow health. The coverage ratios suggest sustainable payments, supporting long-term shareholder value without excessive financial risk.

Score analysis

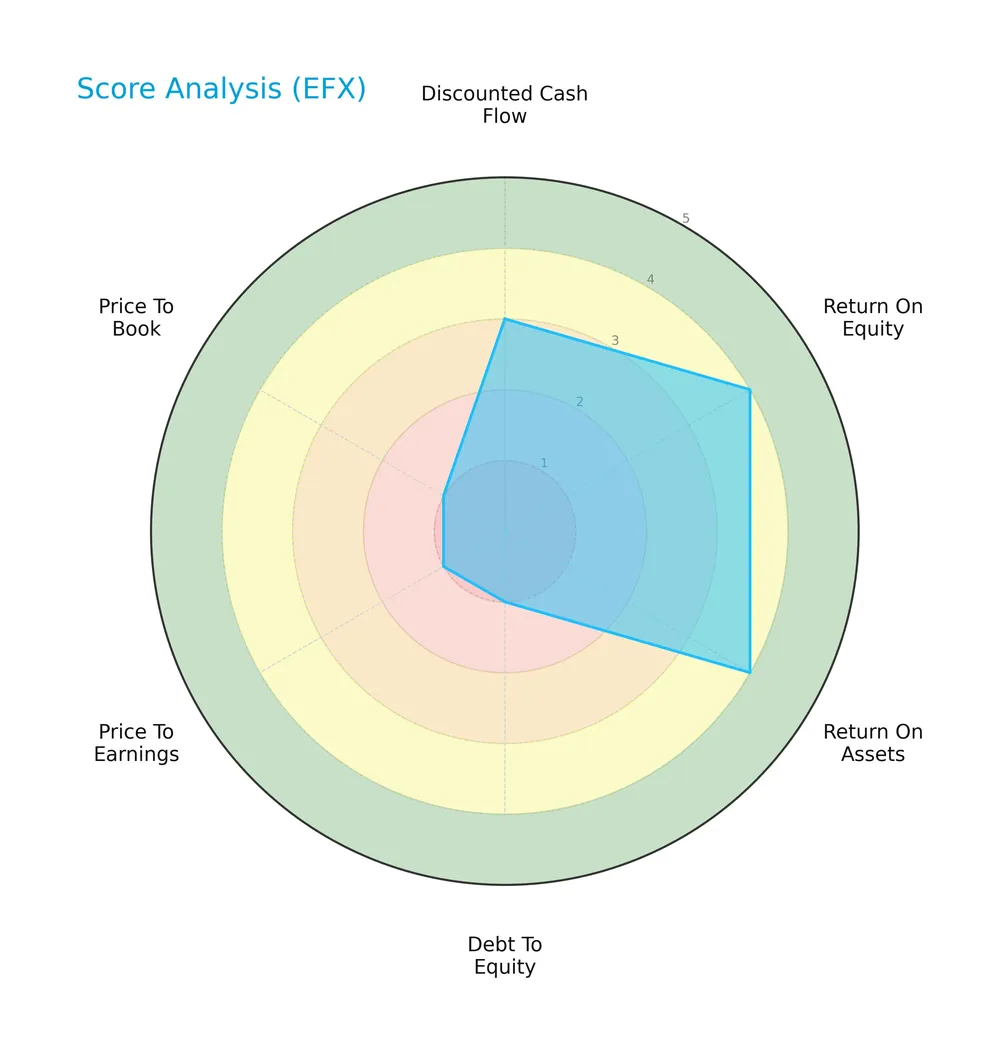

The following radar chart illustrates Equifax Inc.’s key financial metric scores for evaluation:

Equifax shows moderate strength in discounted cash flow and strong profitability with ROE and ROA scores of 3 and 4 respectively. However, debt-to-equity, P/E, and P/B ratios score very low, signaling valuation and leverage concerns.

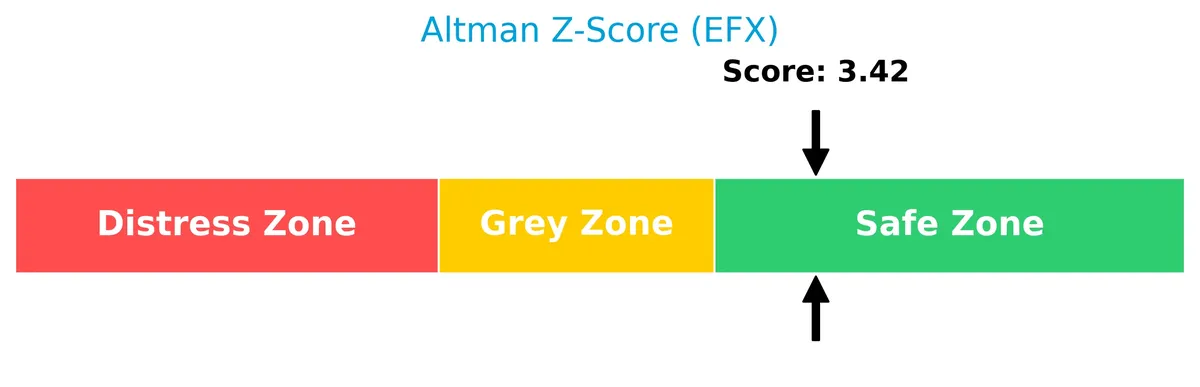

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Equifax firmly in the safe zone, indicating a low risk of bankruptcy and sound financial stability:

Is the company in good financial health?

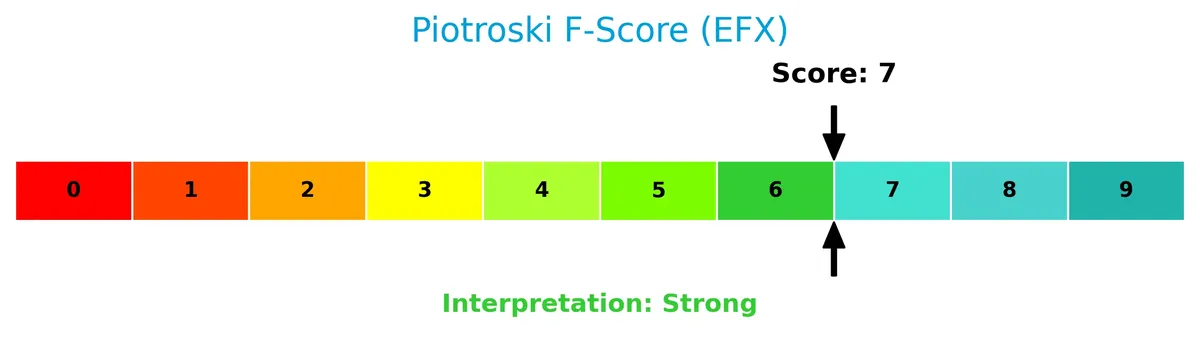

The Piotroski Score diagram presents a comprehensive view of Equifax’s financial strength based on nine criteria:

With a score of 7, Equifax demonstrates strong financial health, reflecting solid profitability, liquidity, and operational efficiency. This level suggests the company maintains a robust financial position.

Competitive Landscape & Sector Positioning

This sector analysis explores Equifax Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Equifax holds a competitive advantage within its industry landscape.

Strategic Positioning

Equifax maintains a diversified portfolio with three distinct segments: Workforce Solutions, US Consumer Information, and International. It operates globally across multiple industries, generating over $4.3B in U.S. revenue and expanding steadily in Australia and the U.K., reflecting broad geographic and sector exposure.

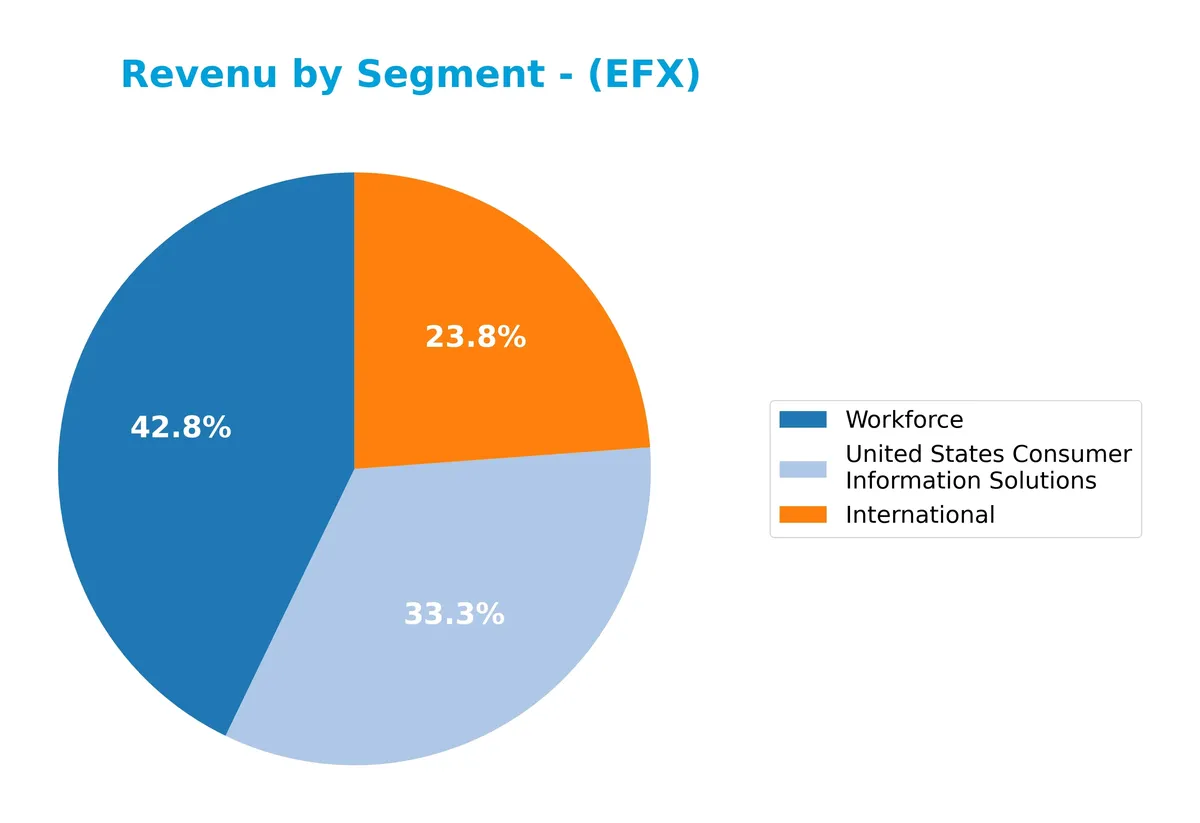

Revenue by Segment

This pie chart illustrates Equifax Inc.’s revenue distribution by segment for the full fiscal year 2024, highlighting the relative contributions of key business lines.

In 2024, Workforce leads with $2.4B, followed by U.S. Consumer Information Solutions at $1.9B, and International at $1.35B. Workforce consistently drives growth, showing steady expansion since 2019. U.S. Consumer Solutions stabilized after strong gains in prior years. The International segment also grew moderately. This balanced mix reduces concentration risk but underscores Workforce’s strategic importance in Equifax’s portfolio.

Key Products & Brands

Equifax’s core offerings span three main segments, serving diverse client needs globally:

| Product | Description |

|---|---|

| Workforce Solutions | Employment, income, criminal history, social security verification, payroll transactions, employment tax management, identity theft protection. |

| U.S. Consumer Information Solutions | Consumer and commercial credit data, credit scoring and modeling, fraud detection, mortgage services, identity management, credit monitoring, portfolio analytics. |

| International | Consumer and commercial credit information, credit scoring and marketing products, debt collection support, and recovery management services across multiple countries. |

Equifax generates substantial revenue from Workforce Solutions and U.S. Consumer Information Solutions, reflecting strong demand for identity verification and credit services. Its International segment supports global credit and marketing needs, illustrating geographic diversification.

Main Competitors

There are 3 competitors in total, with the table listing the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Verisk Analytics, Inc. | 30.8B |

| Equifax Inc. | 26.5B |

| Booz Allen Hamilton Holding Corporation | 10.5B |

Equifax Inc. ranks 2nd among its 3 competitors. Its market cap is about 75% of the leader, Verisk Analytics. Equifax stands above the average market cap of the top 10 but below the sector median. It maintains a 33% premium over the next competitor below, Booz Allen Hamilton.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does EFX have a competitive advantage?

Equifax Inc. does not currently present a competitive advantage. Its return on invested capital (ROIC) trails its weighted average cost of capital (WACC) by over 2%, indicating value destruction and declining profitability from 2021 to 2025.

Looking ahead, Equifax operates across diverse geographic markets and segments. Its expansion in Workforce Solutions, U.S. Information Solutions, and International markets offers opportunities for growth, though the company faces challenges sustaining economic profits.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors shaping Equifax Inc.’s strategic position.

Strengths

- strong brand recognition

- diversified global presence

- favorable operating margins

Weaknesses

- declining ROIC vs WACC

- high debt-to-equity ratio

- weak liquidity ratios

Opportunities

- expanding international markets

- growing demand for identity protection

- technology-driven service innovation

Threats

- regulatory scrutiny

- cybersecurity risks

- intense competition in data services

Equifax’s solid brand and margins provide a strong foundation. However, value destruction from declining ROIC and weak liquidity raise caution. Growth hinges on international expansion and tech innovation, but regulatory and cyber risks require vigilant management.

Stock Price Action Analysis

The weekly chart displays Equifax Inc.’s stock price performance over the past 12 months, highlighting key highs, lows, and volatility patterns:

Trend Analysis

Over the past 12 months, EFX’s stock price declined by 25.69%, signaling a bearish trend with deceleration. The price ranged between 187.95 and 307.13, showing significant volatility with a 24.65 standard deviation. Recent three-month data confirm continued downtrend with a -12.06% drop and moderate volatility.

Volume Analysis

Trading volume increased overall, with seller dominance at 52.05%. In the recent three months, sellers outweighed buyers significantly (buyer dominance at 27.42%), indicating bearish sentiment and heightened market participation from sellers.

Target Prices

Analysts set a clear target consensus for Equifax Inc., reflecting measured optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 195 | 285 | 241.2 |

The target range shows confidence in Equifax’s growth potential, with a consensus price near 241, suggesting moderate upside from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide insight into Equifax Inc.’s market perception.

Stock Grades

Here are the latest verified stock grades for Equifax Inc. from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Stifel | Maintain | Buy | 2026-02-05 |

| Wells Fargo | Maintain | Overweight | 2026-02-05 |

| RBC Capital | Maintain | Outperform | 2026-02-05 |

| Needham | Maintain | Buy | 2026-02-05 |

| Barclays | Maintain | Equal Weight | 2026-02-05 |

| Morgan Stanley | Maintain | Overweight | 2026-02-05 |

| Wells Fargo | Maintain | Overweight | 2026-01-14 |

| Oppenheimer | Maintain | Outperform | 2026-01-12 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| BMO Capital | Maintain | Market Perform | 2025-12-08 |

The consensus remains firmly positive, with a majority of Buy and Outperform ratings. Few Hold or Market Perform grades indicate cautious optimism without immediate downgrades.

Consumer Opinions

Equifax Inc. elicits strong feelings from consumers, balancing trust in its services with concerns over data security.

| Positive Reviews | Negative Reviews |

|---|---|

| Efficient credit reporting with timely updates | Data breach history raises security concerns |

| User-friendly online platform and mobile app | Customer service response times can be slow |

| Comprehensive credit monitoring features | Occasional inaccuracies in credit report details |

Overall, consumers appreciate Equifax’s comprehensive credit tools and user experience. However, recurring concerns about data security and customer service responsiveness temper enthusiasm. The company must address these issues to restore full consumer confidence.

Risk Analysis

Below is a summary table highlighting key risks associated with Equifax Inc. (EFX) as of 2026:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low current and quick ratios at 0.6 signal liquidity pressure, raising short-term risk. | High | Medium |

| Leverage | Debt-to-equity ratio above 1.1 indicates heavy reliance on debt, increasing financial risk. | Medium | High |

| Valuation | Elevated P/E (40.5) and P/B (5.8) ratios suggest overvaluation compared to sector averages. | High | Medium |

| Market Volatility | Beta of 1.56 exposes shares to greater price swings amid economic or sector downturns. | Medium | Medium |

| Regulatory | Operating in multiple countries exposes EFX to complex compliance and data privacy risks. | Medium | High |

| Dividend Yield | Low yield at 0.87% may deter income-focused investors, impacting stock demand. | Low | Low |

Liquidity risks stand out as the most pressing, given Equifax’s unfavorable current ratio well below the standard 1.0 benchmark. Furthermore, high leverage combined with regulatory complexity in global markets amplifies downside risk. Although the Altman Z-score places EFX in the safe zone, valuation multiples remain stretched, warranting caution.

Should You Buy Equifax Inc.?

Equifax appears to be a moderately profitable firm with operational efficiency under pressure, exhibiting a very unfavorable moat due to declining ROIC versus WACC. Despite significant leverage concerns, its financial strength scores suggest a B- rating, indicating cautious value creation potential.

Strength & Efficiency Pillars

Equifax Inc. sustains solid profitability with a net margin of 10.87% and a return on equity of 14.34%. The Altman Z-score of 3.42 places the company comfortably in the safe zone, signaling strong financial health. A Piotroski score of 7 further confirms robust operational fundamentals. However, the company’s ROIC at 7.69% falls short of its WACC at 9.75%, indicating it currently destroys value rather than creates it. Interest coverage at 5.22x and fixed asset turnover of 3.14 reinforce operational efficiency.

Weaknesses and Drawbacks

Valuation metrics pose significant concerns, with a high P/E of 40.48 and a P/B ratio of 5.81, reflecting an expensive premium relative to industry norms. Leverage is elevated; a debt-to-equity ratio of 1.11 and weak liquidity indicated by a current ratio of 0.6 raise solvency risks. Market pressure is evident as sellers dominate recent trading, with buyer dominance at a mere 27.42%, contributing to a 12.06% price decline over the past quarter and an overall bearish trend with a 25.69% drop year-to-date.

Our Verdict about Equifax Inc.

Equifax Inc.’s long-term fundamentals appear moderately favorable, supported by profitability and financial health scores. Yet, its inability to generate returns above its cost of capital and stretched valuation metrics temper enthusiasm. Despite solid operational efficiency, recent market pressure and seller dominance suggest caution. Investors might consider a wait-and-see approach for a more attractive entry point, as the short-term technicals imply continued downside risk.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Equifax stock slumps after senators warn against Medicaid profiteering (EFX:NYSE) – Seeking Alpha (Feb 03, 2026)

- Equifax Inc. (NYSE: EFX) Q4 2025 earnings call transcript – MSN (Feb 05, 2026)

- Equifax: Q4 Earnings Snapshot – KHOU (Feb 04, 2026)

- These Analysts Cut Their Forecasts On Equifax After Q4 Earnings – Benzinga (Feb 05, 2026)

- Is Equifax (EFX) Now An Opportunity After A 32% One Year Share Price Slide? – Yahoo Finance (Feb 05, 2026)

For more information about Equifax Inc., please visit the official website: equifax.com